The new lease accounting standards, IFRS 16 and ASC 842, are the result of a joint effort between the IASB and FASB to meet the objective of improved transparency, comparability and financial reporting requirements. The impact of this effort on business processes is already giving the Sarbanes-Oxley Act (SoX) a run for it’s money, with some economic estimates indicating that the global impact will be as much as $3.3 trillion in operating lease obligations and aggregate changes to company balance sheets.

With effective dates for IFRS 16 and ASC 842 fast approaching, organizations worldwide are in a mad scramble for a solution. With aggressive implementation timelines (including go-live dates of “a month ago”), it seems like the market can’t quite move fast enough.

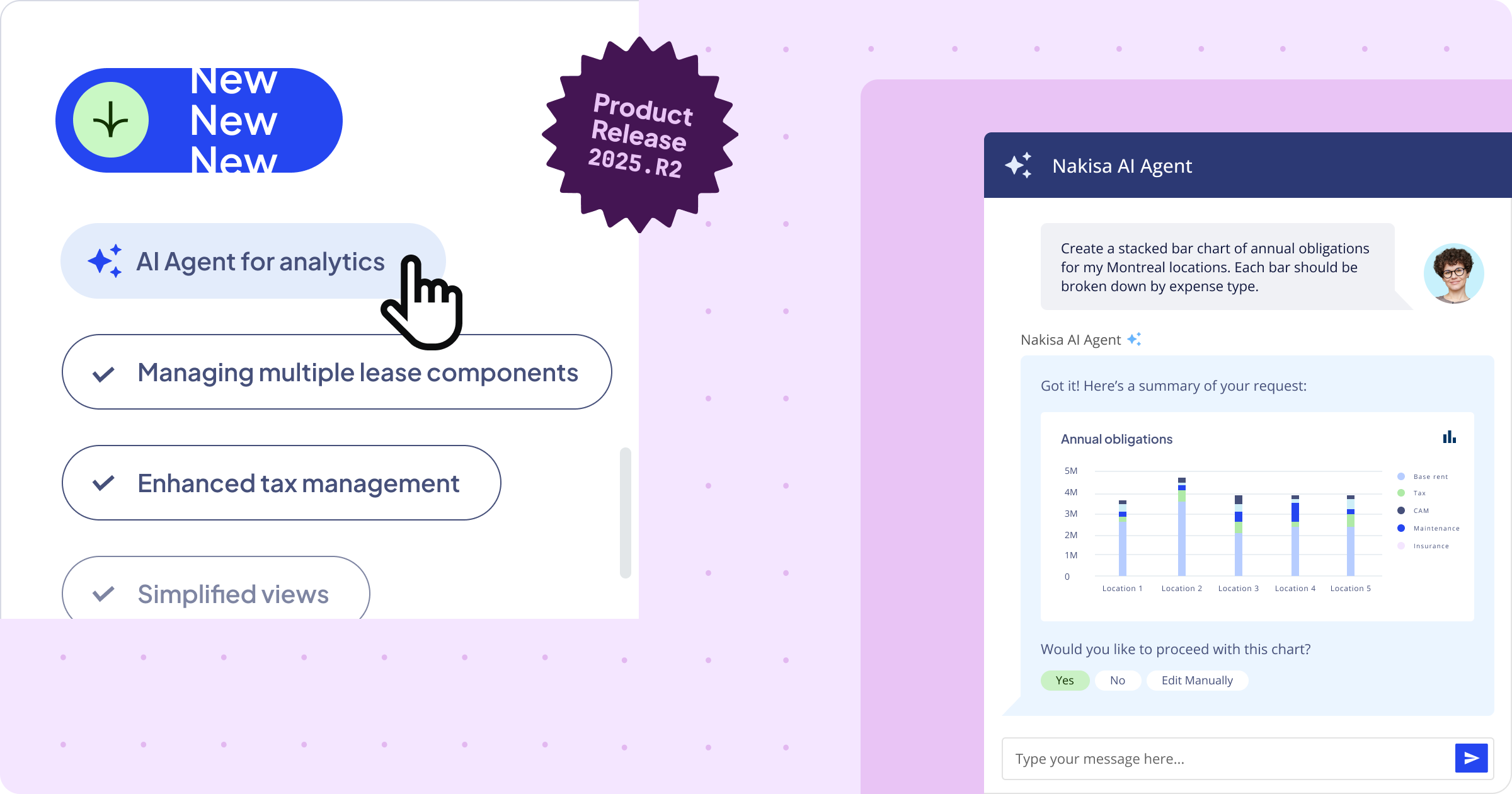

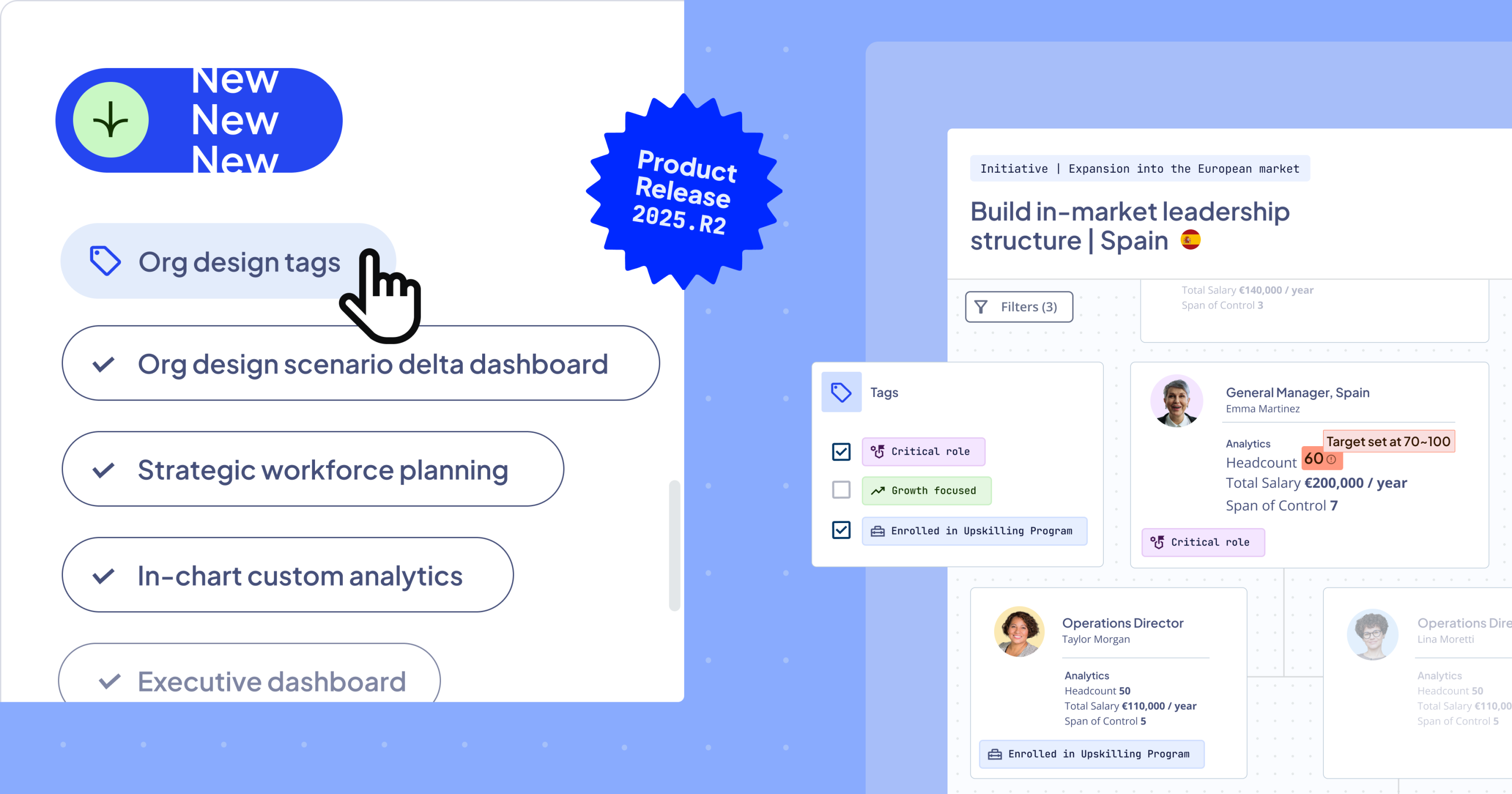

Nakisa has been analyzing this topic since 2010 and has partnered with SAP to tackle this critical issue. The result of this collaborative effort is Lease Administration by Nakisa, a comprehensive lease accounting solution. Lease Administration by Nakisa assists customers by enabling lease accounting compliance and streamlining lease administration processes for global lease portfolios. The new release, version 4.0 is the result of hundreds of interviews with SAP customers and the major accounting advisory firms on the new lease accounting standards and takes lease accounting to the next level with enhanced support for IFRS 16 and ASC 842 and additional functionality.

Key enhancements:

- 1Enhanced Compliance with the new standards – Supports the use of parallel accounting in SAP through Ledger and Account approach

