Secure, compliant enterprise lease accounting and budgeting software

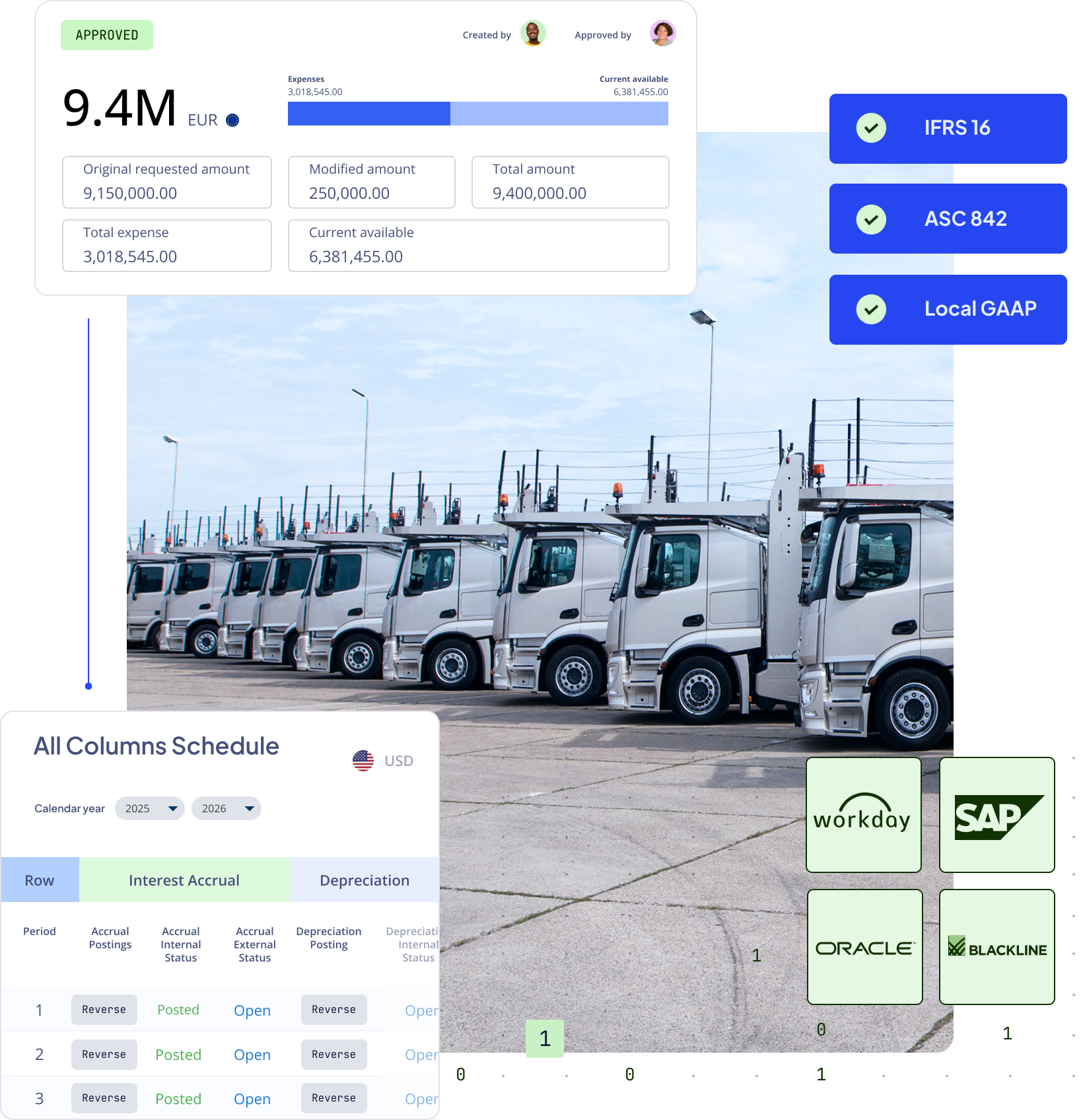

The Nakisa Accounting Portfolio is an AI-powered, cloud-native solution that streamlines financial oversight from forecasting and budgeting to lessee and lessor lease accounting and analytics. It features native, bidirectional integrations with SAP, Oracle, and Workday, and ensures parallel compliance with IFRS 16, ASC 842, and local GAAP to perfectly serve global companies.

