Key business priorities for retail growth and efficiency

For global retailers, managing extensive asset portfolios (including real estate, equipment and machinery, fleet and transportation) across multiple locations while staying competitive is a complex endeavor that requires a careful balance between agility, operational efficiency, and cost control. To navigate these challenges effectively, retailers must focus on key business priorities that will enable them to streamline operations, enhance decision-making, and drive sustainable growth. The following priorities are essential for retailers looking to thrive in today’s fast-paced market.

Enhancing operational efficiency through automation and simplification: Retailers juggle numerous tasks, from site selection to lease administration, complex rent calculation and reconciliation, lease accounting and compliance, maintenance management, and vendor coordination. Automating these processes minimizes errors, reduces administrative overhead, and frees up teams to focus on strategic initiatives that drive growth.

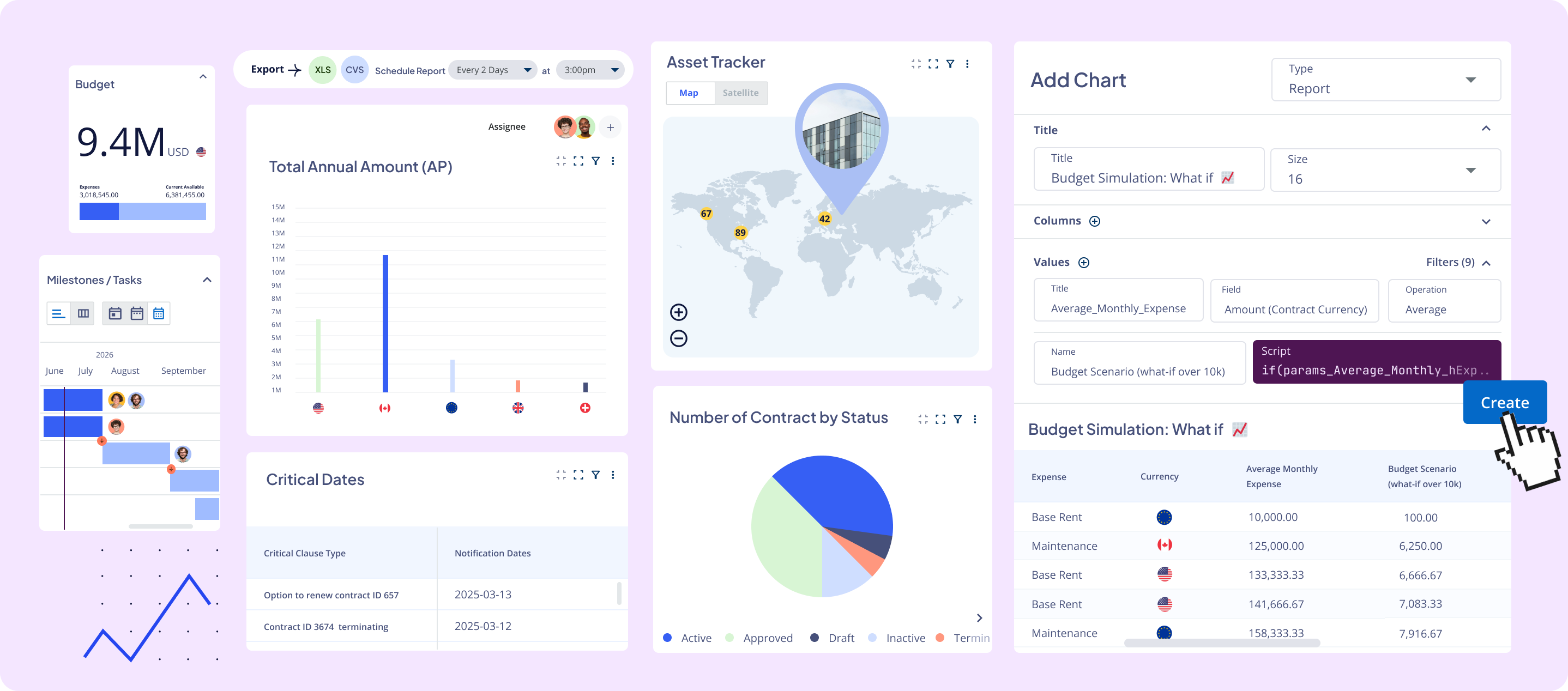

Optimizing portfolio performance with data-driven insights: Retailers need real-time visibility into asset performance, space utilization, and profitability across locations. By leveraging centralized data and analytics, they can quickly identify underperforming stores, optimize space usage, and uncover opportunities for expansion or cost reduction.

Adapting to market trends with agility and flexibility: To stay competitive, retailers must anticipate shifts in consumer behavior, economic conditions, and technological advancements. A data-driven approach provides insights into market conditions, location performance, and emerging trends, enabling quick strategy adjustments. Whether expanding to new locations, optimizing capital projects, renegotiating lease terms, or reallocating resources, this approach supports timely decisions that drive growth and responsiveness.

Ensuring compliance and mitigating risks: Retailers operate in a complex regulatory environment with lease accounting standards (IFRS 16, ASC 842, local GAAP), tax laws, and data privacy regulations. Non-compliance can lead to costly fines and operational disruptions. A compliant portfolio management approach ensures adherence to these standards while maintaining financial transparency.

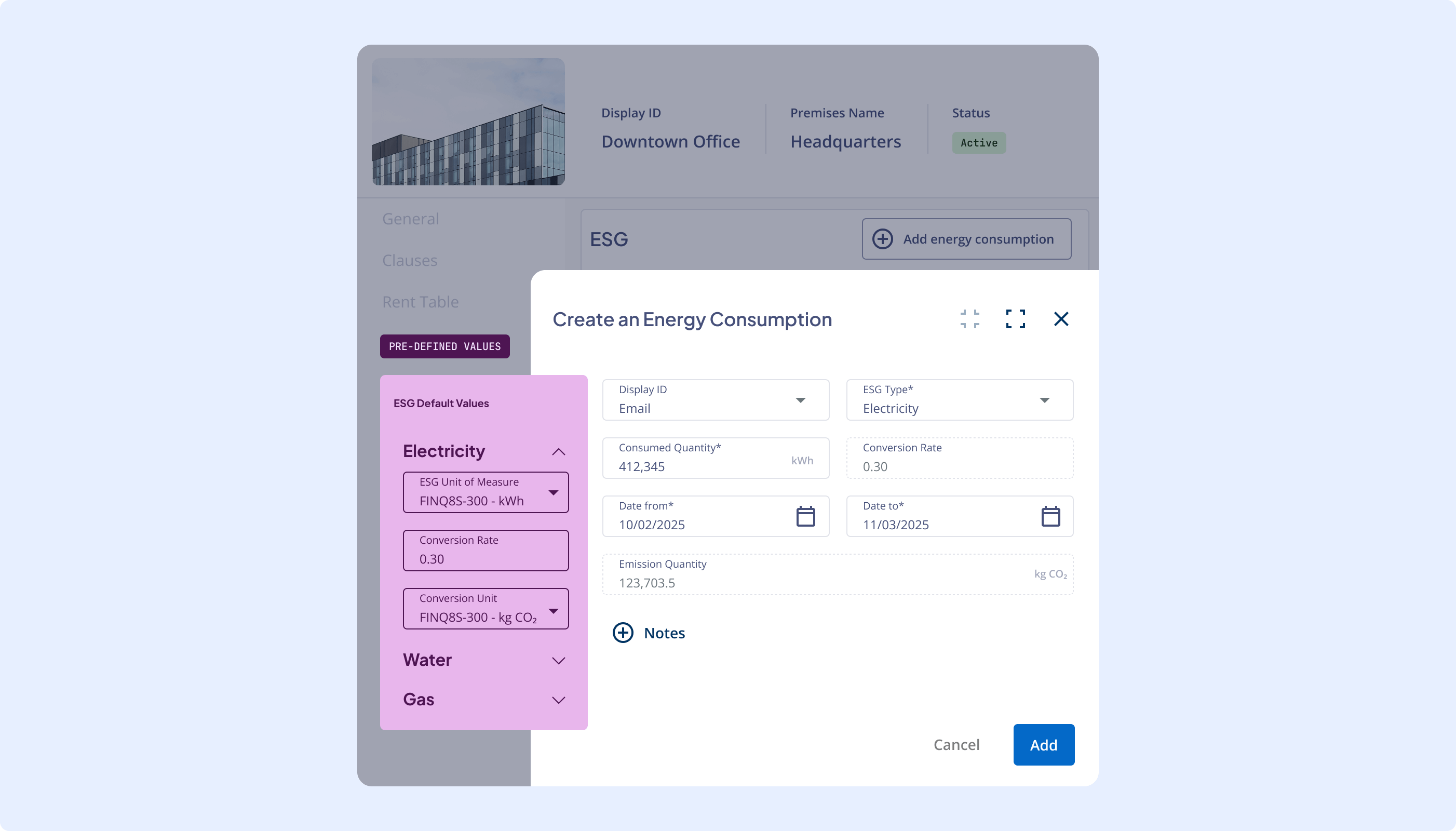

Advancing sustainability initiatives: Retailers are increasingly focused on reducing their carbon footprint, improving energy efficiency, and achieving sustainability goals. Tracking environmental metrics across multiple locations enables better resource management, cost savings, and a stronger brand reputation.

Breaking down silos to improve cross-departmental collaboration: Real estate, finance, operations, and facility management teams must work in sync to ensure smooth business operations. An integrated platform with streamlined workflows fosters better communication, eliminates redundant processes, and aligns teams toward common business objectives.

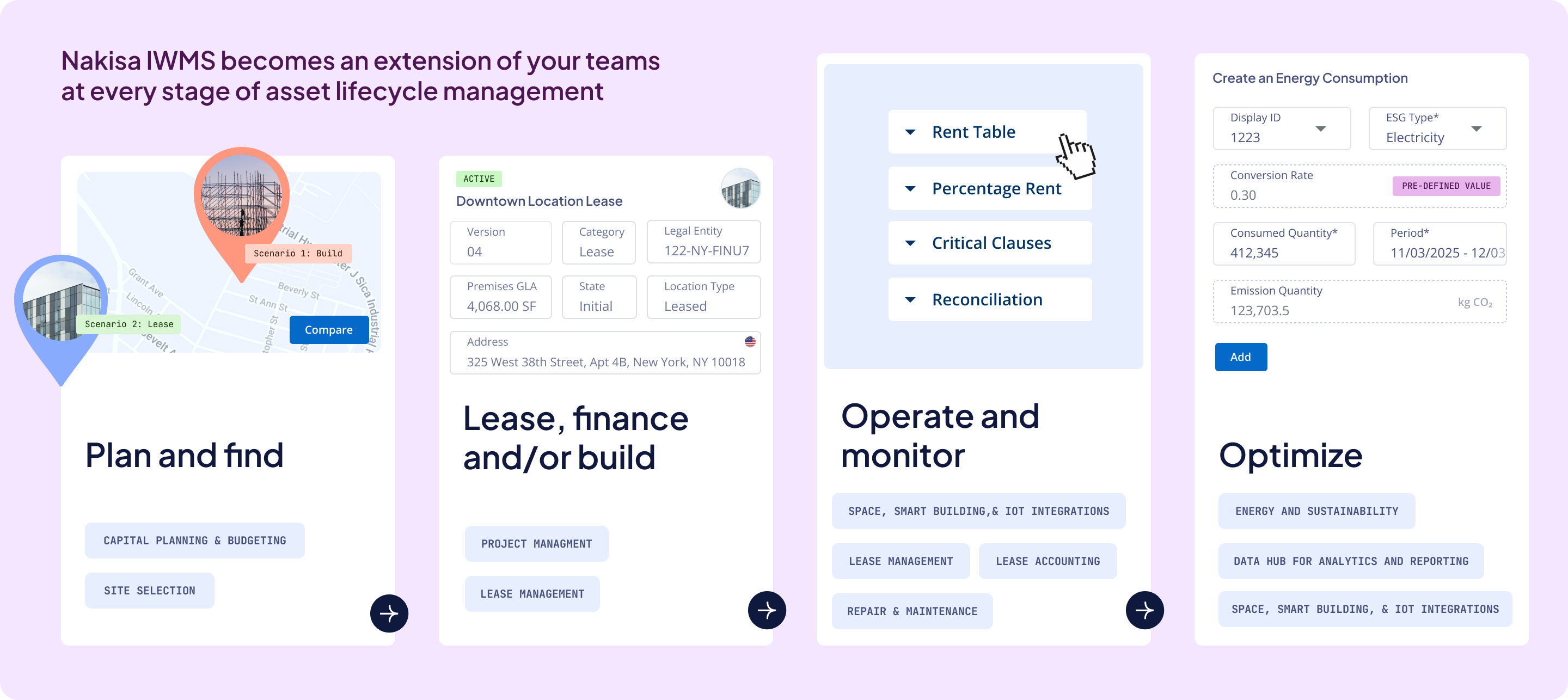

An Integrated Workplace Management System (IWMS) is a centralized software platform designed to help retailers achieve these business priorities. By integrating multiple functions into a unified platform, an IWMS streamlines processes across capital planning and budgeting, site selection, contract management, payment processing, reconciliations, lease accounting, disclosures, facility management, repair and maintenance, and sustainability initiatives.

In the following sections, we’ll take a closer look at the specific challenges retailers face at each stage of the asset lifecycle management and explore how solutions like Nakisa IWMS can effectively address them.

Asset types in the retail industry

Before addressing the specific challenges retailers face, it's helpful to understand the types of assets they typically manage and their unique characteristics. These assets range from physical spaces like stores and warehouses to the equipment and infrastructure needed to keep them running smoothly. Each asset type comes with its own set of management requirements and challenges, making it essential for retailers to have a clear understanding of their portfolio.

Real estate assets

Real estate assets include retail stores (such as storefronts, shopping mall units, and standalone buildings), warehouses, distribution centers, land, and office spaces.

Each of these asset types has distinct requirements. Managing them often involves significant upfront investments for tenant improvements or buildouts, careful site selection, and negotiating and managing complex lease terms, such as rent escalations, percentage-based rent, common area maintenance (CAM) charges, and renewal or termination options. It also requires understanding zoning laws, maintaining compliance with local regulations and accounting standards, and ensuring effective facility and maintenance management to optimize the customer experience. Additionally, adherence to ESG and safety regulations is crucial. Addressing the unique needs of each asset type is essential to ensure efficient operation and compliance.

Leased equipment and machinery

In the retail industry, leasing equipment is a common practice for assets essential to daily operations. Key assets that retailers may lease include point-of-sale (POS) systems, refrigeration units, HVAC systems, networking equipment, self-checkout kiosks, and digital signage. Leasing these critical assets allows retailers to access state-of-the-art technology while minimizing capital expenditures.

