Why traditional lease accounting decision-making struggles in a global context

According to Gartner’s recent Market Guide, most business decisions are still unautomated due to growing complexity, regulatory constraints, and financial, ethical, or reputational risks. Traditional lease accounting systems provide fragmented, context-limited insights, leaving finance and accounting teams reliant on spreadsheets, siloed data, and static reporting rather than real-time intelligence.

For organizations with thousands of leases spread across multiple regions, these challenges intensify. Finance leaders must oversee renewals, terminations, and acquisitions, and the assessment of right-of-use (ROU) assets and liabilities, ensure compliance with IFRS 16 and ASC 842, and forecast the impact of every lease decision — all while keeping up with shifting markets. Each decision directly affects financial statements, capital allocation, and risk exposure, yet, the data they need is often fragmented, incomplete, outdated, or difficult to interpret. The result? Lease accounting and portfolio management becomes a reactive, manual, and error-prone approach, increasing risk and reducing agility at every turn.

Through our work with leading global finance and accounting teams, we’ve identified the main limitations of traditional lease accounting decision-making:

- Decisions based on incomplete data and limited visibility

Lease performance depends on multiple interconnected factors, such as lease terms, payment schedules, discount rates, cost centers, asset utilization, and market rental trends. Yet most legacy systems can’t integrate these datasets seamlessly. Without a unified, real-time view, teams struggle to understand how one decision — like early termination or lease modification — affects both the balance sheet and P&L. Even when data exists, its complexity makes it trends and risk difficult to detect, leading to misstatements, inefficient renewals, and missed optimization opportunities. - No real-time link between lease data and market benchmarks

Market conditions shift constantly, influencing fair value, incremental borrowing rates, and renewal terms. Most lease accounting tools rely on static data snapshots with little to no market context. Without timely benchmarks for rental rates, interest rate movements, or asset values, finance teams lose visibility into whether their leases are performing above or below market. This forces them to spend excessive time on research and manual comparisons, slowing decision-making and limiting proactive cost management. - Limited scenario planning and forecasting

Modeling how future lease decisions affect financial outcomes requires complex calculations across multiple entities and currencies. For example, understanding how extending high-value equipment leases or terminating retail spaces impacts total liabilities, depreciation, and ROU assets can take days or weeks of manual work. Traditional systems rarely support dynamic what-if analysis, making it difficult to simulate the financial implications of different strategic paths or to present alternate strategies to leadership. - Slow and reactive decision cycles that lack agility

Collecting, validating, and consolidating data from multiple stakeholders — finance, operations, procurement, and legal — can take weeks. By the time a lease renewal or impairment decision is finalized, market conditions, interest rates, or operational needs may have already changed. These delayed decision cycles result in outdated insights, compliance risks, and missed opportunities to renegotiate favorable terms or optimize asset use. Without real-time automation, teams are left reacting to issues instead of anticipating them. - Misaligned strategic priorities across departments

When lease data lives in silos, finance, operations, and procurement teams struggle to align on strategy. Finance may prioritize liability reduction, while operations seek lease flexibility or expansion. Without shared, data-driven insights, these misalignments lead to inconsistent decisions that affect compliance, profitability, and long-term strategy execution.

Ultimately, traditional lease accounting frameworks were built for static, compliance-focused environments, not for today’s fast-moving, data-rich financial landscape. To stay ahead, organizations need agility, integrated intelligence, and real-time decision support. These are precisely the capabilities that Nakisa Decision Intelligence (NDI) delivers, empowering accounting and finance teams to analyze data holistically, model outcomes instantly, and make and execute confident, compliant decisions.

What decision intelligence (DI) platforms are and why their adoption is accelerating

According to Gartner Market Guide, while some analytics solutions support decision-making through data science predictions, dashboards, or other siloed analytical and AI applications, they often remain siloed and fail to enable strategic, enterprise-wide decisions.

As organizations seek faster, smarter, and more consistent ways to make and execute strategic decisions, decision intelligence (DI) platforms are gaining rapid traction. Let’s look at how Gartner defines these platforms and why they’re reshaping how businesses use data.

Decision intelligence platforms (DPIs)

are software used to create solutions that support, automate, and augment decision making of humans or machines, powered by the composition of data, analytics, knowledge, and artificial intelligence (AI) techniques. DIPs must have collaborative capabilities for decision modeling, execution, and monitoring. DIPs are used to design decision-centric solutions, explicitly model decisions, orchestrate decision execution flows, and evaluate and govern decisions and audit their outcomes.

By unifying data, automating analysis, and accelerating decision-making, DI platforms are quickly becoming essential to modern enterprise strategy. Gartner predicts that by 2026, 75% of Global 500 companies will adopt decision intelligence practices, including systematic decision logging for future analysis. Furthermore, by 2026, 50% of organizations will need to evaluate analytics and business intelligence (ABI) and data science and machine learning (DSML) platforms as a single, converged solution due to increasing overlap and integration across these technologies.

