Nakisa Lease Accounting 2025.R2 product release: smarter workflows, enhanced financial insights, and seamless integration

The latest Nakisa Lease Accounting release introduces impactful capabilities that streamline financial close processes, enhance

For enterprises, having a good commercial real estate strategy is critical to driving efficiency, cutting costs, and increasing profits. This is especially true with today’s turbulent market dynamics and fluid customer behaviors. Companies spend hundreds of thousands of dollars and man-hours to find the best lease clauses, monitor and adjust their CRE portfolios, and guarantee accounting compliance. Besides operational needs, real estate data is crucial for strategic business decisions such as branch openings or closures. Business leaders need to consider both the company’s data (e.g., lease expenses or profitability of each store) and the market data (e.g., market fluctuations, real estate trends, competitors’ strategies, customer behavior) to make smart choices. You may need help realigning your strategy, and if so, you should read this comprehensive guide.

In this guide, you’ll get a well-researched overview of the commercial real estate (CRE) landscape in 2023 and 2024 along with actionable insights. In the first part, we delve into the top 5 CRE trends and challenges shaping the industry’s trajectory. You will get insightful ideas from various real estate reports, surveys, and compelling examples of how market leaders are adapting their CRE strategies today. The second part explores the increasing complexity of commercial real estate needs and best practices in real estate data management, workflow automation, and cross-team compliance collaboration. There, you will find out what the best solutions must guarantee as well as winning strategies for streamlining your global CRE management. This advice is built off our 10 years of in-field experience working with the biggest retailers in the world.

Let’s forge ahead together and make CRE work for us.

Table of Contents:

1. Commercial Real Estate Trends and Challenges in 2023 and Beyond

2. How to Optimize Commercial Real Estate Management for Global Enterprises Using Proptech Software

Let’s explore the commercial real estate outlook for 2023-2024: what changes have happened lately and how market leaders are adjusting their commercial real estate strategies. We invite you to read these trends, think about how they may affect your company in the near future, and how you can address them proactively.

All commercial real estate professionals confirm that the following five trends are shaping the commercial real estate market right now:

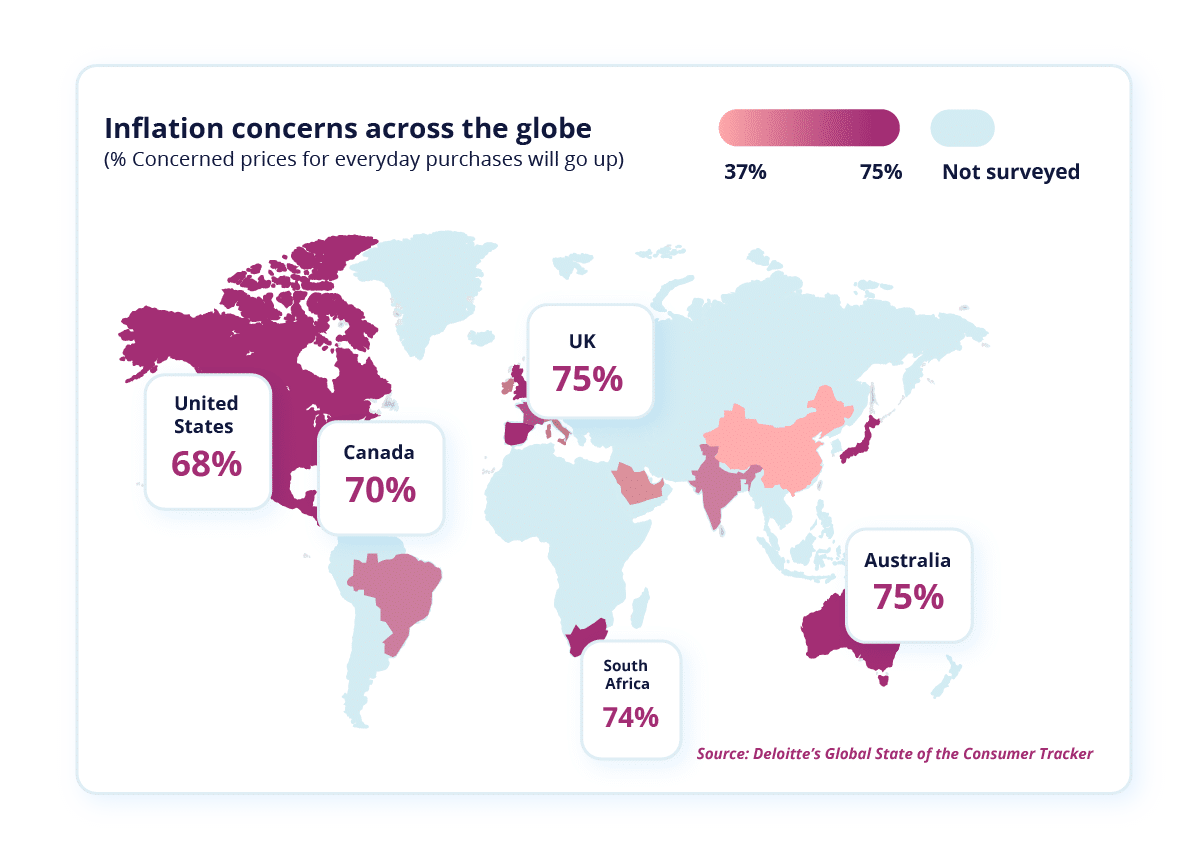

In 2023, post-pandemic challenges, labor shortages, inflation, energy crisis, and disruptions in the supply chains hit the industry again. Global market instability is the primary factor that sets the context for commercial real estate in 2023.

In an unpredictable market, commercial real estate stakeholders are cautious and carefully navigate a period of price discovery. According to PwC’s interviewees, lenders have been imposing stricter borrowing requirements with increased financing costs. This creates obstacles for companies in raising capital and advancing their projects. As a result, competition for deals has decreased during price discovery, as some real estate assets come under pressure. Meanwhile, Colliers’s report of 2023 states that distress will emerge in all asset classes.

Businesses are choosing different strategies for handling market uncertainty. Some of them downsize significantly their real estate footprint. For example, Meta decides to sublease their offices in Seattle and Bellevue instead of using them. Microsoft also announces that they won’t renew the lease after June 2024 for their office in Bellevue and they turn to remote work instead. Some companies even decide to leave specific markets, like Nordstrom which leaves Canada even though their Vancouver store was estimated as the best-performing store worldwide.

Other companies are seeking to seize opportunities. For example, Psycho Bunny enters the Canadian market in 2023, after amazing growth amidst the pandemic when it tripled its business and opened 20 stores across the USA. Uniqlo is set to grow with the plan to open 20-30 new stores in North America each year until 2027. The North Face also is planning to open more than 70 stores in North America and add up to 300 retail and partner locations in the next five years.

What would be the best real estate strategy for your company? Pause and wait, downsize, or expand? To answer these questions, you need to keep a close eye on market fluctuations and make business decisions based on the data from your stores and offices.

What we can say for sure is that it’s high time for transformations. Big and small businesses need to adjust their strategy to new challenges and view the real estate profile as a crucial component of the strategy. During this unstable period, companies need to search for new out-of-the-box solutions. Smart real estate management can ensure the needed resilience and cost optimization.