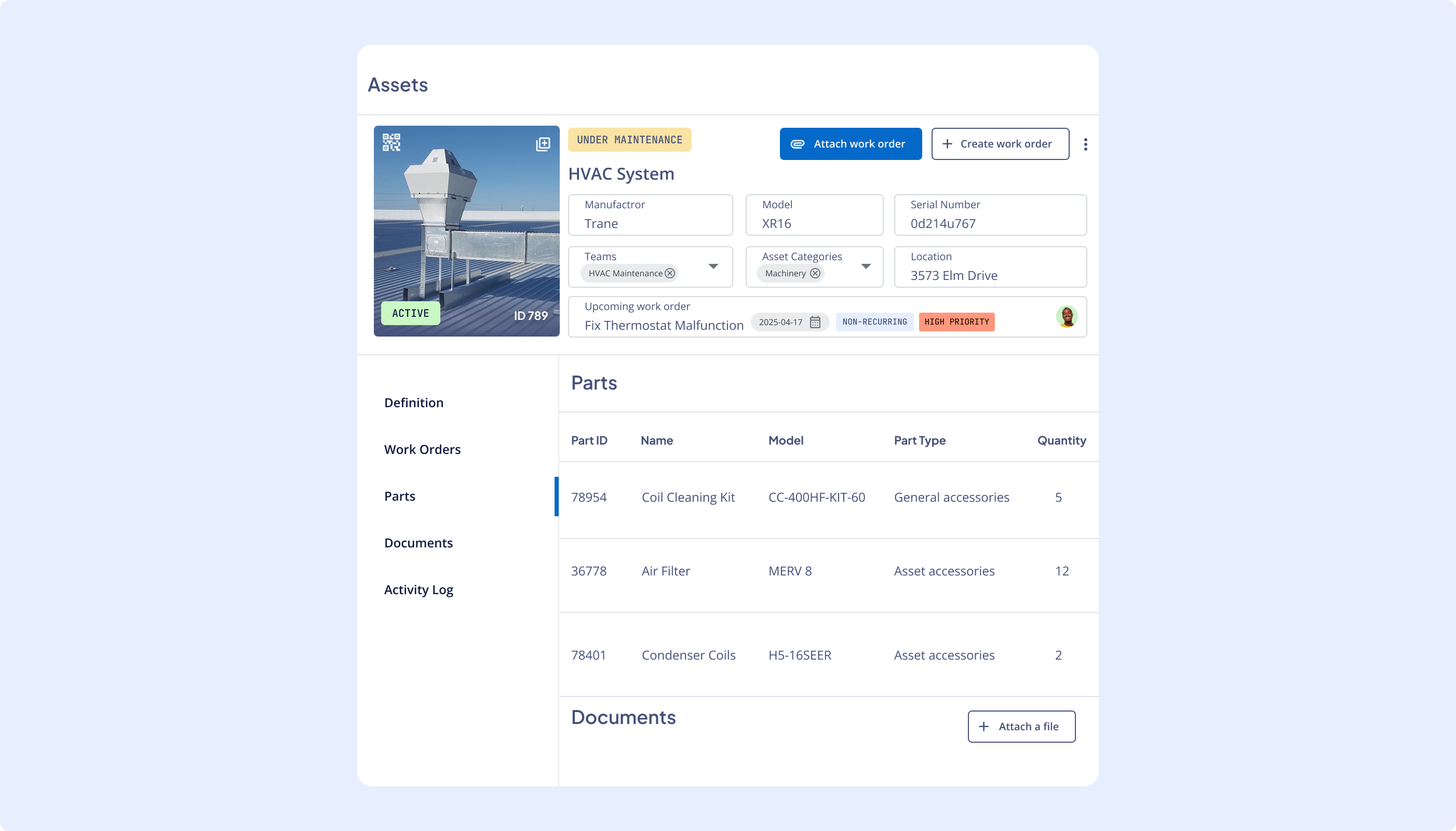

Each type of equipment lease has different needs for lease management, lease accounting, and facility management, which can affect how they are tracked and maintained. Managing these leased items across multiple locations requires an integrated system to track lease agreements, manage maintenance, and optimize usage—something that an IWMS solution can streamline effectively.

Fleet and transportation assets

Fleet and transportation assets play a crucial role for efficient logistics and timely delivery in retail operations. Delivery vehicles (such as trucks and vans) are often leased to transport goods between warehouses, stores, and directly to customers. Leasing these vehicles allows retailers to manage cash flow more effectively while also providing flexibility in fleet size and maintenance needs. Retailers require to track terms, manage mileage limits, coordinate maintenance schedules, and handle end-of-term options for these assets.

Similarly, material handling equipment (such as forklifts and conveyor systems) often leased for use in warehouses and distribution centers, ensures smooth and efficient movement of goods. These assets are usually covered by specific lease terms that include maintenance requirements and service agreements, to ensure optimal performance and safety.

With this diverse range of assets, global retailers face unique challenges in efficiently managing leases, ensuring compliance, and optimizing operations. We’ll explore these challenges in detail in the next section.

Discover our buyer’s guide with RFP scorecard to select the right commercial real estate management software for the retail industry. With tailored evaluation criteria and practical insights, this guide helps you navigate the decision-making process and identify the tools best suited to your organization’s unique needs.

What unique challenges retailers face at each stage of asset and facility lifecycle management and how an IWMS addresses them

Retailers manage their assets through a series of interconnected stages in the asset lifecycle, each with its own set of unique challenges. From strategic planning and site selection to lease negotiation, operational management, and eventually lease renewal or termination, each phase demands meticulous coordination and data-driven decision-making. All those challenges are amplified by the scale and complexity of global retail portfolios.

An IWMS solution provides the necessary tools to address these challenges at every stage, enabling retailers to streamline processes, enhance decision-making, and maximize asset value. Research shows that implementing an IWMS leads to measurable improvements, such as reducing capital project costs by 45%, improving facility usage efficiency by 40%, reducing enterprise asset lifecycle costs by 35%, and enhancing workspace management by 47%. In this section, we will explore each stage of the asset lifecycle for retailers, the common challenges they face, and how an IWMS solution like Nakisa can effectively address them.

Planning and finding

Let's begin with capital projects, which occur even before a real estate asset is added to the portfolio. Our focus will be on key activities such as planning, budgeting, site selection, and performance analysis, as well as the challenges each of these activities presents.

Challenge 1: Managing financial forecasting, budget allocations, and cost control for capital projects

Accurately forecasting costs and allocating resources for capital projects is not an easy task, especially for a global retailer. Aligning expenditures with business objectives demands precise cost estimation, thorough financial forecasting, and buy-in from key stakeholders—all of which can be difficult to achieve.

Improving accuracy in financial forecasting and budget allocations

Misalignment among key stakeholders and the lack of a clear, data-driven approach will lead to inefficient capital project budget allocation, ultimately affecting a retailer’s financial stability and long-term success. Before committing to a budget, it’s crucial to ensure that all stakeholders are aligned on objectives and that data and analytics are thoroughly evaluated to guide decision-making. Stakeholders should estimate key factors such as initial investment costs, operating expenses, lease-related expenses, and projected revenue to evaluate the financial impact of capital projects. By analyzing these factors, they can assess the potential return on investment (ROI) and identify risks that could affect profitability.

Inaccurate financial forecasts are common due to limited visibility into external market conditions and internal constraints. Economic downturns and supply chain disruptions must be factored into contingency plans to mitigate financial strain. The complexity of multi-market retail portfolios, each with unique cost structures and growth pressures, further complicates capital project budgeting and planning. Factors like escalations in rent, CAM (Common Area Maintenance) fees, property taxes, and unexpected fees can significantly impact store profitability. Adding to this are seasonal revenue shifts, e-commerce-driven investment adjustments, and resource bottlenecks, all of which increase the risk of financial misalignment and operational inefficiencies.

It is essential to leverage up-to-date market insights, consider organizational historical data, and use financial models to predict the long-term impact of the upcoming capital project. Accurate financial forecasting is crucial for managing leasing and construction costs across various projects and locations.

How Nakisa IWMS enhances financial forecasting and budget allocations for capital projects

In Nakisa IWMS, the Capital Projects Suite empowers retailers to analyze various financial scenarios, allocate realistic budgets, and maintain budget control. It offers advanced data visibility by integrating data from the current real estate portfolio, upcoming capital projects, external real estate insights, and market trends. This data-driven approach enables project managers and key stakeholders to make informed decisions, allocate budgets based on real-time insights, and adapt to evolving market conditions—moving beyond historical assumptions for a more accurate financial forecast.

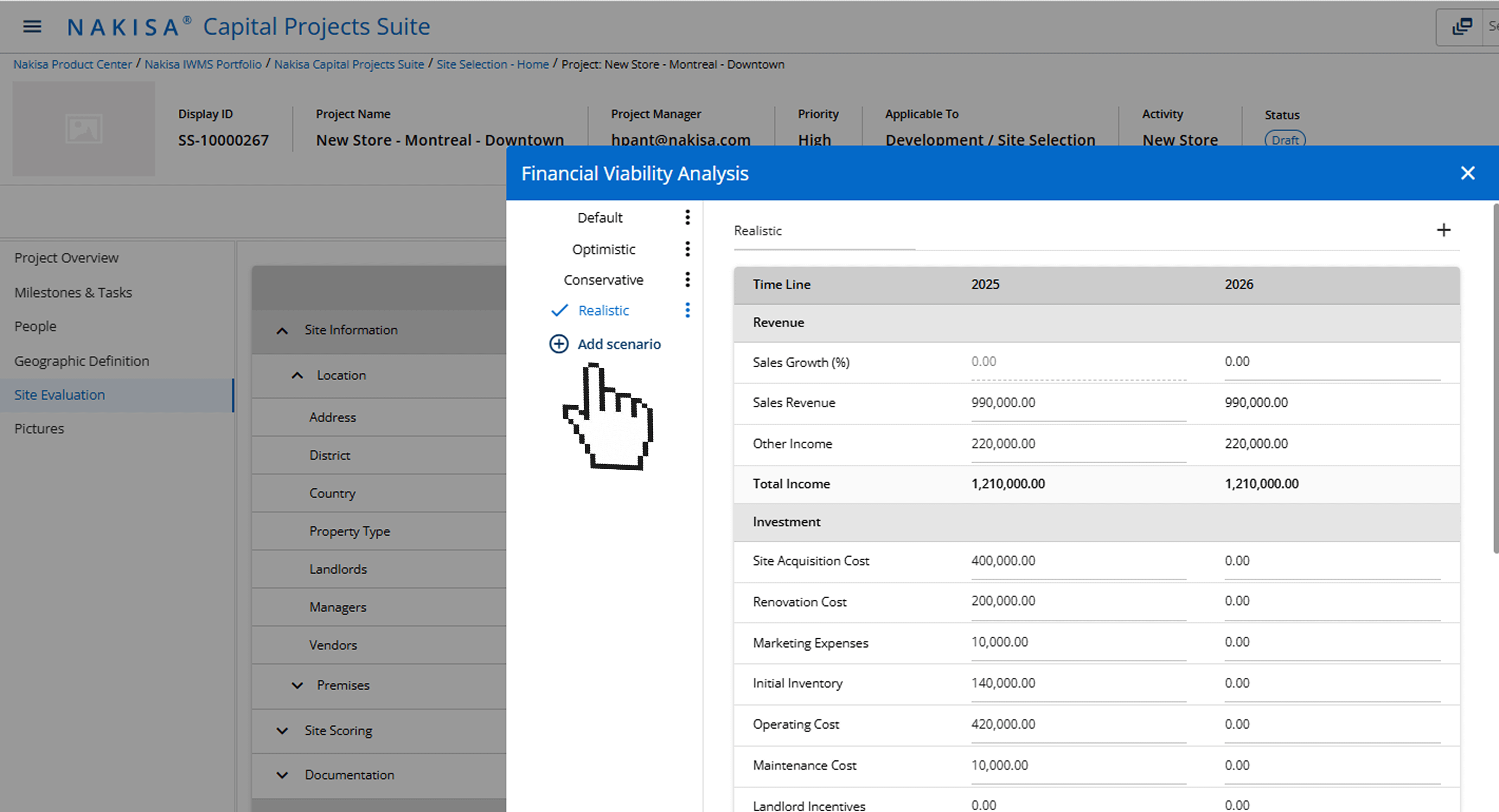

The platform offers automatically calculated financial viability analysis for all capital projects, allowing retailers to assess potential revenue, planned investments, and key financial metrics such as Discounted Cash Flow (DCF), Net Present Value (NPV), ROI, and Break-Even Point.

Additionally, Nakisa enables global retailers to create multiple financial scenarios—ranging from optimistic to conservative—by adjusting assumptions on various factors, including sales revenue, site acquisition costs, marketing expenses, and maintenance.

Nakisa Capital Projects enables multiple scenario creation and management for enhanced decision-making.

Financial scenario planning can be as detailed as per contract-specific terms, such as annual rent increases, seasonal performance variations, or conditional cost reductions. With just a few clicks, capital project managers can generate future payment schedules for each scenario and assess the impact of potential changes. This data-driven approach empowers retailers to make informed decisions and allocate realistic budgets for their capital projects.

Optimizing budget tracking and cost control

Once the budget is approved and allocated, managing it effectively becomes crucial. Without proper oversight, costs can quickly spiral out of control, leading to unexpected expenses that strain financial resources. Inadequate tracking of expenditures and failure to adjust forecasts based on real-time data can result in misallocation of funds, delays in project timelines, and diminished returns on investment. Additionally, the absence of stringent cost control measures during project execution increases the likelihood of overspending, missed opportunities for cost savings, and a failure to meet profitability goals. To mitigate these risks, retailers should implement analytics tools to track spending and forecast costs accurately. Real-time monitoring, coupled with hard stops and automatic notifications when overruns occur, can help maintain financial discipline and ensure timely intervention. By doing so, retailers can closely monitor budgets and make necessary adjustments to stay aligned with business objectives.

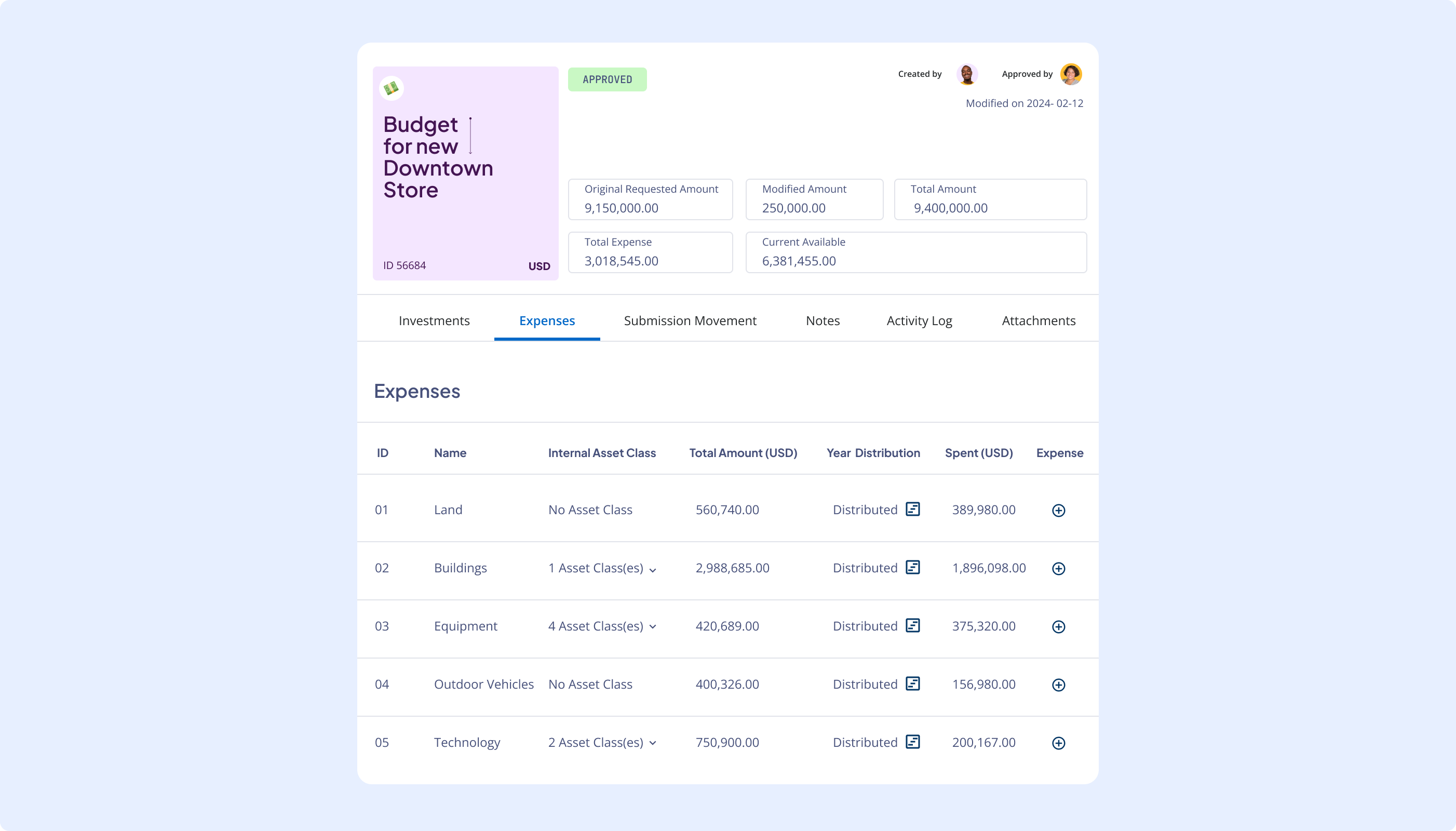

How Nakisa IWMS optimizes budget management and cost control

With configurable, role-based workflows and a multi-level approval system, Nakisa ensures alignment across key stakeholders, from C-level executives to Finance and Real Estate teams. Once approved, budgets can be distributed across multiple capital projects or expense categories for enhanced visibility and control. What’s more, a single capital project can encompass multiple budgets, providing greater flexibility in financial planning and management.

