What defines a Center of Excellence?

A Center of Excellence (CoE) is a small unit of subject matter experts within an organization focused on supporting other teams with their specialized knowledge. They'll provide insights, best practices, and experience-based advice with the goal of, as Gartner defines it, "pushing beyond standard performance norms to deliver incremental value to the organization."

What is the purpose of the leasing Centre of Excellence?

When we think about leasing CoEs, their primary responsibility is understanding the data involved in the lease management operations. Its members typically own the completeness and accuracy of the lease accounting sub-ledger and the audibility of all contracts. Essentially, the leasing CoE needs to understand:

- What lease data elements are required;

- What documentation needs to be captured;

- What the terms and conditions are in the various lease contracts;

- What interactions are needed between the CoE and other departments.

The members of the Center of Excellence need to have strong accounting knowledge (usually, a couple of CPAs are in the team) but something different than a controller. The controller would review and oversee the CoE, a task that will vary according to the level of expertise within the CoE itself, but they don’t need to be a part of it.

How is a leasing Center of Excellence typically composed?

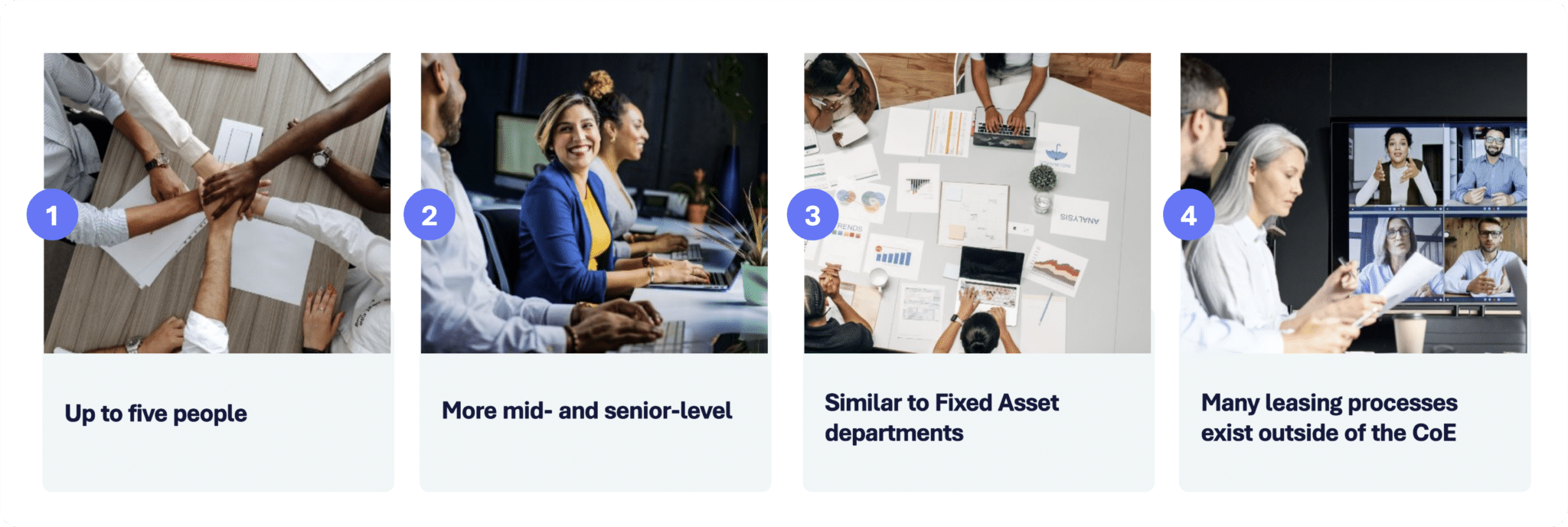

Based on my experience and several research studies, most lease management and lease accounting CoEs in large enterprises will consist of two to five people. And why do I stress the reality of large enterprises here? We can safely assume those organizations assessed the right size of a CoE after the new lease accounting standards made them transform their processes. And by knowing the number of people in these CoEs and their skill sets, you’ll learn what processes they’re typically involved with.

In terms of experience, it’s more common to see an even distribution between mid- to senior-level people in CoEs in large enterprises, with little to no presence of junior-level people. The reason is the complexity associated with leasing and the rather sophisticated systems most large organizations have, which automate the manual procedures usually assigned to less experienced team members. Let’s say a typical CoE’s level of expertise is more like a Fixed Asset department as opposed to Accounts Payable.

You probably know, for instance, that it’s improbable that only three or four people will handle all aspects of enterprise lease management in a large enterprise. So, you assume that a significant amount of the leasing process exists outside the CoE. Or take a real estate management team: they’re focused on things like site selection and contract negotiation, so typically, they’re not part of the CoE. There might be some level of involvement, but they couldn’t be responsible for all aspects of that relationship.

What does a CoE usually look like?

What are the different types of CoE?

We should also talk about centralization with CoEs. Based on my observations and recent research, between 50% and 75% of leasing centers of excellence are highly centralized, while about 25% are highly decentralized, and 25% or less share responsibilities with different entities or business units.

