1. Why is fixed asset leasing important in the oil and gas industry?

The oil and gas industry is a cornerstone of the global economy, supplying energy and raw materials to power industries, transportation, and households worldwide. It is characterized by a complex value chain that spans exploration, production, refining, and distribution.

In the oil and gas industry, Property, Plant & Equipment (PP&E) plays a crucial role in business continuity, particularly in balancing capital expenditure (CapEx) and operational expenditure (OpEx). Leasing is pivotal in this context, allowing companies to access essential fixed assets without incurring large, upfront capital investments. This approach is especially beneficial for exploration and production (E&P) companies, which frequently encounter significant costs associated with acquiring land, drilling equipment, and transportation infrastructure.

Furthermore, oil and gas operations are often geographically diverse, spanning multiple regions, countries, and continents. Companies operating across such a vast footprint must manage assets across different regulatory environments, currencies, and logistical frameworks. One key leasing impact is the extremely high materiality of assets which are movable. Leasing strategies offer the flexibility to deploy and manage assets across international regions, enabling organizations to adapt to local requirements and operational demands. This approach also streamlines consolidated reports, aligning with the organization’s OpEx and CapEx strategies.

2. What are the lease accounting challenges in the oil and gas industry?

Lease accounting in the oil and gas industry presents several unique challenges due to the complexity of lease structures, the scale of operations, and the stringent regulatory environment. Addressing these challenges is critical for ensuring accurate financial reporting and compliance with accounting standards. In this section, we explore the key accounting challenges faced by oil and gas companies, providing insights into managing complex lease arrangements and maintaining compliance.

2.1 Complex lease structures

- Multi-tiered leases: Oil and gas companies often engage in multi-tiered leases involving various parties and asset classes. These structures can include master leases with subleases or joint ventures with shared assets. Managing and accounting for these layered arrangements requires careful documentation and allocation of costs and benefits across different lease components.

- Joint ventures and shared assets: In joint operating agreements, multiple entities share the use of assets such as drilling rigs or pipelines. Accounting for these shared assets involves determining the appropriate recognition and measurement of lease liabilities and right-of-use (ROU) assets for each participating entity. Clear allocation of costs and revenues is essential to ensure accurate financial statements.

2.2 Compliance with IFRS 16 and ASC 842

- Finance vs. operating leases: ASC 842 and IFRS 16 require lessees to recognize right-of-use (ROU) assets and lease liabilities for both financial and operating leases. The criteria for classification involve evaluating factors such as the lease term, ownership transfer, and economic life of the leased asset. The classification of leases affects financial statements, including the balance sheet and income statement. Understanding these impacts is essential for accurate financial reporting and compliance with accounting standards.

- Non-lease expenses linked to operations: Oil and gas companies must also account for non-lease expenses that are directly associated with operational activities at a drill site or other locations. These variable expenses can include costs related to moving equipment, services provided on-site, meals for workers, and other operational necessities. While these costs are crucial for the day-to-day functioning of operations, they are classified as non-balance sheet items because they do not contribute to the asset and liability structure presented in financial statements. Accurate classification is crucial for compliance with accounting standards and provides a clear picture of financial health.

2.3 Lease modifications and remeasurements

- Changing lease terms: Lease modifications, such as adjustments to lease duration, payment terms, or scope of use, can significantly impact financial reporting. Oil and gas companies must reassess and remeasure lease liabilities and ROU assets in response to these changes, ensuring that adjustments reflect the revised lease terms accurately.

- Usage-based leases: In the oil and gas industry, usage-based leases link lease payments directly to an asset's usage, such as the number of operating hours or specific output levels. Changes in expected usage require adjustments to lease liabilities and right-of-use (ROU) assets, impacting financial reporting on both the balance sheet and income statement. Accurate tracking of usage rates is essential to reflect the economic reality of these leases, ensuring compliance with accounting standards and minimizing the risk of misstatements in financial statements.

2.4 Embedded leases and complex service contracts

- Identifying embedded leases: In the oil and gas sector, service contracts often include embedded leases where an asset is integral to the provided service. For example, a drilling contract may bundle the use of a drilling rig with the provision of drilling services. Identifying these embedded leases is essential for accurate lease accounting and financial reporting.

- Service agreements in practice: Service agreements may involve transportation, storage, or drilling services that include the use of leased assets. These agreements often require detailed analysis to separate lease components from non-lease components, ensuring compliance with accounting standards.

- Bundled service contracts: Contracts that bundle asset use with additional services or materials (e.g., concrete and piping for drilling) present challenges in distinguishing between lease and non-lease components. Accurate valuation and allocation of these components are critical for proper financial reporting.

2.5 Currency and geographical diversity

- Managing multiple jurisdictions: Oil and gas companies operate globally, often dealing with leases in various currencies and regulatory environments. This geographical diversity complicates lease accounting, requiring careful management of currency translation, parallel compliance with both local and international accounting standards, and coordination across different regulatory frameworks.

- Currency fluctuations: Lease payments and liabilities may be subject to currency fluctuations, impacting financial statements. Oil and gas companies need to implement effective strategies for managing currency risk and ensuring accurate accounting for leases denominated in foreign currencies.

- Movable assets: The geographical diversity of movable assets, such as drilling rigs and transport vehicles, introduces additional complexities. These assets may be subject to varying foreign exchange impacts depending on their location at a given time. Consequently, oil and gas companies must closely monitor exchange rates and assess how these fluctuations affect lease payments and overall asset valuations. Ensuring accurate accounting for movable assets across different jurisdictions is crucial for maintaining compliance and achieving financial reporting accuracy.

2.6 Impairment of leased assets

- Understanding impairment: Impairment of right-of-use (ROU) assets can occur due to changes in market conditions, operational shifts, or adverse events. Companies must assess and recognize impairment losses in compliance with accounting standards, ensuring that financial statements accurately reflect the true value of leased assets.

- Identifying triggering events: Oil and gas companies need to identify events that trigger impairment testing, such as significant changes in commodity prices or operational performance. Implementing effective processes to monitor and evaluate these events is crucial for timely and accurate impairment assessments.

- Impact on lease reassessments: Impairment losses may impact lease reassessments, requiring adjustments to lease liabilities and ROU assets. Companies must address these impacts in their financial reporting and adjust their accounting practices as needed.

Addressing these accounting challenges necessitates a strategic mindset, well-defined processes, and a deep understanding of both industry-specific nuances and regulatory frameworks. This is where Nakisa’s lease accounting solution excels. The software offers enterprise-grade lease accounting capabilities tailored to meet these needs, enabling enterprises to streamline lease management processes, enhance compliance efforts, facilitate informed decision-making, and stay ahead in a dynamic, ever-evolving landscape.

Discover our buyer’s guide with RFP scorecard designed to simplify the selection of lease accounting solutions for the oil and gas industry. With tailored evaluation criteria and practical insights, this guide helps you navigate the decision-making process and identify the tools best suited to your organization’s unique needs.

3. How Nakisa’s lease accounting software addresses specific lease types and use cases in the oil and gas industry

Nakisa's lease accounting software is designed to tackle the most complex use cases in the oil and gas industry, ensuring compliance with IFRS 16, ASC 842, and local GAAP, while maintaining accuracy across diverse scenarios. It addresses challenges such as managing marine vessel leases, drill ships, drill rigs, fleet leases, and retail station leases, as well as the unique needs of joint operating agreements (JOA) and handling impairment and abandoned assets. In the following use cases, we'll discuss these challenges in detail and highlight the solutions Nakisa provides to address them.

3.1 Marine vessel leases

The challenge:

Marine vessel leases in the oil and gas industry present significant complexities due to intricate contract terms that impact lease accounting. Key challenges include:

- Variable rent structures: Leases often have daily rates payable monthly, with escalations tied to time.

- Comprehensive costs: Daily rates typically include both the vessel and crew, along with additional costs such as training, fuel, towage, pilotage, and port fees that can vary.

- Off-hire provisions: Contracts may include provisions for off-hire periods due to repairs, complicating payment schedules and potentially extending lease terms.

- Profit-sharing arrangements: These arrangements add further layers of complexity to lease accounting.

- Frequent remeasurements: Rent may be linked to fluctuating reference rates such as LIBOR, necessitating ongoing monitoring and adjustments.

The solution:

Nakisa’s lease accounting solution addresses the complexities of marine vessel leases with precision and flexibility:

- Daily calculations with monthly payments: Nakisa’s software enables daily rent calculations while processing monthly payments, ensuring that lease data remains consistently updated.

- Managing lease terms: The software manages lease terms, such as escalating daily rates and contract amendments, through Nakisa’s Payment Term module that maintains a comprehensive audit trail for compliance and accuracy.

