Importance of asset leasing in the retail industry

In the competitive and dynamic retail industry, asset leasing is a strategic cornerstone for driving growth, enabling flexibility, and managing costs effectively. For global retailers, leasing is not merely an operational necessity but a key enabler of strategic objectives, supporting expansion, innovation, and adaptability in a rapidly evolving marketplace. Below, we delve into the key reasons why leasing has become an indispensable strategy for retail success.

Enabling strategic growth through portfolio expansion

Leasing provides retailers with the flexibility to expand into new markets or upscale operations in high-traffic areas without committing to capital-intensive processes such as property ownership, equipment acquisition, or supply chain infrastructure. This approach supports the rapid deployment of flagship stores, pop-up locations, and regional distribution centers—key strategies for gaining market share in competitive environments. By leveraging lease arrangements, global retailers can maintain liquidity and allocate resources to customer-centric innovations, ensuring long-term profitability.

Adapting to market demands with flexibility

The retail landscape is shaped by constant shifts in consumer behavior, economic conditions, and technological advancements. Leasing allows retailers to scale operations in response to seasonal peaks, emerging trends, or evolving logistical requirements. Whether transitioning to smaller store formats, opening dark stores for e-commerce fulfillment, or pivoting to hybrid retail models, leasing enables the agility required to stay competitive.

Optimizing operational costs

Leasing eliminates the need for substantial upfront investments, allowing retailers to redirect capital to strategic priorities such as digital transformation, supply chain enhancements, and customer experience improvements. Additionally, leasing agreements often include provisions for maintenance and upgrades, further reducing operational costs while ensuring access to state-of-the-art facilities and equipment.

Mitigating risks and ensuring financial predictability

Leasing helps mitigate the risks associated with asset ownership, such as property depreciation or market fluctuations. With fixed lease payments, retailers can better forecast expenses and maintain financial stability, even in volatile market conditions. This predictability supports informed decision-making and ensures alignment with overarching business objectives.

For global retailers, asset leasing serves as a key lever in balancing financial prudence with ambitious growth objectives. By supporting flexibility, expansion, and operational efficiency, it becomes an integral part of a successful retail strategy.

Types of leased assets in retail

Global retailers rely on various leased assets to support operations, drive growth, and adapt to the evolving marketplace. These assets span real estate, land, equipment, and fleet categories, each contributing to the retail value chain.

Real estate leases

Real estate leases form the backbone of retail operations, providing the physical infrastructure necessary for storefronts, logistics, and administrative functions without the heavy financial commitment associated with property ownership. Under IFRS 16 and ASC 842, these leases must be recognized on the balance sheet, reflecting both the right-of-use (ROU) asset and the lease liability.

- Retail stores and flagship locations: Leases for prime retail locations must be recognized as ROU assets and corresponding lease liabilities, with lease payments allocated between principal and interest. Retailers must ensure that lease terms, including renewal options and variable payments, are accurately accounted for to reflect the true financial impact on their balance sheet.

- Land leases for build-to-suit projects: These leases often involve significant long-term commitments and should include accounting for the construction phase. Retailers must assess the lease term, embedded lease agreements, and options to extend or terminate the lease to determine the lease liability. Additionally, the depreciation of the ROU asset associated with the land needs careful management in line with accounting standards.

- Warehouses and distribution centers: Efficient lease management for logistics hubs is key for reducing costs and ensuring accurate lease liability reporting. Under IFRS 16 and ASC 842, these leases must be tracked in the same way as real estate leases, ensuring that lease renewals and embedded leases for equipment are captured in financial reports, impacting operational expenses and balance sheet values.

- Pop-up stores and temporary locations: Short-term leases are subject to different accounting treatment, as they may qualify for recognition exemptions under both IFRS 16 and ASC 842, provided the lease term is 12 months or less. Retailers must track these leases effectively and determine whether they should be capitalized or expensed depending on the lease’s term and conditions.

- Office spaces for administrative operations: As with other real estate leases, these leases must be recorded on the balance sheet, with retailers ensuring alignment with global accounting standards for accurate reporting of lease liabilities and ROU assets. These leases often span multiple locations and need proper integration into the company’s financial systems to maintain scalability and compliance.

Leased equipment and machinery

Leasing equipment and machinery provides retail businesses with access to essential tools and technologies that enhance operational efficiency. Under IFRS 16 and ASC 842, leases of equipment and machinery must also be recognized as ROU assets and liabilities, impacting the financial position and performance of retailers.

- Point-of-sale (POS) systems: These systems, leased for retail operations, must be accounted for under lease accounting standards. Retailers must recognize the ROU asset for the leased POS system and record a corresponding liability for future payments. Any additional clauses, such as renewals or variable payments, must be reflected accurately in financial statements.

- Refrigeration units: Leased refrigeration units are subject to similar accounting treatment, with ROU assets and lease liabilities recorded on the balance sheet. Retailers must ensure that lease terms, such as maintenance clauses or asset improvements, are considered when calculating the depreciation of the asset and the amortization of the lease liability.

- HVAC systems: Leasing HVAC systems also falls under the scope of lease accounting standards. Retailers must accurately reflect the ROU asset for the HVAC system and the related lease liability in their financial statements, considering the useful life of the system and the lease term.

- Security systems: For leased security systems, such as surveillance cameras and alarms, the corresponding ROU asset and liability must be recognized in the financial statements. The lease term, including any renewal or purchase options, must be assessed to ensure compliance with accounting standards.

- Networking equipment: Leased networking infrastructure, including routers and servers, requires recognition as an ROU asset and lease liability. Retailers must track lease payments and allocate them correctly to align with the lease term and interest rates stipulated in the agreement.

- Self-checkout kiosks: These systems are considered leased equipment under IFRS 16 and ASC 842, requiring accurate reporting of ROU assets and liabilities. Retailers must also assess how the kiosks impact their operational efficiency and customer service while ensuring proper financial reporting.

- Digital signage: Leasing digital signage systems is similarly treated under lease accounting standards, with the ROU asset and lease liability being recorded. Retailers must manage these leases carefully, ensuring accurate depreciation and amortization calculations, especially for short-term or seasonal leases.

Fleet and transportation assets

Leasing fleet and transportation assets is crucial for retail logistics and mobility, and these leases are subject to the same accounting treatment as other equipment leases under IFRS 16 and ASC 842.

- Delivery vehicles: Leased delivery vehicles must be recognized as ROU assets, with a corresponding lease liability. Retailers must track lease payments and any performance metrics that impact the lease term, ensuring accurate reporting in financial statements.

- Logistics and freight equipment: Leased forklifts, pallet jacks, and other transportation-related equipment must be accounted for in the same manner, with the ROU asset and lease liability recognized on the balance sheet. Any embedded lease terms, such as maintenance or operational clauses, must be incorporated into lease accounting practices.

- Corporate fleet for employee mobility: Leases for vehicles used by employees for operational tasks must also be captured under lease accounting standards. These leases may involve varying lease terms and costs, requiring careful attention to detail for compliance with IFRS 16 and ASC 842.

By leveraging leased real estate, equipment, and fleet assets, retail businesses can focus on strategic growth, operational optimization, and adapting to market demands. Leasing offers flexibility and scalability, helping retailers remain competitive in a rapidly changing global environment.

Discover our buyer’s guide with RFP scorecard designed to simplify the selection of lease accounting solutions for the retail industry. With tailored evaluation criteria and practical insights, this guide helps you navigate the decision-making process and identify the tools best suited to your organization’s unique needs.

How lease accounting software solves complex challenges for global retailers in each step of the lease lifecycle

Challenge 1: Large, global, and multi-faceted retail portfolios

Managing large, global, multi-faceted retail portfolios presents several complexities for lease accountants, especially when dealing with mass lease management across multiple locations, currencies, calendars, and contracts. Retail enterprises with a global footprint often have thousands of leases to manage, each with unique terms and conditions. The challenge lies in ensuring accurate and efficient lease accounting while maintaining consistency and compliance across diverse regions and jurisdictions.

- Mass lease management across multiple locations: Retailers operate in various regions, often leasing both real estate and equipment at multiple locations, including retail stores, warehouses, distribution centers, and corporate offices. Each location may have different lease terms, asset types, and reporting requirements. Additionally, managing leases in multiple languages to ensure clear communication and understanding across global teams is essential. Accurately tracking leases across many locations and ensuring consistent application of accounting standards is critical. Failure to do so can lead to discrepancies in lease liabilities and right-of-use (ROU) assets, affecting financial reporting and compliance.

- Multi-currency management: For global retailers, dealing with multiple currencies is a constant challenge. Lease agreements in different countries involve payments in local currencies, and fluctuations in exchange rates can impact lease liabilities and ROU assets over time. Without robust tools to handle multi-currency management, retail companies risk errors in financial reporting due to incorrect translation of lease data into the company's reporting currency.

- Multi-calendar management: Retailers operate in various fiscal calendars, with each region or country following different reporting periods. Aligning lease accounting with diverse local fiscal calendars while maintaining a consistent internal reporting period is a critical task. Failure to properly align lease payments, liabilities, and assets with the company’s accounting periods can result in inaccurate financial statements.

- Handling multi-contract structures: In a global retail environment, lease agreements are often not straightforward. Retailers may manage various types of lease contracts, such as real estate leases, equipment leases, and mixed contracts. Each lease may have different terms, including rent escalations, renewal options, variable rents based on sales, co-tenancy clauses, and embedded leases. Managing these diverse contracts under one unified system can be challenging.

How Nakisa solves large, global, and multi-faceted retail portfolio challenges

Several features in Nakisa Lease Accounting are designed to help retailers manage the complexities associated with large, global lease portfolios. These features address key challenges in lease accounting, ensuring accurate financial reporting and operational efficiency across regions and jurisdictions.

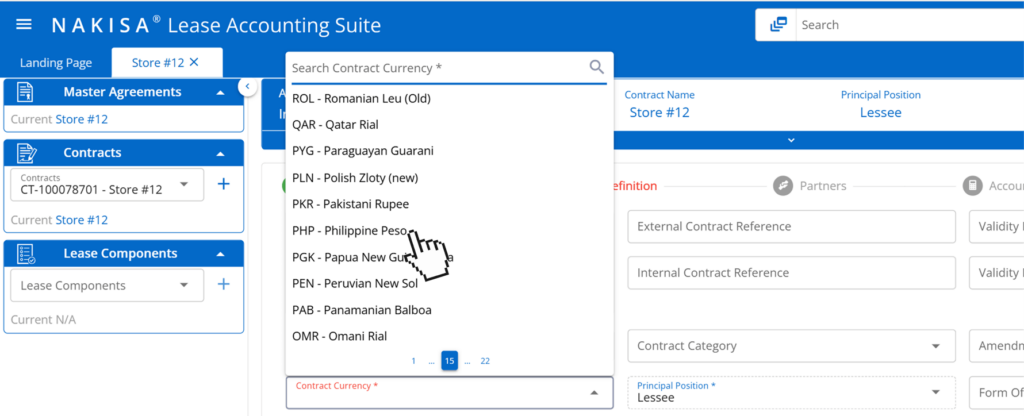

- Multi-currency capabilities: For retailers with international portfolios, managing leases in various currencies is essential. Nakisa Lease Accounting simplifies this challenge by offering robust multi-currency capabilities. Retailers can easily manage rent payments and lease calculations in different currencies, ensuring accurate conversions and financial reporting across regions. This feature helps retailers maintain compliance with accounting standards in multiple countries, while streamlining processes and mitigating risks associated with exchange rate fluctuations between contract, functional, and reporting currencies.

