Why traditional real estate decision-making struggles in a global context

According to Gartner’s recent Market Guide, most business decisions remain unautomated due to growing complexity, regulatory constraints, and ethical, financial, or reputational risks. Traditional systems offer fragmented, context-limited insights, forcing teams to rely on guesswork, spreadsheets, or siloed data instead of real-time intelligence.

For global real estate portfolio management, the challenge is even greater. CRE leaders must manage hundreds of locations across the globe, deciding where to expand, which leases to renegotiate, how to allocate capital for maintenance or renovation, and when to exit underperforming markets. Each decision has a ripple effect on costs, brand presence, and long-term profitability. Yet the financial, operational, and market data required for such decisions is often scattered across systems, outdated, or locked in static reports. The result? A reactive, manual, and risk-prone approach to portfolio management.

From our work with Fortune 1000 real estate leaders, we’ve seen that traditional decision-making in global portfolio management faces major limitations, such as:

- Decisions based on incomplete data and limited visibility. Real estate performance depends on interconnected factors like market trends, financial performance, workforce distribution, supply chain routes, customer foot traffic, and facility utilization. Yet most legacy tools can’t integrate these datasets seamlessly. Without a unified view, leaders struggle to see how one factor influences another, like how staffing shifts affect sales per square foot, and find it difficult to align portfolio strategy with financial goals. Even when data exists, its scale makes it hard for humans to detect patterns or act fast, leading to inefficient capital allocation, redundant leases, and poorly timed exists.

- No real-time link between portfolio data and market benchmarks. Market conditions evolve constantly, but traditional systems rely on static data snapshots. Without up-to-date benchmark comparisons, such as rental rates, occupancy levels, or demographic shifts, leaders lose visibility into how their portfolio performs relative to the market. Data fragmentation and the necessity of data research overload real estate teams, reduce their efficiency, and delay the identification of opportunities or threats before competitors.

- Limited scenario planning and forecasting. Modeling the financial impact of location closures, relocations, or new openings requires sophisticated analysis that many teams cannot perform quickly. For example, understanding how closing five underperforming sites in Europe would affect total revenue, logistics costs, and workforce distribution might take weeks of manual modeling. Traditional tools simply can’t simulate multiple outcomes or help visualize trade-offs in real time.

- Slow and reactive decision cycles that lack agility. Collecting data from multiple stakeholders, generating reports, conducting research, and interpreting data can take weeks. By the time a decision is made, market conditions or internal circumstances may have already shifted. Slow decision loops, outdated insights, and reluctance to reanalyze data prevent leaders from responding quickly to emerging trends, reduces the ability to pivot strategy and hinders timely decision-making for store expansions, closures, CAPEX planning, or other corporate real estate actions across offices, facilities, and global assets.

- Misaligned strategic priorities across teams: Without shared, data-driven insights, alignment between real estate, finance, and operations teams and executives becomes difficult. Finance may focus on reducing occupancy costs while operations push for store growth, leading to inconsistent decisions that hurt overall profitability.

Ultimately, traditional decision-making frameworks were built for static environments. But today’s real estate landscape is dynamic, data-rich, and fast-moving, so it requires agility, integrated intelligence, and real-time decision support. These are precisely the capabilities that AI-first platforms like Nakisa Decision Intelligence bring to the table.

What decision intelligence (DI) platforms are and why their adoption is accelerating

Gartner Market Guide states that while some analytic solutions offer functionality to facilitate decision-making including data science predictions, business-unit level dashboards, or other siloed analytical and AI applications, they still fall short of supporting strategic decisions, especially for large enterprises.

As organizations seek smarter and faster ways to make strategic decisions and execute them, decision intelligence platforms are gaining rapid traction. Let’s see how Gartner defines these platforms and how they can transform the way we work with data.

Decision intelligence platforms (DPIs)

are software used to create solutions that support, automate, and augment decision making of humans or machines, powered by the composition of data, analytics, knowledge, and artificial intelligence (AI) techniques. DIPs must have collaborative capabilities for decision modeling, execution, and monitoring. DIPs are used to design decision-centric solutions, explicitly model decisions, orchestrate decision execution flows, and evaluate and govern decisions and audit their outcomes.