Interactive demo: Escalating rent

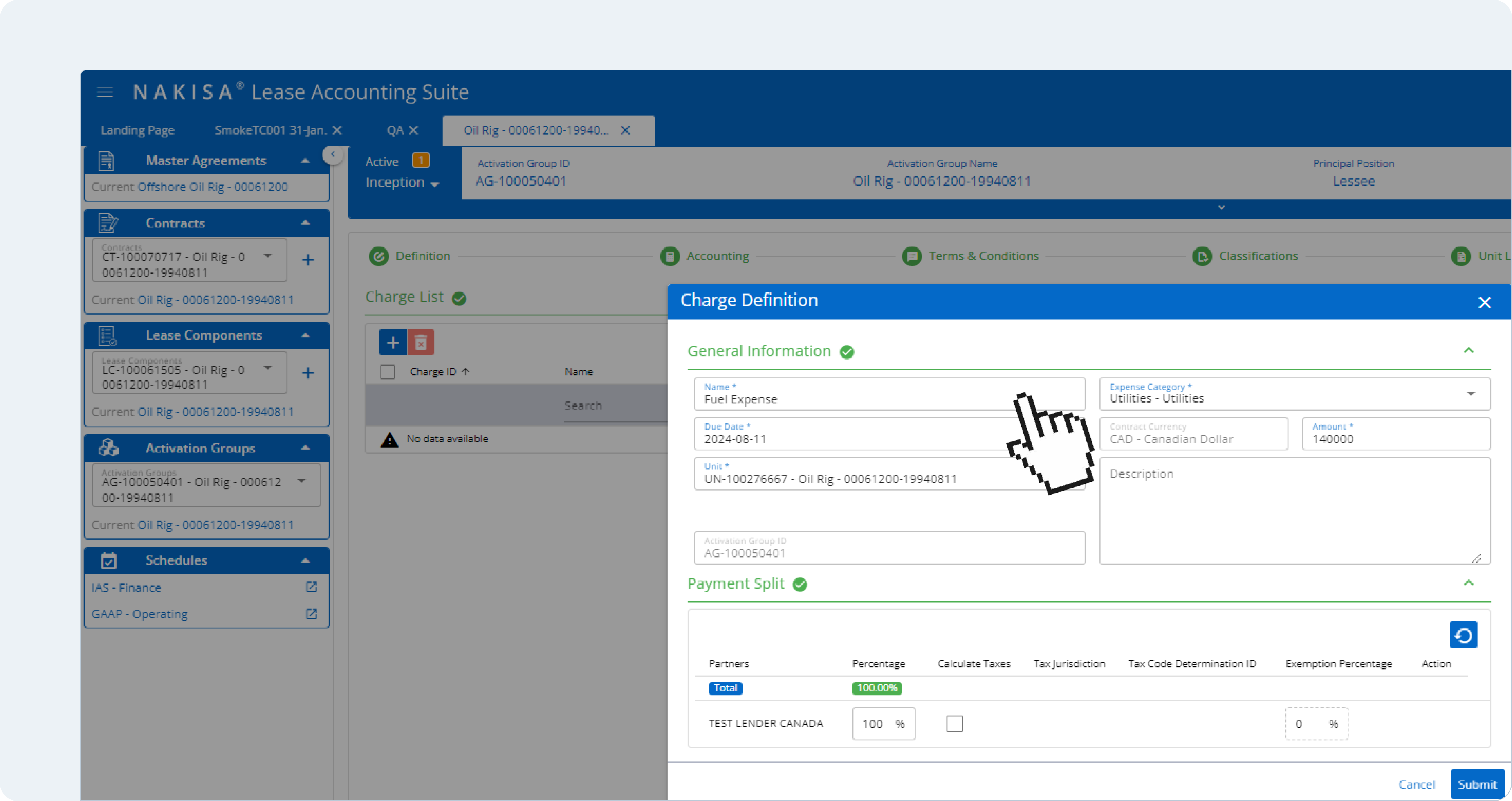

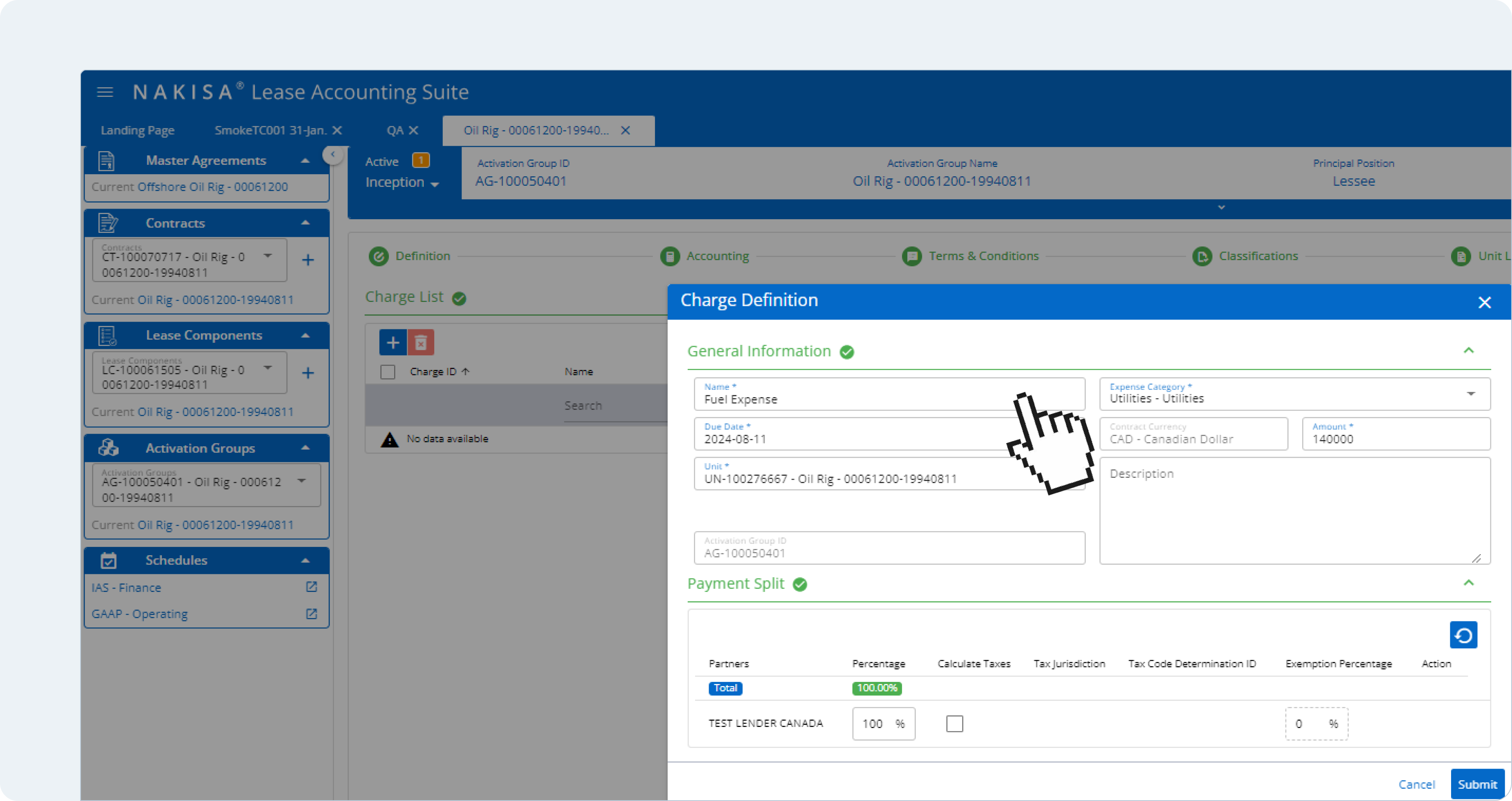

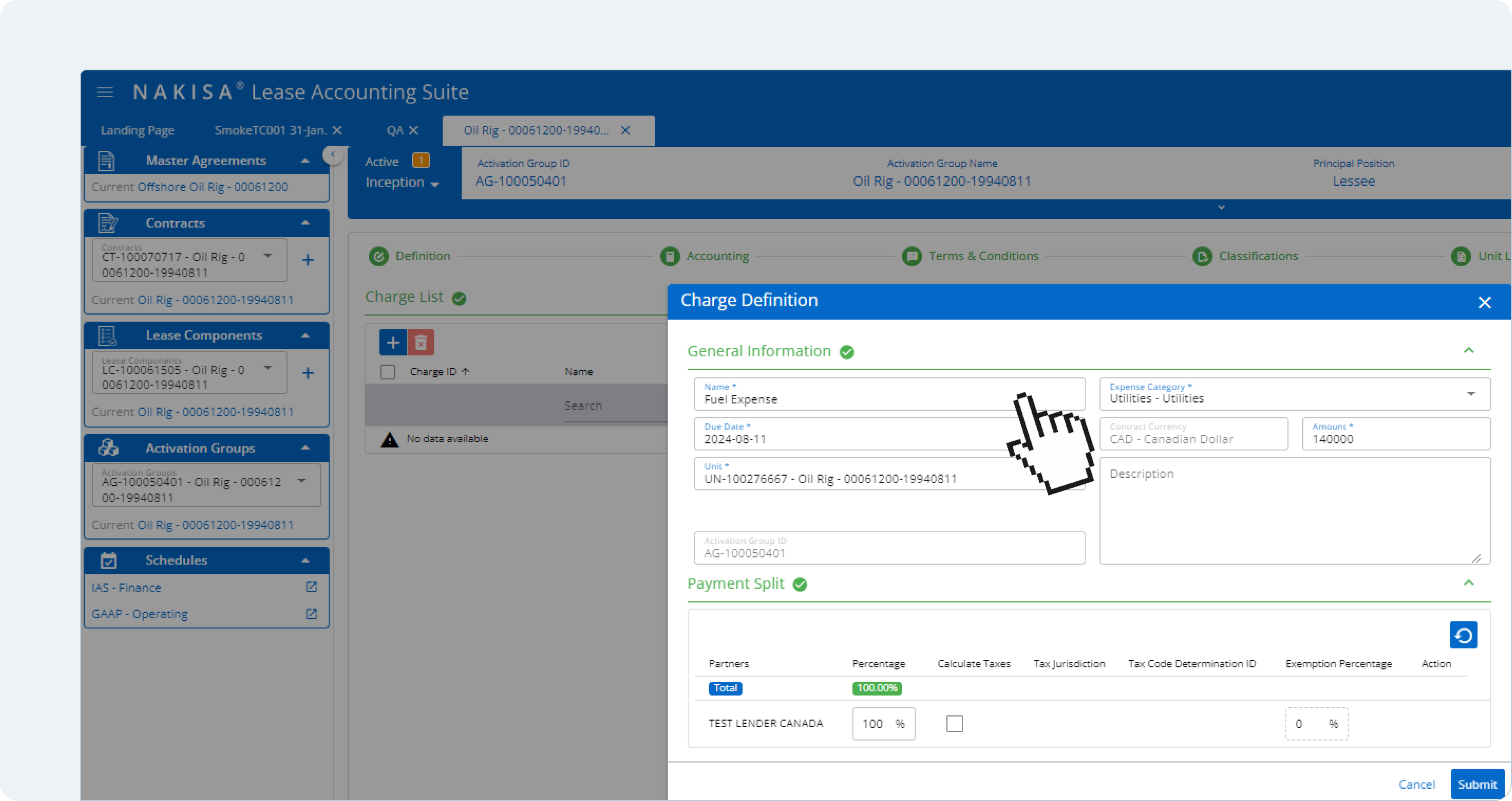

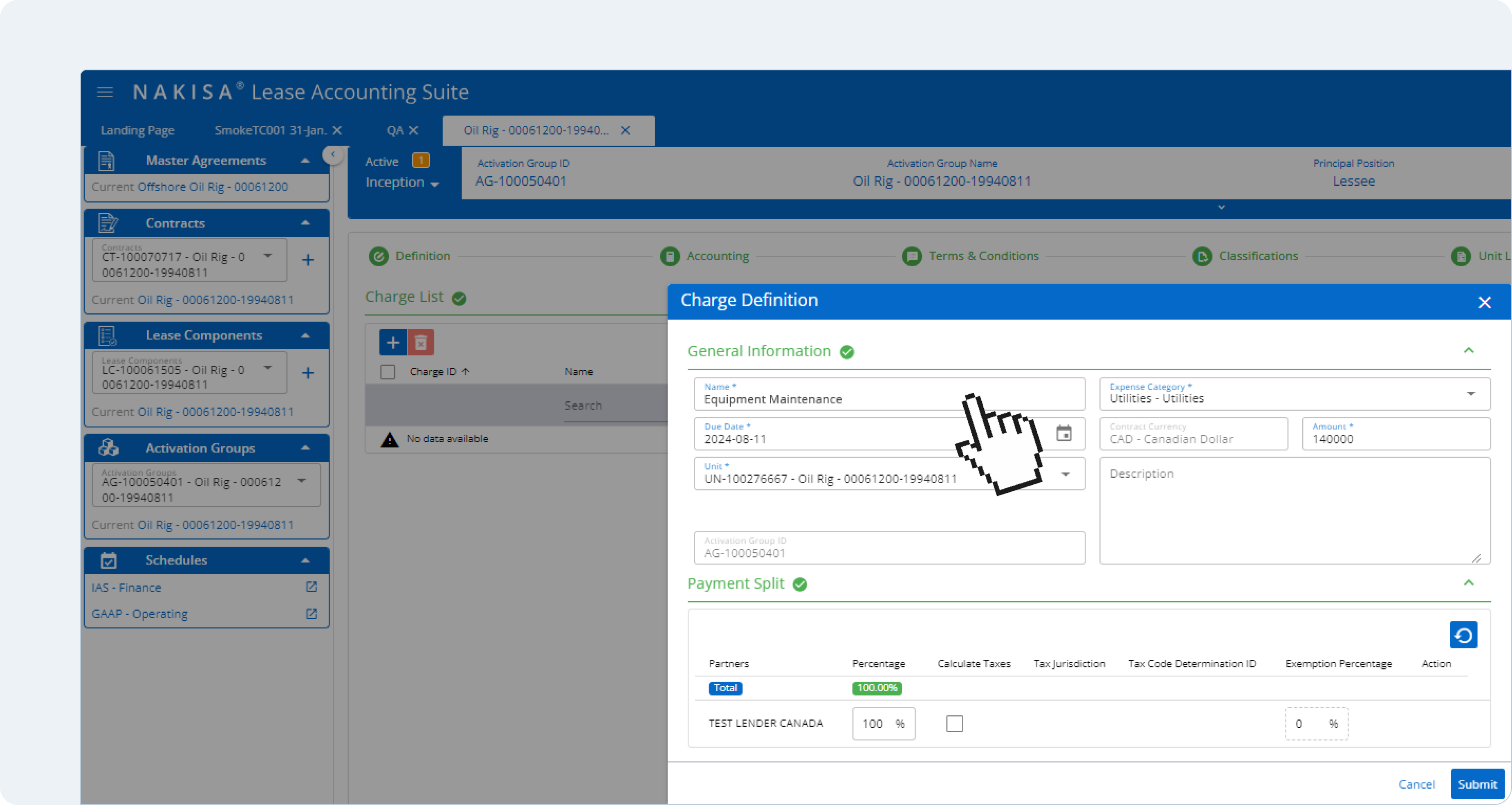

- Handling of non-lease components: Additional costs like fuel and port fees can be recorded as variable lease expenses, with Nakisa’s Charge Definition functionality seamlessly capturing and integrating these costs.

Nakisa’s Charge Definition functionality allows users to define additional expenses, such as fuel costs, directly within the module.

- Ongoing remeasurements: The software automatically remeasures lease liabilities according to IFRS 16 and ASC 842 guidelines when reference rates like LIBOR fluctuate, minimizing the need for manual adjustments.

- Seamless integration with accounts payable: The existing accounts payable processes remain unchanged, as Nakisa’s software provides necessary calculations for lease liabilities and ROU assets, ensuring smooth accounting operations.

The result:

Nakisa’s lease accounting solution streamlines marine vessel lease accounting by automating the calculation of ROU assets and lease liabilities. Key outcomes include:

- Accurate initial values: The software ensures precise initial values for ROU assets and lease liabilities.

- Automated postings: This facilitates automatic postings for asset amortization, accruals, and payments, reducing manual workloads.

- Centralized reporting: Consolidated transaction reports provide a comprehensive view of lease activity, with in-app configurable dashboard reporting allowing you to pivot and filter based on your unique reporting requirements.

