Enterprise lease accounting software

Enterprise-grade solution trusted by industry leaders

Why does your enterprise need Nakisa's lease accounting software?

Enterprise-grade PLATFORM

Efficiently manage large, complex portfolios across their lifecycle

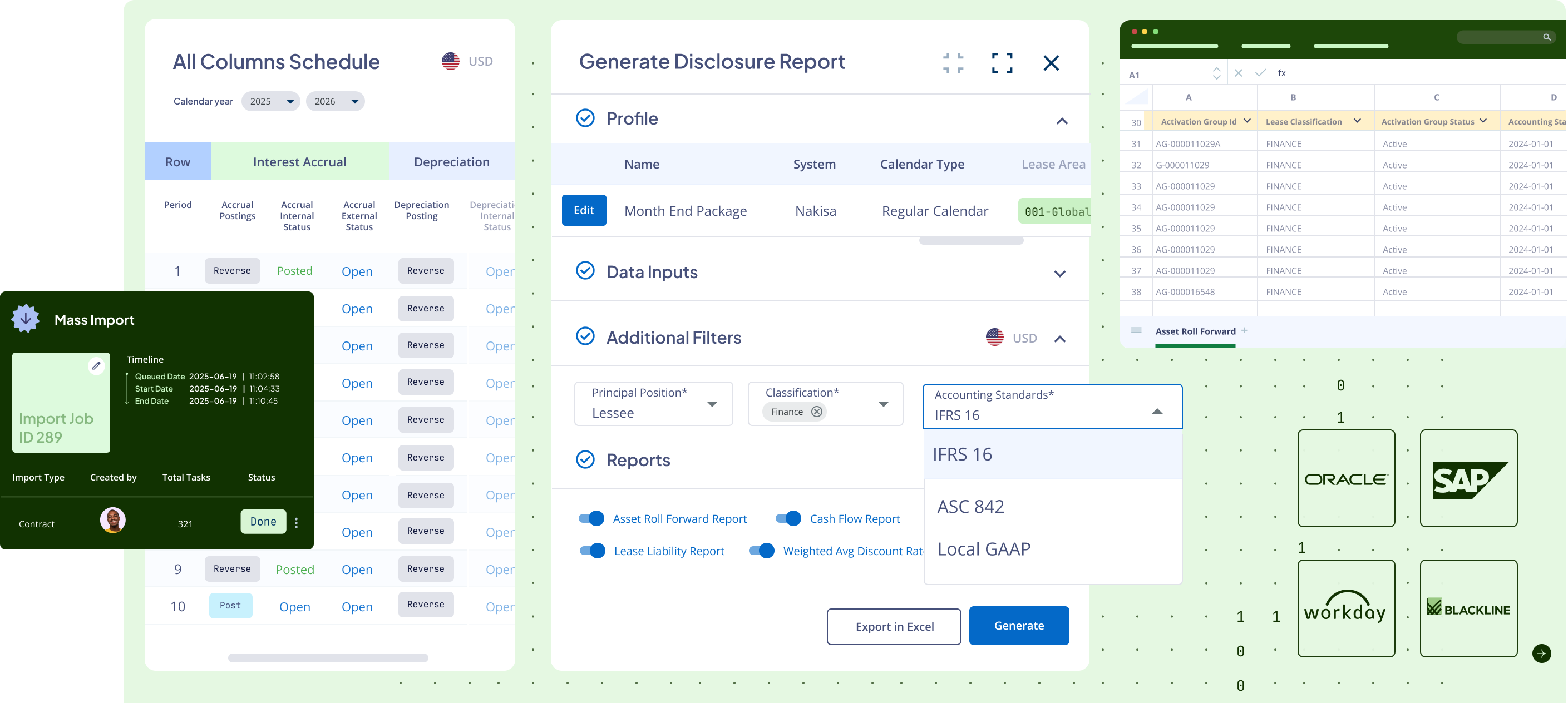

Built for global enterprises, Nakisa offers scalable solutions with advanced configurability and flexible analytics to manage complex use cases, including high contract volumes (100,000+), diverse asset types (equipment, property, land, or fleet), lessees or lessors, irregular calendars, multiple ERPs, various accounting standards, multiple currencies and languages, and frequent modifications and events. Benefit from true contract- and asset-level accounting.

CROSS-TEAM ALIGNMENT

Bring together contract admin, accounting, executive teams

Say goodbye to siloed systems and teams. With Nakisa’s integrated solutions, all your data is centralized, saving time, ensuring integrity and accuracy, and enabling timely audits and seamless collaboration. Contract managers, accountants, and executives work within the same system, eliminating the hassle of chasing each other or reconciling data from different sources. Automating complex rent calculations—percentage or sales-based rent, tax, insurance, CAM, and CPI indexation—is a breeze.

Maximized Return on Investment

Save time and eliminate errors with automation, integration, mass operations

Nakisa’s native integrations (SAP, Oracle, Workday) and powerful APIs eliminate data duplication and reconciliation. We offer critical date alerts, mass operations, automated workflows, out-of-the-box calculations, and parallel compliance with IFRS 16, ASC 842, and local GAAP. Plus, Nakisa Lease Accounting seamlessly integrates with Nakisa IWMS products— Capital Projects, Portfolio Management, and Facility Management—for full asset lifecycle management.

Agile growth

Experience rapid deployment, easy maintenance, seamless upgrades

Unlike other vendors requiring significant upfront setup, customization costs, and third-party resources for maintenance or upgrades, Nakisa is a cloud-native solution designed for easy configuration and rapid deployment. Benefit from two major releases annually and updates every six to eight weeks to stay aligned with your evolving needs. We design and build all our upgrades based on what our clients want and what we know they’ll need.

What our clients say about Nakisa's lease accounting software

We worked closely with the Nakisa team to build a solution that would fit the size and requirements of a corporation like Nestlé and that would bring value to other similar organizations in terms of scale and accuracy. Nakisa has a lot to offer in terms of flexibility, user-friendliness, ERP Integration and its cloud solution.

