What unique workforce challenges banks and financial institutions face, and how next-gen org design, workforce planning, and advanced analytics solutions address them

Banks and financial institutions operate in one of the most complex workforce environments, shaped by stringent regulations, rapid technological advancements, a globalized clientele and workforce, and dynamic market conditions. These factors demand constant adaptation and strategic foresight to maintain operational efficiency and long-term success. Based on our experience working with leading financial institutions, these challenges can be grouped into the following key categories:

- Organizational complexity and regulatory challenges – Managing multi-layered hierarchies across regions while staying compliant with evolving financial regulations.

- Technology and cybersecurity challenges – Adapting to rapid digital transformation while safeguarding critical systems and data.

- Structural and operational challenges – Navigating frequent reorganizations, shifting reporting lines, and efficiency issues across business units.

- Talent and workforce challenges – Forecasting future needs and hiring, retaining, and developing tech-savvy talent in a highly competitive market.

Effectively addressing these challenges requires banks and financial institutions to conduct thorough workforce assessments and develop a deep understanding of their current workforce and future needs. This is essential for ensuring compliance, maintaining organizational health in the short and medium term, and preparing for long-term success.

In the following sections, we’ll explore each of these challenges in detail and discuss how an advanced, end-to-end solution that comprises org design, workforce planning, org visualization, and advanced HR analytics can help overcome them.

Challenge 1: Navigating organizational and regulatory challenges banks and financial institutions face

Banks and financial institutions often operate within large, multi-layered structures that span regions and business units, creating significant organizational complexity. Managing these complex hierarchies manually results in inefficiencies, miscommunication, and data silos. Poor data quality, caused by inconsistent updates or disconnected systems, further complicates decision-making. As a result, maintaining organizational alignment and managing spans of control, layers, and reporting structures across global operations becomes increasingly difficult.

Compounding this complexity is the highly regulated environment in which these institutions operate. Regulatory requirements extend beyond financial transaction oversight to impact governance, staffing transparency, and workforce planning. Compliance with these regulations is critical to maintaining legal and operational integrity, yet it demands meticulous oversight and robust systems to address evolving standards effectively.

For example, the Dodd-Frank Act introduced stricter governance and risk management requirements, increasing the need for clear role definitions, reporting structures, and oversight mechanisms within financial institutions. Banks must ensure that key governance roles—such as risk officers and compliance teams—are structured effectively and have clear reporting lines to meet regulatory expectations.

Similarly, Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations require financial institutions to train employees on anti-money laundering procedures and meet compliance staffing requirements. This necessitates specialized teams, clear access controls, and structured oversight to detect and prevent financial crimes. Organizations must also maintain well-documented compliance teams and ensure they have the necessary expertise and reporting mechanisms in place.

In addition, many jurisdictions enforce diversity, equity, and inclusion (DEI) reporting regulations, such as the UK Gender Pay Gap Reporting and the EU Corporate Sustainability Reporting Directive (CSRD). Further complicating matters, different regulations apply across different regions, making staffing compliance a serious challenge for multinational institutions.

These regulations require organizations to track and report workforce composition, pay equity, and diversity metrics, and compare them against established goals and benchmarks, which can be challenging without a centralized system for workforce visibility and analytics.

The financial services sector has notable diversity gaps, particularly at senior management levels. Women and people of color remain underrepresented, prompting a need for targeted recruitment strategies that prioritize diversity. To address this, financial institutions must develop robust employee resource groups and mentorship programs to foster an inclusive workplace culture. Ensuring compliance with DEI regulations is not just about meeting legal requirements; it also strengthens employer branding, enhances talent retention, and mitigates reputational risks.

Another challenge is localization and succession planning requirements. In many jurisdictions, banking regulations mandate that subsidiaries be increasingly staffed with in-country personnel or require financial institutions to establish clear succession plans for key leadership roles. For example, credit unions are required to ensure that their boards of directors implement written leadership succession plans, which must be reviewed at least every 24 months. This adds complexity to workforce planning, making it essential for banks to have solutions that can track regulatory compliance over time, visualize workforce structures, and model future staffing scenarios.

Given the variability of workforce regulations across jurisdictions, financial institutions must take a proactive approach to workforce planning, ensuring that hiring, talent retention, and organizational structures align with evolving regulatory, stakeholder, and public expectations.

We can argue that meeting regulatory and compliance requirements in the banking and financial sector is fundamentally about addressing the following challenges:

- Transparency, visibility, and record-keeping – Ensure compliance with regulations such as DEI, AML, KYC, and localization and succession planning mandates by maintaining centralized workforce data, structured reporting, and audit trails.

- Having the right employees in place – Maintain specialized compliance teams, risk officers, and governance roles while ensuring in-country staffing requirements and fostering diversity at all levels to meet regulatory and organizational expectations.

- Ensuring the right skills and knowledge – Support ongoing training, certifications, and upskilling to keep pace with evolving financial regulations, risk management standards, and jurisdiction-specific workforce compliance requirements.

In the following section, we’ll explore how an enterprise-grade solution like Nakisa can empower banks and financial institutions to navigate these regulatory and compliance challenges effectively.

How Nakisa addresses organizational and regulatory challenges in banking and finance

For banks and financial institutions, ensuring compliance requires an approach that integrates HR data, provides real-time visibility, and enables seamless reporting for regulatory audits. Without a centralized system with advanced reporting capabilities, it takes a remarkable amount of work to truly understand the makeup of a financial institution’s workforce, particularly if it’s a multinational organization with many employees.

Nakisa Org Chart provides a comprehensive solution to achieve this, with powerful organization visualizations, out-of-the-box reporting, and advanced analytics, to slice and dice data, drill down, filter, and perform elastic searches.

A single source of truth

Nakisa seamlessly integrates with major ERP and HCM systems like SAP HCM, SAP SFSF, Workday, Oracle Fusion, Oracle EBS, and PeopleSoft and offers robust, platform-agnostic APIs to connect with third-party systems. Nakisa consolidates all datasets, with no record limits, from different systems (talent, skills, finance, HR, payroll, employee surveys, and more) into a single source of truth. This eliminates data cleansing and validates data quality by addressing issues like orphan records, vacancies, multiple managers, multiple incumbents, and missing or inaccurate data.

By ensuring global accuracy in banking data, Nakisa helps financial institutions meet regulatory requirements while accelerating workflows and reducing operational risks. With access to clean, up-to-date, consistent information, organizations can have an accurate view of their workforce and confidently execute strategic and operational workforce planning initiatives, without the setbacks caused by inadvertently using outdated or inconsistent data.

Easy, dynamic workforce visualization and monitoring

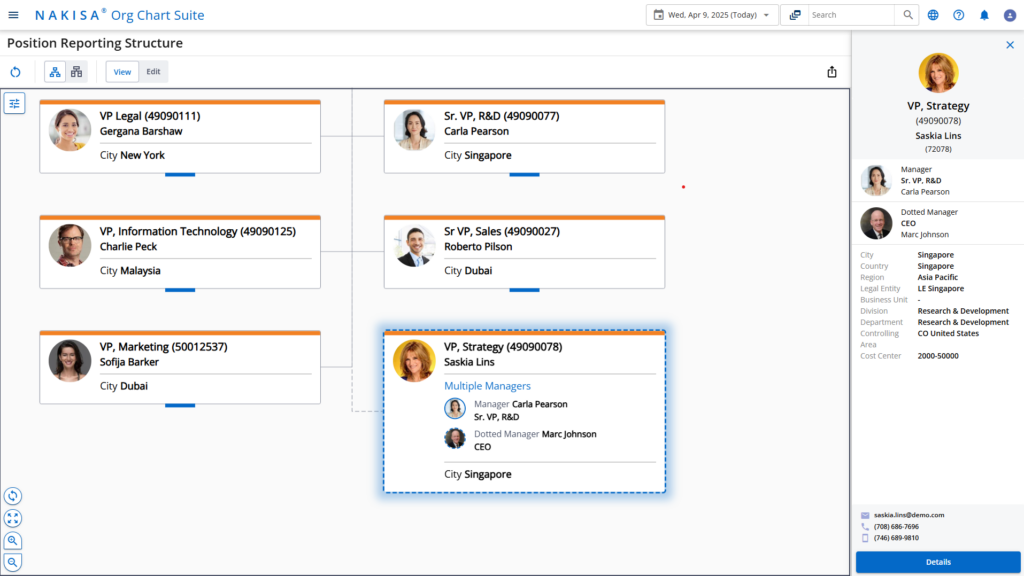

Nakisa’s interactive, real-time org charts provide you with a comprehensive view of all employees, roles, reporting hierarchies, and vacancies within a bank. These charts update dynamically to reflect organizational changes as they happen, whether minor operational updates, such as employee role changes, or major transformations, including mergers, restructuring, reorganizations, or large-scale workforce shifts. Beyond workforce insights, compliance-related information can also be accessed directly from org charts, helping financial institutions meet regulatory requirements effectively.

Key capabilities include:

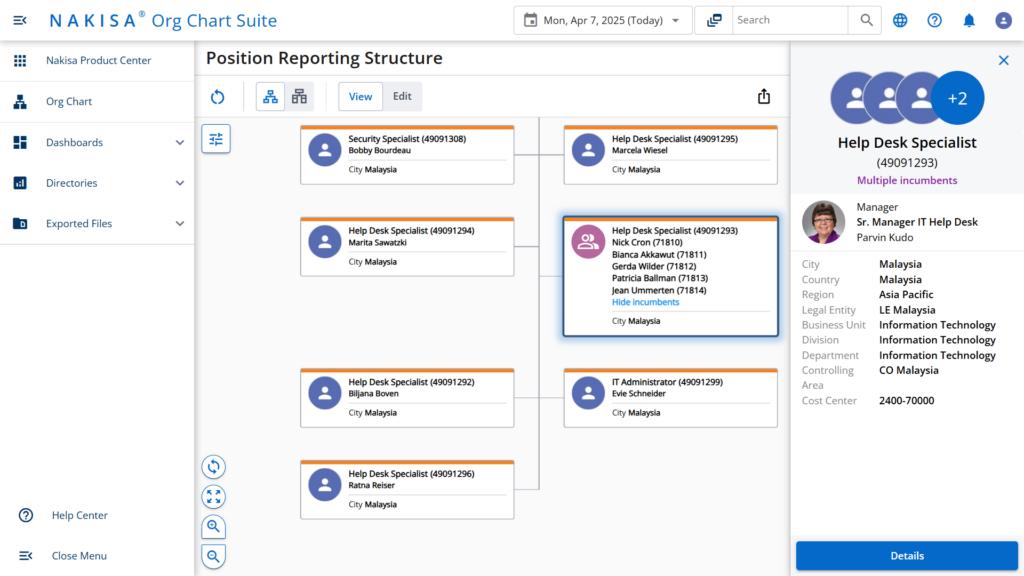

- Clear visibility of reporting structure – Easily visualize your organization's reporting hierarchy as maintained in your ERP and HCM. Use a scoped search to generate a hierarchical list of all positions and employees. Visualize multiple incumbents of a role directly in org charts and identify orphaned positions to help HR professionals correct data inconsistencies. Visualize all standard and complex reporting structures common in financial institutions, including hierarchical, matrix, and dotted-line reporting.

