In 2015, the US Securities and Exchange Commission (SEC) undertook a rare review of its rules with the understanding that the world has changed significantly since the last overhaul in 1977. In doing so, the regulator recognized that the primary driver of a company’s value is now human capital and not physical capital. This was the first step towards human capital disclosure requirements.

Ensuring your company’s workforce is made up of employees from diverse backgrounds is about more than ethics or compliance. It’s now an investment matter. Last year, the SEC mandated human capital disclosure from publicly traded companies. Within a few years, the change will permeate all organizations, even privately-held companies and nonprofits. This means that investors now require an enhanced understanding of how companies manage their workforce—and on the other side of the coin, companies will need to deal with investors who are concerned with how businesses align with their own personal values. Part of this broader management also involves having a clear physical security plan to protect both human and physical capital, ensuring a safe and supportive work environment that meets modern compliance standards.

“I am particularly supportive of the increased focus on human capital disclosures, which for various industries and companies can be an important driver of long-term value,” said SEC chairman Jay Clayton when the new measures came into effect in November 2020. Until then, according to the SEC’s 1977-era rules, public companies were only obligated to disclose the number of employees in their company. Now they are required to share more details about their workforce, including a description of its human capital resources as well as any human capital measures or objectives, such as those related to employee safety, engagement and retention, as well as attracting and developing talent. All of this information will now be considered by investors before they buy or sell a company’s stock.

Something to keep in mind is that this does not just have an impact on generating various reports. If an organization fluctuates on their human capital score, it will now have to explain in its SEC report what its plan is to improve. The organization will also need to comment on new HR initiatives, software systems, new total compensation approaches and new performance management processes. What’s important is not just sharing the results of the organization’s human capital but commenting on how the human capital score affects the company and explains management processes.

Four key takeaways from the SEC’s new regulations

- There are no specific metrics offered, but the SEC has provided clear direction.

- The disclosure requirements came into effect for publicly-traded companies in November 2020.

- There is a risk of SEC action or shareholder lawsuits if a company does not make a human capital disclosure.

- The International Organization for Standardization (ISO) recommends 10 metrics for public reporting by small and medium organizations and an additional 13 for by large organizations.

How your organization should begin creating reports for its human capital disclosure

Nakisa recommends starting with an outline of all the recommended criteria. Here, we’ve listed what companies need to keep in mind when making their reports.

