What is a parallel currency?

A parallel currency is one or more currencies issued or recognized by a sovereign state as an official secondary currency, and exists in parallel to the nation’s legal tender currency. Additionally, parallel currency can also be designated legal tender. The majority of the world’s nations do not issue parallel currencies, but a significant number of countries do so (there are between 24-28 such nations that issue parallel currencies as of this writing).

Why are parallel currencies used? They’re used for several reasons. Most often, it’s simply a business accounting situation where companies operating across international borders account for the domestic currency used by their clients or partners alongside their own currency of operation.

However, there is a darker side to the raison d’être of parallel currencies – nations may issue such currencies to mitigate large economic issues or crises, such as foreign exchange shortages, debt crises, or most severely, hyperinflation.

In fact, inflationary pressures are one of the most likely reasons for nations to adopt indexed currencies, which we’ll cover in the next section.

What is an indexed currency?

An indexed currency is adjusted for inflation based on a particular index, frequently the consumer price index (CPI) (although the producer price index can also be used). Why are indexed currencies used? Countries faced with inflation that’s severe enough to cause unmanageable volatility and a drop in purchasing power will often index their currency. By tying a currency to the CPI, the indexed currency (theoretically) buys the same volume of services and goods over time irrespective of price ebbs and flows caused by inflation (or deflation).

Later in this article we’ll be showing precisely how one such indexed currency, the Unidad de Fomento (UF), helps buyers maintain stable purchase value over time. But before we get there, we should note that the UF is, in addition to being a parallel currency and an indexed currency, it’s also a non-circulating currency. So, let’s have a quick look at what that means.

What is a non-circulating currency?

A non-circulating currency is a legal tender not circulated in the economy. This is because the face value of a non-circulating currency is often much lower than the actual value of the currency. For example, a legal tender commemorative coin such as a gold dollar piece is nominally worth its face value but is (usually) worth much, much more owing to its collectability or the amount of precious metal used to mint it.

With such an odd mismatch between actual versus nominal value, this question arises: Why are non-circulating currencies used? Unlike the other two alternative currencies mentioned above, this type of currency is usually not intended to address the effects of hyperinflation or other crises but is often designed to be used for commemorative purposes. They can also be issued to help a nation or entity skirt international sanctions, provide alternatives to circulating currencies, or attract investment.

It should be clear that parallel, indexed, and non-circulating currencies are separate forms of alternative currencies. However, as we’ve alluded to above with the UF, a currency can simultaneously be all three. Historically, it’s not the only such example. Everyone’s favorite metal gold is another one that comes to mind, as well as the European Currency Unit (ECU). Given their historical status, working through an example using either wouldn’t be very practical. So, let’s look at how the UF is used in modern times.

What is the Unidad de Fomento?

The Unidad de Fomento (UF) is a unique financial instrument used in Chile. Introduced in 1967, the UF was intended as a unit of account. It’s a non-circulating currency that’s not legal tender, but by indexing its currency value to inflation daily, the UF is a reliable benchmark for long-term contracts and leases, particularly those inked with foreign investors. Enterprises doing business in Chile contend with the UF in all their transactions to ensure the stability of their payments (and therefore, their profitability).

Why was the UF necessary in the first place? It’s because Chile’s truly massive historic hyperinflation and subsequent double-digit inflation made the country’s actual currency, the Chilean peso (CLP) extremely volatile. Notably, Chile’s inflation rate spiked from 20% in 1971 to 505% in 1974, with annual double-digit inflation persisting after that till 1994. In fact, the Chilean peso is estimated to have lost 99.999% of its value since 1971.

As you can imagine, this degree of hyperinflation is a serious problem for anyone, domestic or foreign, who wants to do business in Chile. Being paid in CLP would almost certainly mean taking a loss or at least a drop in returns in the short term. This is why the UF is used as a unit of account - it preserves the value of any given transaction against inflation. The UF does this by acting as a multiplier that smooths out changes brought about by inflation.

How does a fluctuating currency make lease accounting unpredictable?

