What is lease management and why does it matter for large enterprises?

Lease management, also known as lease administration, involves comprehensive oversight and execution of contractual obligations within a company's lease portfolio. As a key component of portfolio management, it ensures that lease terms and expenditures align with business goals. This process includes managing of all aspects of leasing assets (PP&E), such as lease negotiations, documentation, lifecycle events, financial management, and compliance with accounting standards like IFRS 16, ASC 842, cybersecurity standards, and other industry-specific regulations.

For global enterprises, lease management is particularly challenging due to diverse leases spanning regions, jurisdictions, currencies, calendars, and standards. Effective lease management helps minimize risks, ensure compliance, optimize resource allocation, and support data-driven decision-making.

What are the different stages of portfolio and lease management?

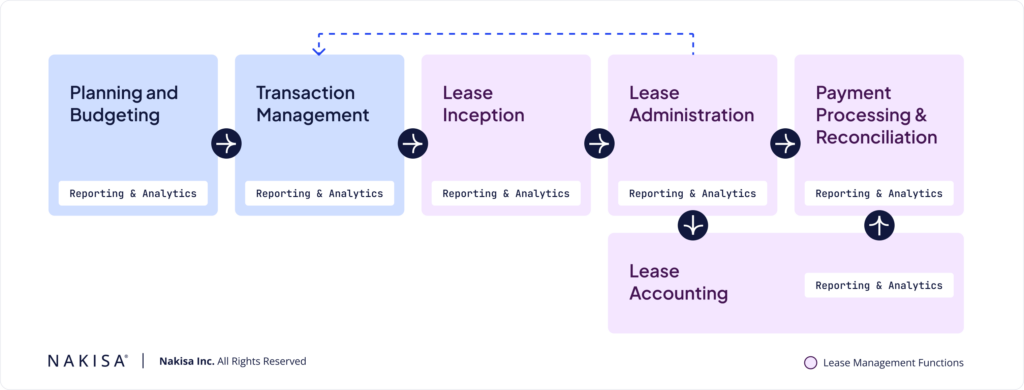

Portfolio management involves the end-to-end management of an organization’s leased or owned asset portfolio (PP&E) to optimize asset performance and ensure compliance throughout their lifecycle. The graph below outlines the stages of portfolio management and how lease management fits within it.

Different stages of portfolio management and where lease management integrates into the process

Portfolio management typically begins with planning and budgeting where future space needs are forecasted, and financial resources are allocated. This is followed by transaction management, which involves negotiation, approval, and execution of lease agreements in line with the company’s strategic goals. Once these fundamental steps are completed, the focus shifts to key lease management functions for day-to-day operations.

Lease inception involves establishing and activating lease agreements, setting terms for occupancy, payments, and critical conditions that govern the relationship between lessee and lessor. Lease administration focuses on day-to-day operations, including record-keeping, monitoring critical dates, and ensuring adherence to lease terms. Payment processing and reconciliation manage financial transactions and resolve discrepancies—such as common area maintenance (CAM) charges—to maintain accurate financial liabilities and ensure transparency. Effective lease accounting practices are important throughout these last stages, as a parallel operation usually translated to the Finance organization, as they ensure compliance with accounting standards and provide clear financial reporting and disclosures.

Each stage plays a crucial role in managing lease portfolios and aligning leasing strategies with organizational goals. However, effectively navigating these stages requires addressing several recurring challenges, and understanding how a lease management solution can help overcome them.

What are the key activities in the lease management process?

In global enterprises, lease management involves recurring activities that must be carefully coordinated across diverse regions and complex portfolios to ensure operational success. The table below highlights these key activities.

| Data abstraction: Extraction, concise lease summaries, and analysis | Calculate indexations: CPI-based, variable escalations, retroactive adjustments | Capital costs: Costing for capital projects associated to leases |

| Critical terms capture: Critical dates, clauses and options, key reminders | Variable rent: Sales-based percentage rent calculations, escalations | Subleases: Tenant management, accounts receivable and invoicing |

| Track lease events: Lifecycle events, end of term, month-to-month | Schedule payments: Recurring schedules, one-time charges, and adjustments | Portfolio analysis: Reporting and dashboards for slicing-dicing data and for key decisioning |

| Track incentives: Fixed or reduced rent, relocation costs, reimbursements | Reconciliations: Pro-rata CAM, exclusions, payment caps, and overpayments | Lease accounting: Compliance with standards (ASC 842, IFRS 16, local GAAP) |

Recurring lease management activities in global enterprises

What are the key challenges in lease management?