Babak Varjavandi

CEO at Nakisa

Introducing Nakisa Decision Intelligence (NDI) for lease accounting

With NDI, organizations can achieve:

- reduce time-to-decision by up to 40%

- improve analysis accuracy by 90%

- perform complex portfolio analyses up to 60x faster

Now, let's explore how Nakisa Decision Intelligence (NDI) can transform lease accounting and management with specific examples from day-to-day operations.

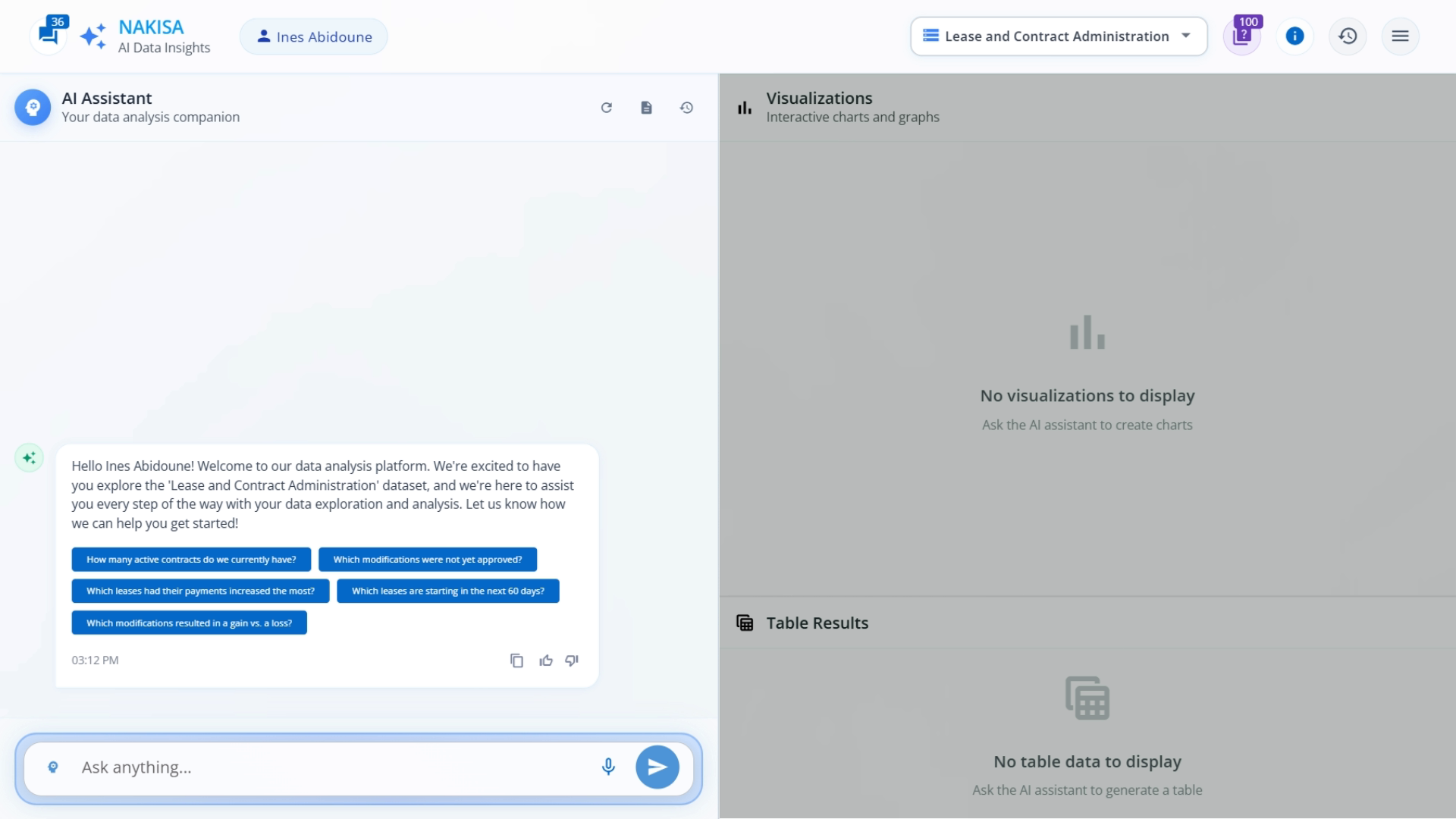

Getting started with NDI: Interface

Nakisa Decision Intelligence (NDI) provides a highly intuitive, AI-driven interface designed for business users. No coding or technical expertise is needed, and you can interact through text or voice prompts. Its UI is user-friendly, making even complex data exploration clear, fast, and actionable:

- Chat panel (left). Here, you can communicate with NDI by typing, speaking, or selecting smart prompts.

- Visualization panel (right). Find here interactive reports, tables, and charts generated in real time.

Nakisa Decision Intelligence interface with AI chat panel and interactive data visualizations for real-time analysis and decision-making.