Let’s look at a very simple (and purely fictional) example using true historical CLP-USD exchange rates. “A” Company is an American company using US dollars as its functional currency. It has a 12-month lease for an office from “ChileSub” Corp, an American subsidiary operating out of Chile. ChileSub therefore uses CLP for local accounting and must contend with USD in its transactions with A Company. A Company’s lease is inked for $10,000 USD from April 2015 through April 2016.

Here are the historical CLP-USD exchange rates for that period:

| Date | CLP-USD Exchange Rate |

| 2015-04 | 0.00163 |

| 2015-05 | 0.00165 |

| 2015-06 | 0.00158 |

| 2015-07 | 0.00154 |

| 2015-08 | 0.00145 |

| 2015-09 | 0.00145 |

| 2015-10 | 0.00146 |

| 2015-11 | 0.00142 |

| 2015-12 | 0.00142 |

| 2016-01 | 0.00139 |

| 2016-02 | 0.00142 |

| 2016-03 | 0.00147 |

| 2016-04 | 0.00149 |

That doesn’t look too bad at first glance, right? It’s a range of 0.00165 through 0.00139 – just a 0.00026 difference. However, when you actually do the conversion rate, we start seeing real problems for both companies:

| Date | Rent in CLP |

| 2015-04 | 6,142,506.14 |

| 2015-05 | 6,079,027.36 |

| 2015-06 | 6,321,112.52 |

| 2015-07 | 6,497,725.80 |

| 2015-08 | 6,877,579.09 |

| 2015-09 | 6,910,850.03 |

| 2015-10 | 6,839,945.28 |

| 2015-11 | 7,047,216.35 |

| 2015-12 | 7,037,297.68 |

| 2016-01 | 7,209,805.34 |

| 2016-02 | 7,027,406.89 |

| 2016-03 | 6,802,721.09 |

| 2016-04 | 6,697,923.64 |

Note the monthly difference in rent owed/received (depending on whether you’re the lease accountant for A Company or ChileSub Corp). There are some very wild swings, and the range is literally over 1 million CLP over the span of the year (1,130,777.98 CLP, to be precise). With swings this large, several issues emerge, especially if Chile’s inflation rate were in the double digits.

ChileSub Corp would have to deal with both fluctuating revenue and compliance requirements. The revenue issue is easier to understand – there’s no predictability of the month over month revenue, making planning and other related activities challenging. However, the larger problem would almost certainly be compliance. Assuming the currency fluctuation were due to hyperinflation in the above example (it wasn’t in real life from April 2015 through April 2016, but as noted elsewhere in this blog, hyperinflation in Chile was present for a long time), then ChileSub Corp’s lease accountant would run afoul of the IAS 29 standard. Full treatment of the standard is well, well beyond the scope of this blog, but I’ll highlight the pertinent point to our example right here (quoted from Grant Thornton’s 2020 IFRS Alert on the IAS 29):

- “All items in the statement of comprehensive income are expressed in terms of the measuring unit current at the end of the reporting period. Therefore, all amounts need to be restated from the dates when the items of income and expenses were initially recorded in the financial statements.”

- “A gain or loss on the net monetary position is included in profit or loss.”

Or, in short, the financial statement must be restated to reflect the change in profit or loss to comply with the IAS 29 standard. Between the precipitous income volatility and the extra accounting work, ChileSub Corp’s lease accountant is in for a pretty rough year.

How does an indexed currency make lease accounting predictable (and compliant!)?

