1. Introducing Nakisa AI

Nakisa is integrating powerful AI functionality into its innovative cloud-native platform, enhancing all three of our product portfolios—Accounting, IWMS, and Workforce Planning. Our platform now leverages advanced generative and agentic AI technologies and ensures that all future innovations and upgrades seamlessly integrate into every Nakisa product.

Before diving into our AI functionality, an important note: Nakisa takes client security and trust seriously. Our AI models are not and will never be trained on client-specific data. To maintain data and feature-level security, Nakisa AI inherits and respects access permissions based on user roles defined at the product level and by user groups. Each client is assigned a unique encryption key for maximum protection, and their data is isolated and segregated to prevent accidental access by unauthorized parties.

To empower our clients with the latest technologies, Nakisa is developing a conversational AI assistant and multiple AI agents. Let’s explore how they work:

Nakisa AI Assistant (Alpha release, general availability in 2025.R2 product release): Leveraging the power of Generative AI and Retrieval-Augmented Generation (RAG) technology, this conversational AI assistant is designed to provide intelligent, context-aware support. Trained on Nakisa’s extensive documentation library, it ensures accurate and relevant responses, enhancing the user experience across all products. Simply ask the Nakisa AI Assistant about lease accounting topics or specific product functionalities, and it will provide precise, helpful information. Additionally, with context-aware help, the Nakisa AI Assistant offers smart suggestions tailored to ongoing tasks, boosting productivity and streamlining workflows.

Nakisa AI Agents: AI Agents are specialized, task-oriented AI models designed to streamline complex workflows, reduce manual effort, and enhance operational efficiency. Unlike traditional automation tools, these agents leverage advanced AI technologies to interpret context, adapt to evolving scenarios, and execute tasks within the application based on prompts from users. At their most advanced, agentic AI can act autonomously, making decisions, taking actions, and continually learning to solve complex, multi-step problems. Nakisa develops multiple AI Agents, tailored to each product and suite, all recognizable by the 'AI' in their titles.

In the 2025.R1 product release, Nakisa introduced several AI Agents across different product portfolios and suites— and more are on the way! For Nakisa Lease Accounting, we’ve introduced AI Agents for analytics—explore the details here.

2. ERP integration

2.1 Custom BAPI integration for SAP

In large-scale enterprise environments, managing financial data synchronization between SAP and Nakisa Lease Accounting can be challenging due to the vast volume of data involved. Organizations often deal with tens of thousands of GL accounts and an even larger number of vendors, spanning various business activities beyond leasing. Pulling all configurations from an ERP system into Nakisa Lease Accounting is neither practical nor necessary. Instead, focusing only on the relevant data ensures a more efficient and streamlined integration.

To address this, our lease accounting solution introduces custom BAPI integration, allowing users to sync specific data from their SAP system into Nakisa Financial Organization Structure (FOS). Instead of retrieving the entire dataset, users can configure the system to pull only the subset of data relevant to leasing activities.

This targeted approach reduces sync time, minimizes the risk of job failures due to data overload, and ensures greater alignment with ERP configuration. This feature gives users full control over master data synchronization, resulting in seamless and accurate data transfer.

Start using this feature in Nakisa

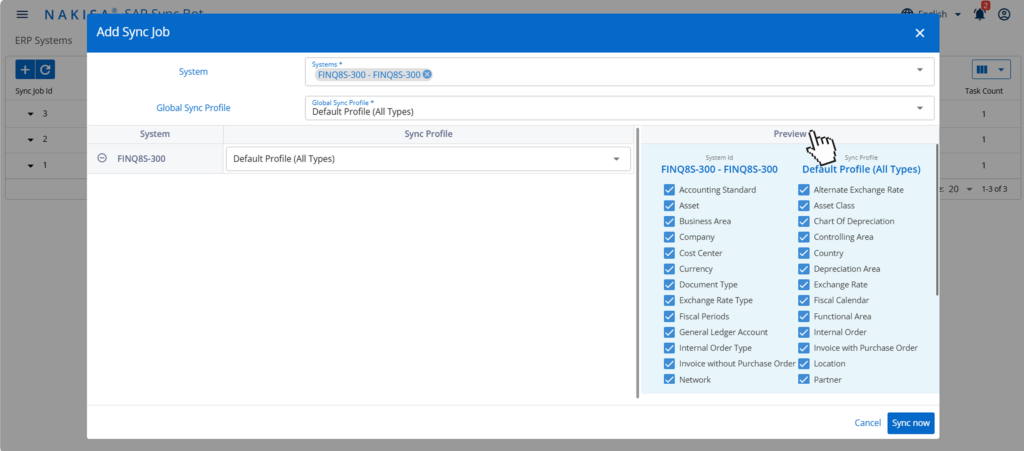

The SAP sync configuration is accessible through the SAP Sync Bot microservice in the Nakisa Financial Organization Structure (FOS) system settings. Within this interface, users can view a structured table displaying all BAPIs used for data synchronization. Out-of-the-box BAPI settings are visible by default, and users can modify them as needed to align with their specific ERP configurations.