Now the team can update contracts much faster and save a lot of time while working on monthly, quarterly, and annual financial reports. If before Nakisa some countries needed to spend 6-7 working days to identify financial impacts, now it only takes 1 day or, during a particularly eventful month, 2 days. This is a significant win for us. This efficiency benefits both the company and end users, ensuring accurate and timely presentation of financial statements.

Not only did Nakisa provide inherent workflows and automation for IFRS 16, generating time savings, but the solution’s built-in segregation of duties, audit logs, and disclosure reporting also met all our auditing requirements... The solution integrates seamlessly with our multiple SAP ERPs, our users find the tool easy to use, and our Group Finance and Financial Shared Service Center spend far less time resolving lease accounting issues.

LESSEE AND LESSOR ACCOUNTING

Enterprise-grade lease accounting software that supports your portfolio growth

Nakisa offers the best enterprise lease accounting software for lessees and lessors. Easily handle large and complex lease portfolios of 100,000+ contracts from A to Z. Leverage true asset-level accounting and lease asset tracking throughout lease events, from inception to modifications, renewals, and purchases. Native ERP integrations, streamlined processes, and automatic calculations save time, reduce errors, and allow your team to focus on strategic tasks.

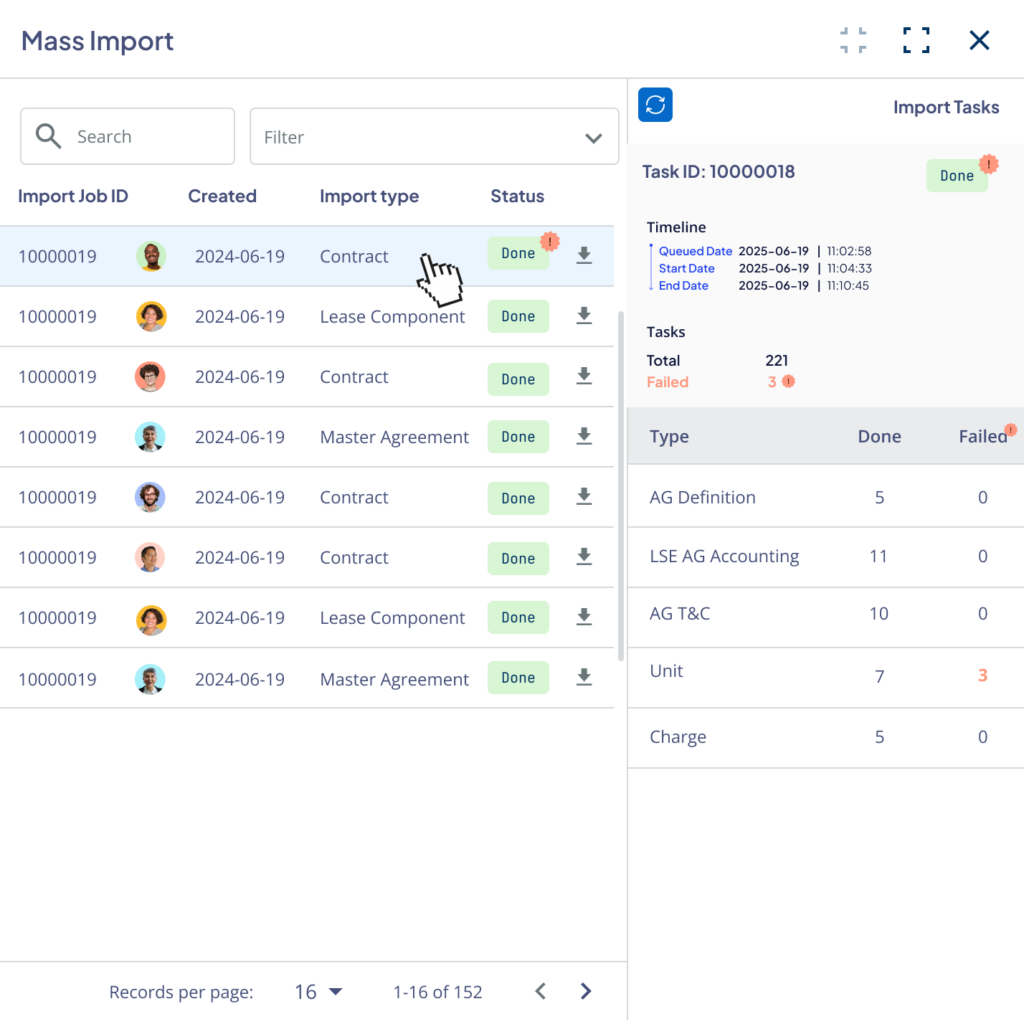

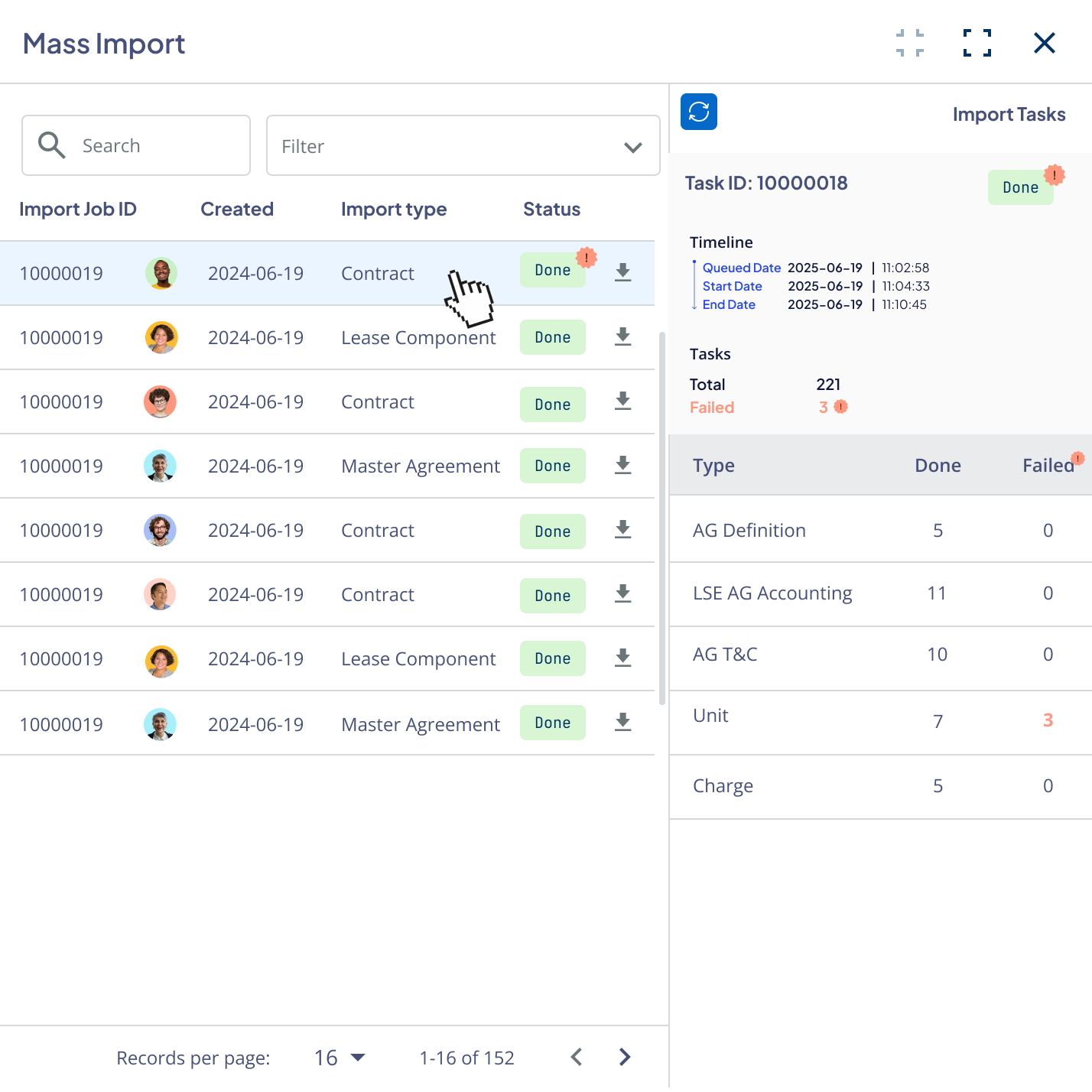

Utilize mass data uploads through bilateral ERP sync, APIs, or flat files. Our software facilitates seamless mass import of lease agreements from diverse sources, such as spreadsheets and legacy solutions. Use the Nakisa AI Agent for document abstraction to streamline the extraction, validation, and processing of critical lease accounting data from a variety of documents, including lease agreements, amendments, invoices, and more. Built for scale and precision, it reduces manual effort while maintaining full auditability and control, ensuring key fields are accurately captured and validated during migration.

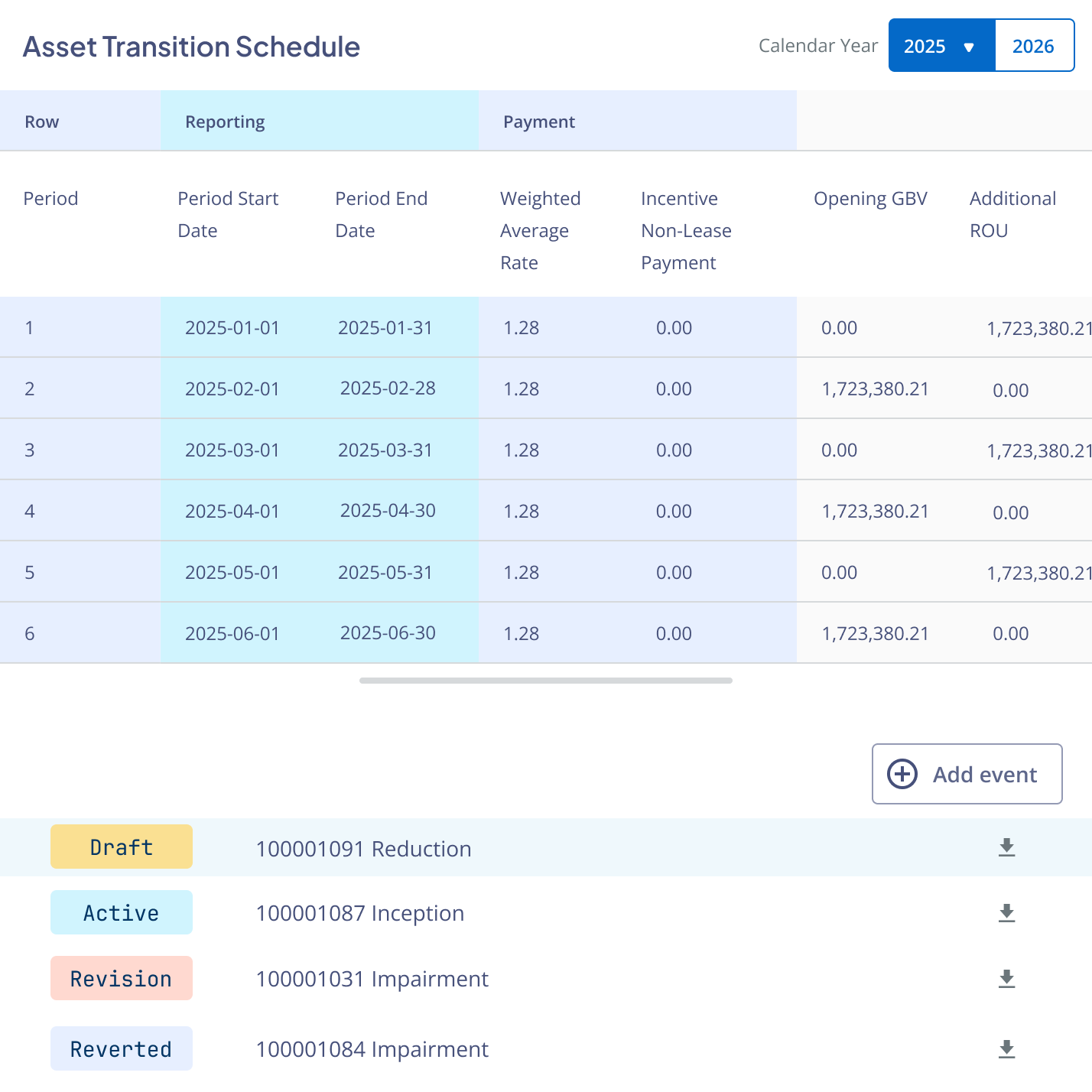

Leverage comprehensive lease accounting and administration capabilities across the lease lifecycle, from inception to modifications, renewals, and purchases. Unlike other vendors, we provide true contract- and asset-level accounting capabilities. Our mass operations feature streamlines bulk processes such as modifications, indexations, or workflow transitions.

