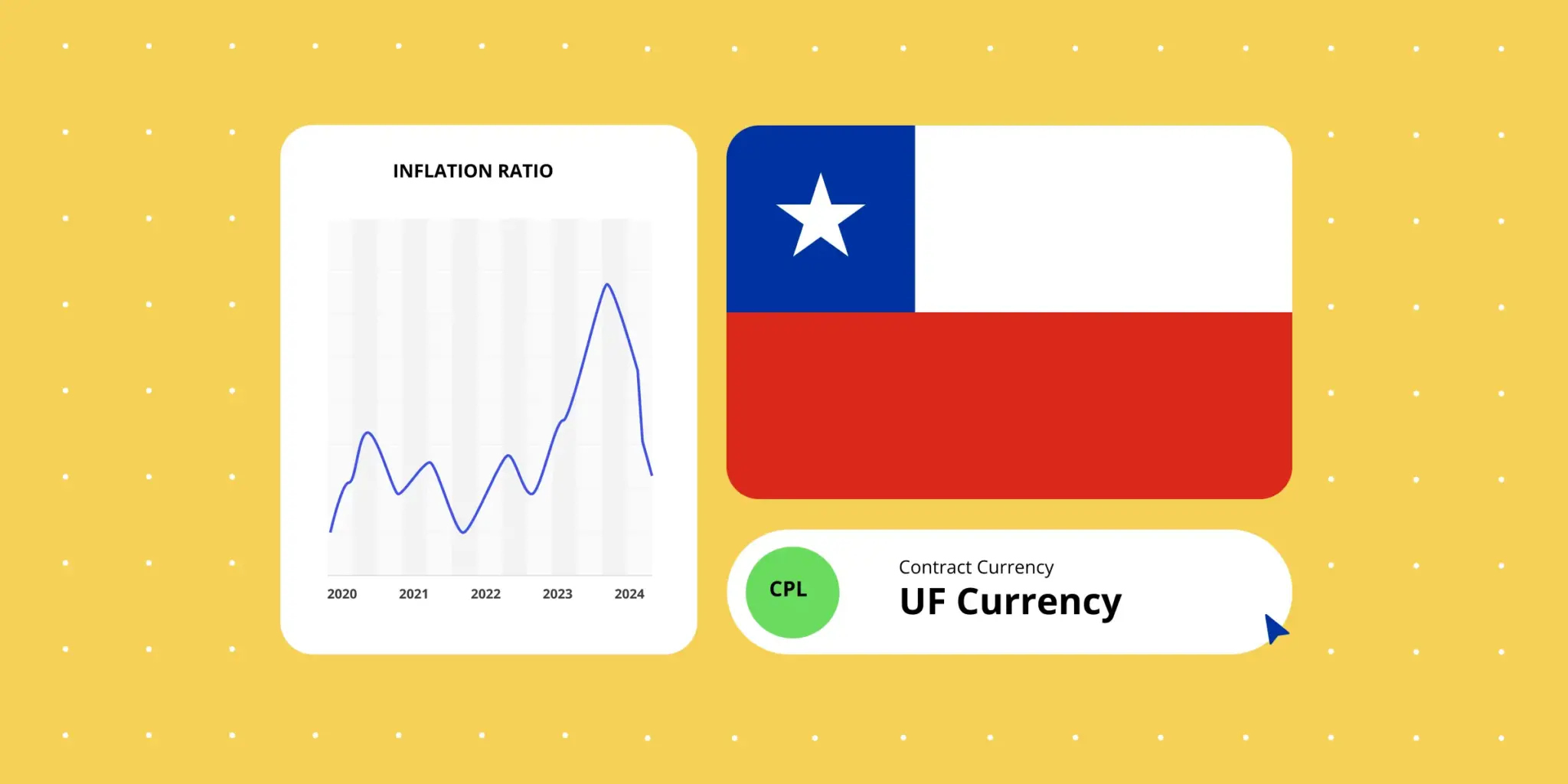

Why multinational corporations need lease accounting software to navigate alternate and parallel currencies

Explore how enterprise lease accounting software can assist you in managing multi-currency contracts by tracking, calculating, and reconciling finances in real-time, especially amidst currency fluctuations.