Pharmaceutical companies are adept at operating in a fast-paced industry. But the COVID-19 crisis presented a substantial challenge that continues to test the limits of each unit of your business. R&D priorities have almost completely shifted, supplies are stretched, demand is high as ever, and sustainable growth is a constant concern. How is your company acquiring the assets it needs to keep pace? If leased property and equipment forms a large part of the equation, it’s very important to be compliant with current lease accounting regulations and understand how these will affect your company’s balance sheet.

Accounting for leases

Leasing assets has proven attractive in this sector. This strategy provides a great way to introduce high-tech equipment into your operation while conserving cash and leaving the door open for upgrades down the line. For instance, assets like capsule fillers, sifting machines, sterilizing equipment and more can be leased for small monthly installments, removing the burden of owning capital-intensive assets that quickly depreciate as they age. Now that you have been leasing equipment and property on a greater scale due to COVID-19, your accountants may be feeling squeezed by the compliance demands of ASC 842 or IFRS 16, the laws that require most of your leased assets to be reported on your balance sheet. The best way to process all your leasing data in accordance with these regulations, and produce the mandatory disclosure reports, is to adopt or upgrade your lease accounting software.

Measuring the impact of IFRS 16 and your local GAAP on your balance sheet

There are many things to consider when the costs of your leases appear in the general ledger.

Leases are exposed

The first is that the increased nuance of lease accounting has left your balance sheet looking materially different. Before the rules came into effect in 2019, enterprises would routinely treat leases as operating expenses and include them in the notes section of their financial statements. The days of having such expenses go unnoticed are over. The regulations mean that, for many pharma companies, millions of dollars in ROU assets and lease liabilities have been exposed to the public, which can affect how your company’s financial situation is perceived.