Nakisa’s org chart software supports dotted-line reporting, vacant positions, and multiple incumbents per position.

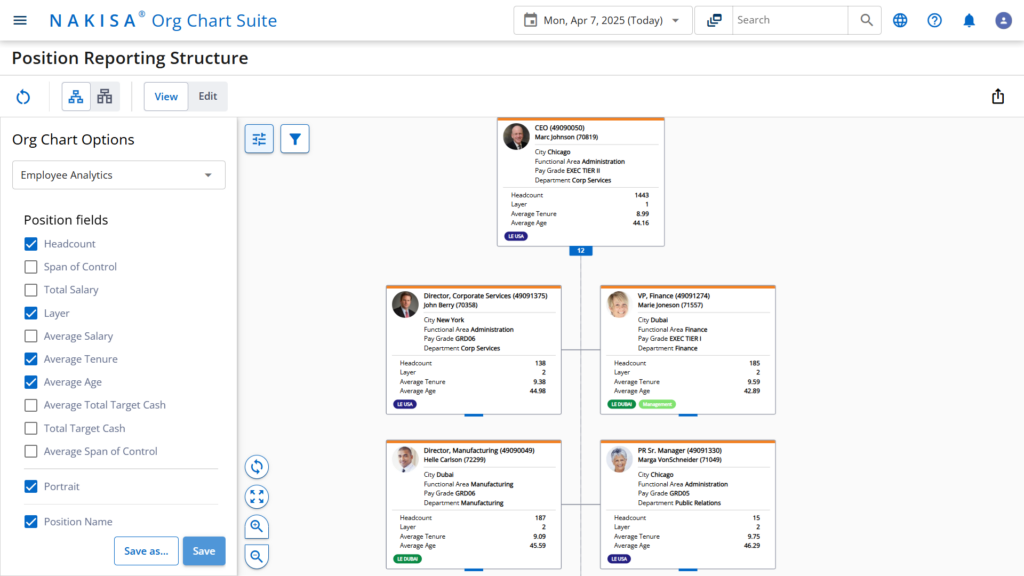

- Real-time org charts with in-chart metrics – Create interactive, real-time org charts that reflect the current structure of your organization, and visualize key KPIs (e.g., span of control, layers, headcounts, performance, and skills) right in your chart to cut down time spent jumping across files and screens.

- Summarized complex HR data – Access streamlined summaries of workforce-related information for better decision-making.

- Historical org charts – See snapshots of org structures from past iterations of your workforce, to show past reporting lines and workforce compliance at any given time.

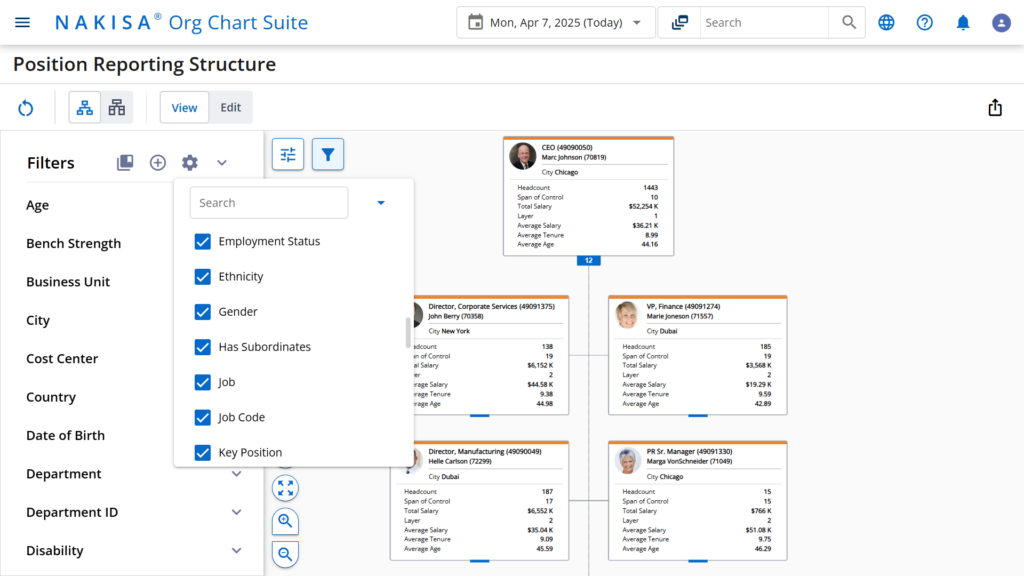

- Dynamic workforce visualization – Utilize out-of-the-box filters to visualize specific workforce metrics by function, geography, business unit, or product line, regulatory oversight, reporting lines, and more. Leverage multi-view capabilities to switch between different custom organizational views, tailored to your use cases such as talent management and succession planning.

- Out-of-the-box and tailored reporting – View your organization’s talent from every angle. Leverage comprehensive dashboards and out-of-the-box reports on people analytics, recruitment, termination, span of control, succession management, and more from Day 1. You can easily drill down data, filter, exclude, and organize the information in easy-to-configure, schedulable reports to track targets and visualize trends on an ongoing basis.

Michelle Seymore

Head People & Culture Transactional Solutions at Standard Bank Group

Nakisa’s org chart software allows for a vast selection of filters to slice, dice, and drill down data.

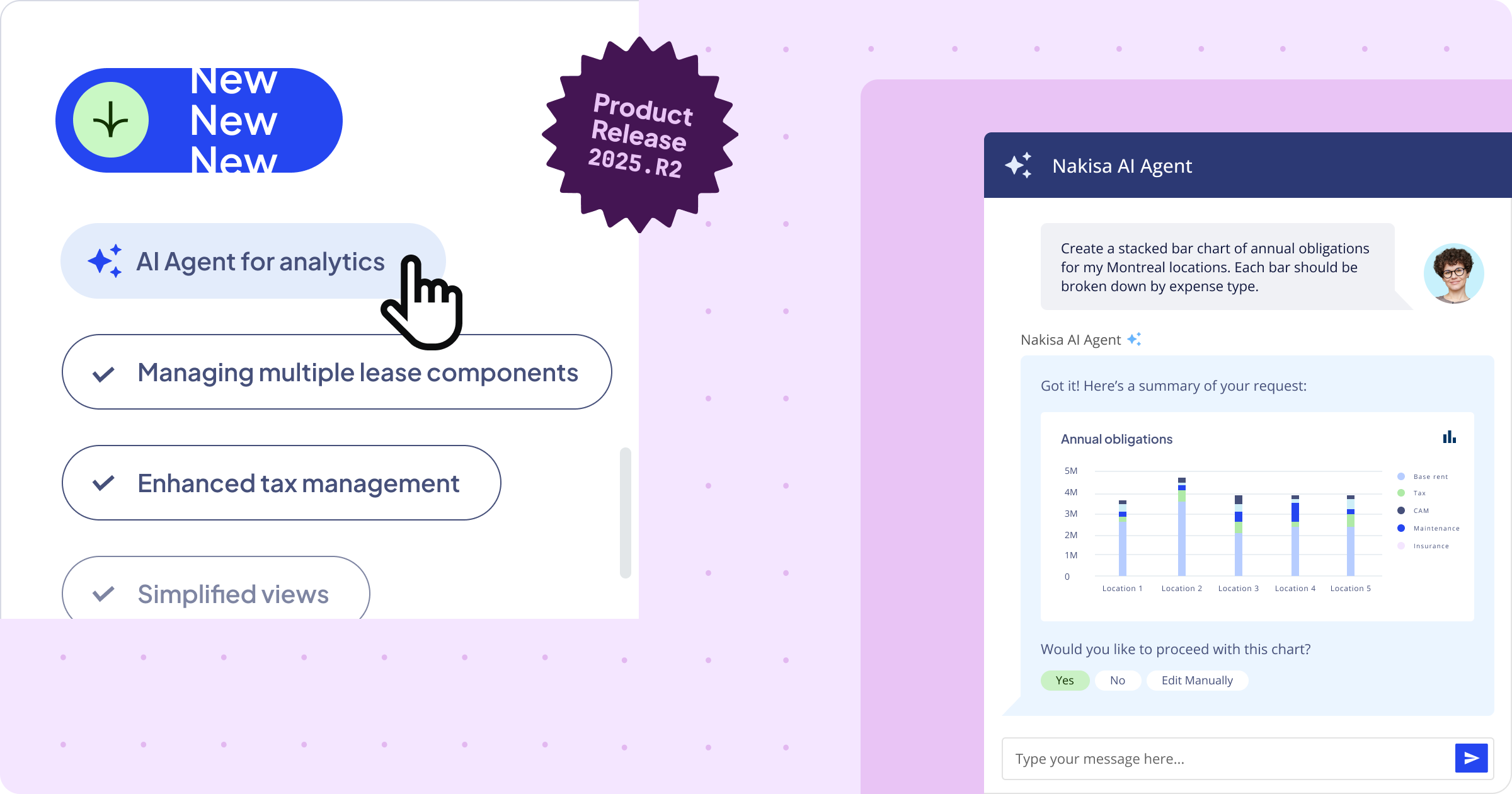

- AI-driven dashboards – Nakisa’s AI Agent supports dashboard creation and management by generating charts based on simple text prompts to provide valuable insights about your organization. Any user can instantly create charts tailored to their needs, with no need for technical expertise. Additionally, Nakisa's AI assistant can respond to conversational questions, offering advice or tips on the type of dashboard to create.