Nakisa IWMS helps retailers manage costs by offering tools for accurate budget tracking in multiple currencies. Capital project managers can monitor budgeted versus actual expenses in real-time and track remaining budget availability. Built-in hard stops automatically flag and halt transactions exceeding budget limits, while automated notifications and email reminders ensure prompt action from the appropriate team members.

You can easily manage capital project budgets and track the associated expenses in Nakisa Capital Projects (part of Nakisa IWMS)

With advanced invoice management, Nakisa IWMS allows external partners to upload invoices through the Partner Portal. This centralized approach enables retailers to track budgeted, contractual, and invoiced expenses in one place, providing enhanced transparency and accuracy.

With real-time expense monitoring and AI-driven Assistant, capital project managers gain actionable insights into expenditure patterns, enhancing financial discipline and improving future estimates.

Moreover, Nakisa offers budget management and cost control not only for capital projects but also for leases and facilities. The platform tracks construction costs, capital project expenses, lease costs (including rent payments, taxes, insurance, and utilities), and facility maintenance costs (such as scheduled work orders or repairs). All this data and functionality is seamlessly organized for each team and role, ensuring that users can leverage a centralized source of truth in a straightforward and user-friendly manner, without feeling overwhelmed.

Challenge 2: Finding the best location for retail operations

For global retailers, optimizing site locations is critical, especially for stores, pick-up points, distribution centers, and warehouses. Rapid growth requires balancing customer demand with market opportunities, along with the operational realities of expansion across international markets.

To find an optimal site, retailers need to evaluate multiple factors, such as demographic trends, competitive landscapes, and logistical considerations, all while ensuring that new locations contribute to long-term profitability.

Aligning site selections with long-term retail growth strategies requires careful evaluation of location potential and portfolio optimization on a global scale. Retailers must ensure that each site, whether new, renewed, or terminated, supports overall business goals such as expanding market presence or boosting omnichannel operations across different regions. However, prioritizing sites based on projected ROI, market share, and customer proximity remains challenging due to the complexity of balancing numerous variables such as market conditions, competition, and location specifics, and logistical feasibility.

Fragmented communication and siloed systems further complicate the process, as executives often lack a comprehensive, real-time view of the portfolio, relying on fragmented insights from multiple teams. Property and capital project managers often use disconnected tools and manual data management. Combined with outdated or inconsistent data sources, it hinders the evaluation of factors like foot traffic, consumer demographics, and local trends, leading to poor site decisions and missed opportunities.

Additionally, failing to track evolving market conditions, including competitor store openings or closures and shifts in consumer demand, can result in poor site decisions, missed revenue opportunities, or underperforming retail locations.

How Nakisa IWMS optimizes site selection for global retailers

The Nakisa Site Selection solution, part of the Nakisa Capital Project Suite, empowers global retailers with purpose-built features to find an optimal location, aligned with the business strategy. Here’s what it offers:

- Centralized site repository: A comprehensive list of all potential and existing sites, including site details, photos, documentation, configurable KPI metrics, and financial forecasts. Capital project managers can visualize sites on a map with Geographic Information Systems (GIS) integration and analyze surrounding areas for valuable insights to drive higher traffic, boost sales, and support strategic expansion or consolidation. Robust filter capabilities and dynamic dashboards make it easy to slice and dice through data, enabling efficient site searches based on various parameters.

- Reports and advanced analytics: Nakisa IWMS provides advanced market analytics and geographic data to identify prime locations aligned with target audience profiles. It integrates external data sources, such as real estate market data, foot traffic, and demographic insights, via powerful APIs. This ensures accurate, up-to-date insights into demographic trends, consumer behavior, local trends, and competitive landscapes, eliminating reliance on outdated data. Retailers can confidently evaluate potential sites for expansion, relocation, or downsizing.

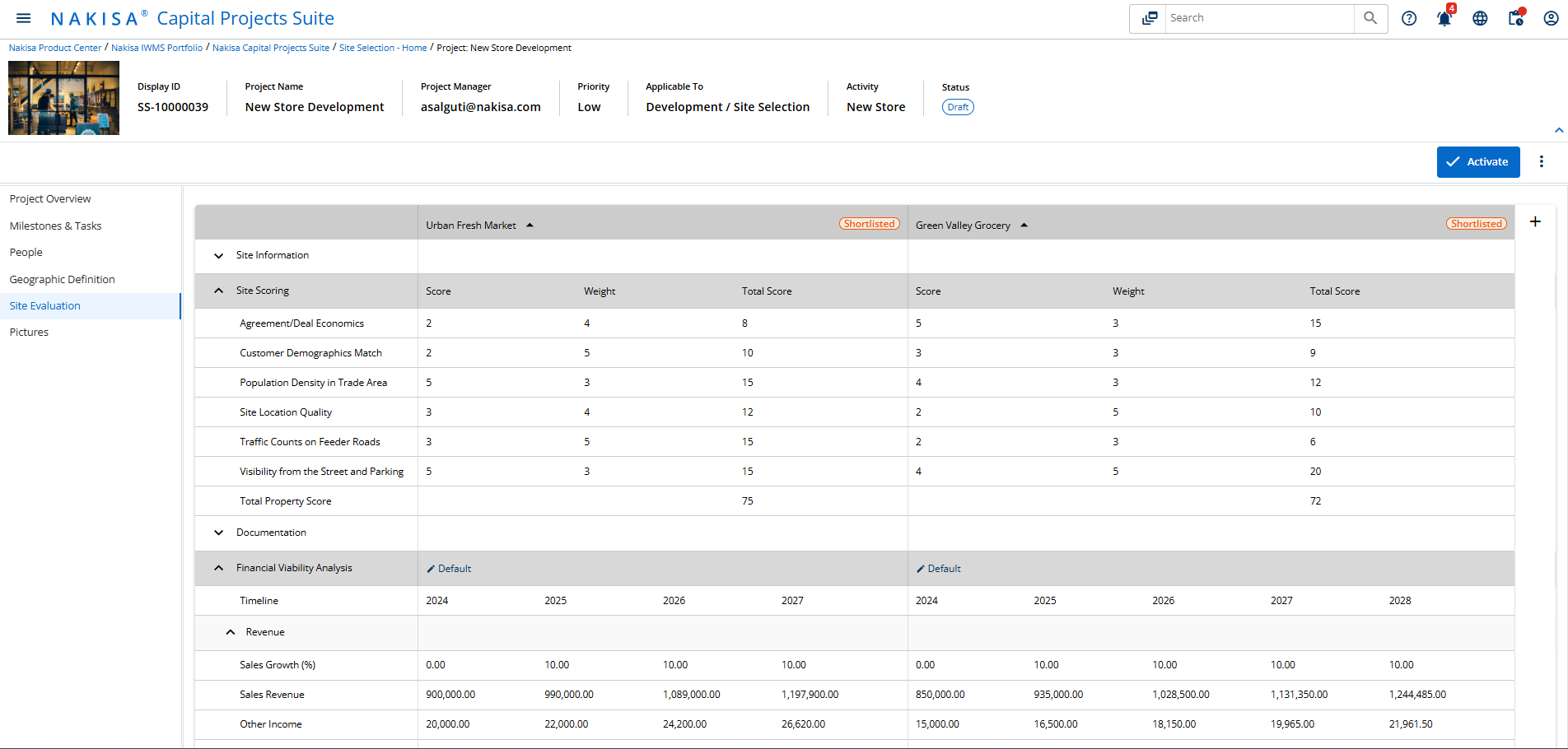

- Site alignment with strategic goals: Capital project managers can configure location scorecards with any KPI metrics critical to their business, such as customer demographic match, population density, site location quality, street visibility, or any other criteria. Each metric can be assigned a custom weight, and locations can be scored accordingly. When choosing the optimal site for a capital project, managers can compare up to ten sites side by side and shortlist the best options for this specific project. They can assess the total score per each location and drill down into individual metrics as needed. Besides this functionality, the site comparison table provides detailed site information, including dynamic area size conversion. It also has the financial viability analysis, allowing retailers to assess potential revenue, planned investments, and key financial metrics such as Discounted Cash Flow (DCF), Net Present Value (NPV), ROI, and Break-Even Point.

During site selection, compare up to 10 locations side-by-side, evaluating site scores and financial analysis. Shortlist locations and make informed portfolio decisions to drive higher ROI with Nakisa IWMS

Challenge 3: Effective capital project management for global retailers

Project management is critical for global retailers when financing, building, or renovating their retail spaces. Above, we covered financial forecasting, cost monitoring, and location selection, all of which can also be considered parts of capital project management.

In this section, we’ll focus specifically on project management challenges, including timeline and milestone tracking, project prioritization, internal team coordination, third-party collaboration, and regulatory compliance. Effectively managing these processes is crucial to delivering projects on time while minimizing risks to profitability and operational efficiency.

Managing project priorities, timelines, and milestones

An important aspect of capital project management is determining which activities to prioritize based on ROI and strategic alignment. The need to balance aggressive growth strategies with tight budgets heightens the difficulty of accurately prioritizing and allocating resources. This lack of alignment can delay projects, frustrate stakeholders, and result in the misallocation of resources, ultimately diminishing the success of capital planning.

Once priorities are set, global retailers must manage multiple projects, each with a series of milestones, tasks, and approvals that must stay on schedule. Retailers often face tight project timelines, especially when projects must be completed before key retail seasons or promotional periods. Coordinating schedules across internal teams, external vendors, and contractors adds further complexity.

Delays often stem from manual processes, vendor performance issues, cost overruns, or missed deadlines, leading to inefficiencies and stakeholder dissatisfaction. Without a clear structure and regular progress checks, managing multiple projects can overwhelm capital project managers, driving up costs and slowing execution.

To ensure on-time project delivery, retailers must streamline task tracking, monitor progress in real-time, and enhance team coordination—minimizing bottlenecks and maximizing efficiency.

How Nakisa IWMS streamlines priority, timeline, and milestone management

The core value proposition of Nakisa Capital Projects is that it offers purpose-built functionality for capital and real estate projects, tailored to CRE-specific needs. Capital project managers can define the project’s main activity, whether opening a new location, expanding, relocating, downsizing, or closing. They can set project scopes (premises-only or full site development), assign priority levels, and control privacy settings to keep sensitive projects secure.

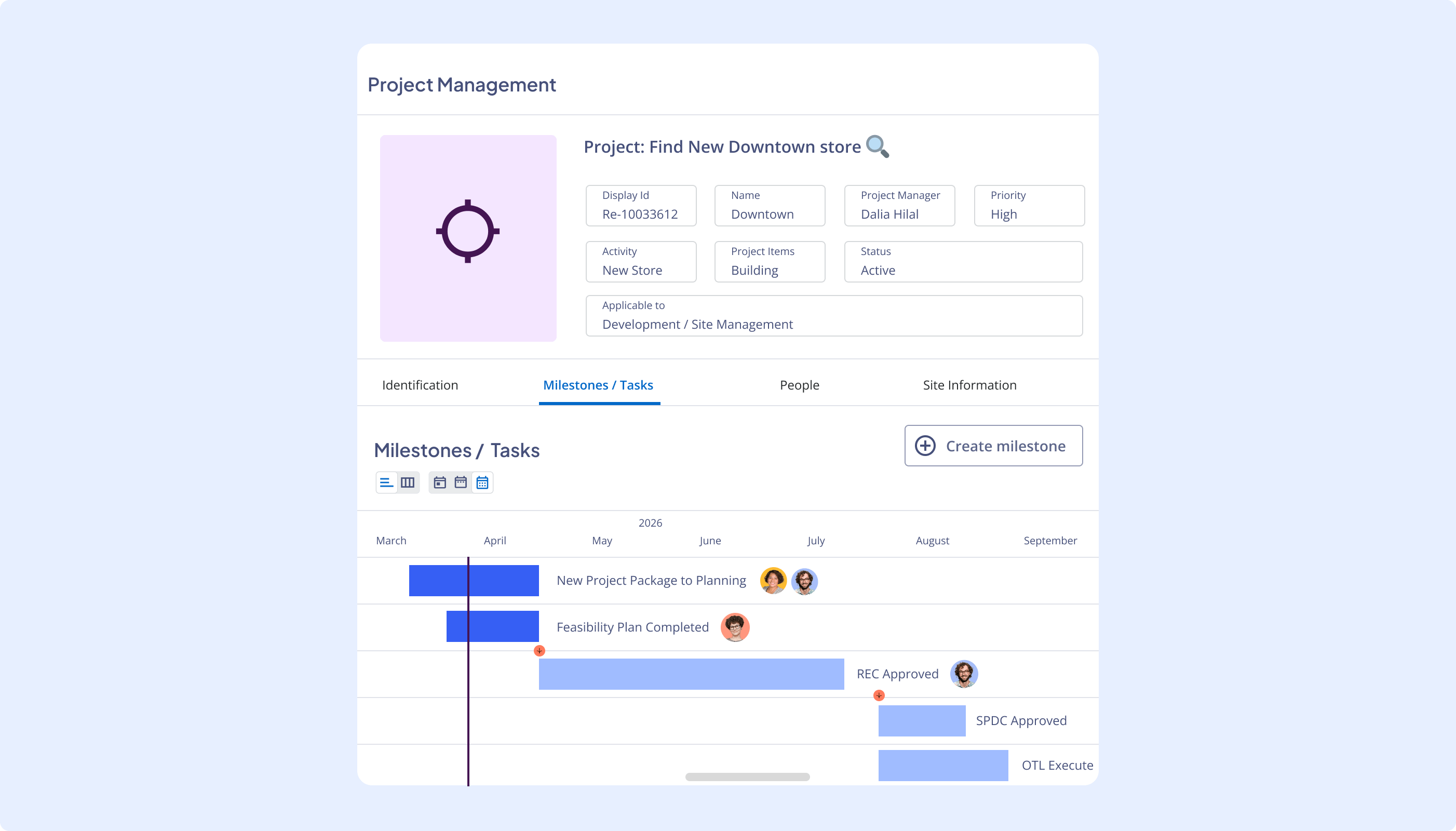

Nakisa Capital Projects supports project oversight by offering detailed tracking tools for monitoring project milestones, site progress, and approvals in real-time. Project managers can create projects, attach tasks and milestones to them, all while prioritizing the most critical activities. They can also assign internal and external team members, establish clear deadlines, and use Gantt charts with automated reminders to keep tasks on track, preventing delays and maintaining project flow across global operations.