Once a custom BAPI is defined and the logic is implemented, the system applies it during the sync process, ensuring that only the required data is imported to FOS. This capability enhances system efficiency, user control, and alignment with unique ERP requirements, delivering a more tailored and effective integration experience.

In the Nakisa SAP Sync Bot, users can easily create a sync job, choose a system, and select a global sync profile to define the data they want to sync.

2.2 ERP field mapping

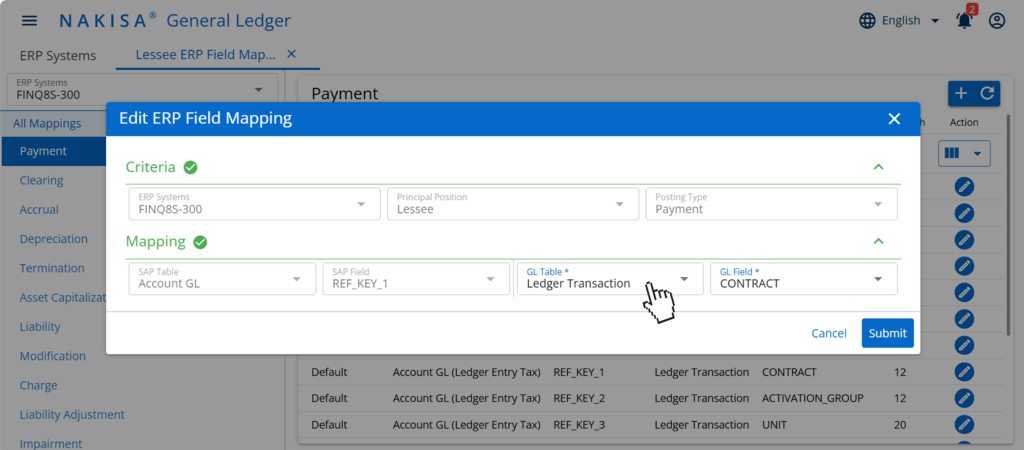

ERP field mapping in Nakisa Lease Accounting enables accurate data transfer and field mapping between source and target systems, giving users full control over the information sent from Nakisa applications to external ERP systems for greater flexibility and accuracy in financial data integration. When performing activities such as activating an activation group, posting a payment, reversing a charge, or reverting an event, documents are created and stored in Nakisa General Ledger until an SAP posting job transfers them to the external ERP system. However, businesses often require adjustments to the data being sent.

ERP field mapping addresses this need by allowing users to modify the information included in posted documents, both within Nakisa General Ledger and before transmission to the ERP system. This feature enhances data consistency and integration across applications, supporting diverse organizational needs. By enabling custom field mapping, Nakisa accommodates various data structures and formats, ensuring a seamless flow of information between systems for its global customer base across multiple industries.

Start using this feature in Nakisa

To enable ERP field mapping, Nakisa Lease Accounting introduces a new menu item called SAP Posting Bot - ERP Field Mappings within Nakisa General Ledger. Users can select their ERP system and document type, view the default out-of-the-box mappings, and modify editable SAP fields as needed. Built-in controls and validations ensure data integrity, preventing errors and maintaining consistency in financial data transfers. This structured approach allows businesses to tailor their ERP data mapping while ensuring compliance and accuracy across integrated financial systems.

In the SAP Posting Bot – ERP Field Mappings menu, users can select their ERP system, choose a document type, view default out-of-the-box mappings, and modify editable SAP fields as needed.

3. Lease accounting

3.1 Consolidated import files

Nakisa Lease Accounting enhances the consolidated import files, making the object creation process more efficient. Previously, importing followed a step-by-step approach—starting with master agreements, followed by contracts, lease components, and activation groups.

With this update, users can now import multiple objects in a single file, reducing the number of import jobs while still retaining the flexibility for individual imports when needed.