With AI-powered capabilities, automate the creation and management of terms, conditions, and charges; track critical dates, payment schedules, and lease clauses with proactive notifications; and gain real-time insights into portfolio performance through customizable reporting and analytics tools. Automate complex calculations for right-of-use assets, lease liabilities, and interest expenses, and ensure compliance with disclosure reporting under multiple standards.

Utilize scheduled or on-demand posting from Nakisa’s subledger to your ERP GL for seamless financial data synchronization and automated payment processing, with posting start dates defined per accounting standard. Preview journal entries before posting to assess their impact.

Our software manages complex payment scenarios, including variable rent, percentage-based rent, CPI indexations, multi-vendors, and multi-currency, and supports various payment schedules—from simple monthly payments to non-standard structures—while maintaining a clear audit trail for compliance and tracking purposes. Efficient batch payment processing handles multiple transactions simultaneously, saving time and reducing errors.

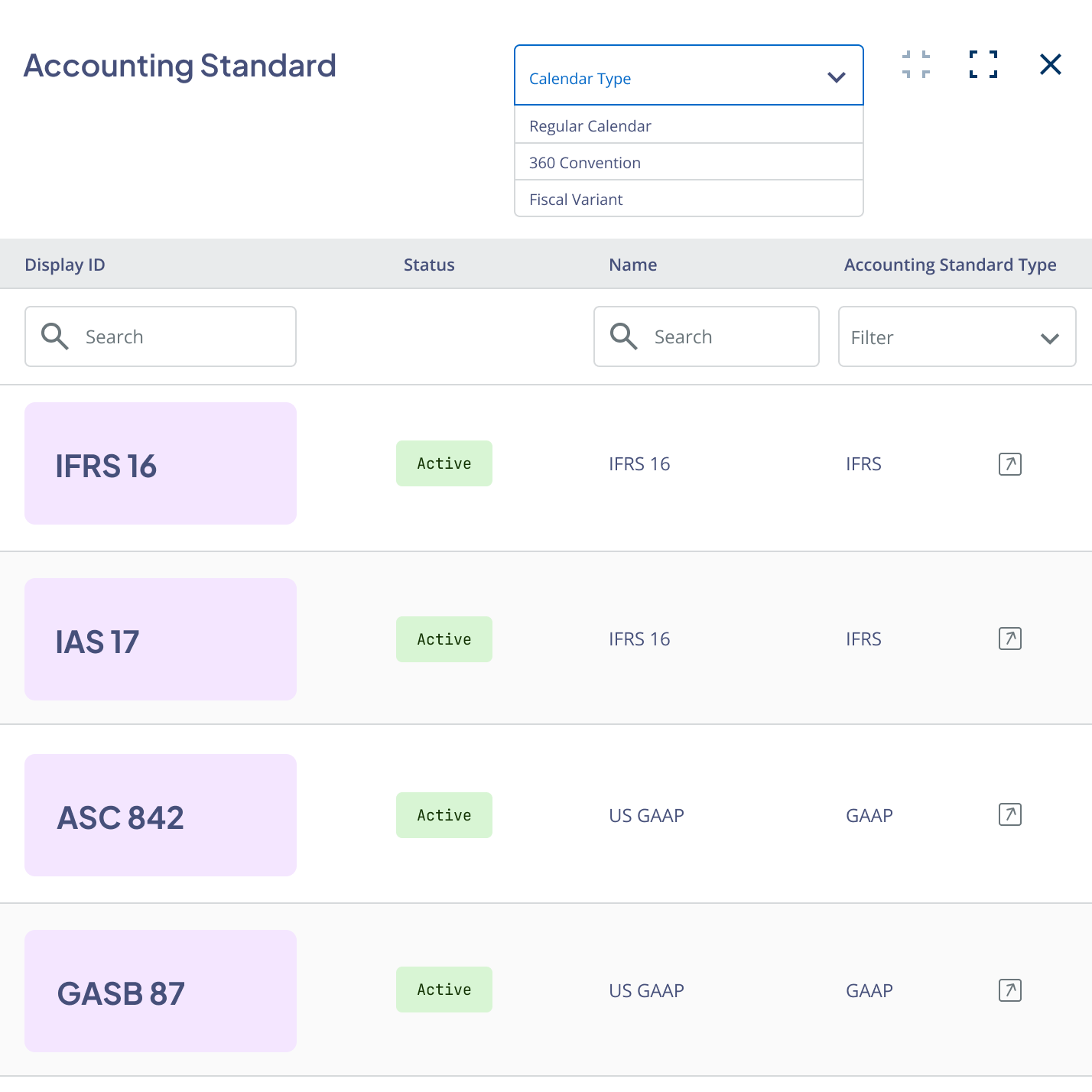

Automate compliance with ASC 842, IFRS 16, and local GAAP standards while easily generating comprehensive disclosure reports. Our software features highly configurable dashboards for financial transparency and offers extensive flexibility, including non-standard 4-4-5 calendars, automated indexation adjustments, multi-currency FX translation under ASC 830 and IAS 21, and modification and reassessment recordings on any effective date.

Ensure complete financial control and accurate period-end closings with automated period-end balance calculations, ledger enrichment mapping for seamless data consistency, and secure general journal entry workflows for controlled GL adjustments.