Secure, compliant enterprise lease accounting and budgeting software

The Nakisa Accounting Portfolio is an enterprise-grade, cloud-native solution that streamlines financial oversight from forecasting and budgeting to lessee and lessor lease accounting and analytics. It features native, bidirectional integrations with SAP, Oracle, and Workday, and ensures parallel compliance with IFRS 16, ASC 842, and local GAAP to perfectly serve global companies.

Fortune 1000 companies trust Nakisa’s lease accounting and lease management solutions

Fortune 1000 companies trust Nakisa’s lease accounting and lease management solutions

Tell us what you do, and we’ll help you achieve your best results

There’s no lease accounting need we can’t fulfill, no investment budgeting we can’t manage, and no fixed asset we can’t account for compliantly.

- Lease accounting

- Reporting & analytics

- Forecasting & budgeting

Nakisa Lease Accounting

Streamline end-to-end lessee and lessor accounting lifecycle for 100,000+ leased, sub-leased, and owned tangible assets (such as real estate, equipment, and fleet).

Manage mass operations, dual ledgers, multi-currency, multi-language, multi-calendar, multi-ERP, and parallel compliance with IFRS 16, ASC 842, and local GAAP.

Simplify complex lease accounting processes by managing variable rent calculations (e.g., CPI-based rent, escalating clauses, and sales-based rent), intricate lease structures (e.g., subleasing arrangements, embedded leases, and prepaid leases), lease reassessments (e.g., impairment, rent reductions, buy-out options), and year-end reconciliations for CAM, taxes, and insurance.

Accelerate period-end closings by 71%, eliminate errors, and drive proactive decision-making with intuitive tools, collaborative workflows, and AI-powered support, analytics, document abstraction, and automation of terms, conditions, and charges.

Achieve asset-level accounting delivering precise compliance, accurate reporting, and granular visibility by tracking each asset individually.

Ensure complete financial control and accurate period-end closings with automated period-end balance calculations, ledger enrichment mapping for seamless data consistency, and secure general journal entry workflows for controlled GL adjustments.