Contracts are scrutinized

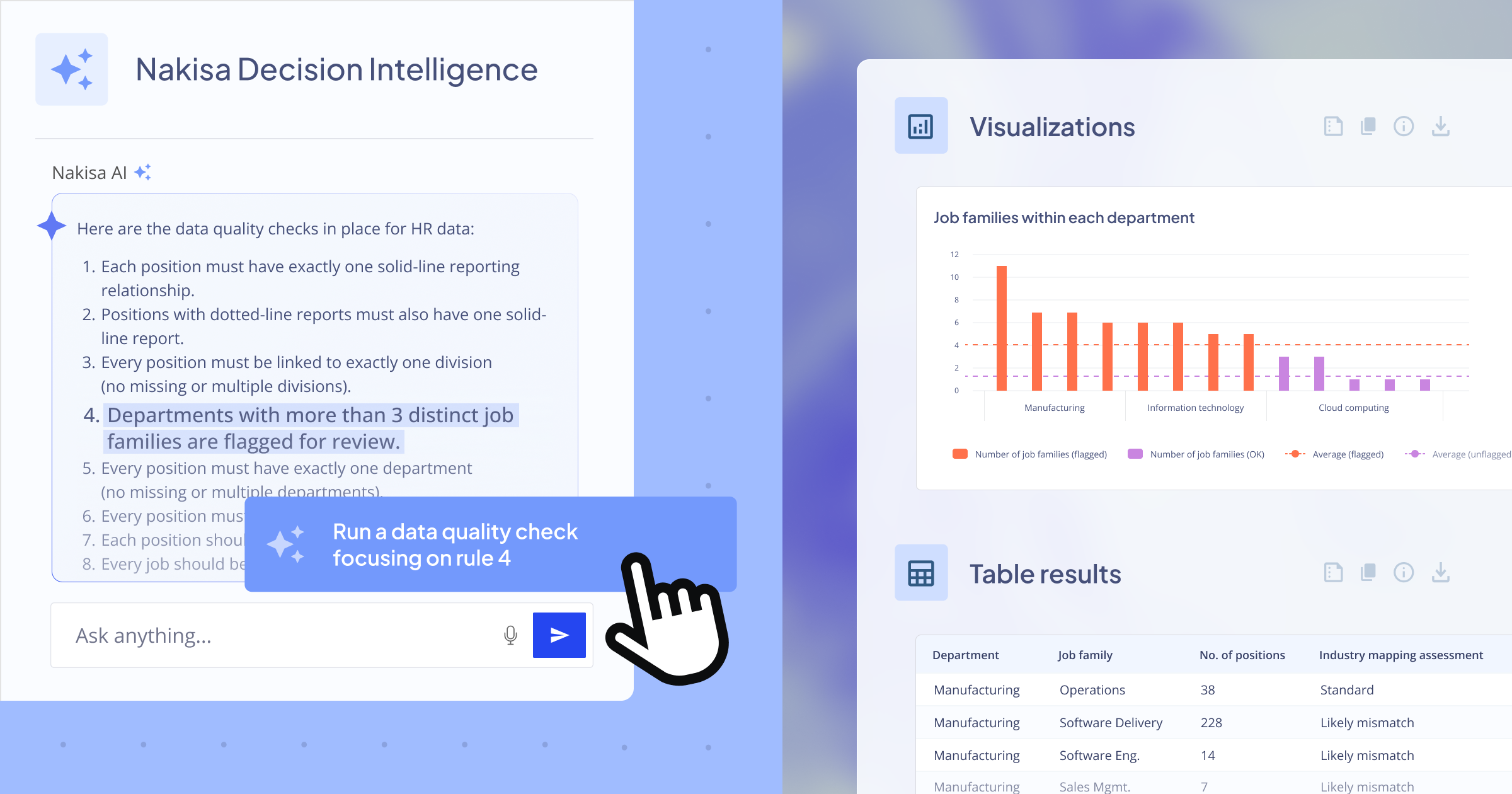

For company leaders, the increased scrutiny placed on lease contracts may have brought key internal benefits. Companies have likely paid more attention to critical dates and evaluate whether contracts should be tacitly renewed beforehand. Lease accounting software featuring built-in critical date alerts and notifications, like Nakisa Lease Administration, can help pharma companies avoid massive contract cancellation fees.

Software helps ensure compliance and increase efficiency

However, the sheer number of contracts pharma companies contend with today makes budgeting a challenge. One only needs to look at the situation surrounding production of the COVID-19 vaccine to get a sense of the magnitude of newfound complexity. We saw Merck loan two facilities to competitor Johnson & Johnson: one provided fill-finish services and the other produced the vaccine. Meanwhile Moderna, which owned only one facility in December 2020, struck deals with multiple companies to help manufacture and package its vaccine. To reign in expenses, organizations need to adopt centralized contract management, complete with accurate and up-to-date data.

This helps immensely with agility and efficiency as well. For example, perhaps your company is paying several million dollars to lease packaging equipment that serves multiple different facilities. Full visibility of these contracts, coupled with software-enabled financial analysis and reporting, would make it easier for your financial planning teams to identify whether the equipment is only really needed at one or two locations. If that were the case, the move to cancel or modify the contracts would be reflected in the form of better cost management.

Are you equipped for compliance?

Compliance is key to maintaining your reputation, especially with auditors. Recently at the annual CBI Finance & Accounting for Bioscience Companies Conference, finance leaders from the pharmaceutical sector discussing these lease accounting regulations agreed that one of the biggest compliance challenges involved operationalizing changes across their enterprise. Attempting to do this manually with spreadsheets just won’t cut it. Pharma companies engage in many complex arrangements with suppliers and partners, and evaluating the circumstances surrounding each contract is key to proper accounting. Leaders across industries agree that adopting lease accounting and management software is the only way to sustainably manage large volumes of complex contracts and streamline compliance

When looking for such a platform, choose one that comes with management dashboards, and supports multiple currencies and languages to help drive compliance in all countries in which you operate. Nakisa Lease Administration software was tailor-made by accountants to serve enterprises with these benchmarks in mind. Our intuitive solution has saved our clients in the pharmaceutical industry as many as 2,500 hours per month by simplifying lease administration and core finance operations as well.

Talk to us and see why Nakisa Lease Administration is the best lease accounting and management solution for pharma companies in the post-pandemic environment.

SCHEDULE A CALL NOW