Now, let’s look at the same contract scenario but with ChileSub Corp using the UF instead of the CLP in its transactions. Let’s begin with the UF-USD exchange rates for the same period:

| Date | UF-USD Exchange Rate |

| 2015-04 | 40.65005 |

| 2015-05 | 40.64944 |

| 2015-06 | 40.65021 |

| 2015-07 | 40.65004 |

| 2015-08 | 40.65020 |

| 2015-09 | 40.65073 |

| 2015-10 | 40.65006 |

| 2015-11 | 40.65006 |

| 2015-12 | 40.65066 |

| 2016-01 | 40.65039 |

| 2016-02 | 40.65035 |

| 2016-03 | 40.65036 |

| 2016-04 | 40.65043 |

It should be apparent that there’s considerably less fluctuation in the exchange rate, which should make sense, since the UF was designed to be more stable by indexing to inflation. This stability is further reflected in the month-to-month rent revenue/payment:

| Date | Rent in UF |

| 2015-04 | 246.00 |

| 2015-05 | 246.01 |

| 2015-06 | 246.00 |

| 2015-07 | 246.00 |

| 2015-08 | 246.00 |

| 2015-09 | 246.00 |

| 2015-10 | 246.00 |

| 2015-11 | 246.00 |

| 2015-12 | 246.00 |

| 2016-01 | 246.00 |

| 2016-02 | 246.00 |

| 2016-03 | 246.00 |

| 2016-04 | 246.00 |

The difference is literally 1 penny throughout the entire year. This makes life easier for lease accountants across the two companies. An additional benefit, particularly for ChileSub Corp’s lease accountant, is that the inflation adjustment is already baked into the UF; there’s no need for further restatement per the IAS 29 standard, regardless of the hyperinflation on the ground.