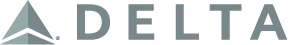

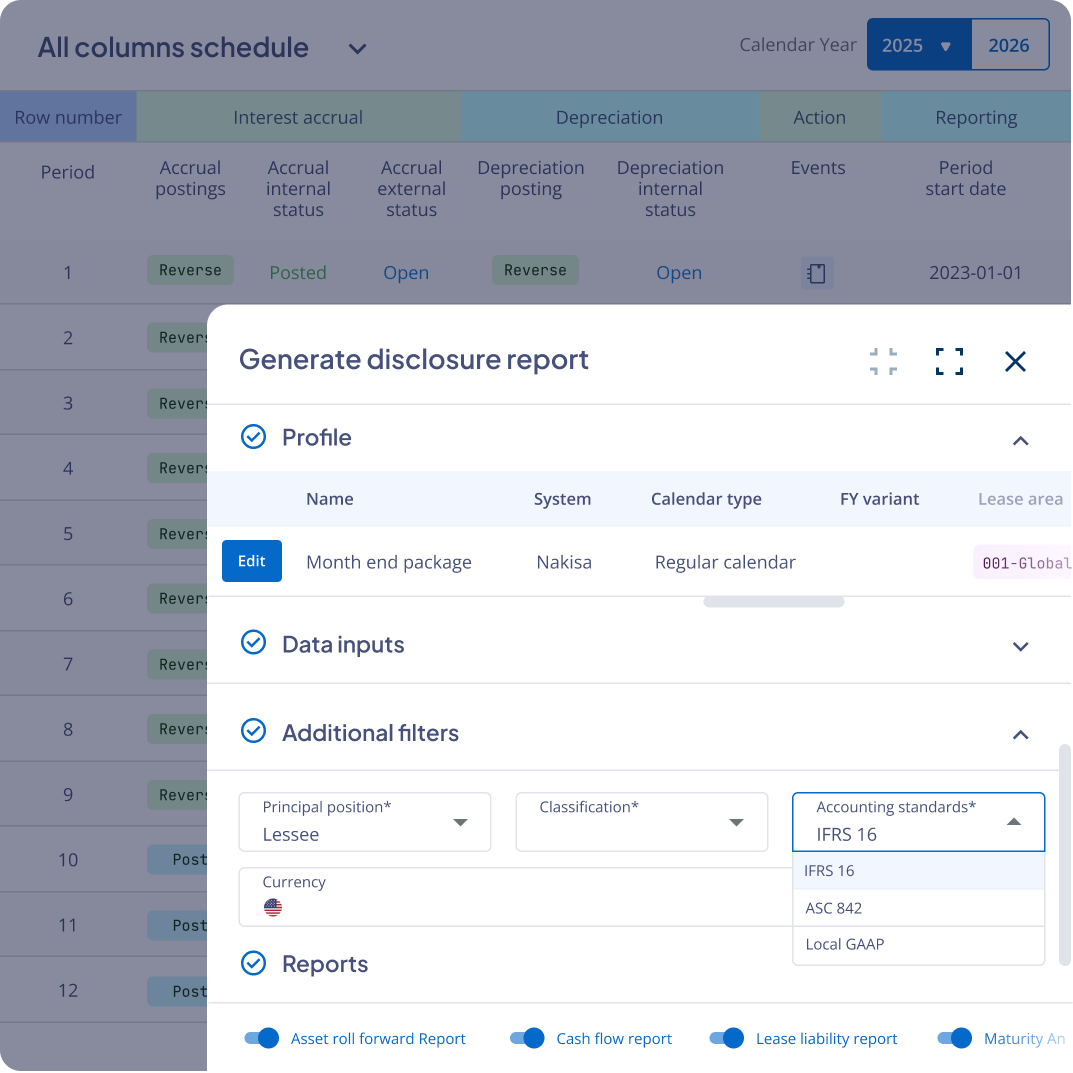

Generate AI-powered, out-of-the-box, auditable, and compliant financial reports such as Income Statement, Balance Sheet, and Cash Flow, along with detailed disclosure reports, including Asset Roll Forward, Lease Liability, Weighted Average Lease Term, Weighted Average Discount Rate, and Maturity Analysis, which support regulatory filings like 10-K and 10-Q.

Leverage a cloud-native platform for native bidirectional ERP integration (SAP, Oracle, and Workday), unmatched configurability, and rapid innovation.

USE CASES

Parallel compliance

Period-end closing

Auditing

Nakisa Financial Analysis and Reporting

Benefit from an IFRS 16- and ASC 842-compliant tool for enhanced global visibility into your leased assets.