Metrics for small to medium sized firms

- Total workforce cost

- Turnover rate

- Number of employees

- Number of full-time equivalents

- Human capital ROI

- Development and training cost

- Percentage of employees who have completed compliance training

- Number of accidents

- Number killed during work

- Revenue per employee

Additional metrics for large firms

- Diversity by age, gender, and disability

- Leadership diversity

- Time to fill vacant positions

- Time to fill critical vacant positions

- Percentage of positions filled internally

- Percentage of critical positions filled internally

- Leadership trust

- Percentage of employees who receive training

- Percentage of leaders who receive training

- Percentage of leaders who receive leadership development

- Average hours of training per year

How large enterprises can leverage HR data and create reports

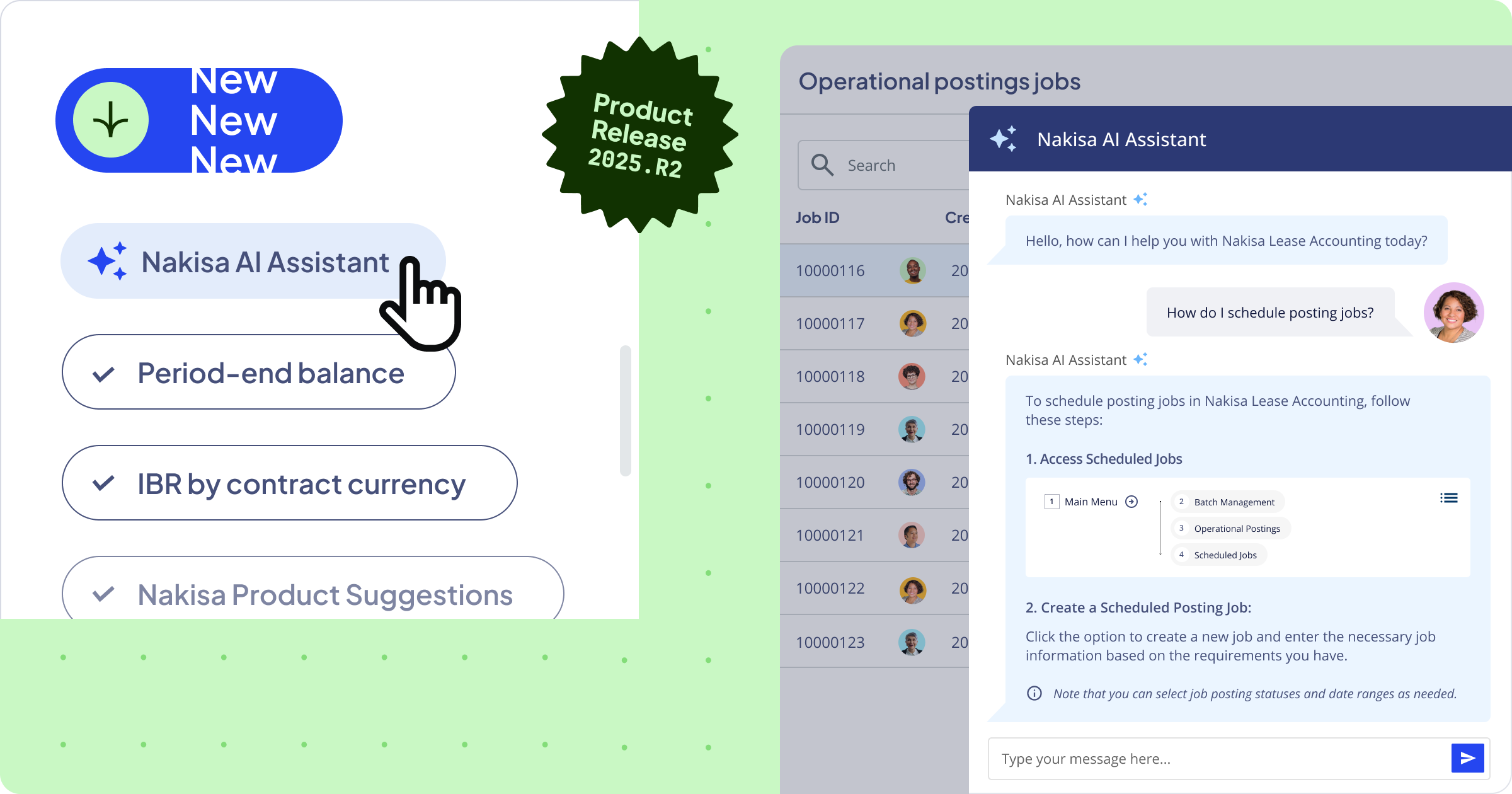

Nakisa Hanelly’s DE&I solution allows leaders to visualize data across multiple organizational structures—all with a single tool. The solution enables users to create and extract various diversity, equity and inclusion reports to ensure that their company disclose workforce composition, metrics and objectives, and track performance against objectives. With Nakisa Hanelly DE&I, organizations can develop customized, targeted filters to flag unconscious bias, focus on potential problem areas, and measure the effect of targeted DE&I initiatives using the Diversity and Equity Analyses and Timelines. Nakisa Hanelly’s user-friendly dashboards enable HR professionals to demonstrate how any potential DE&I initiatives might impact business performance metrics over time.

It also allows users to collaborate in real time, model any proposed organizational changes, and share insights with all stakeholders securely to reinforce progress toward goals and improve accountability.

Using Nakisa Hanelly DE&I features, business leaders in large enterprises will be able to make conscious and considered choices to foster a thriving, more inclusive, and more diverse workforce.

