How AI, automation, and data integration are shaping the future of lease accounting: what’s next for compliance and decision-making

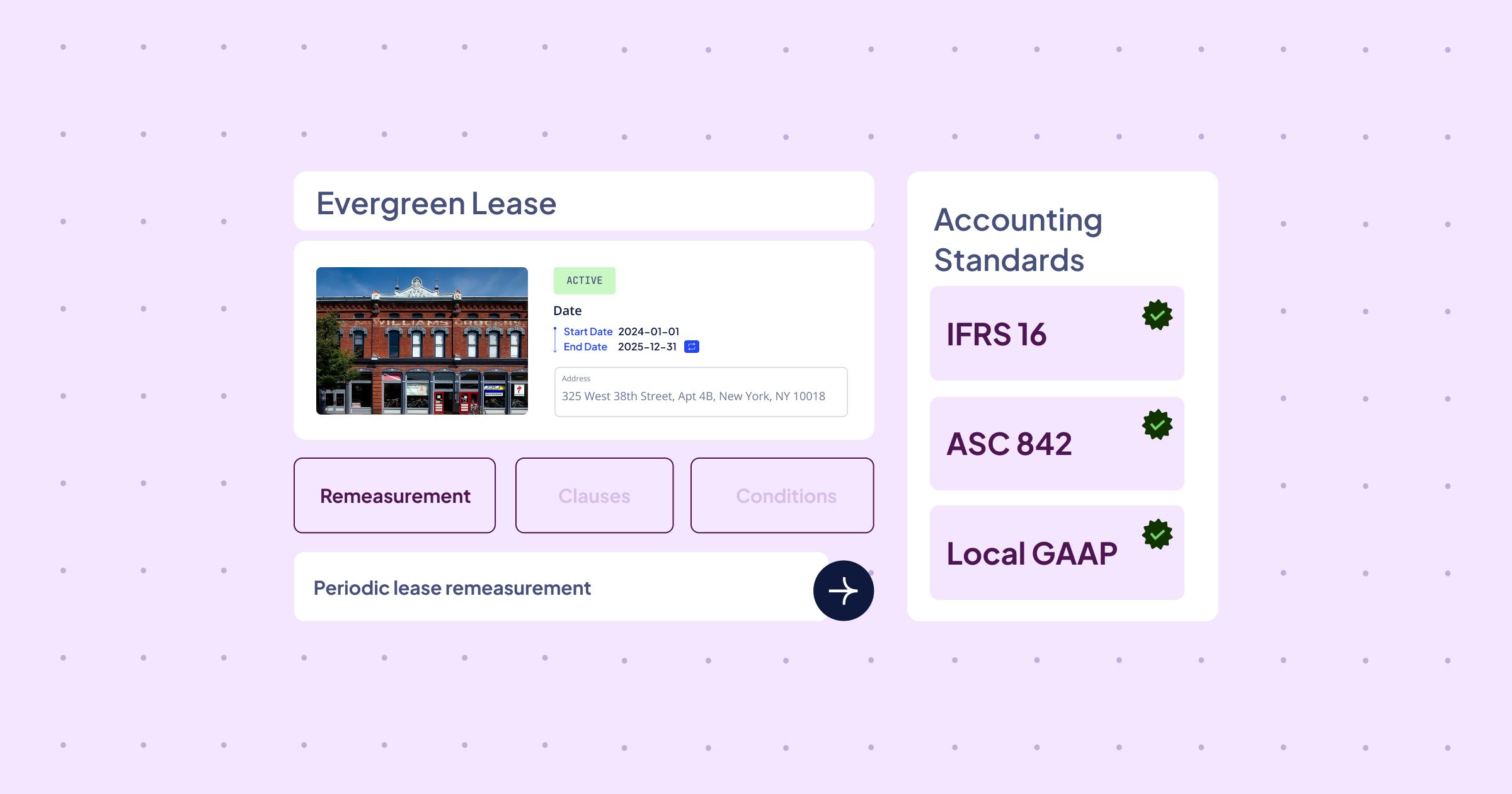

Discover how AI, intelligent automation, and seamless data integration are transforming lease accounting. Learn how Nakisa’s AI-powered solutions enable global enterprises to simplify compliance, minimize manual tasks, and make more informed financial decisions.