Create and prioritize tasks, assign people, and stay on top of the deadlines with Nakisa Capital Projects

The platform also offers tailored templates for various project types—such as site openings, expansions, relocations, and closures—adaptable to different countries and regions, and easily configurable. Retailers can also create their templates, adapted to their specific business needs. These templates ensure tasks are organized, progress is tracked, and adjustments are made as necessary, improving project efficiency and reducing the likelihood of delays or budget overruns. Reusable project and milestone templates standardize processes and ensure key project steps are not overlooked while offering flexibility to adapt to changing project needs.

Enhancing internal collaboration

Managing global projects requires seamless coordination between the capital project team and various internal departments, including legal, finance, operations, and project management. Each team brings its own priorities, workflows, and deadlines, which can sometimes conflict, leading to bottlenecks that delay progress.

One of the biggest challenges is ensuring alignment across these teams while maintaining clear communication. Without a centralized system to track project status, responsibilities, and dependencies, teams may struggle with miscommunication, duplicated efforts, or overlooked tasks. This lack of visibility can result in missed deadlines, budget overruns, and operational inefficiencies.

Additionally, as projects scale across multiple regions, time zone differences, language barriers, and varying regulatory requirements add further complexity. Ensuring that all internal stakeholders have real-time access to project updates, approvals, and financial data is crucial for keeping projects on track.

How Nakisa IWMS facilitates cross-departmental collaboration

Effective internal collaboration requires well-defined roles, clear task ownership, and structured workflows that enable teams to work efficiently. Nakisa IWMS serves as a single source of truth, allowing any team member to check assigned tasks, deadlines, and responsibilities in real time. This eliminates confusion, enhances accountability, and streamlines project execution. As mentioned earlier, project and milestone templates further simplify task management by providing standardized workflows.

To keep teams aligned, Nakisa IWMS includes reminders, in-app notifications, and an action center that consolidates all relevant action items per user. Teams can easily track mentions, assigned tasks, and pending approvals, ensuring nothing falls through the cracks.

The platform also offers flexible access controls, allowing project owners to add participants and define their level of involvement. Capital projects can be set as private (visible only to participants) or public (accessible to all users), ensuring the right people have access to the right information without overwhelming others with unnecessary details.

Additionally, Nakisa IWMS enhances stakeholder coordination. Teams such as legal, finance, and project management can view only the information relevant to them, reducing miscommunication and improving efficiency. Proposals and comments further enhance collaboration by tracking stakeholder feedback, ensuring full visibility across teams.

Enhancing external collaboration: contractors, advisors, landlords, suppliers, and more

Global retailers must also handle relationships with multiple vendors and suppliers across different countries. Managing these relationships, ensuring they meet performance expectations, and staying on top of contracts can be extremely complex—particularly when dealing with multiple sites and projects simultaneously. Delays, quality issues, or changes in cost can disrupt timelines and escalate costs, causing frustration and inefficiencies across the board. The challenge is further complicated by the need to develop and maintain large-scale supplier relationships internationally while navigating global supply chain disruptions.

How Nakisa IWMS facilitates external collaboration with third parties

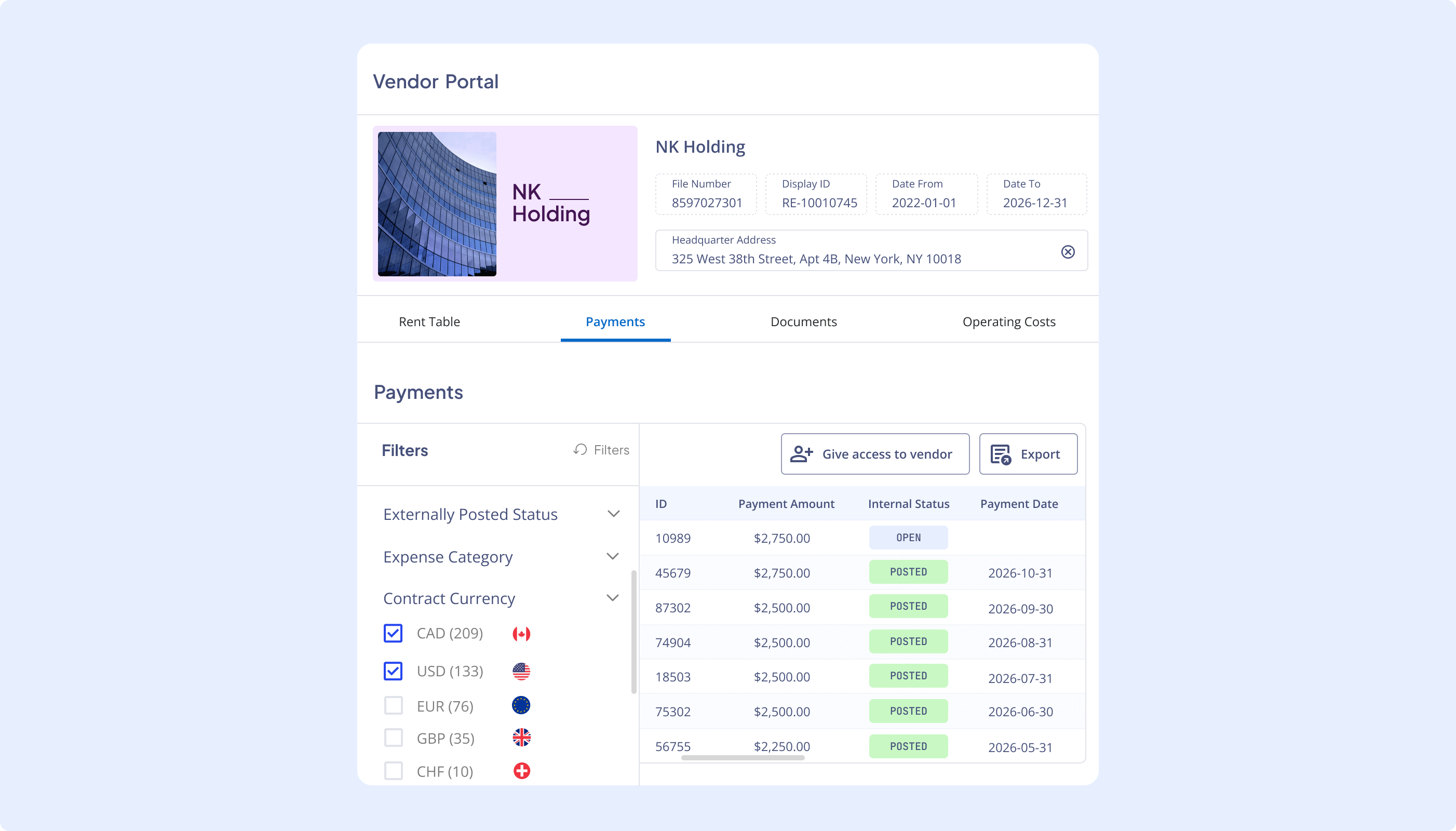

Nakisa Capital Projects, along with other product suites in Nakisa IWMS, provides a powerful Partner Portal designed for seamless third-party collaboration. This enables real estate professionals to efficiently manage vendors, landlords, suppliers, and contractors within a structured and centralized system.

The Partner Portal serves as a comprehensive database, storing essential details such as vendor names, locations, project-specific commitments, and historical performance metrics. It ensures easy tracking of third-party engagements, payments, and contractual obligations, helping organizations optimize vendor selection and maintain strong business relationships.

To enhance efficiency, Nakisa IWMS also includes standardized communication templates, reducing manual effort and ensuring consistency in vendor interactions. The dedicated Partner Portal allows external collaborators to directly upload invoices, credit notes, and supporting documents into the system, enabling real-time tracking, automated reconciliation, and improved financial accuracy.

By centralizing all third-party collaboration activities, Nakisa IWMS minimizes communication gaps, enhances transparency, and streamlines administrative processes, ultimately driving more efficient and cost-effective capital project execution.

Navigating regulatory compliance and risk management across jurisdictions

Managing compliance with regulations across multiple jurisdictions is a critical part of global capital project management. Retailers face the risk of non-compliance, which can result in fines and delays. They must also navigate retail-specific regulations such as those related to consumer safety, product labeling, accessibility standards (e.g., ADA compliance), and data privacy (e.g., PCI DSS compliance for payment systems). Additionally, unforeseen risks such as supply chain disruptions, economic shifts, or natural disasters complicate project planning, leading to costly delays or cancellations. Insufficient risk management and lack of contingency planning exacerbate these challenges, leaving projects vulnerable to changing conditions.

The complexity is amplified by the need to navigate sustainability initiatives and unclear government directives related to environmental standards across different markets.

How Nakisa IWMS ensures compliance with global regulations

Nakisa IWMS provides centralized compliance tracking, enabling retailers to stay on top of regulatory requirements throughout the project lifecycle. Here’s how Nakisa helps mitigate these challenges:

- Centralized project data and regulatory tracking: Nakisa centralizes all project data, enabling managers to track project progress, regulatory requirements, and compliance status in one place. The platform provides real-time visibility into every aspect of the project, ensuring that stakeholders are aligned and any potential issues are addressed before they become major roadblocks. For each project, capital project managers can add risk level and environmental effect estimates, allowing for better-informed decision-making and proactive management of potential challenges. This ensures that all necessary approvals and certifications are readily available when needed, reducing compliance risks and improving audit readiness.

- Proposal comments: To enhance documentation and accountability, Nakisa IWMS streamlines compliance-related communication with its proposal comments feature, allowing capital project managers to track discussions, approvals, and regulatory concerns. This structured approach minimizes miscommunication and creates a clear audit trail, making it easier to demonstrate compliance during inspections or audits.

- Tracking compliance metrics: With Nakisa Capital Projects, retailers can define custom compliance metrics using scorecards for each site, ensuring every location is evaluated against relevant legal and operational requirements.

- Energy management: Nakisa also supports energy management tracking to help retailers align with ESG (Environmental, Social, and Governance) standards. By monitoring energy consumption and sustainability initiatives, retailers can proactively manage environmental compliance, reduce their carbon footprint, and adhere to green building regulations.

- Risk management and contingency planning: The platform’s real-time tracking and forecasting capabilities enable capital project managers to quickly identify emerging risks and adjust plans accordingly. With robust scenario modeling and contingency planning features, users can simulate various scenarios to determine their impact and implement corrective actions early on.

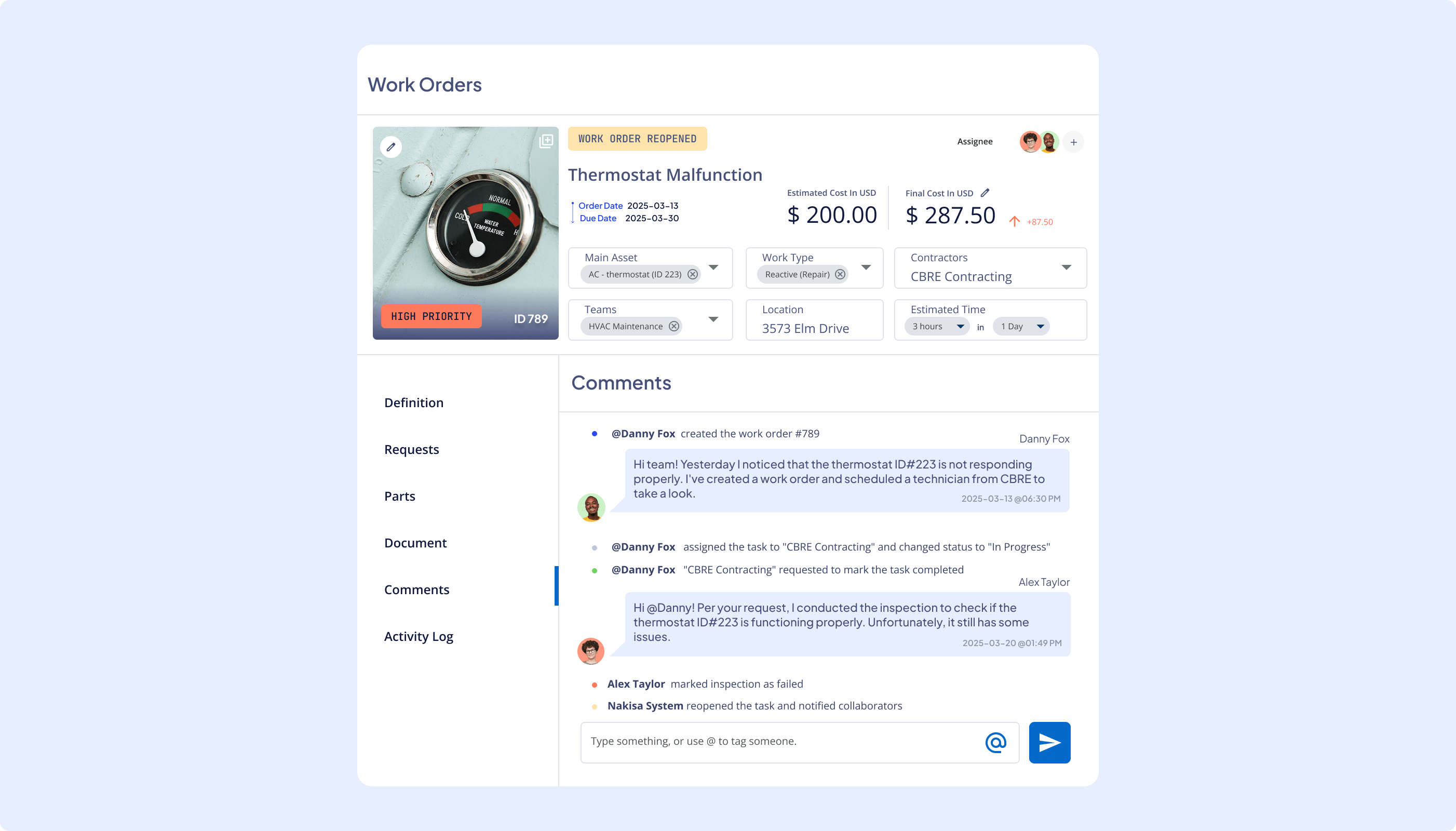

- Streamlined facility management and building code compliance: Nakisa Facility Management includes asset status tracking, ensuring real estate assets comply with building codes and safety regulations. This feature helps retailers manage maintenance schedules, structural inspections, and renovations, preventing compliance issues and maintaining operational integrity.

- Zoning and construction considerations: Some projects require adherence to zoning regulations, and Nakisa helps ensure these are properly managed. With centralized documentation, detailed project descriptions, and configurable KPI metrics, the platform ensures that all team members are aware of the requirements and that all projects align with local zoning laws. Additionally, the system monitors timelines for approvals or necessary repairs, to keep projects on track without delays.

Challenge 4: Overcoming technology integration challenges in retail asset management

Integrating advanced technology to support site selection is essential for modern retailers but often proves to be challenging. Retailers often rely on inefficient processes (such as manual data aggregation and analysis) or fragmented CRE systems and struggle to gain a holistic view of potential sites and projects. This lack of streamlined data-driven workflows results in slower decision-making and more costly errors.

Without seamless integration between their real estate systems, real estate professionals risk making investment decisions in isolation, for instance, planning a new store while overlooking insights from their existing real estate portfolio. A lack of visibility into current leases with similar characteristics can lead to suboptimal site selection and missed opportunities for cost savings.

Additionally, all capital project costs, including construction, lease initiation, and associated expenses—must flow through finance and ERP systems. However, manual data entry across multiple systems (ERP, finance, real estate, and facility management) slows decision-making and hinders agility in responding to market shifts, reducing overall capital planning effectiveness.