Start using this feature in Nakisa

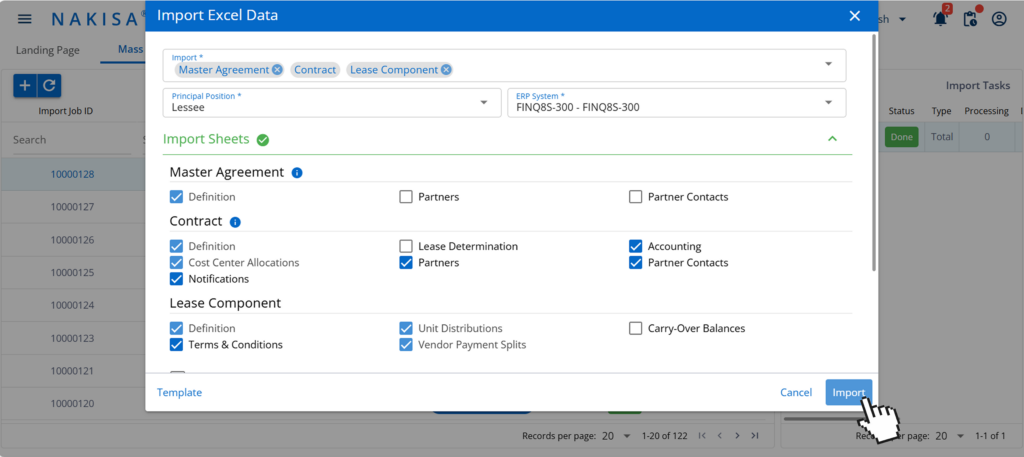

With this enhancement, users can now mport any object including master agreements, contracts, and lease components simultaneously significantly reducing manual effort. While multi-object selection is enabled, logical sequencing is maintained—ensuring that dependencies, such as contracts following master agreements, remain intact. The system dynamically generates structured import sheets based on selected objects, aligning with job parameters and visually distinguishing different object types through a color-coded UI. Upon upload, built-in validations ensure that workflow steps are followed correctly, and any errors are displayed directly in the relevant sheets for quick identification and resolution. This streamlined process enhances efficiency, improves usability, and aligns with customer needs, enabling a more seamless import experience within our enterprise lease accounting software.

In Nakisa Lease Accounting, users can simultaneously import consolidated data files, including master agreements, contracts, and lease components.esign

3.2 Mass workflow

Nakisa Lease Accounting has redesigned its mass workflow functionality, adopting an action-based, sequential, role-based model, allowing the introduction of robust controls and validations. Previously, mass workflows allowed users to move contracts from defined to active status without focusing on the specific actions being performed. Now, the process aligns with individual actions, such as sending contracts for assessment or approving them, providing greater control and validation.

The previous batch role granted broad access, allowing users to perform all mass workflow actions, which limited its assignment to a small subset of users. To enhance security and alignment, batch permissions have been refined to ensure users can only perform mass actions that align with their manual capabilities, preventing unintended actions. This improvement strengthens access control while increasing adoption, enabling more users to leverage batch management for greater workflow efficiency without compromising security.

Start using this feature in Nakisa

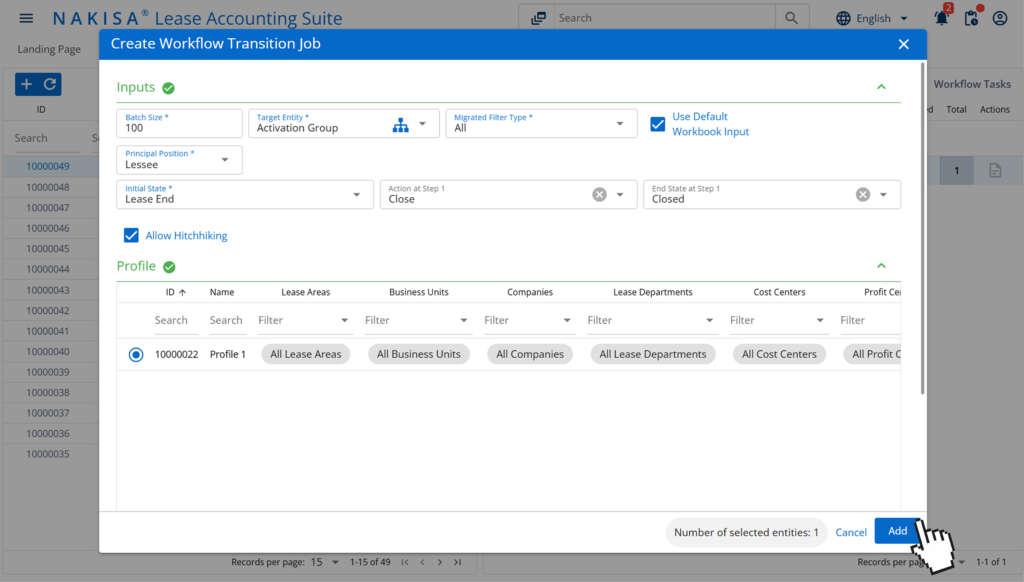

Users first define an Initial State and then select an Action or End State for the job to execute. Role-Based Permission Transitions ensure that only authorized users can perform specific actions, preventing unauthorized mass transitions. Additionally, multiple actions can be linked within a single job, enabling step-by-step workflow progression for greater efficiency.

In Nakisa Lease Accounting, users can create workflow transition jobs by defining an Initial State, selecting an Action or End State, and choosing a profile.

3.3 Expense-based GL mapping for lease payments

To enhance financial clarity and reporting accuracy, Nakisa Lease Accounting now supports expense-based GL mapping for lease payments. This feature originated from customer requirements, particularly from those upgrading from legacy systems that previously allowed lease payment splitting within financial postings.

This feature allows lease payments to be recorded as separate line items in journal entries, enabling mapping to different GL accounts based on expense categories.

With this update, lease payments such as base rent and supplemental rent can now be assigned to separate GL accounts based on their expense categories. Previously, these payments were grouped into a single line item, but now, for example, a base rent can be posted to GL Account 0001, while a supplemental term can be posted to GL Account 0002.