- Efficient reconciliation: Non-lease components are reconciled efficiently via lease clearing accounts, simplifying financial reporting.

- Bulk updates: Nakisa’s software allows for mass updates in response to global CPI changes across multiple contracts, ensuring consistency.

- Auditable lease lifecycle: Every change is logged, and disclosure reports are automatically updated, providing a fully auditable lease lifecycle for compliance purposes.

Nakisa’s lease accounting software ensures that even the most intricate marine vessel lease arrangements are managed efficiently, providing the oil and gas industry with a robust solution that simplifies lease accounting while ensuring compliance and financial accuracy.

John van Oorschot

Head of Global Controlling at INEOS

3.2 Drill ships and drill rigs leases

The challenge:

Leases for drill ships and drill rigs in the oil and gas industry present significant challenges due to the complex interplay of lessor and lessee considerations. Key issues include:

- Interpretation differences: The lessor (drill operator) and lessee (oil company) may have differing interpretations of lease versus non-lease components.

- Practical expedients decisions: Deciding whether to combine or separate lease and non-lease components can be difficult.

- Segregation of payment types: Identifying and segregating various payment types, such as fixed rent, in-substance fixed payments, non-lease components, and variable payments, is essential for accurate accounting.

- Variable daily rates: Contracts typically feature daily rates applicable during both operating and idle periods, alongside additional fees for mobilization, de-mobilization, hourly move rates, and truck charges.

- Early-termination clauses: Complicated clauses may adjust daily rates in case of early termination, adding complexity to financial reporting.

- Joint interest billing arrangements: These arrangements further complicate lease accounting processes.

The solution:

Nakisa’s lease accounting software addresses the challenges of drill ship and drill rig leases through the following capabilities:

- Flexible treatment of lease and non-lease components: Nakisa’s software accommodates both combined and separated treatment of lease and non-lease components, providing dedicated fields and calculations to fit the user’s choice.

Nakisa’s software supports non-lease components with dedicated fields and tailored calculations that adapt to the user's specific needs.

- Daily calculations with monthly invoicing: The platform supports daily rate calculations while processing payments on a monthly basis, ensuring timely and accurate financial reporting.

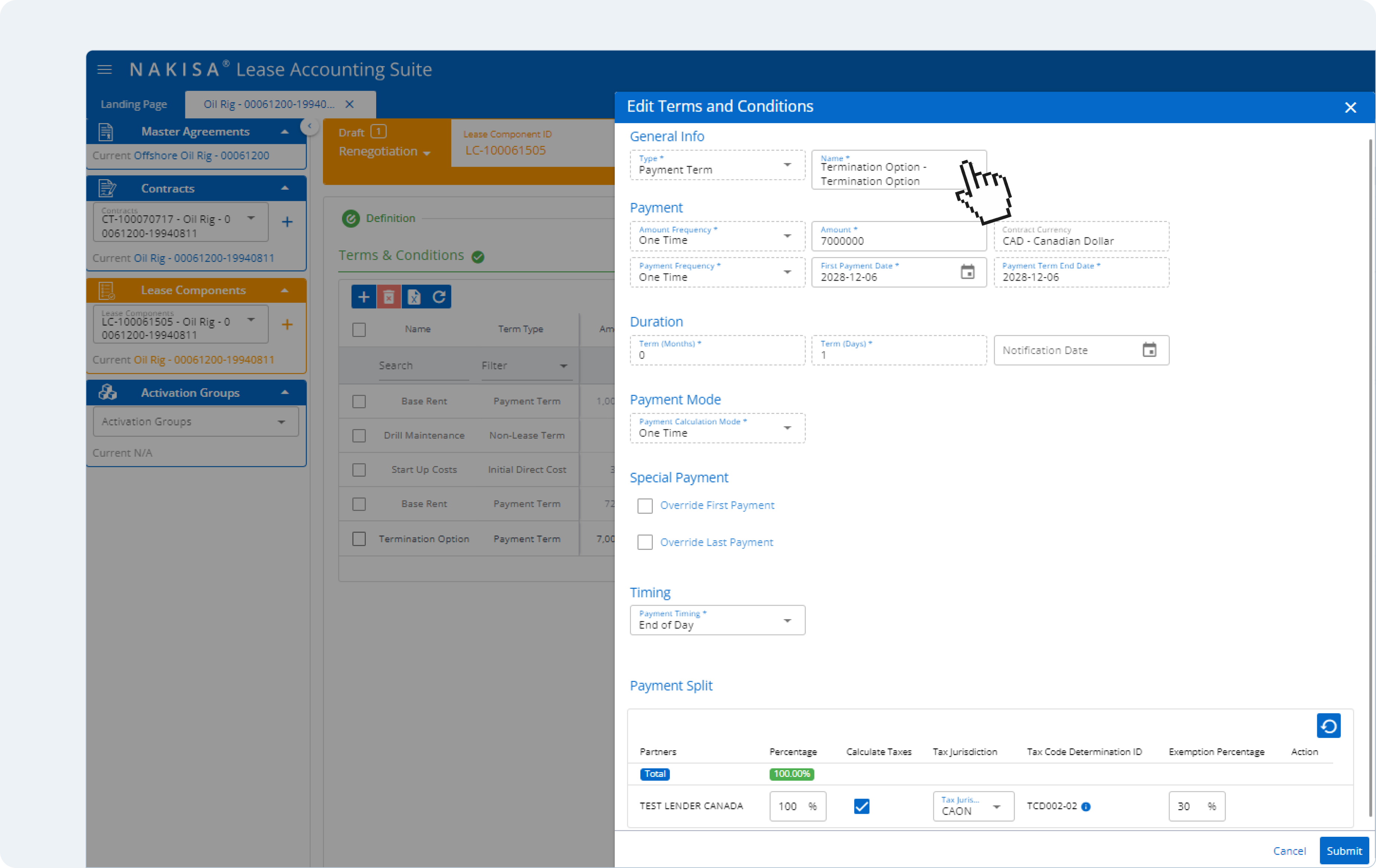

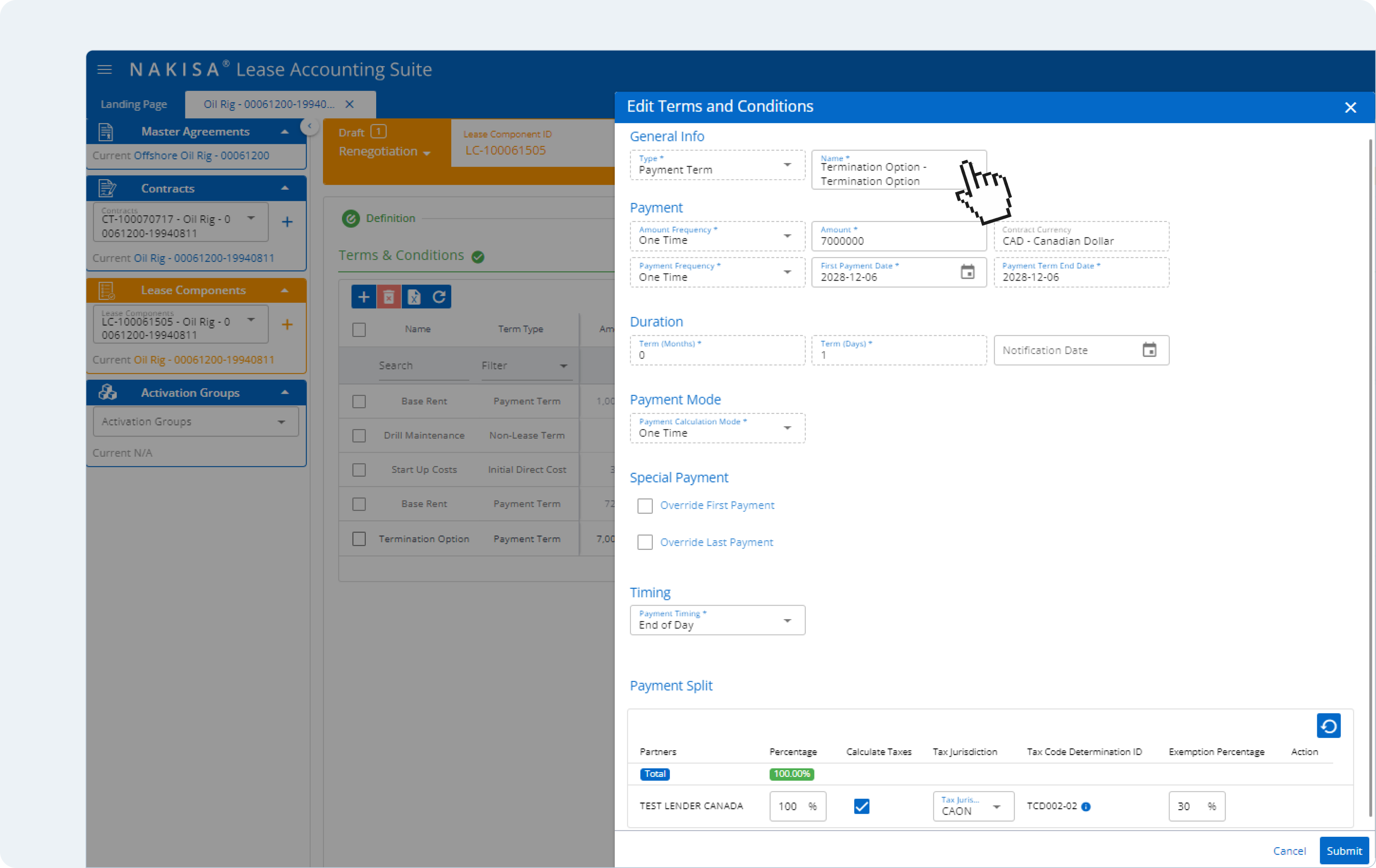

- Management of early-termination clauses: Adjustments to contract terms, such as changes in daily rates due to early termination, are seamlessly managed using Nakisa’s Terms and Conditions module. This ensures compliance and preserves the audit trail.

Nakisa’s Terms and Conditions module enables users to easily replicate real-world contractual terms such as termination clauses.

- Invoiced items and variable payments: Additional costs such as move rates, truck charges, and variable lease expenses are captured accurately through Nakisa’s Charge Definition functionality, without affecting the lease liability or ROU asset values.

Additional expenses such as fuel expenses can be defined within Nakisa’s Charge Definition functionality.

The result:

Nakisa’s lease accounting solution streamlines the lease accounting process for drill ships and drill rigs, enabling comprehensive management of both lease and non-lease components. Key benefits include:

- Accurate calculations: Nakisa’s software provides precise calculations of lease liabilities and ROU assets, with initial values generated and tracked efficiently.

- Automated postings: The software facilitates automated postings for asset amortization, accruals, and payments, all reflected in consolidated transaction reports for clarity and ease of analysis.

- Seamless reconciliation: Nakisa allows for straightforward reconciliation of non-lease components and invoiced items using lease clearing accounts, simplifying financial operations.

- Quick entry of variable lease expenses: Users can easily enter variable lease expenses as one-time charges, ensuring they do not impact lease liabilities, with straightforward access to these expenses in transaction reports.

- Auditable lease lifecycle: All changes are tracked in an audit log, with disclosure reports automatically updated to reflect any modifications, ensuring compliance and operational transparency.

With Nakisa’s lease accounting software, oil and gas companies can efficiently navigate the complexities of drill ship and drill rig lease accounting, ensuring parallel compliance with IFRS 16, ASC 842, and local GAAP, while enhancing operational efficiency.

Dini Hadiyanti

Senior Specialist for Business Systems at Trakindo

3.3 Fleet and rail cars leases

The challenge:

Managing leases for fleets and rail cars presents unique challenges, particularly when dealing with multiple units arriving at different times and managing assets with varying terms. Key challenges include:

- Inception considerations: Fleet and rail car leases often involve multiple units arriving in batches. Despite belonging to the same contract, lessees must capitalize each asset as it is received to comply with accounting requirements based on the lesser of the asset's useful life or the lease term.

- Different terms and conditions: When a lease covers multiple vehicles (e.g., trucks and trailers), managing these assets under a single contract with differing terms requires careful consideration of each vehicle's specific conditions and requirements.

- Modifications: Early terminations, lease extensions, and asset casualties (such as a rail car breakdown) require modifications to the original lease agreement.

- Tracking variable lease costs: Costs such as mileage, repairs, and maintenance need to be accurately tracked without affecting the lease liability.