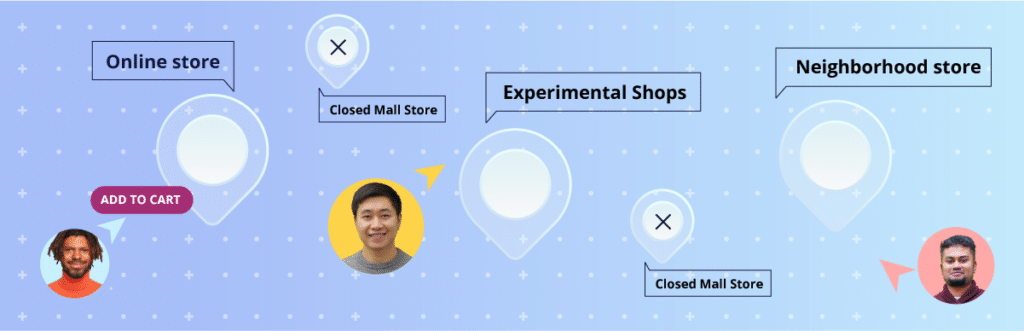

It’s crucial to learn from previous crises and recessions. When Covid-19 hit, companies that managed to rethink their real estate strategy and apply quickly new approaches could benefit from new opportunities and stay ahead of the curve of global transformations. Restaurants were adding cloud kitchens or ghost kitchens and food delivery services, retail was moving to online shopping and office workers switched to remote in order to face the change. Even after the pandemic, these trends continue to shape the future of the industries.