This improvement provides greater financial clarity by enabling separate postings for different expense types, improves tracking and reconciliation by ensuring payments are categorized correctly, and enhances compliance with accounting standards by maintaining accurate financial records.

Start using this feature in Nakisa

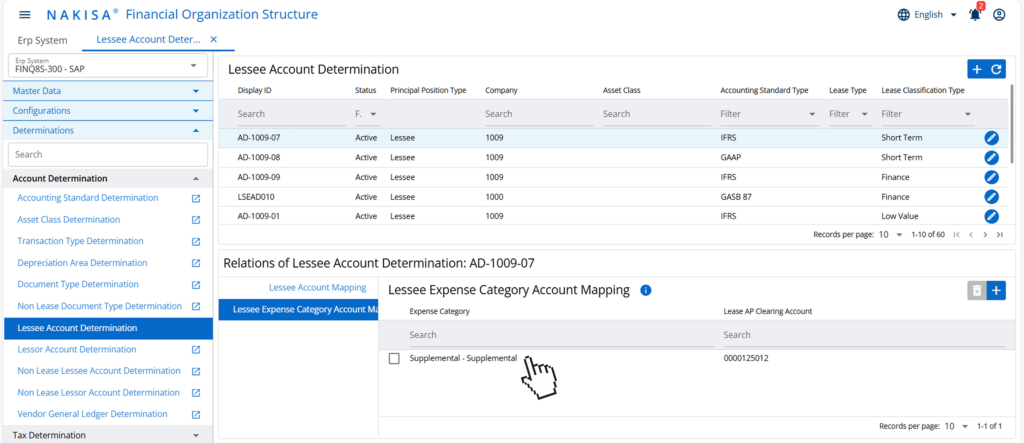

In Nakisa Financial Organization Structure, users can enable or disable Payment Split in System and Company Financial settings. Once activated, each Lease Payment is posted as a separate line item according to its expense category.

Additionally, this feature integrates with the lessee account determination page, allowing users to map accounts payable accounts by expense category—similar to how non-lease expenses (such as insurance, taxes, and maintenance) are mapped.

By default, if no AP account is configured, the system will default to the AP Lease Clearing Account, ensuring seamless functionality while providing the flexibility to customize postings as needed.

In Nakisa Financial Organization Structure (FOS), users can map accounts payable accounts by expense category.

4. Lessor accounting for subleases

Many businesses, especially in retail and commercial real estate, function as both lessees and lessors. For instance, a supermarket leasing a retail space might sublease part of it—such as a pharmacy—to another business. To accommodate this common practice, Nakisa Lease Accounting has introduced new functionality and enhancements for subleases under the operating lease classification, ensuring compliance with IFRS 16 and ASC 842. This update ensures compliance with accounting standards by properly tracking the financial impact of subleases and main lease contracts. It enhances financial tracking by providing improved reporting and greater visibility into sublease arrangements. Additionally, it enables seamless integration between Nakisa’s lease accounting and real estate management portfolios, driving greater efficiency in lease management.

This feature not only simplifies sublease accounting but also opens new opportunities for businesses managing complex lease structures, reinforcing Nakisa’s commitment to delivering value-driven solutions.

Start using this feature in Nakisa

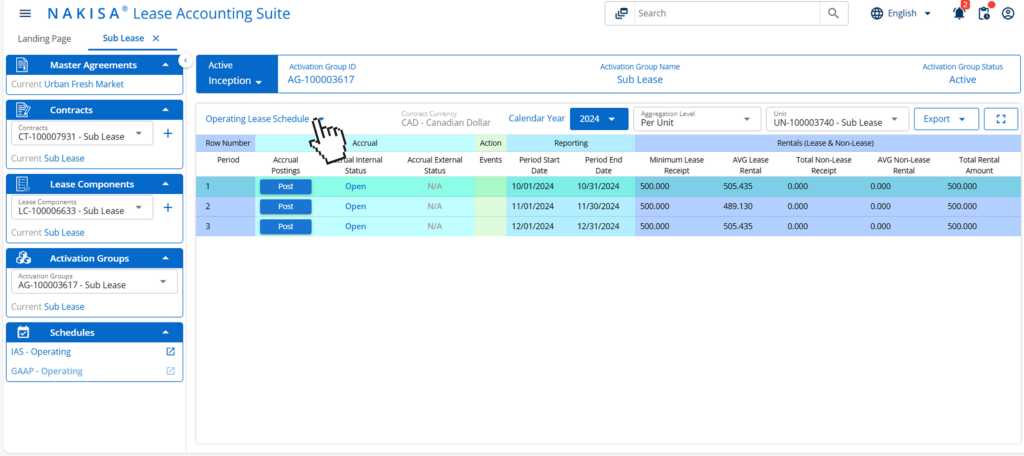

Users can now create lease contracts under Lessor as principal position and classify them as subleases, linking them to corresponding Lessee contracts. New capabilities enhance object workflows, event execution, batch management, reporting, and data import/export, ensuring seamless management of sublease arrangements. These improvements also establish feature parity between Lessee and Lessor-Sublease contracts, providing a more consistent and efficient leasing experience.