Use case 1: Understanding the lease portfolio and historical trends

For global organizations, lease portfolios are vast and multifaceted, spanning multiple regions, contract types, and currencies. Finance and real estate leaders often struggle to consolidate this information into a single source of truth. Without this visibility, identifying performance trends, assessing financial exposure, or answering critical questions quickly becomes a major challenge.

Organizations need a way to unify lease data and access it instantly, so that any important question, whether about portfolio health, historical trends, compliance risk, audits, regulatory reporting, or future obligations, can be answered in real time. Without this capability, decision-making is slow, reactive, and prone to errors, making it difficult to plan strategically for what’s ahead.

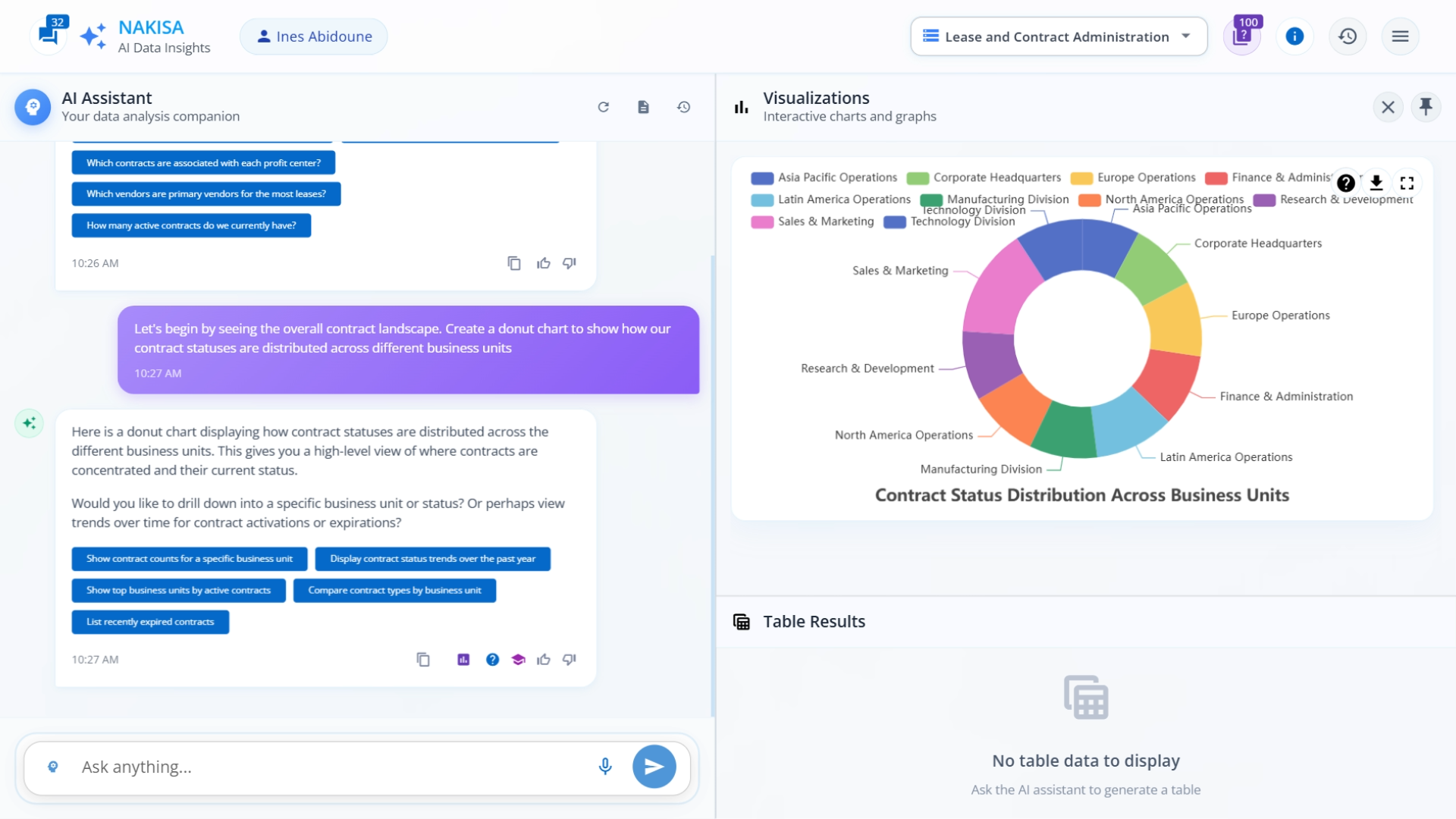

Prompt: Show a donut chart of contract statuses by business unit.

Result: NDI instantly generates a donut chart visualizing how lease contracts are distributed across business units. By clicking into Asia Pacific Operations, we drill down to view contract-level details, including contract IDs, descriptions, and current statuses.

With a simple natural language prompt, Nakisa Decision Intelligence visualizes lease contract statuses by business unit and region in a dynamic donut chart.

Together, these insights help finance leaders understand how their lease strategy affects the balance sheet, a foundational step toward better capital management.