With their ability to unify data, automate analysis, and accelerate decision-making, decision intelligence platforms are quickly becoming a must-have for modern enterprises. Gartner predicts that by 2026, 75% of Global 500 companies will adopt decision intelligence practices, including the systematic logging of decisions for later analysis. Gartner also predicts that by 2026, 50% of organizations will need to evaluate analytics and business intelligence (ABI) and data science and machine learning (DSML) platforms as a single platform due to market convergence.

Babak Varjavandi

CEO at Nakisa

Introducing Nakisa Decision Intelligence (NDI) for real estate portfolio management

Nakisa Decision Intelligence (NDI) empowers real estate leaders to strategically optimize portfolios, anticipate market shifts, and deliver measurable impact across scaling initiatives, portfolio optimization, and complex business pivots.

With NDI, organizations can achieve:

- up to 40% faster time-to-decision

- 90% more accurate analyses

- up to 60x faster complex portfolio analyses

Now, let's explore how Nakisa Decision Intelligence (NDI) can transform real estate portfolio management with specific examples from day-to-day operations. You’ll see how to use text or voice-based prompts in NDI to easily get and configure a comprehensive overview of global real estate portfolio and accurately assess financial impact per region, country, or location. Then, we'll explore how to quickly identify leases at risk, analyze trends in missed critical dates, and set up reminders for upcoming critical dates per location by using Nakisa AI Agents.