In Nakisa Lease Accounting, users can create and manage subleases under the operating lease classification.

5. Reporting and analytics

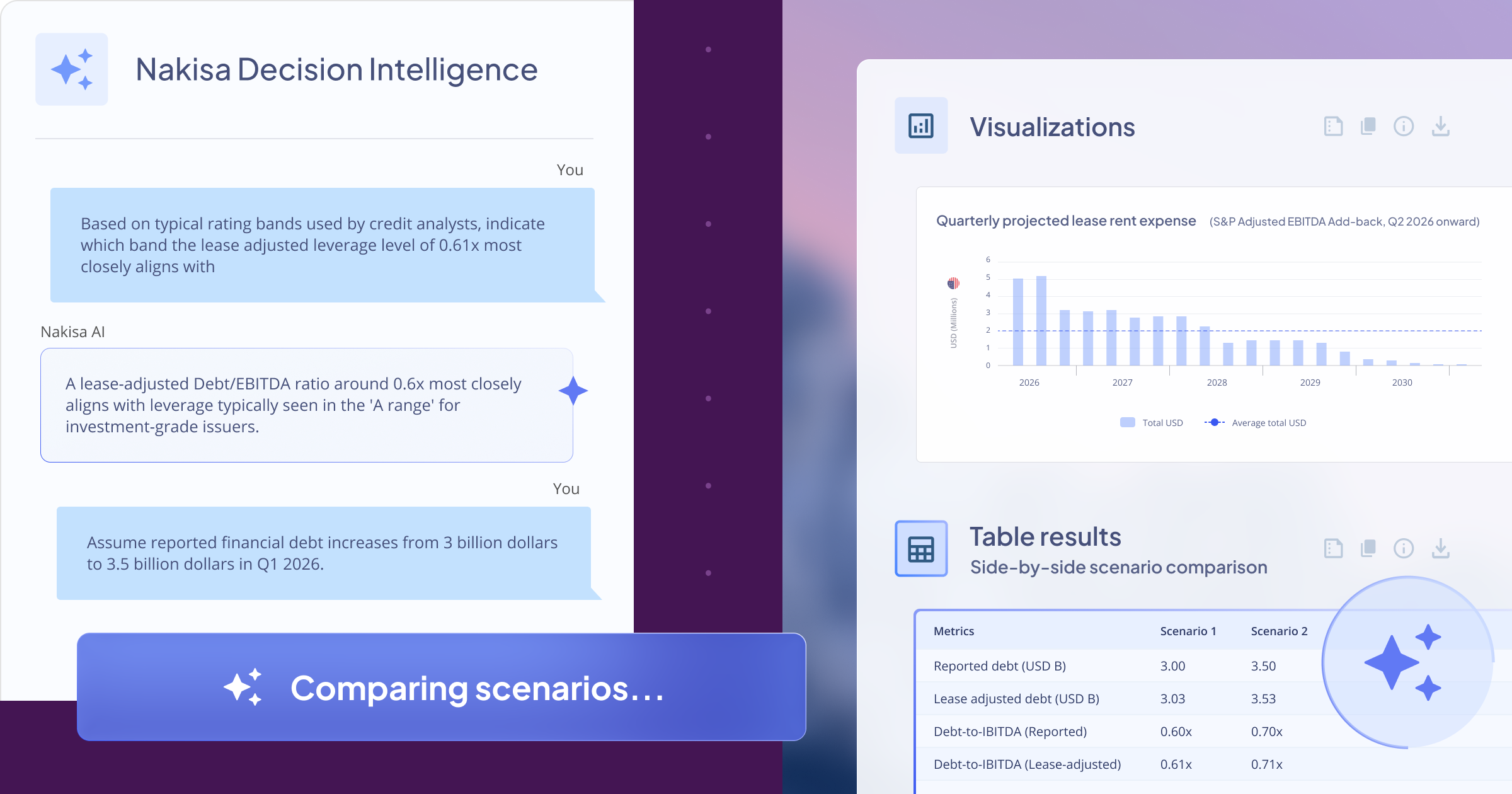

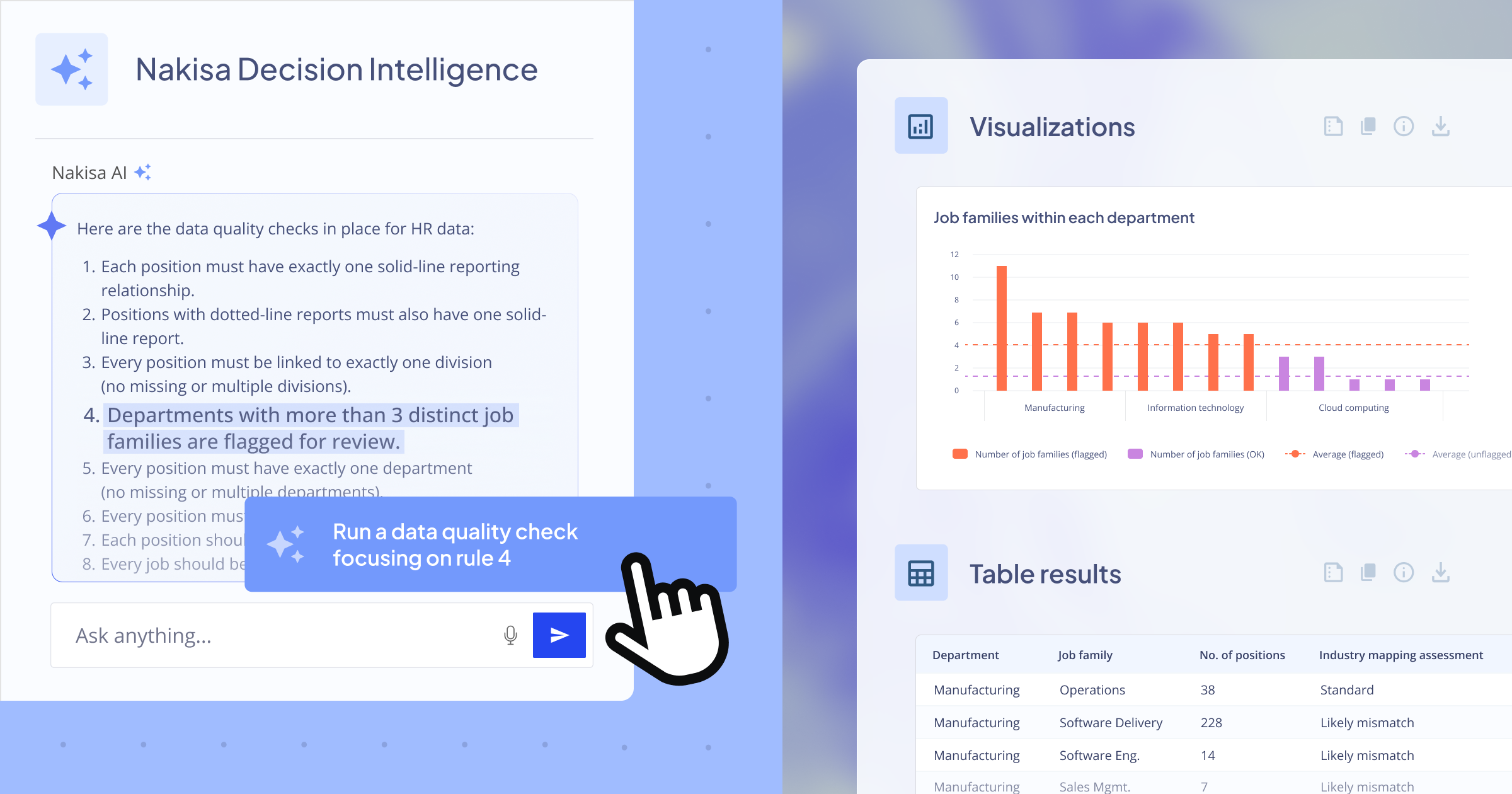

5.1 AI Agents for analytics