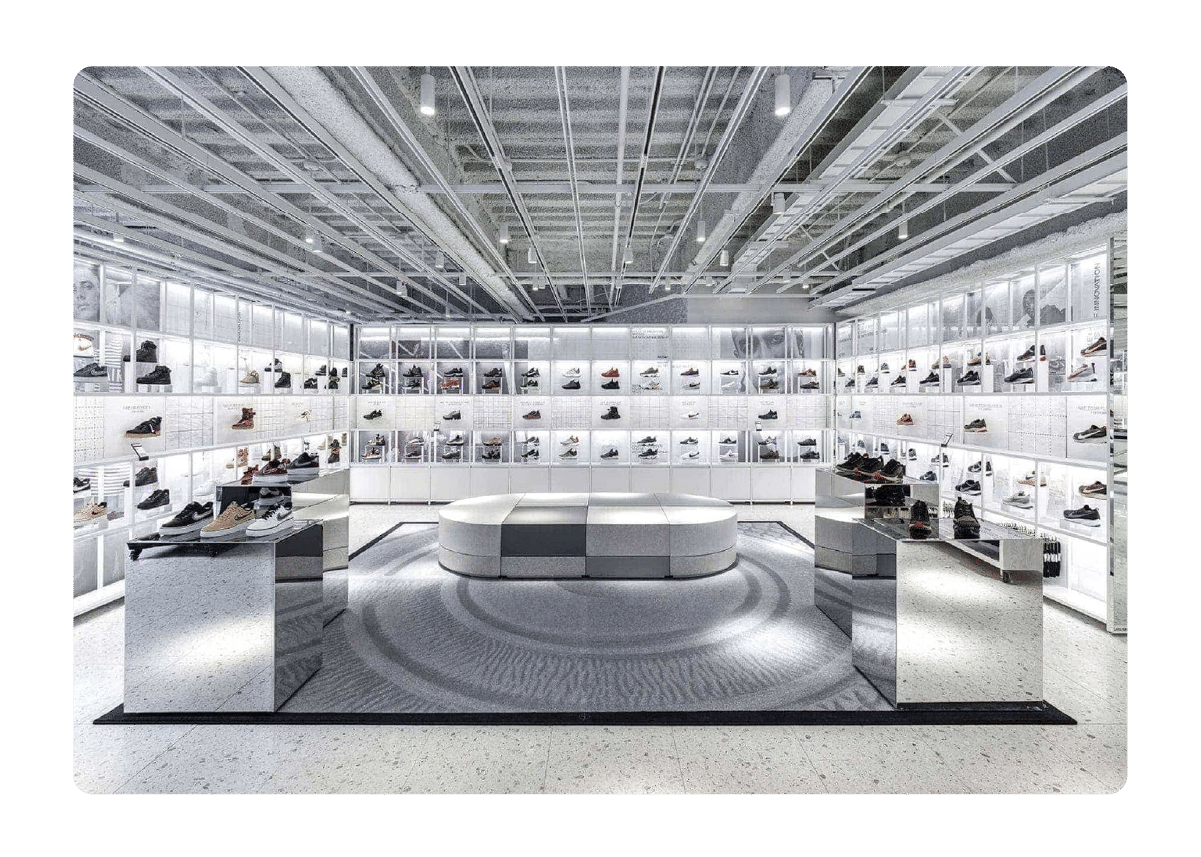

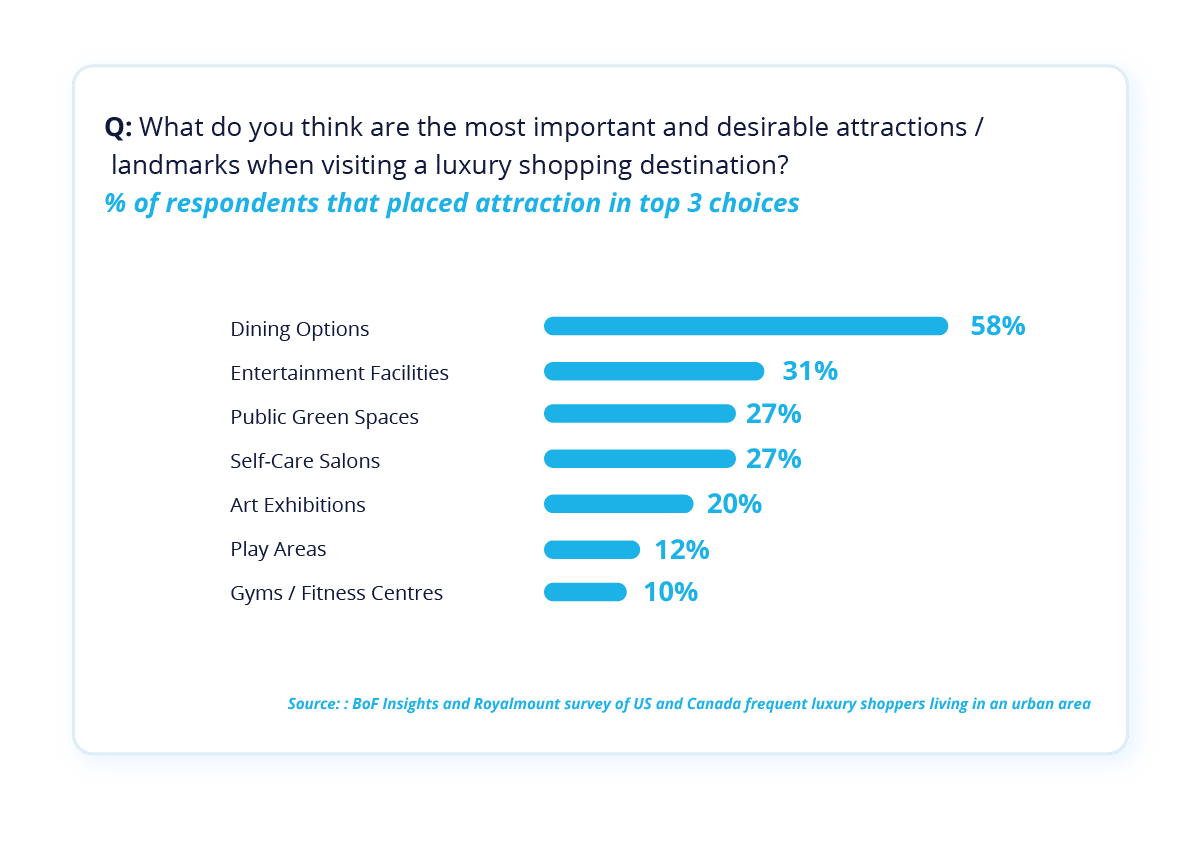

Retail bounces back after Covid-19, but it has greatly transformed. Now it is adapting to changing consumer buying habits and an evolving work landscape.