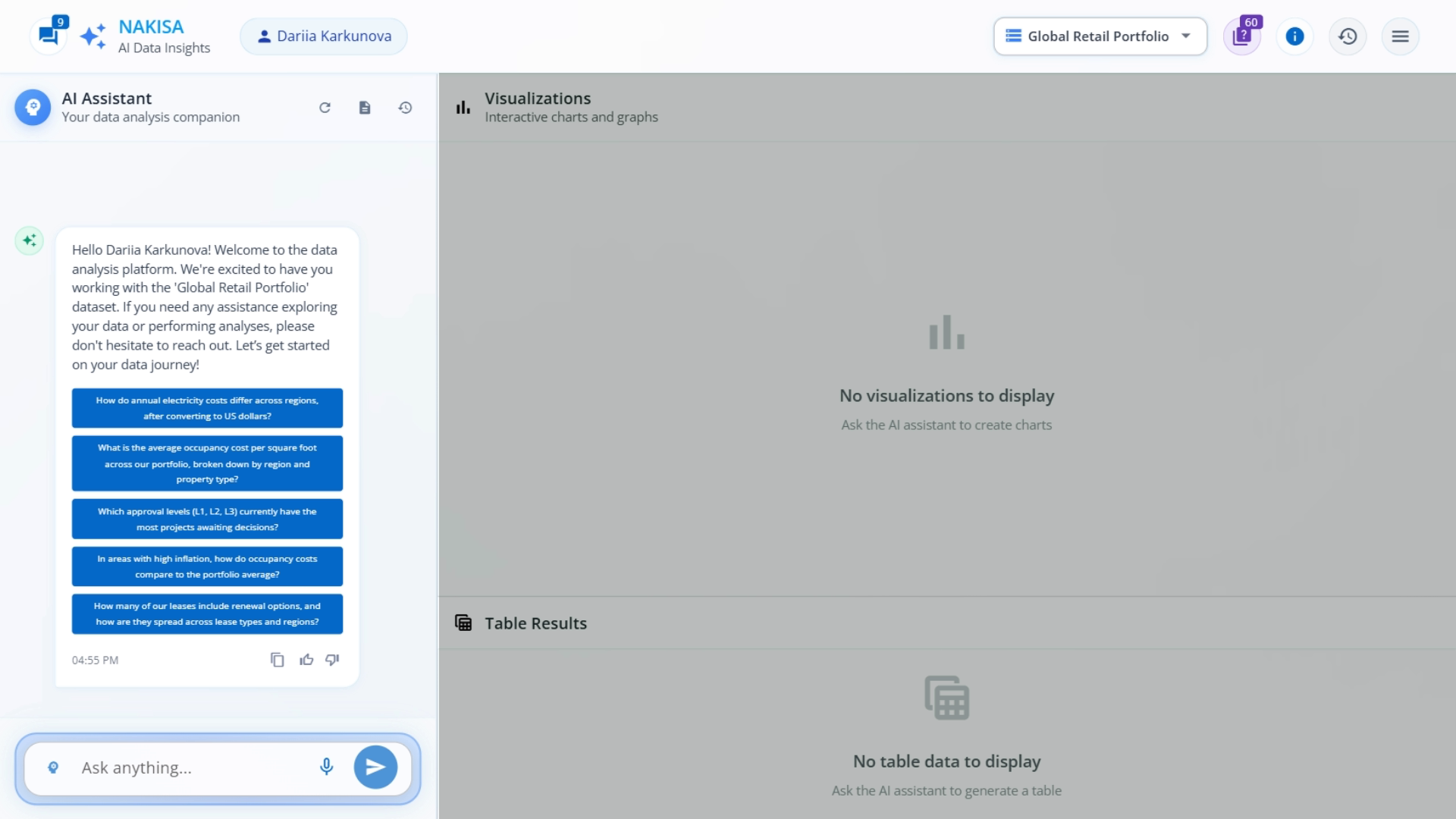

Getting started with NDI: Interface

Nakisa Decision Intelligence (NDI) provides a highly intuitive, AI-driven interface designed for business users. No coding or technical expertise is needed, and you can interact through text or voice prompts. Its interface is user-friendly, making even complex data exploration clear, fast, and actionable:

- Chat panel (left). Here, you can communicate with NDI by typing, speaking, or selecting smart prompts. NDI responds with real-time visualizations, tailored recommendations, and suggested actions or follow-up questions.

- Visualization panel (right). Find here interactive reports, tables, and charts generated in real time.

The NDI interface lets users interact via text, voice, or smart prompts while viewing real-time charts and reports.

In the top right bar menu, you’ll find:

- Datasets menu. Different teams can leverage different datasets if required. Each dataset can include multiple internal and external data sources organized by your administrator.

- Information icon. By clicking on the information icon, you can see all the data sources and data mapping in the selected dataset. You’ll find descriptions per data source, and the fields NDI takes from them, the data mapping, and suggested questions based on the data from the selected dataset.