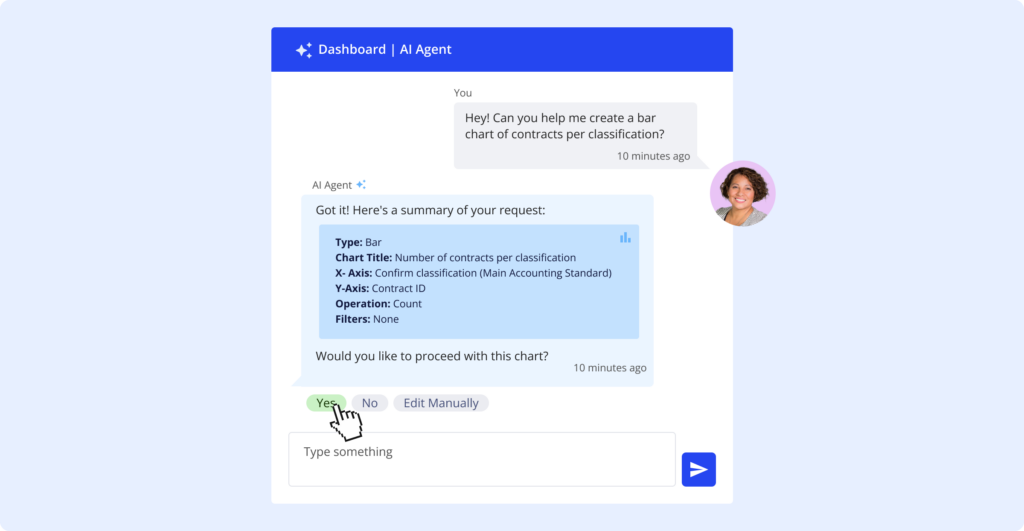

The Nakisa AI Agent is now available within custom dashboards in Nakisa Lease Accounting, offering enhanced capabilities for dashboard creation and management by automatically generating charts that provide valuable insights into your portfolio.