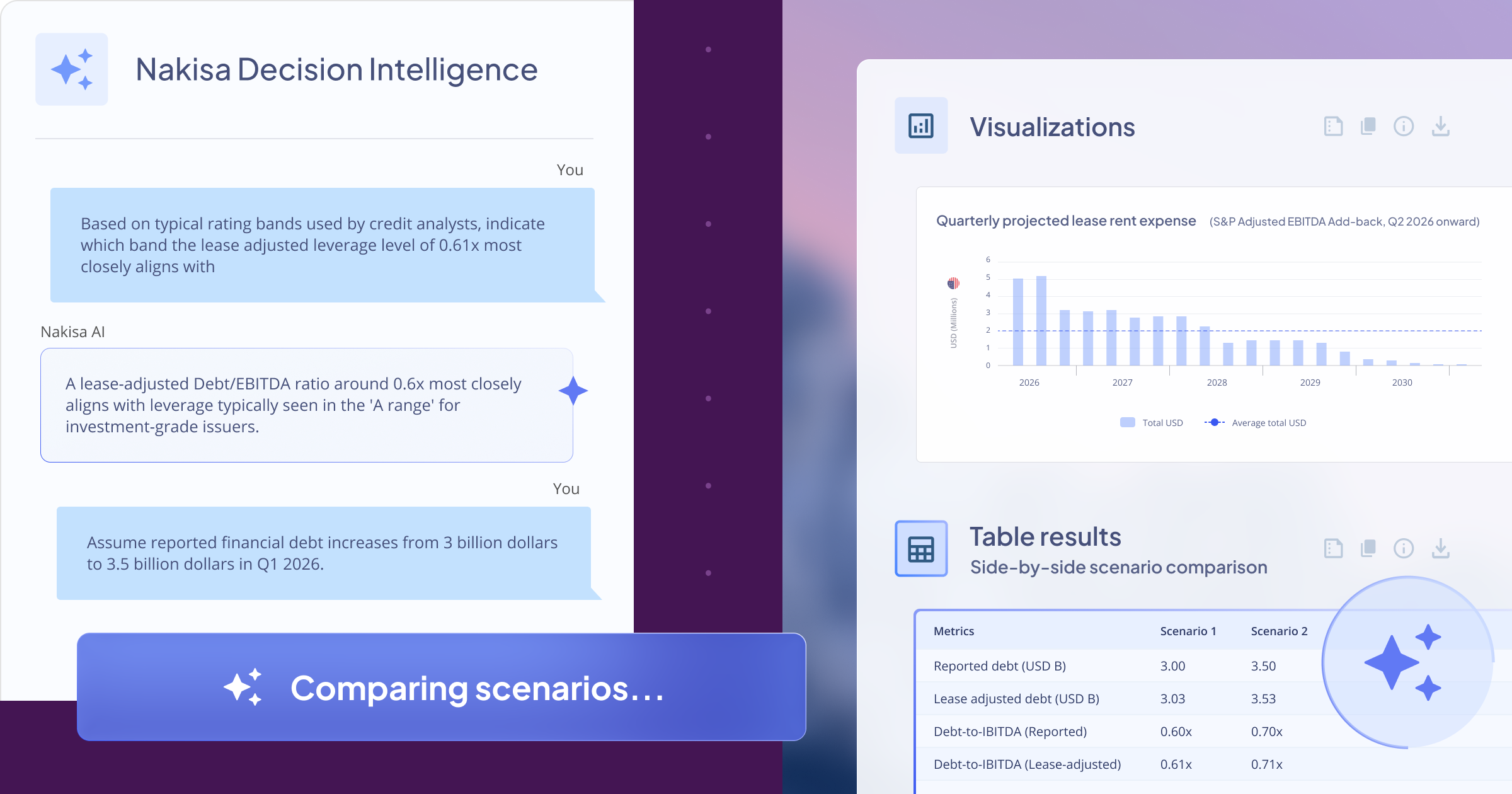

Now, obviously, real-life scenarios are much more complicated to navigate than this example. All of which brings us (finally!) to the thesis of this blog: Multinational corporations need good lease accounting solutions that handle alternative currencies with ease, regardless of the standards and calculations involved. This is because, again, we’re now operating in a truly global village.

The necessity of dealing with parallel currencies

While most multinational transactions do not have as complex a character as those that involve Chilean companies or subsidiaries, global corporations nonetheless find themselves operating across borders, with each beachhead operating using its native currency. This necessitates contracts and agreements being drafted in different currencies, adding complexity to financial management, often daily.

So, if someone were to build this good enterprise lease accounting software that addresses all manner of complexity, it would seamlessly integrate and manage contracts involving different currencies, all while tracking, calculating, and reconciling financial data in line with the real-time value fluctuations of these currencies. It would ensure that every pertinent accounting standard (particularly IFRS 16, ASC 842, ASC 830, and IAS 29) is respected. It would eliminate manual tracking and calculation of financial data in multiple currencies since many errors will occur without software automation to handle these processes.

What does such a solution look like? It looks like Nakisa’s lease accounting software (NLA).

How does Nakisa’s lease accounting software handle indexed currencies?

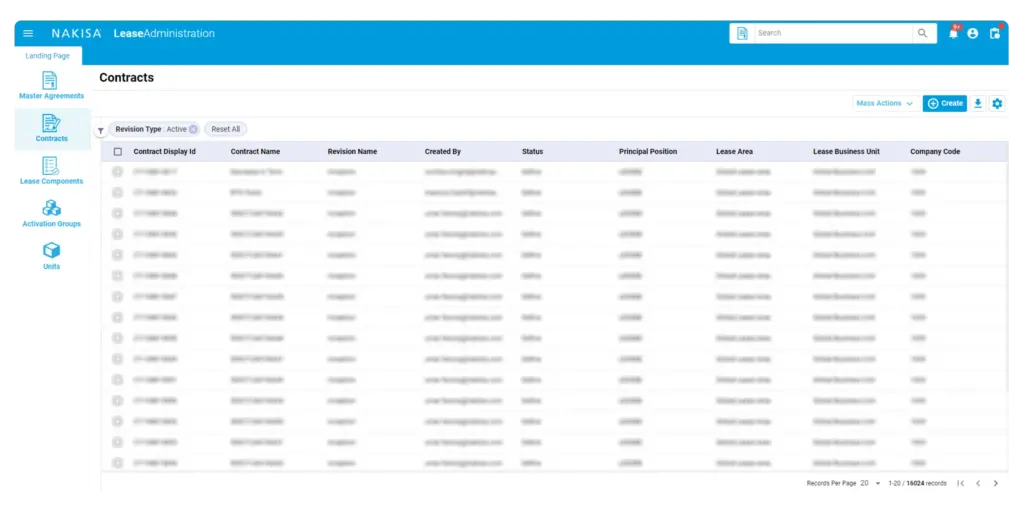

Let’s go back to the UF. If one of our NLA software clients wants to set up a contract using UF/CLP currencies for Chile, they would most likely use UF as the contract currency, and create the contract in a company where the company currency was set up as CLP. They would then use an indexation event every month to update the CLP values for that month's postings. This would be the procedure they’d follow to set up their contract and activation group to use an indexed currency:

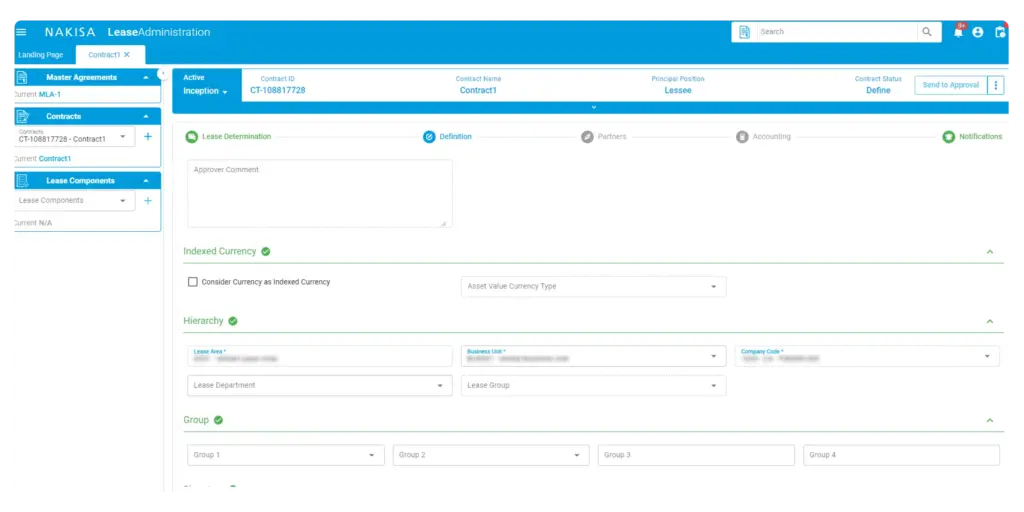

- On the Contract Definition page, they’d set the following fields in the Indexed Currency section:

- Select the Consider Currency as Indexed Currency checkbox.

- In the Asset Value Currency Type, they would select whether they want to enter asset field values (i.e., for FMV, GRV, and carryover balance fields) in contract currency or company currency.

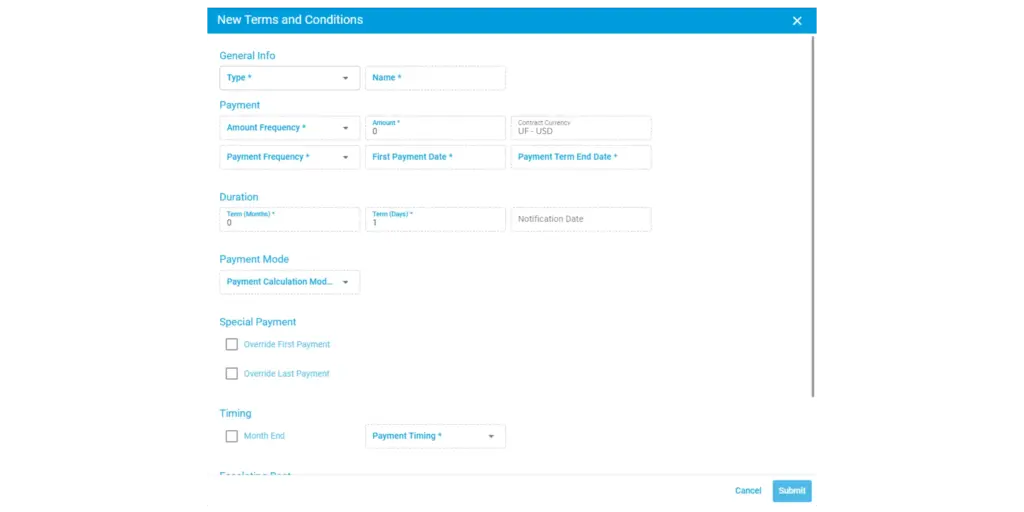

- In the lease component, they’d enter the terms and conditions in the contract currency.

