Nakisa Lease Accounting 2025.R2 product release: smarter workflows, enhanced financial insights, and seamless integration

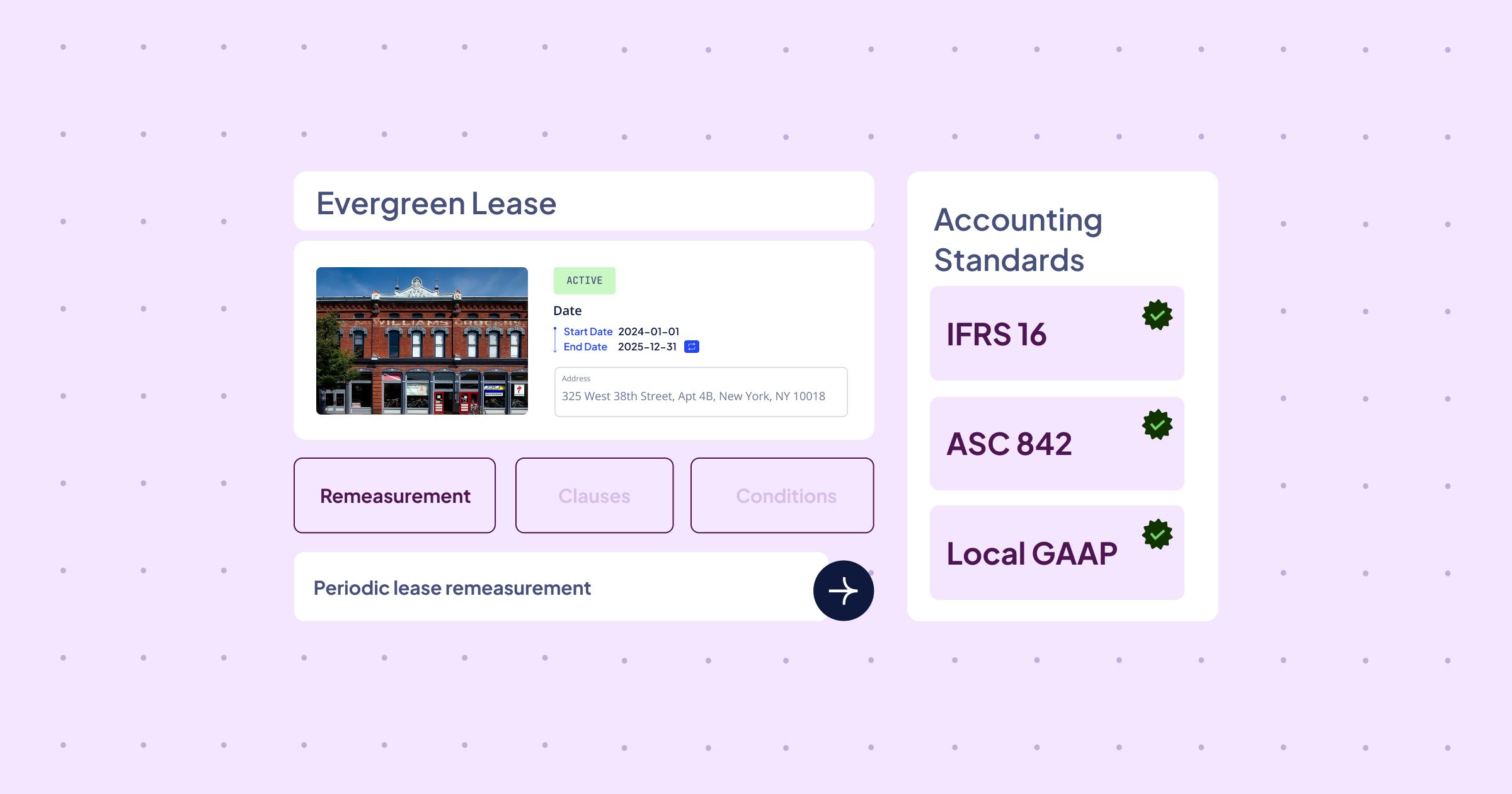

The latest Nakisa Lease Accounting release introduces impactful capabilities that streamline financial close processes, enhance organizational control, and improve reporting accuracy and compliance. Explore what’s new in this product release post.