Retailers also face the challenge of integrating capital planning systems with retail-specific technologies such as point-of-sale (POS) systems, inventory management software, CRM tools, and e-commerce platforms. This integration is crucial for making informed decisions based on real-time operational data.

Traditional methods, such as manual forecasting and reliance on spreadsheets, often lack the accuracy, depth, and flexibility required to overcome these challenges. Inefficient processes can lead to forecast errors, misallocated resources, and delayed responses to changing market conditions. To optimize investments and ensure efficient capital project execution, retailers need streamlined processes and integrated solutions like Nakisa IWMS.

What integrations Nakisa IWMS offers and their benefits

Nakisa IWMS’s cross-product integration, native bidirectional integration with major ERP systems like SAP, Oracle, and Workday, and robust APIs ensure seamless data flow, effectively addressing the complex technological ecosystems of global retail enterprises. Let’s explore how each type of integration benefits global retailers:

- Cross-product Nakisa IWMS integration: Nakisa IWMS enables various teams to leverage a single, up-to-date data repository, ensuring that information is seamlessly shared between capital project, real estate, and facility teams. Each team has its own user interface, but they all have access to the same core data. For example, capital project managers can analyze the current CRE portfolio before initiating a new project, allowing them to evaluate the new project in context and make strategic growth decisions. Once a capital project is executed, it automatically becomes a premise in the CRE portfolio, where it can be managed further, including lease management and lease accounting. Similarly, the premise can be added to the facility management system to ensure proper maintenance and property performance. Nakisa also collects comprehensive vendor, landlord, and contractor information across all its products, providing valuable insights for improved vendor management and future project planning.

- Finance systems and ERP integration (SAP ECC, SAP S4/HANA, Oracle, Workday): Nakisa offers a powerful accounting engine that can be easily integrated with various finance platforms, including BlackLine. This ensures smooth data flow between real estate and accounting teams. Native bidirectional integration with major ERP systems like SAP, Oracle, and Workday further enhances data flow, enabling efficiency for the accounting teams by reducing the risk of errors and performing mass postings in one click.

- API to external tools: Nakisa IWMS connects with external tools via robust APIs, allowing access to critical data such as market insights, foot traffic, and location-specific details to inform capital planning decisions. It can easily sync with external data centers specialized in CRE operations or be integrated with point-of-sale systems to analyze store performance and calculate sales-based rent, when applicable.

- Advanced analytics and Nakisa AI Assistant: With easy-to-share reports and insights, Nakisa transforms what is traditionally a manual process into a streamlined, data-driven approach. By leveraging Nakisa’s advanced analytical tools and configurable dashboards, retailers can efficiently allocate resources, prioritize projects, track targets vs. actuals, and mitigate risks associated with capital investments, optimizing them for long-term success throughout the asset lifecycle.

Nakisa AI Assistant analyzes data and can create customized dashboards per capital project managers’ requests. By inputting the requirements through our AI Assistant, capital project managers can quickly locate relevant properties and analyze data across the whole portfolio. Nakisa AI automatically processes criteria, extracting valuable insights and generating visual dashboards that provide a clear overview of key metrics. Paired with Elasticsearch and advanced filters, the AI system delivers the most relevant properties while offering real-time analytics, saving time and ensuring that your decisions are backed by data-driven insights.

Leasing, financing, and/or building

Once capital projects are prioritized and planned, retailers must navigate the complexities of leasing, financing, and/or building sites. The leasing phase involves negotiating complex terms, managing financial obligations, and staying compliant with local and international regulations. After securing the lease, the next phase focuses on financing and construction, which also requires strict coordination and oversight to meet timelines and budgets. Each step represents its own difficulties that can disrupt operations if not handled properly.

Challenge 5: Managing complex lease negotiations for global retail portfolios

Negotiating favorable lease terms and making timely decisions present significant hurdles for global retailers. The availability of prime locations is often limited, with high demand driving up prices and restricting options in desired markets. Delays in decision-making, whether due to slow internal processes or lack of coordination between CRE teams and stakeholders, can result in missed opportunities, extended store opening timelines, and settling for suboptimal locations.

While choosing between building, leasing or buying, retailers must weigh several factors, including market trends, property values, financial obligations, potential hidden costs, and the long-term impact of rent escalation clauses and renewal options. Managing these leases effectively involves tracking various financial terms, such as rent payments, taxes, insurance, maintenance fees, and utilities, which can fluctuate and affect overall profitability.

Failing to address these elements during the lease negotiation phase can lead to unexpected financial burdens down the line. Without a centralized system to monitor these terms, there is a higher risk of overlooking critical information, leading to unfavorable lease terms and potential financial strain after leases are signed. Relying on manual processes or spreadsheets increases the risk of errors and can lead to missed critical information, negatively impacting long-term profitability on a global scale.

How Nakisa IWMS simplifies lease negotiations and financial terms

Navigating lease negotiations for large, international retail portfolios requires precision, foresight, and effective management of financial complexities. Nakisa IWMS, the Capital Projects Suite empowers retailers to tackle these challenges head-on by providing a centralized, intelligent solution to manage lease negotiations, ensuring favorable terms while mitigating long-term risks. Here’s how it does it:

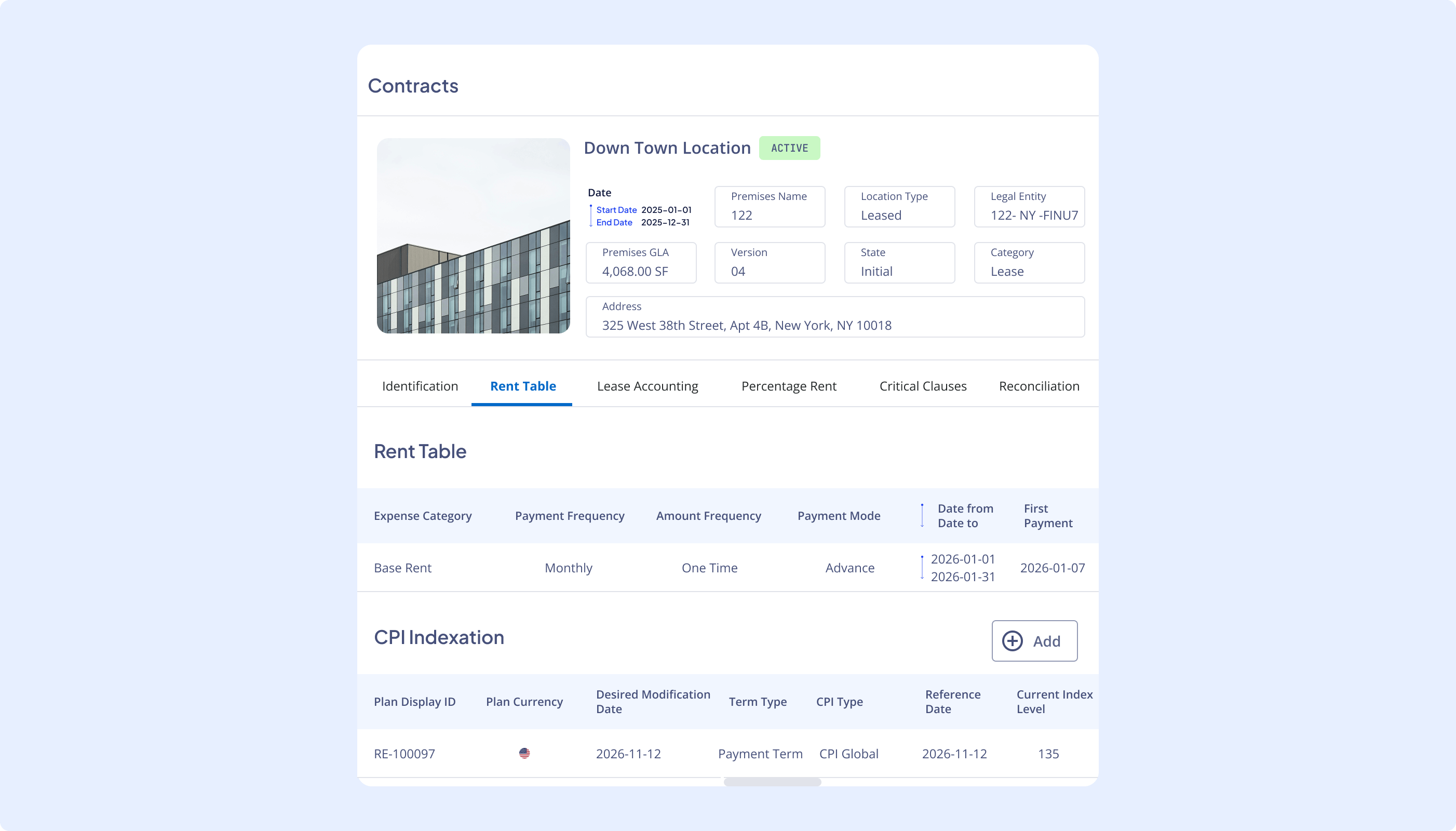

- Side-by-side comparison between potential sites (leased, owned, or both). Compare terms side by side, see potential revenues and planned investments, as well as automatically calculated financial KPIs to select the best location, under the best terms and conditions.

- Financial scenario modeling and forecasting capabilities: The system enables retailers to evaluate the long-term financial impact of lease terms, including rent escalation, taxes, insurance, and maintenance fees, across multiple currencies and economic environments. Contract managers can create draft leases or properties, input suggested terms and conditions, and generate future payment schedules to evaluate their financial implications. With built-in financial scenario modeling tools, retailers can simulate different outcomes, anticipate market fluctuations, and negotiate terms that optimize profitability while ensuring financial stability.

- Market data insight integration: Nakisa IWMS integrates market insights with portfolio data, allowing retailers to benchmark potential lease agreements against market trends and existing leases. This ensures that negotiated terms are competitive and aligned with broader global business strategies.

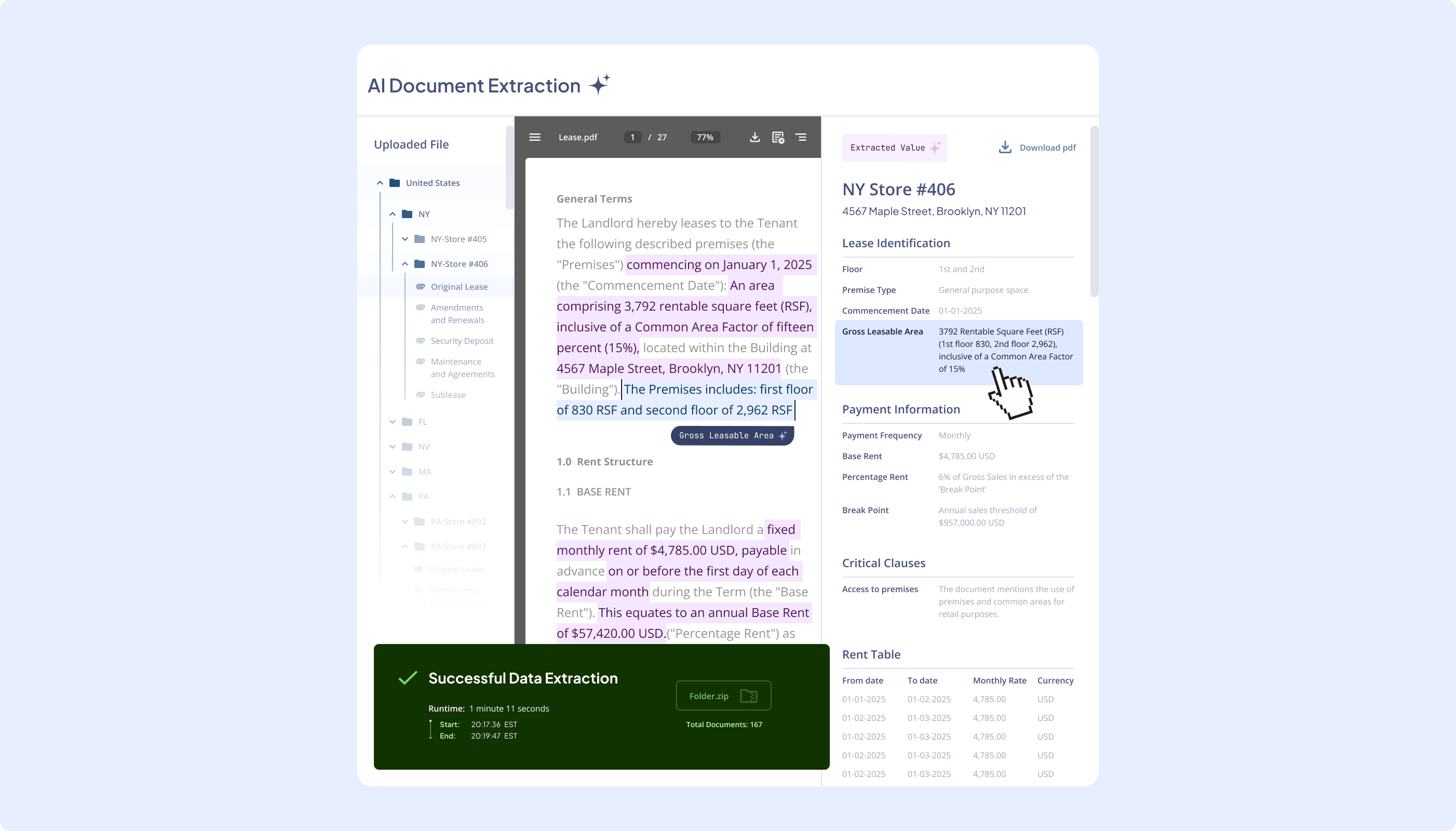

- Nakisa AI Document Abstraction enables rapid and accurate identification, abstraction, and validation of key fields in documents, with automation and precision across multiple languages and jurisdictions. This helps streamline lease management by reducing manual effort, minimizing errors, and speeding up workflows when considering a new contract sign.

Upload multiple documents and let Nakisa AI abstract them. You’ll see the extracted key data alongside the original document for quick validation

- Nakisa’s virtual library consolidates all lease-related data into a single, centralized platform, ensuring no detail—such as rent escalation clauses, renewal options, or financial obligations—is overlooked. Contract managers can easily search, tag, and view all documents associated with specific leases in one place. This centralization eliminates the risk of manual tracking errors and ensures that critical information is easily accessible to stakeholders worldwide.

- Internal coordination: Lease negotiations can be time-consuming, involving input from multiple departments across various regions. Nakisa IWMS accelerates this process with automated workflows, role-based access, and real-time collaboration tools. This enables teams to negotiate efficiently while maintaining full transparency and control. All negotiation-related documents are stored in an organized, centralized repository, accessible to authorized users. This not only simplifies the negotiation process but also ensures a clear audit trail for future reference.