Here are some of the retail trends in 2023:

These trends reflect the evolving consumer preferences and the industry’s response to meet their demands for convenience, personalization, sustainability, and immersive experiences. Retailers that successfully embrace these trends are likely to thrive and remain competitive in the dynamic retail landscape of 2023 and 2024.

The return to the office brings new considerations for businesses. While some companies may opt for remote work arrangements, others recognize the value of physical office spaces for collaboration and fostering company culture. This has led companies to lean toward smaller but premium office spaces (Grade A or A+) designed to attract and retain top talent, providing an enhanced employee experience and promoting productivity.

Let’s explore more trends for the corporate real estate market in 2023-2024:

These trends reflect the evolving nature of work and the changing expectations of employees.

With growing awareness of sustainability and social responsibility, stakeholders in the industry are increasingly recognizing the need to incorporate ESG principles into their operations. From reducing carbon footprints and energy consumption to promoting community engagement and ethical practices, ESG initiatives are driving positive change in commercial real estate.

Various companies are already committed to ecological and social matters and promote them as their mission and values. Brands have various initiatives supporting zero-waste and raising awareness of environmental problems. One of the examples is a new Uniqlo store in Maebashi, Japan. It is built from recycled materials and equipped with solar panels to achieve zero-carbon emissions. Also, it has a repair and customization service RE.UNIQLO STUDIO that helps clients repair, reuse and remake their favorite clothes.

However, not many companies are ready for the upcoming ESG real estate regulations. According to Deloitte, only 12,2% of companies are prepared to meet future requirements immediately.

In terms of environmental factors, commercial real estate stakeholders need to work to reduce their environmental impact. This includes implementing energy-efficient technologies, such as smart building systems and renewable energy solutions, to minimize energy consumption and carbon emissions.

Deloitte and PwC reports insist that the transparency of ESG metrics is required and state that soon we will see new ESG disclosure rules and regulations. For instance, in the United States, the Securities and Exchange Commission (SEC) has proposed a new rule that would require issuers to share information about climate-related factors. This includes vital details like greenhouse gas emissions and climate risks. Real estate tenants, investors, or lenders associated with SEC issuers, might have to provide this information. It is all part of an effort to promote transparency and ensure that everyone is aware of the environmental impact of their assets.

Commercial real estate professionals need to keep in mind upcoming regulations and be ready for them. By integrating ESG principles into their strategies, commercial real estate stakeholders can align their operations with global sustainability goals, enhance their competitive edge, and contribute to a more sustainable and socially responsible future.

For a long time, the real estate industry was slow at digitalization. Historically, the industry heavily relied on traditional methods such as physical property listings, face-to-face interactions, and manual paperwork.

Recently, property technology, or PropTech, has emerged. PropTech includes digital solutions that help real estate professionals build, manage, maintain, buy, sell, and lend property. Covid-19 and economic shocks gave another boost to PropTech and helped fasten the digitalization of the industry. Digitalization is driven by thousands of entrepreneurs and start-ups. According to Forbes, the Proptech market is currently valued at $18.2 billion and is forecasted to reach $86.5 billion by 2032.

One of the most interesting trends in digitalization is the Internet of Things (IoT). It is an interconnected network of physical objects that are equipped with sensors, software, and technologies that collect and share data with little to no human involvement. According to BuildingEngines report, the property team’s interest to invest in smart buildings and IoT increased by 53% since the previous year.

Here are four amazing examples of how IoT helps commercial real estate professionals and businesses achieve their goals:

Besides the Internet of Things, proptech offers a great variety of solutions for commercial real estate professionals: digital documentation and transactions, online platforms to discover new commercial real estate assets and opportunities, visual tours of the premises, as well as highly analytical tools for a better understanding of operational efficiency, lease management, and maintenance needs.

Among various types of proptech software, commercial real estate or CRE software is particularly interesting. Commercial real estate strategy corresponds to one of the biggest cost contributors and its optimization can bring quick wins and agility required for the business to adjust to new market challenges.