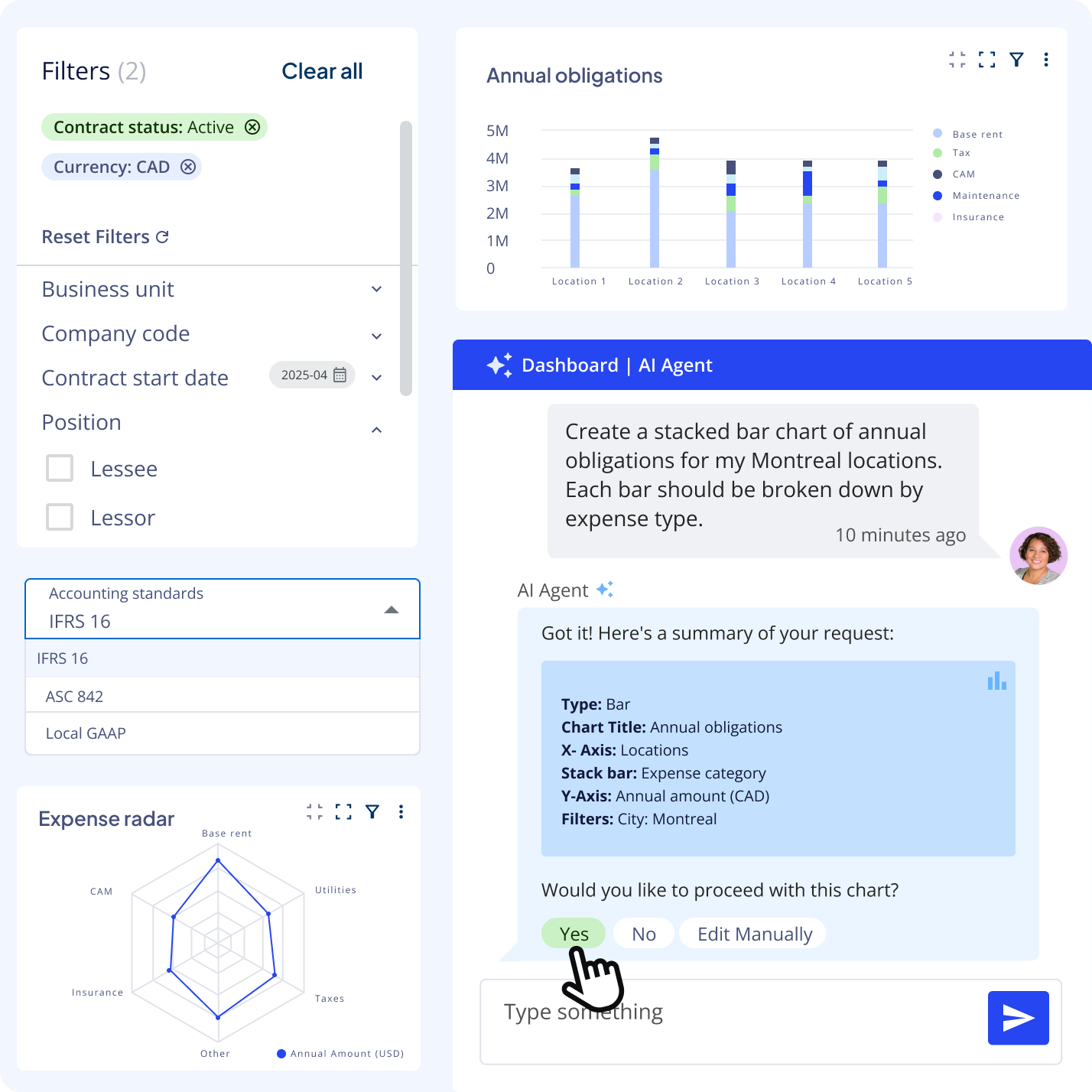

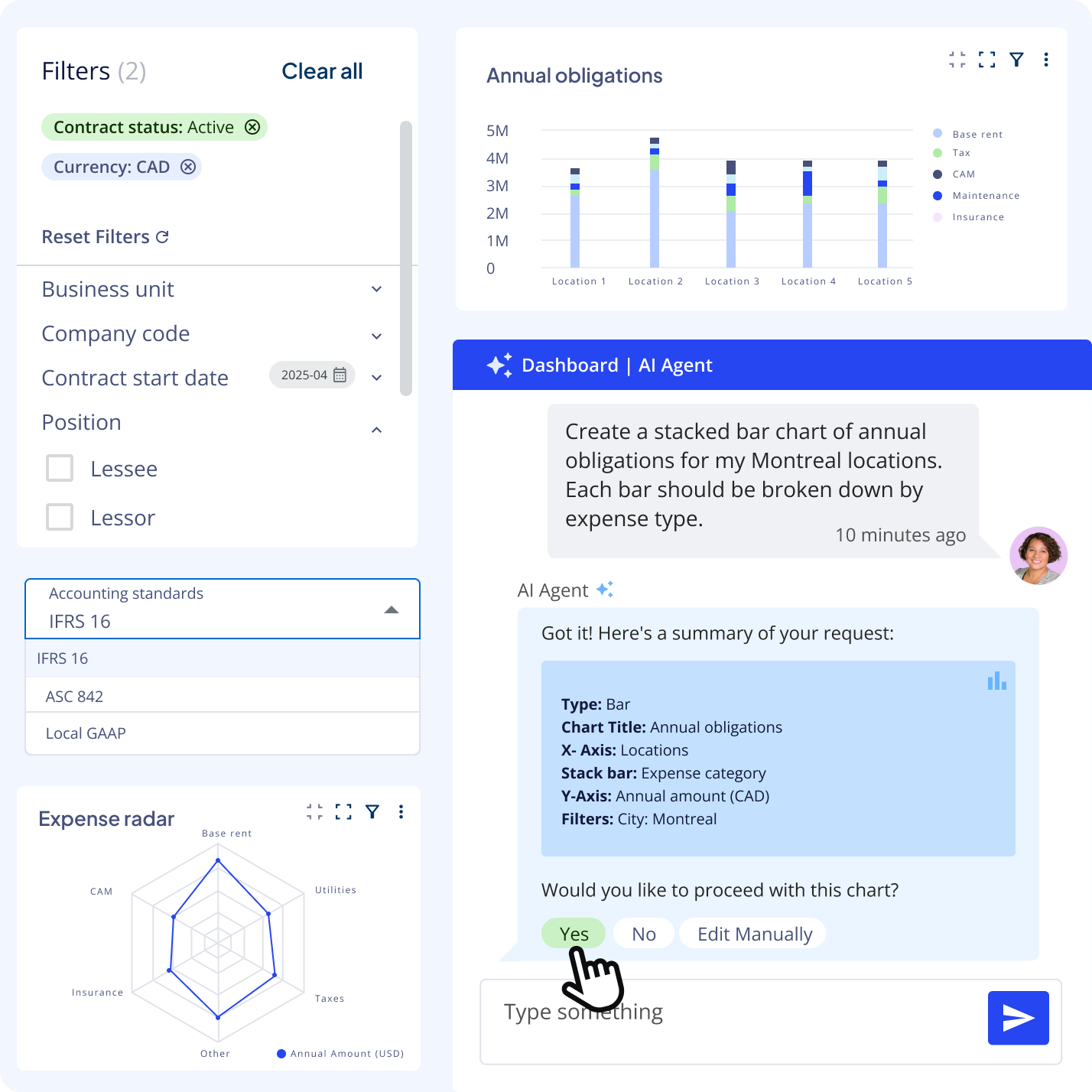

Leverage AI Agents to instantly generate insightful dashboards and deliver real-time, intelligent recommendations, all through simple, natural language prompts.

Leverage the Nakisa AI Agent for analytics and generate out-of-the-box and customizable analytics for real-time portfolio insights and KPI tracking using no-code formulas and flexible scripts. From location and premises dashboards to specialized reports like CAM reconciliation, percentage rent, and financial obligation and disclosure reporting, access the insights you need to support decision-making and compliance.

Collaborate by sharing dashboards and reports with team members, and ensure consistent updates by automating the delivery of monthly or quarterly reports to support data-driven decision-making.

Ensure data protection with robust security features, including role-based access control, multi-segregation, and ITGC compliance.