Nakisa generates audit-ready reports with drill-down capabilities, ensuring compliance with IFRS 16, ASC 842, and local GAAP. The platform supports complex calculations, such as right-of-use (ROU) assets and lease liabilities, while offering standard and customizable reports. Nakisa offers comprehensive financial reports such as Income Statement, Balance Sheet, and Cash Flow, and detailed disclosure reports, including Asset Roll Forward, Lease Liability, Weighted Average Lease Term, Weighted Average Discount Rate, and Maturity Analysis, which support regulatory filings like 10-K and 10-Q. Nakisa also provides transactional and management reports, such as Consolidated Financial Schedules, Periodic Posting Status, Contract Expiration, and Data Quality and Integrity (DQI). Multi-dimensional reporting across lease types, locations, and variables is configurable at the company or user level, with robust scenario analysis and forecasting capabilities.

Lease data capture

Utilize mass data uploads through bilateral ERP sync, APIs, or flat files. Our software facilitates seamless mass import of lease agreements from diverse sources, such as spreadsheets and legacy solutions. Use the Nakisa AI Agent for document abstraction to streamline the extraction, validation, and processing of critical lease accounting data from a variety of documents, including lease agreements, amendments, invoices, and more. Built for scale and precision, it reduces manual effort while maintaining full auditability and control, ensuring key fields are accurately captured and validated during migration.

Lease accounting and administration

Leverage comprehensive lease accounting and administration capabilities across the lease lifecycle, from inception to modifications, renewals, and purchases. Unlike other vendors, we provide true contract- and asset-level accounting capabilities. Our mass operations feature streamlines bulk processes such as modifications, indexations, or workflow transitions.

With AI-powered capabilities, automate the creation and management of terms, conditions, and charges; track critical dates, payment schedules, and lease clauses with proactive notifications; and gain real-time insights into portfolio performance through customizable reporting and analytics tools. Automate complex calculations for right-of-use assets, lease liabilities, and interest expenses, and ensure compliance with disclosure reporting under multiple standards.

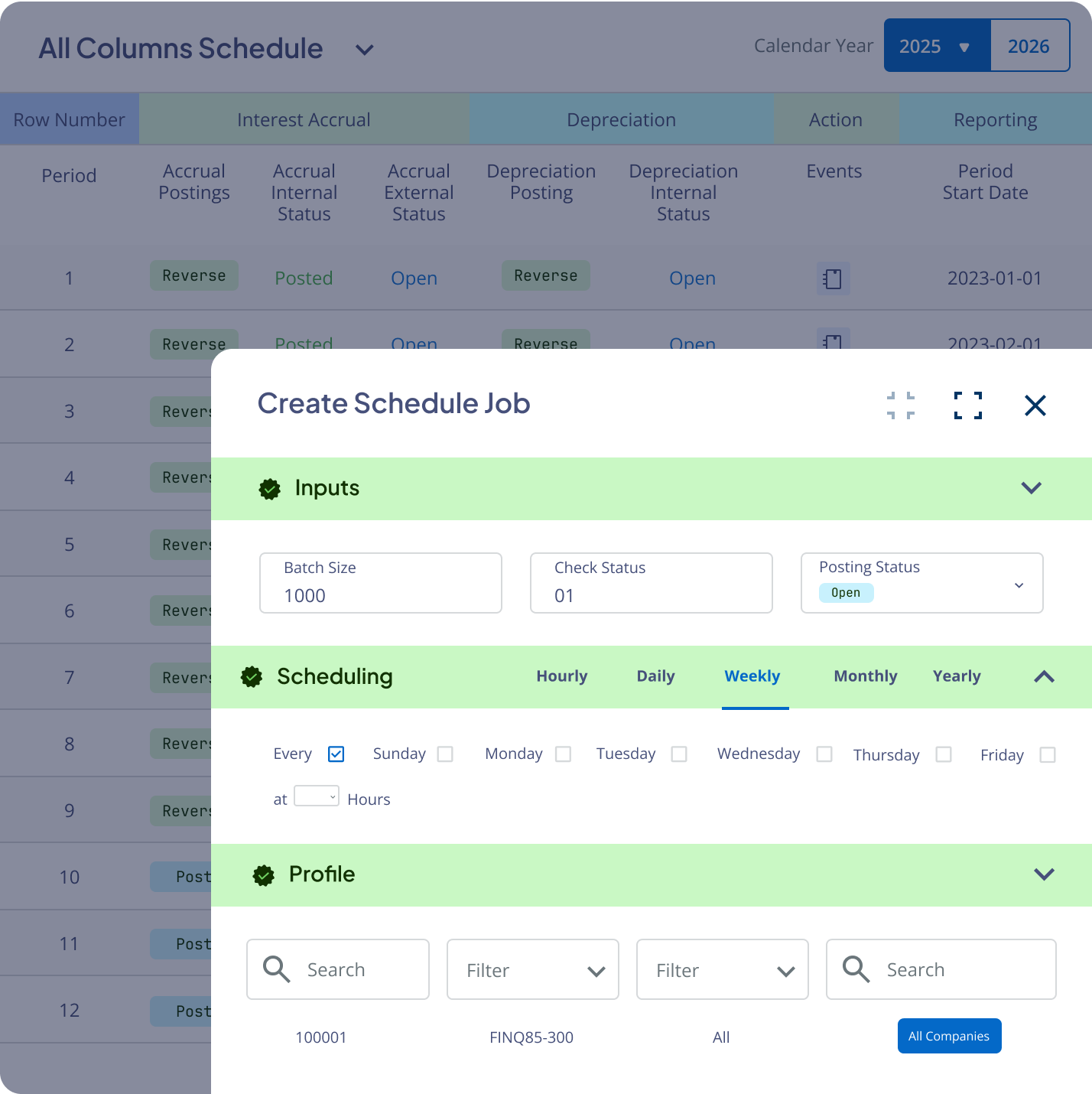

Transaction posting and payment

Utilize scheduled or on-demand posting from Nakisa’s subledger to your ERP GL for seamless financial data synchronization and automated payment processing, with posting start dates defined per accounting standard. Preview journal entries before posting to assess their impact.

Our software manages complex payment scenarios, including variable rent, percentage-based rent, CPI indexations, multi-vendors, and multi-currency, and supports various payment schedules—from simple monthly payments to non-standard structures—while maintaining a clear audit trail for compliance and tracking purposes. Efficient batch payment processing handles multiple transactions simultaneously, saving time and reducing errors.