In Nakisa Lease Accounting software, users can apply any type of contract currency to support global lease portfolios.

- Mass operations, automation, reversal, and detailed logs: Nakisa Lease Accounting streamlines large-scale lease management with powerful mass operations tools. Mass data import ensures efficient, accurate handling of vast datasets with validation and error resolution. The mass event management tool enables bulk modifications to lease components, simplifying updates to terms and ROU asset values. Bulk integration automates tasks like transaction postings, workflows, and asset remeasurements, saving time for portfolios with hundreds of leases. Mass reversals and period adjustments allow accurate historical updates, while the job posting scheduler automates month-end activities with detailed logs for real-time tracking.

Interactive demo: Mass indexation

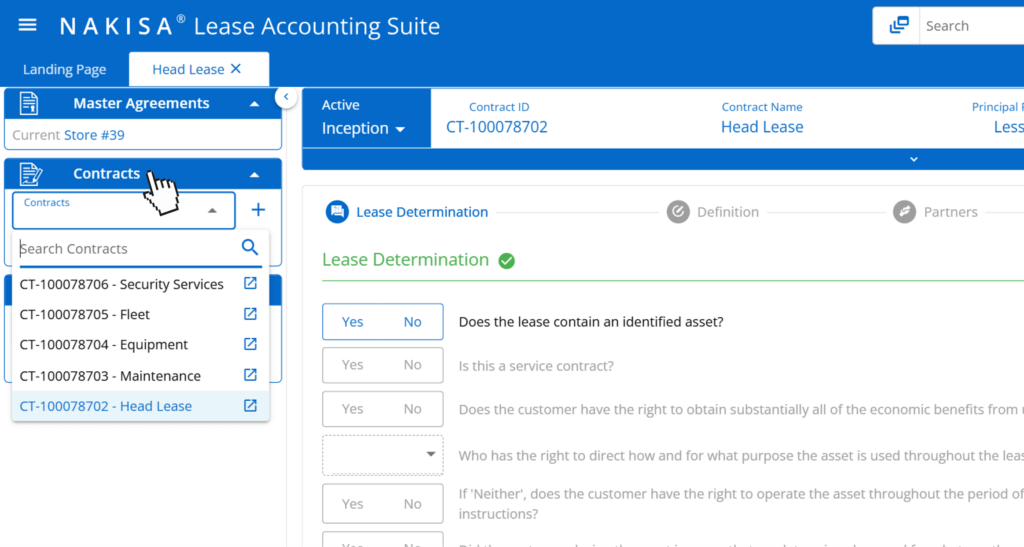

- Contract tracking and management: Retailers often deal with multiple contracts associated with a single location, such as head leases and various service agreements (e.g., security, maintenance). Nakisa Lease Accounting provides a feature that enables users to track and manage multiple contracts per master lease agreement. This allows contract managers to oversee all associated agreements, conditions, and payment processes at the premises level. Additionally, users can attach lease contract files in various formats, ensuring they have easy access to the original lease agreements at any time. By centralizing contract management, retailers gain better visibility, accuracy, and control over their financial and operational obligations across different locations.

In Nakisa Lease Accounting software, users can track and manage multiple contracts under the same master lease agreement.

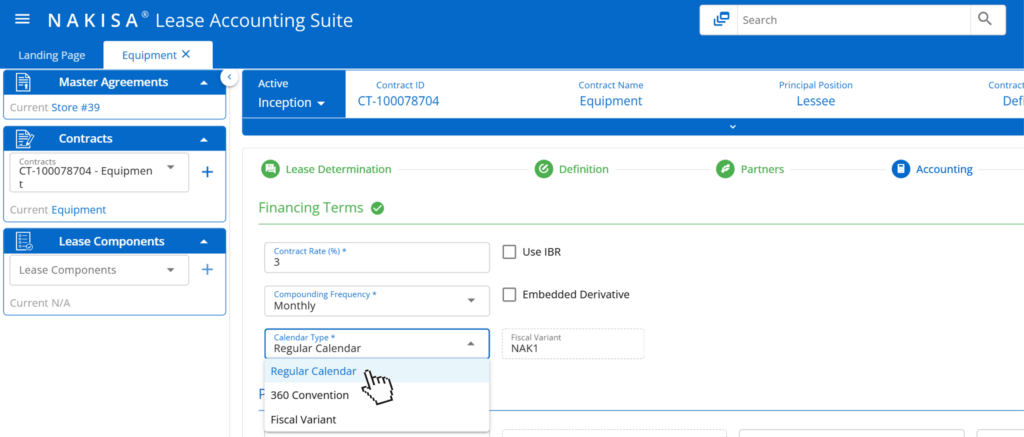

- Multi-calendar support: Nakisa Lease Accounting offers multi-calendar support, allowing users to manage leases across non-standard calendars (e.g., 4-4-5, 4-5-4, or other custom calendars). This ensures accurate alignment of lease entries with a retailer's unique financial reporting periods, regardless of the local fiscal calendar variations. By offering flexibility in calendar management, Nakisa Lease Accounting helps retailers maintain consistent and precise lease accounting, regardless of regional differences in calendar systems.

Nakisa Lease Accounting software supports various calendar types such as regular calendar, 360 convention, and fiscal variant.

- Multi-language support: Nakisa Lease Accounting is equipped with multi-language functionality, enabling retailers to operate seamlessly across global teams with diverse language needs. This feature ensures that all users, regardless of their location, can access lease information in their preferred language, improving communication and reducing errors. It supports global operations, making compliance with local regulations more efficient and enhancing the overall user experience for multinational teams.

Olof Ruhe

Product Owner, Tax and Statutory Reporting at Volvo Car

Case study: Walmart’s global lease accounting and compliance success with Nakisa

To comply with ASC 842 and IFRS 16, Walmart required a robust solution to manage its extensive, global, and diverse lease portfolio. Walmart needed a system capable of integrating diverse data, including vendors, exchange rates, cost objects, and asset classes, while ensuring accurate multi-currency remeasurement and reporting. Below are the key figures illustrating the scale of Walmart’s lease accounting challenges:

- Global presence: 10,500+ stores in 24 countries and e-commerce websites in 10 countries

- Number of contracts: 65,000+ globally

- Type of lease assets: Equipment, movable assets, and real estate

- ERP systems: SAP S4/HANA and ECC

Thanks to Nakisa Lease Accounting, Walmart achieved parallel compliance with ASC 842 and IFRS 16, multi-ERP integration, multi-currency management, and scalability across multiple regions and legal entities. This success underscores the power of Nakisa Lease Accounting to handle the complexities of large-scale, global lease portfolios with precision and reliability.

Shawn Husband

Senior Director, Lease Center of Expertise at Walmart

Challenge 2: Complex fixed and variable rent calculations

The management of fixed and variable rent calculations presents a significant challenge for retail lease accountants. Retail leases frequently combine fixed rents with escalation clauses and variable rents, both of which require rigorous tracking, precise calculation, and continual adjustment to ensure compliance with accounting standards and accuracy in financial reporting.

Escalation clauses

While fixed rent structures are generally predictable, the inclusion of escalation clauses adds a layer of complexity. Escalation clauses, often tied to inflation, market conditions, or periodic reviews, can significantly alter rent obligations over the lease lifecycle. Let’s delve into how these clauses impact lease accounting and financial reporting:

- Escalation tracking and forecasting: Escalation clauses often stipulate that rent will increase at predefined intervals, typically linked to indices such as the Consumer Price Index (CPI) or specified by a fixed percentage. Accurately projecting these increases is critical for maintaining the integrity of lease liability and right-of-use (ROU) asset calculations. Monitoring the timing and application of these increases is crucial for budgeting, forecasting, and ensuring financial statements reflect the most current terms of the lease.

- Varying legal requirements and external factors: For global retailers, managing escalation clauses is particularly challenging due to varying legal requirements for rent increases across locations, currency fluctuations affecting escalation calculations, and diverse market conditions influencing fair escalation rates. Gaining proper visibility into these fluctuations is key, enabling strategies like hedging to protect against foreign exchange losses. These factors require robust systems to adapt to regional differences and maintain compliance with lease accounting standards.

- Complexity in lease renewal or termination: When leases are renewed or terminated, the application of escalation clauses may change. In renewals, new terms can result in significant alterations to rent escalation schedules. For accountants, this necessitates recalculating lease liabilities and ROU assets to reflect the new agreement. Any miscalculation or delay in reassessing these terms can lead to material errors in financial reporting, potentially resulting in a budget deficit or, in some cases, insufficient funds to manage payments.

- Impact on financial reporting: The mismanagement of escalation clauses can result in discrepancies in both the balance sheet and income statement. Underestimating or overestimating future rent payments—due to incorrect assumptions about escalation calculations—can lead to misstatements that affect compliance with accounting standards, such as IFRS 16 and ASC 842. These errors can have a lasting impact on the financial health and reporting accuracy of the retail entity.

How Nakisa solves escalation clause challenges for global retailers

Nakisa’s lease accounting software streamlines the management of escalation clauses using robust forecasting and escalation tracking capabilities:

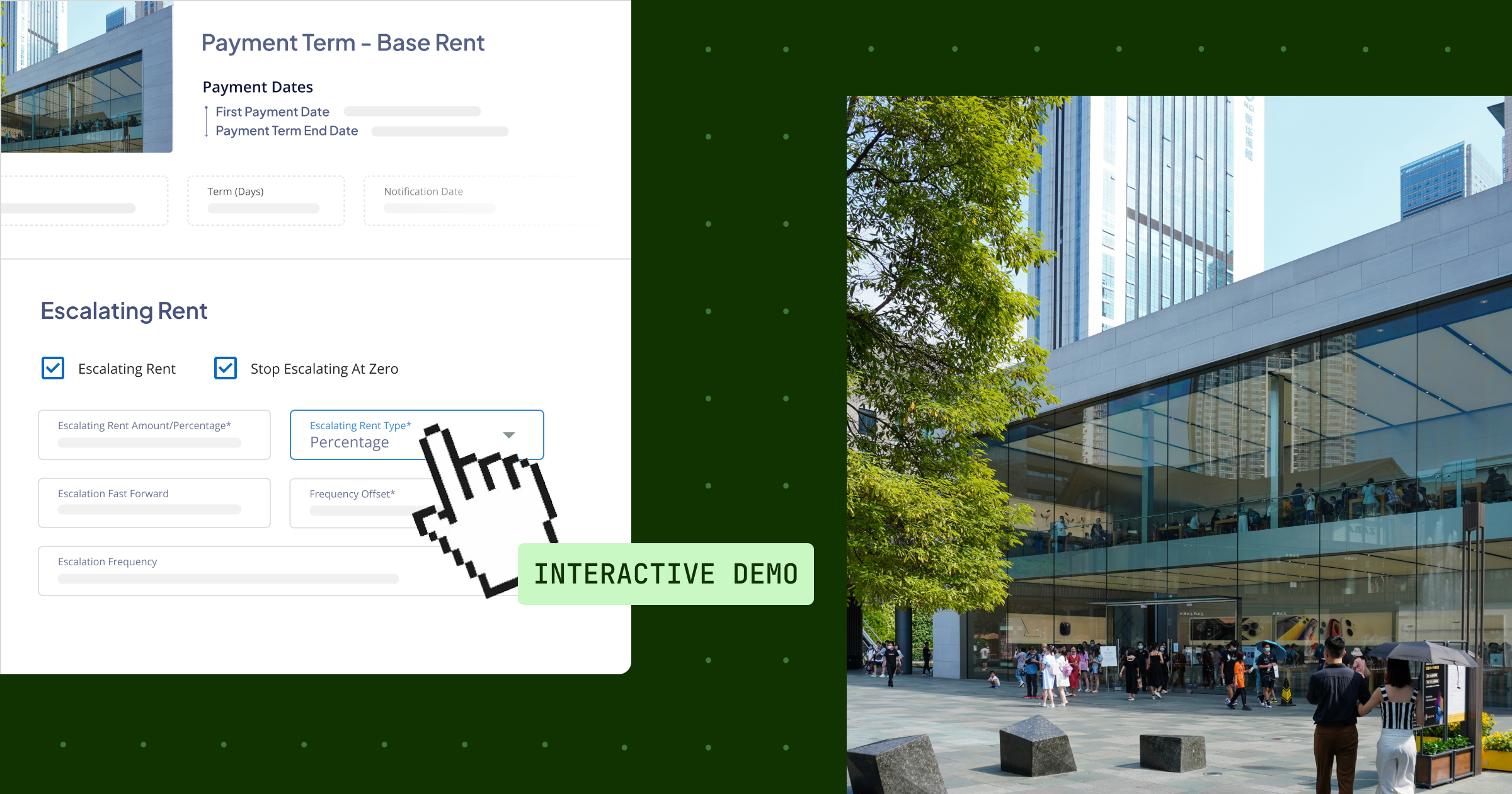

- Accurate escalation projections: The Payment Term module in Nakisa Lease Accounting allows users to manage escalating rates and contract amendments with ease, providing a comprehensive audit trail to ensure compliance and accuracy. Users can automate the calculation of future rent increases based on lease terms, adjusting for applicable indices or fixed percentages, thereby eliminating manual efforts and minimizing the risk of errors.

Interactive demo: Escalating rent

- Real-time adjustments: As escalation clauses take effect, Nakisa Lease Accounting updates lease liabilities and right-of-use (ROU) asset calculations in real-time, ensuring that the financial statements reflect the most current terms.

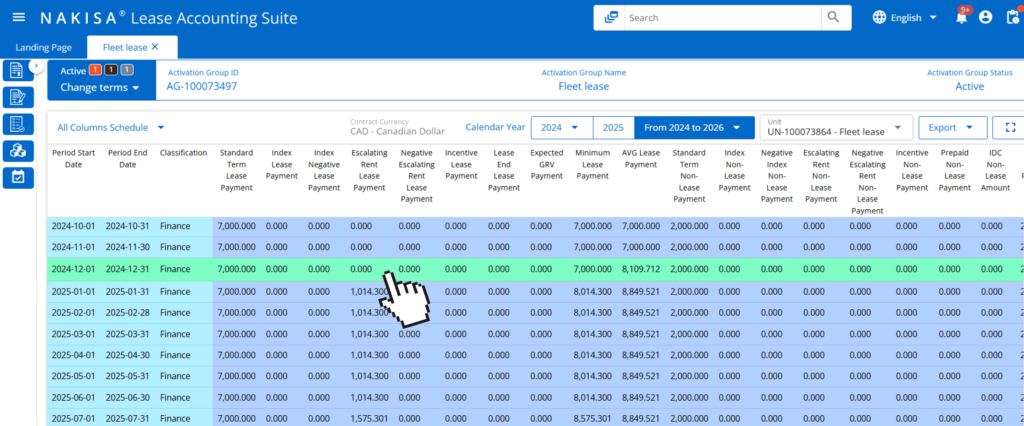

In Nakisa’s all-column schedule, users can track and view details of the exercised event highlighted in the green row.

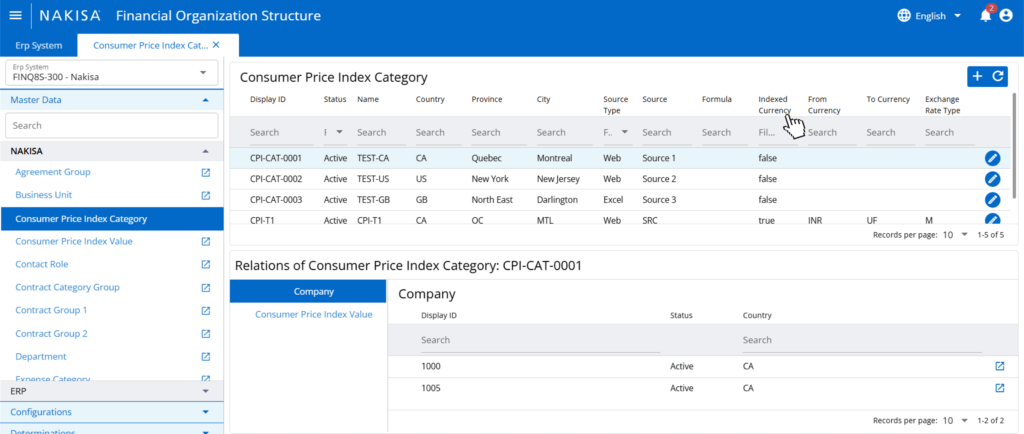

- Efficient management of CPI adjustments: Together, Nakisa Lease Management (NLM) and Nakisa Lease Accounting (NLA) provide an integrated solution—NLM ensures accurate operational calculations, while NLA ensures compliance and financial reporting alignment—allowing retailers to efficiently manage CPI escalations with flexibility and accuracy. Nakisa Lease Management provides the operational foundation for managing CPI adjustments, supporting multi-category CPI configurations for regional compliance. Its formula-based CPI computation enables the creation of custom Global CPI categories, blending multiple CPI inputs with specific rates to ensure precise regional inflation adjustments. These capabilities help retailers stay compliant with local regulations through composite CPI configurations. Nakisa Lease Accounting complements this by handling the accounting aspects of CPI adjustments. It allows lessees to set Conditional Indexation with ceiling and floor rates, defining CPI applicability limits within lease agreements. This ensures that CPI adjustments align with financial policies, protecting both landlords and tenants while facilitating smoother accounting processes.

In Nakisa’s Financial Organization Structure, users can define information related to the consumer price index category.

- Seamless renewal and termination handling: In the event of a lease renewal or termination, Nakisa efficiently recalculates the lease terms, adjusting for any new escalation clauses or changes in rent structures. This ensures that lease obligations and ROU assets are correctly adjusted and compliant with the latest terms of the lease.

Percentage rent

Retail leases with variable rent components, particularly those involving performance-based elements such as percentage rents tied to sales, further complicate accounting efforts. These rents fluctuate with business performance, requiring continuous monitoring and adjustment. Let’s explore the main challenges with managing variable rent components in retail leases:

- Percentage rent and sales performance calculation: Percentage rent calculations require precise tracking of sales data to ensure that rent obligations are accurately calculated. Any errors or delays in capturing sales performance can lead to underreporting or overreporting of rent expenses, which must be corrected through periodic adjustments.

- Reconciliation of rent adjustments: Many leases with variable rent terms require periodic reconciliation (true-ups) based on actual sales data. Retail lease accountants must ensure these adjustments are processed correctly and in a timely manner. Inaccurate reconciliations can distort lease obligations, leading to discrepancies in financial statements that may trigger non-compliance with relevant accounting standards.

How Nakisa solves percentage rent challenges for global retailers

Nakisa Lease Management (NLM) provides features that simplify the tracking and reconciliation of percentage rent calculations with seamless, no-touch integration with Nakisa Lease Accounting (NLA):

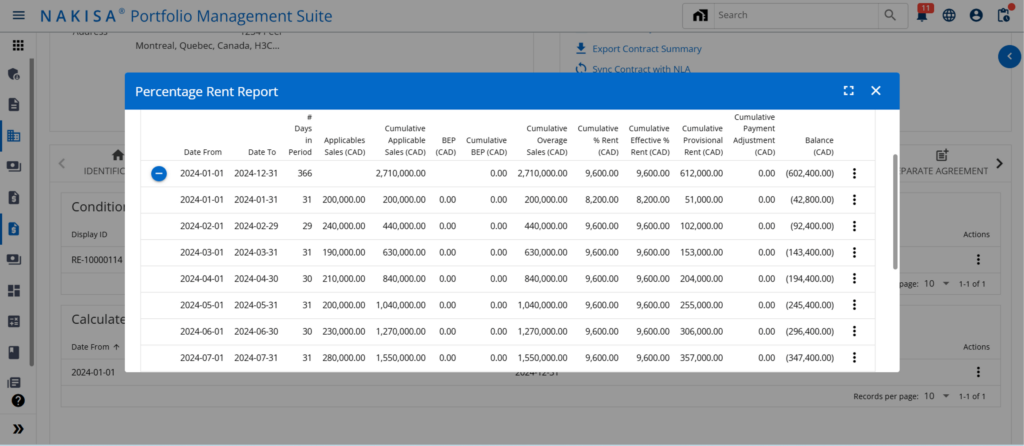

- Sales data integration and percentage rent calculations: Nakisa Lease Accounting integrates seamlessly with Nakisa Lease Management, handling complex percentage rent calculations. NLM allows users to define advanced percentage rent formulas tailored to their business needs, incorporating if-else statements, comparison operators, minimum and maximum values, absolute values, excluded categories, and more. Variables such as total sales, sales per category, days in period, or days in adjusted period can be integrated into these calculations, offering unmatched flexibility to accommodate diverse rent structures and financial arrangements. NLA then uses the calculated data from NLM to ensure precise rent tracking, eliminating manual calculations and maintaining accurate financial reporting.

In Nakisa Lease Management software, users can generate percentage rent reports and calculations.

- True-up and reconciliation: Nakisa Lease Management supports the reconciliation of rent adjustments, ensuring that any variances between estimated and actual sales are captured and corrected in a timely manner. This feature automates the true-up process, reducing the risk of underreporting or overreporting rent obligations.

- Accurate financial reporting: By automating percentage rent calculations and ensuring timely reconciliations, Nakisa Lease Accounting prevents discrepancies in financial statements, ensuring compliance with accounting standards such as IFRS 16 and ASC 842. This allows retail lease accountants to maintain the accuracy of their financial reporting, even when rents fluctuate based on performance.