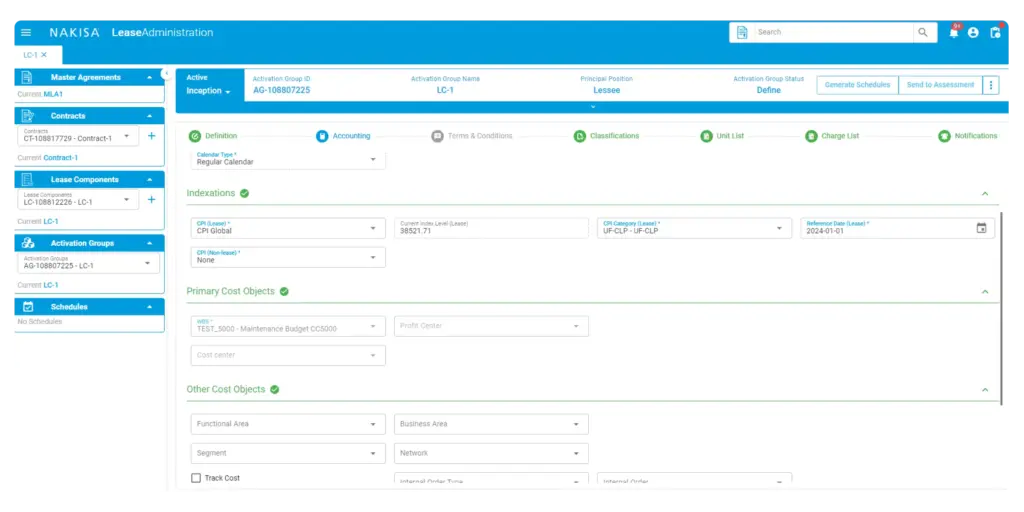

- When they reach the step of defining an activation group, they’d have to do the following:

- Set CPI to "CPI Global".

- Select the CPI Category that was configured to index the currency.

- Select the Reference Date that is used to look up the Current Index Level.