For global enterprises, effective lease management is crucial to maintain compliance, optimize lease terms, and mitigate risks. However, as organizations scale and manage complex portfolios, they often encounter several challenges that hinder efficiency and accuracy. These challenges can arise from gaps in people, processes, and/or technology. Below are some of the key challenges enterprises face in lease management and their negative consequences:

| Lease management challenge | Consequences |

| Inaccurate and incoherent lease data | Financial discrepancies, incorrect billing, revenue loss, disputes with landlords, and audit failure |

| Failure to comply with lease standards | Legal penalties, financial restatements, damaged reputation, and increased scrutiny from regulators |

| Inadequate tracking of obligations and critical dates | Overlooked obligations, missed renewals and terminations, contractual breaches, and financial and legal risks |

| Lack of portfolio visibility | Inability to optimize space, poor strategic planning, inefficient use of resources, and excess costs |

| Limited integration and access to real-time data | Data silos, slow response to market changes, hindered decision-making, and missed market opportunities |

| Reactive reporting | Delays in adapting to changes, inadequate insights, strategic disadvantages, and inability to leverage market trends |

| Overpayments and unoptimized lease terms | Unnecessary expenses, failure to capitalize on favorable terms, financial inefficiency, and missed saving opportunities |

| Manual and inefficient lease administration | Human errors, operational bottlenecks, higher likelihood of errors, and increased operational costs |

| Unclear roles | Lack of accountability, confusion in responsibilities, and inefficient collaboration |

Lease management challenges global enterprises face and their negative operational, financial, or legal consequences

Effectively addressing these challenges requires a robust software solution. This brings us to a critical question: should enterprises build this software in-house, or buy it from a vendor? To help you make an informed decision, let’s debunk some of the most common myths about either option.

5 common myths about building vs. buying lease management software

Myth 1: Building lease management software gives full control over features, upgrades, scalability, and customization

Building software in-house is often seen as a way to maintain control over features, upgrades, scalability, and customization options, but this is rarely the case. We often see companies repurposing generic tools like CRM or ERP systems for lease management. While these systems excel in their core functions, they struggle to handle complex lease agreements, workflows, and financial compliance requirements, falling short of addressing the full spectrum of specialized needs, during both adoption and maintenance. As a result, adapting these tools to meet complex requirements and evolving business needs proves resource-intensive and inefficient. On the other hand, purchasing a solution from a vendor provides access to a proven product with purpose-built features, regular updates, built-in scalability, and dedicated support—eliminating the long-term maintenance burden.

Myth 2: All lease management software meets leading security standards

The second myth is that purchasing a software solution automatically enhances security and provides superior data structures for tracking and centralizing operational and financial data. While vendors need to undergo multiple cycles of external audits to align with industry standards, only a few leading vendors consistently meet and exceed benchmarks and evolving compliance requirements. For instance, achieving certifications such as SOC 1, SOC 2 Type 2 compliance, and adhering to GDPR and EU-specific standards requires significant effort. Security is ultimately only as strong as the vendor’s specific capabilities, innovation cycles, and ability to effectively implement and maintain their solution. For instance, features like Role-Based Access Control (RBAC), which limits data access based on user roles, are essential to reducing risks and preventing breaches. Thus, buying software does not automatically guarantee superior security or compliance; it requires a thorough vendor evaluation and continuous oversight.

Myth 3: Building lease management software enables faster development

A common misconception is that building in-house software enables easy prioritization, control, and acceleration of development projects. In large enterprises, internal teams—whether in real estate or IT—often face competing priorities from core business operations, making it challenging to allocate sufficient resources for developing lease management technology. These resources are often assigned to projects more central to their primary job roles, causing lease management system implementations to become secondary or an afterthought. Due to extended timelines or scope changes, achieving the desired pace and focus for in-house projects can be difficult.

