A 2018 survey by PwC indicated that nearly one-third of companies making significant changes to their lease accounting systems were unsure or did not think they would make the effective date of the new standards.

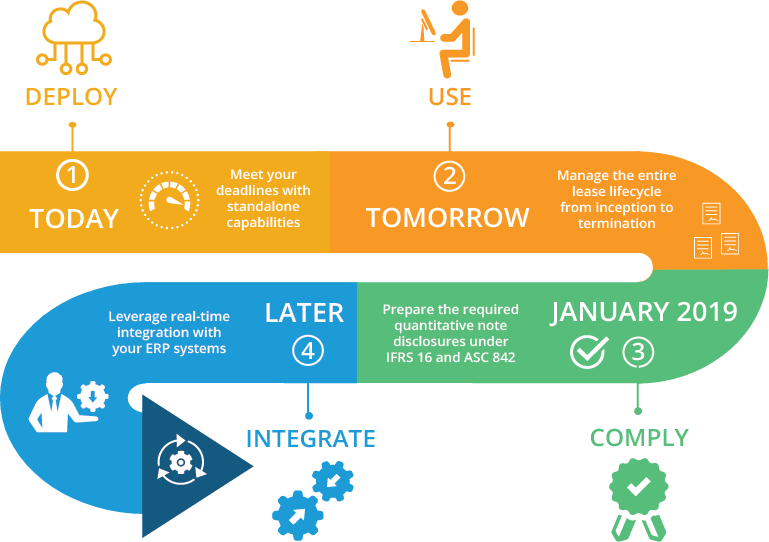

If you’re having trouble coping with the unprecedented changes to the lease accounting standards, know that you’re not alone. Accounting under the new standards is complex. Many organizations are looking for a way to speed up their implementation process, but this can’t come at a cost of functionality and accounting capabilities. What most organizations don’t realize, is that after data collection, integration is one of the most time-consuming steps in the implementation process. Unfortunately, there’s no work around for data collection (it’s critical that all lease contracts are consolidated in a single repository). However, initial focus can be put on accounting and compliance with integration following after your deadlines to further simplify ongoing lease management and accounting.

Accounting Complexities Under the New Standards

The new lease accounting standards will affect the balance sheet of lessees in two ways:

- The lessees will need to create an asset

- The lessees will need to create a liability of the ROU asset or the leased asset

The accounting of both assets and liabilities are equally important. Initial recognition of the lease liability comes at the commencement date of a lease. One key difference in the new rules is that certain changes in the decision to exercise the renewal, purchase or termination options are subject to remeasurement of the lease liability (and ROU asset) and hence the lease liability (and ROU asset) is adjusted accordingly. With increasing balance sheet volatility, a lease accounting solution is required to determine the revised lease payments and recalculate the lease liability (and ROU asset).

Leveraging Financial Data BEFORE Integration

With initial focus on meeting compliance deadlines, deployment can be simplified by abstracting data from specific organizational units using a combined effort from project teams and ready-to-use configuration templates. In this scenario, your lease accounting solution provides entities with the flexibility to select which master data configuration is required for deployment and which can be individualized at a later time.

Before integration is configured, lease accounting technology can be used to amortize ROU assets and lease liability schedules internally. It remains important that this data is reflected in your ERP systems. Postings are generated in various file formats to support mass upload in a manual fashion.

Achieving Efficiencies with Integration

Integration is very important in order to eliminate manual work and simplify lease accounting. As lease liabilities and ROU assets go through frequent remeasurements due to changes in the lease terms and conditions and also due to changes in user decisions in terms of extension and termination, the information needs to be reflected in ERP systems.

When integrated, postings are sent directly to the GL accounts of your ERP systems. Most organizations are resistant to unnecessary changes as it requires a great deal of time and effort to make changes globally. A lease reconciliation account can be used as an alternative to the accounts payable account in order to minimize changes to existing processes.

We Can Help You Make Your Deadlines

Nakisa Lease Administration is designed to accelerate compliance with the new lease accounting standards by automating, centralizing, and simplifying lease accounting operations. Offered as a cloud solution with standalone capabilities, Nakisa Lease Administration supports IFRS 16 and ASC 842 compliance initiatives while ensuring deadlines are met.