Compliance

Automate compliance with ASC 842, IFRS 16, and local GAAP standards while easily generating comprehensive disclosure reports. Our software features highly configurable dashboards for financial transparency and offers extensive flexibility, including non-standard 4-4-5 calendars, automated indexation adjustments, multi-currency FX translation under ASC 830 and IAS 21, and modification and reassessment recordings on any effective date.

Ensure complete financial control and accurate period-end closings with automated period-end balance calculations, ledger enrichment mapping for seamless data consistency, and secure general journal entry workflows for controlled GL adjustments.

Auditing and reporting

Nakisa generates audit-ready reports with drill-down capabilities, ensuring compliance with IFRS 16, ASC 842, and local GAAP. The platform supports complex calculations, such as right-of-use (ROU) assets and lease liabilities, while offering standard and customizable reports. Nakisa offers comprehensive financial reports such as Income Statement, Balance Sheet, and Cash Flow, and detailed disclosure reports, including Asset Roll Forward, Lease Liability, Weighted Average Lease Term, Weighted Average Discount Rate, and Maturity Analysis, which support regulatory filings like 10-K and 10-Q. Nakisa also provides transactional and management reports, such as Consolidated Financial Schedules, Periodic Posting Status, Contract Expiration, and Data Quality and Integrity (DQI). Multi-dimensional reporting across lease types, locations, and variables is configurable at the company or user level, with robust scenario analysis and forecasting capabilities.

Our advanced capabilities mirror your real-life challenges

Enterprise-grade solution

Built for large, complex portfolios of 500,000+ contracts of leased, sub-leased, and owned tangible assets (such as real estate, equipment, and fleet), Nakisa supports mass operations, dual ledgers, multiple currencies, languages, calendars, ERPs, and parallel compliance with IFRS 16, ASC 842, and local GAAP. Our solutions grow with your success, designed and built based on client needs and future requirements.

Advanced configurability, automation, and AI-driven innovation

Configure Nakisa at multiple levels—environment-wide, specific ERP, company, or entity. Tailor workflows and processes to perfectly align with your operational needs while ensuring system-wide consistency. With AI-powered capabilities, multi-level approval, intuitive tools, and cross-team collaboration, achieve up to 71% faster period-end closings and a 97% reduction in errors.

Asset-agnostic support

No need for separate lease accounting solutions. Our asset-agnostic platform supports all tangible assets, including equipment, property, land, and fleet. It serves both lessees and lessors, offering comprehensive management across all asset types.

Asset-level accounting

In a single contract, multiple lease assets may have different lives, such as amortization period start and end dates, or distinct events (modifications, renewals, buyouts, terminations). We provide precise tracking and management of these complexities at the asset level.

Mass operations and workflows

Leverage mass operations, including bulk contract uploads, revisions, modifications, and batch jobs like journal entry postings. Use advanced workflow configuration to align processes with your operational needs and scale with your business.

Native bilateral ERP integrations and robust APIs

Connect ERPs, isolated data sources, and various SaaS tools (such as Blackline) using our native bidirectional ERP integrations (SAP, Oracle, Workday) and REST APIs to build a single source of truth. Achieve comprehensive financial management and streamlined workflows with SAP FI-AA and general ledger integration. No need for data duplication and reconciliation. Others take months to integrate; we’re done in days.

Parallel accounting compliance

No need for separate lease accounting solutions. With Nakisa, manage all your leases under IFRS 16, ASC 842, local GAAP in one unified platform. We accommodate each standard’s unique requirements and generate auditable, compliant disclosure reports out of the box. Our general ledger supports manual journal entries for direct adjustments to the leasing subledger, ensuring a single source of truth for accurate financial reporting.

Security and segregation of duties

Nakisa is built on a secure cloud-native platform with data encryption both at rest and in transit, granular role-based access control, Single Sign-On (SSO), and robust audit capabilities to track changes and enable recovery, ensuring compliance with SOC 1 Type II, SOC 2 Type II, FIPS 140-2, GDPR, and IT General Controls (ITGC). Implement granular role-based access control and design workflows for data gathering and approvals across different teams to ensure clear segregation of duties.

Expert change management and ongoing support

With over 20 years of experience supporting Fortune 1000 companies, Nakisa ensures smooth transitions through expert change management and seamless historical data migration. We provide ongoing support, tools, and training necessary for successful adoption and long-term success, all within a cloud-native platform built on independent microservices with 99.5% uptime to ensure continuity for enterprise clients.

Our advanced capabilities mirror your real-life challenges

Enterprise-grade solution

Built for large, complex portfolios of 500,000+ contracts of leased, sub-leased, and owned tangible assets (such as real estate, equipment, and fleet), Nakisa supports mass operations, dual ledgers, multiple currencies, languages, calendars, ERPs, and parallel compliance with IFRS 16, ASC 842, and local GAAP. Our solutions grow with your success, designed and built based on client needs and future requirements.

Advanced configurability, automation, and AI-driven innovation

Configure Nakisa at multiple levels—environment-wide, specific ERP, company, or entity. Tailor workflows and processes to perfectly align with your operational needs while ensuring system-wide consistency. With AI-powered capabilities, multi-level approval, intuitive tools, and cross-team collaboration, achieve up to 71% faster period-end closings and a 97% reduction in errors.

Asset agnostics solution

Asset-level accounting

In a single contract, multiple lease assets may have different lives, such as amortization period start and end dates, or distinct events (modifications, renewals, buyouts, terminations). We provide precise tracking and management of these complexities at the asset level.

Mass operations and workflows

Leverage mass operations, including bulk contract uploads, revisions, modifications, and batch jobs like journal entry postings. Use advanced workflow configuration to align processes with your operational needs and scale with your business.

Native bilateral ERP integrations and powerful APIs

Connect ERPs, isolated data sources, and various SaaS tools (such as Blackline) using our native bidirectional ERP integrations (SAP, Oracle, Workday) and REST APIs to build a single source of truth. Achieve comprehensive financial management and streamlined workflows with SAP FI-AA and general ledger integration. No need for data duplication and reconciliation. Others take months to integrate; we’re done in days.