However, falling into a given bucket is more complex than you might think. For example, a highly centralized CoE can receive data and contracts from the business units. But do you know how that data is provided? Or in a highly decentralized organization where the CoE basically just provides support, do you know how far that support goes before the CoE starts looking, well… centralized?

The answer often has to do with the business processes you're looking at.

You may be highly centralized with some business processes within the CoE but highly decentralized with other business processes within your leasing process. Does that make your CoE more centralized or decentralized? It’s hard to answer. That's why labeling those buckets doesn't necessarily mean a lot.

We should also talk about geography. Traditionally, most Centers of Excellence are centralized in one location—although remote work and collaborative tools might have changed this a bit. If that’s your case and you have worldwide operations in satellite offices, ensure you have 24/7 support because of the different time zones. If you’re just based in North America, though, it shouldn’t be a problem.

How do you structure a Center of Excellence?

When the new lease accounting standards went into effect, only a little over half of organizations had a satisfactory strategy for their lease accounting centers of excellence —the rest were either planning one or working on one. In any case, many organizations still lack a documented business plan and clear areas of responsibility for their CoEs.

A good start is having a RACI matrix. RACI stands for Responsible, Accountable, Consulted, and Informed, i.e., the four generic roles an individual or CoE can play in completing tasks for a business process. If you don't have a RACI matrix already, I strongly recommend you start working on one. If you don’t have it, chances are you don’t have sufficient and appropriate documentation for your Center of Excellence.

But don’t assume implementing a RACI matrix is a one-off. It will change over time: as people change, systems change, and processes change, the type of leasing might change, too—and this means the RACI needs to be continually updated for every single business process within enterprise lease management.

Of course, you could say that about any process, but it’s even more critical in leasing, given the number of stakeholders and the complexity associated with those processes, not to mention their impact on accounting, taxes, procurement, treasury, end users, real estate… the list is immense.

What is the best option: outsourcing or internalizing my leasing CoE?

Now you have a clearer idea of what a Center of Excellence is, what it’s for, and how it’s constituted. In the next article, we’ll discuss the relationship between the leasing CoE and the other business units and departments and how the processes look in more detail. But now, we’re getting to a crucial point for many organizations: to outsource or not to outsource? Well, that is the question.

First, let me be clear: I'm not opposed to outsourcing a Centre of Excellence. However, I must point out some of the potential problems that I’ve seen with outsourcing rather than in-sourcing:

- Adaptability and agility - Until you're involved daily with all the different tasks, it may be challenging to lay out all the roles and responsibilities or the RACI matrix early on. Also, business environments are constantly changing, so it might be hard to stay agile and adaptable when outsourcing.

- Communication - I don't want to start a discussion about remote work or hybrid work. Still, some complaints about individuals not communicating effectively in a remote setup can be even more pronounced when you outsource leasing services. It's not like with payroll or fleet management, where you define an objective clearly with a limited number of stakeholders within the company. Maybe that’s why we’re not seeing most public companies go with outsourcing leasing CoEs ostensibly.

- Coming and going – When it comes to leasing, many different departments need to communicate constantly for many reasons. So, it’s difficult for an outsource company to maintain those relationships and keep those communications channels open when people are onboarding and exiting in both the CoE and the company. This happens to all types of CoEs but is more prevalent in leasing.

- Using different software – Most outsourced CoEs work with their own leasing solutions, so it’s more difficult for those tools to have APIs and push and pull data from inside the company. On the other hand, if you have that system internally, communication between systems is much easier. So, think of it as not just individuals communicating but also systems having to speak with each other. The lease management application the CoE uses needs to communicate efficiently with other systems—ERP being the main one, but you might also consider AP sub-ledgers, IT asset management systems, or fleet management systems.

That said, you should always consider outsourcing certain functions. It’s just that we’re assuming most leasing operations are conducted internally within your organization. Maybe they're centralized in some areas and decentralized in others, but ultimately, every company should reevaluate annually who’s doing what and why. This is when you realize if outsourcing (or not) is the way to go.

As I mentioned, I’m not totally against outsourcing leasing CoEs. They can be a fine solution if you don’t have many leases or if your leases are not incredibly complex or strategic. For example, are you leasing a plane, a warehouse space, or a few dozen computers? Are you operating in many countries or just locally? All those questions are central to your decision whether to outsource your CoE or keep it internal. However, if a large enterprise asks itself those questions, given the problems I listed above, I’d be amazed if it decided to outsource. In the second blog in this series, I will discuss which lease management processes should be handled by a leasing Center of Excellence.

Before I go, here is a quick word about Nakisa’s lease accounting software (NLA) and how it optimizes lease accounting and lease lifecycle management for Fortune 1000 companies, reducing manual errors, ensuring time and cost savings, and letting your team focus on strategic tasks. If you want to learn more about our lease accounting and lease management solutions, check our case studies about Nestlé and Air France KLM —or contact us to book a demo!