“Corporates will need to revisit their CRE strategies and invest in solutions that enable continuous adaptation to rapidly changing market dynamics”, says JLL.

Let’s dive even deeper and explore what benefits CRE software can bring to your business in the second part of our guide. There, you will find detailed explanations of how to achieve real estate data centralization, automated workflows, and cross-team collaboration.

1. Data Management in Real Estate: Centralization and Analytics

Gartner reports that organizations believe inaccurate data can cost businesses an average $15 million per year. But how to manage the data efficiently? You need two things: a centralized and regularly updated database and the ability to slice and dice data according to your day-to-day operational and analytical needs.

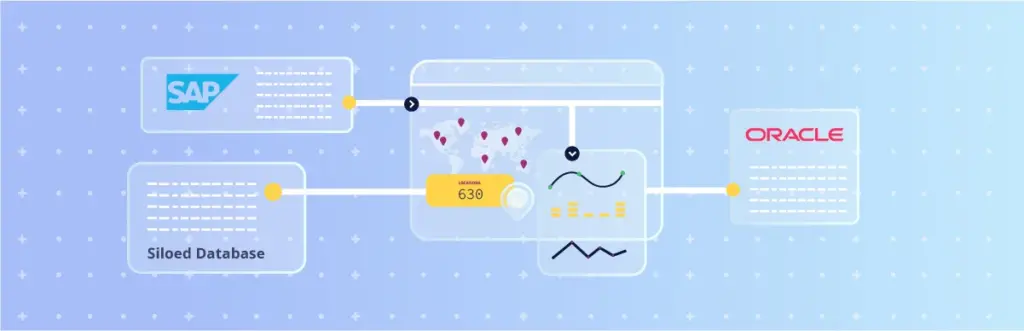

Most enterprises keep their real estate data in ERP systems (usually SAP or Oracle), or other siloed in-house databases created many years ago. Companies often house their commercial real estate data in multiple different locations, which ultimately wastes time and increases errors during validation and reconciliation tasks. Even when companies have a single source of real estate asset data, they may not be able to drill down into the data, which makes it hard to interpret numbers or get any actionable items.

Modern CRE software can connect multiple data sources, including ERP systems, isolated databases, or data from other SaaS tools. For example, your company can integrate data from point of sale (POS) systems with your real estate software, so that sales and revenue data is shown alongside real estate costs for each location. This way, your team can have more insights on the profitability of specific stores and decide whether you need to expand or reduce square footage, close a store, or open a new one.

For example, POS data may show you that your most profitable shops are in residential neighborhoods and have a pick-up section. This insight may impact not only your commercial real estate strategy but perhaps also transform your whole business strategy. Getting data on income and expenses out of silos allows you to see the bigger picture and leads you to more creative and successful business solutions.

Of course, once you gather all your commercial real estate data in one place, there is a big chance of getting lost in all your numbers and information. To avoid confusion and achieve efficient data management in real estate, it’s crucial that the software you choose can visualize and manipulate data. Usually, CRE software offers automatic pre-set reports and dashboards with the possibility to configure them to your company’s needs and create new reports with custom fields. Here are just some examples of out-of-the-box reports that should be available from Day 1 to boost your data analysis in real estate (ask your vendor for them by name):

These reports should further be bolstered by machine learning so that the analytics provide deeper insights into current trends in the commercial real estate landscape. Obviously, legacy real estate management software does not offer fine-grained data analytics.

Modern CRE software centralizes its regularly updated client data, it usually has notification functions that remind property managers and lease administrators about any upcoming event or deadline. With thousands of leases, it is easy to miss a deadline which costs the business a lot of money. Deadline notifications and reminders are extremely valuable.

Our clients have been saving millions of dollars annually by automating their commercial real estate with NRE. Want to know how much money your organization could save with the right CRE software?

Summary: What are the benefits of centralized data for real estate management?

You get:

Looking for the right Proptech software for your enterprise? Consult our Real Estate Software Buyer Guide!