Nakisa’s software simplifies the management of complex fixed and variable rent structures by automating calculations, managing escalation clauses, and accurately tracking percentage rents. This ensures compliance, reduces manual errors, and provides retail accountants with the tools to efficiently handle the intricacies of lease agreements.

Challenge 3: Complex lease structures

The intricate nature of retail lease structures introduces several unique challenges for lease accountants. Subleasing arrangements and embedded leases clauses often create accounting complexities that require specialized expertise to manage effectively while remaining compliant with IFRS 16 and ASC 842.

Subleasing arrangements

Subleasing is a common practice for global retailers to maximize underutilized spaces or adjust to changing market conditions. It gives rise to a unique challenge known as a "sandwich lease." This occurs when a retailer (acting as the intermediate lessee) leases property from a landlord and subsequently subleases all or part of that property to a third party. The term "sandwich lease" reflects the intermediary's position between the landlord and the subtenant, effectively acting as both a lessee and a lessor within the same property.

Retailers frequently use subleasing to optimize costs and space. Department stores may sublease sections to beauty brands, big-box retailers might lease space to coffee shops, and grocery chains often sublease to pharmacies. These arrangements allow retailers to remain agile while enhancing customer convenience.

- Dual roles as lessee and lessor: Subleasing arrangements place the retailer in the dual role of lessee to the primary property owner and lessor to the subtenant. Managing this duality requires separate accounting treatments for the lease liability (as a lessee) and lease income (as a lessor), complicating financial reporting.

- Lease liability and ROU adjustments: Subleasing often necessitates the reassessment of the right-of-use (ROU) asset and lease liability. Retail lease accountants must accurately remeasure these components to reflect the subleased portion of the asset.

- Compliance with lease modifications: If the terms of the original lease are modified to accommodate subleasing, additional calculations may be required to ensure compliance with IFRS 16 and ASC 842, increasing administrative effort and the likelihood of errors.

How Nakisa solves subleasing arrangements challenges for global retailers

Nakisa Lease Accounting addresses subleasing arrangements challenges by offering:

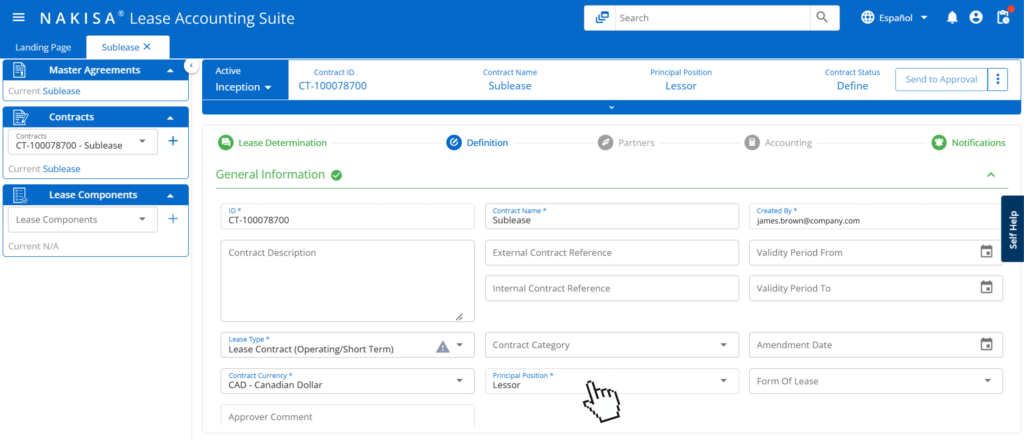

- Lessor accounting: Nakisa automates the process of managing dual roles as lessee and lessor. The software separates the lease liability (as a lessee) and lease income (as a lessor) and applies the appropriate accounting treatment for each, ensuring compliance with IFRS 16 and ASC 842. Nakisa Lease Accounting's lessor accounting module supports operating, sales-type, and direct financing leases, streamlines event management for individual and bulk leases, and handles modifications efficiently. The module provides automated financial schedules, periodic postings, and detailed reports, enhancing accuracy and supporting effective lease portfolio management.

Nakisa’s lessor accounting module supports operating, sales-type, and direct financing leases and handles calculations efficiently

- Lease liability and ROU asset reassessment: The software automatically recalculates the ROU asset and lease liability when subleasing occurs, ensuring that these components accurately reflect the subleased portion of the asset. This reassessment eliminates the risk of errors and ensures accurate financial reporting.

- Seamless lessee and lessor accounting integration: Nakisa Lease Accounting ensures seamless integration between lessee and lessor accounting. Any changes made in lessor accounting are automatically reflected in the lessee accounting, streamlining workflows and ensuring consistency across both sides of the lease transaction.

Embedded leases

Embedded leases refer to lease components that are embedded within larger service or outsourcing agreements. For example, a retailer might outsource its digital signage operations or third-party logistics, and the contract might include the use of specific equipment or assets that qualify as leases under accounting standards.

- Identification of embedded lease components: The primary challenge lies in identifying lease components within broader service agreements. Retail accountants must analyze contracts to determine whether a particular arrangement conveys control over a specific asset, as required by lease accounting standards.

- Separation of lease and non-lease components: Once identified, the lease and non-lease components must be accounted for separately. This process requires accurate allocation of contract payments, which can be time-consuming and error-prone without automated tools.

- Ongoing monitoring of contracts: Retailers often enter into long-term outsourcing agreements that evolve over time. Accountants must continuously monitor these agreements for changes that could impact the accounting treatment of embedded leases.

How Nakisa solves embedded lease challenges for global retailers

Nakisa Lease Accounting helps retail accountants handle these complexities by offering:

- AI-powered lease abstraction: Nakisa’s AI-powered lease abstraction feature streamlines the management of complex lease structures, including embedded leases, by automatically extracting and organizing key lease information. It quickly identifies important lease terms, renewal options, clauses, and conditions, consolidating all relevant data into a central database. This approach reduces the risk of errors, ensures compliance, and ensures that no crucial lease obligation is overlooked, improving both operational efficiency and accuracy.

- Separation of lease and non-lease components: Once embedded lease components are identified, Nakisa automates the process of separating lease and non-lease components. It allocates contract payments accurately between the two, ensuring that the appropriate lease-related payments are accounted for as required by IFRS 16 and ASC 842.

Nakisa Lease Accounting software supports non-lease components with dedicated fields and tailored calculations that adapt to the user's specific needs.

- Ongoing monitoring and adjustment: Nakisa Lease Accounting continuously monitors the evolving contracts for changes that could impact the classification or treatment of embedded leases. This feature allows retail lease accountants to stay on top of long-term agreements and adjust lease calculations accordingly.

Whether dealing with complex sublease arrangements or identifying embedded leases, Nakisa’s solution reduces manual errors, enhances visibility, and ensures that all lease obligations are met. Enterprise retailers can confidently manage these intricate lease structures, improving efficiency and maintaining full compliance across their lease portfolios.

Alanna Bilben

Business Transformation IT RTR Lead at 3M

Challenge 4: CAM, insurance and tax reconciliation

Lease reconciliation is a critical process in lease accounting, ensuring that all lease-related expenses and income are accurately recorded and reconciled. For retail lease accountants, one of the most significant aspects of this process involves Common Area Maintenance (CAM) costs, which are typically shared between the landlord and tenants in multi-tenant properties. CAM includes expenses for maintaining shared spaces, such as parking lots, lobbies, and hallways. In addition to CAM costs, insurance and tax reconciliation play crucial roles in the lease reconciliation process. Insurance premiums related to the leased property must be accounted for, ensuring that both the landlord and tenants' contributions are appropriately recorded. Similarly, tax reconciliation ensures that property taxes, which are often passed on to tenants, are correctly calculated and allocated. Ensuring the accuracy of these elements is vital to maintaining proper financial records and meeting compliance requirements.

- Distinguishing lease vs. non-lease components: One of the key challenges with CAM, insurance and tax costs is determining whether they should be classified as lease or non-lease components. Under IFRS 16 and ASC 842, the allocation between lease and non-lease components is essential for accurate financial reporting and lease liability management.

- Variable CAM expenses and lease reassessments: In many cases, CAM costs are variable and can change year by year based on the operating expenses of the property. This creates challenges when recalculating lease liabilities, especially when the CAM expenses increase significantly. Retail lease accountants must regularly reassess lease terms and ensure that the projections for variable CAM costs are updated accordingly in the financial records. A failure to track changes in CAM costs can result in inaccurate calculations for lease liabilities and operating expenses.

- Lease reconciliation with non-standard accounting calendars: Retailers often utilize non-standard accounting calendars to align their financial reporting with seasonal and operational cycles, deviating from the traditional monthly or quarterly schedules. Common examples include the 4-4-5, 4-5-4, 5-4-4, 13-period, and retail calendars. These customized calendars can simplify internal reporting and budgeting but present challenges for lease reconciliation. Aligning CAM, insurance, and tax charges, rent payments, and other variable costs with a retailer's unique fiscal cycles requires tailored processes and calculations, complicating the reconciliation process.

How Nakisa solves CAM, insurance, and tax reconciliation challenges for global retailers

Nakisa Lease Accounting and Nakisa Lease Management empower users to address the complexities of lease reconciliation effectively. Here’s how it supports users in managing these challenges:

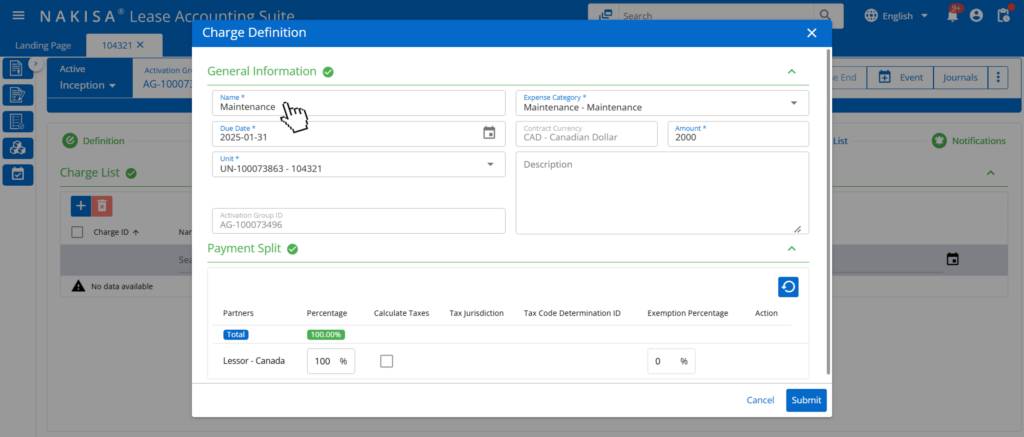

- Lease reconciliation management: Nakisa Lease Management software simplifies the management of shared expenses between landlords and tenants, including CAM, tax, and insurance charges. Retailers can efficiently upload these charges in bulk using the mass import tool, enabling quick and accurate reconciliation. The software allows global retailers to upload landlord invoices, which automatically populate CAM, tax, and insurance charges on a yearly basis. This streamlined process helps track accrued expenses against total costs, while considering lease conditions such as pro-rata shares, expense caps, and limits. Nakisa also assists retailers in identifying discrepancies and resolving year-end vendor invoice disputes across multiple leases. By automating mass operations, the software enhances efficiency, ensures accurate tenant billing, and reduces errors and penalties in managing CAM, tax, and insurance expenses.