- Seamless sharing and export – Provide interactive links to your team so they can explore charts and reports on their own, while ensuring access permissions are respected. For added flexibility, you can export charts and reports in high-definition PDF, PowerPoint, or PNG formats for easy distribution and collaboration.

Brigín Walsh

Senior Organization Effectiveness Consultant at AIB

Audit trail and configurable reporting for compliance oversight

Nakisa’s software maintains detailed logs and historical snapshots of all organizational changes, providing users and auditors with access to historical versions of reporting structures. This functionality is essential for conducting accurate audits, internal reviews, and ensuring regulatory compliance. Additionally, the software documents approvals for organizational changes, which is crucial for demonstrating compliance with internal controls.

Accurate reporting is paramount, with a focus on generating automated compliance reports tailored to specific regulatory requirements, including SOX compliance reports outlining organizational hierarchies and control structures, Basel III reports detailing risk management staffing and qualifications, and AML compliance reports highlighting the structure and responsibilities of compliance teams.

Nakisa’s configurable reporting capabilities enable organizations to generate these reports with ease while ensuring that compliance-related information is directly viewable within org charts through conditional formatting. This allows you to highlight positions subject to specific regulatory oversight, ensuring clear visibility of compliance-related roles, and to identify reporting lines crucial for regulatory compliance, providing an accurate view of oversight structures.

By integrating compliance insights directly into workforce visualization, Nakisa enhances transparency, facilitates regulatory adherence, and ensures governance and accountability across financial institutions.

Comprehensive DEI reporting and planning tools

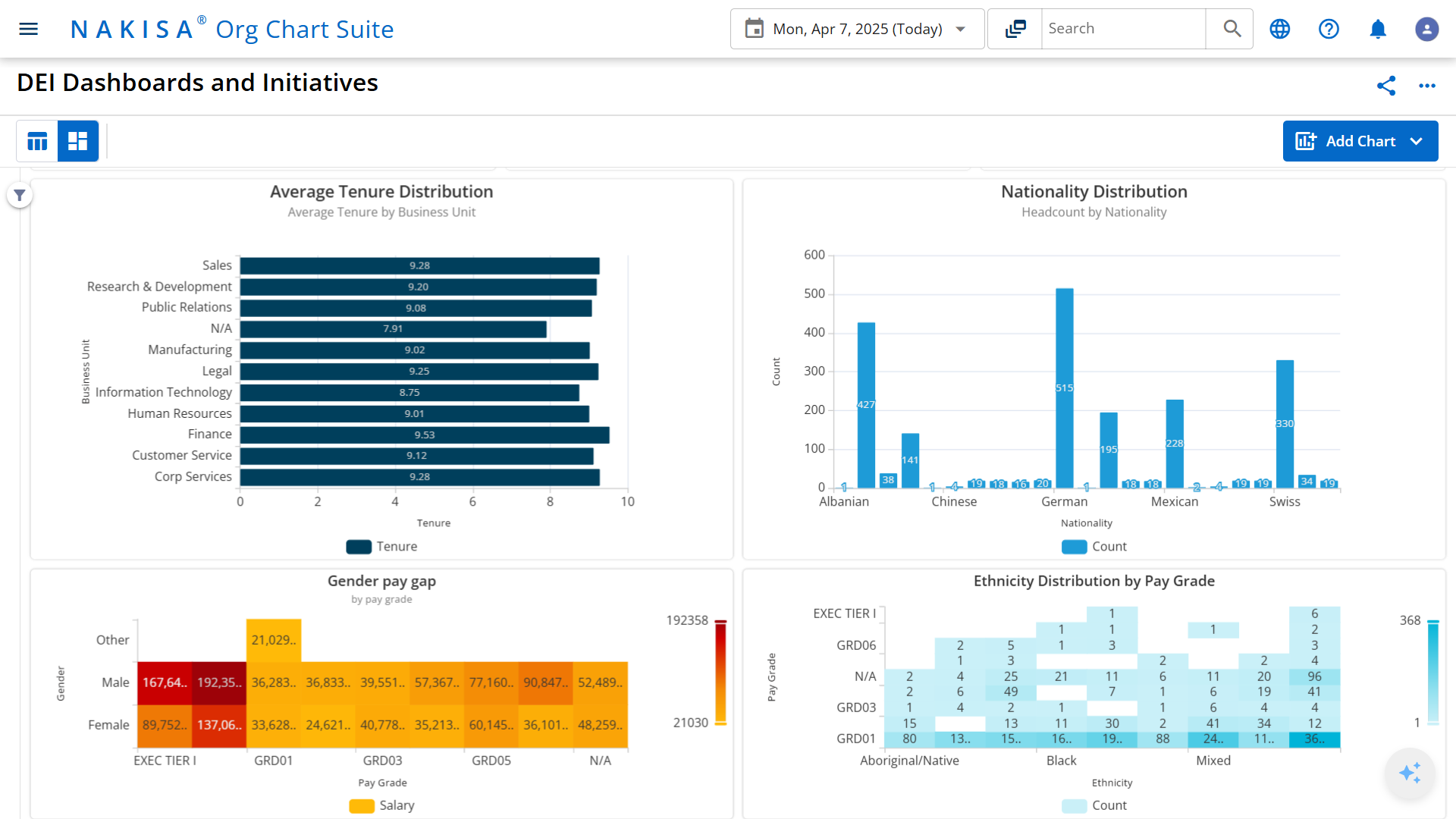

Nakisa Org Chart provides advanced visualization, analytics, and reporting to support diversity, equity, and inclusion (DEI) initiatives. Out-of-the-box reports and dashboards offer clear insights into the current DEI landscape, enabling data-driven decision-making. You can analyze organizational structures through a DEI lens, helping identify gaps and areas of improvement.

Nakisa’s org chart software enables the creation and configuration of multiple dashboards and charts to support DEI initiatives, powered by advanced analytics and filtering options.

The software also facilitates diverse talent pipeline management by enabling the creation and comparison of talent pools with a focus on diversity, fostering a more inclusive talent pipeline across the organization. Tools are available to identify and nurture diverse talent for future leadership roles, ensuring a broad representation of perspectives in succession planning.

Dynamic "what-if" scenario modelling incorporates diversity data, allowing users to assess the impact of organizational changes on DEI metrics. Centralizing HR data, including DEI information, enhances data consistency and reporting accuracy. The platform also includes DEI-specific filters and pay equity analysis tools to track progress, uncover disparities, and strengthen diversity strategies.

Role-based access further supports inclusive decision-making by allowing managers to view relevant DEI data for their teams, promoting broader participation in diversity planning. At the same time, advanced security features ensure sensitive DEI data remains accessible only to authorized personnel, maintaining privacy and compliance.

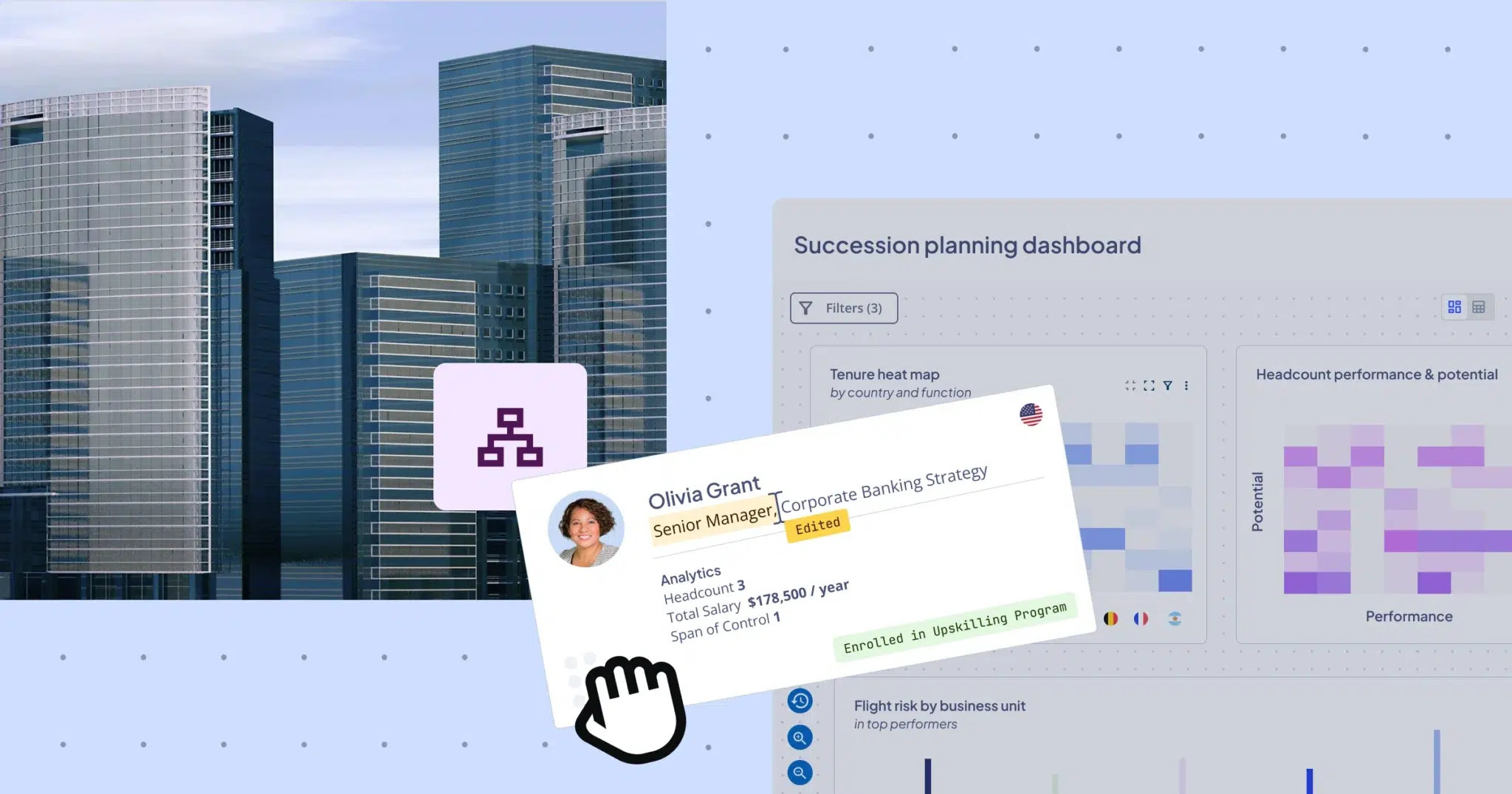

Powerful succession planning capabilities

Nakisa’s succession planning tool helps banks and financial institutions meet compliance and regulatory requirements while ensuring organizational stability. The platform provides transparency and sends time-sensitive notifications to keep succession plans up to date.