The solution:

Nakisa’s lease accounting software offers comprehensive tools to address these complex leasing requirements:

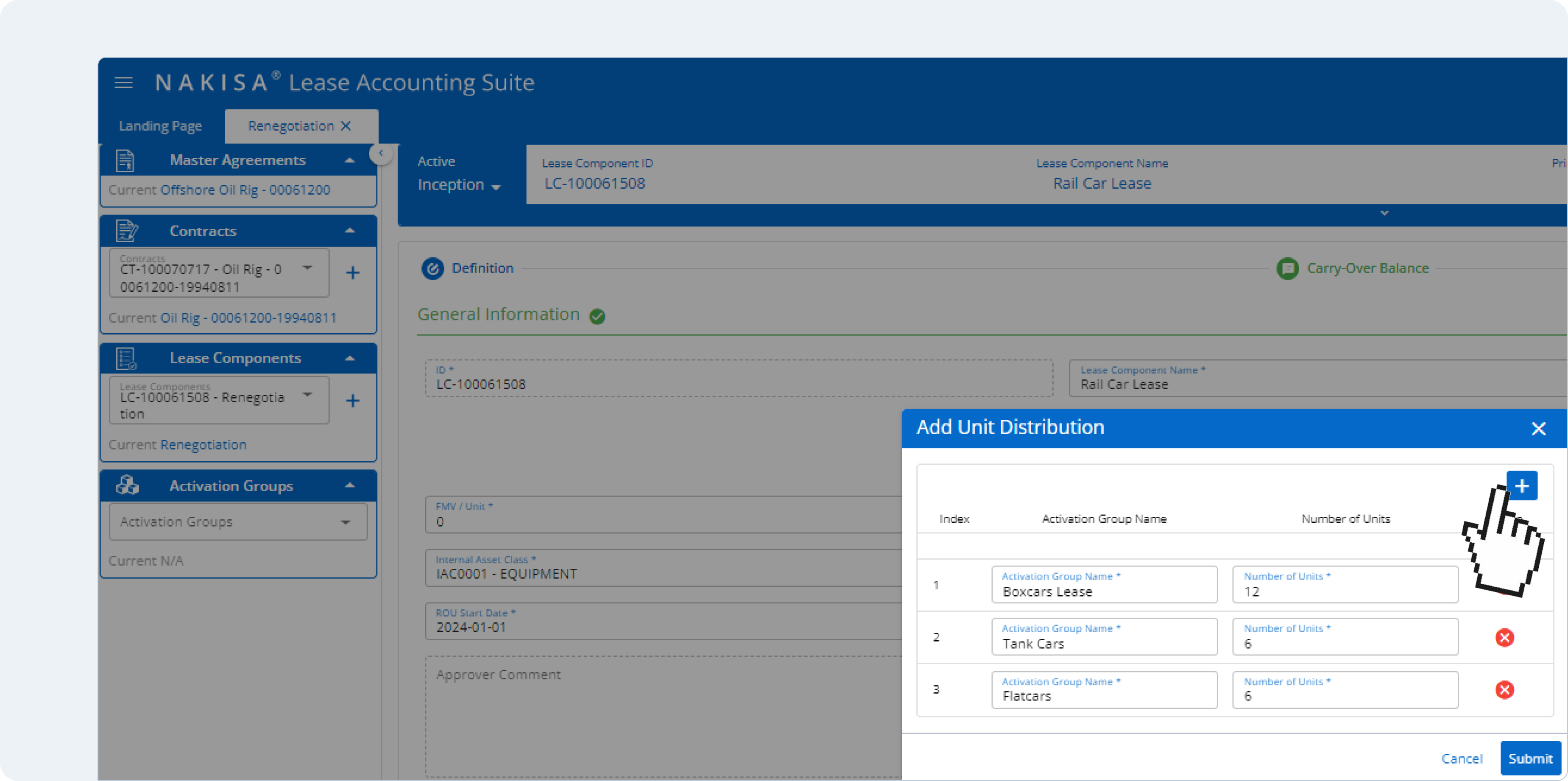

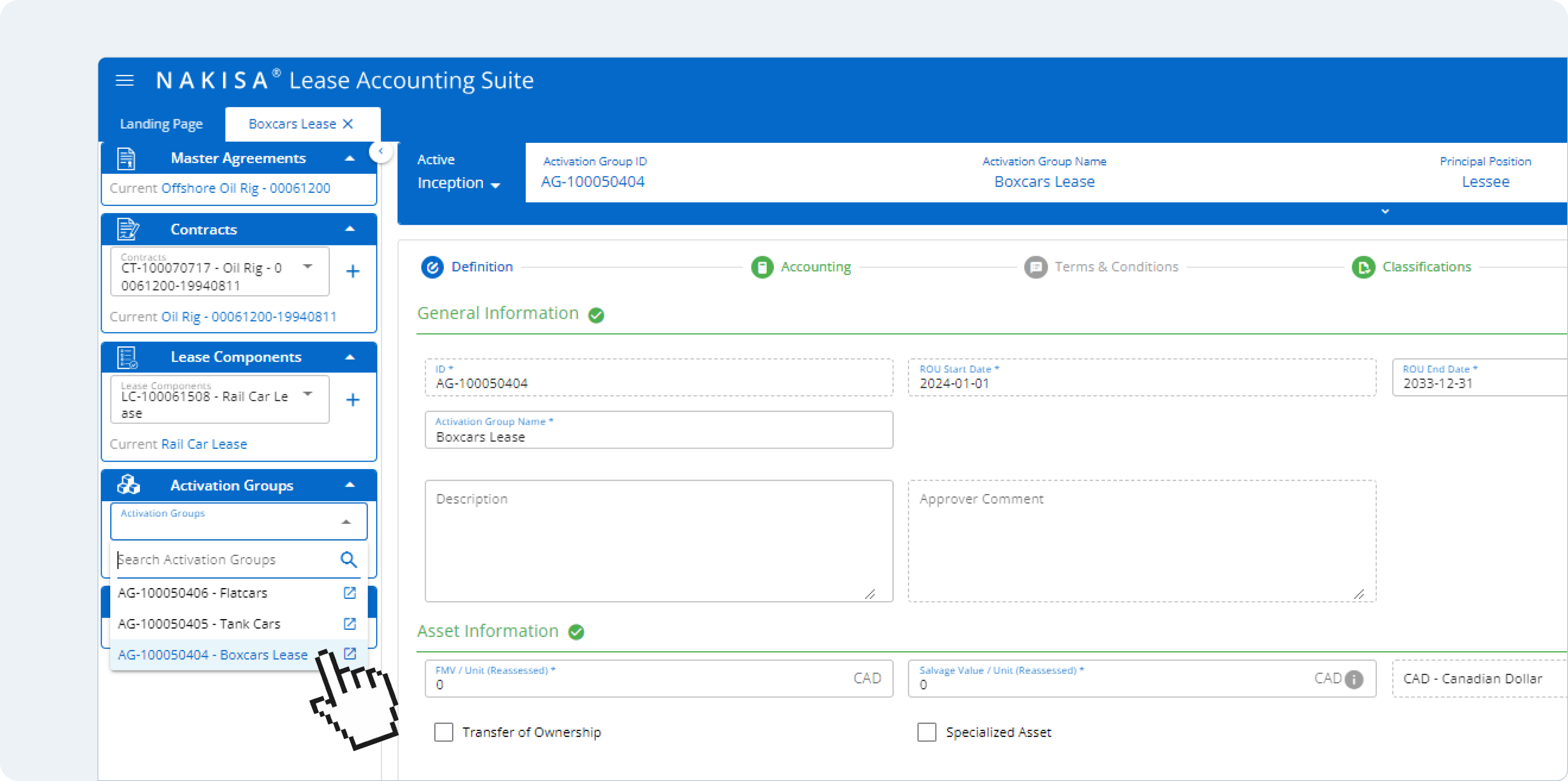

- Multi-level contract structure: When a contract includes multiple assets, such as rail cars or fleet vehicles, these assets can be grouped together under a single contract. The contract contains lease components that define the number of units (assets). Once these units are determined, they are organized into Activation Groups. Each Activation Group represents a subset of units activated together, allowing multiple Activation Groups to be created within a single contract.

In Nakisa’s software, users can add Activation Groups and define the number of units.

Nakisa’s software organizes units into Activation Groups, allowing the creation of multiple Activation Groups under a single contract.

- Efficient handling of variable lease expenses: Variable lease costs (e.g., additional mileage or maintenance) are easily tracked as one-time expenses, rather than remeasuring the ROU asset and lease liability. This approach simplifies the accounting process while ensuring accurate reporting.

In Nakisa’s software, additional expenses such as fuel expenses can be defined within the Charge Definition functionality.

- Support for casualty events: Nakisa’s lease accounting software supports casualty events, allowing users to retire specific assets due to incidents. The calculation engine adjusts ROU asset and lease liability values based on the event inputs.

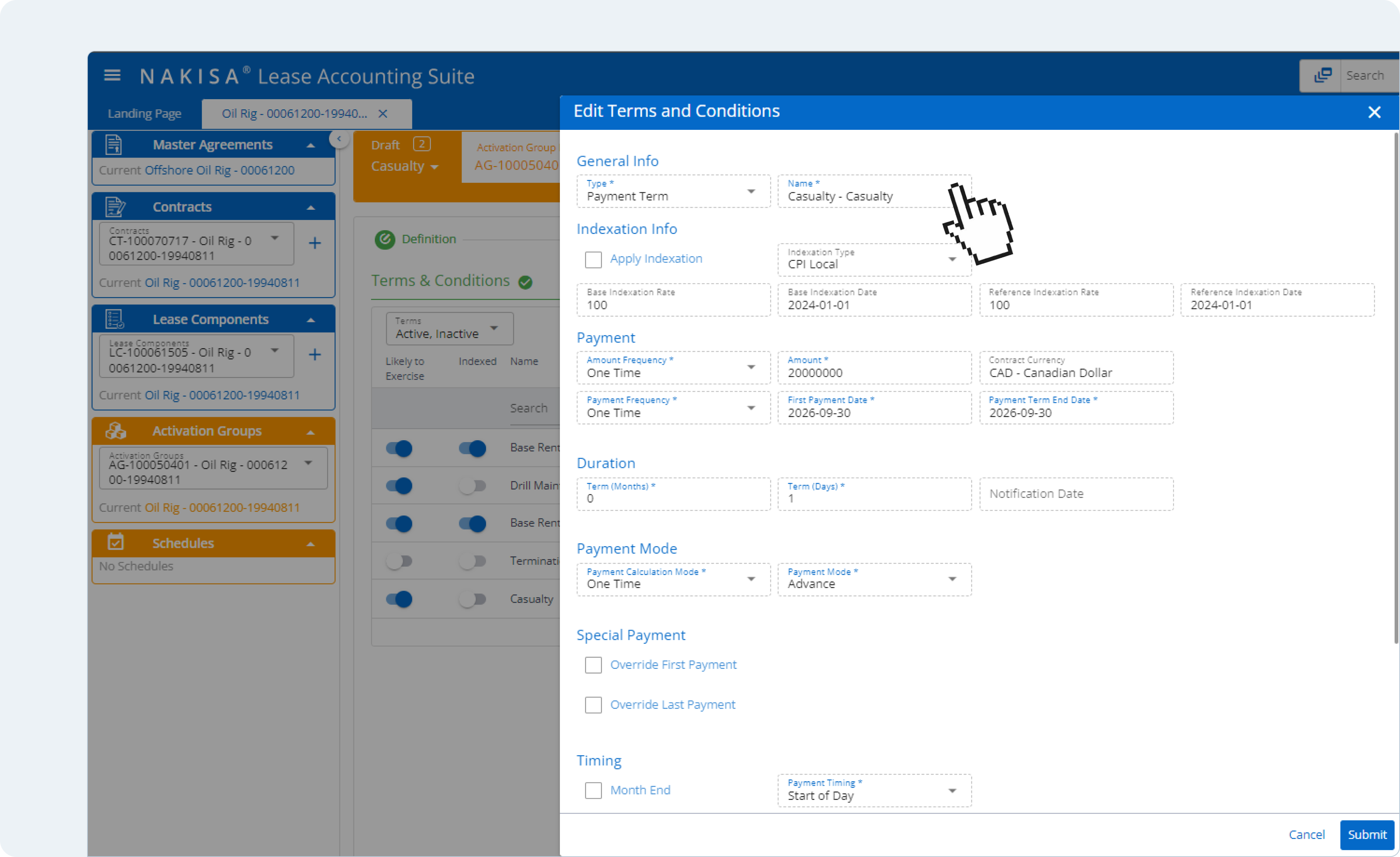

In Nakisa’s Terms and Conditions functionality, users can conduct a Casualty Event to retire the asset.