Use case 2: Identifying key cost drivers and vendor dependencies

Not all leases are created equal. Some cost centers or vendors disproportionately drive expenses, often hidden within aggregate reports. Uncovering these cost drivers helps organizations control unnecessary spending, strengthen vendor negotiations, and align leasing strategies with business priorities.

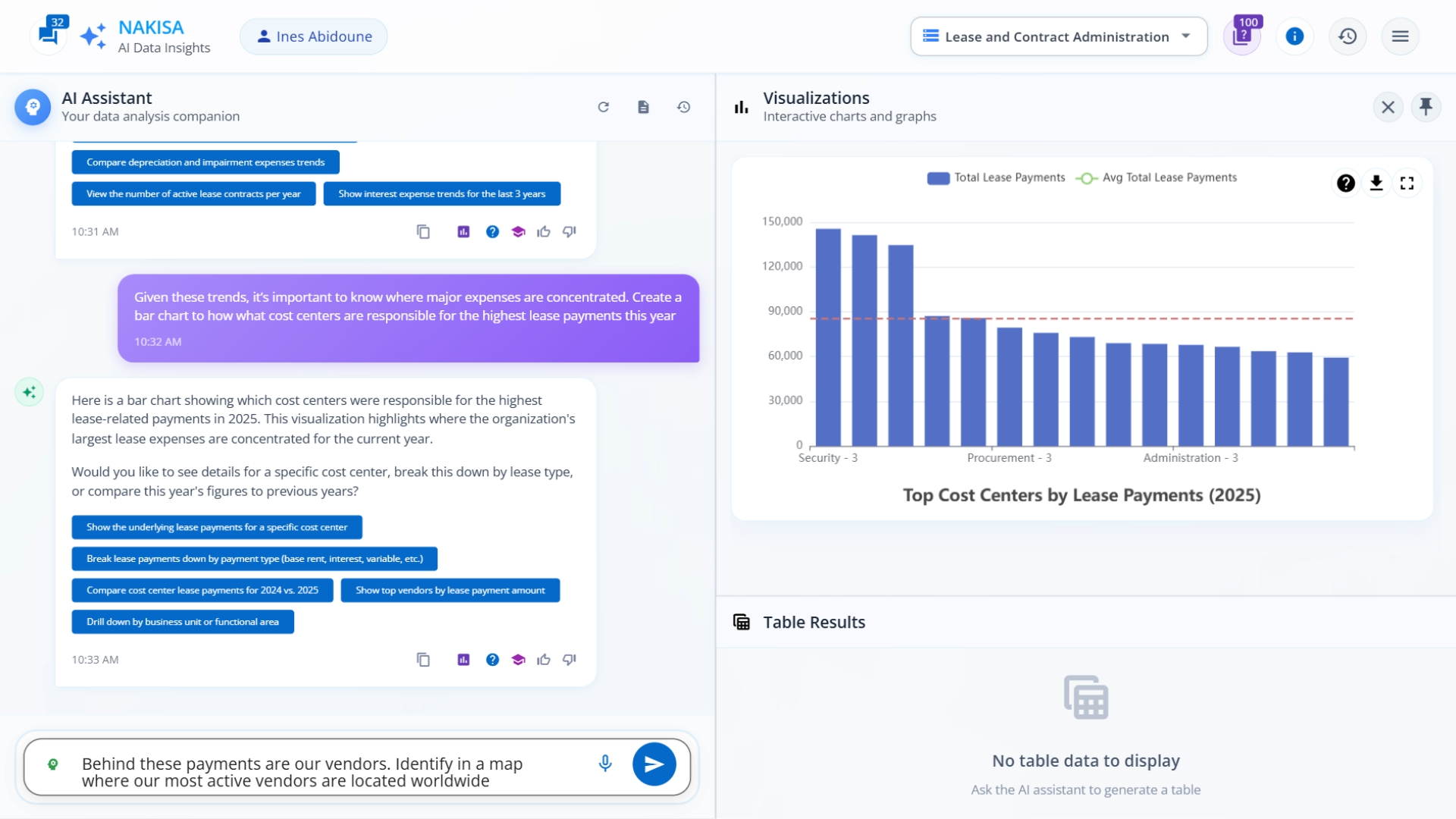

Prompt: Create a bar chart ranking cost centers by total lease payments this year.

Result: NDI displays a ranked bar chart showing that Security and Procurement carry the highest lease costs this year. With a single visual, stakeholders could identify where resources are most heavily committed, enabling targeted cost optimization efforts.

With Nakisa Decision Intelligence, teams can uncover high-impact lease cost drivers in real time through intuitive, AI-driven analyses and visualizations.