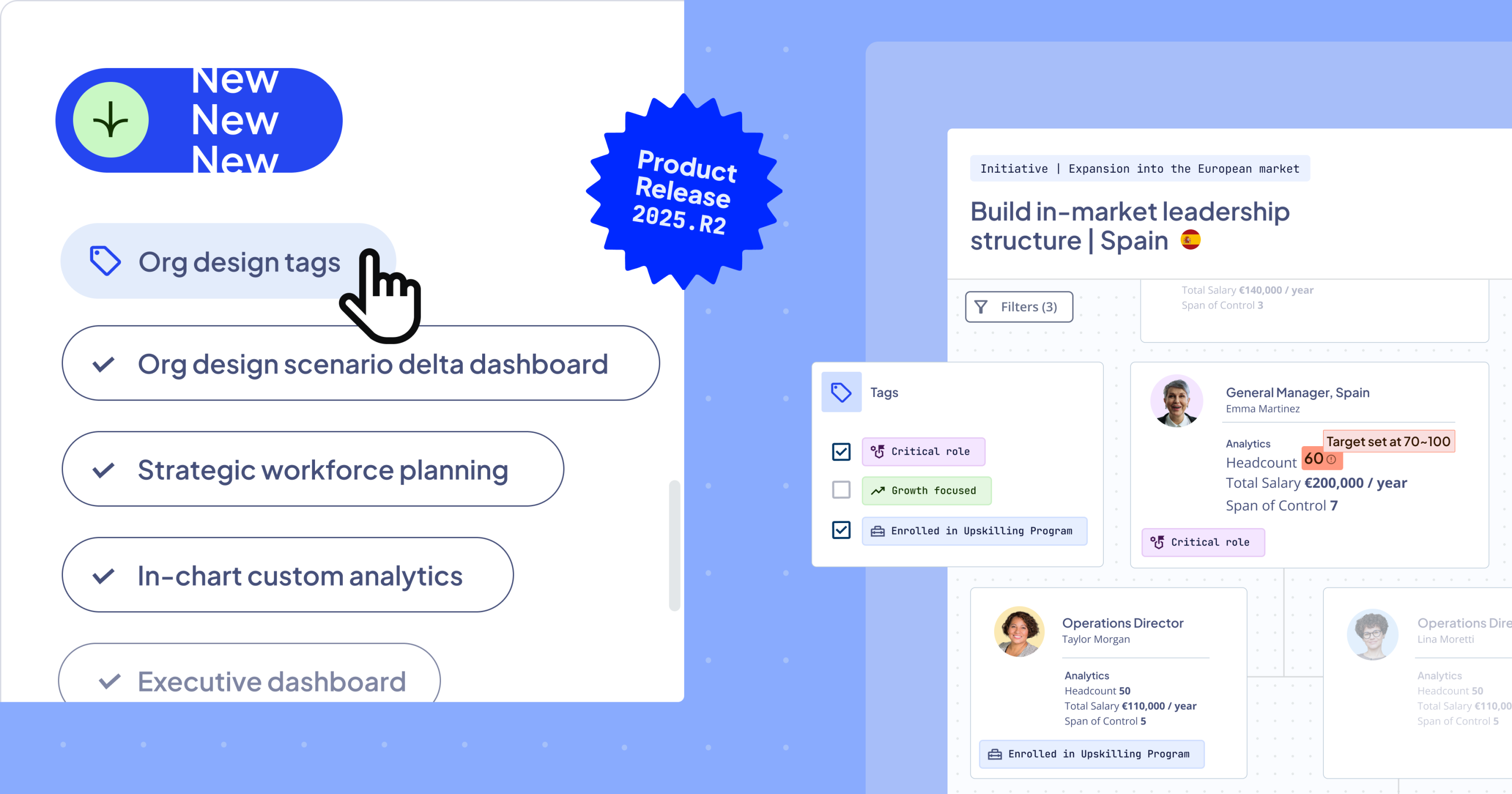

Workforce planning and talent management professionals can directly assign successors from org charts or profile pages, making it easy to designate candidates for key positions. Customizable successor attributes, such as ranking and readiness, allow for more informed and strategic succession planning and talent assessment. In-chart tags and icons allow setting custom important parameters to be observable at a glance, such as retiring key positions, top performers, or potential successors. Succession pools further enhance this process by maintaining a repository of future leaders with the attributes mentioned above.

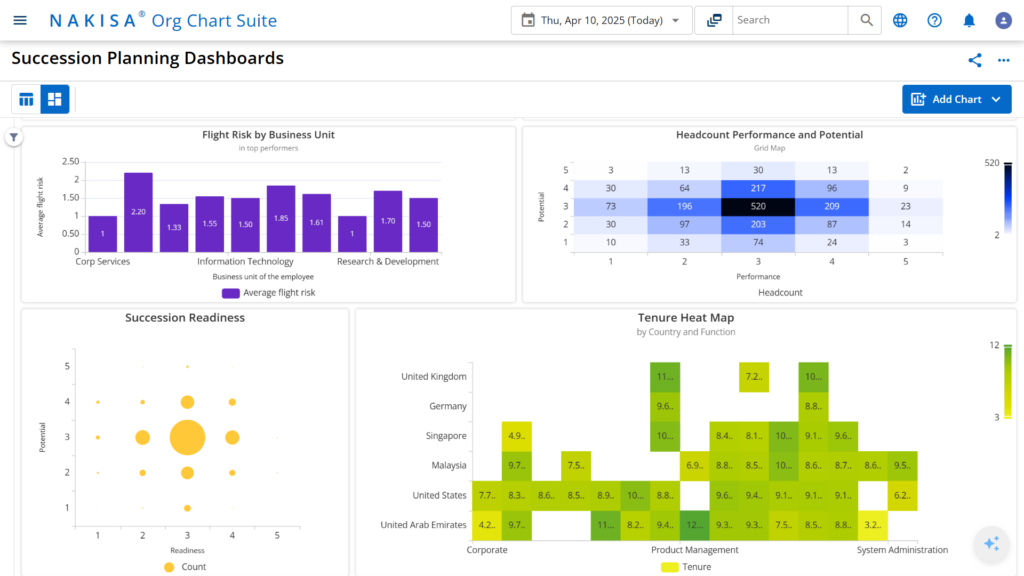

Advanced analytics and reporting provide insights into organizational bench strength, with dashboards showing succession readiness across multiple dimensions such as pay grade, functional area, country, legal entity, and department. Visual data representations, such as heat maps or talent grids, enable quick gap identifications and more proactive workforce planning and risk management.

Nakisa’s org chart software provides advanced in-chart analytics along with custom badges and icons to identify and group potential successors.

Dynamic succession modeling enables proactive planning with “what-if” scenario tools. You can simulate the transfer of successors to key positions and analyze organizational impacts in real-time. These scenarios integrate directly with the org chart for a holistic view of potential changes.

Nakisa’s org design software makes it easy to create and model teams with new successors in place.

The platform also supports the ongoing development of potential successors. HR managers can easily drill down into data and track employees for development plans, ensuring those in succession pools continue to grow and remain prepared for future leadership roles.

Discover our buyer’s guide with RFP scorecard for selecting org design, workforce planning, and analytics software in the banking and financial industry. With tailored evaluation criteria and practical insights, this guide helps you navigate the decision-making process and identify the tools best suited to your organization’s unique needs.

Challenge 2: Addressing technology and cybersecurity challenges banks and financial institutions face

Beyond regulatory and societal pressures, banks and financial institutions must continuously adapt to rapid technological advancements. Innovation not only transforms operations but also reshapes workforce demands, requiring institutions to rethink their org design, talent strategy, and workforce planning.

On one side, fintech and AI-driven solutions provide unprecedented investment and financing insights, offering a competitive edge to organizations that can effectively integrate them. On the other hand, the fast pace of technological change requires financial institutions to upskill employees, restructure teams, and optimize workforce planning to remain agile. Without the right skills in place, predictive analytics becomes a challenge, hindering both the core banking operations and strategic decision-making processes, ultimately impacting the bank’s overall performance and competitiveness.

As technology reshapes the industry, financial institutions must assess how workforce roles evolve, where skills gaps emerge, and how to align workforce changes with digital transformation goals. Identifying and addressing these gaps is critical to keeping pace with digital advancements. The shift from traditional teller roles to digital banking specialists, the creation of fintech development teams, and the integration of AI and machine learning specialists all require a workforce that is prepared for change. Additionally, the growing impact of automation on back-office functions forces institutions to rethink team structures and redeploy talent effectively. Without a clear strategy for workforce adaptation, banks risk inefficiencies, talent shortages, and skill mismatches that can hinder their ability to compete in an increasingly digital landscape.

Furthermore, banks must address the broader challenge of aligning workforce planning with long-term strategic objectives. Workforce optimization isn’t just about filling skill gaps; it’s about ensuring that the right people are in the right roles at the right time to support the institution’s vision for the future.