- Lease modifications for terminations and extensions: Early terminations are managed through the Terms and Conditions module, allowing the definition of a termination option, including termination dates and associated payment amounts. Similarly, extension terms can be added to extend the lease term beyond the original ROU and made likely to be exercised within an Activation Group as of a user-determined effective date.

Nakisa’s Terms and Conditions functionality enables users to easily replicate real-world contractual terms such as termination clauses.

The result:

Nakisa’s robust solution ensures accurate accounting for fleet and rail car leases, even when assets are received in batches. Key outcomes include:

- Batch capitalization: Contracts often include multiple components that apply to various assets. These assets are organized within activation groups, where users can define terms and conditions likely to be exercised. This information is then used to calculate the ROU asset amount that is capitalized.

- Simplified variable lease expense management: One-time variable lease expenses are easily entered without impacting lease liabilities, with full accessibility in transaction reports.

- Asset-level financial impact updates: The system updates financial information on an asset-by-asset basis.

- Comprehensive event management: Nakisa’s software Terms and Conditions module streamlines lease reassessments, ensuring that modifications, such as terminations or extensions, are accurately captured and reported.

- Complete audit trail: All changes throughout the lease lifecycle are tracked in the audit log, ensuring transparency and maintaining compliance with lease accounting standards.

Nakisa’s lease accounting software provides a scalable and compliant solution for managing the complex details of fleet and rail car leases, ensuring accurate financial reporting and efficient lease management across the board.

Irene Garcia

Assistant Corporate Controller at Sanimax

3.4 Joint operating agreements (JOAs)

The challenge:

In the oil and gas industry, joint operating agreements (JOAs) are common arrangements where multiple parties, such as operators and non-operators, collaborate to explore and develop oil or gas properties. Under this structure, multiple working interest owners share undivided ownership without creating a separate legal entity. While this arrangement provides significant flexibility, it complicates lease accounting due to shared responsibilities and the need to determine the appropriate recognition of assets and liabilities.

Key challenges in lease determination under JOAs include:

- Control and economic benefit: Determining which party—operator or non-operator—has greater control over and benefits more from the leased assets.

- Contract signatories: Identifying whether the operator signed the lease contract as a principal or on behalf of the joint arrangement.

- Ownership structure: Determining how each party's working interest impacts asset and liability recognition on a gross or net basis.

The solution:

Nakisa’s lease accounting software addresses these complexities with specific functionalities designed for JOAs.

- Operator as principal: When the operator signs the lease contract as a principal or enters into the agreement on behalf of the joint arrangement, Nakisa’s software recognizes 100% of the ROU asset and lease liability on the operator’s books, while non-operators do not need to recognize any asset or liability.

- Co-signatory lease assets: In cases where the operator is a co-signatory and the leased asset is for the exclusive use of the joint property, Nakisa’s software recognizes ROU assets and lease liabilities based on each party’s percentage of working interest (net basis). This applies to both operators and non-operators, ensuring proportionate accounting.

- Non-operator as contracting party: If the non-operator enters into the lease agreement on behalf of the joint arrangement, Nakisa recognizes the ROU asset and lease liability for the non-operator based on their working interest percentage. If the non-operator is not involved in the agreement, they do not need to recognize any asset or liability.

The result:

Nakisa’s software simplifies and streamlines lease accounting for JOAs through:

- Maintaining existing processes: Nakisa can seamlessly integrate with your existing joint interest billing and accounts payable processes, ensuring minimal disruption to established workflows.

- Accurate asset and liability recognition: The software calculates the appropriate ROU asset and lease liability amounts, whether on a gross or net basis, based on their working interest and role in the JOA.

- Periodic amortization: The software automatically handles the periodic amortization of ROU assets and lease liabilities, ensuring consistent financial reporting throughout the lease term.

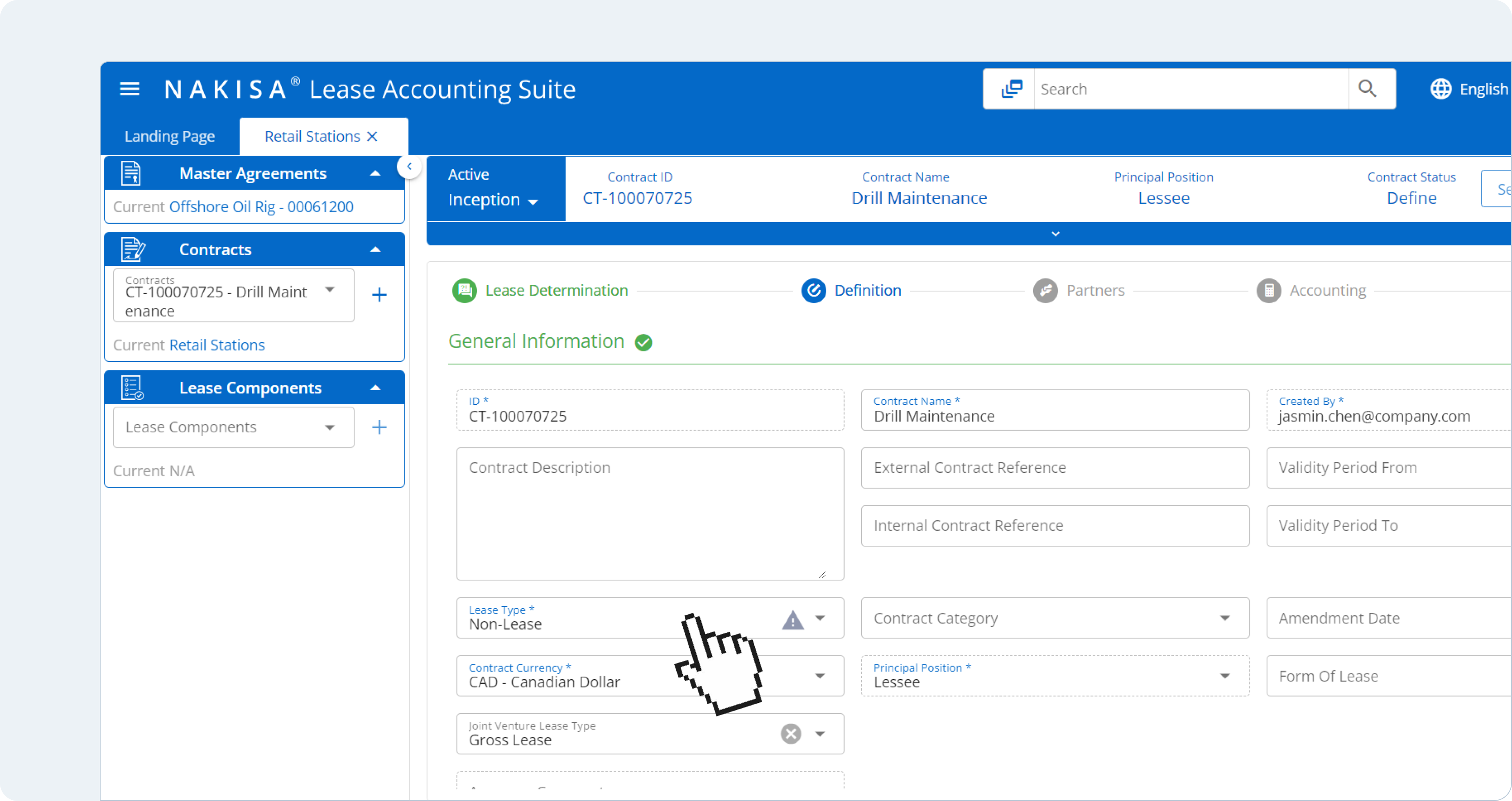

- Lease determination questionnaire: Nakisa’s software includes a built-in lease determination questionnaire that helps users decide on the correct asset and liability recognition under IFRS 16 and ASC 842, guiding them through lease reporting and financial treatments.

- Lease categorization: Users can define leases under JOAs as either "Gross" or "Net" leases, helping users keep track of which accounting method applies to each arrangement.

By addressing the unique requirements of JOAs, Nakisa ensures that oil and gas companies can manage their lease portfolios with precision, compliance, and efficiency, regardless of the complexity of their business arrangements.

3.5 Retail stations leases

The challenge:

Retail stations often face the challenge of managing leases with escalating monthly rental payments, payments that may be indexed to cover inflation, and additional invoiced costs like land upkeep and equipment maintenance. Leased land can further complicate the accounting for these agreements due to different depreciation rules. Lease remeasurements also become essential when changes in future cash outflows occur due to fluctuations in index rates, as required under IFRS 16 and ASC 842. Key challenges include:

- Escalating payments: Escalating monthly rental payments and payments that may be indexed to cover inflation require constant re-measurement of lease liabilities and ROU assets under IFRS 16, and treatment as a variable lease expense under ASC 842.

- Variable lease expenses: Costs such as land upkeep and equipment maintenance may vary and need to be accounted for separately from the fixed lease payments.

- Prepaid leases: When land leases are fully prepaid, companies must continue to depreciate the ROU asset on a periodic basis, unless there is a transfer of ownership. In the case of a buyout, depreciation would stop, as land always retains intrinsic value and can provide ongoing economic benefit.

The solution:

Nakisa’s lease accounting software effectively addresses these requirements for retail stations by providing robust functionality for lease management and compliance:

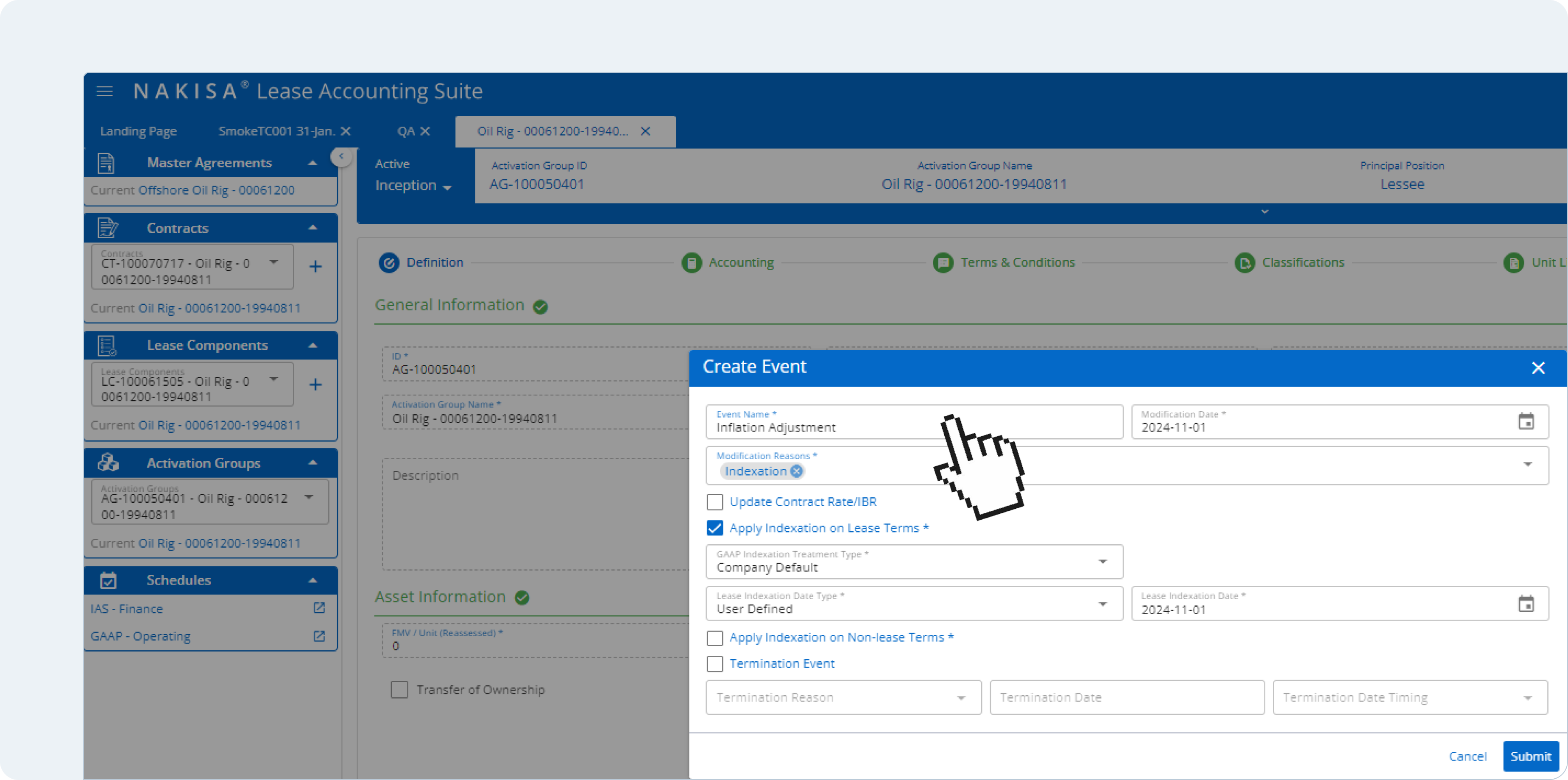

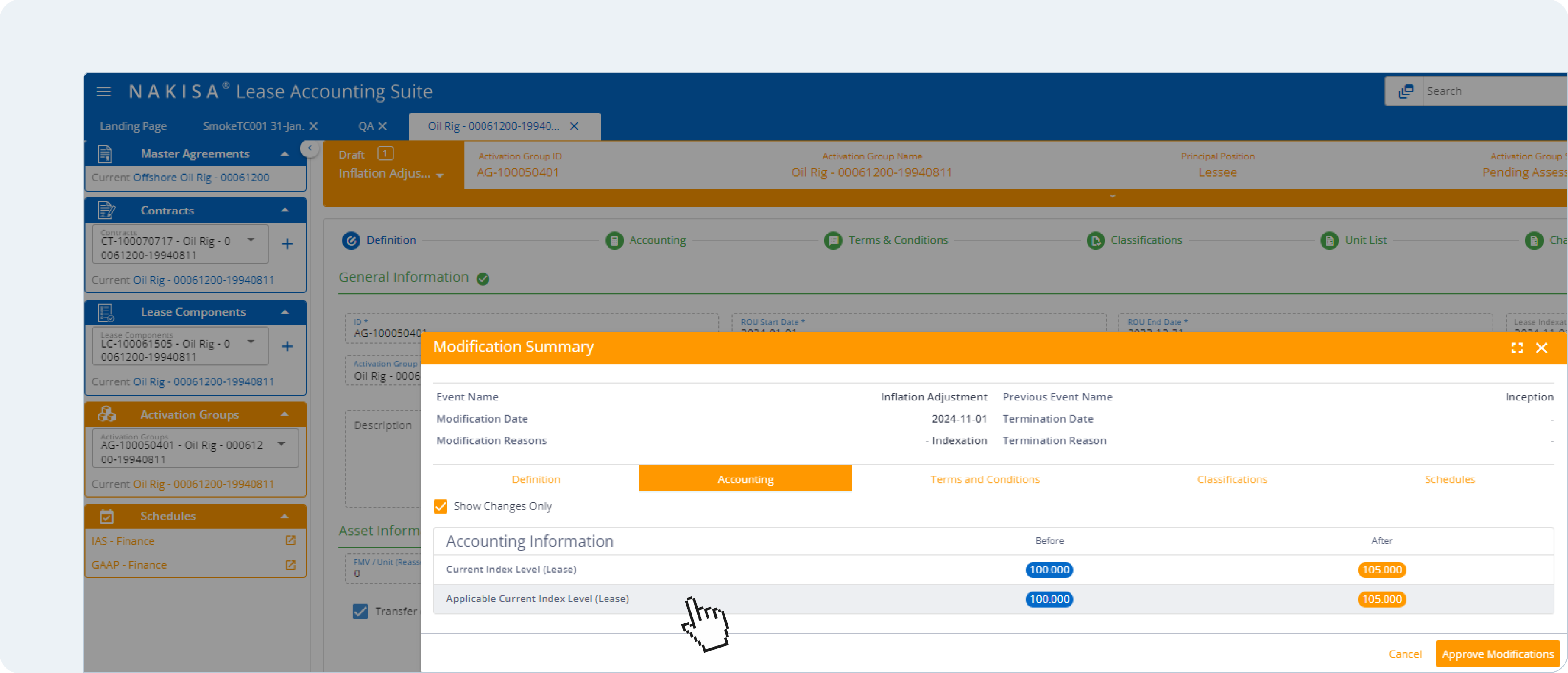

- Indexation tracking: Nakisa’s out-of-the-box indexation functionality tracks changes in inflation or index rates. For IFRS 16, the lease liability and ROU assets are automatically remeasured whenever future cash outflows change. For ASC 842, the software allows users to specify the financial treatment of index rate differences. Users can choose between three methods: standard behavior, where the difference is treated as non-lease and capitalized upon the next lease remeasurement; enforced lease treatment, where amounts are immediately capitalized (similar to IFRS 16); or enforced non-lease treatment, where index payments are treated as non-lease and remain so throughout the lease term. The chosen method depends on the indices being used (e.g., LIBOR), and once selected, it applies consistently across the entire activation group for the remainder of the lease term.

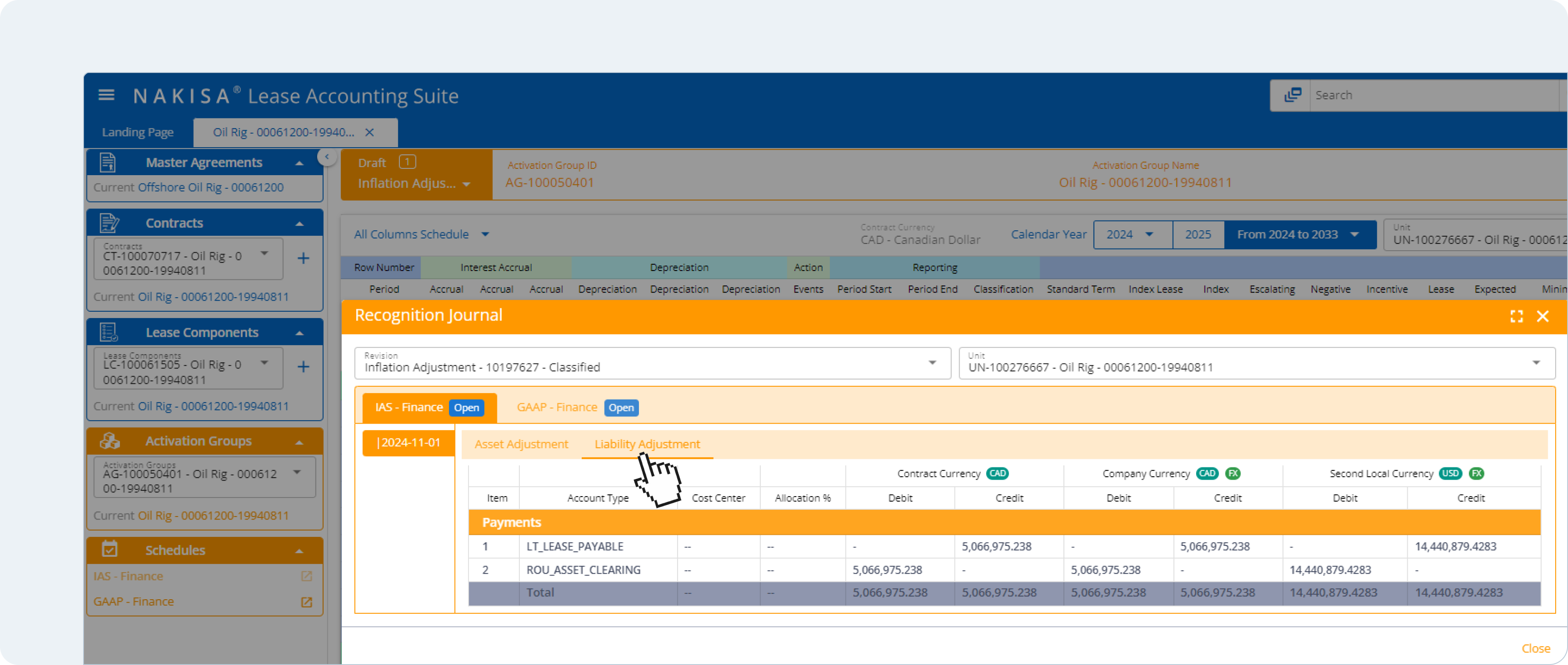

In Nakisa’s software, users can create events such as an Inflation Adjustment.

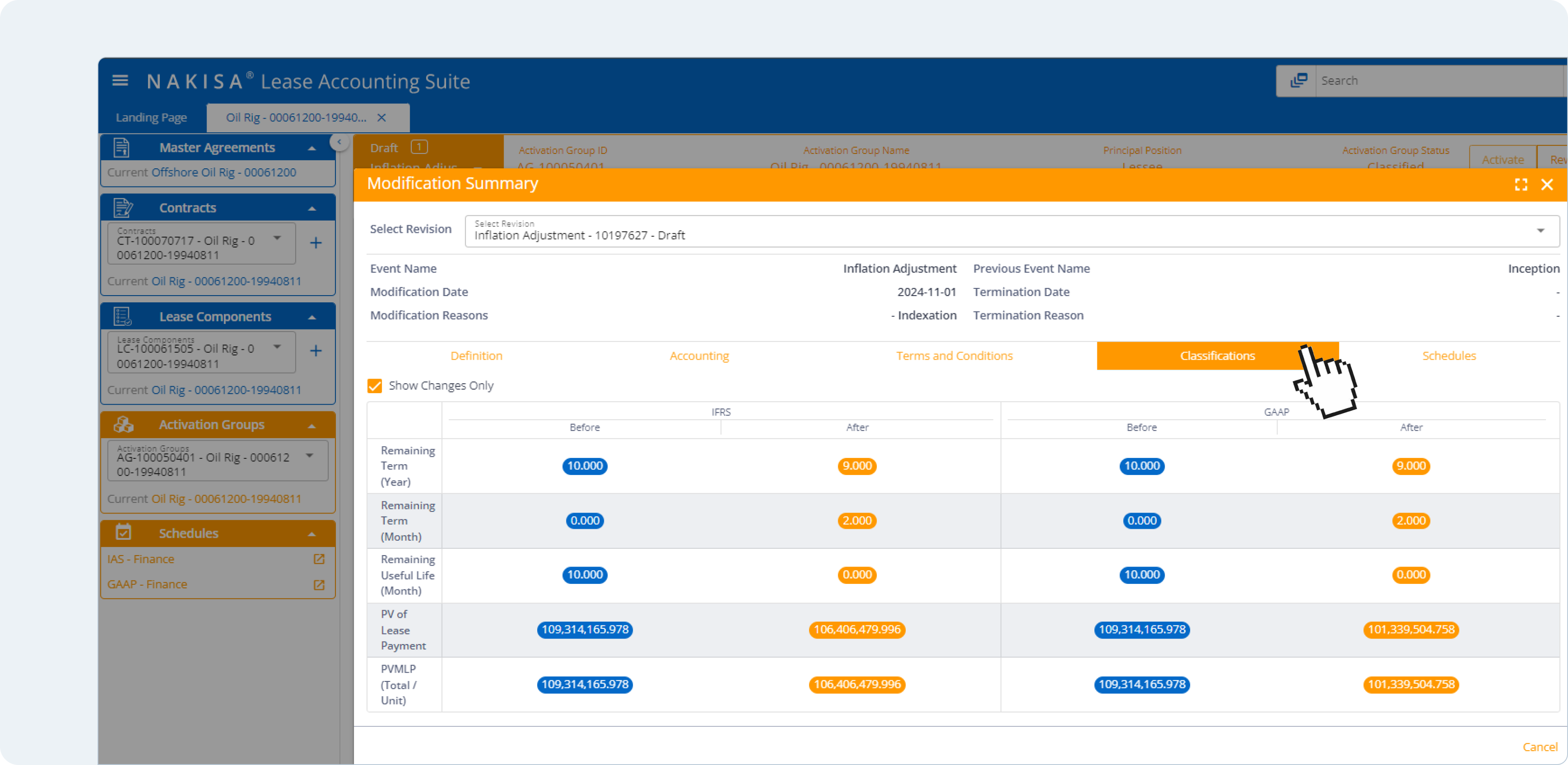

In Nakisa’s software, users can view the before-and-after values for key metrics, allowing them to easily track changes resulting from the Inflation Adjustment event.

Nakisa’s lease accounting software seamlessly calculates adjustments to contractual terms with reference to index rates ensuring compliance with IFRS 16 and ASC 842 accounting requirements

- Event management for lease remeasurements: Nakisa’s software comprehensive event management automates the calculation of lease remeasurements due to index rate fluctuations, ensuring accounting compliance.

In Nakisa’s software, users can view the before-and-after values for key metrics, allowing them to easily track changes resulting from the modification event.

- Variable lease expense tracking: Variable expenses and non-lease components, such as land upkeep or maintenance of leased equipment, are handled separately. Rather than adjusting the ROU asset and lease liability for these items, Nakisa treats them as variable lease expenses, streamlining the process.

In Nakisa’s software, additional expenses such as equipment maintenance can be defined within the charge definition functionality.