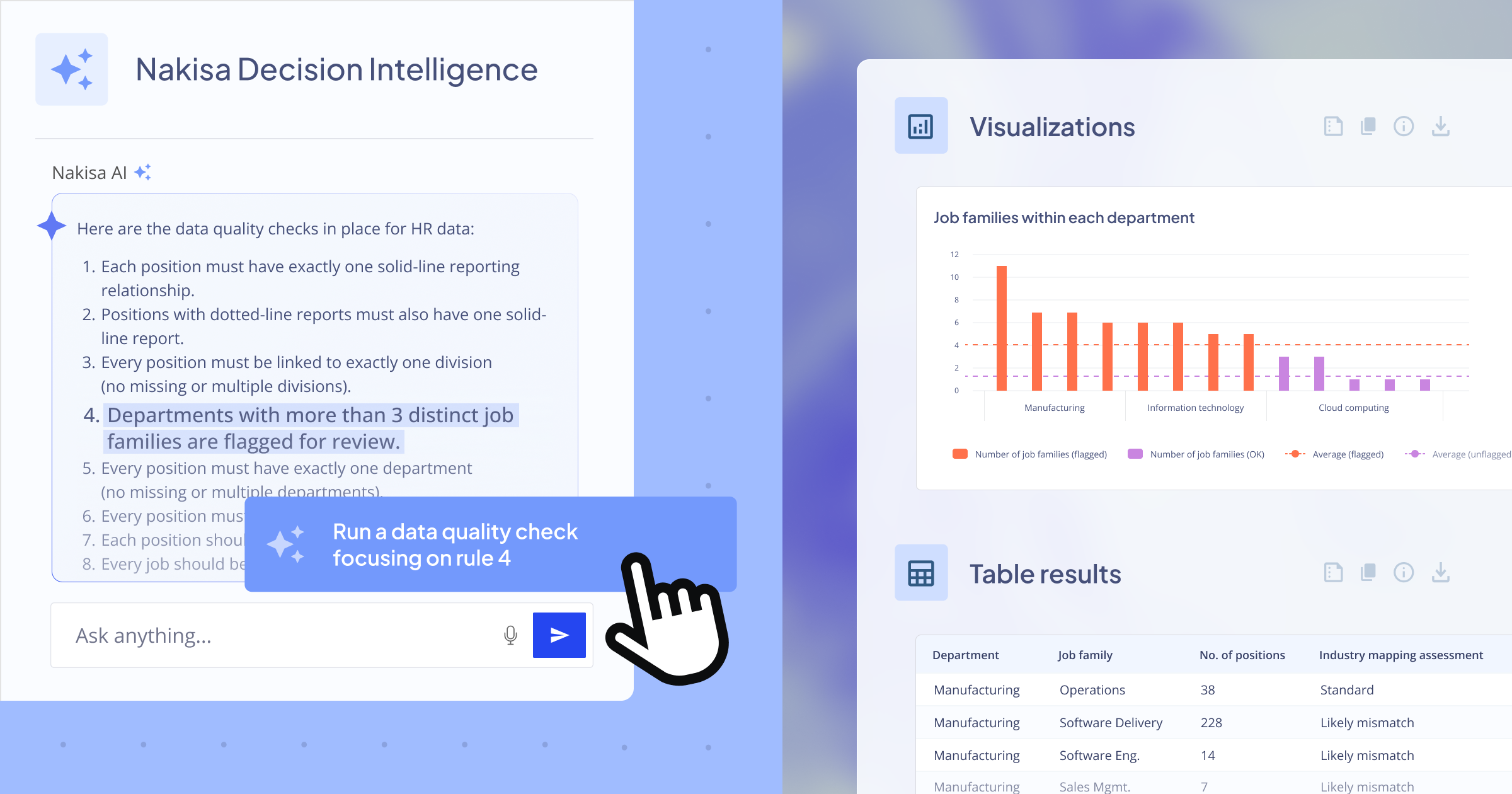

As a result of this configuration, the activation group operates in UF. And that’s it. Did you notice that there’s no actual calculation necessary for the user? But that’s just the beginning of the benefits. Here are the three major benefits that come from using a modern lease administration solution:

- NLA automatically ensures IFRS/USGAAP compliance: Thanks to the fact that UF is recognized as a useable currency in NLA, the automatic benefit of handling the inflation-driven restatements is eliminated, thereby eliminating extra work for the lease accountant. That said, even if CLP were used, NLA would automatically do the necessary compliance-required restatements over time without further input from the lease accountant. That’s a lot of time and effort saved while keeping squarely on the right side of the law.

- Users can work with predictable rent tables in UF for real estate contracts: short- and medium-term planning becomes possible because now, monthly cashflows stop requiring guesswork.

- Mass and online UF indexation: There’s no need to contend with daily currency fluctuations when dealing with a multitude of vendors. NLA automates every transaction with all similar vendors with just a few clicks, and always remains accurate. It’s a simple way (if not the simplest way) to ensure financial transparency for enterprise lease accountants working on multinational accounts.

Now, the above benefits are couched in terms of how NLA benefits lease accountants who must deal with UF in their work, but honestly, these benefits hold true for any enterprise lease accountant who must contend with parallel currencies. The globalized workplace makes lease accounting challenging, but lease accounting software prevents it from being impossible.

So, are you ready to make your international lease accounting easier? Learn more about Nakisa’s lease accounting software , read from our clients, and request a demo. Or start simple and check our YouTube channel that shows how our clients use NLA to streamline their lease accounting and lease management. Simplify your processes, gain sharper insights, and stay compliant across borders.