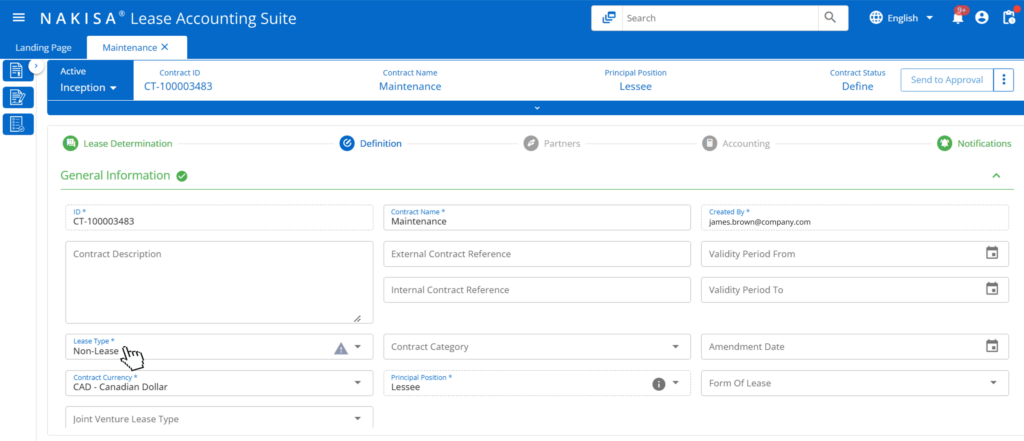

- Lease and non-lease components classification: In Nakisa Lease Accounting, users can easily classify CAM, insurance, and tax costs into lease and non-lease components to ensure compliance with IFRS 16 and ASC 842. Certain CAM expenses can be included as part of the lease by incorporating them into the base rent and assigning the appropriate expense category, particularly for maintenance. Alternatively, these expenses can be treated as separate non-lease amounts. The software offers the flexibility to allocate a single expense across multiple expense categories and consolidate them into one main account. This functionality allows users to clearly identify lease-related expenses, such as security and HVAC maintenance, while accurately distinguishing non-lease components like marketing services, reducing the risk of misclassification.

In Nakisa’s software, additional expenses such as maintenance can be defined within the Charge Definition functionality.

- Accurate reporting of CAM, insurance, and tax costs and lease liabilities: Users can maintain accurate records by recalculating lease liabilities and ROU assets when CAM, insurance, and tax costs are included in lease agreements. With detailed audit trails, users have the confidence to support compliance efforts and ensure precise financial reporting.

- Efficient management of variable CAM expenses: On Nakisa Lease Accounting, users can track and update variable CAM costs throughout the lease term, ensuring financial records reflect any changes. With automated lease reassessments and proactive notifications, users can stay ahead of fluctuations, preventing inaccuracies in lease liabilities and operating expenses.

By providing these capabilities, Nakisa Lease Accounting enables users to streamline processes, enhance accuracy, and maintain compliance while handling the complexities of CAM, insurance, and tax costs and lease reconciliation.

Dana Jircikova

Head of Capital and Financial Investments Reporting at Nestlé

Challenge 5: Taxation

Enterprise retailers face significant challenges in managing tax obligations across their lease portfolios. With complex tax regulations varying by region and lease type, ensuring compliance and accuracy can be cumbersome. The dynamic nature of lease agreements, especially with modifications, further complicates tax management.

- Multi-jurisdictional compliance: Navigating the complexities of differing tax regulations across regions, especially for global retailers, requires constant vigilance and adjustment to stay compliant.

- Complex tax laws: Retailers must comply with intricate and ever-changing tax laws, such as value-added tax (VAT) and sales tax, which often have different treatment for lease accounting based on location and lease type.

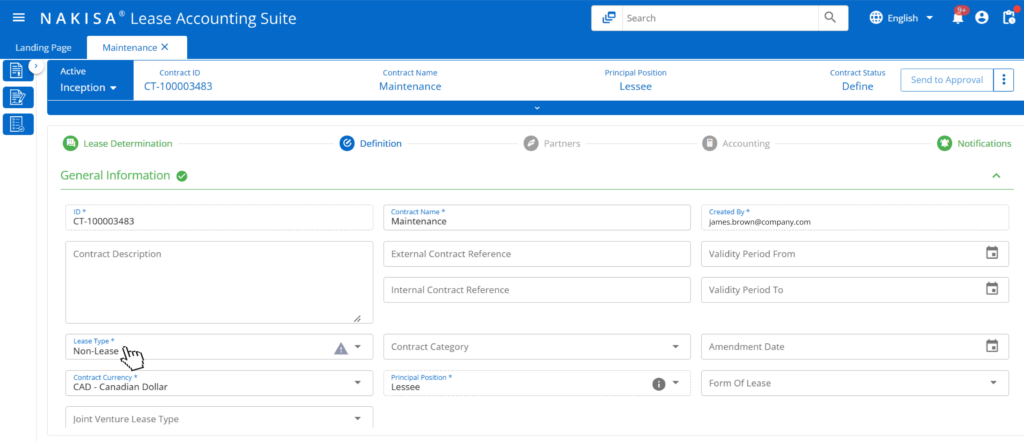

- Lease type and tax treatment: Different lease types, such as operating versus finance leases, have distinct tax implications, necessitating careful classification and treatment to avoid errors in tax calculations.

- Tax calculation accuracy: Manual tax calculations can lead to errors and inefficiencies, especially for large portfolios with complex lease structures. Accurate tax reporting is essential to prevent penalties and audits.

- Recalculation due to lease modifications: Changes in lease terms, such as renewals or terminations, can affect the tax treatment of leases, requiring timely updates to ensure tax obligations are accurately adjusted.

How Nakisa solves taxation challenges for global retailers

Nakisa Lease Accounting provides a comprehensive solution to the taxation challenges enterprise retailers face, offering automation, real-time updates, and seamless integration to ensure compliance with complex tax laws across multiple jurisdictions. Here's how Nakisa addresses these challenges:

- Multi-jurisdictional tax management: Nakisa’s software supports complex tax calculations across various jurisdictions, ensuring that retailers can manage VAT, sales tax obligations in line with local regulations. The system administrator can configure the tax settings to True, enabling the setup for both Tax and No Tax Jurisdiction for each country and linking the appropriate company code to its respective country. This streamlined process ensures that tax treatments are tailored to regional requirements, maintaining compliance wherever retailers operate. Additionally, tax amounts are included in journal entries and displayed alongside vendor payments, providing a comprehensive view of tax-related transactions.

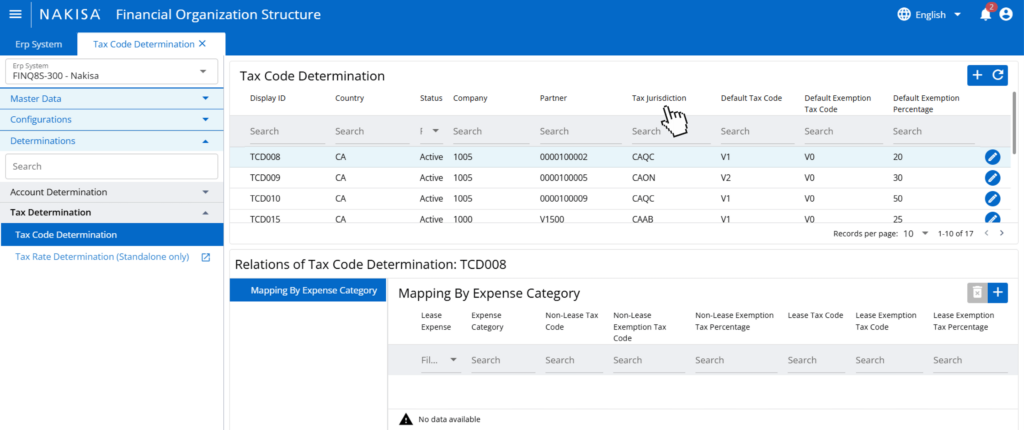

In Nakisa’s Financial Organization Structure, users can configure information related to the tax code determination.

- Flexible tax treatment configuration: Nakisa’s solution allows retailers to define specific tax treatments by setting up jurisdictions, tax codes, tax rates, countries, company codes, and exemption rates. This flexibility ensures that tax calculations are accurately aligned with local tax regulations, optimizing tax strategies and compliance while minimizing manual intervention.

- Automated tax calculations and adjustments: By automating tax calculations based on lease type category and jurisdiction, Nakisa reduces the burden of manual calculations. The software automatically adjusts tax obligations as lease terms change, whether due to renewals, modifications, or terminations. This feature ensures accurate tax reporting and minimizes the risk of underreporting or overreporting.

- Real-time tax updates: With real-time updates to lease data, Nakisa ensures that tax obligations are always based on the most current lease terms. As leases are modified or renewed, the platform automatically recalculates taxes, keeping tax records accurate and up to date without the need for manual intervention.

Taxation is a complex challenge for enterprise retailers, with varying tax laws and the need for accurate, real-time updates. Nakisa Lease Accounting simplifies this by automating tax calculations, ensuring compliance with complex regulations, and offering flexible tax treatment. This unified approach helps retailers reduce errors and stay compliant, improving efficiency in lease management.

Challenge 6: Compliance with accounting standards

For global retailers, compliance with accounting standards such as IFRS 16, ASC 842, and local GAAP is both critical and complex. These standards mandate strict rules for lease classification, recognition, and reporting, creating significant challenges for retailers managing large and diverse lease portfolios.

- Accurate lease classification: Leases must be classified as either finance or operating leases based on specific criteria. Misclassification can lead to incorrect financial reporting, penalties, and reputational damage. Retailers often face difficulty in interpreting lease terms, especially for embedded leases or variable payment structures.

- Non-lease components identification: Identifying and separating non-lease components, such as maintenance or services, from the lease itself can be a complicated process. Incorrectly including these components as part of the lease can lead to incorrect asset and liability calculations, which may result in non-compliance with accounting standards.

- Lease data centralization and accuracy: Retailers often manage leases across multiple locations and jurisdictions. Consolidating lease data for compliance purposes is time-intensive and prone to errors, especially when lease terms vary significantly. Missing or incomplete data can lead to non-compliance during audits.

- Financial reporting and disclosure requirements: Under IFRS 16 and ASC 842 standards, lessees must recognize right-of-use (ROU) assets and lease liabilities on the balance sheet for nearly all leases, eliminating the previous off-balance-sheet treatment of operating leases. These lease liabilities must be measured at the present value of future lease payments, with the ROU assets reflecting the same value, adjusted for factors like initial direct costs. Additionally, both standards require detailed disclosures in the financial statements, including lease terms, payment schedules, and the nature of lease expenses, to provide clear insight into a company’s lease obligations.