Myth 4: Buying lease management software is more expensive than developing an in-house solution

Cost is often a major factor in software decisions. Many believe that building software in-house is cheaper because it appears to be a one-time cost. However, when considering two key factors—strategic purchase costs and unforeseen full-time employee (FTE) costs—it often turns out to be more expensive, especially when the off-the-shelf solutions effectively meet your day-to-day needs. Building in-house software can be costly due to expenses related to development, data management, licensing, integrations, and ongoing support. On the other hand, buying typically involves lower ongoing costs, with vendor support and pre-built integrations often included. When evaluating the total cost of ownership, including design, development, testing, deployment, integrations, project management, change management, and contingencies, the build option often results in higher overall costs.

Myth 5: Building lease management software ensures seamless integration with existing enterprise systems

Finally, it is often believed that building an in-house solution guarantees seamless integration with existing enterprise systems due to the organization’s familiarity with its own infrastructure. However, custom-built systems often face the same integration challenges as off-the-shelf solutions. Even with internal IT teams experienced in integration methodologies—such as APIs, webhooks, middleware, flat files, or SDKs—custom solutions can still encounter unexpected costs and complexities during implementation and ongoing maintenance. The key to successful integration lies in selecting the right approach and thoroughly validating it before development begins. This neutral consideration is crucial for both building and buying, emphasizing that no solution inherently guarantees perfect integration without careful planning and execution.

Now that we've debunked some common myths, let's explore the best practices to address these misconceptions and ensure the successful implementation of lease management software.

How to successfully implement lease management software

As we discussed earlier, the gaps that create lease management challenges typically fall into one of these areas: people, process, or technology (including data). Below I share some practical insights, with three key steps for each area, to help you prepare for the right software deployment model (build or buy) within your enterprise.

| Category | Key considerations | ||

| People | Internal experience and track record | Internal support and collaboration | Transformation readiness |

| Process | Portfolio complexity | Operating model | Process standardization |

| Technology and data | Technology maturity | Existing solutions | Data management |

Framework of key considerations before starting search for a lease management solution

Software implementation: the people

Start by assessing whether your team has the necessary expertise and a proven track record in managing complex software systems. Evaluate the level of internal support and readiness for collaboration required for long-term enterprise-grade software implementation. Finally, consider your organization’s transformation readiness and how any larger business transformations might affect the implementation of new lease management software.

Software implementation: the process

Consider the complexity of your portfolio—including its global spread, size, asset type diversity, and frequency of changes. Understanding your operating model is key to accommodating new responsibilities when implementing a new system. Clearly define functions, organizational structure, and whether tasks are handled in-house or outsourced. Then, evaluate whether your leasing processes remain effective or need streamlining.

