Intro - What You'll Learn

Lease contracts are the most popular means for organizations to support their operations. By opting for leasing as opposed to owning, companies can acquire the latest equipment, preserve their working capital, and avoid hefty upfront payments. In fact, around 80 percent of U.S. companies choose to lease some or all their equipment, as reported by the Equipment Leasing and Finance Association (ELFA).

With so many companies relying on leasing, the importance of effectively managing these leases cannot be overstated. This is where enterprise-grade lease management software steps in to save the day. It offers a range of valuable benefits, including streamlined lease accounting processes, lease accounting compliance, and centralized access to essential lease data.

Just the act of selecting lease management software itself is truly onerous work. You could use some experienced, expert guidance to choose your ideal solution. That is why we leveraged our 10+ years of domain experience to build this buyer's guide. We will help you select the best lease administration software for your unique business requirements. Throughout this guide, we will provide you with valuable insights on a variety of topics. You can expect to learn about the distinct types of leases, discover essential software features worth considering, compare various lease management solutions, and stay informed about the latest emerging trends within the industry.

Why trust this guide? We’re Nakisa, a trusted leader in lease management. We tapped our army of certified experts to lend their expertise to write this guide. Backed by 10+ years of experience and deep insights into lease management for large enterprises, we are uniquely qualified to guide you in choosing the perfect solution that precisely aligns with your requirements.

As a bonus, this guide links to our comprehensive vendor selection scorecard (RFP Checklist & Features Template). This scorecard allows you to easily compare up to three vendors across nearly 150 critical lease management criteria. And because your use case is unique, this resource offers evaluation criteria with weighted scoring that enables you to prioritize essential features based on your business needs. With this guide and the linked scorecard, you can make informed purchasing decisions to drive your lease accounting forward. Let us find the solution to propel your lease management to new heights!

Step 1 - Understanding the types of Leases

A comprehensive understanding of the distinct types of leases and their fundamental disparity is essential for effectively managing leasing activities across an enterprise. Without this understanding, lease management can quickly become fragmented, leading to disjointed decision-making where critical information may be overlooked. To facilitate your understanding, lease types can be categorized into two main groups as outlined below:

Real Estate Leases - This category involves land or structures, such as corporate offices, distribution centers, warehouses, or manufacturing plants.

Equipment Leases - On the other hand, equipment leases encompass a broader range of assets, from coffee machines, rail cars, airplanes, and everything else in between.

However, the fundamental disparity between equipment and real estate leases lies in the number of units leased in a specific contract. Real estate contracts often pertain to a single unit, whereas equipment contracts may involve thousands of units within the same agreement.

Furthermore, real estate rents are market-driven and frequently based on utility metrics like cost per square foot. In contrast, equipment lease rents can be determined by lease rate factors expressed as percentages or multipliers of the equipment value. These are just two examples of the many possible disparities between real estate and equipment leases. While organizations with a less complex lease portfolio might manage with alternative leasing solutions such as spreadsheet-based management, those with more complex lease portfolios will undoubtedly require an enterprise-grade lease management solution.

Therefore, we recommend starting by evaluating your organization's lease management needs. Consider factors such as the number of leases, lease types (e.g., real estate, equipment), lease complexity, and lease lengths. Determine if you need features such as lease classification, lease modification tracking, and automated lease calculations. Considering these factors will guide you in selecting the most suitable lease management solution that meets your organization's unique requirements.

Step 2 - 5 Key Elements to Look for in a Lease Management Software

Once you understand your lease management requirements, the next step is to select the right solution for your enterprise. This task can be particularly challenging when aiming to satisfy the expectations of multiple stakeholders, including executives, finance, and IT teams.

At Nakisa, we have your back. With extensive experience working alongside large enterprises managing over 10,000 lease contracts, we have honed our expertise in implementing top-notch lease management solutions. And now, we are here to share our insights by offering you a vendor scorecard (RFP Checklist & Features Template) that is built from exclusive consultations with certified lease management professionals.

Even before you get to the scorecard’s nearly 100 criteria, here are the five features that we consider particularly noteworthy when selecting a vendor. From experience, these features are the most critical things to evaluate, paving the way for you to choose the most suitable and effective solution for your organization.