Next, to understand supplier concentration and global dependencies, we ask:

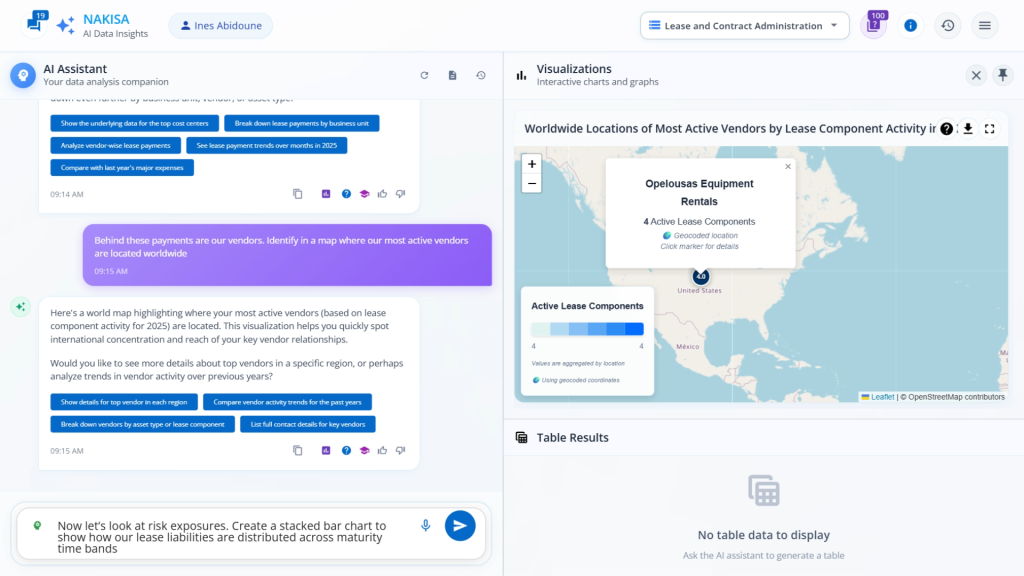

Prompt: Show a world map highlighting where our vendors are located.

Result: NDI generates a world map displaying vendor hotspots, with a clear concentration in North America. By clicking on the U.S., we can see the top vendors and associated costs, revealing geographic dependencies and potential risks in the supplier network.

Nakisa Decision Intelligence generates interactive maps from simple prompts, highlighting vendor hotspots and global supply risks.

This level of insight allows procurement teams to negotiate smarter, diversify vendor relationships, and align lease spending with strategic sourcing objectives.