Large enterprises have complex departmental structures to operate more efficiently. However, it is important to organize knowledge and data sharing between departments to avoid silos and duplicated work.

Lease managers, real estate managers, and their accounting teams often lack streamlined communication and collaboration. This is counterproductive since these teams need input and approval from each other to proceed in their work. Slow collaboration between these departments can not only lead to delays but also contribute to lost revenue. For example, we have often seen accounting teams pay for leases that were closed months prior because they weren’t informed about their termination.

When you work in a large enterprise, it is hard to make these miscommunications and errors visible. However, leveraging current technology helps. Having one source of truth for all teams and allowing them to collaborate in single software with dedicated and tailor-made workflows can be a game-changer.

Before, there was a lot of work duplication; accountants needed to manually add information to their general ledger, and real estate professionals added the same data in their separate property management system (database or legacy software). However, with a single source of truth, once a property manager adds the lease contract information, it is automatically available to the accounting team. Using CRE software, when a property manager adds a new lease contract, all the information can be transferred to the accounting team, pre-formatted under the right categories and subledgers, simply awaiting their approval. When it’s approved, the property manager gets a notification, and the contract data is saved in the General Ledger of the ERP system for further use. There’s no duplication of manual data entry, only a streamlined workflow.

Another crucial example where real estate and accounting teams need to collaborate side-by-side is in compliance. Accounting teams need to make sure that property managers provide all the necessary information for real estate lease assets according to the correct accounting standard. The right proptech software consolidates data into a single source of truth for both teams and would automatically format the lease contract data entered by property managers to the appropriate accounting standard. Accountants can then complete reports more quickly and ensure that the standards required by compliance are accurately followed. Month-end closes and audits become much faster and more efficient as an additional benefit.

A word of caution should be added here: for such smooth collaborations to happen, it is not enough to just use any one single software for both teams. Sometimes companies ask real estate professionals to use solutions designed for accountants, and this works poorly. We cannot forget that real estate professionals and accountants have different goals and require different features to achieve them. For example, for a property manager it is important to know the exact square footage and type of lease (warehouse, store, or pick-up point) whereas for an accountant it is more important to ensure compliance and regular payments. That’s why you need to make sure that the software you choose will not only offer data centralization but also will have all the features crucial to both teams.

Summary: What are the benefits of facilitating smooth collaborations between the real estate and accounting teams?Discover Nakisa Real Estate Software and the benefits it brings to your commercial real estate operations

2023-2024 are not easy years for the global economy and commercial real estate industry. The commercial real estate outlook is being shaped by unstable market dynamics, retail and office transformations, ESG considerations, and rise of proptech. Companies choose different strategies to face these trends and gain agility. Experimenting with new solutions and optimizing CRE strategy with proptech software can help companies stay ahead of the curve of this transformation. Data management, process automation, and cross-team collaboration are gaining crucial importance and should be leveraged for your business profitability.

We hope that our guide has helped you to better understand CRE trends, challenges, and technologies, and provided you with fresh ideas on how to optimize costs and seize growth opportunities.

We, at Nakisa, offer the expertise and tools to optimize commercial real estate portfolios and operations. Our team of commercial real estate professionals have developed both depth and breadth of experience from working with Fortune 1000 companies like Walmart, Nestle, Danone, and 3M for many years. The insights we can provide you about how to choose and use the right commercial real estate software can fully optimize your day-to-day real estate management operations and drive your company’s productivity and, most importantly, profitability.

The latest Nakisa Lease Accounting release introduces impactful capabilities that streamline financial close processes, enhance

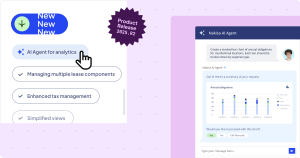

With the 2025.R2 release, Nakisa IWMS introduces advanced functionality, including AI Agent for analytics, multiple

The 2025.R2 release brings several purpose-built updates to the Nakisa Workforce Planning Portfolio, including in-chart

Comments are closed.