USE CASES

Financial analysis

Portfolio analysis

Financial planning & forecasting

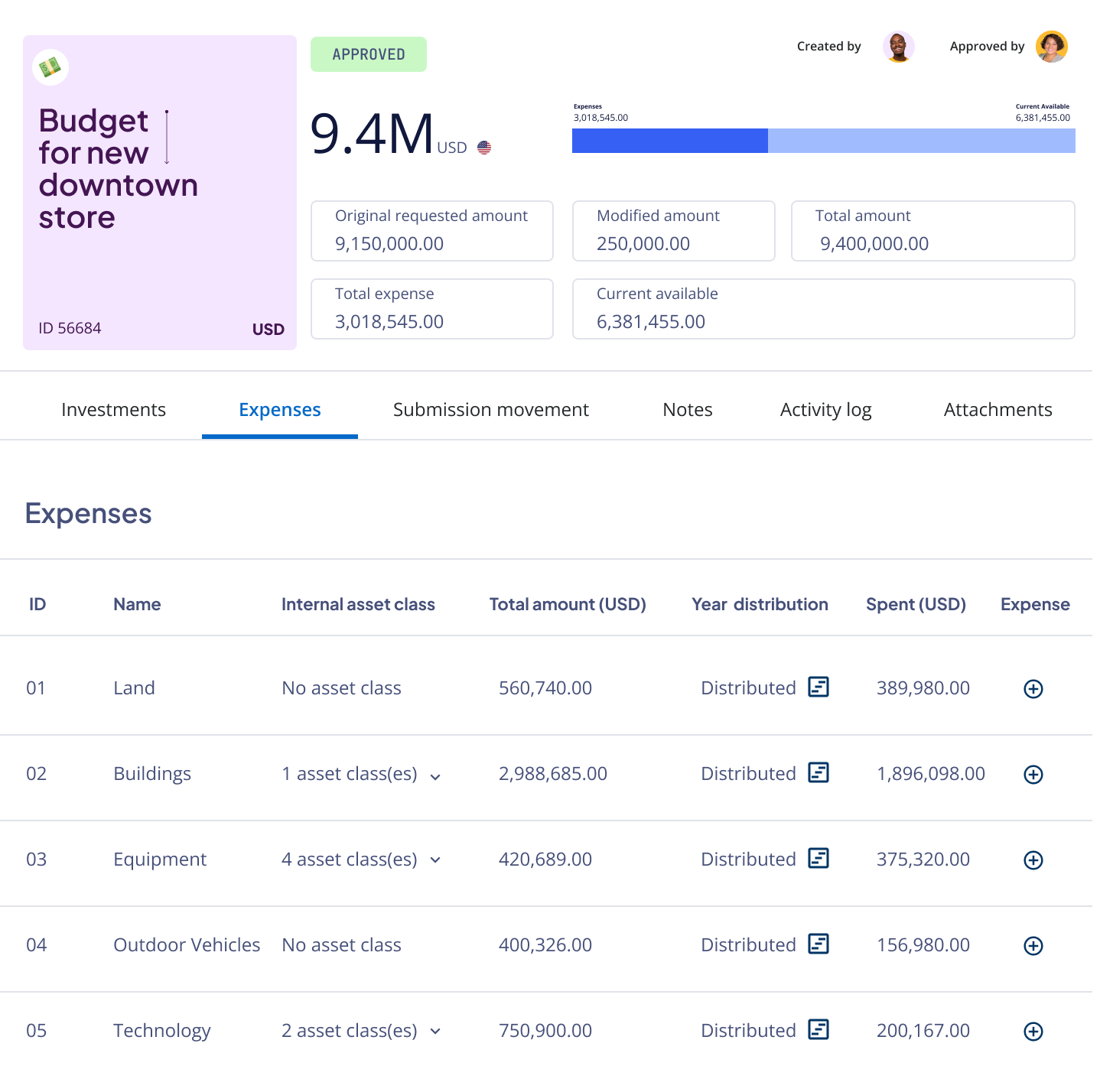

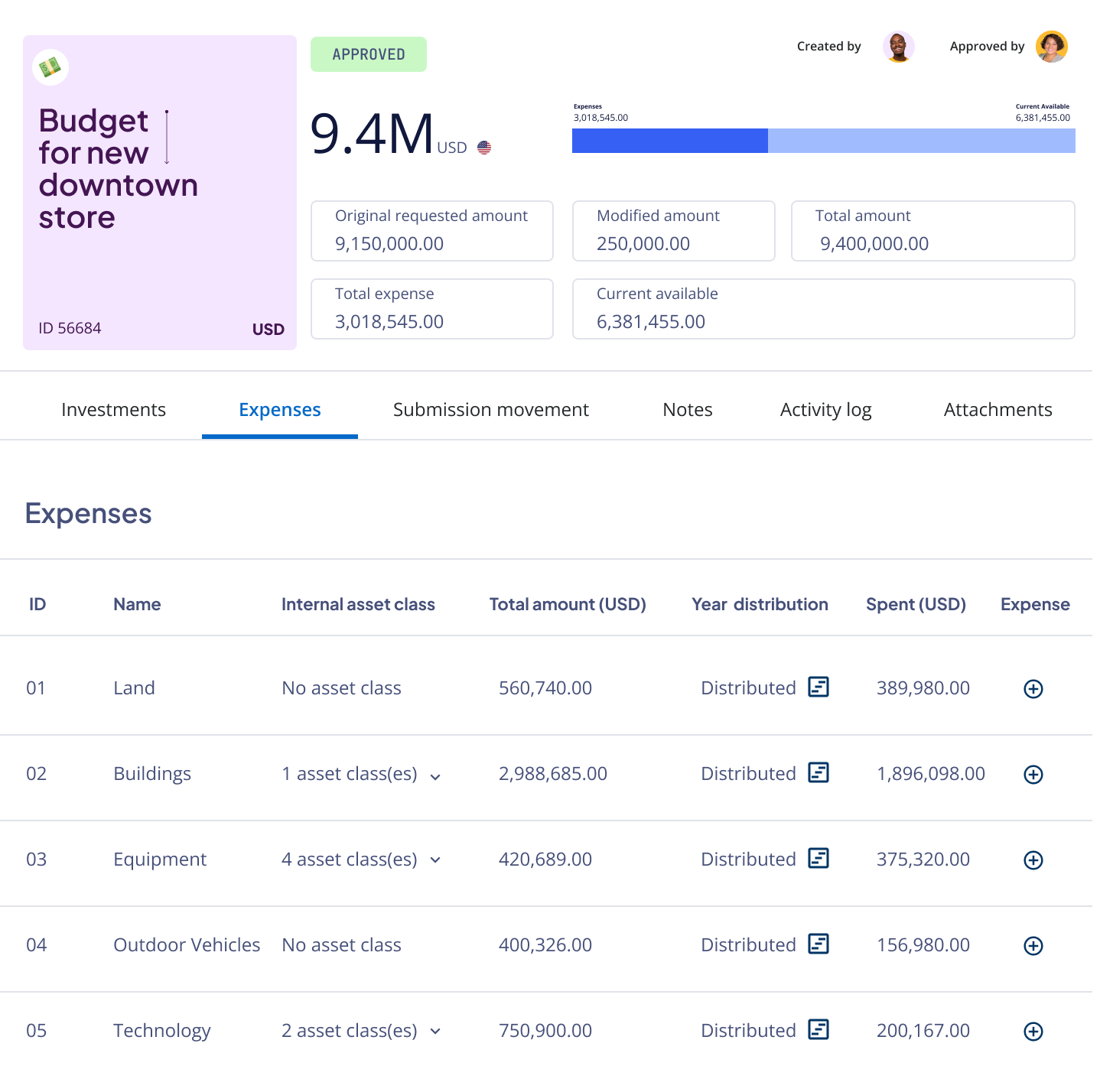

Nakisa Capital Investment and Budgeting

Streamline budget finalization with a budget approval workflow, enabling real-time tracking of actual expenses against the approved budget.

