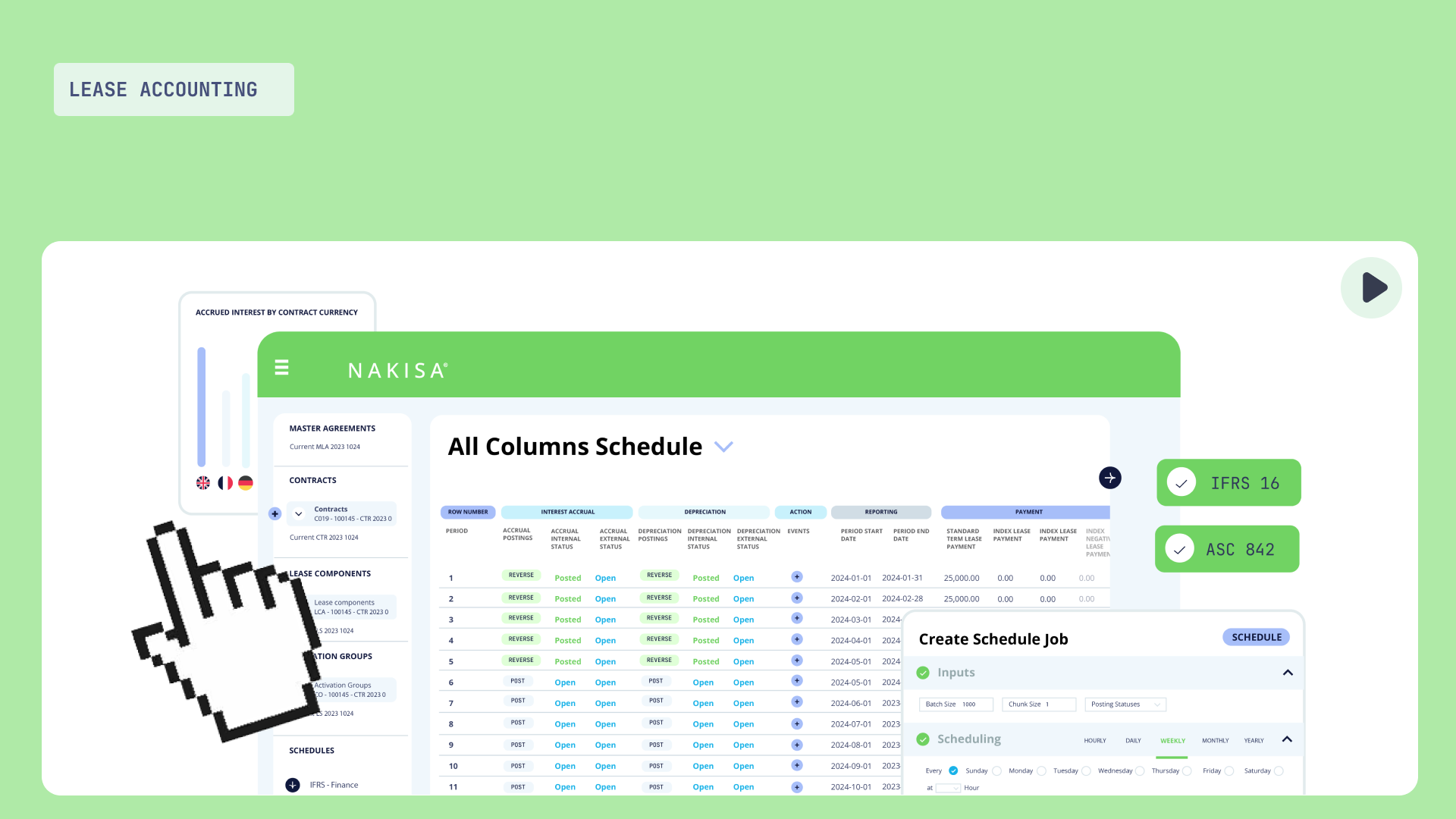

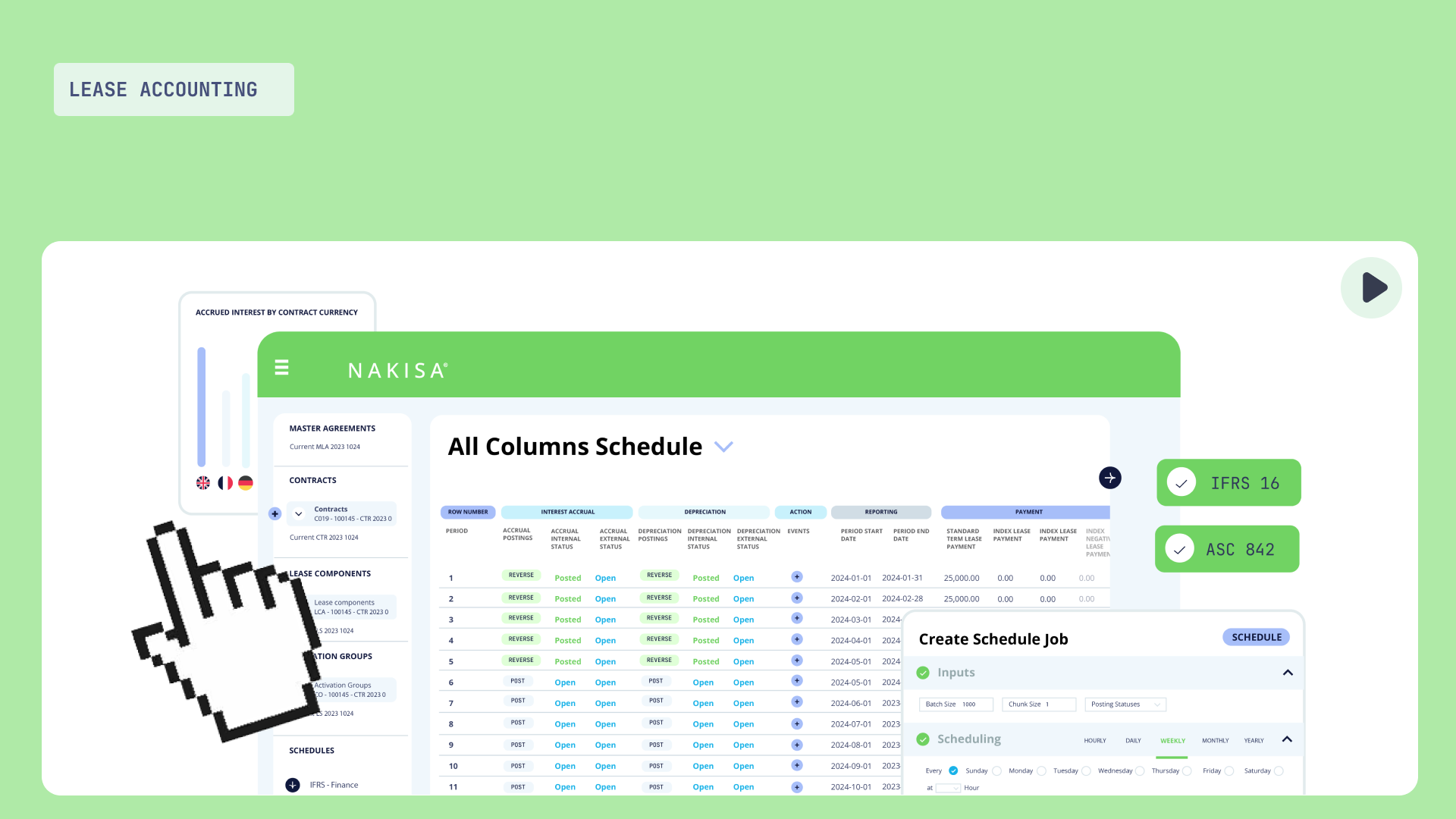

Nakisa lease accounting software (NLA) demo catalog

Watch short demos of Nakisa lease accounting software to see how it can optimize your enterprise lease accounting and ensure IFRS 16, ASC 842, and local GAAP compliance.

Explore latest insights, tips, and trends on transition accounting from Nakisa

Watch short demos of Nakisa lease accounting software to see how it can optimize your enterprise lease accounting and ensure IFRS 16, ASC 842, and local GAAP compliance.

Learn more about the latest enhancements of Nakisa Lease Administration’s 2021 R1 release, designed to streamline operations, manage global assets, and ensure compliance, including a local GAAP framework for precise reporting, a Global Asset Tracker for comprehensive portfolio management, and a Data Quality and Integrity

Discover the origins and evolution of Nakisa’s cloud-native commercial real estate management software, Nakisa Real Estate, formerly IMNAT Software’s InfoSite. This solution provides a comprehensive real estate management platform for global enterprises to centralize data, automate workflows, offer real-time analytics, and integrate with Nakisa’s

The R2 2020 release of Nakisa Lease Administration introduces the Intercompany Asset Transfer functionality, enabling users to easily transfer lease assets between companies without triggering asset disposal, thus maintaining compliance with lease accounting standards.

Gain insights into the specific lease accounting guidelines under German GAAP, including the criteria for classifying leases as finance or operating leases, and the accounting treatment for finance leases from both the lessee’s and lessor’s perspectives.

This blog explores the critical lease accounting challenges companies face during turbulent periods and how a robust lease accounting software solution can help address them.

Learn more about the implications of ASC 842 lease accounting rules on impairment testing for oil and gas companies across upstream, midstream, and downstream operations.

This post covers calculating the depreciation expense and lease liability amortization schedule under GASB 87 lease accounting. It also discusses how lease modifications require remeasuring lease liabilities, payments, and assets—a process that specialized lease accounting software can automate.

The post walks through an example scenario to illustrate the first three steps for GASB 87 lease accounting calculations: the initial lease liability, the right-of-use asset value, and the interest expense for each period under the new lease accounting rules for government entities.