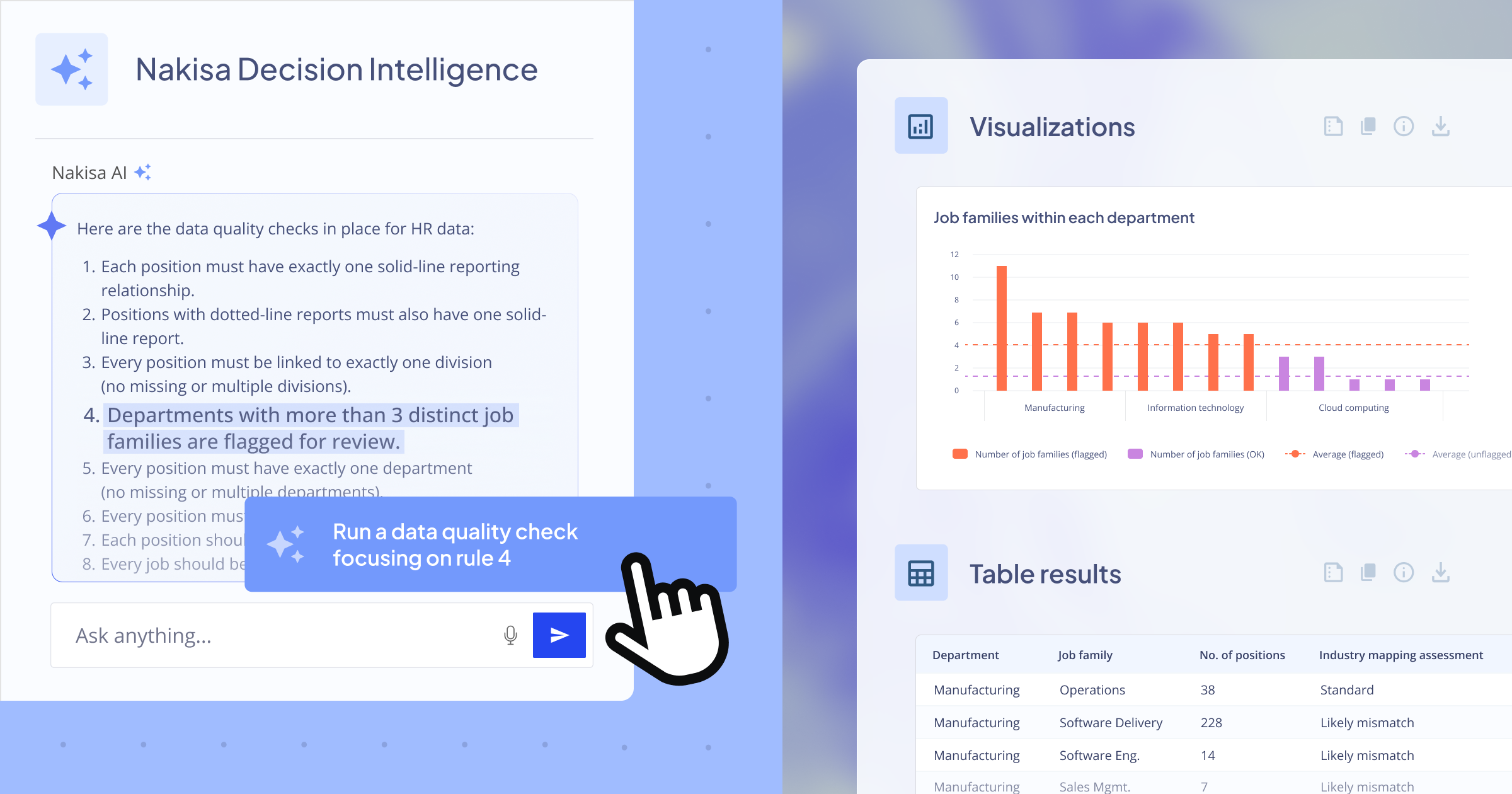

Software implementation: the technology

Gauge the maturity of your current technology infrastructure and assess your ability to deploy new software efficiently while ensuring security, compliance, and seamless integration with existing systems. Identify existing systems with natural adjacencies to lease management (e.g., lease accounting) that can be expanded to include lease management by the same vendor to ensure smooth integration. Additionally, address data management challenges, including limited visibility into existing—often referred to as dark data. Understanding both the data you have and the data you need should be a key factor in selecting lease management software to ensure the new system aligns with your strategic goals rather than adding unnecessary complexity.

Now that we’ve covered the key best practices to keep in mind before starting the search for a lease management solution, let’s explore some tangible examples.

Is it more cost-effective to build or buy lease management software?