Initiate pre-approvals and request additional budget approvals when future cash outflows exceed the remaining budget.

Trigger notifications for adverse variances caused by lease events, keeping users informed of budget changes.

Analyze and visualize variances between budgeted amounts and actual expenses, offering enhanced financial oversight.

USE CASES

Forecasting and planning

Budget management and cost control

Financial reporting

Lease accounting

Nakisa Lease Accounting

Streamline end-to-end lessee and lessor accounting lifecycle for 100,000+ leased, sub-leased, and owned tangible assets (such as real estate, equipment, and fleet).

Manage mass operations, dual ledgers, multi-currency, multi-language, multi-calendar, multi-ERP, and parallel compliance with IFRS 16, ASC 842, and local GAAP.

Simplify complex lease accounting processes by managing variable rent calculations (e.g., CPI-based rent, escalating clauses, and sales-based rent), intricate lease structures (e.g., subleasing arrangements, embedded leases, and prepaid leases), lease reassessments (e.g., impairment, rent reductions, buy-out options), and year-end reconciliations for CAM, taxes, and insurance.

Accelerate period-end closings by 71%, eliminate errors, and drive proactive decision-making with intuitive tools, collaborative workflows, and AI-powered support, analytics, document abstraction, and automation of terms, conditions, and charges.

Achieve asset-level accounting delivering precise compliance, accurate reporting, and granular visibility by tracking each asset individually.

Ensure complete financial control and accurate period-end closings with automated period-end balance calculations, ledger enrichment mapping for seamless data consistency, and secure general journal entry workflows for controlled GL adjustments.

Generate AI-powered, out-of-the-box, auditable, and compliant financial reports such as Income Statement, Balance Sheet, and Cash Flow, along with detailed disclosure reports, including Asset Roll Forward, Lease Liability, Weighted Average Lease Term, Weighted Average Discount Rate, and Maturity Analysis, which support regulatory filings like 10-K and 10-Q.

Leverage a cloud-native platform for native bidirectional ERP integration (SAP, Oracle, and Workday), unmatched configurability, and rapid innovation.

USE CASES

Parallel compliance

Period-end closing

Auditing

Reporting & analytics

Nakisa Financial Analysis and Reporting

Benefit from an IFRS 16- and ASC 842-compliant tool for enhanced global visibility into your leased assets.

Leverage AI Agents to instantly generate insightful dashboards and deliver real-time, intelligent recommendations, all through simple, natural language prompts.

Leverage the Nakisa AI Agent for analytics and generate out-of-the-box and customizable analytics for real-time portfolio insights and KPI tracking using no-code formulas and flexible scripts. From location and premises dashboards to specialized reports like CAM reconciliation, percentage rent, and financial obligation and disclosure reporting, access the insights you need to support decision-making and compliance.

Collaborate by sharing dashboards and reports with team members, and ensure consistent updates by automating the delivery of monthly or quarterly reports to support data-driven decision-making.

Ensure data protection with robust security features, including role-based access control, multi-segregation, and ITGC compliance.

USE CASES

Financial analysis

Portfolio analysis

Financial planning & forecasting

Forecasting & budgeting

Nakisa Capital Investment and Budgeting

Streamline budget finalization with a budget approval workflow, enabling real-time tracking of actual expenses against the approved budget.

Initiate pre-approvals and request additional budget approvals when future cash outflows exceed the remaining budget.

Trigger notifications for adverse variances caused by lease events, keeping users informed of budget changes.

Analyze and visualize variances between budgeted amounts and actual expenses, offering enhanced financial oversight.

USE CASES

Forecasting and planning

Budget management and cost control

Financial reporting

See what Nakisa can do for your enterprise

Schedule time with our team to share your challenges and unique business requirements, and experience a personalized demo. Our solutions are built to address the most complex lease accounting, real estate, and facility management use cases that large enterprises face.

What people are saying

We worked closely with the Nakisa team to build a solution that would fit the size and requirements of a corporation like Nestlé and that would bring value to other similar organizations in terms of scale and accuracy. Nakisa has a lot to offer in terms of flexibility, user-friendliness, ERP Integration and its cloud solution.