- 2Better Control - Enables users to manage the lease process and cascade fields from the Master Lease Agreement to the Contract level

- 3Strong Central Governance - Enables control of lease contracts with multi-layered approval process resulting in clear segregation of duties

- 4Integrated Questionnaire – Assistance with contract creation process and support with audits using a detailed audit trail

- 5Broader Systems Integration – Improved SAP integration, 3rd party system integration support, and disconnected-state support

- 6Additional enhancements include:

- Management of new Lease Events: multiple lease activations, reassessment scenarios, extension options, casualty, replacement, return/transfer of assets, (early) termination, and buyouts

- Mass upload capabilities using Excel

The new functionality enhances the solution to better support comprehensive lease accounting requirements and transition accounting, allowing you to; manage your lease portfolio, transition to the new standards, process the required accounting lookback, and fulfill reporting requirements. This is something that every business with operating lease commitments cares about.

The good news (ish) is that you aren’t alone and almost everyone is behind schedule – the most obvious reason being implementation of the new revenue recognition rules (IFRS 15). The real question becomes: what steps can you take to ensure you are ready?

Click here to learn more about the new lease accounting standards and what actions you should be undertaking now to assure compliance, with this joint webinar hosted by the IMA and presented by SAP, Deloitte, and Nakisa: “Leases On The Balance Sheet And Compliance With The New Standards”.