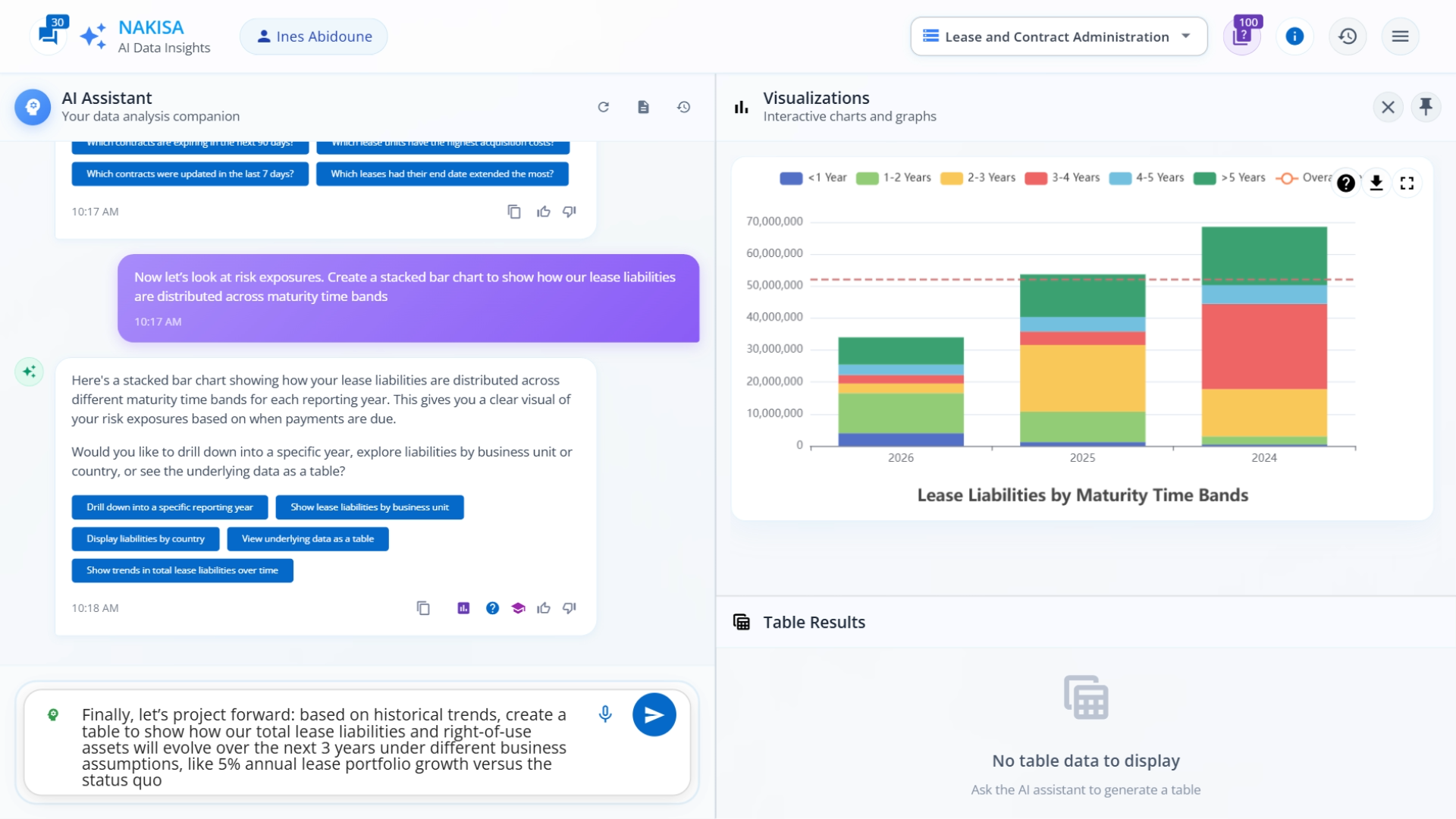

Use case 3: Assessing financial risks across lease maturities

Lease liabilities don’t just represent current costs; they are future financial commitments.

Understanding when these liabilities mature helps finance and treasury teams manage liquidity, mitigate refinancing risks, and ensure adequate cash flow planning.

Many organizations struggle to visualize maturity patterns across hundreds or thousands of leases. NDI automates this analysis with a single prompt.

Prompt: Show the maturity profile of our leases by time band.

Result: NDI creates a maturity profile chart illustrating lease obligations by year.

The visualization reveals a concentration of liabilities in the 2–3-year band (2025) and 1–2-year band (2026), indicating potential near-term refinancing risk.

With Nakisa Decision Intelligence, users can instantly visualize lease maturity patterns and proactively plan refinancing and liquidity strategies.

With this insight, treasury and finance leaders can plan refinancing activities proactively, balance short- and long-term lease commitments, and manage exposure to interest rate fluctuations and liquidity constraints.

This proactive visibility turns lease data into a strategic financial management tool.