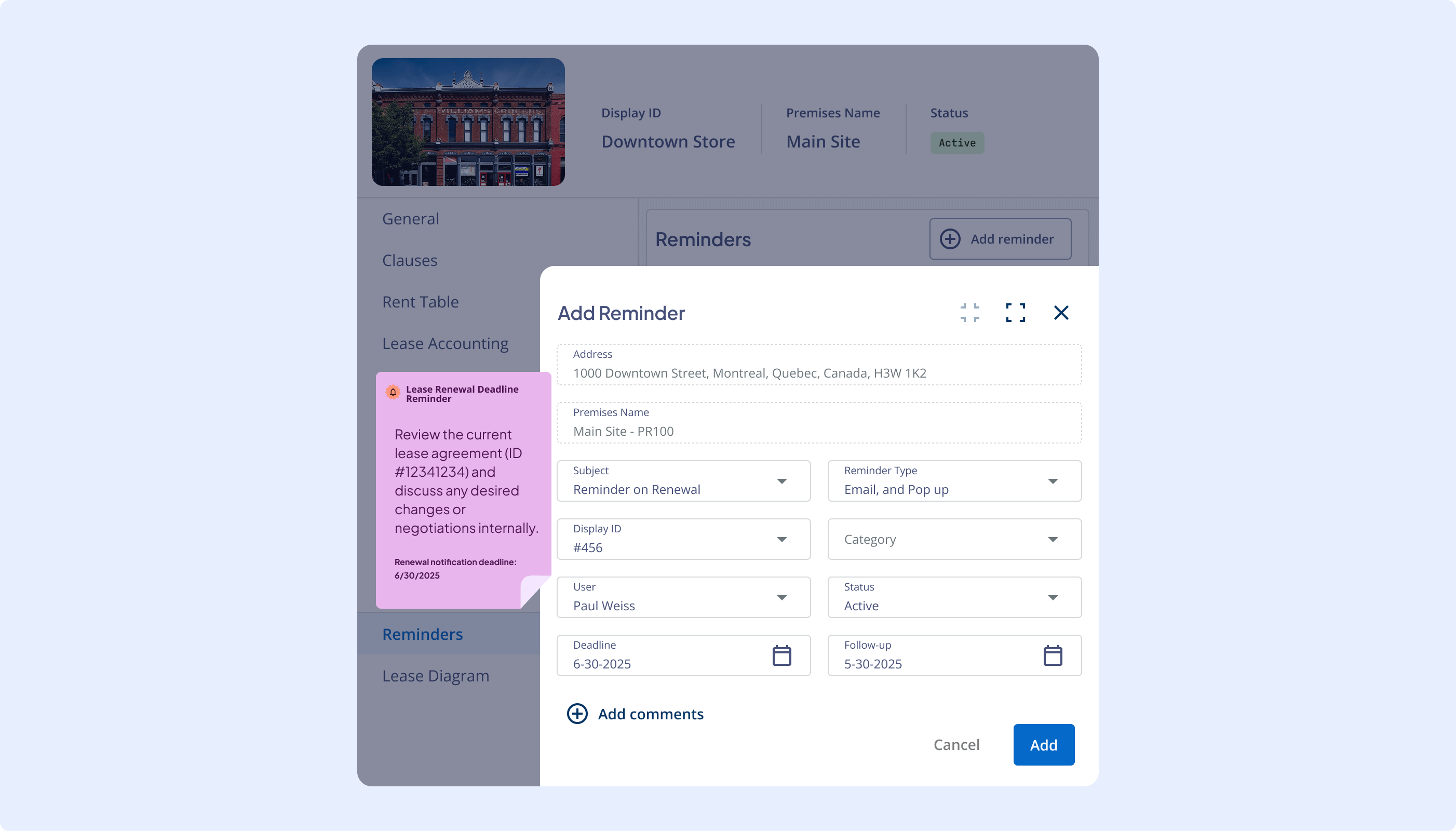

- Timeline management: Nakisa IWMS tracks and flags critical dates, such as negotiation deadlines, renewal windows, and payment schedules. Assignees will receive in-app notifications and email reminders to ensure they don’t miss any critical date.

These features help contract managers gain the visibility and confidence to approach lease negotiations strategically. Centralized tracking and organization ensure that every lease detail is easily accessible and set up for a seamless transition into the next phase—operating and monitoring leases, which we’ll cover more in depth in the next section, after looking at common challenges retailers would face while leasing, financing and building.

Jane Yi

Financial Analyst at EMCO

Operating and monitoring leases and facilities

Once leases are active, the focus shifts to managing their day-to-day operations while ensuring compliance with financial and contractual obligations. This stage involves tracking lease payments, monitoring critical dates, and ensuring adherence to financial reporting standards like IFRS 16, ASC 842, and local GAAP. For global retailers managing large and complex portfolios across multiple regions, maintaining visibility and control over lease performance is a critical challenge. Effective lease management is essential for optimizing costs, reducing risks, and driving operational efficiency—especially when dealing with intricate lease structures, varying payment models, and strict compliance requirements.

Let’s explore these challenges in more detail and how an IWMS solution like Nakisa can address them.

Challenge 6: Managing large, global, multi-asset retail portfolios

Global retailers face the complexity of managing a geographically dispersed portfolio. Each contract may have unique terms, regional compliance requirements, and operational nuances that must be coordinated across different time zones, currencies, and local regulations. As portfolios grow, centralized oversight and streamlined processes become critical to ensure consistency, efficiency, and strategic alignment. Without the right tools, organizations risk inefficiencies, data silos, and missed opportunities to optimize their assets.

Handling high contract volumes and manual lease data challenges

Global retailers often manage hundreds, or even thousands, of lease contracts. Each lease may come with its own set of terms, payment structures, escalation clauses, and renewal dates. Relying on manual management or spreadsheets is not only inefficient but also increases the risk of errors, missed deadlines, and non-compliance with contractual obligations. Legacy systems struggle to keep up with the complexity and volume of contracts, leaving retailers vulnerable to operational inefficiencies and financial discrepancies. A centralized enterprise-grade system is essential for tracking, analyzing, and reporting on extensive lease portfolios in real time to minimize operational costs and regulatory risks.

How Nakisa IWMS automates large-scale lease portfolio management

In Nakisa IWMS, the Portfolio Management Suite offers powerful lease management and accounting capabilities that address the complexities of managing large, global portfolios for retailers. Built on a cloud-native, innovative platform, Nakisa’s software easily handles complex portfolios of 300,000+ contracts from inception to termination.

With AI-driven automation and mass operations, Nakisa IWMS reduces manual work at all the stages of lease management.

- Centralized contract management: Nakisa’s virtual library consolidates all lease-related data into a single platform, ensuring no detail is overlooked. Nakisa organizes commercial real estate data into three intuitive levels: location, premise, and contract, ensuring seamless management and navigation. Retailers often manage multiple contracts for a single location, including head leases and various service agreements (e.g., security, maintenance). Nakisa allows teams to track and manage multiple contracts under a master lease agreement, providing a comprehensive view of all associated agreements, conditions, and payment processes at the premises level.

Additionally, users can attach lease contract files in various formats, ensuring easy access to original agreements when needed. Contract managers can easily search, tag, and view all documents associated with specific leases in one place, improving visibility and control while reducing the risk of missing obligations. Automatic alerts and email reminders help contract managers stay on top of critical dates, pending activations, renewal or termination deadlines, payment schedules, and more. The software enables retailers to efficiently manage, track, and reconcile all contracts within a unified platform, enhancing accuracy and control over their financial and operational obligations across different locations while ensuring seamless lease management and compliance. - Nakisa AI Document Abstraction: The tool enables rapid and accurate identification and abstraction of key fields in lease agreements and invoices. It allows for mass document abstraction, quick validation, and export of abstracts to eliminate manual work and reduce the risk of errors.

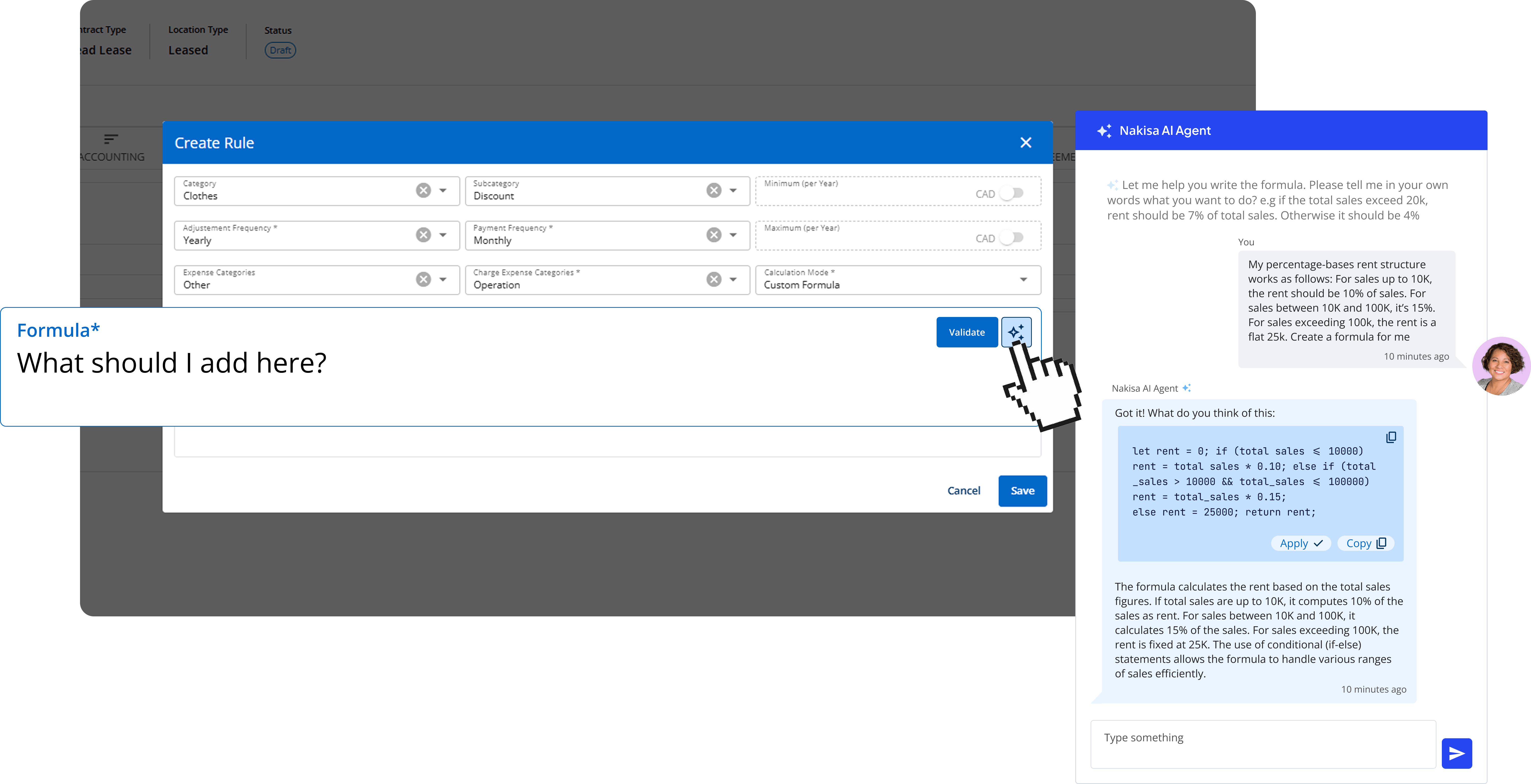

- Nakisa AI Agents: Leveraging cutting-edge agentic AI, Nakisa develops AI agents that significantly enhance operational efficiency for global retailers. For example, one AI agent assists with sales-based formula creation: contract managers just input the terms and conditions of the sales-based rent in plain English, and the agent automatically generates the corresponding Excel-like formula for the engine. Another AI agent simplifies the creation of custom dashboards—users can describe their requirements, and the agent designs a tailored dashboard that meets their specific needs.

- Automated mass and batch operations: The platform’s powerful mass data import capabilities streamline data entry, while incorporating format validation and error handling to help users quickly identify and resolve data discrepancies. The mass event management tool enables bulk modifications to lease components, simplifying updates to terms and ROU asset values. Contract managers just need to filter leases and contracts they want to apply changes for and schedule a mass modification job. Bulk integration automates tasks like transaction postings, workflows, and asset remeasurements, saving time for portfolios with hundreds of leases. Mass reversals and period adjustments allow accurate historical updates, while the job posting scheduler automates month-end activities with detailed logs for real-time tracking. This allows for efficient management of large volume of contracts while reducing the potential for errors, crucial to retailers with extensive global holdings.

- Automated calculations for both lease and non-lease expenses: Nakisa’s engine create rent tables and generates journal entries based on contractual agreements. Once the contract terms and conditions are entered into the system, the system automatically calculates variable rent payments and assists in reconciling contractual with actual expenses.

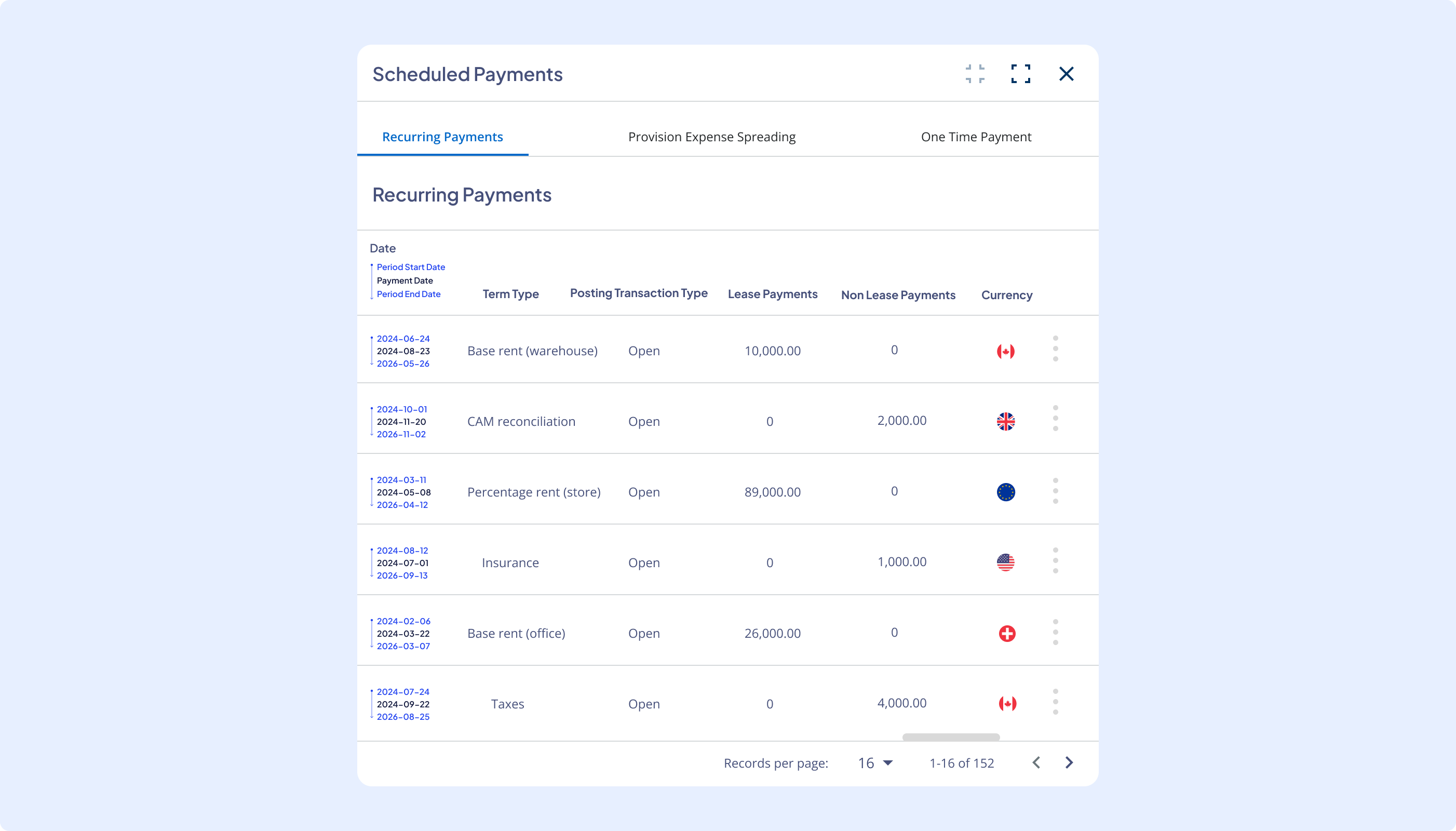

Based on contractual agreements, Nakisa Portfolio Management software schedules recurring and one-time payments for lease and non-lease expenses.