Start using this feature in Nakisa

The AI-powered analytics introduce various chart types, including bar, line, pie, and metric charts, with support for single-axis functionality, basic filtering, automatic chart type suggestions, and core indexes in Nakisa Lease Accounting. To start using the new AI-powered dashboards, simply enable the feature through the Dashboard AI Agent switch in the Financial Organization Structure (FOS). Keep in mind that while the AI generates useful insights, it’s crucial to review the content for accuracy and completeness before applying it.

In Nakisa Lease Accounting, users can interact with an AI Agent to generate a real-time analytics dashboard.

5.2 Portfolio Financials dashboard

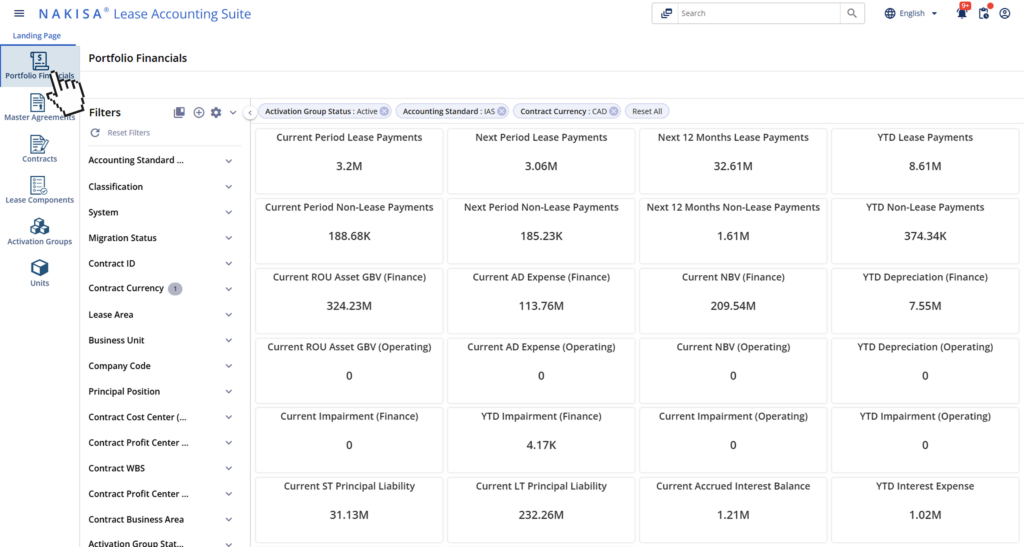

Contract managers require a comprehensive financial view of all leases to ensure alignment with strategic objectives. Tracking lease and non-lease financials across multiple contracts can be time-consuming, especially when compiling reports manually. To streamline this process, the Portfolio Financials dashboard provides a centralized view, offering quick insights into key financial metrics and improving decision-making.

Start using this feature in Nakisa

The Portfolio Financials dashboard provides a structured overview of financial data, offering clear visibility into payments, assets, and liabilities across multiple contracts. Users can further analyze the data by applying filters based on asset class and other key criteria, allowing for more targeted analysis. With this enhanced visibility, organizations can track financial obligations, optimize budget management, and make informed decisions without the inefficiencies of manual reporting.

In Nakisa Lease Accounting, users can generate a Portfolio Financials dashboard to gain insights into payments, assets, and liabilities across multiple contracts.