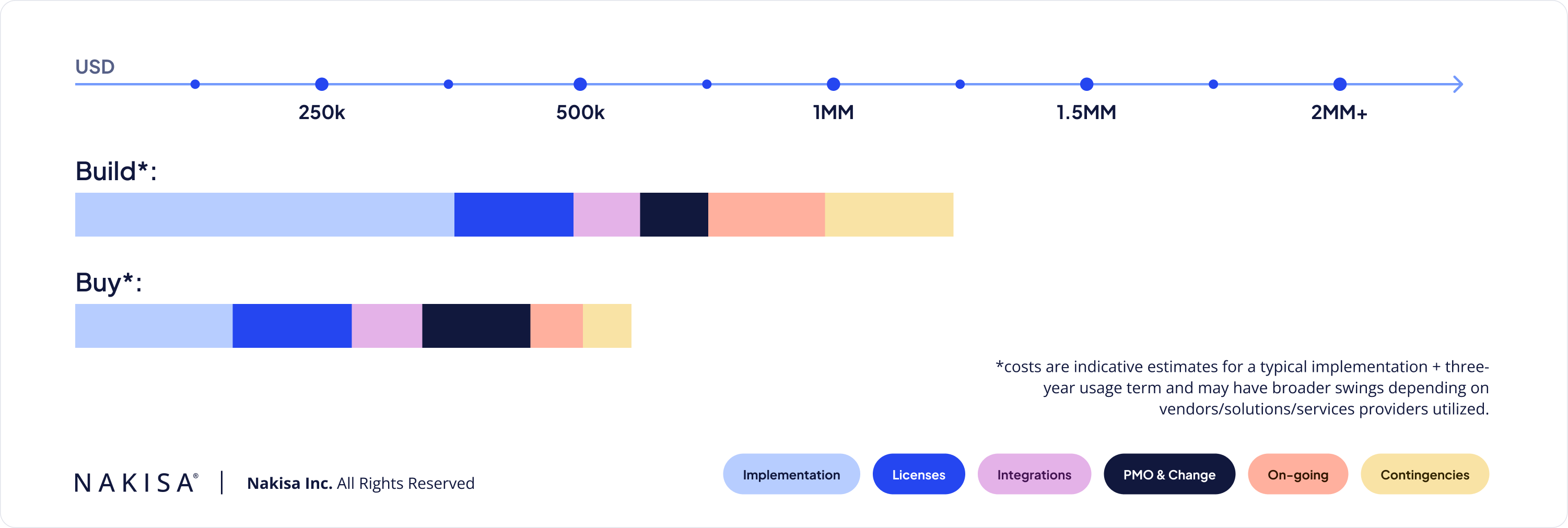

Total cost of ownership is often the biggest factor to consider when choosing a lease management solution and typically determines whether companies build or buy. The table below outlines the cost components of each step of development of a lease management solution, whether building in-house or buying.

| Implementation | Licenses | Integrations | PMO and change management | On-going support and enhancements | Contingencies | |

| Build | Design Build Test Deploy Data clean-up Data migration | Dev tools Platform Database Hosting Ad-hoc software | Requirements Design Build Test Deploy Middleware | Requirements definition Process design Enablement Project management Travel | Support Enablement Design Build Test Deploy | Customizations Backup and recovery Legal and compliance Warranties |

| Buy | Professional services Data clean-up | Active/concurrent users Connectors | Professional Services | Professional services Project management | Managed services Enhancements | Customizations Scope creep |

Cost considerations for building vs. buying a lease management solution

Let’s calculate the 3-year total cost of ownership of building vs. buying a lease management solution. For a hypothetical company operating globally, the graph below showcases where the different costs would be, for both approaches. In this scenario, they are managing over 1,000 leased assets (primarily as a tenant), expecting 25+ users for lease management, and requiring robust ERP and BI tools integrations for payments, journal entries, and reporting We assume that priorities are set up font in terms of what needs to be accomplished, how it needs to be done, and there is a clear view into people, processes, technology, and data considerations, and goals.

Looking at each of the cost components, the implementation costs are significantly reduced, as the FTE time for a large part goes away due to a third party taking over most of that function. Licenses could stay comparable; however, you may be able to gain efficiency with licenses in your build cycle if it’s purely internal and not expansive to other software that you would anyway have to procure. Integrations would remain the same due to dependencies on other teams, but you may get more handholding and support with the right vendor. The PMO and change management aspects are much lighter when you build, as internal structures already account for much of the PMO work. Ongoing costs are, very naturally, much cheaper from the buy perspective. You’re not treating enhancements as standalone mini-implementation projects because the buy cycle typically covers aspects such as upgrades, patches, fixes, biannual reviews of your software, compliance checks, etc. Finally, contingencies are comparable but tend to taper down more quickly in the buy perspective than in the build perspective.