Now the team can update contracts much faster and save a lot of time while working on monthly, quarterly, and annual financial reports. If before Nakisa some countries needed to spend 6-7 working days to identify financial impacts, now it only takes 1 day or, during a particularly eventful month, 2 days. This is a significant win for us. This efficiency benefits both the company and end users, ensuring accurate and timely presentation of financial statements.

Not only did Nakisa provide inherent workflows and automation for IFRS 16, generating time savings, but the solution’s built-in segregation of duties, audit logs, and disclosure reporting also met all our auditing requirements... The solution integrates seamlessly with our multiple SAP ERPs, our users find the tool easy to use, and our Group Finance and Financial Shared Service Center spend far less time resolving lease accounting issues.

Technology

Learn why Nakisa has been cloud-native since 2018

The industries we serve

- RETAIL

- PHARMACEUTICAL

- TRANSPORTATION

- FINANCIAL SERVICES

- TELECOM

- MANUFACTURING

Pharmaceutical

Transportation

Financial Services

Manufacturing

What sets Nakisa apart?

Built for large, complex enterprise portfolios

Nakisa easily handles complex scenarios like large contract volumes, high monthly activities, irregular calendars, multiple ERPs, standards, currencies, languages, modifications, and events. Our solutions grow with your success. We design and build all our upgrades based on what our clients want and what we know they'll need.

Native ERP integration and robust APIs

Connect isolated data sources, ERPs, and various SaaS tools with the open platform to build one source of truth. Use native bidirectional ERP integrations (SAP S4/HANA, SAP ECC, Oracle, Workday) and robust APIs to streamline, validate, and write back data. Ensure data integrity with our technologies.

Learn more about Nakisa's integrations

Parallel compliance with IFRS 16, ASC 842, local GAAP

Fortune 1000 companies have successfully used Nakisa for reporting and disclosures since the inception of the new accounting standards. With Nakisa, manage all your leases under these standards simultaneously on one unified platform. Our lease accounting system accommodates each standard’s unique requirements and allows you to generate disclosure reports accordingly.

Learn more about Nakisa's compliance

Automation and AI-driven innovation

Unlike other vendors, Nakisa is built on an innovative cloud-native platform, leveraging microservice-based architecture. This robust technology provides clients with the flexibility, resilience, and speed they need to thrive in today’s digital landscape.

Integrated with state-of-the-art generative and agentic AI and leveraging Retrieval-Augmented Generation (RAG), Nakisa automates daily tasks, reduces manual workloads, and boosts productivity.

Learn more about Nakisa's technology

Explore Nakisa's AI capabilities

Team-specific UIs, single asset repository

Various teams can leverage purpose-built interfaces and tailored features to meet their specific goals, all while working from a unified data repository. With seamless cross-product data integration and analytics, teams gain a holistic view and can make data-driven decisions with confidence. Granular role-based access controls and robust segregation of duties ensure secure collaboration, data integrity, and compliance.

Cyber security and data privacy

Nakisa is built on a secure platform with data encryption, role-based access control, Single-Sign-On, and audit capabilities to ensure compliance requirements with provide SOC 1 Type II & SOC 2 Type II, ISO 27001, ISO 27017 FIPS 140-2, GDPR, and IT General Control (ITGC). Learn more about Nakisa's security

What sets Nakisa apart?

Built for large, complex enterprise portfolios

Native ERP integration and robust APIs

Connect isolated data sources, ERPs, and various SaaS tools with the open platform to build one source of truth. Use native bidirectional ERP integrations (SAP S4/HANA, SAP ECC, Oracle, Workday) and robust APIs to streamline, validate, and write back data. Ensure data integrity with our technologies.

Parallel compliance with IFRS 16, ASC 842, local GAAP

Fortune 1000 companies have successfully used Nakisa for reporting and disclosures since the inception of the new accounting standards. With Nakisa, manage all your leases under these standards simultaneously on one unified platform. Our lease accounting system accommodates each standard’s unique requirements and allows you to generate disclosure reports accordingly.

Automation and AI-driven innovation

Team-specific UIs, single asset repository

Cyber security and data privacy

Nakisa is built on a secure platform with data encryption, role-based access control, Single-Sign-On, and audit capabilities to ensure compliance requirements with provide SOC 1 Type II & SOC 2 Type II, ISO 27001, ISO 27017 FIPS 140-2, GDPR, and IT General Control (ITGC).

Ready to optimize your finance and real estate management?