- Handling lease modifications, renewals, and terminations: Lease modifications, renewals, and terminations significantly impact accounting compliance. Retailers must reassess lease terms, adjust right-of-use (ROU) assets and liabilities, and account for changes to certain clauses, lease terms, or payment schedules in accordance with IFRS 16 and ASC 842. Failure to capture these changes accurately can result in material misstatements or audit findings.

How Nakisa ensures compliance with accounting standards for global retailers

Nakisa Lease Accounting (NLA) empowers enterprise retailers to achieve compliance with IFRS 16, ASC 842, and local GAAP. Let’s explore the software’s main compliance features:

- Parallel compliance with ASC 842, IFRS 16, and local GAAP: Nakisa’s lease accounting software ensures seamless compliance with ASC 842, IFRS 16, and local GAAP by supporting the recognition of ROU assets, lease liabilities, and efficient management of complex lease classifications and modifications. It allows for simultaneous management of leases across all standards on a single platform, generating disclosure reports in compliance with each standard’s requirements.

- Flexible treatment of lease and non-lease components: Nakisa’s software accommodates both combined and separated treatment of lease and non-lease components, providing dedicated fields and calculations to fit the user’s choice.

Nakisa Lease Accounting software supports non-lease components with dedicated fields and tailored calculations that adapt to the user's specific needs.

- Asset-level accounting: Nakisa’s lease accounting software provides asset-level tracking, enabling precise management of multiple lease assets within a single contract. Each asset, with its own lifecycle, including unique amortization periods, start and end dates, and specific events like modifications, renewals, buyouts, and terminations, is tracked individually. This granular approach ensures accurate management in compliance with accounting standards and provides detailed financial reporting.

- Auditable reports: Nakisa enables the generation of audit-ready reports with advanced drill-down capabilities, ensuring full compliance with IFRS 16, ASC 842, and local GAAP. The platform supports complex financial calculations, such as the measurement of right-of-use (ROU) assets and lease liabilities, while offering both standard and customizable reports. Nakisa offers comprehensive financial reports such as Income Statement, Balance Sheet, and Cash Flow, along with detailed disclosure reports, including Asset Roll Forward, Lease Liability, Weighted Average Lease Term, Weighted Average Discount Rate, and Maturity Analysis, which support regulatory filings like 10-K and 10-Q. It also provides transactional and management reports, such as Consolidated Financial Schedules, Periodic Posting Status, Contract Expiration, and Data Quality and Integrity (DQI). Multi-dimensional reporting allows for scenario analysis and forecasting, evaluating the financial impact of different lease strategies.

Interactive demo: Reports

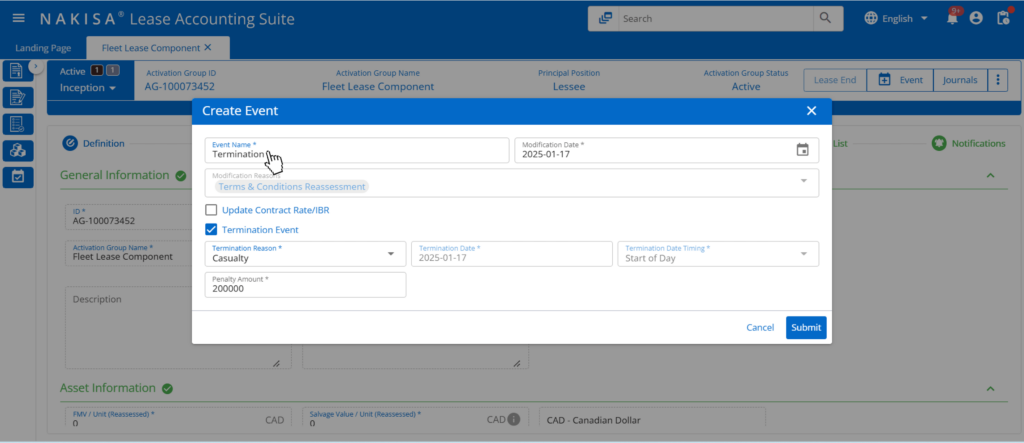

- Event management: Nakisa Lease Accounting efficiently handles lease modifications, renewals, and terminations, ensuring compliance with IFRS 16 and ASC 842. The software automatically recalculates lease terms, adjusting right-of-use (ROU) assets and lease liabilities based on updated clauses, payment schedules, or lease terms in real-time. With a comprehensive audit trail, Nakisa provides full transparency and ensures accurate financial reporting, reducing the risk of misstatements and facilitating audit readiness. By aligning all lease adjustments with accounting standards, Nakisa ensures global retailers maintain compliance and accurately reflect any changes in their lease obligations.

Nakisa Lease Accounting software supports event creation and management such as termination. The interface displays fields such as termination reason, termination date, and penalty amount.

Nakisa Lease Accounting offers comprehensive features that ensure compliance with IFRS 16, ASC 842, and local GAAP. By leveraging these capabilities, global retailers can confidently manage their leases and meet financial reporting requirements with accuracy and efficiency.

Case study: PUMA’s streamlined IFRS 16 compliance with Nakisa Lease Accounting

Before adopting Nakisa Lease Accounting (NLA), PUMA faced significant challenges in managing their global lease portfolio. The scale and complexity of their operations highlighted the need for a more efficient solution. Here are some key details that illustrate the scope of their lease management needs:

- Number of contracts: 2,200+ globally

- Types of lease assets: IT and office equipment, fleet, storefronts, offices, and warehouses

- Number of companies: 17 European-based, 82 global organizations

- Number of users: 290+ responsible for managing lease data

- Previous lease accounting solution: Excel tools

- ERP systems: Multiple SAP and non-SAP ERP systems

Nakisa Lease Accounting provided a comprehensive solution, streamlining lease accounting processes and ensuring IFRS 16 compliance. Key features included multi-currency support, centralized lease data management, automated reporting, and global consolidation of Incremental Borrowing Rates (IBR), all of which enabled PUMA to close books on time and improve operational efficiency.

Barbara Book

Senior Teamhead of Consolidation & Group Reporting at PUMA

Challenge 7: Lease reassessment

Lease reassessment during significant events such as lease termination, lease extension, lease indexation, buy-out option, rent reduction, and impairment presents a major challenge for retailers in managing their lease portfolios. These events require careful evaluation of lease terms, reassessment of financial obligations, and potential adjustments to lease accounting. Retailers must be able to handle the complexities of these adjustments efficiently and in compliance with IFRS 16 and ASC 842 accounting standards.

- Lease termination: When a lease is terminated, retailers must reassess the remaining lease term and adjust the associated liabilities accordingly. Lease termination often involves early exit fees, penalties, or adjustments based on the terms of the lease agreement. Accurately reflecting these changes in the accounting records and financial statements is crucial.

- Lease extensions: Lease extensions require recalculating the lease term and determining whether the extension is enforceable under the terms of the agreement. If the lease is extended, retailers must adjust the right-of-use asset and lease liability to reflect the extended term, often requiring a recalculation of future payments, including rent escalations, variable payments, and other lease-related costs. Understanding whether an extension is a practical option under the lease terms is key to ensuring accurate lease accounting.

- Lease indexation: Lease indexation, where rental payments are adjusted based on an external index (e.g., Consumer Price Index or other inflation-related measures), poses significant challenges in lease accounting for retailers. Under IFRS 16 and ASC 842, retailers must reassess lease liabilities and right-of-use (ROU) assets whenever index-linked rent changes occur.

- Buy-out option: A buy-out option allows a retailer to purchase the leased asset, often at a price below fair market value, at a specified point during or at the end of the lease term. Under IFRS 16 and ASC 842, retailers must evaluate whether the buy-out option is "reasonably certain" to be exercised. After exercising the purchase option, the lease is classified as a finance lease, and at the end of the term, the leased asset is transferred to an owned asset. This requires detailed forecasting of future cash flows, assessing the likelihood of exercising the buy-out option, and recalculating the lease liability and ROU asset accordingly.

- Rent reduction: When rent reductions occur, retailers must evaluate whether they qualify as lease modifications, which could involve adjusting the lease liability and ROU asset. A reduction in rent typically leads to a decrease in the lease liability, but this adjustment must consider the revised payment schedule, discount rates, and any potential changes in lease term or other significant conditions. Retailers must ensure that the modified terms are reflected accurately in their financial statements, maintaining compliance and providing a true representation of their lease obligations.

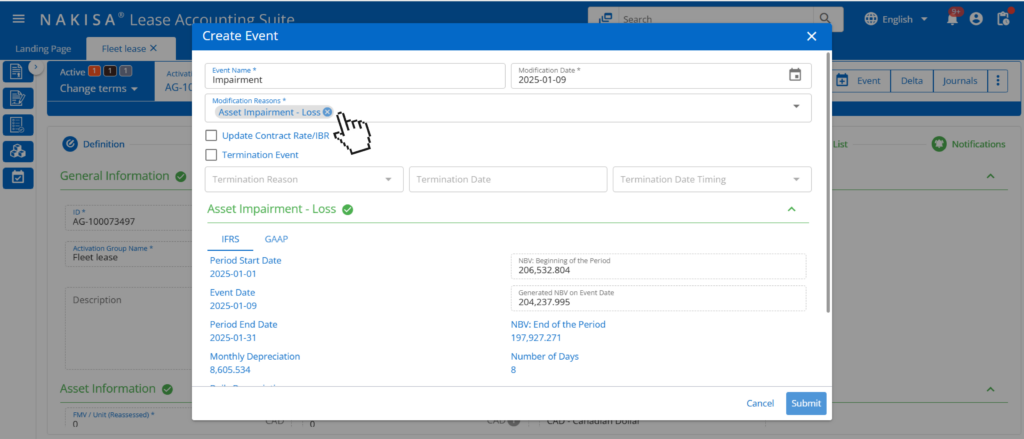

- Impairment: Impairment of a lease arises when the carrying value of the right-of-use asset exceeds its recoverable amount. This situation typically occurs when the leased asset is no longer expected to provide future economic benefits as originally anticipated, such as in cases where a location is no longer profitable or strategic. Retailers must evaluate and measure impairment based on current market conditions, making necessary adjustments to reflect the impairment of assets in financial statements.

How Nakisa solves lease reassessment challenges for global retailers

- AI-powered lease abstraction: Nakisa's AI lease abstraction tool plays a vital role in managing complex lease agreements by automatically extracting and organizing key lease data. This feature simplifies the tracking of various lease terms, renewal options, and clauses, especially when dealing with multi-layered or non-standard lease structures. By centralizing all relevant lease information in one database, retailers can easily access critical details without relying on manual data entry. This not only reduces the risk of errors but also ensures that important lease obligations are never missed, enhancing both efficiency and compliance.

Nakisa Lease Accounting supports event creation and management such as impairment. The interface displays fields such as modification reasons, modification date, and asset impairment loss.