Overall, the buy cycle will be much simpler, more linear, and significantly less expensive than the build cycle, provided you select the right vendor. Key factors include reduced implementation costs, vendor-provided integration and professional services, as well as lower ongoing support and contingencies costs.

3-year total cost of ownership of a lease management solution: building can incur higher costs than buying it from the right vendor

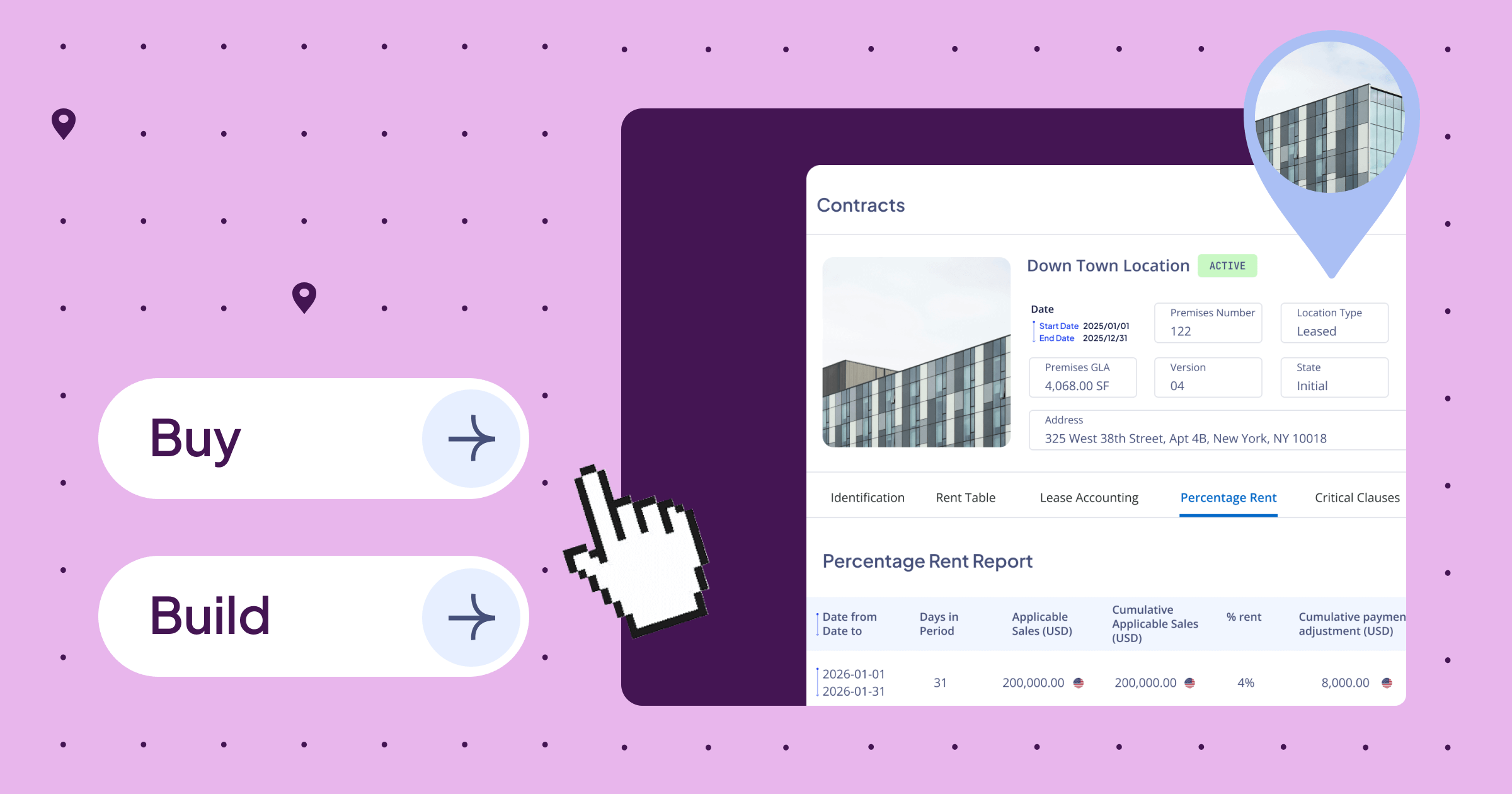

Case study: transitioning from in-house lease management software to Nakisa

One real-life example of this transition is a global discount retailer chain with over 1,500 stores and annual revenue of $4 billion. Initially, they were using an in-house solution built on a home-grown database that heavily relied on the expertise of the original developer. The system lacked essential functionalities and could no longer meet their evolving operational needs.