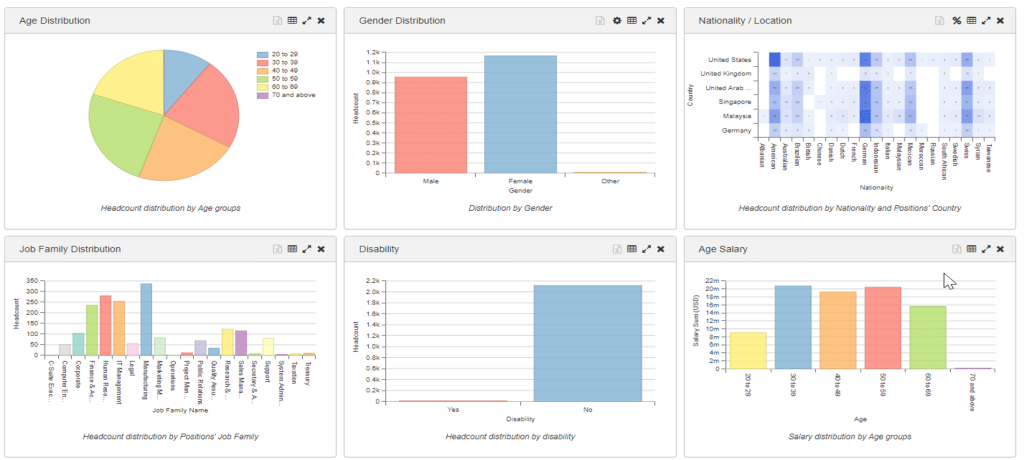

Dashboards that can help meet SEC disclosure requirements

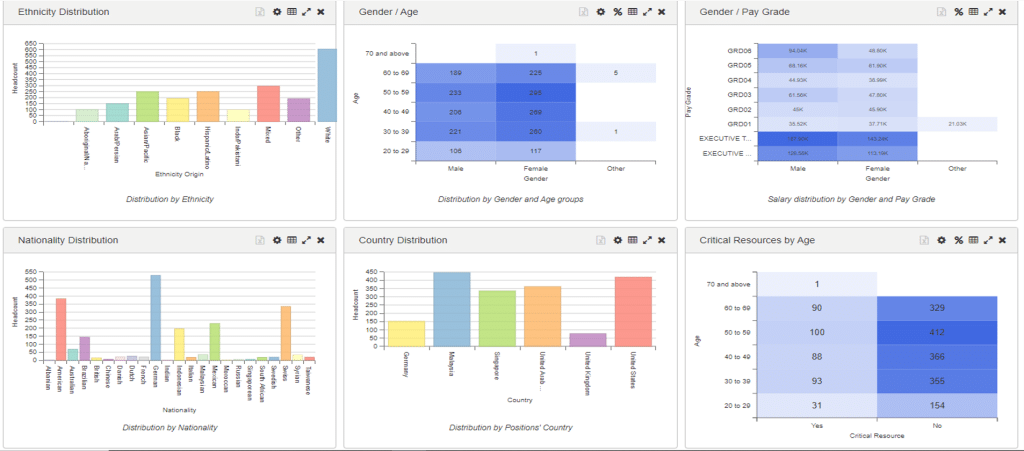

Employee dashboards

Report on age and gender distribution, nationality by location, salary by age group, headcount by disability, gender by pay grade, risk of loss by gender or minority, and many more.

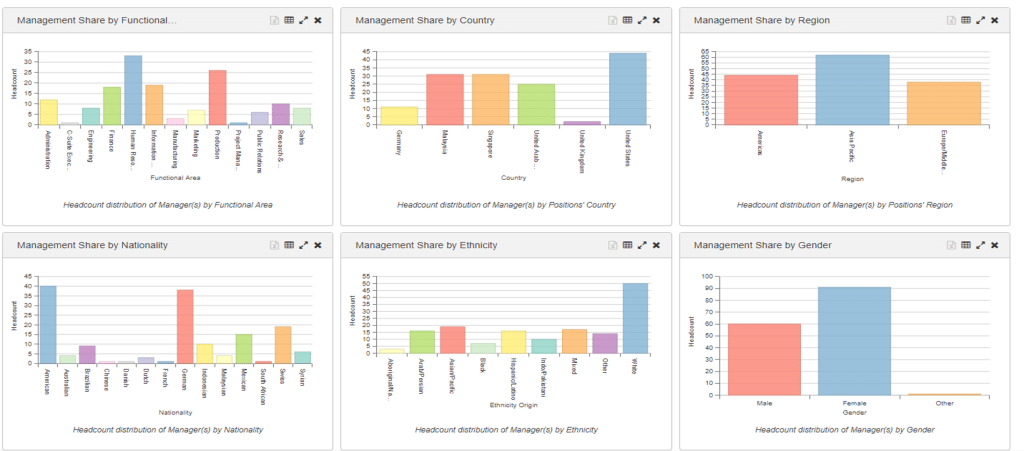

Management dashboard

For governance and other purposes, report on management share by gender, ethnicity, nationality, and more.

See how Nakisa Hanelly can help your organization achieve SEC compliance.