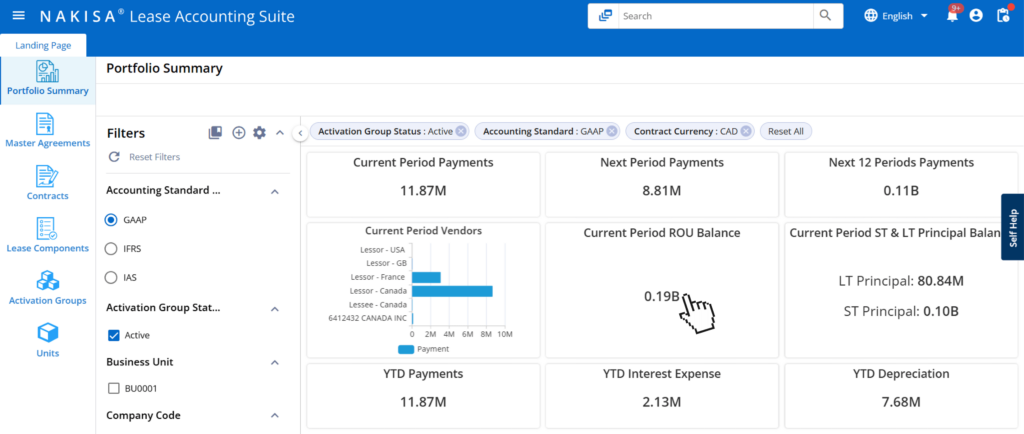

- Critical date and event tracking: Nakisa Lease Accounting offers powerful critical date and event tracking capabilities that help retailers stay ahead of important milestones in the lease lifecycle. These features allow businesses to monitor key events such as lease termination, lease extension, lease indexation, buy-out option, rent reduction, and impairment in real time. Additionally, it provides a portfolio summary of due lease and non-lease payments for the current month, next month, and the next 12 months, enhancing forecasting and budgeting accuracy. This proactive approach minimizes the risk of errors or omissions, reducing the administrative burden and helping retailers remain compliant with accounting standards without missing key events in their lease agreements.

Nakisa Lease Accounting provides a portfolio summary of due lease and non-lease payments for the current month, next month, and the next 12 months.

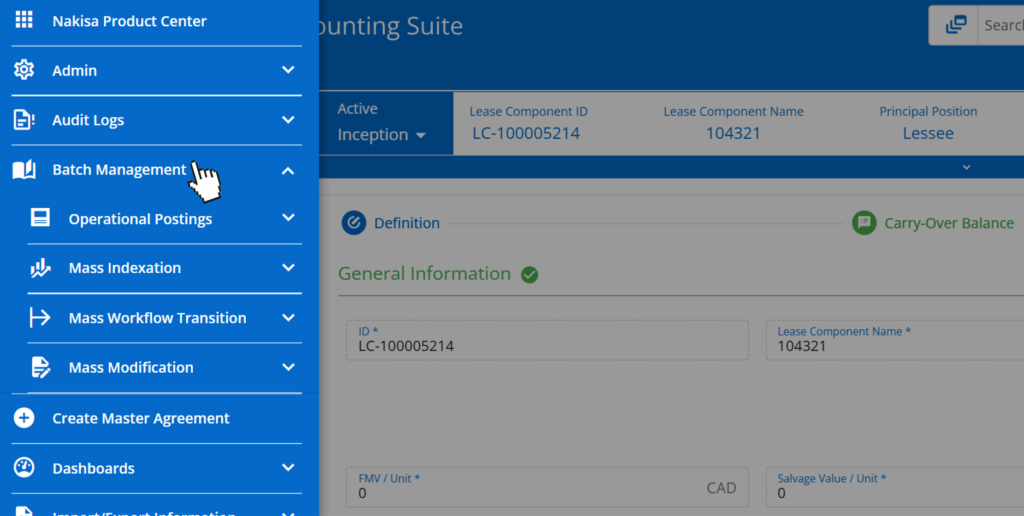

- Mass event management tool: Nakisa Lease Accounting’s mass event management tool allows users to make simultaneous adjustments to lease components and activation groups, enabling them to update terms and apply changes (e.g., exercising terms affecting ROU asset and liability values) efficiently in one streamlined process.

In Nakisa Lease Accounting software, users can perform batch management operations such as mass indexations, mass workflow transitions, and mass modifications.

- Recalculation and adjustment tools: The recalculation and adjustment tools within Nakisa Lease Accounting automatically update lease liabilities and right-of-use (ROU) assets in response to critical lease events. These tools are designed to ensure that lease data remains accurate and compliant with accounting standards, even after changes such as terminations or modifications. With these automated workflows, retailers can streamline the process of recalculating and adjusting lease data, eliminating the need for manual intervention and ensuring that lease accounting remains precise and up to date.

Challenge 8: Technology, data security, and integration limitations

One of the most significant challenges in lease accounting for retail companies is overcoming technology and integration limitations. Many organizations operate in complex environments with multiple ERP systems, legacy systems, or fragmented software solutions that hinder the seamless flow of financial data. These integration gaps lead to inefficiencies, data discrepancies, and increased manual intervention, which complicate the process of managing leases in accordance with accounting standards like IFRS 16 and ASC 842. Additionally, the lack of integration between lease accounting software and ERPs can create challenges in tracking real-time financial data, reconciling accounts, and ensuring compliance.

- Multiple ERP systems: Retail companies often use different ERP systems across various regions or departments, creating silos of data that are difficult to consolidate. This fragmentation complicates financial reporting and lease management, requiring manual data reconciliation.

- Data security risks: Without proper data security measures, sensitive information becomes vulnerable during transmission and storage. Without encryption, data can be intercepted during transfer between ERP systems and cloud platforms, and insecure storage practices can expose it to unauthorized access. Weak access controls, poorly configured firewalls, and insufficient monitoring further increase the risk of breaches. Additionally, failing to meet compliance standards can result in legal and financial consequences.

- Real-time data flow: Many companies struggle with the timely transfer of lease-related data between accounting systems and ERPs, leading to delays in decision-making and an increased risk of errors in financial reporting.

- Complex data structures: Different ERPs may have varying data structures, making it difficult to synchronize lease data and ensuring that all relevant information flows into the accounting system accurately and efficiently.

- Legacy system constraints: Many organizations still rely on outdated legacy systems, which may not be capable of handling the modern integration needs of lease accounting software, creating bottlenecks and slowing down the overall process.

- Disconnected lease accounting and asset management: The lack of integrated technology creates silos between lease accounting, real estate, and facility management, leading to fragmented data, inefficiencies, and compliance risks. Without a unified system, organizations struggle with inconsistent asset information, manual data transfers, and misaligned financial and operational decisions, ultimately impacting accuracy and strategic planning.

How Nakisa solves technology, data security, and integration challenges for global retailers

Nakisa Lease Accounting addresses these challenges by offering seamless integration with leading ERP systems through the Nakisa Cloud Platform (NCP). This cloud-native platform utilizes a microservices architecture that supports bidirectional integration via the Nakisa Cloud Connector (NCC). This advanced architecture allows smooth integration with major ERP systems such as SAP (S/4HANA and ECC), Oracle (EBS and Fusion), and Workday. Additionally, Nakisa’s powerful APIs facilitates seamless integration with other ERPs and third-party systems like BlackLine, offering even greater flexibility for retailers. The platform also allows for easy connection to existing financial systems, enhancing workflow automation and ensuring data consistency across all systems. Additionally, Nakisa operates through a global network of data centers, which includes multiple sites in the United States, Canada, Germany, Singapore, and the United Arab Emirates.

- Bidirectional integration: Nakisa’s software ensures real-time, bidirectional data flow between lease accounting software and ERP systems, eliminating the need for manual data transfers or reconciliations. This seamless exchange of data between systems helps reduce errors and improve efficiency, ensuring that financial data is always accurate and up to date.

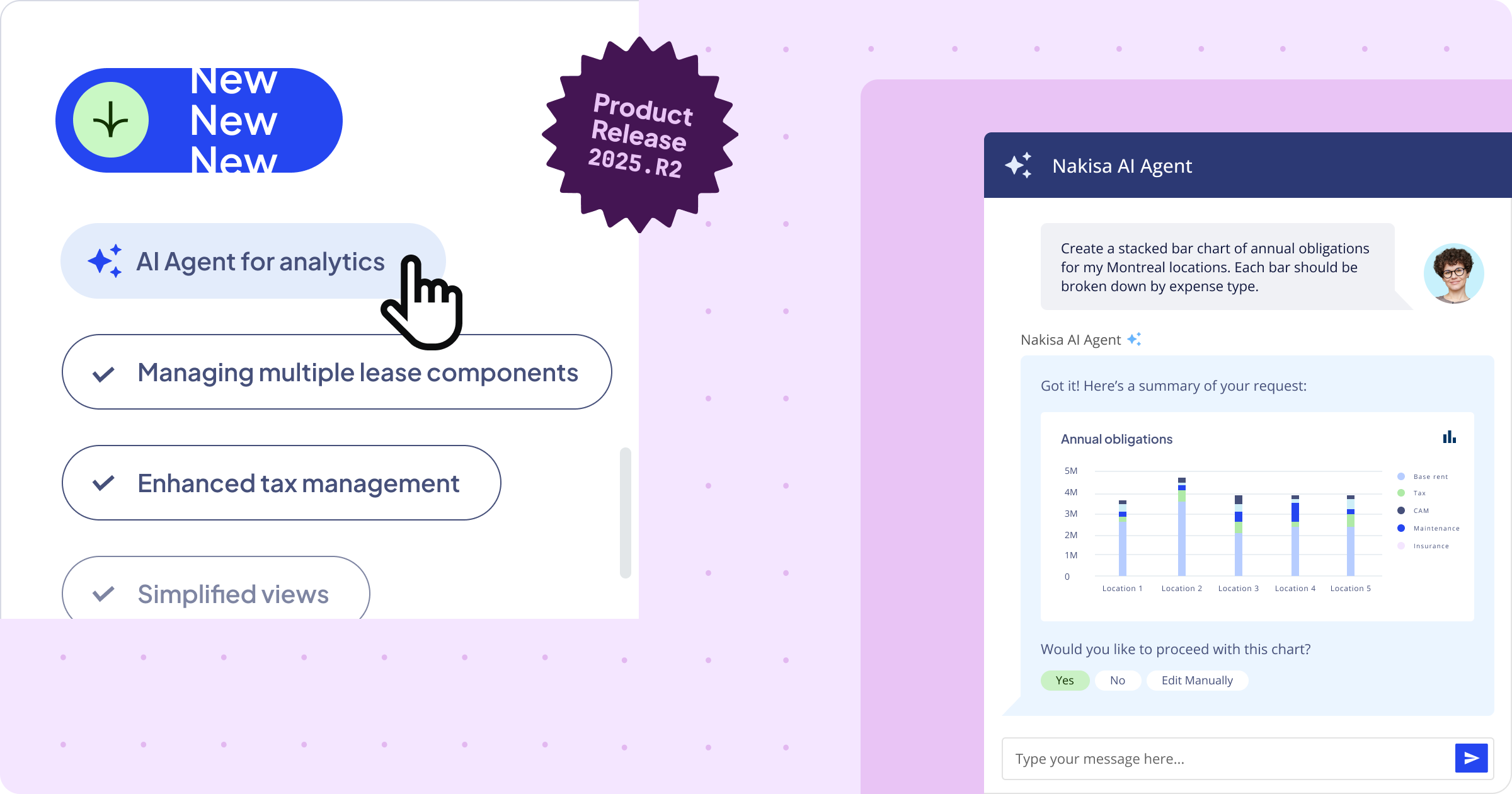

- Nakisa AI Assistant: Leveraging the power of Generative AI and Retrieval-Augmented Generation (RAG) technology, this conversational AI assistant is designed to provide intelligent, context-aware support. Trained on Nakisa’s extensive documentation library, it ensures accurate and relevant responses, enhancing the user experience across all products. Simply ask the Nakisa AI Assistant about lease accounting topics or specific product functionalities, and it will provide precise, helpful information. Additionally, with context-aware help, the Nakisa AI Assistant offers smart suggestions tailored to ongoing tasks, boosting productivity and streamlining workflows.