Parallel accounting compliance

No need for separate lease accounting solutions. With Nakisa, manage all your leases under IFRS 16, ASC 842, local GAAP in one unified platform. We accommodate each standard’s unique requirements and generate auditable, compliant disclosure reports accordingly. Our general ledger supports manual journal entries for direct adjustments to the leasing subledger, ensuring a single source of truth for accurate financial reporting.

Security and segregation of duties

Nakisa is built on a secure cloud-native platform with data encryption both at rest and in transit, granular role-based access control, Single Sign-On (SSO), and robust audit capabilities to track changes and enable recovery, ensuring compliance with SOC 1 Type II, SOC 2 Type II, FIPS 140-2, GDPR, and IT General Controls (ITGC). Implement granular role-based access control and design workflows for data gathering and approvals across different teams to ensure clear segregation of duties.

Expert change management and ongoing support

What our clients say about Nakisa's lease accounting software

We selected Nakisa to comply with IFRS 16 and were very pleased with the tool’s wide range of disclosure reporting capabilities. By automating and centralizing our lease accounting process, we wanted to keep the workload low, given the diversified users and entities working with the solution. Nakisa is an intuitive application that handles all types of leases. We also found it to be the only solution that fully operates in multiple currencies, which is ideal for our global business requirements.

Nakisa allowed us to close our books a week before month-end. Now anyone can easily run a report the last week of the month to verify depreciation, cost centers, and other aspects and ensure they are all correct. We are starting to use the automation of contract uploads and mass lease modifications, and they are going to be a huge win for us. I think we will get a lot of productivity gains out of those features.

We got Nakisa into more markets faster than we had any other software program we’ve ever installed. Nakisa for us is the one we are using for real estate for all our markets. The benefit that we have seen is that it can do the accounting IFRS 16 and ASC 842, and have an SAP integration.

Let's have a no-obligation call!

There, we’ll discuss how Nakisa's lease accounting software can simplify your global lease management, improve operational efficiency, and accelerate month-end closing processes.

Unlock the power of a truly integrated asset management solution with the Nakisa IWMS

The Nakisa Accounting and Nakisa IWMS work together hand-in-hand to streamline asset management by simplifying complex processes. Unify your finance, real estate, facilities, development, and management teams on a single platform, maintaining a single source of truth, gaining portfolio-level visibility, and drilling down into details as needed.

Explore our IWMS products—for capital project planning and management, portfolio management, and facility management—to unlock the full potential of an integrated, enterprise-grade asset management solution.

Comprehensive lease accounting capabilities for your industry

Nakisa’s lease accounting software solutions are designed to be flexible and scalable, catering to a wide range of industries including oil and gas, retail, pharmaceutical, transportation, manufacturing, telecom, financial services, healthcare, public sector, and more.

Oil and gas

Oil and gas lease accounting software automates ASC 842 and IFRS 16 compliance across diverse assets, from drilling rigs and production facilities to pipeline rights-of-way and storage terminals. It streamlines contract management, automating lease lifecycle processes for large contract volumes across regions and business units. Complex arrangements like production sharing agreements, variable payments tied to oil volumes, and long-term land leases are handled with ease. The software tracks key dates, regulatory permits, and equipment recertifications, centralizing lease data to optimize asset portfolios, manage decommissioning liabilities, and ensure accurate reporting of leased assets' impact on production costs.

Read our guide →Retail and Restaurants

Retail lease accounting software is essential for managing extensive lease portfolios—storefronts, warehouses, and equipment—across multiple locations. It automates compliance with ASC 842, IFRS 16, and local GAAP by calculating lease liabilities and right-of-use assets. The software centralizes lease data, tracks critical dates for rent escalations and renewals, and generates customized reports tailored to retail needs. By providing visibility into occupancy costs and lease obligations, it enables retailers to ensure accurate financial reporting, optimize real estate strategies, and make informed decisions on expansions or closures.

Read our guide →Pharmaceutical

Pharmaceutical lease accounting software streamlines ASC 842 and IFRS 16 compliance across diverse assets, from lab equipment to research facilities. It efficiently handles complex R&D leases, tracks specialized equipment, and manages multi-site office spaces. Nakisa’s advanced accounting engine mirrors real-world contracts, supports flexible payment terms, and provides comprehensive financial schedules for GMP facilities. Offering insights into lease costs, it aids strategic decisions on global expansion while ensuring accurate financial reporting for investor confidence. By centralizing lease data, pharmaceutical firms can optimize their lease portfolios while staying focused on core research and production activities.

Transportation

Transportation lease accounting software streamlines ASC 842 and IFRS 16 compliance across diverse assets, including vehicles, warehouses, offices, and facilities. It manages variable-term vehicle leases, calculates right-of-use assets for long-term facility rentals, and handles complex equipment leases with varying terms. The software tracks fuel card agreements, handles cross-border leasing regulations, and generates reports for fleet performance analysis. Providing actionable insights, it supports vehicle acquisitions and disposals while ensuring accurate reporting of leased assets across jurisdictions—enabling precise financial reporting and supporting strategic planning in the competitive transportation sector.

Manufacturing

Manufacturing lease accounting software automates accounting and ensures ASC 842 and IFRS 16 compliance for complex portfolios, including facilities, warehouses, and equipment. It manages equipment leases with embedded services, calculates ROU assets for long-term facility rentals, and handles variable payment leases. The software tracks tooling agreements, integrates with ERP systems for real-time production data, and generates reports for capacity utilization analysis. Providing actionable insights, it supports lease renewal decisions and ensures accurate reporting of leased assets' impact on manufacturing costs. By centralizing lease data, manufacturers can optimize their asset mix while maintaining operational efficiency and financial compliance.

Telecom

Telecom lease accounting software streamlines ASC 842 and IFRS 16 compliance across diverse assets— cell towers, data centers, and network equipment. It automates calculations for complex arrangements like tower co-location agreements, manages variable lease payments, and supports cross-border spectrum and multi-currency leases. The software centralizes lease data, tracks critical dates for equipment upgrades, site access renewals, and capacity expansions. It generates reports for regulatory filings and network performance analysis, providing actionable insights. This allows telecom companies to optimize network deployment strategies, manage capacity efficiently, and ensure accurate reporting of leased assets' impact on operational expenses.