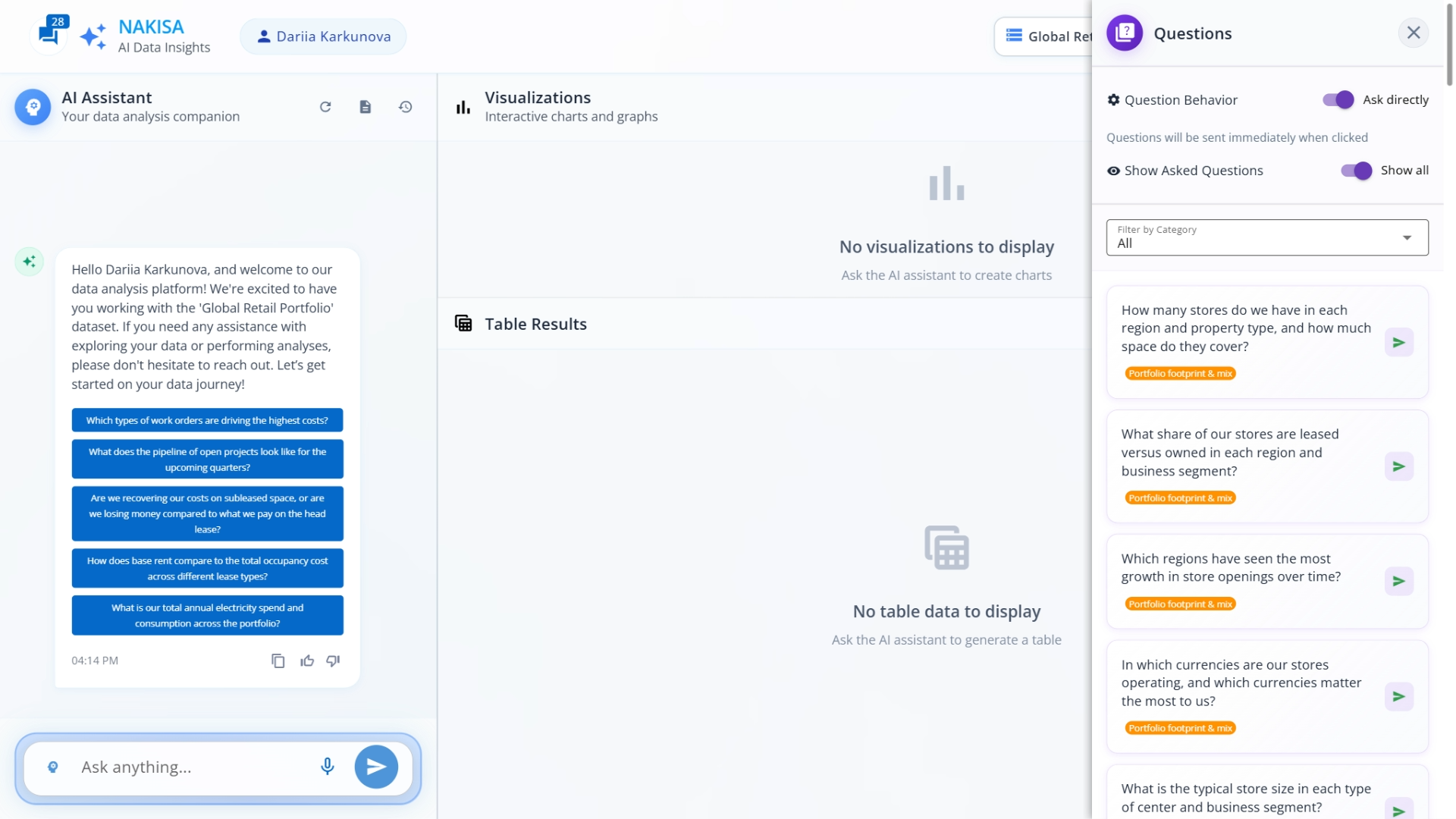

- Question icon. Besides your custom questions, the system suggests predefined questions, organized by various categories. NDI automatically interprets the selected dataset, organizing it into categories of contextual questions you can ask. These predefined questions make it easy to start your analysis immediately, without the blank canvas effect or endless preparation.

- History of previous chats and pinned visualizations and reports. NDI keeps a history of previous chats and pinned visualizations and reports. This lets you quickly revisit prior analyses, find insights faster, and pin your favorite queries for easy access, streamlining your workflow, and ensuring consistency across projects.

Quickly start analyzing your real estate data with NDI’s suggested questions organized by categories.

Use case 1: Visualize your global real estate portfolio

Let’s start with a comprehensive overview of our global real estate portfolio.