- Data security: During data transmission, Nakisa uses encrypted tunnels to securely transfer information from ERP systems to the Nakisa Cloud Platform. Once the data reaches its destination, encryption at rest ensures it remains protected on trusted platforms like Amazon AWS and Microsoft Azure. To further safeguard your data, we implement role-based access control, access control lists, and firewall rules within a virtual private cloud, minimizing external threats. Our commitment to compliance with ISO 27001, ISO 27017, SOC 1 Type II, and SOC 2 Type II ensures that access is tightly restricted to authorized personnel, with regular audits monitoring the entire process.

- Multi-ERP integration: Nakisa’s platform is designed to handle complex multi-ERP integration scenarios, making it ideal for global retail companies that operate across diverse regions and utilize various ERP systems. Whether a retailer is using SAP, Oracle, or Workday, Nakisa consolidates lease data from up to 45 different ERP systems into a single, unified instance, streamlining the process and reducing the administrative burden.

- Real-time data synchronization: Nakisa enables real-time synchronization between its lease accounting software and ERP systems, ensuring that all lease-related financial data is consistent and accurate across the enterprise. This helps retailers keep track of lease liabilities, payments, and other financial obligations in real-time, leading to better financial oversight and control.

- Scalability and flexibility: As retail organizations grow and expand into new markets, Nakisa’s integration capabilities scale to meet the needs of a larger, more complex portfolio. The software’s flexibility ensures that as retailers adopt new ERP systems or expand their operations, the integration process remains smooth and seamless.

- Unified lease accounting and asset management: Nakisa Lease Accounting (NLA) is part of Nakisa IWMS, leveraging integrated technology to unify lease accounting, real estate, and facility management through a single asset repository. This seamless integration enhances cross-functional collaboration and ensures alignment between financial and operational data.

Daniel Marosi

Manager, IT Finance Solutions at Amer Sports

Case study: Unicomer Group's technology integration and data management with Nakisa enhances data quality by 97% and cuts period-end closing time by 71%

Before implementing Nakisa, Unicomer Group faced significant challenges in managing their lease portfolio. The reliance on outdated lease management tools resulted in inefficiencies, errors, and delays in lease modifications and financial reporting. With a growing number of contracts and increasing complexity, Unicomer needed a powerful solution to streamline their lease management processes and ensure accurate, real-time data. Below are key data points that highlight the complexity of the challenges the company was facing:

- Types of lease assets: Vehicles, machinery, properties, spaces, solar panels, and more

- Global presence: 21 countries in Latin America and the Caribbean and 25+ commercial brands

- Previous lease accounting solution: Excel tools

Unicomer Group saw significant improvements with Nakisa Lease Accounting, including a 97% data quality improvement, thanks to automation that eliminated manual work and reduced errors. Period-end closing times were reduced by 71%, with automation features streamlining lease modifications and bulk posting. The integration with Unicomer’s ERP system facilitated scalable operations, centralized lease data, and improved data management across regions and departments, ensuring consistency and accuracy.

Italo Ferrufino Magaña,

IFRS Corporate Analyst at Unicomer Group

Challenge 9: Lack of cross-functional collaboration

A common challenge faced by retail organizations is the lack of cross-functional collaboration between the accounting, real estate, and facility management teams. This disconnect often leads to inefficiencies, inaccurate lease data, and delays in decision-making. Retail lease accountants rely on accurate, real-time data to maintain compliance with accounting standards like IFRS 16 and ASC 842, while real estate and facility management teams manage the operational aspects of leases, such as space utilization, maintenance, and facilities management. Without seamless collaboration and integration, discrepancies between financial data and operational data can arise, creating complications in lease management, reporting, and compliance. When lease accounting and real estate teams work in silos, several challenges can emerge:

- Inconsistent data: Accounting teams may rely on manually collected or outdated operational data for financial reporting, which can lead to inaccuracies in lease calculations, payment schedules, and compliance with lease terms.

- Delayed updates: Lease modifications, such as renewals, terminations, or space reconfigurations, may not be communicated promptly between departments, resulting in outdated records or incorrect financial entries.

- Inefficient processes: The lack of collaboration can lead to duplicate data entry, errors, and time-consuming manual reconciliation processes, reducing overall efficiency and increasing the risk of compliance issues.

- Limited visibility: When financial and operational data are stored in separate systems or not integrated, stakeholders lack a comprehensive view of lease obligations, making it harder to assess the impact of operational changes on financial reporting.

How Nakisa IWMS solves cross-functional collaboration challenges for global retailers

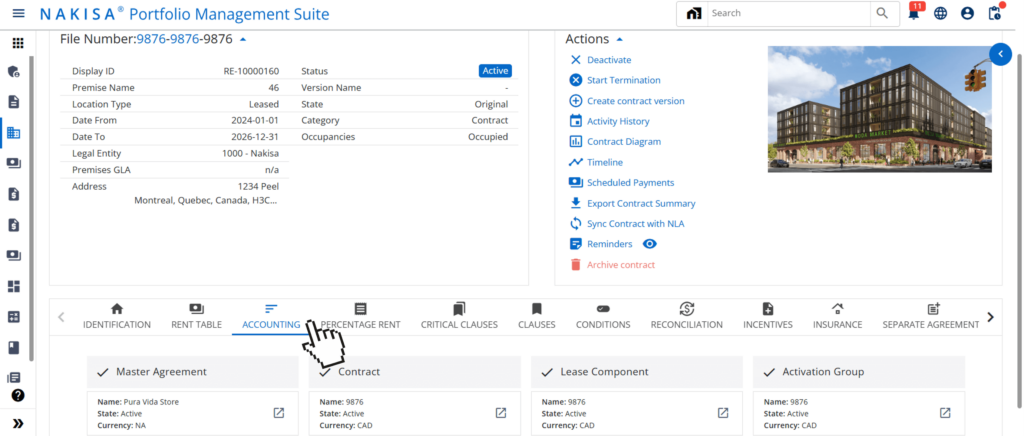

Nakisa Lease Accounting (NLA) is part of Nakisa IWMS, bridging the gap between lease accountants, real estate, and facilities management teams to foster cross-functional collaboration and ensure both financial and operational data are aligned.

- Single asset repository: Nakisa IWMS portfolio unifies lease accounting, real estate, and facility management within a single asset repository. By breaking down data silos, it enables real-time data synchronization, enhances cross-functional collaboration, and streamlines workflows. This seamless integration ensures consistency between financial and operational data, improving accuracy, efficiency, compliance, and strategic decision-making across the organization.

- Streamlined workflows: The integration eliminates the need for duplicate data entry and reduces the risk of errors. As changes occur in the IWMS system—such as lease modifications, space adjustments, or maintenance updates, they are automatically reflected in the lease accounting system, ensuring that lease liabilities, right-of-use assets, and payment schedules are always current.

- Real-time updates: Critical events like lease renewals, terminations, and space adjustments are tracked and communicated seamlessly between the two software. This ensures that accounting, real estate, and facility management teams are working with the same information, reducing the potential for miscommunication and enabling timely decisions.

- Comprehensive reporting: With integrated systems, Nakisa provides enhanced visibility into both financial and operational data. This allows cross-functional teams to access real-time, comprehensive reports that reflect both the financial and operational status of each lease, improving decision-making and strategic planning.

Nakisa Lease Management software seamlessly integrated with Nakisa Lease Accounting software through the Accounting tab.

Case study: NTUC FairPrice’s real estate and accounting integration with Nakisa cuts month-end closing time by 50%

Before Nakisa, Singapore’s largest retailer NTUC FairPrice relied on Excel sheets and emails to manage leases, which resulted in inefficiencies and communication breakdowns between the real estate and finance teams. The lack of a unified system led to data inconsistencies, missed deadlines, and recurring audit issues. The lease accounting team spent significant time validating and calculating data manually, which prolonged month-end and year-end closing times. Here are some key figures that highlight the complexity of their operations:

- Type of lease assets: Real estate

- Number of contracts: 500+

- Previous lease accounting solution: Excel tools

- ERP systems: 2 SAP entities

NTUC FairPrice selected Nakisa Lease Accounting for its highly configurable solution that met their regional needs and operational workflows. Key benefits included streamlined end-to-end lease management, where lease data automatically flowed from the real estate team to the finance team and then to SAP for financial reporting. Real-time synchronization between Nakisa and SAP ensured data consistency across two SAP entities. Additionally, automatic notifications and updates kept both teams aligned, reducing errors and ensuring accurate, up-to-date information. As a result, month-end closing time was reduced by 50%, saving valuable man-hours.

Lyn Kok

Project and Change Management Lead at NTUC FairPrice

Explore our buyer's guide, featuring an RFP scorecard designed to streamline the selection of lease accounting solutions for the retail industry. With customized evaluation criteria and actionable insights, this guide supports you in making informed decisions and finding the tools that best match your organization’s specific needs.

Conclusion

Effective lease accounting is no longer a back-office task but a strategic enabler for enterprise retail businesses. As the retail landscape evolves, so do the challenges—complex lease calculations, global portfolio management, and the need for seamless integration across systems and departments. These complexities demand a robust solution that not only ensures compliance but also drives operational efficiency and strategic decision-making.

Nakisa Lease Accounting equips retailers like Nestle, Walmart, Puma, 3M, Volvo, Rona, NTUC FairPrice, and Unicomer Group with the tools to meet these demands. From handling sophisticated lease structures and fluctuating rent costs to enabling global compliance and enhancing cross-functional collaboration, the software addresses the real-world challenges retailers face daily. Beyond simplifying processes, it provides the data transparency and analytical capabilities needed to make informed decisions in a highly competitive market.

By leveraging next-gen technology like Nakisa Lease Accounting software, global retailers can shift their focus from operational hurdles to growth opportunities. They gain the flexibility to adapt to market changes, the foresight to mitigate financial risks, and the scalability to support long-term success.

To understand how Nakisa Lease Accounting can optimize your lease accounting processes and ensure full compliance, we invite you to schedule a personalized demo. Experience firsthand how our solutions can enhance operational efficiency, streamline complex tasks, and equip your enterprise with the tools needed for sustained success in the retail sector.