Technological advances also have a dark side, cybercrime. With cybercrime a $10.5 trillion industry, financial institutions are 300 times more likely to be targeted than organizations in other sectors. Workforce security is therefore critical, not only in terms of technology, but also in having the right talent, governance structures, and security protocols in place. Any solution used in banking must adhere to high security and compliance standards, such as SOC 1 Type II, SOC 2 Type II, FIPS 140-2, and incorporate role-based access control (RBAC) to protect sensitive data. Additionally, ensuring segregation of duties (SoD) is essential to prevent fraud and unauthorized access by ensuring that no single individual has control over critical financial systems or processes.

From a workforce perspective, addressing cybersecurity threats requires proactive planning. Financial institutions must focus on recruiting and retaining specialized cybersecurity talent in an increasingly competitive job market while also developing upskilling programs to ensure that all employees are equipped with the necessary knowledge on security best practices. Additionally, security concerns centered on remote access (owing to the ongoing adoption of remote or hybrid work) to sensitive systems add a further layer of complexity. In all cases, high demand for cybersecurity professionals in the banking and financial sector, burnout, and high global turnover add to the challenge. The limited talent pool of tech-savvy professionals intensifies competition and has resulted in many unfilled positions.

As institutions work to address these challenges, org design and workforce planning solutions become essential to navigating the rapidly changing digital and security landscape. A secure and compliant solution that integrates skills tracking, gap analysis, and strategic workforce modeling will empower organizations to stay ahead of the curve and ensure they are properly resourced to face these evolving challenges and demands.

In the following section, we’ll explore how an enterprise-grade solution like Nakisa can empower banks and financial institutions effectively to navigate these technology and cybersecurity challenges.

How Nakisa addresses technological and cybersecurity challenges in banking and finance

Before tackling the challenge of hiring and retaining qualified personnel to address technological and cybersecurity threats, banks and financial institutions must first ensure that the tools they rely on meet the highest security standards.

Robust security and compliance for financial institutions

Nakisa is built on a secure, enterprise-grade platform with robust encryption, granular role-based access control (RBAC), Single-Sign-On (SSO), and comprehensive audit capabilities. It complies with industry-leading security frameworks, including SOC 1 Type II, SOC 2 Type II, FIPS 140-2, GDPR, and IT General Control (ITGC), ensuring data integrity and regulatory compliance.

Nakisa’s RBAC enforces the principle of least privilege, allowing organizations to define and manage access based on user roles and responsibilities. This minimizes the risk of insider threats and unauthorized data exposure while reducing administrative overhead.

To further enhance security, Nakisa provides continuous monitoring and detailed audit trails, logging all user activities and system modifications. These capabilities enable proactive threat detection, streamlined incident response, and full transparency for compliance audits.

Beyond access control, Nakisa employs advanced security measures to safeguard sensitive financial and identity data. Its adherence to rigorous compliance standards reinforces cybersecurity resilience, ensuring financial institutions can confidently operate in an evolving threat landscape.

Helping banks and financial institutions hire and maintain tech-savvy staff

By integrating strategic workforce planning, organizational design, headcount planning, and advanced workforce analytics, Nakisa provides end-to-end solutions that help banks and financial institutions hire, retain, and develop tech-savvy staff. With a focus on data-driven decision-making and skill-based planning, Nakisa helps build teams that drive innovation and support digital transformation.

The platform offers real-time visibility into workforce composition and highlights potential flight risks in critical roles or key business units. This empowers HR and business leaders to implement proactive retention strategies and targeted compensation initiatives. With automated skill tracking and gap analysis, Nakisa’s software monitors workforce trends in real time, compares current state to future needs, and identifies areas lacking technical expertise, enabling informed decisions about hiring, upskilling, and restructuring.

Nakisa’s org chart software makes it easy to build advanced reports and dashboards that provide visibility into key workforce KPIs, enabling proactive talent assessment and retention strategies.

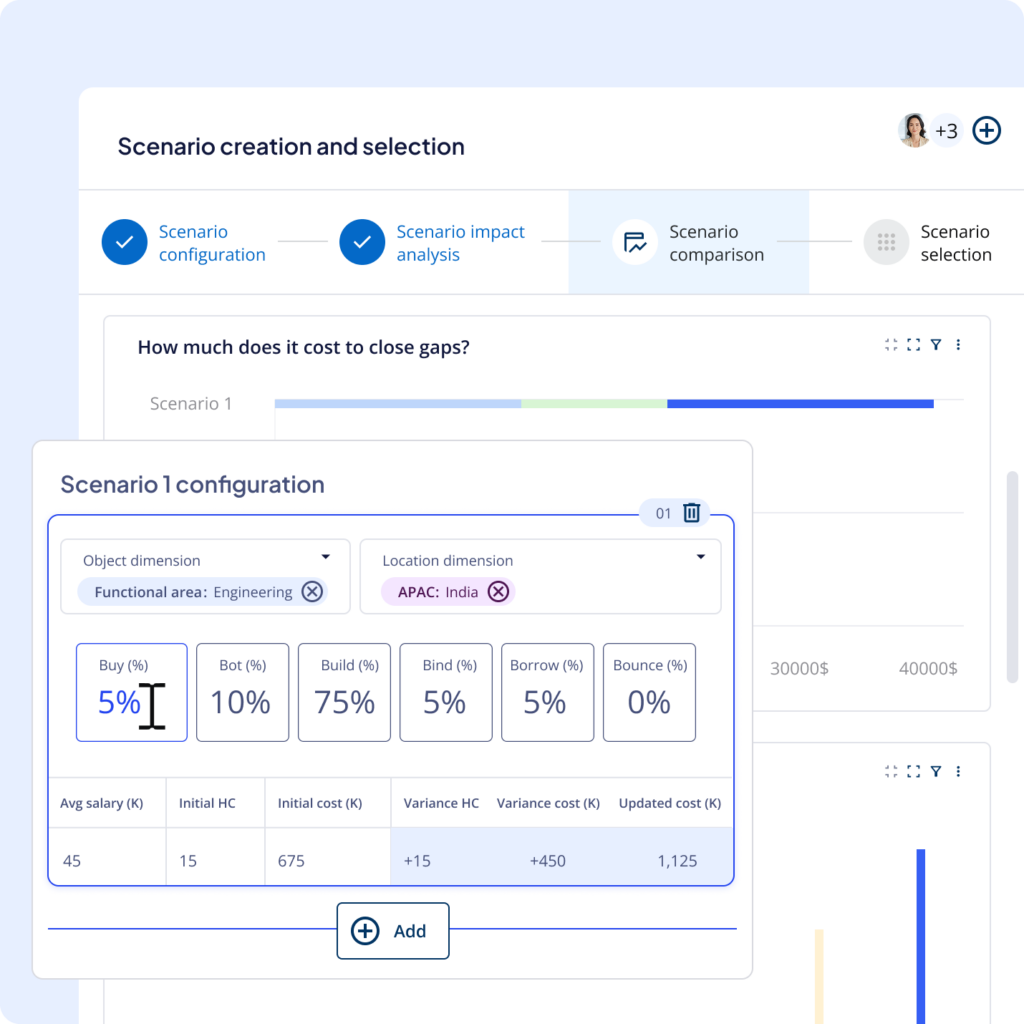

Nakisa also enables scenario planning using the 6B Strategy (Buy, Build, Bot, Borrow, Bind, Bounce), allowing financial institutions to evaluate different workforce strategies, assess trade-offs, and select the most effective approach for balancing cost, capacity, and capabilities, while aligning with organizational goals and constraints. This allows banks to proactively close gaps through targeted recruitment, upskilling initiatives, or other initiatives.

Using Nakisa’s skill-based org design capabilities, banks can build organizational structures that prioritize essential technical competencies. This ensures they attract and retain the right talent while aligning staffing levels with long-term objectives. Nakisa further enhances workforce agility through robust scenario modeling. Banks can simulate the impact of hiring new talent, upskilling existing employees, or restructuring tech teams to adapt to evolving industry needs. These simulations provide actionable insights into how staffing changes affect workforce composition and target KPIs.

Nakisa’s org chart software supports multiple incumbents for a single position, ideal for roles like key security positions with specific security requisites.

Nakisa’s headcount planning capabilities offer a centralized, intuitive platform to streamline headcount planning. AI-powered insights support this process by analyzing headcount plans, recommending adjustments, tracking feedback, and enabling plan creation, all from a single prompt.

Throughout the process, secure role-based access control (RBAC) protects sensitive workforce data, while a single source of truth and collaborative tools ensure alignment across HR, finance, executives, and other stakeholders.

By providing an integrated, end-to-end solution, Nakisa enables banks and financial institutions to maintain the workforce capacity required to support innovation. The result is a future-ready organization equipped to enhance agility and drive long-term success.

Challenge 3: Overcoming strategic and operational structural challenges banks and financial institutions face

Banks and financial institutions often undergo frequent changes in their organizational structure. These changes can be small, such as adjusting team roles, or large, such as reorganizing entire departments or functions. A recent study found that 83% of industry professionals expect a continued increase in restructuring activities over the next two years, with a focus on managing debt and improving operational efficiency.

The drivers behind these changes vary widely and can be categorized by the type of organizational design they primarily affect: strategic org design and operational org design.

Strategic org design drivers

These reflect higher-level, top-down initiatives tied to business model shifts, long-term goals, or enterprise-wide change. Typically led by org design professionals, the focus is on ensuring that the organization remains adaptable to changing market conditions while supporting its mission and vision.

- Market dynamic: Shifts in market conditions, customer demands, or competitive landscapes often prompt banks to restructure to remain agile and competitive. This could involve creating new departments, adjusting go-to-market teams, or reallocating resources to capture emerging opportunities.

- Structural specialization: Some banks are moving away from the universal model toward specialized platforms, such as embedded finance or Banking-as-a-Service. This structural shift, which allows them to focus on distinct areas for competitive advantage, requires a fundamental redesign of the organization to align with their strategic focus.

- Succession planning: As mentioned earlier, effective succession planning is crucial for maintaining leadership continuity and ensuring long-term stability. Financial institutions often need to identify and develop future leaders, which requires restructuring teams, adjusting reporting lines, or creating new roles to align with the evolving strategic goals of the organization.