- Prepaid lease management: When leased land is fully prepaid, the software allows for the entry of a one-time prepayment, resulting in no lease liability after day 1. The ROU asset then depreciates over the lesser of the asset’s useful life or the lease term.

The result:

By leveraging Nakisa’s lease accounting software, retail stations can reduce the complexities of managing large and complex lease portfolios while ensuring compliance with IFRS 16 and ASC 842 accounting standards.

- Automated accounting updates: Index rate adjustments are accounted for, with remeasurement amounts automatically calculated and displayed in financial schedules to ensure accurate reporting.

- Global indexation updates: Global or local CPI changes can be mass updated across multiple contracts, saving time and effort for companies with large lease portfolios.

- Event tracking for modifications: The event management functionality simplifies tracking of lease reassessments and modifications, ensuring that any changes are accurately recorded and reported under lease accounting standards.

- Streamlined variable lease expense entry: Nakisa’s software allows the entry of non-lease expenses and one-time charges that do not affect lease liability or ROU Asset values.

Nakisa’s comprehensive lease accounting solution enables retail stations to effectively manage both complex rental escalations and variable costs, ensuring full compliance with IFRS 16 and ASC 842.

Lyn Kok

Project Lead at NTUC FairPrice

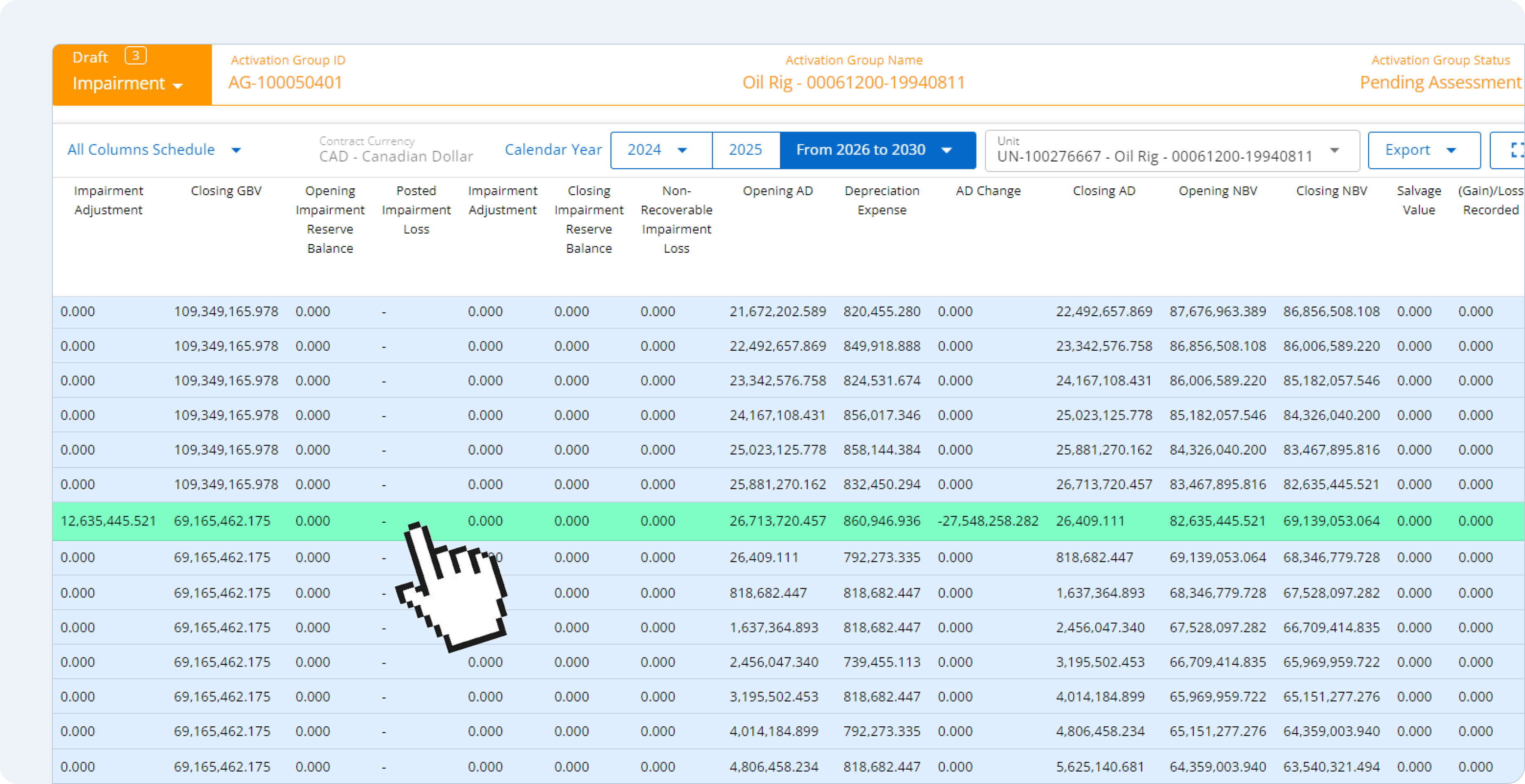

3.6 Impairment and abandoned assets

The challenge:

The oil and gas industry has experienced significant economic fluctuations, impacting various sectors reliant on oil and gas. Key complications include:

- Asset impairment: Fluctuating market conditions can lead to asset impairment if the market value of oil and gas equipment falls below its recorded book value, requiring an adjustment to reflect its current market value accurately.

- Abandonment of assets: The rise of remote work has reduced foot traffic at retail stations, prompting oil and gas companies to terminate leases early or abandon retail assets.

- Depreciation adjustments: When impairments occur, the value of the ROU asset is reduced, resulting in a lower depreciation amount over its remaining useful life, while the lease liability remains unchanged.

- Compliance differences: The accounting treatment of impairment and abandoned assets differs between ASC 842 and IFRS 16, complicating compliance and reporting.

The solution:

Nakisa’s lease accounting software streamlines the recording of asset impairment, while ensuring accounting compliance effectively:

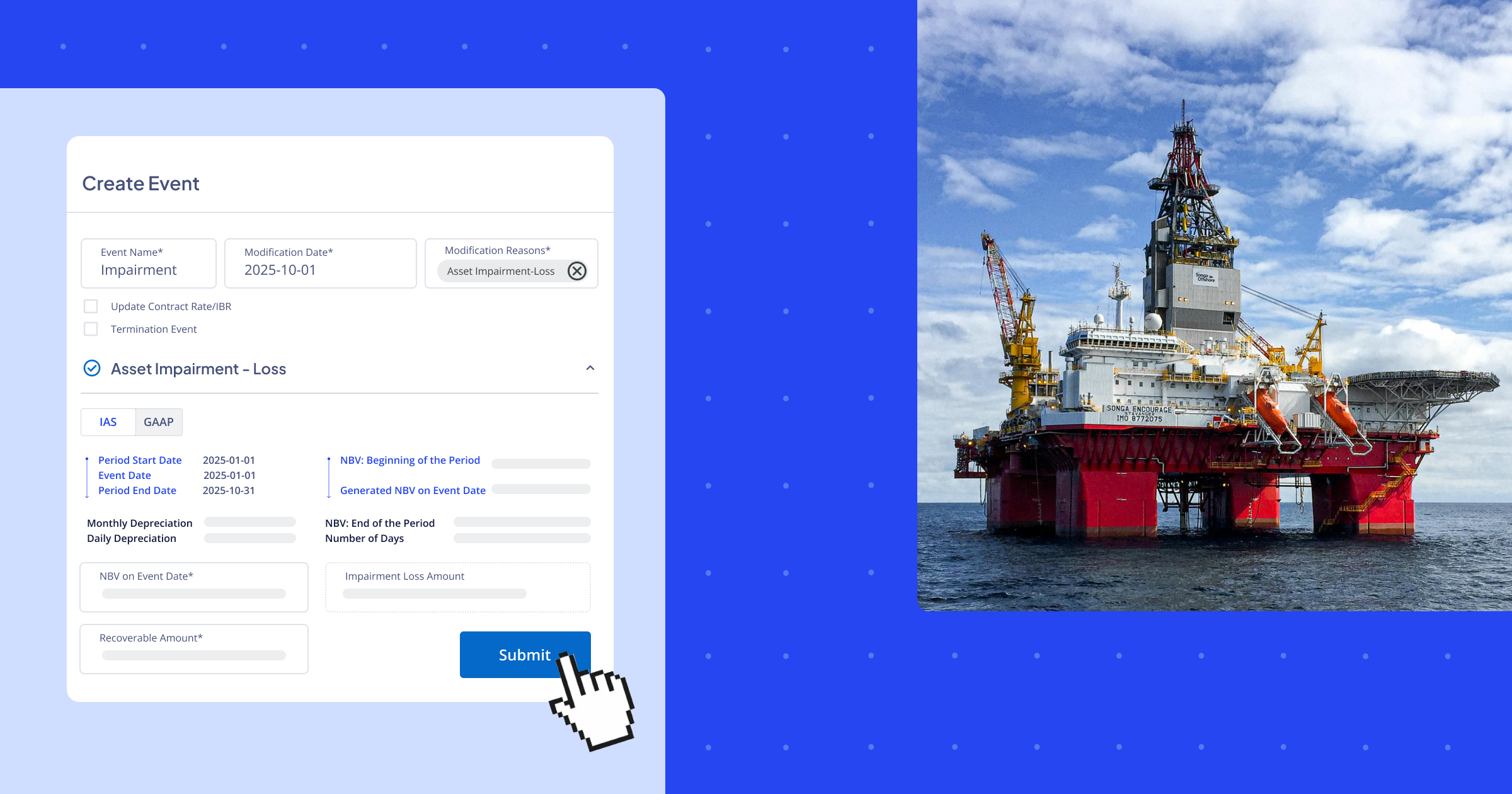

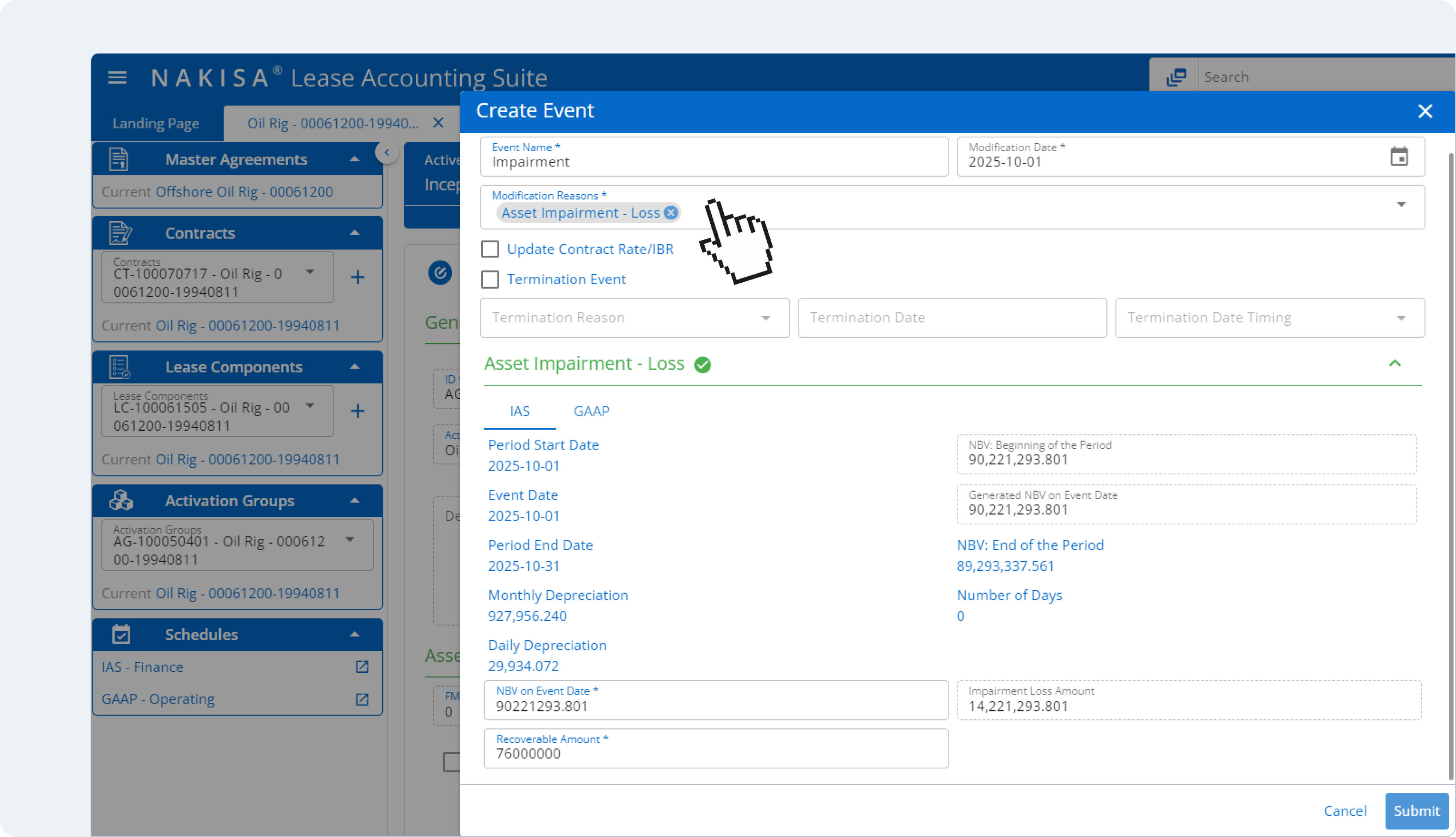

- Impairment accounting: When the recoverable amount of an ROU asset is less than its carrying value, the software enables impairment. The difference between the carrying value and the recoverable amount is recorded as an impairment loss.