The lack of scalability pushed them to search for a solution that could meet several critical requirements, including:

- Global visibility into their portfolio

- Automated reminders and workflows for critical dates to minimize human error

- Full accounting compliance with IFRS 16 for all leased retail stores

- Native ERP integration to streamline operations

Ultimately, they chose Nakisa, which provided end-to-end real estate management and seamless data flow through a comprehensive solution. Not only did it address their initial requirements, but it also delivered additional benefits, such as:

- Provisional rent reconciliation,

- Improved store selection and development capabilities,

- Automation of complex rent calculations like percentage rent,

- Full compliance with accounting standards, and

- Bidirectional ERP integration.

This is just one of many examples. To learn more about similar success stories, I encourage you to visit our case studies page.

Key considerations for a successful lease management program—whether you build or buy

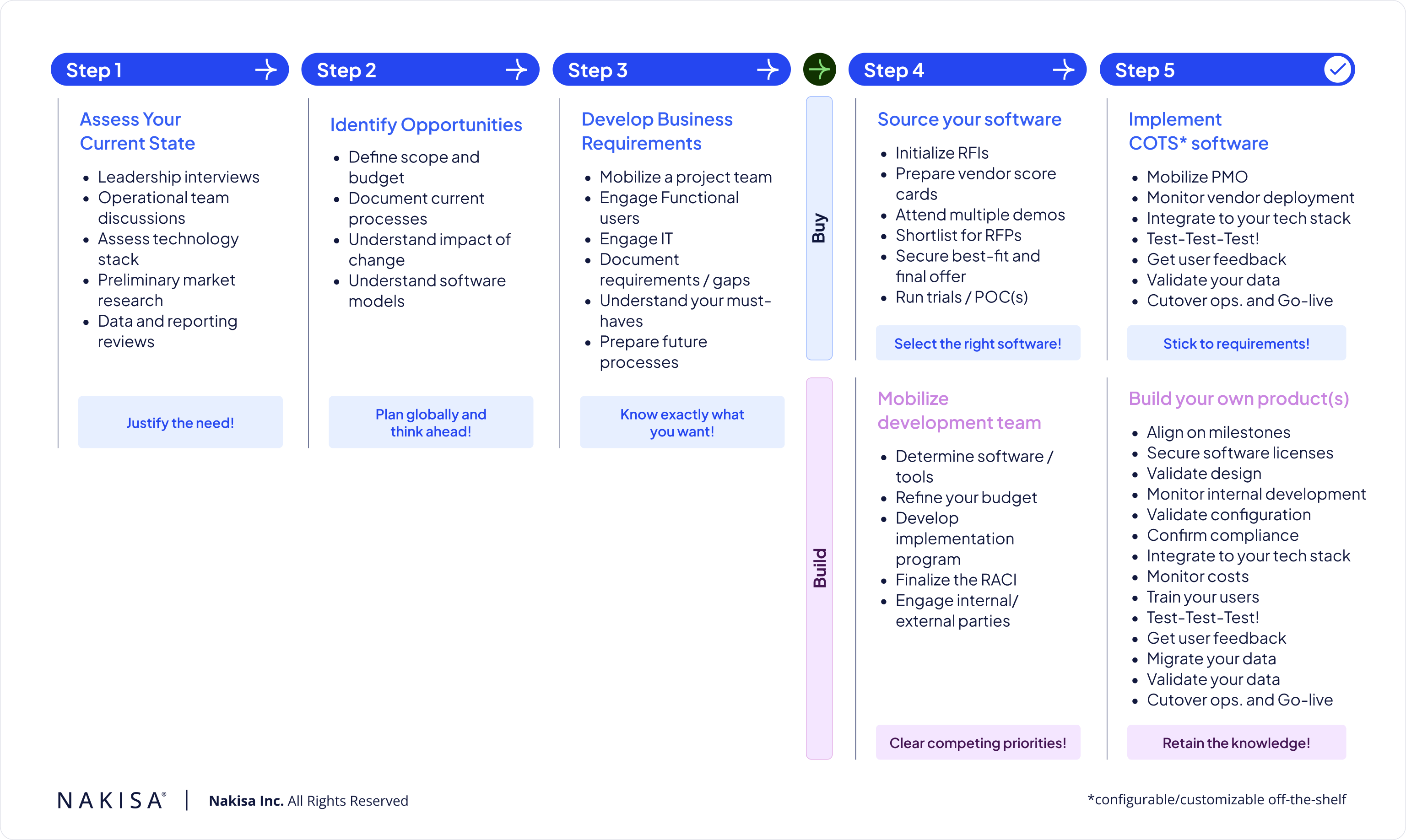

Before concluding, it’s important to mention that ultimately, whether you choose to build or buy a lease management solution, there are common steps every organization should follow to ensure a successful outcome. The graph below highlights these steps, guiding you through the critical considerations at each stage.

Key considerations to ensure a successful program, whether you decide to build or buy lease management software

The first three steps are shared across both approaches, focusing on preparation and evaluation. However, the final steps differ depending on whether you decide to build or buy, as each path comes with unique requirements.

No matter which direction you choose, justifying the need for lease management software is a critical first step. This requires thorough internal evaluation and a detailed assessment of your organization’s current state. Once the need is identified, the next step is to define a clear scope of opportunities, anticipate potential risks, and plan for the impacts of the change. Before committing to building or buying, it’s essential to develop well-defined business requirements. Knowing exactly what you need ensures a smoother transition to the future system. Establishing must-have features and preparing process workflows before engaging vendors or internal teams is key to determining the best solution for your needs.