- Restructuring to focus on core competencies: As banks reposition strategically or pivot toward core business areas like wealth management, digital banking, or regulatory compliance, non-core departments or functions may be downsized or eliminated. A reduction in force (RIF) is often part of this process as organizations focus resources on areas with the highest growth potential.

- Digital transformation: As banks integrate new technologies such as AI, machine learning, or cloud computing, this often results in shifts in job responsibilities, the creation of new roles, and the consolidation of existing ones. Automation, in particular, can lead to the reduction of manual roles, requiring adjustments in the organizational structure.

- Mergers and acquisitions (M&A): M&A activities are common in the financial industry, and they often lead to large-scale organizational restructuring to align with the new strategic direction. This includes consolidating redundant roles or departments and forming new teams to support post-merger goals.

Operational org design drivers

These are primarily day-to-day or execution-focused changes that keep the organization compliant and efficient. Typically managed by HRBPs or line managers, these adjustments follow structured approval processes to preserve the capacity of org design teams for more strategic initiatives. The drivers listed below are generally operational and routine; however, if any of these adjustments are implemented on a large scale or as part of a broader transformation, they may become strategic drivers.

- Regulatory changes: Financial institutions must continuously adapt to new or updated regulatory requirements, often requiring changes in reporting lines or the creation of new compliance teams. Regulators may also encourage cost-cutting measures, such as RIF, to enhance institutional stability and reduce overhead costs.

- Cost optimization and ongoing restructuring: Economic factors such as rising interest rates, post-pandemic changes to work habits, economic pressures, and broader market changes are driving many organizations to streamline operations. This can lead to workforce reductions, role consolidations, or process improvements.

- Adoption of agile practices: Rapidly adapting to market shifts, regulatory changes, and fluctuating demands is essential for maintaining resilience in a dynamic industry. As banks move toward more agile, flexible work structures, they need to continuously reassess and modify team configurations, role definitions, and workflows to accommodate more responsive and dynamic work environments.

- Improving organizational agility: To stay competitive and responsive to market changes, banks reduce hierarchical layers, broaden spans of control, consolidate functions, and eliminate inefficiencies. This improves decision-making speed and adaptability, ensuring the organization can quickly pivot in response to emerging challenges.

These structural challenges make it critical for banks and financial institutions to adopt a data-driven approach to organizational design. Frequent changes, whether driven by regulatory shifts, market dynamics, M&A, or cost optimization, require careful planning to maintain efficiency, compliance, and agility.

In the following sections, we’ll explore how Nakisa facilitates strategic and operational org design for global banks and financial institutions by providing real-time visibility, robust scenario modeling, cross-functional collaboration, and seamless workforce alignment, ensuring that every transformation supports long-term business goals.

How Nakisa addresses strategic structural challenges in banking and finance

Nakisa Strategic Org Design empowers banking leaders and org design professionals in top-down organizational planning, enabling them to make data-driven decisions during complex structural changes. Whether it’s reorganizing the entire organization or some specific departments, managing mergers and acquisitions, handling divestitures, or creating new divisions, Nakisa provides the purpose-built tools to model, analyze, and implement changes with ease. Its intuitive UI ensures easy adoption and usability by in-house OD teams.

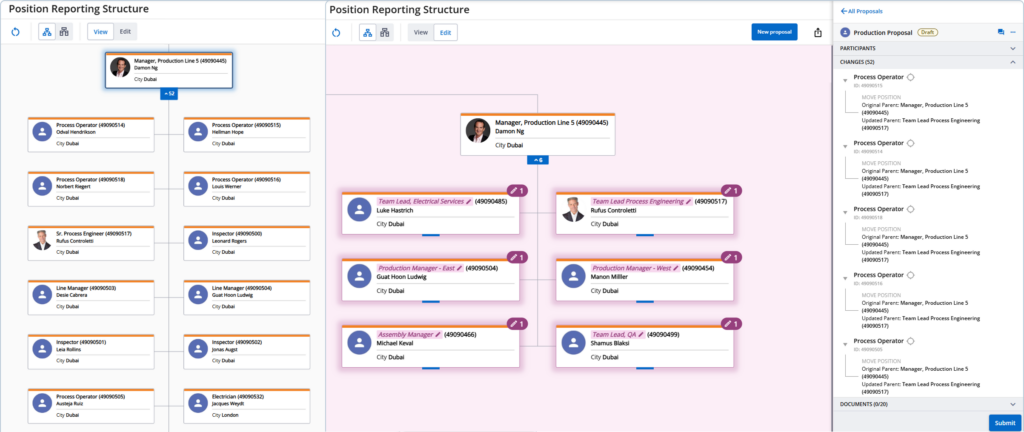

The solution’s advanced scenario modeling capabilities enable the creation of unlimited what-if scenario iterations. At the start of the modeling process, you can set headcount and structure targets and track progress to ensure alignment with organizational goals. This includes quantitative targets, such as reducing headcount by a certain percentage or adjusting span of control, or qualitative objectives, like enhancing DEI or streamlining workforce structures. Real-time analytics measure the impact of each scenario on these goals, enabling precise decision-making.

On a more granular level, all Nakisa clients (particularly those in the banking and financial sectors) greatly value the solution’s side-by-side comparison feature, as it clearly illustrates differences between scenarios. For example, users can contrast the organization’s current hierarchy with a future-state organization model or compare different plans and their KPIs against one another. Drag-and-drop functionality across various views, spanning departments and divisions, further streamlines organizational design activities and facilitates navigation within large, financial organizations.

Nakisa’s org design software enables easy side-by-side comparison of different plans and their KPIs, helping you choose the best one for your organization.

With native bidirectional integration to leading systems like SAP HCM, SAP SFSF, Workday, Oracle Fusion, Oracle EBS, and PeopleSoft, along with a robust API framework, Nakisa ensures clients always have access to their real-time updated data for organizational modeling. This degree of data accuracy is crucial for the ever-changing landscape of banking and finance.

You can safely and quickly create what-if scenarios in a sandbox environment to model changes in your organization’s structure and workforce without affecting the current arrangement. Unlike other vendors, Nakisa imposes no limits on the number of employee records used in org design activities. Users can upload all data at once for a comprehensive view, and scenario comparisons, eliminating inefficiencies caused by smaller batch uploads.

In addition, Nakisa makes it simple to create, edit, move, delimit, or delete new positions and employees, including reporting lines (double-dotted or dotted lines). Bulk changes and automation save time and streamline processes by allowing users to edit, move, normalize, and compare records in bulk. These streamlining efforts can also be easily tracked via detailed summaries of modifications within scenarios made available through change reports. Critical functions such as data syncs, error detections, reporting, and one-click writebacks are supported and accelerated through automation.

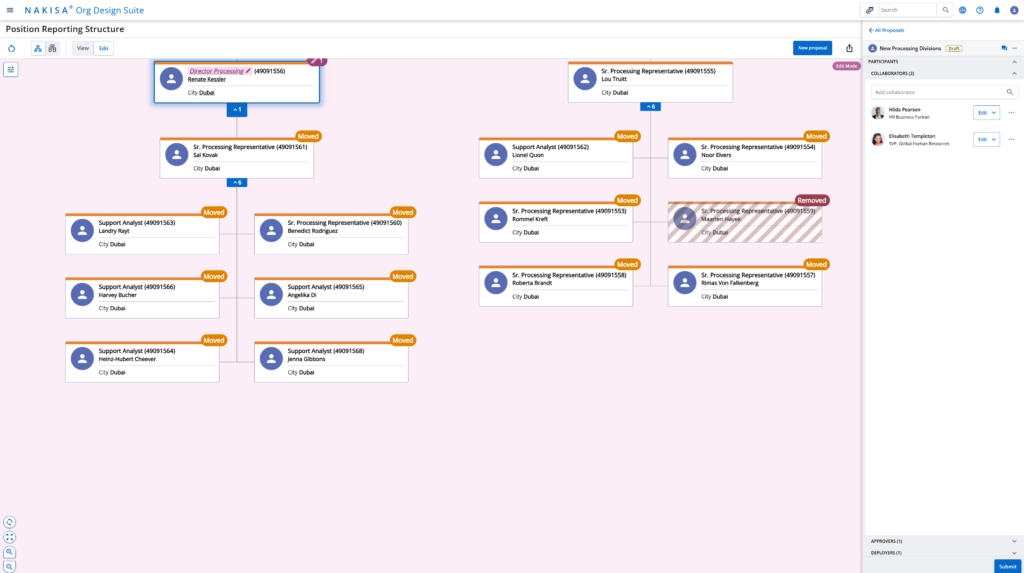

For large-scale organizational design tasks, Nakisa allows users to break them down into smaller work areas and assign dedicated owners to each. Collaboration is enhanced with integrated chat and approval workflows, ensuring all stakeholders are aligned. The proposed org chart can also be downloaded as an editable PowerPoint to share offline with diverse stakeholders for flexible collaboration.

Nakisa’s org design software enables collaboration with multiple stakeholders in real time.

Beyond making large tasks eminently more manageable, Nakisa also allows users to easily design future organizational structures for upcoming changes, such as mergers, acquisitions, reductions in force, or succession planning, and determine their potential impact as part of planning. In particular, users can develop various what-if scenarios and collaborate with stakeholders in real-time to build their ideal future organizations.

Nakisa’s solution also features approval workflows that feature seamless write-back functionality, allowing users to push org edits back to their core ERP, HCM, and HRIS with just a few clicks, while ensuring data consistency across platforms. Effectively, this enables users to focus on designing, validating, and approving new org plans while Nakisa handles the data updates across their systems.

Even with the writeback capability, Nakisa further provides a sync process check that detects any changes or conflicts between the scenario and source data, a critical step in ensuring that organizations have the right information underpinning their designs. Additionally, a powerful scenario validation feature allows users to apply predefined validation rules to ensure the scenario aligns with the business logic of the source data, flagging violations like missing parent nodes for review. This eliminates the risk of human error and streamlines implementation, ensuring new structures are accurately executed.

Finally, Nakisa’s comprehensive user control and role-based access ensure that users can access only the data they need based on their roles and permissions. Whether you’re a manager, administrator, or collaborator, the software allows for granular control over who can view, edit, or share specific objects within the org chart. This helps streamline collaboration while ensuring that sensitive or restricted information is safeguarded and accessible only to authorized individuals.