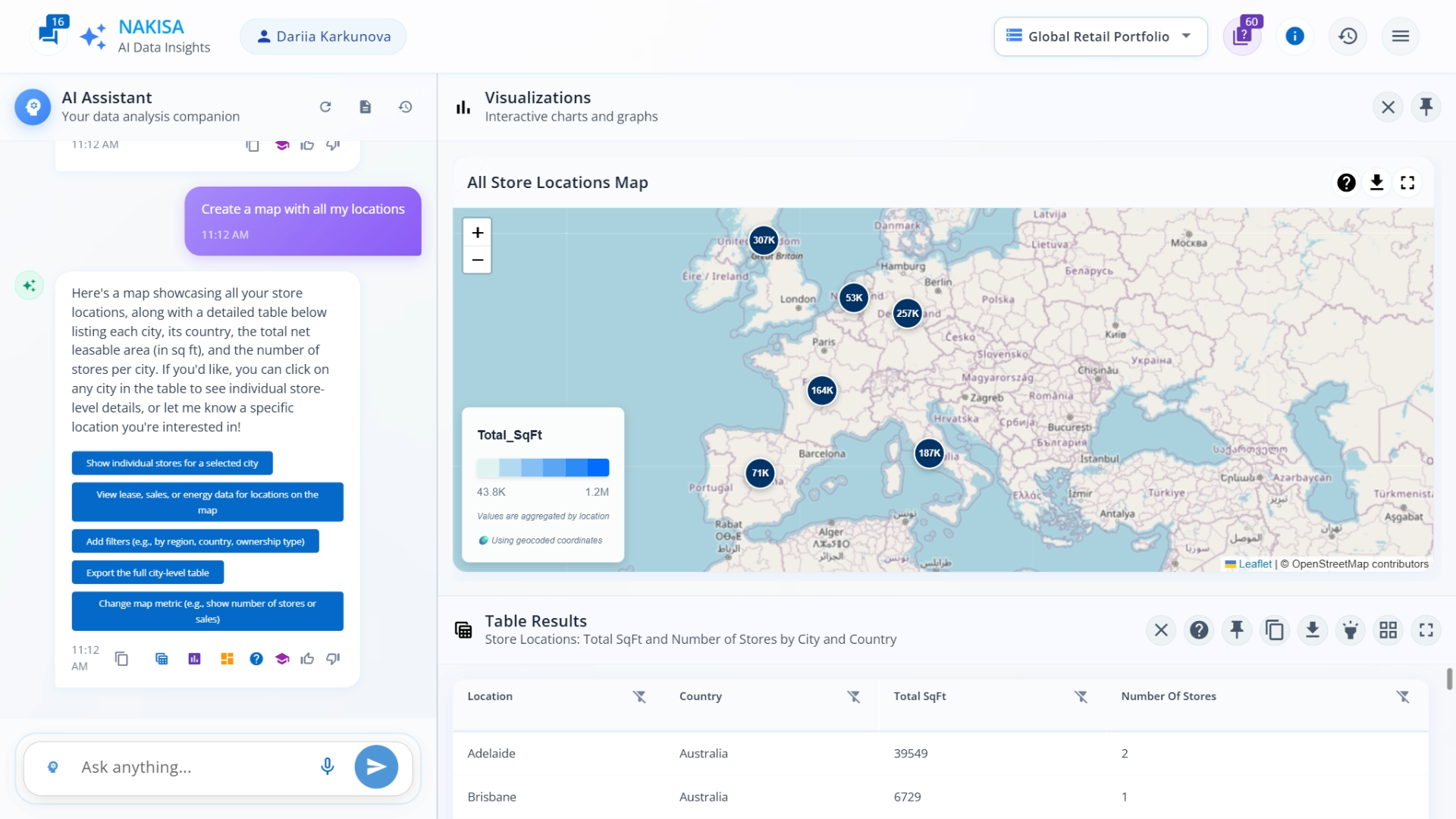

Prompt: Generate a map of all portfolio locations.

Result: NDI instantly generates an interactive map with all locations. We can zoom in on specific regions like Europe. Clicking on a country opens a detailed card showing the number of locations and key metrics such as total space and property details. All data can be exported to PNG or Excel.

Instantly visualize all portfolio locations worldwide and explore regional metrics with NDI.

Use case 2: Assess financial impact per region, country, and location

Next, we want to understand capital spend across regions and lease structures.