- Compliance with standards: Nakisa’s solution supports both IFRS 16 and ASC 842 requirements. Under IFRS 16, adjustments to previously recorded impairment amounts can be made using the Impairment Gain functionality. The solution intelligently calculates the maximum permissible impairment reversal, ensuring full IFRS 16 compliances.

Impairment amounts can be recorded under Nakisa’s software Asset Impairment event.

- No changes to lease liability: The lease liability remains unchanged under both IFRS 16 and ASC 842 standards, simplifying the accounting process.

- Abandoned assets management: For assets considered abandoned, Nakisa’s software accelerates the amortization of the ROU asset to reach a value of zero, while the lease liability remains intact.

- Depreciation method adjustment: Depreciation methods are automatically adjusted upon the triggering of an impairment event for leases under ASC 842 leases, using a straight-line method of depreciation after impairment recognition as per accounting requirements.

Nakisa’s software adjusts the depreciation method for the ROU asset to a straight-line method once impairment is triggered (indicated by the green row) for ASC 842 operating leases.

The result:

Nakisa’s lease accounting software provides a comprehensive solution for managing impairment and abandoned assets, crucial for the oil and gas industry in an ever-evolving landscape. Key benefits include:

- Robust compliance: The software effectively addresses the compliance divergences between IFRS 16 and ASC 842, enhancing operational efficiency.

- Flexible depreciation management: While many lease accounting solutions struggle to change the depreciation method of operating leases once they are active. Nakisa’s software seamlessly switches the depreciation method when impairment is triggered under ASC 842.

- Controlled impairment gain: The software allows adjustments to previously recorded impairment amounts through Impairment Gains, as permitted under IFRS 16.

- Streamlined closing process: Nakisa facilitates the generation of gain/loss journal entries resulting from impairment, and automatically adjusts depreciation calculations, schedules, and posting amounts based on user inputs during the event.

With Nakisa’s lease accounting software, companies can effectively manage the complexities of asset impairment and abandonment, maintaining compliance with evolving accounting standards.

Randy P.

Senior IT Systems Analyst at Marathon Oil

Discover our buyer’s guide with RFP scorecard designed to simplify the selection of lease accounting solutions for the oil and gas industry. With tailored evaluation criteria and practical insights, this guide helps you navigate the decision-making process and identify the tools best suited to your organization’s unique needs.

4. How Nakisa’s lease accounting software streamlines complex oil and gas lease portfolios

Nakisa’s lease accounting software is specifically designed to address the unique complexities of oil and gas lease portfolios. Let’s discuss how Nakisa enhances the management of complex lease portfolios and ensures compliance in the oil and gas industry leveraging the following capabilities:

- Comprehensive lease lifecycle management for oil and gas assets

- Scalability and advanced configurability for all types of assets

- Bidirectional integration with leading ERPs for up-to-date financial data

- Parallel compliance with ASC 842, IFRS 16, and local GAAP

- Simplified disclosure reporting

- Auditable reports

- Mass operations, automation, reversal, and detailed logs

- Complex lease management

4.1 Comprehensive lease lifecycle management for oil and gas assets

Nakisa’s lease accounting software offers comprehensive capabilities to manage every stage of the lease lifecycle —from the initial contract to modifications, renewals, and lease ends (including purchases and terminations). What sets Nakisa apart from other vendors is its ability to deliver true asset-level accounting, ensuring every detail of each lease is accurately captured and reported. This precision empowers companies to confidently manage their lease portfolios, tracking key dates, payments schedules, and contractual terms and conditions. With built-in notifications for upcoming actions, such as renewals or amendments, businesses can stay ahead of their lease obligations and avoid costly oversights.

4.2 Scalability and advanced configurability for all types of assets

Nakisa offers scalable, asset-agnostic solutions with advanced configurability and flexible analytics, making it ideal for managing complex use cases in the oil and gas industry. The platform supports high contract volumes (100,000+), various accounting standards, multiple currencies, languages, and frequent modifications and events. Nakisa’s asset-agnostic design allows you to handle a wide range of assets, from drilling rigs and production facilities to pipeline rights-of-way and storage terminals—for both lessees and lessors. This versatility is crucial for oil and gas companies operating across varied asset types and regions with unique regulatory and operational requirements. By centralizing and streamlining asset management, Nakisa provides the flexibility oil and gas companies need to efficiently manage complex lease portfolios and ensure compliance with evolving accounting standards.

John van Oorschot

Head of Global Controlling at INEOS

4.3 Bidirectional integration with leading ERPs for up-to-date financial data

Nakisa’s lease accounting solution offers seamless integration with leading ERP systems, powered by the Nakisa Cloud Platform (NCP) —a cloud-native platform with a microservices architecture that supports bidirectional communication through the Nakisa Cloud Connector (NCC). This advanced architecture enables smooth integration with major ERPs such as SAP (S/4HANA and ECC), Oracle, and Workday, whether in cloud or on-premises environments.

Nakisa’s lease accounting software is designed to handle complex multi-ERP integration scenarios, making it ideal for oil and gas companies operating across diverse regions and using various ERP systems. The platform consolidates data from up to 45 different ERP systems into a single, unified instance, streamlining the flow of financial data while maintaining accuracy and consistency. By enabling real-time data synchronization and transfer between the software and ERP systems, the solution enables companies to manage their lease portfolio more effectively.

This integration ensures optimal data integrity and continuity, facilitating smooth consolidation of leasing transaction —from initial measurements of right-of-use (ROU) assets to subsequent lease modifications, remeasurements, and complex scenarios such as lease extensions, intercompany asset transfers, or early terminations.

Dana Jircikova

Head of Capital and Financial Investments Reporting at Nestle

4.4 Parallel compliance with ASC 842, IFRS 16, and local GAAP

Ensuring parallel compliance with the lease accounting standards—ASC 842, IFRS 16, and local GAAP—requires robust, precise software capabilities. Nakisa’s lease accounting software is designed to fully support the recognition of right-of-use (ROU) assets, lease liabilities, and the efficient management of complex lease classifications and modifications. With Nakisa, you can manage all your leases under these standards simultaneously on one unified platform. The software accommodates each standard’s unique requirements and allows for the generation of disclosure reports in accordance with those standards.

Nakisa also offers highly configurable dashboards that provide financial transparency and flexibility. It supports non-standard calendars, such as 4-4-5, automates indexation adjustments, and handles lease modifications or reassessments on any effective date, ensuring compliance while streamlining accounting processes for greater accuracy and efficiency.

Shawn Husband

Senior Director, Lease Center of Expertise at Walmart

4.5 Simplified disclosure reporting

- Asset-level reporting: Nakisa’s lease accounting software offers true asset-level accounting, allowing for precise tracking and management of multiple lease assets within a single contract. Each asset may have its own unique lifecycle, including different amortization periods, start and end dates, or distinct events such as modifications, renewals, buyouts, and terminations. This level of granularity ensures that each asset is accurately managed according to its individual characteristics, providing full compliance and detailed financial reporting.

- Global lease portfolio aggregation: The solution simplifies the management of large lease portfolios by consolidating data across all lease contracts. This allows users to aggregate financial statements, integrating facilities, drilling equipment, and marine vessel leases, which helps reduce the potential for misstatements or restatements.

- Foreign currency adjustments: To ensure compliance with IAS 21 and ASC 830, Nakisa’s software generates detailed reports with multi-currency translations for leases in different jurisdictions, improving visibility and control over global, multi-currency portfolios.

4.6 Auditable reports

Nakisa’s solution allows you to configure audit-ready reports with advanced drill-down capabilities, ensuring full compliance with IFRS 16, ASC 842, and local GAAP, as well as meeting 10K and 10Q filing requirements. You can perform complex financial calculations, such as the measurement of right-of-use (ROU) assets and lease liabilities, while generating both standard and custom reports, including profit and loss statements, balance sheets, and cash flow reports. The platform’s multi-dimensional reporting is fully customizable across lease types, locations, and variables, enabling scenario analysis and forecasting to evaluate the financial impact of different lease strategies.

Interactive demo: Reports

Robert Reddmann

Senior Manager Corporate IT (CIT) at ASK Chemicals

4.7 Mass operations, automation, reversal, and detailed logs

- Mass event management tool: Mass modification enables users to simultaneously adjust lease components and activation groups, allowing them to set new terms and decide on their application (e.g., exercising terms that impact ROU asset and liability values) in a single streamlined process.

Interactive demo: Mass indexation

- Bulk integration and automation: The software efficiently handles bulk tasks, such as posting transactions, executing workflows, and remeasuring multiple assets at once. This functionality is vital for organizations overseeing hundreds or even thousands of lease contracts that require regular updates, significantly reducing the time and effort involved in these processes.

- Mass reversals and period-lock: The system also supports prior period adjustments, including mass reversals of postings. Users can select an effective date for any modification, allowing them to accurately adjust leases for past periods. This feature ensures that users can manage historical lease data effectively while maintaining compliance with accounting standards.

- Job posting scheduler and logs: Nakisa’s automated scheduler streamlines month-end close activities by automatically posting accruals, depreciation, and payments to the ERP system. Detailed logs enhance transparency throughout the posting process, enabling real-time monitoring and tracking of all transactions.

Alanna Bilben

Business Transformation IT RTR Lead at 3M

4.8 Complex lease management

- Complex lease arrangements: Nakisa’s software effectively manages complex lease structures, including joint ventures, subleases, and embedded leases. It supports the separation of lease and non-lease components, ensuring accurate cost and benefit allocation. Additionally, the software handles intricate arrangements like production sharing agreements, variable payments linked to oil volumes, and long-term land leases, ensuring that all financial impacts are thoroughly captured and reported for compliance and operational efficiency.

- Key dates and regulatory tracking: Nakisa’s software tracks critical dates related to leases, such as renewal deadlines, regulatory permit expirations, and equipment recertifications. This centralized approach ensures that important lease milestones are monitored, reducing the risk of non-compliance.

- Managing decommissioning liabilities: The solution manages decommissioning liabilities associated with leased assets. This includes tracking and estimating future costs for dismantling and restoring assets, aligning with regulatory requirements and corporate responsibility.

Italo Ferrufino Magaña

IFRS Corporate Analyst at Unicomer Group

5. Conclusion

Navigating the complexities of lease accounting in the oil and gas industry requires a robust and adaptable approach to manage the diverse array of lease structures and contract terms. As this guide has illustrated, the industry faces unique challenges, including joint operating agreements, variable rental payments, and fluctuating economic conditions, all of which necessitate a robust technology solution for precise and compliant accounting practices.

Nakisa’s lease accounting software stands out as an invaluable tool for oil and gas companies, offering solutions tailored to these specific use cases. From marine vessel leases and drill rigs to managing impairments and abandoned assets, Nakisa equips organizations with the capabilities needed to maintain accurate right-of-use (ROU) assets and lease liabilities. By automating calculations, facilitating ongoing remeasurements, and ensuring compliance with IFRS 16 and ASC 842 standards, Nakisa’s software optimizes lease management and enhances financial reporting.

As the oil and gas landscape continues to evolve, adopting innovative lease accounting solutions is essential for companies aiming to optimize operations and maintain compliance. With Nakisa, businesses can confidently navigate the complexities of lease accounting, ensuring they are well-equipped to meet today’s challenges and seize tomorrow’s opportunities.

To explore how Nakisa’s lease accounting software can transform your lease accounting processes, we invite you to get a personalized demo of our software and experience firsthand how our solutions can streamline your operations and ensure compliance, positioning your enterprise for success in the dynamic oil and gas sector.