How Nakisa addresses operational structural challenges in banking and finance

Banks and financial institutions must continuously adapt to regulatory updates, market shifts, and internal restructuring needs. These adjustments cannot always be effectively managed through strategic organizational design alone. Operational organizational design is essential for making agile, iterative adjustments at the departmental or team level to keep institutions efficient and compliant.

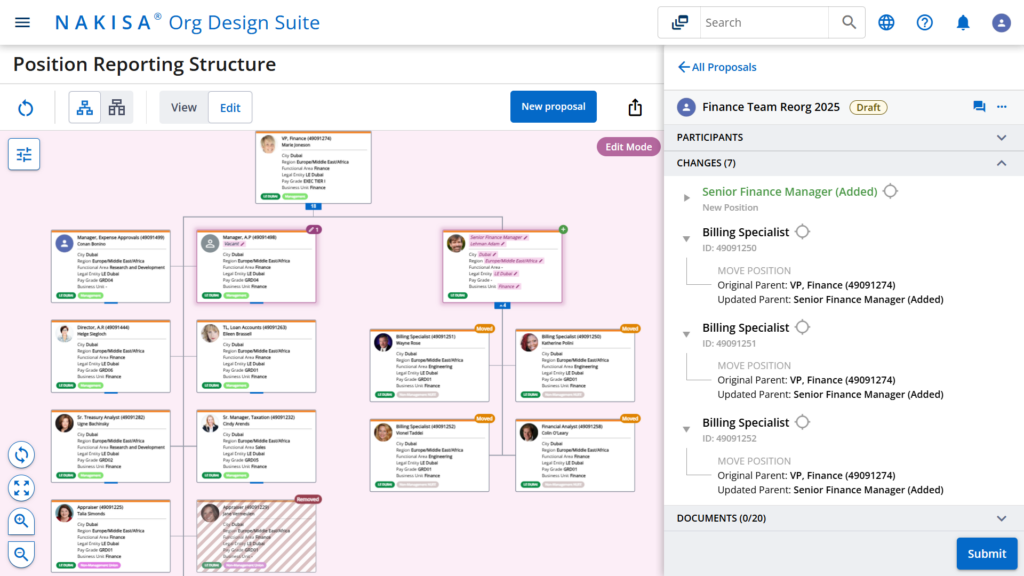

Nakisa Operational Org Design provides a market-first framework that enables banks to swiftly adjust team structures, redistribute workloads, and redefine spans of control to align with business goals. HRBPs and line managers can leverage what-if scenario modeling to simulate and visualize potential changes, assessing their impact on spans of control, labor costs, DEI, and other key workforce metrics.

Once the desired changes are identified, the solution’s collaborative proposal management allows line managers and HRBPs to create staffing proposals and share them with collaborators and approvers (such as leadership, compliance officers, risk managers, and other key stakeholders) for real-time feedback.

Structured approval workflows ensure alignment with bank strategy, budget constraints, and regulatory requirements, while built-in audit trails provide transparency for regulatory reporting. Nakisa enhances decision-making with AI-powered insights, summarizing discussions, tracking proposed changes, and suggesting responses to streamline collaboration. Seamless bidirectional ERP and HCM integration (SAP HCM, SAP SFSF, Workday, Oracle, PeopleSoft) ensures that approved changes are automatically synchronized across systems, eliminating manual errors and accelerating execution.

By leveraging Nakisa’s operational org design solution, banks can respond swiftly to evolving business demands without disrupting broader strategic goals. The solution reduces administrative burdens, lowers operational costs, and supports data-driven decision-making.

Challenge 4: Tackling strategic and operational workforce planning challenges banks and financial institutions face

Banks and financial institutions operate in a highly dynamic and complex environment, requiring them to balance short-term operational workforce needs with mid- to long-term strategic objectives. Workforce challenges stem from a wide range of factors. These drivers can be categorized based on the type of workforce planning they primarily influence: operational workforce planning and strategic workforce planning.

Drivers of operational workforce planning

Operational workforce planning focuses on addressing short-term workforce needs, typically within a 12-month horizon. Its drivers are rooted in day-to-day operations, ensuring optimal workforce size and staffing levels, responding to immediate workforce demands, meeting budget constraints, complying with regulatory requirements, and aligning with long-term needs. Common operational drivers include:

- High turnover rates: Competitive job markets, wage pressures, and shifting employee expectations drive high attrition rates, making it difficult to maintain consistent service levels. Banks must invest in employee retention strategies such as competitive compensation, engagement programs, and professional development opportunities.

- Tight labor market: Specialized roles in areas like digital banking, cybersecurity, AI, and automation are difficult to fill due to talent shortages. Banks must act quickly to attract top talent while retaining existing employees.

- Staffing optimization: Balancing cost-cutting pressures with operational efficiency requires ensuring the right people are in the right roles at the right time across branches and subsidiaries, and support functions.

- Balancing costs with staffing needs: Rising labor costs require banks to align headcount planning with budget constraints while maintaining adequate staffing levels for seamless operations.

- Seasonal and cyclical workforce needs: Events such as tax season or loan surges necessitate temporary staffing adjustments without disrupting long-term workforce strategies.

- Regulatory compliance: Banks must maintain staffing levels that meet regulatory standards for anti-money laundering (AML), Know Your Customer (KYC), cybersecurity, and other compliance requirements to avoid fines or reputational damage. Continuous employee training is critical to meet evolving requirements.

- Inaccurate demand forecasting: Shifting customer preferences (e.g., digital banking over in-person services) or economic uncertainties can lead to overstaffing (increasing costs) or understaffing (impacting service quality).

- Rapid upskilling for digital banking: As reliance on digital banking grows, banks must quickly upskill employees to adapt to new technologies while maintaining high-quality customer service.

Drivers of strategic workforce planning

Mid-term planning, typically covering 12 to 18 months, bridges operational needs with broader strategic goals by addressing workforce optimization challenges tied to emerging trends in technology, regulation, and market dynamics. This includes bridging skill gaps, implementing training programs, and preparing for shifts in the business environment.

- Effective turnover analysis and retention planning: Predicting attrition patterns requires advanced analytics tools that help banks develop proactive retention strategies.

- Integration of AI, automation, and data analytics: The adoption of AI-driven tools into banking operations places increasing pressure on workforce planning, as institutions must ensure that employees develop the necessary technical competencies to work alongside these tools.

- Talent acquisition strategies: Emerging threats like cybercrime demand specialized skills that banks must acquire through targeted hiring efforts or partnerships with educational institutions.

- Adapting to regulatory changes: Evolving compliance requirements necessitate adjustments in hiring practices and training programs to align with new standards.

- Scenario planning and forecasting: Banks must anticipate market changes, economic shifts, and regulatory demands by integrating scenario modeling into their workforce strategies for flexible staffing levels and skill set adjustments.

- Fragmented workforce data: Without a centralized system for workforce data management across HR, finance, and operations departments, insights remain disconnected, making it difficult to assess current headcount needs or plan for future staffing requirements.

- Siloed data and disconnected processes: Cross-departmental collaboration is essential for aligning HR strategies with finance and business unit needs, but is often hindered by siloed systems.

Long-term planning, which extends over three to five years, focuses on large-scale transformational initiatives that align the workforce with organizational strategy, technological innovations, and market evolution.

- Anticipating future workforce needs: The rise of fintech, blockchain, AI-powered solutions, and embedded finance reshapes financial services, requiring banks to anticipate future workforce needs and develop a pipeline of talent equipped with the right expertise.

- Shift in workforce demand due to digital banking: As demand for traditional branch staff declines and tech-savvy roles increase (such as universal bankers or data analysts), banks must forecast these shifts accurately while reallocating resources effectively.

- Leadership succession planning: Preparing the next generation of leaders involves restructuring teams and creating development pathways for high-potential employees as senior professionals retire.

- Mergers and acquisitions (M&A): M&A activities require strategic alignment of workforces through team integration, cultural harmonization, role definition, and role redundancy elimination post-merger.

- Economic volatility: Banks must plan for potential downturns that may require layoffs or restructuring while maintaining agility for expansion during growth periods.

- Sustainability and diversity, equity, and inclusion (DEI) goals: Long-term workforce strategies in BFIs increasingly emphasize inclusive hiring practices, building diverse leadership teams, and ensuring the workforce reflects the communities served, meeting both regulatory requirements and public expectations.

- Globalization and talent mobility: As banks expand internationally, they face cross-border regulations, labor market challenges, cultural differences, and employee relocation needs. These factors require workforce strategies that support globally distributed teams, ensure compliance with local employment laws, and enable smooth mobility.

- Branch network optimization: Strategic decisions about opening, closing, or resizing branches directly impact staffing needs. These require careful analysis of market conditions, customer behavior trends, and operational efficiency to align the workforce with the evolving branch strategy.

Here is a summary table of workforce planning time horizons and their strategic focus areas for banks and financial institutions.

| Time Horizon | Duration | Focus |

| Short-term | Up to 12 months | Day-to-day workforce management, scheduling, immediate staffing issues, and short-term adjustments to meet current demands for bank branches or regional subsidiaries of financial institutions. |

| Mid-term | 12-18 months | Achieving specific workforce goals, addressing skills gaps, implementing training programs, and data-driven workforce optimization to leverage the newest available banking technology and to combat evolving cybercrime threats against financial institutions. |

| Long-term | 3-5 years | Anticipating and preparing for major business changes (such as M&A), market trends, and technological advancements impacting workforce needs. |

| Extended horizon | More than 5 years | Planning for significant long-term shifts, such as branch staffing evolution and growing demand for as yet undeveloped technology roles. |

Workforce planning time horizons and their strategic focus areas for banks and financial institutions.

By addressing workforce challenges across these different time horizons, banks and financial institutions can build resilient, future-ready teams capable of navigating industry disruptions while maintaining operational stability and compliance. In the following sections, we’ll explore how an enterprise-grade solution like Nakisa can help banks and financial institutions effectively navigate both strategic and operational workforce planning challenges.