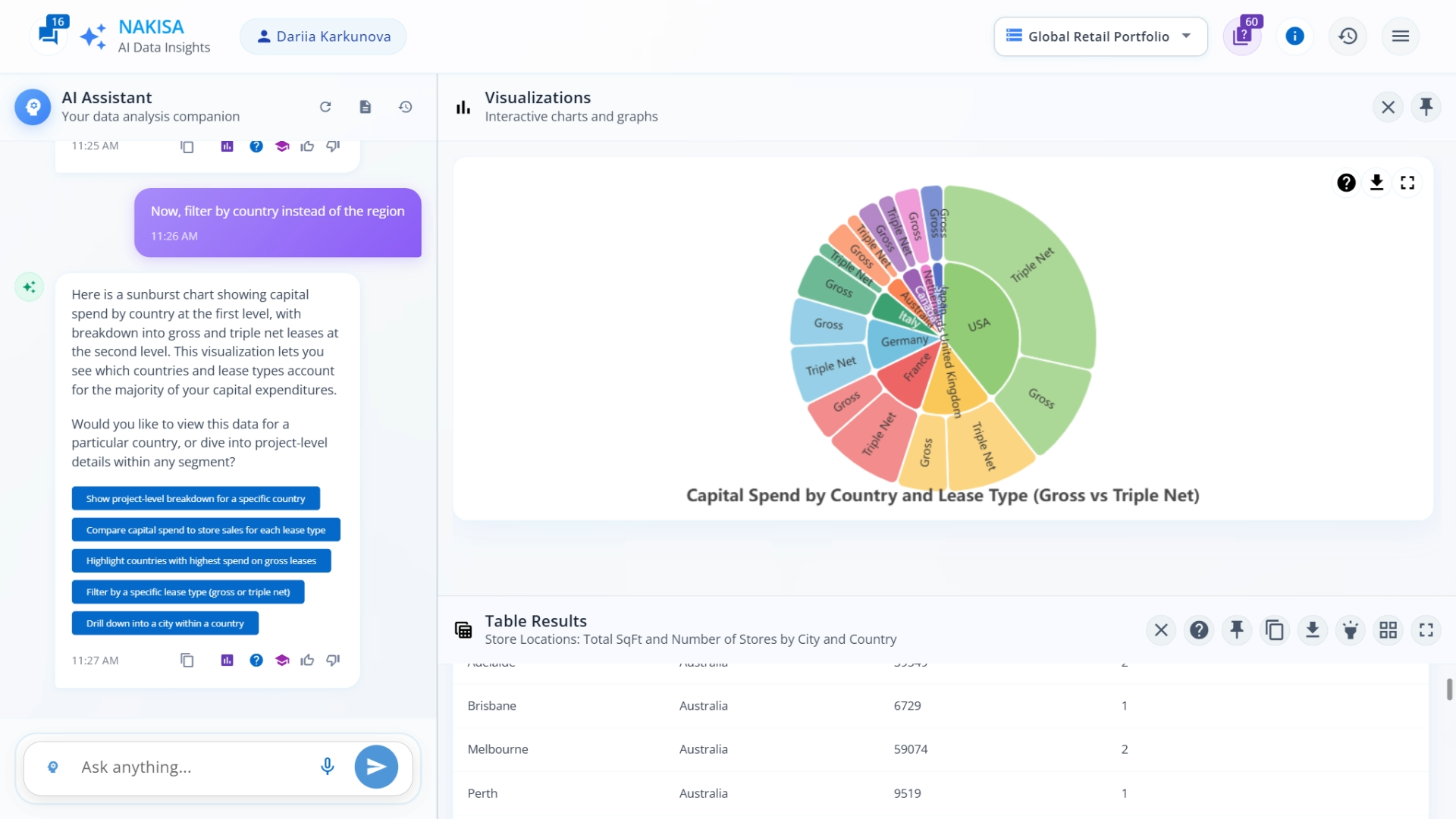

Prompt: Create a sunburst chart showing capital spend per region and the correlation between gross and triple net leases

Result: NDI instantly generates a sunburst chart visualizing capital spend by region and lease type (gross vs. triple net). This helps decision-makers identify which regions carry the highest costs and how lease type impacts overall expenditure.

To explore further, simply ask NDI to filter by country instead of region. The chart updates in real time, allowing you to compare cost and lease structure distribution across countries.

Identify cost distribution across regions and lease types to guide capital planning decisions.