5.3 Portfolio Insights dashboard

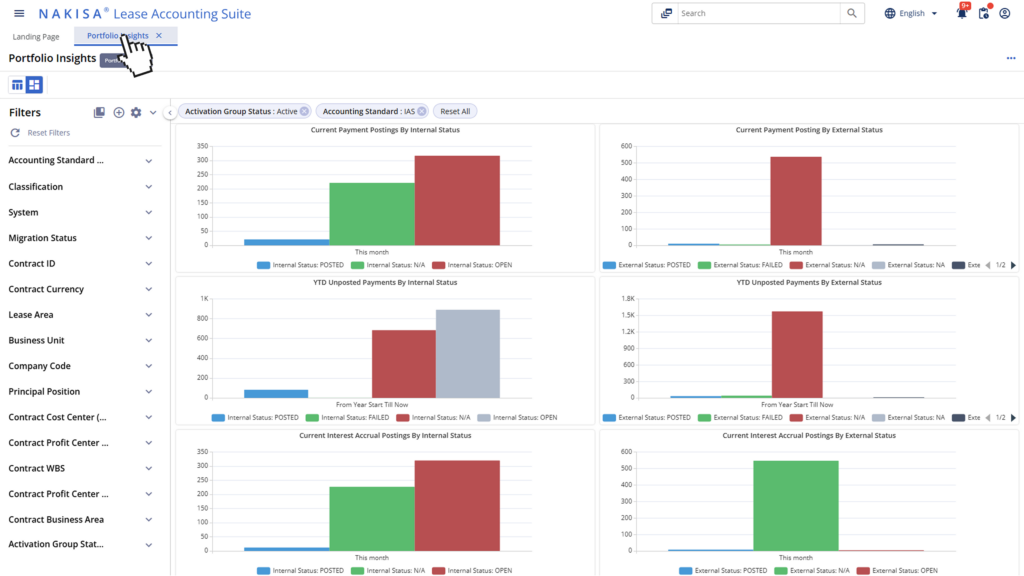

Accountants require a high-level financial accuracy check to ensure that amounts in schedules align with posted figures without the need to manually verify individual contracts. Tracking unposted payments, interest accruals, and depreciation discrepancies across a portfolio is essential for accurate financial reporting and compliance. To enhance efficiency in financial reconciliation, the Portfolio Insights dashboard provides a streamlined approach to identifying anomalies, ensuring greater accuracy across contracts.

Start using this feature in Nakisa

The Portfolio Insights dashboard automates financial data comparison, ensuring alignment between schedules and postings for key elements like payments, interest, and depreciation. Interactive visual charts make it easier to detect anomalies, while advanced filtering options allow users to refine their analysis based on asset class and other key parameters. By providing real-time visibility into pending postings, this feature accelerates month-end closing, enhances reconciliation accuracy, and supports compliance efforts.

In Nakisa Lease Accounting, users can generate a Portfolio Insights dashboard to view schedules and postings for payments, interest, and depreciation.

5.4 Consolidated Financial Schedules report

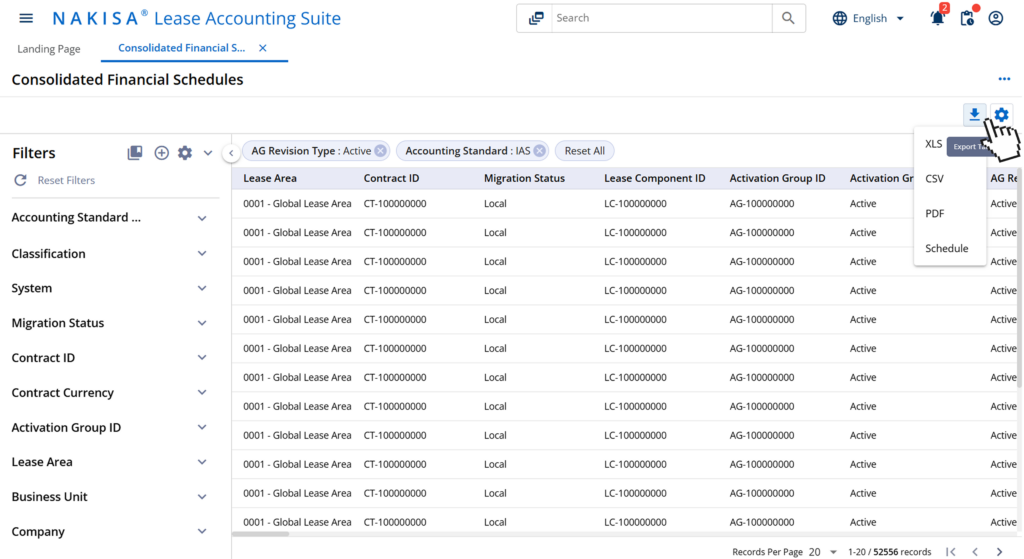

Accountants often need to reconcile all column schedules for multiple lease contracts, a process that traditionally requires manual data compilation from various sources. Ensuring efficient reporting without extensive navigation and reducing repetitive tasks through automation are key priorities for financial teams. The Consolidated Financial Schedules enhancement addresses these needs by providing a centralized approach to financial schedules, simplifying data access, and improving reporting efficiency.

Start using this feature in Nakisa

The enhanced Consolidated Financial Schedules now provide a single-view report displaying all column schedules across multiple contracts, including schedules for past revisions. This enhancement eliminates the need for manual data gathering and allows users to access a broader range of historical data in one view. Customizable filters refine reports based on specific criteria, while maintaining secure, role-based access. Additionally, flexible export options enable instant downloads in XLS/CSV formats, and scheduled automated exports ensure timely retrieval of reports without repeated manual effort.

In Nakisa Lease Accounting, users can generate Consolidated Financial Schedules reports with customizable filters and export options.

Conclusion

The Nakisa Lease Accounting 2025.R1 product release delivers impactful advancements in ERP integration, data management, financial reporting, and analytics. The introduction of the Nakisa AI Assistant and Nakisa AI Agents further enhances automation and intelligence, providing proactive insights and optimizing lease accounting workflows. Enhanced financial reporting and analytics provide deeper, more actionable insights, improving decision-making and financial oversight. Together, these innovations empower lease accounting teams to manage leases with greater precision, drive operational efficiency, and ensure compliance with ease, all while maintaining a seamless user experience.

To gain a deeper understanding of these features, explore our NLA demo catalog for a comprehensive overview or watch our 2025.R1 product enablement session.

For a tailored experience, book a personalized demo with one of our experts today.

To access the latest release notes, please visit the Nakisa Customer Portal or the Nakisa Resource Center.