Managing multi-asset retail portfolios

Managing multi-asset portfolios, including properties, equipment, land, and fleets, presents significant challenges for large retailers. Each asset type requires unique management, maintenance, and compliance processes. For instance, properties demand lease administration and CAM reconciliation, equipment necessitates lifecycle tracking, and fleets require route optimization and maintenance scheduling. The complexity increases as retailers must consolidate and analyze vast amounts of data across these diverse asset categories, often stored in disparate systems, making it difficult to gain a unified view of the portfolio.

Additionally, retailers must manage both leased and owned real estate assets, ensuring proper oversight of lease obligations while also tracking owned property usage, associated costs, and maintenance requirements. Without a centralized approach, this can result in fragmented data, making it harder to optimize space utilization and financial planning.

Accurate cost allocation further complicates matters, as retailers need to distribute expenses, such as maintenance costs or property taxes, across multiple assets and locations, a process that can be both time-consuming and prone to errors.

Scalability is another concern, as managing a growing portfolio with diverse asset types becomes increasingly challenging when trying to align operational efficiency with strategic goals. Furthermore, the lack of integration between systems managing different asset categories often leads to inefficiencies and data silos, hindering cross-portfolio visibility and effective decision-making.

How Nakisa IWMS centralizes multi-asset portfolio management

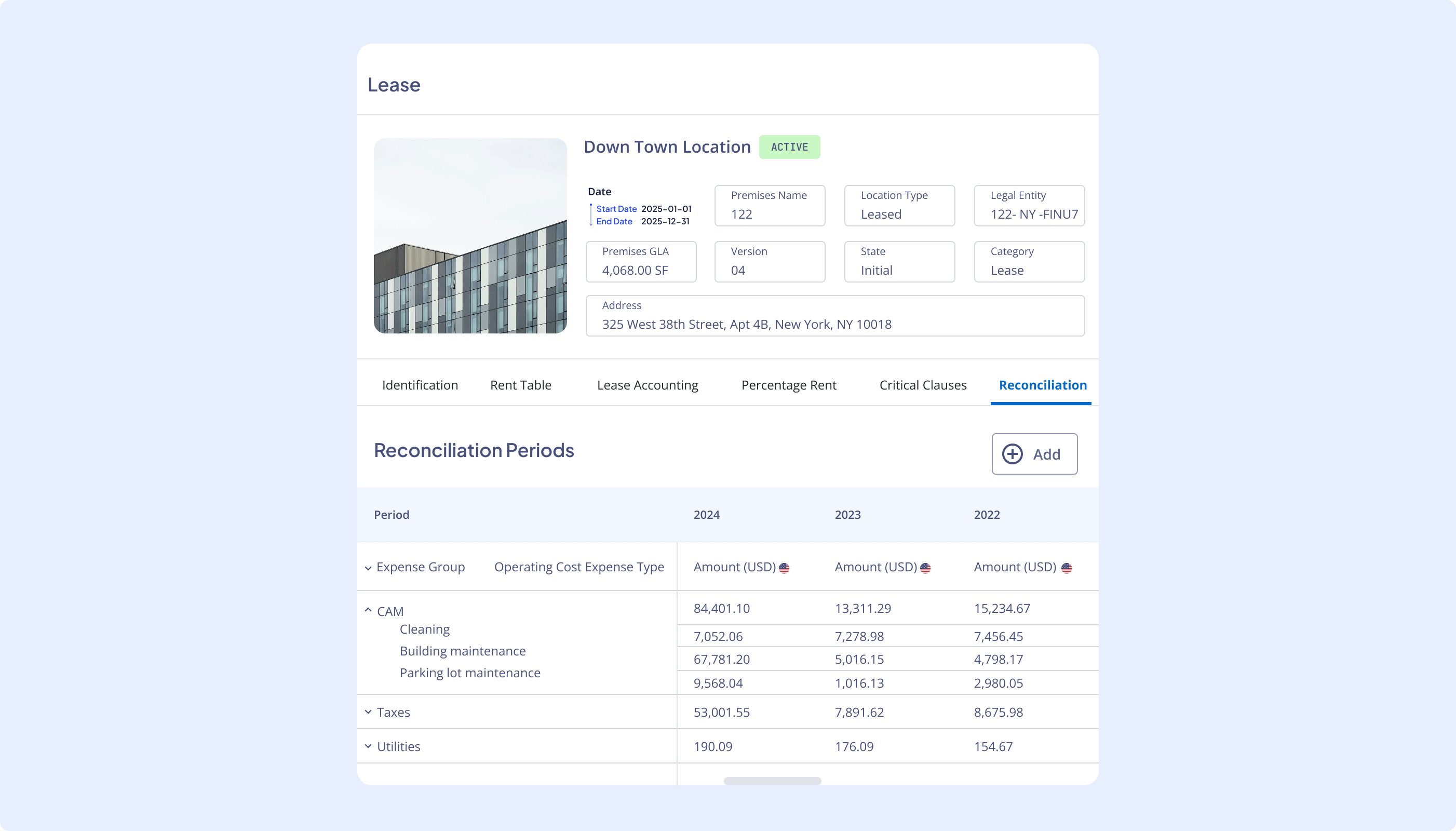

Nakisa IWMS addresses the complexities of managing multi-asset portfolios by providing a centralized platform that streamlines the management of any tangible asset, including properties, equipment, land, and fleets. It automates lease administration tasks such as CAM reconciliation and percentage-based rent for properties while facilitating lifecycle management and inventory tracking for equipment and optimizing fleet operations through granular lease structure from master lease agreement to activation group and unity-level.

Nakisa enables organizations to manage all owned, leased, and subleased assets within the same platform. This holistic approach eliminates data silos and enhances decision-making by providing a complete portfolio overview. Retailers can easily manage premises for their owned real estate assets and track all documents and asset-related expenses from a single platform, ensuring full visibility of their property footprint.

With Nakisa, retailers can ensure compliance with various regulatory requirements across asset types, including adherence to lease accounting standards like IFRS 16, ASC 842, and local GAAP. The platform provides true asset-level accounting, enabling retailers to track and manage individual assets within a single contract. This level of granularity ensures precise cost allocation, depreciation tracking, and reporting, reducing potential errors in financial reporting and ensuring compliance with accounting standards.

Optimizing global portfolio management: parallel accounting standards, multi-currency, multi-calendar, and multi-language support

Managing leases across numerous locations adds layers of complexity—especially when each region has its own specifics.

- Compliance requirements, financial standards, and tax implications: A retailer's portfolio could span several countries with different lease regulations that impact lease agreements. Retailers need a system that consolidates information from various locations while ensuring compliance with international and local standards (such as IFRS 16, ASC 842, and local GAAP), tax codes, and landlord obligations. As the portfolio grows, maintaining visibility into these leases and ensuring consistency across regions becomes even more critical. The lack of a centralized system offering parallel compliance can result in fragmented data, inefficiencies, and errors, ultimately hindering a retailer's ability to achieve compliance, make data-driven decisions, and optimize their global portfolio.

- Multi-currency translation: Global retailers often deal with leases in different currencies. Each contract may be negotiated in a local currency while the company's financial operations are conducted in a different corporate currency. This divergence complicates lease payments, financial reporting, and budgeting—especially when currency fluctuations impact expected costs. Retailers require a system that seamlessly handles multi-currency agreements to ensure accurate tracking of payments in different currencies and conversions when necessary. Furthermore, the system should generate consolidated financial reports in the corporate currency while allowing localized reporting in relevant lease currencies. This flexibility ensures retailers can maintain financial clarity and consistency across diverse markets and contracts while minimizing risks associated with exchange rate movements.

- Multi-calendar management: Retailers often face challenges managing leases with different calendar systems. Different countries or regions may follow distinct fiscal years, such as a calendar year (January to December) or a fiscal year that ends in March. Leases may involve multiple parties—such as tenants and landlords—who follow different calendar systems or fiscal periods. Local holidays, market-specific calendars, and lease-specific terms (e.g., anniversary dates for rent escalations or renewals) can further complicate matters.

Additionally, many retailers adopt non-standard accounting calendars that align financial reporting with seasonal and operational cycles rather than traditional monthly or quarterly schedules. Examples include the 4-4-5 calendar, which divides each quarter into three months with four, four, and five weeks respectively, totally 13 weeks per quarter; the 4-5-4 calendar, which follows a similar structure but allocates five weeks to the second month of each quarter; and the 13-period calendar, which splits periods to four weeks each, ensuring uniform reporting periods. These misalignments can complicate lease payment schedules, budgeting, reconciliation, financial reporting, and renewals. Global retailers need a system that integrates multi-calendar functionality, enabling them to manage lease obligations seamlessly across different periods and avoid confusion and delays arising from these discrepancies. - Multi-language management: In global operations, retailers often manage leases in different languages. This adds complexity in interpreting legal terms, financial obligations, and renewal clauses. Misunderstandings or incorrect translations can lead to contractual disputes, payment errors, or compliance issues. Furthermore, managing leases in multiple languages increases the administrative burden on teams who must ensure accurate and consistent data across all regions. A centralized system that supports multi-language capabilities is essential for avoiding errors and streamlining global lease management.

How Nakisa IWMS helps retailers manage global portfolios

- Multiple jurisdictions: Nakisa IWMS supports multi-location management by ensuring that each lease adheres to the relevant accounting practices, tax regulations, and compliance standards, such as IFRS 16, ASC 842, and local GAAP. This capability allows retailers to maintain consistent reporting across regions while staying compliant with diverse requirements. The platform integrates seamlessly with ERP systems, helping align financial reporting for global operations, improving visibility, and reducing the risk of errors.

- Multi-currency translation: Nakisa’s multi-currency support enables retailers to handle complex lease calculations and payments, including sales-base rent, across various currencies, while ensuring compliance with local as well as international regulations and accounting standards. The system tracks lease calculations and rent payments in different currencies, automatically converts them into the company’s reporting currency, and accounts for exchange rate fluctuations, ensuring precise financial reporting and streamlined lease management.

Alanna Bilben

Business Transformation IT RTR Lead at 3M

- Multi-language support: Nakisa IWMS offers multi-language functionality (English, French, Spanish), enabling retailers to operate seamlessly across global teams with diverse language needs. This feature ensures that all users, regardless of their location, can access lease information in their preferred language, improving communication and reducing errors. It supports global operations, making compliance with local regulations more efficient and enhancing the overall user experience for multinational teams.

- Multi-calendar support: with Nakisa’s multi-calendar functionality, retailers can seamlessly manage leases across various market-specific calendars and fiscal periods, including standard and non-standard formats like 4-4-5, 4-5-4, 360, and custom calendars. This ensures that lease payment schedules, renewals, rent escalations, and financial reporting align precisely with both company policies and regional requirements. By accommodating diverse fiscal structures, this feature helps prevent misalignments in payments or reporting, reducing errors and enhancing operational efficiency across multiple regions. Additionally, Nakisa allows users to create fiscal variants for each legal entity, offering flexibility tailored to industry-specific needs and global operations.

Overall, Nakisa IWMS offers global retailers a comprehensive, flexible, and robust solution for managing and operating extensive portfolios. By enhancing visibility, ensuring accuracy, and supporting compliance, it serves as an essential tool for retailers aiming to optimize their global asset management strategies.

Rodolfo Etelwof Juarez Arevalo

IFRS and Accounting Policies Manager at Unicomer Group

Challenge 7: Managing complex lease structures in retail operations

Retailers face significant challenges in managing complex lease structures, especially subleases and sandwich leases. Each lease comes with unique terms that demand careful tracking and coordination. Without effective management, these complexities can lead to financial penalties, missed opportunities for renegotiation, or even disputes, making it crucial to address them proactively.

Handling embedded leases

Embedded leases refer to lease components often hidden within broader service contracts such as logistics or maintenance agreements, making them hard to track. Due to this lack of visibility, retailers may unknowingly fail to account for these embedded leases, leading to substantial legal and compliance risks, particularly under accounting standards like ASC 842 or IFRS 16, which require leases to be capitalized on the balance sheet.

Managing embedded leases is time-consuming and complex. Once identified, the lease and non-lease components must be accounted for separately. Retailers’ long-term outsourcing agreements often evolve, requiring accountants to monitor changes affecting embedded lease accounting.

How Nakisa simplifies embedded lease tracking

Nakisa simplifies embedded lease management by providing a centralized platform where retailers can track both the lease itself and any related service or maintenance agreements as non-lease expenses. Instead of manually separating embedded lease components across different systems, Nakisa ensures that all contractual obligations—whether lease-related or service-based—are managed in one place.

Once an embedded lease is identified, Nakisa automatically classifies the lease component for capitalization under IFRS 16 or ASC 842 while recording related service and maintenance agreements as non-lease expenses. This structured approach ensures accurate financial reporting by correctly allocating payments, preventing misclassification, and maintaining compliance. Additionally, Nakisa allows finance teams to track cost fluctuations, renewal terms, and contract modifications over time, ensuring that both lease and service costs are fully accounted for throughout the contract lifecycle.

With Nakisa, retailers gain a single source of truth for managing embedded leases, reducing manual effort, eliminating data silos, and ensuring a clear distinction between lease and non-lease financial commitments.

Managing subleases and sandwich lease structures

Retailers who act as both tenants and landlords face a unique set of challenges, requiring them to manage two different sets of responsibilities. Balancing these roles demands a deep understanding of lease agreements, financial obligations, and operational efficiency.

As a tenant, retailers must ensure compliance with lease terms, including rent payments, common area maintenance (CAM) charges, property taxes, and insurance premiums. At the same time, as a landlord, they must track income from tenants, manage lease escalations, and ensure property maintenance according to lease agreements. This dual responsibility increases administrative complexity, as both income and expenses must be effectively managed and aligned.

Subleasing adds further complexity, particularly in sandwich lease arrangements where the retailer leases property from an owner and then subleases it to a third party. This scenario requires handling separate obligations for both the primary lease (tenant) and the sublease (landlord), with distinct accounting treatments for each role.

From a lease management perspective, subleasing requires aligning payment schedules, monitoring compliance with local laws, and managing obligations to both the landlord and the subtenant. From a lease accounting perspective, this dual role necessitates separate accounting treatments for the lease liability (as a lessee) and lease income (as a lessor), further complicating financial reporting. Subleasing often necessitates the reassessment of the ROU asset and lease liability. Additionally, if the terms of the original lease are modified to accommodate subleasing, retailers must perform additional calculations to ensure compliance with lease accounting standards such as IFRS 16 and ASC 842.

Without a proper, centralized system in place, these multi-layered arrangements can lead to discrepancies, financial instability, and compliance risks. This makes it crucial for retailers to adopt robust tracking and management tools to stay on top of their subleasing commitments while ensuring transparency in financial reporting.

