What are general journal entries

General journal entries are a fundamental component of financial control in lease accounting, serving as an intermediate step that requires approval before transactions are permanently recorded in the general ledger (GL). They act as temporary records that allow finance teams to document, validate, and approve lease-related transactions before they are officially posted. By implementing general journal entries, organizations ensure that every adjustment, accrual, or correction undergoes proper scrutiny and approval workflows, reducing the risk of errors and misstatements in financial reporting.

In lease accounting, general journal entries are especially important due to the complexity of lease transactions, which involve intricate calculations, multi-period adjustments, and strict compliance requirements under IFRS 16, ASC 842, and local GAAP. Without a structured general journal entry process, finance teams may inadvertently post inaccurate lease data directly into the general ledger, leading to misstated financial statements, compliance violations, audit challenges, and discrepancies between the leasing subledger and the general ledger.

Why general journal entries are important in general ledger workflows

Use case 1: Month-end adjustments after subledger closure

One of the most essential applications of general journal entries in lease accounting is during the month-end close process. Closing the subledger finalizes lease-related transactions for the period, ensuring the financial statements remain accurate and consistent. However, finance teams frequently face late adjustments that must be recorded after the subledger has been closed. Without a structured general journal entry process, these adjustments would require reopening the subledger—an action that carries significant risks:

Recalculated entries: Reopening the subledger can trigger automatic recalculations of lease-related figures, such as interest accruals, depreciation, and modifications, potentially altering previously finalized numbers.

Report discrepancies: Financial reports that were already generated and shared with stakeholders may no longer be accurate, requiring rework and revalidation.

Persisted balance issues: If balances have already been carried forward to the next period, late adjustments can lead to inconsistencies that disrupt financial reconciliation processes.

Audit challenges: Modifying a closed subledger introduces changes to a previously finalized period, making it more difficult to track adjustments and increasing audit complexity.

Use case 2: Chart of accounts changes and GL code updates

When organizations update their chart of accounts—whether due to an ERP migration, a restructuring initiative, or internal financial policy changes—they must ensure a smooth transition of balances from old GL codes to new ones. Since subledgers typically do not support direct account transitions, these balance transfers must occur at the general ledger level using general journal entries. Without a structured approach, this process can lead to several financial and operational risks:

Misaligned financial reporting: If balances are not properly transferred, financial statements may reflect outdated or incorrect GL account numbers, leading to inconsistencies across reports.

Manual reconciliation efforts: Without a general journal entry process, finance teams may need to manually adjust balances, increasing the risk of errors and inefficiencies.

Audit and compliance risks: Changes to the chart of accounts without a controlled transfer process can increase audit challenges, as tracking adjustments becomes more complex.

Disruptions to financial workflows: If the transition is not handled properly, discrepancies in reporting can affect budgeting, forecasting, and other financial processes that rely on accurate account structures.

How the Nakisa General Ledger handles general journal entry management

The Nakisa General Ledger offers a streamlined, efficient process for managing the approval and processing of general journal entries, ensuring that lease-related adjustments are accurately recorded and validated before being posted to the general ledger, all while maintaining strong financial control. Let’s dive into the key features of general journal entry management in the Nakisa General Ledger:

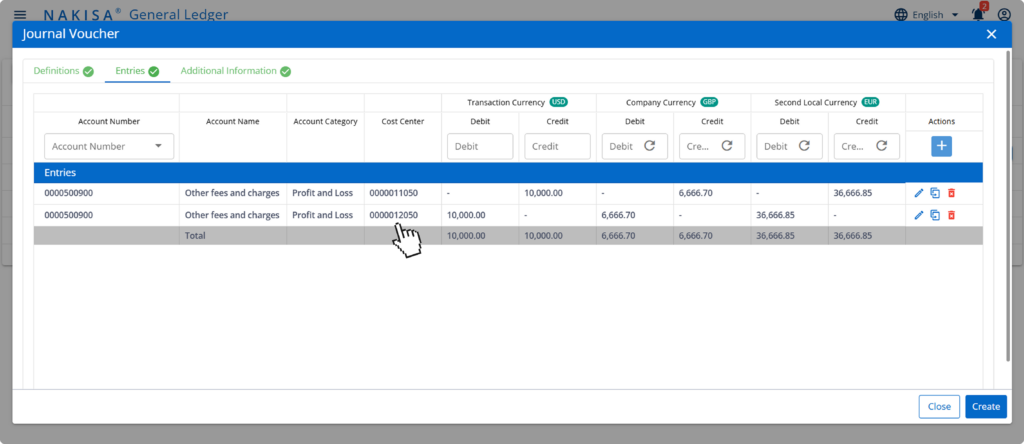

In the Nakisa General Ledger, users can efficiently create and manage general journal entries within the journal voucher module, ensuring accurate financial recording and streamlined reconciliation processes.

Approval workflow

The Nakisa General Ledger enforces a structured approval process for general journal entries, ensuring that each entry is properly validated before being posted to the general ledger. Finance teams can configure approval hierarchies, allowing only authorized personnel to approve and post entries. This helps minimize the risk of errors or unauthorized entries while enhancing overall financial control.

Integration with subledger

The Nakisa General Ledger integrates seamlessly with the lease subledger, providing real-time visibility into lease transactions and ensuring that any adjustments made through general journal entries are accurately reflected in the general ledger. This integration eliminates the risk of discrepancies between the leasing subledger and the general ledger.

Auto-reverse feature

The Nakisa General Ledger supports an auto-reverse feature for general journal entries, ensuring that any temporary adjustments are automatically reversed in the following period. This feature is particularly useful for managing month-end close adjustments, as it limits the impact of temporary timing differences to a single accounting period. The auto-reversal functionality minimizes the risk of long-term discrepancies in financial statements.

Real-time reporting and monitoring

The Nakisa General Ledger offers real-time reporting tools that provide finance teams with immediate access to the status and history of general journal entries. This enables quick identification of any pending, approved, or posted general journal entries, allowing for effective monitoring and timely decision-making.

Audit and compliance assurance

The Nakisa General Ledger supports comprehensive audit trails, which can be crucial during internal or external audits. They ensure that every general journal entry is properly documented, with full visibility into its creation, approval, and posting process. This enhances auditability and ensures compliance with accounting standards. Any further changes made to general journal entries are also tracked, providing a clear audit trail. Users can also upload external backup or reference documents, further reinforcing the integrity of the audit process.

Error prevention and validation rules

To further ensure accuracy, the Nakisa General Ledger includes built-in validation rules for general journal entries. These rules automatically check for common errors, such as invalid account codes, incorrect amounts, or unsupported transaction types, preventing mistakes from being posted to the general ledger. Additionally, the system requires journal entries to be balanced before they can be posted, further preventing errors and ensuring the integrity of the general ledger.

By automating and streamlining the general journal entry management, the Nakisa General Ledger not only improves the accuracy and efficiency of lease accounting workflows but also enhances financial control, compliance, and reporting. This allows organizations to focus on strategic decision-making with confidence in their financial data.

Conclusion

Managing general journal entries effectively is essential in lease accounting. The Nakisa General Ledger supports this process through structured approval workflows, seamless subledger integration, real-time reporting, and robust auto-reverse and error-prevention features. These tools help reduce discrepancies, enhance accuracy, and improve auditability. By providing a clear and efficient process for handling general journal entries, the Nakisa General Ledger empowers finance teams to maintain confident and compliant financial records while streamlining their workflows.

The Nakisa General Ledger integration with Nakisa Lease Accounting further strengthens this process, ensuring that lease-related data is accurately captured, compliant with IFRS 16, ASC 842, and local GAAP, and seamlessly incorporated into the overall financial framework. Together, they provide an end-to-end solution that simplifies the complexities of lease transactions, supporting organizations in maintaining accuracy and financial control at scale.

To see how the Nakisa General Ledger and the Nakisa Lease Accounting software can optimize your lease accounting processes and ensure full compliance, we invite you to schedule a personalized demo. Discover how our lease accounting solution enhances operational efficiency, streamlines complex tasks, and provides Fortune 1000 companies such as 3M, Volvo, Puma, Pfizer, and Nestlé with the tools needed for continued success.