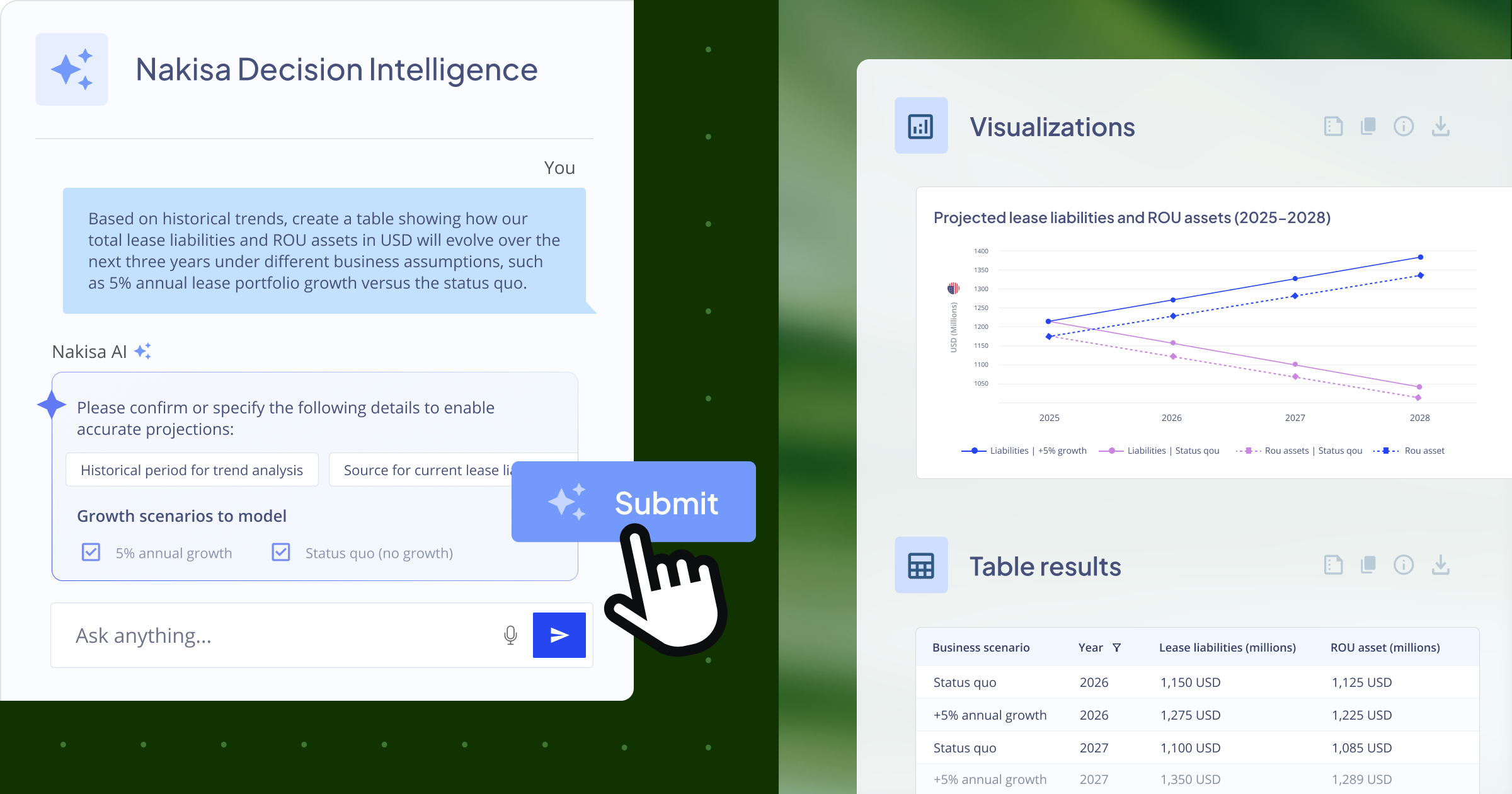

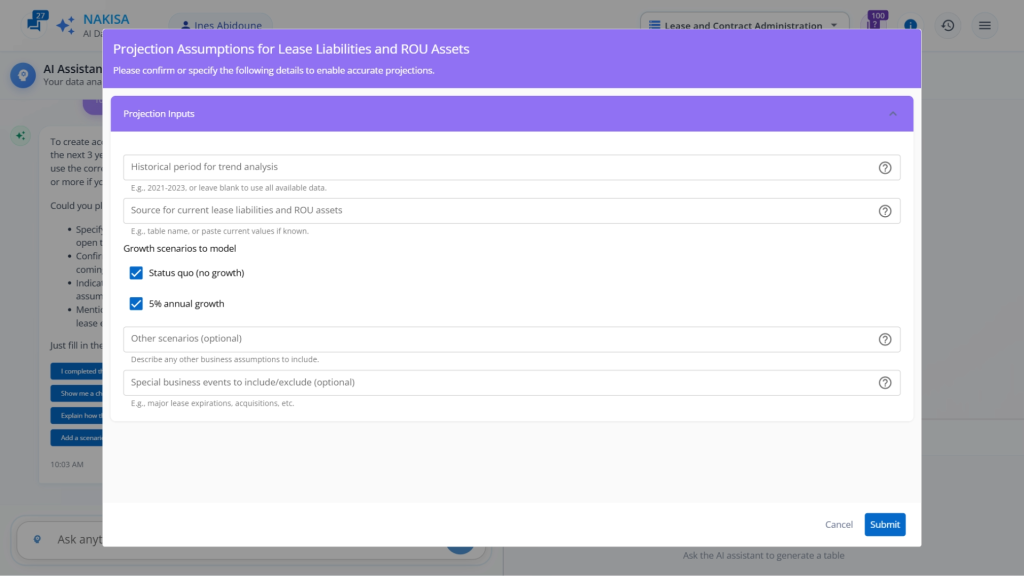

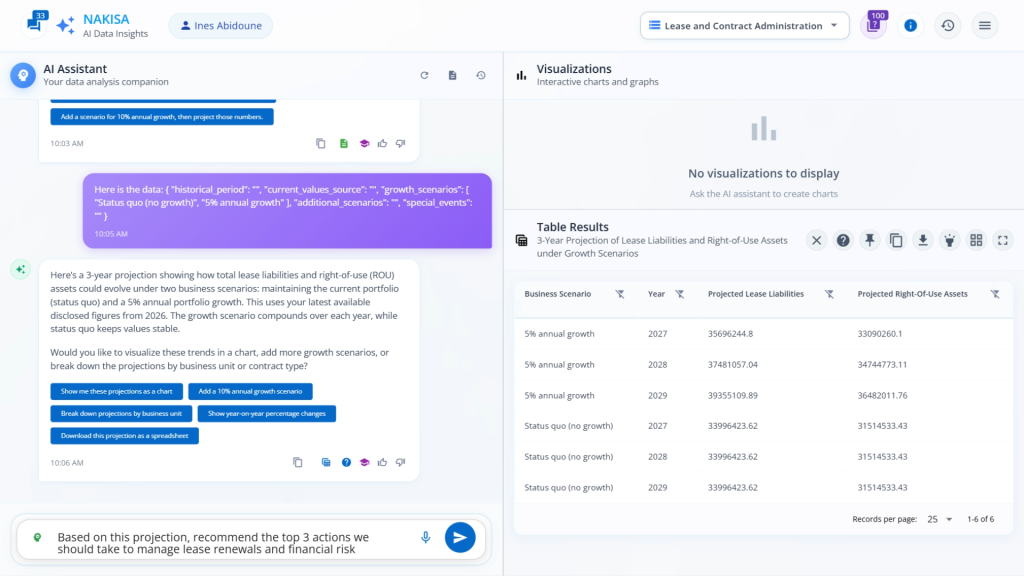

H3: Use case 4: Projecting future scenarios to guide smarter capital and lease strategy

Organizations must make forward-looking decisions about expanding or optimizing their lease portfolios. Scenario planning enables leaders to test the financial impact of potential growth or contraction before making commitments, reducing risk and improving capital efficiency.