How Nakisa IWMS streamlines sublease and sandwich lease management

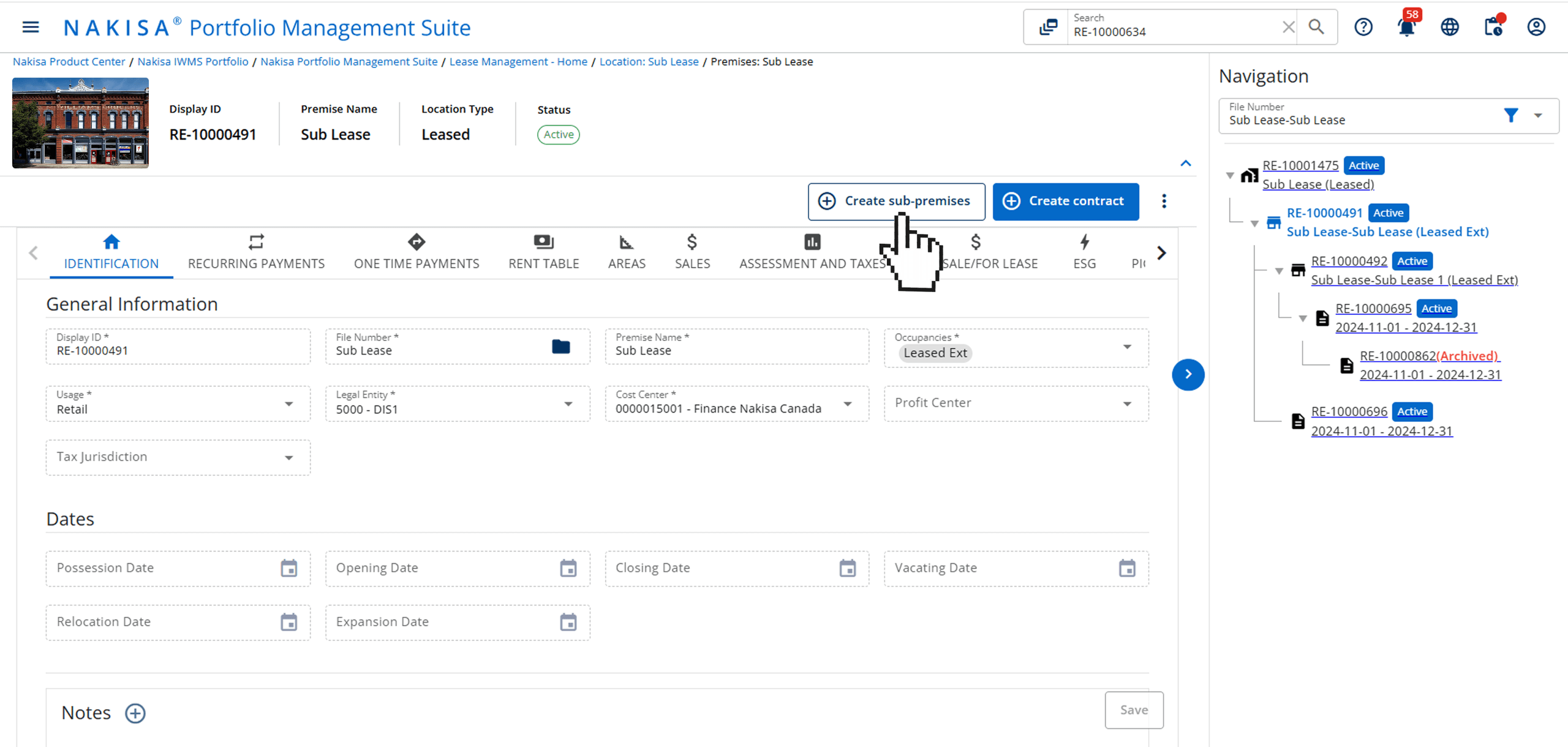

Nakisa IWMS is purpose-built for global retailers. The Portfolio Management Suite provides robust capabilities to effectively manage complex lease structures, including lessor, lessee, and sublease functionality.

For retailers managing both lessee and lessor roles, Nakisa IWMS provides a centralized platform for end-to-end lease management and accounting. This includes automating the separation of lease liability (as a lessee) and lease income (as a lessor), ensuring compliance with IFRS 16 and ASC 842 through appropriate accounting treatments. Nakisa's lessor accounting module supports operating leases, allowing retailers to manage any asset with precision. The module streamlines event management for individual and bulk leases, handles modifications efficiently, and provides automated financial schedules, periodic postings, and detailed reports to enhance lease portfolio management.

Nakisa IWMS serves as a centralized repository for storing and managing all lease agreements, facilitating efficient tracking of both primary leases and subleases. Retailers can generate lessor leases to easily track and administer subleased assets. The software then automatically recalculates the ROU asset and lease liability, ensuring that these components accurately reflect the subleased portion of the asset. The software allows for the management of subleased areas (square meters/square footage), adding an extra layer of granularity that saves time and improves accuracy.

Nakisa IWMS simplifies the management of sandwich leases by enabling retailers to create two contracts for the same location, one for the head lease and another for the sublease, while maintaining full control over lease terms and ensuring compliance from subtenants. Retailers can easily compare clauses in two contracts to spot discrepancies and inconsistencies. The platform also automates the reassessment of right-of-use (ROU) assets and lease liabilities when subleasing occurs, ensuring that financial components accurately reflect the subleased portions and eliminating the risk of errors.

Additionally, the software automatically adjusts for any modifications to original lease terms, such as those related to subleasing, reducing administrative effort and minimizing non-compliance risks. Nakisa generates separate invoices for landlords and subtenants, streamlining payment processes, and provides robust reporting capabilities for real-time visibility into lease and financial performance.

Nakisa IWMS also enhances sublease tracking and reporting with comprehensive dashboards and lessor-specific reporting tools, providing real-time visibility into subleased assets, lease income, and financial performance. Retailers can easily monitor sublease agreements, track payments, and analyze occupancy data through dashboards and automated reports that consolidate key lease metrics, including sublease revenue, lease modifications, and financial impacts.

With built-in audit trails and configurable reporting, Nakisa ensures full transparency, simplifies compliance, and enables data-driven decision-making for retailers managing subleased properties. These features empower retailers to make informed decisions while maintaining transparency and accuracy in their lease portfolios.

Nakisa Portfolio Management software makes sublease creation and management easy, thanks to its clear hierarchy of location, premises, and contracts.

Managing evergreen leases

Global retailers frequently use evergreen leases, particularly for retail store and product leasing agreements. These leases automatically renew for successive terms unless terminated. For example, a clothing brand may sign a five-year lease for a prime storefront with an automatic renewal clause, extending the lease for additional five-year terms unless either party provides notice to terminate. This offers stability and flexibility, allowing the retailer to maintain a presence in high-traffic locations without constant renegotiation. Similarly, retailers often lease space in shopping malls with automatic renewal provisions, ensuring continuity in desirable locations and minimizing operational disruptions. Retailers may also engage in evergreen leasing for products and fixtures, such as flooring.

These evergreen leases present unique challenges in both lease management and financial reporting. From a management perspective, retailers must carefully track lease terms, conditions, and payments for each renewal cycle. The indefinite duration of these leases complicates long-term financial planning, as the lease continues without a defined end date unless terminated.

In terms of accounting, evergreen leases require compliance with standards like IFRS 16 and ASC 842, which mandate the recognition of right-of-use (ROU) assets and lease liabilities. The continuous renewal process makes it difficult to assess the long-term financial impact. Additionally, managing lease modifications—such as changes in terms—and ensuring proper accounting for renewal periods becomes more complicated due to variations in regulations across jurisdictions.

Accurately identifying evergreen leases in an organization’s portfolio also presents a challenge. Retailers must review lease agreements to spot automatic renewal clauses. Failure to properly identify these leases can lead to unexpected financial commitments, operational disruptions, and difficulties in renegotiating favorable terms. Addressing these complexities requires robust systems and processes to ensure compliance and effective lease management.

How Nakisa IWMS enhances evergreen lease management with automated contract extension

Nakisa IWMS supports evergreen leases, enabling retailers to automatically renew lease agreements while ensuring compliance with accounting standards. Retailers retain control over which leases are extended, providing flexibility and oversight.

The solution automates month-to-month contract extensions after the original contract end date. This setting can be activated at lease inception or at any point during the lease term through contract versioning. Admin-level configurations direct all financial postings for these renewals to a non-lease expense category, simplifying tracking and reporting for leases extended beyond their contractual term. By automating this process, Nakisa ensures seamless payment generation without manual intervention. This not only streamlines lease management but also reduces administrative effort.

However, without proper oversight, the automatic renewal process can lead to extended lease periods without necessary review or renegotiation, potentially misaligning with current business needs or market conditions. Nakisa IWMS mitigates this risk by providing powerful reporting, customizable dashboards, and real-time lease status overviews. Contract managers can easily track leases that have switched to month-to-month extensions and conduct timely reviews. Additionally, automated reminders and alerts notify contract managers in advance of upcoming renewal dates, facilitating proactive reviews and adjustments.

Regularly assessing evergreen lease terms and market value ensures retailers remain in control, allowing them to take timely actions—whether adjusting or terminating leases—to avoid unforeseen financial or operational impacts.

Overall, Nakisa IWMS empowers global retailers by providing a comprehensive solution for managing complex lease structures efficiently. With its advanced features for automation, compliance tracking, and real-time reporting, Nakisa enhances operational efficiency, ensuring their long-term success in a dynamic marketplace.

Challenge 8: Managing complex fixed and variable rents

For retailers, managing complex lease agreements is a significant challenge, particularly when dealing with percentage rent leases and escalating rent structures across a vast network of stores. With multiple locations and varying lease terms, accurate rent calculation and forecasting are critical to maintaining financial accuracy and lease compliance. Without the right tools, managing these complexities can lead to errors, financial inefficiencies, and strained landlord-tenant relationships.

Simplifying percentage and sales-based rent management

Percentage rent leases, where tenants pay a percentage of their sales (often gross sales) in addition to a base rent, are common in retail. The percentage applied may vary across different sales ranges or product categories, adding layers of complexity to the calculation process. While this structure can be beneficial for both tenant and landlord, it introduces several challenges. Retailers must accurately track fluctuating sales performance data, which can vary due to seasonal demand, location, and other factors.

Calculating the correct rent can be complex, especially for retailers managing multi-location lease agreements. Any inaccuracies in sales tracking or rent calculations can result in disputes with landlords and potential financial losses.

Furthermore, many leases with variable rent terms require periodic reconciliation (true-ups) based on actual sales data. Retailers must ensure these adjustments are processed correctly and in a timely manner. Inaccurate reconciliations can distort lease obligations, leading to discrepancies in financial statements that may trigger non-compliance with relevant accounting standards.

Ensuring timely and accurate rent payments often requires automated rent tracking tools to capture and analyze sales data in real time.

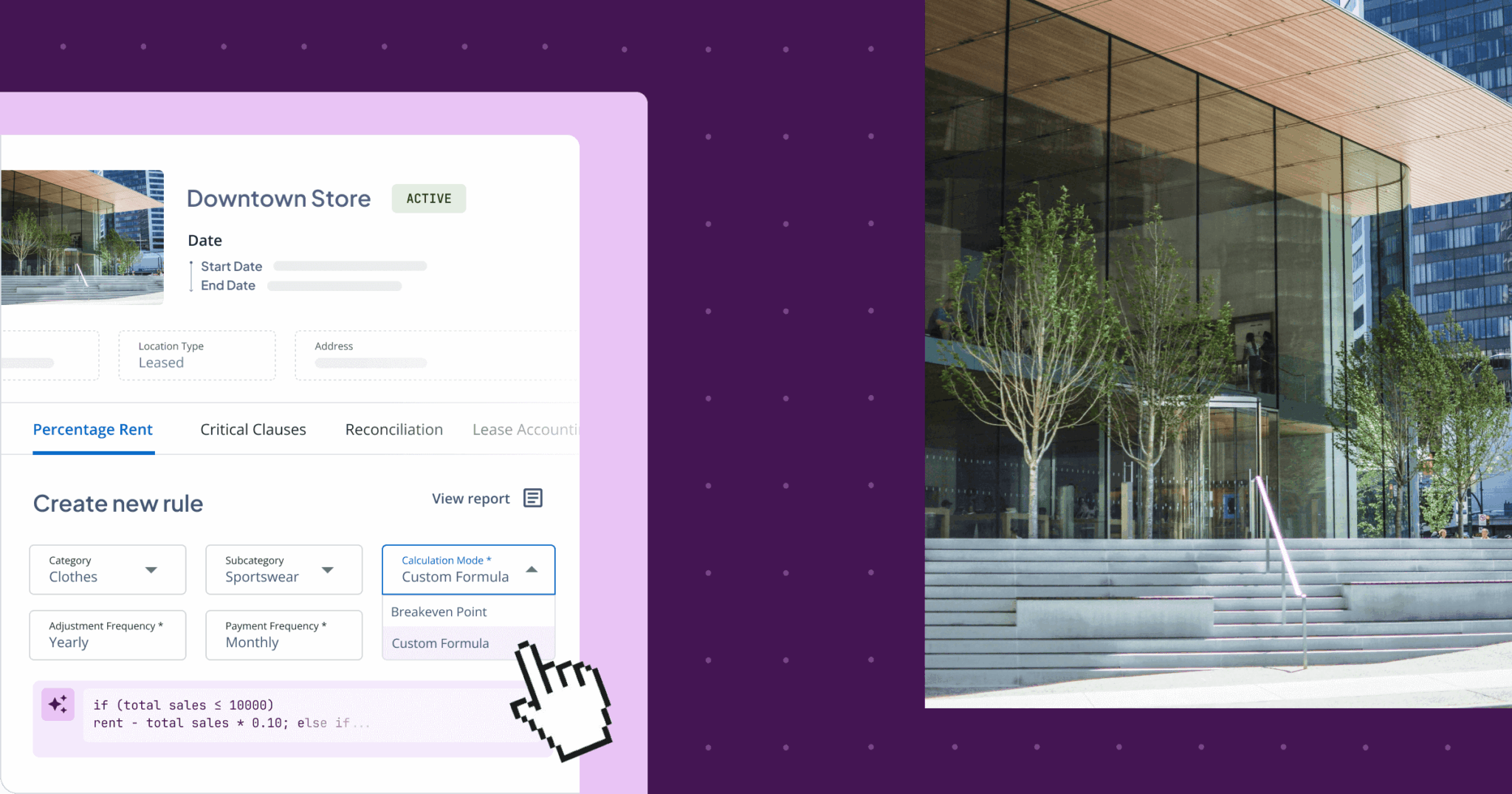

How Nakisa IWMS automates complex variable rent calculation and management

Nakisa IWMS streamlines calculation, tracking, reconciliation, and payment of complex percentage rent scenarios. The software automates percentage rent calculations based on actual sales data, which can be uploaded manually, through an Excel template, or API integration with POS systems. Contract managers can define complex percentage rent formulas specific to their business needs. These formulas can include if-else statements, comparison operators, minimum and maximum values, absolute values, excluded categories, and more. They can integrate variables such as total sales, sales per category, days in period, or days in adjusted period into calculations, providing unmatched flexibility to accommodate diverse rent structures and financial arrangements unique to each business requirements.

What’s more, Nakisa AI Agent for variable rent calculation can assist with formula creation—contract managers need just to enter the contractual obligation in a chat, and the AI Agent will generate the correct formula for the system.

Nakisa AI Agent simplifies complex variable rent calculations by converting lease terms into accurate, ready-to-use formulas.

Real estate professionals can create batch work to generate multiple percentage rent calculations simultaneously, further enhancing efficiency. The system also supports multi-currency transactions to eliminate manual calculation errors and reduce the administrative burden for retailers with extensive portfolios.

Nakisa IWMS also offers the reconciliation of rent adjustments, ensuring that any variances between estimated and actual sales are captured and corrected in a timely manner. This feature automates the true-up process, reducing the risk of underreporting or overreporting rent obligations.

Furthermore, by automating percentage rent calculations and ensuring timely reconciliations, Nakisa prevents discrepancies in financial statements, ensuring accounting compliance such as IFRS 16 and ASC 842. This allows lease accountants to maintain the accuracy of their financial reporting, even when rents fluctuate based on performance.

Managing escalating rent across retail locations