2A- Compliance with Accounting Standards:

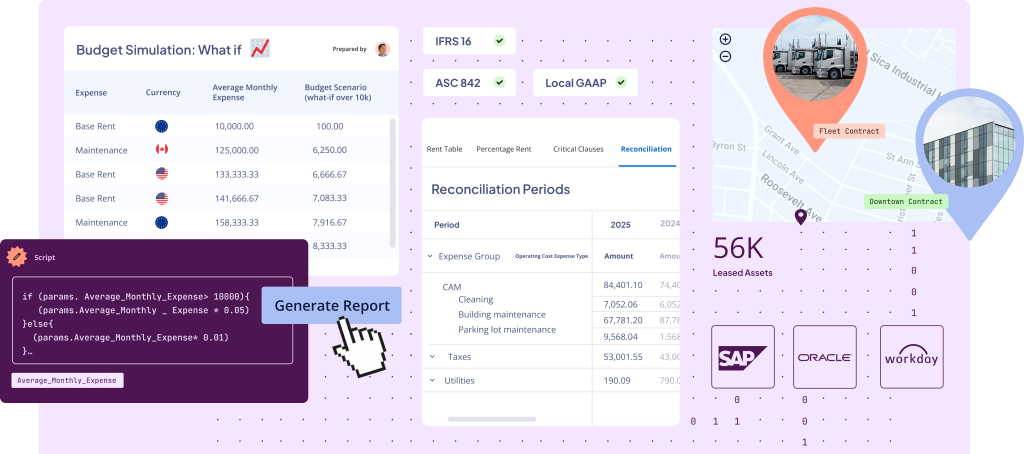

Ensure the software you are choosing can support the fundamental accounting standard you need (ASC 842 for American companies, IFRS 16 for European companies, and so on). Additionally, the software should at least offer features for accurate lease classification, tracking lease modifications, and generating the required financial reports for compliance purposes.

2B - Integration with Your Existing Systems:

Evaluate the software’s ability to integrate with your existing systems. Seamless integration can streamline data flow, eliminate manual data entry, and enhance efficiency. As a result, to ensure data consistency, we recommend that your software be the one source of truth for your lease management needs and have a bidirectional integration with robust ERPS such as SAP and Oracle.

2C- Lease Data Security:

The solution needs to support essential security protocols such as end-to-end data encryption, GDPR and “SOC 1 Type 2″ & “SOC 2 Type 2 ” compliance certifications while also allowing you to give your users role base access and automated approval workflows to support ITGC (Information Technology General Controls) requirements for SOX (Sarbanes Oxley) compliance.

2D – Automation of processes & analytics:

The solution must support core functionalities such as mass import, allowing you to upload lease data using flat files from legacy applications and Excel spreadsheets. Additionally, the solution should provide out-of-the-box disclosure reporting capabilities and includes additional dashboards for financial planning and analysis, and transaction reports for reconciliation purposes.

2E - Cloud Nativity:

To ensure your solution is ahead of the curve, we recommend that your solution be built on a cloud–native computing foundation. Cloud-native solutions are architected as collections of independent, loosely coupled microservices. They are built in a way that enables them to take better advantage of cloud computing models to increase product innovation, flexibility, security, and quality while reducing deployment risks.

Step 3 - Acquiring a Lease Management Software

In this final step, you will use the insights gained from the previous steps to make a well-informed decision on the vendor you want to proceed with. While the vendor ranked highest on the scorecard is important to consider, additional factors come into play, such as the vendor's reputation and industry experience.

To ensure the best choice is made, it is common practice for enterprises to seek multiple bids for their requirements. This approach helps secure favourable financing rates and terms. However, the procurement process can be time-consuming, stretching for weeks or even months. One significant challenge lies in attracting the right vendors to participate in the bidding process. To address this, providing a clear and comprehensive overview of your requirements is crucial, enabling vendors to understand the full scope of your needs.

Moreover, it is highly recommended to explore the vendor's provided resources in more depth. Take the time to delve into their case studies, solution briefs, eBooks and product demos. These valuable resources offer insights into the vendor's expertise, successful implementations, and the value they bring to their customers.

Lastly, it is worth visiting the vendors customer portal to gain further familiarity with their product roadmap and training resources. This can be achieved by reviewing documents like their latest release notes and accessing publicly available training videos. This step lets you gain insights into the vendor's ongoing development and commitment to improving their offerings. By considering these elements alongside the scorecard rankings, you will be equipped to make a comprehensive and well-rounded decision, ensuring the selection of a vendor that best meets your organization's needs.

Happy Shopping!

Discover the Nakisa Portfolio Management

Fortune 1000 companies place their trust in Nakisa for lease management, lease accounting, and compliance, and there's a good reason why. With Nakisa, you can access an innovative and scalable framework designed specifically for managing extensive lease portfolios with diverse assets, complex terms and conditions, and ongoing activity. It's a comprehensive solution that meets the unique needs of global organizations.

To delve into the details of the Nakisa Portfolio Management and its exceptional features, we invite you to explore our website. There, you'll find valuable information about the software's capabilities, customer testimonials, and our renowned reputation in the industry.

Lyn Kok

Project and Change Management Lead at NTUC FairPrice