NDI’s scenario modeling puts powerful, data-driven insights within reach of every user, fast, intuitive, and easy to use.

Prompt: Create a table forecasting total lease liabilities and ROU assets over the next three years under two scenarios:

- Status quo

- 5% annual growth in the lease portfolio.”

Result: NDI creates a forecast table comparing both scenarios side by side.

The results show how even modest portfolio growth would increase both lease liabilities and right-of-use assets, affecting long-term balance sheet structure and cash flow planning.

With Nakisa Decision Intelligence, users can quickly model lease portfolio scenarios, gaining insights to guide smarter financial and capital decisions.

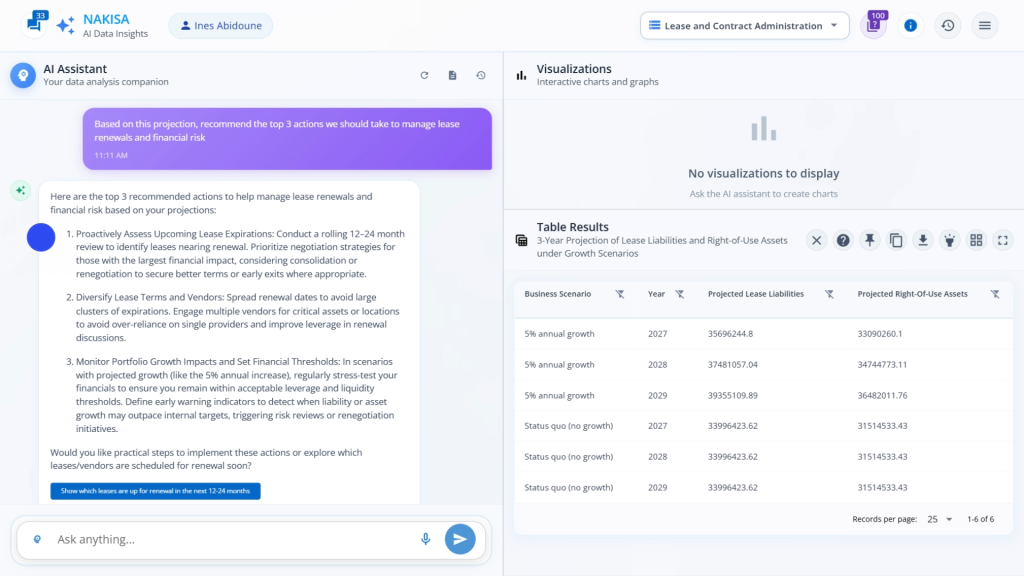

To turn projections into strategic guidance, we add a follow-up prompt:

Prompt: Provide recommendations for managing lease renewals and financial risks.

Result: NDI delivers three concrete recommendations for optimizing lease renewals, managing portfolio growth, and mitigating financial risks.

With Nakisa Decision Intelligence, teams receive expert, AI-driven recommendations to optimize leases, mitigate risks, and support proactive lease and portfolio strategy.

By linking predictive insights with actionable strategies, NDI closes the loop between data, analysis, and execution, helping leaders make proactive, confident decisions about capital allocation and leasing strategy.

Conclusion

Traditional lease accounting and portfolio management often depend on manual reconciliations, static spreadsheets, and disconnected systems, making processes slow, error-prone, and reactive. Nakisa Decision Intelligence (NDI) changes this by unifying internal and external data into an AI-first platform that delivers real-time insights, forecasts, simulations, intuitive visualizations, and automated workflows, all through natural language prompts (text or voice). The result: finance and accounting teams move beyond compliance to drive strategic impact.

With just a few natural language prompts, users can:

- Get a clear view of their entire lease portfolio and historical trends

- Identify key cost drivers, high-spend cost centers, and vendor dependencies

- Assess financial risks across lease maturities and anticipate upcoming obligations

- Model future lease liabilities and right-of-use assets under different growth assumptions

- Receive instant, expert recommendations for renewals, refinancing, and exposure management

All of this happens without manual data manipulation or complex queries. NDI empowers lease accounting professionals to make faster, smarter, and more strategic decisions, transforming raw data into actionable insights and freeing teams to focus on high-value strategic activities.

As AI continues to reshape lease accounting landscape, increasing speed, accuracy, and strategic visibility, NDI remains at the forefront, helping finance organizations adapt and thrive in this new era of intelligent decision-making.

Join us in revolutionizing lease accounting! Learn more about Nakisa Decision Intelligence (NDI) and our lease accounting solution to see how AI can deliver tangible value across your organization. Request a demo of Nakisa Decision Intelligence here, or reach out to your dedicated Client Success Manager to access the preview environment.

Subscribe to our YouTube channel for the latest insights and innovation updates.