How Nakisa addresses strategic workforce planning challenges in banking and finance

Nakisa Strategic Workforce Planning provides a powerful, flexible tool to address a variety of workforce planning needs, supporting different timeframes and organizational requirements. It empowers banks and financial institutions to navigate workforce challenges, from short-term adjustments to mid-term (12 to 18 months) and long-term (3–5 years) planning, with a data-driven, AI-powered approach. The platform enables organizations to develop strategic workforce plans across key dimensions, including legal entities, business units, job families, and geographic locations, ensuring alignment with evolving business needs.

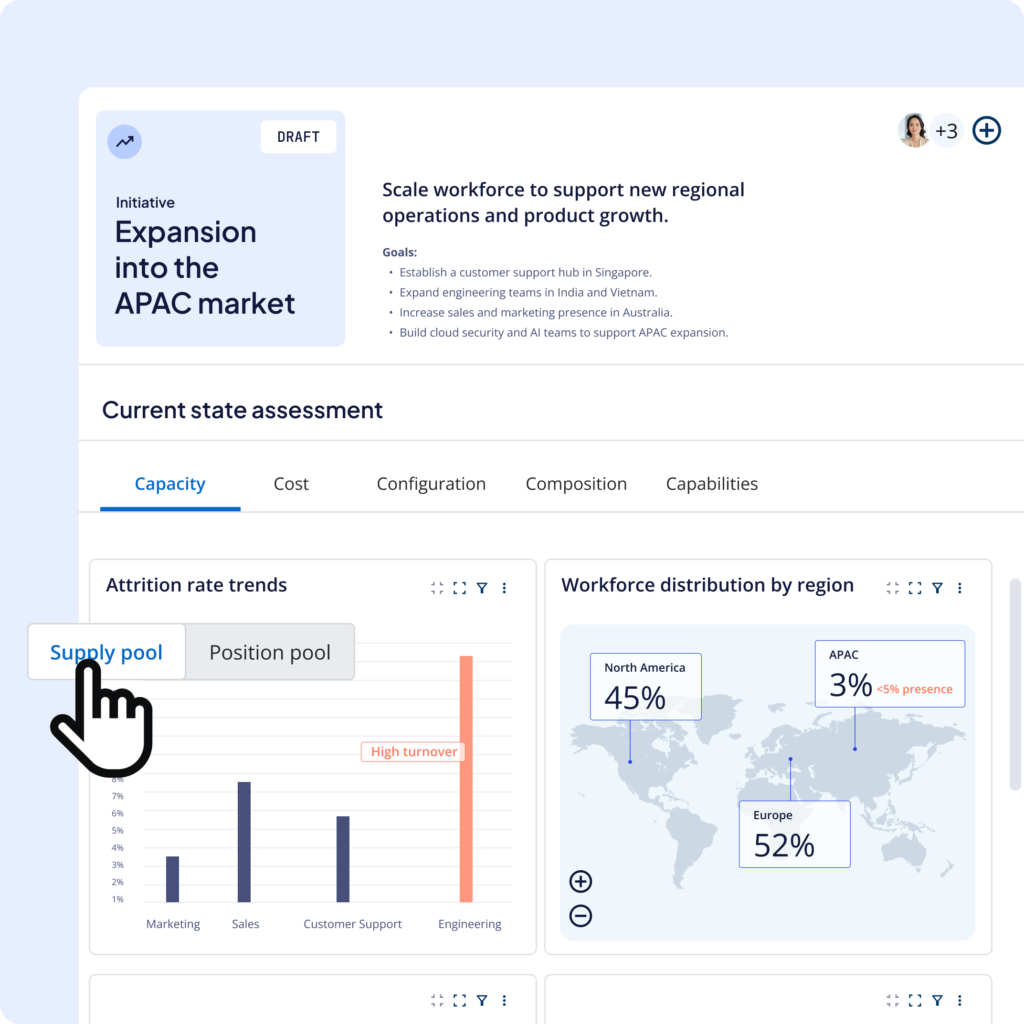

By consolidating workforce data from HRIS and other systems, Nakisa provides a comprehensive assessment of the current state using a 5C framework—Capacity, Cost, Capabilities, Composition, and Configuration. Interactive dashboards help visualize and analyze key workforce metrics such as headcount trends, salary and compensation data, skills and competencies, role mix, demographics (DEI), and environmental (ESG) considerations, and organizational structures. This enables financial institutions to identify trends and risks in areas such as workforce distribution, tenure, and leadership readiness.

Nakisa’s strategic workforce planning software enables efficient assessment of your organization’s current resource state.

AI-driven modeling enhances forecasting of the future state by incorporating supply (attrition, retirement, promotion) and market (inflation, unemployment, regulatory changes) drivers, while leveraging predictive analytics and allowing manual input for demand (growth targets, expansion, new product lines, operational efficiency goals) drivers.

Nakisa’s dynamic gap analysis compares current workforce metrics against future targets using the 5C framework, identifying potential misalignments that could hinder business objectives. Examples include identifying skill gaps in critical roles, such as cybersecurity experts or AI specialists, discrepancies between target and actual diversity in leadership, imbalances in staffing across regions or business units, and underrepresentation of key competencies like digital or data analytics skills. Additionally, it can reveal gaps in leadership succession planning or challenges in meeting gender or diversity hiring targets. You can view data in easy-to-understand tabular and graphical formats on a yearly basis, enabling comparisons across years within the selected time horizon and supporting strategic workforce planning.

The platform enables scenario planning using the 6B Strategy (Buy, Build, Bot, Borrow, Bind, Bounce), allowing financial institutions to evaluate different workforce strategies, assess trade-offs, and implement the most effective approach to balancing cost, capacity, and capabilities, while aligning with organizational goals and constraints.

Nakisa’s strategic workforce planning software enables easy scenario creation to explore and apply the right 6B strategies for closing workforce gaps.

With continuous tracking and seamless integration with external HR systems, Nakisa ensures that workforce plans remain aligned with organizational goals. Compare actual progress against the initial plan and adjust as needed, while incorporating feedback from external tools or manual inputs to provide a holistic view of workforce planning progress.

Whether addressing short-term needs such as immediate staffing adjustments and resource allocation, supporting mid-term initiatives like workforce restructuring, succession planning, and skill development, or driving long-term transformations such as digitalization, globalization, and sustainability, Nakisa equips financial institutions with the agility and strategic foresight needed to navigate an evolving industry landscape.

How Nakisa addresses operational workforce planning challenges in banking and finance

Banks and financial institutions operate in a highly regulated, fast-paced, and competitive environment. Effective workforce planning is critical to balancing immediate staffing needs with long-term growth objectives across branches, departments, and business units, while ensuring compliance with regulatory requirements and alignment with budgetary constraints. Nakisa Operational Workforce Planning provides a centralized, intuitive platform designed to streamline headcount planning and address these unique challenges.

Nakisa centralizes headcount plans into a unified platform, providing full visibility into team structures, hiring gaps, and plan outcomes. HRPBs and managers can create monthly or quarterly plans and subplans, allocate respective budgets, and set precise headcount and budget targets. This ensures efficient staffing across branches, departments, and business units while staying aligned with organizational goals, budgetary constraints, and regulatory requirements.

To provide a unified view of organizational structures, Nakisa Operational Workforce Planning seamlessly integrates with Nakisa Org Chart. This integration automatically identified and visualized vacancies to streamline recruitment planning. Users can easily add new items to headcount plans for further flexibility in addressing workforce needs.

Nakisa’s advanced analytics and dynamic reporting capabilities track workforce trends, measure real-time performance against strategic goals, and support informed staffing adjustments that align with real business needs. The platform’s conversational AI agent further simplifies headcount planning by analyzing HR data, suggesting adjustments, tracking feedback, and enabling headcount plan creation, all from a single, well-worded prompt. This feature enhances decision-making efficiency while reducing complexity.

The solution also facilitates team- and department-level planning. Managers can collaborate with finance, HR, executives, and other stakeholders in a transparent and efficient process. Configurable notifications keep all collaborators informed of progress and next steps, minimizing communication gaps and improving decision-making. Streamlined approval workflows help align staffing needs with business objectives while adhering to budgetary constraints and regulatory requirements.

Nakisa integrates seamlessly with major ERPs and HCMs (SAP HCM, SAP SFSF, Workday, Oracle, PeopleSoft), as well as third-party systems via robust APIs. The bidirectional integration consolidates real-time headcount data into a centralized platform, enabling accurate planning based on up-to-date figures from multiple sources.

By leveraging Nakisa’s operational workforce planning solution, banks and financial institutions can optimize workforce strategies to support transformation efforts while ensuring compliance, efficiency, and agility in staffing processes.

Conclusion: empowering banks and financial institutions with AI-driven org design, workforce planning, and analytics software

As this guide has illustrated, global banks and financial institutions (BFIs) navigate a complex and highly regulated landscape, where challenges such as organizational silos, regulatory compliance, digital transformation, cybersecurity threats, and frequent market shifts are constant. These institutions must be agile and forward-thinking to remain competitive, particularly as they manage large, distributed teams while striving for operational efficiency, cost control, and regulatory alignment.

Balancing these demands with broader organizational goals can overwhelm even the most seasoned teams. That’s where Nakisa’s Workforce Planning Portfolio, comprising org chart visualization and analytics, strategic and operational org design, and strategic and operational workforce planning, comes in. Designed to address every major workforce challenge, Nakisa empowers HRBPs, org design professionals, executives, and managers to collaborate and transform their organizations for the better.

With Nakisa’s cloud-native, AI-powered solutions, financial institutions can centralize and streamline critical functions, from org visualization and analytics to strategic and operational org design, headcount planning, and strategic workforce planning. Nakisa provides real-time, actionable insights into team structures, labor costs, and talent trends and needs, and offers automated workflows and enhanced collaboration tools, allowing BFIs to plan proactively for growth and adapt swiftly to dynamic market conditions. This enables them to stay competitive and optimize costs across their global operations.

Discover how Nakisa stands out from the market. We invite you to experience a personalized demo of our software and see why market leaders such as State Street, Standard Bank, and Allied Irish Banks (AIB) trust Nakisa to manage org design and workforce planning effectively.