Financial Services

Enterprise-grade lease accounting software is essential for financial firms managing complex lease portfolios—office spaces, data centers, and equipment. It handles complex arrangements for bank branches, manages variable lease payments for cloud computing services, and calculates ROU assets for long-term data center leases, and tracks critical dates for renewals and equipment upgrades. Nakisa’s audit trail and compliance features ensure robust governance, with detailed logs for master data changes, batch tasks, and time-stamped entries, supporting ASC 842 and IFRS 16 compliance. The software provides insights into cost allocation across business units and ensures accurate reporting of leased assets. Centralizing lease data enables financial institutions to optimize physical and digital footprints while maintaining compliance in a highly regulated industry.

Healthcare

Healthcare lease accounting software optimizes accounting and ensures ASC 842, IFRS 16, and local GAAP compliance across diverse assets—hospitals, clinics, medical equipment, and office spaces. It automates calculations for complex arrangements, such as equipment leases with service components, manages variable payments, and handles long-term hospital building leases. The software tracks critical dates for medical equipment leasing and facility accreditations and generates reports for regulatory filings. By centralizing lease data, it enables healthcare providers to optimize property, facility, and equipment mix, manage capacity efficiently, and ensure accurate financial reporting—crucial for balancing quality patient care with financial sustainability in a highly regulated industry.

Public sector

Lease accounting software for public sector entities streamlines compliance for local GAAP, ASC 842, IFRS 16 and GASB 87 across diverse assets— government buildings, equipment, and infrastructure. It automates calculations for complex arrangements, such as intergovernmental leases, manages variable payments for equipment rentals, and handles long-term land leases for public projects. The software tracks critical dates for renewals and generates reports for budget hearings and public audits. It provides insights into lease obligations and costs while ensuring accurate reporting of leased assets' impact. By centralizing lease data, it enables government entities to optimize resource allocation, enhance fiscal transparency, and demonstrate responsible stewardship of public funds.

Ready to optimize your lease accounting?

Our experts are here to discuss your unique lease accounting and compliance needs and provide a tailored demo of our solution designed to meet the specific requirements of your global enterprise.

GET FREE DEMO

Explore how Nakisa can benefit your business firsthand

Frequently Asked Questions

What is lease accounting software?

Lease accounting software, such as Nakisa Lease Accounting (also known as Nakisa Lease Administration or NLA) is designed to help companies manage and report leases in compliance with financial standards like IFRS 16, ASC 842, and local GAAP. These recent standards require companies to recognize most lease liabilities on their balance sheets. Lease accounting software centralizes all lease-related information, including key dates and payment amounts, while automating complex calculations, such as lease liabilities and right-of-use (ROU) asset amortizations. The software is particularly useful for global enterprises, as it streamlines the management of large lease portfolios across different regions, ensures consistent compliance with varying regulatory requirements, and provides centralized oversight—reducing the complexity and risks associated with multinational operations.

What to look for in lease accounting software?

If your company is looking for new lease management software, start with assessing your lease portfolio needs. Next, examine the functionalities offered by various vendors. Key considerations include compliance with lease accounting standards, ERP integration capabilities, automation, analytics, data security, and scalability. For a comprehensive guide and checklist, refer to our Ultimate Guide on Selecting Lease Accounting Software. There, you will find a detailed vendor scorecard/RFP checklist to objectively evaluate market solutions.

Can Nakisa’s lease accounting software integrate with other financial systems used by my organization?

Certainly! Nakisa’s lease accounting software seamlessly integrates with various financial systems within your organization. Its cloud-native architecture facilitates advanced integrability, allowing Nakisa to easily connect with your existing systems through native integrations (ERP), APIs for third-party SaaS tools like Blackline, or flat file integrations.

Can I import lease agreements from spreadsheets or legacy solutions to Nakisa’s lease accounting solution?

Absolutely! Nakisa enables easy import of lease agreements from spreadsheets or legacy solutions. The software supports mass import from Excel, complete with data validation tools to ensure accurate migration. Additionally, our Nakisa team is ready to assist in migrating data from your previous lease management software. We collaborate closely with your team to audit and validate the migration process, even when dealing with multiple data sources.

What training and support options are provided for users of Nakisa Lease Accounting?

Nakisa prioritizes client support, offering dedicated client assistance 24/7/365 along with an assigned customer success manager for each client. We provide comprehensive onboarding materials and monthly training through NLA Office Hours and NLA User Group.

NLA Office Hours offer insights into new features, while User Group sessions encourage discussions among our user community on various use cases and scenarios. Access our training resources on YouTube and C Portal, or join live sessions by signing up here. Additionally, check our Resource Center for more step-by-step guidelines. We are committed to empowering users with the knowledge and support they need to succeed.

Does Nakisa Lease Accounting support pre-paid leases?

Yes, Nakisa Lease Accounting (also known as Nakisa Lease Administration or NLA) accommodates pre-paid leases, which can include full-prepayment and partial prepayment.

Can I modify lease contracts at any point in Nakisa Lease Accounting?

Yes, Nakisa’s lease accounting software supports a wide range of lease events and modifications throughout the life of the contract. You can apply modifications to either a lease contract or an activation group. Here are some of the events we support: contract rate change (to update the contract rate or IBR by asset class or contract currency), terms and conditions reassessment (to exercise or un-exercise terms); indexation; asset impairment; decrease in term; decrease in asset; early buy-out, termination, and more.

What types of reporting and analytics are supported in Nakisa Lease Accounting? What audit reports does it offer?

Accounting reports:

With Nakisa’s software, you can create various disclosure reports in compliance with multiple standards, including asset roll forward, cash flow, expense, lease liability, maturity analysis, non-lease charge expense, weighted avg discount rate, and weighted avg lease term. We provide out-of-the-box reports, ad-hoc reports, and highly configurable dashboards on-the-fly for additional analysis.

Security reports:

Our software also provides audit logs reports, which include a comprehensive change log and audit trail. These logs capture each time-stamped event with user IDs, comments, and other relevant details. This information is always accessible and remains linked to your contracts.