Finally, if you choose to buy your lease management software, sourcing the right software is critical. Evaluate multiple demos, prepare vendor scorecards, and ensure the functionalities match your requirements. Run trials and conduct thorough testing. During implementation, prioritize user feedback through regular sessions with the vendor, and always refer to your initial requirements to guide decisions.

Discover our buyer’s guide with RFP scorecard the selection of lease accounting solutions for the retail industry. With tailored evaluation criteria and practical insights, this guide helps you navigate the decision-making process and identify the tools best suited to your organization’s unique needs.

If you decide to build your lease management solution, mobilize your development team by refining the budget and allocating resources. From there, focus on design validation, user training, and rigorous testing throughout the development process. Regularly monitor costs and progress to ensure the project stays on track. Like the buy approach, involving end-users and aligning with your initial requirements are crucial for success.

Conclusion

In conclusion, whether to build or buy lease management software is a significant decision that depends on various factors unique to your business. While building a solution in-house may offer additional control, it often comes with high costs, integration challenges, and resource constraints.

For global enterprises, the complexity and scale of operations typically make purchasing a solution a more efficient choice. Buying a solution allows you to leverage the expertise of specialized vendors, ensures compliance with industry standards, and provides faster deployment, enabling your business to focus on growth rather than the intricacies of software development.

If purchasing a SaaS lease management solution aligns with your business goals, Nakisa is here to help. Our lease management software is designed for large, global enterprises, offering advanced configurability and highly flexible analytics in an intuitive interface. It allows you to handle complex use cases, such as high contract volumes, diverse asset types (real estate, equipment, fleet, etc.), several ownership statuses (leased, sub-leased, and owned), irregular calendars, multiple ERPs, various accounting standards (IFRS 16, ASC 842, local GAAP), multiple currencies and languages, frequent modifications and events, and complex fixed and variable rent calculations.

John van Oorschot

Head of Global Controlling at INEOS

We’ve successfully supported clients across various industries, including retail, manufacturing, energy, banking, airlines, food, government and pharmaceuticals. Want to explore how Nakisa can benefit your business? Book a demo with us today, and get a free demo tailored to your unique business use cases.