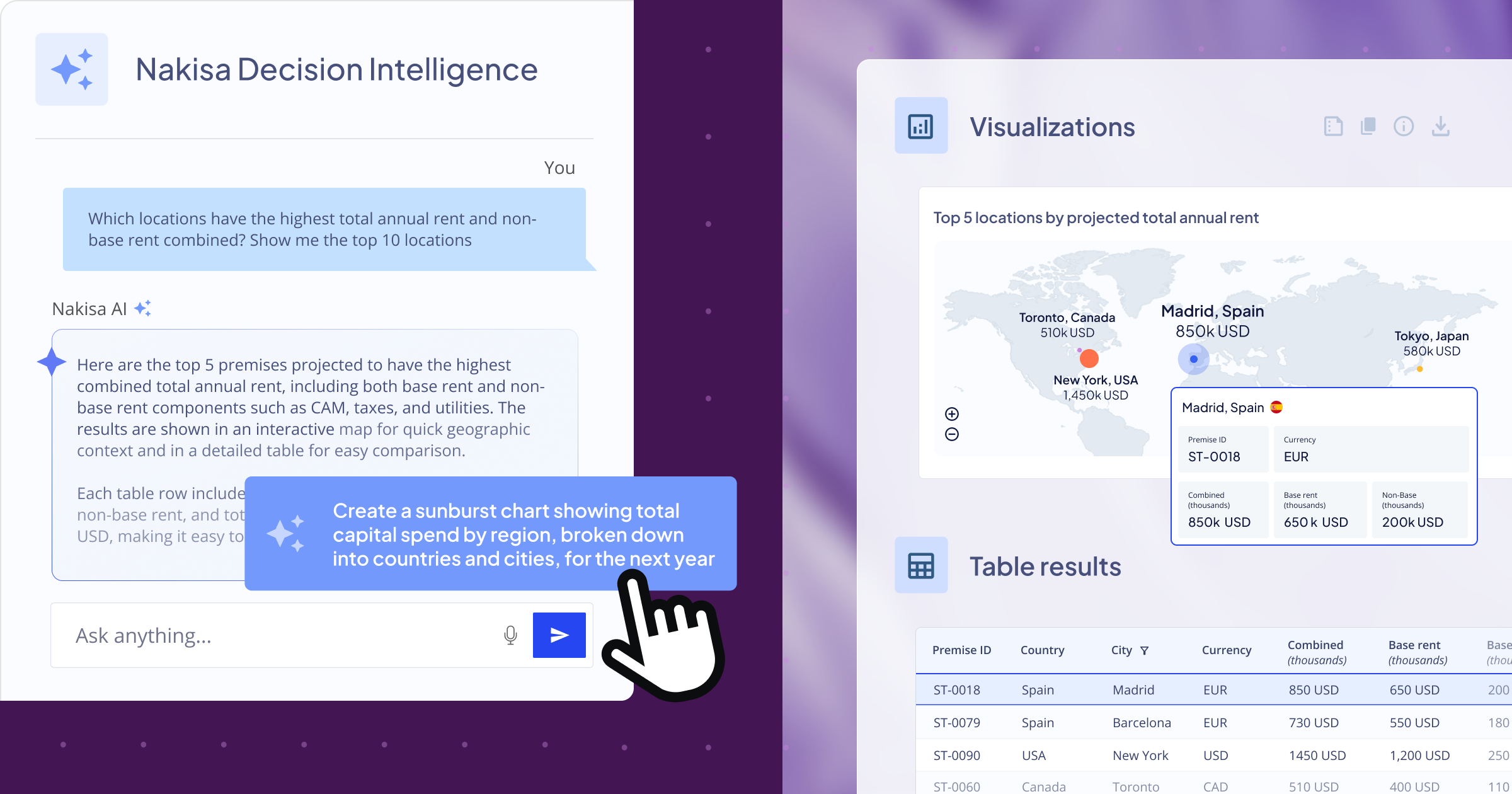

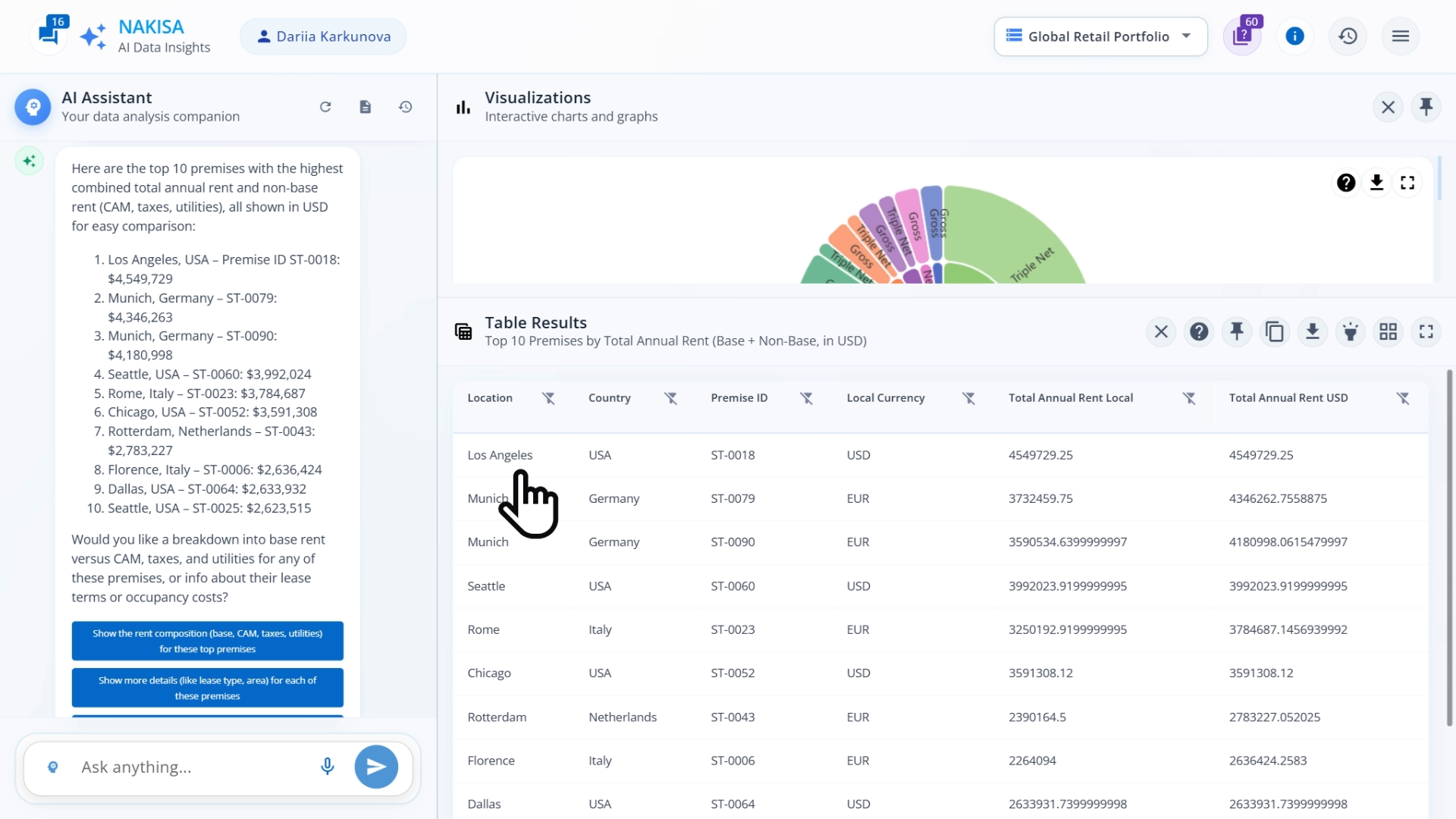

Now, let’s get even more granular and ask NDI to identify the top 10 locations by combined annual rent and non-base rent.

Prompt: Which locations have the highest total annual rent and non-base rent combined? Show me the top 10.

Result: NDI generates a dynamic, interactive table listing the top 10 out of 865 portfolio locations. Each entry includes city, country, premise ID, local currency, total in local currency, and total in USD. The system automatically converts all values into USD (the preferred currency set by the admin) for consistent comparison. Every row is clickable, giving users immediate access to detailed insights into each property’s financial performance.

Quickly see which locations have the highest costs with Nakisa Decision Intelligence.

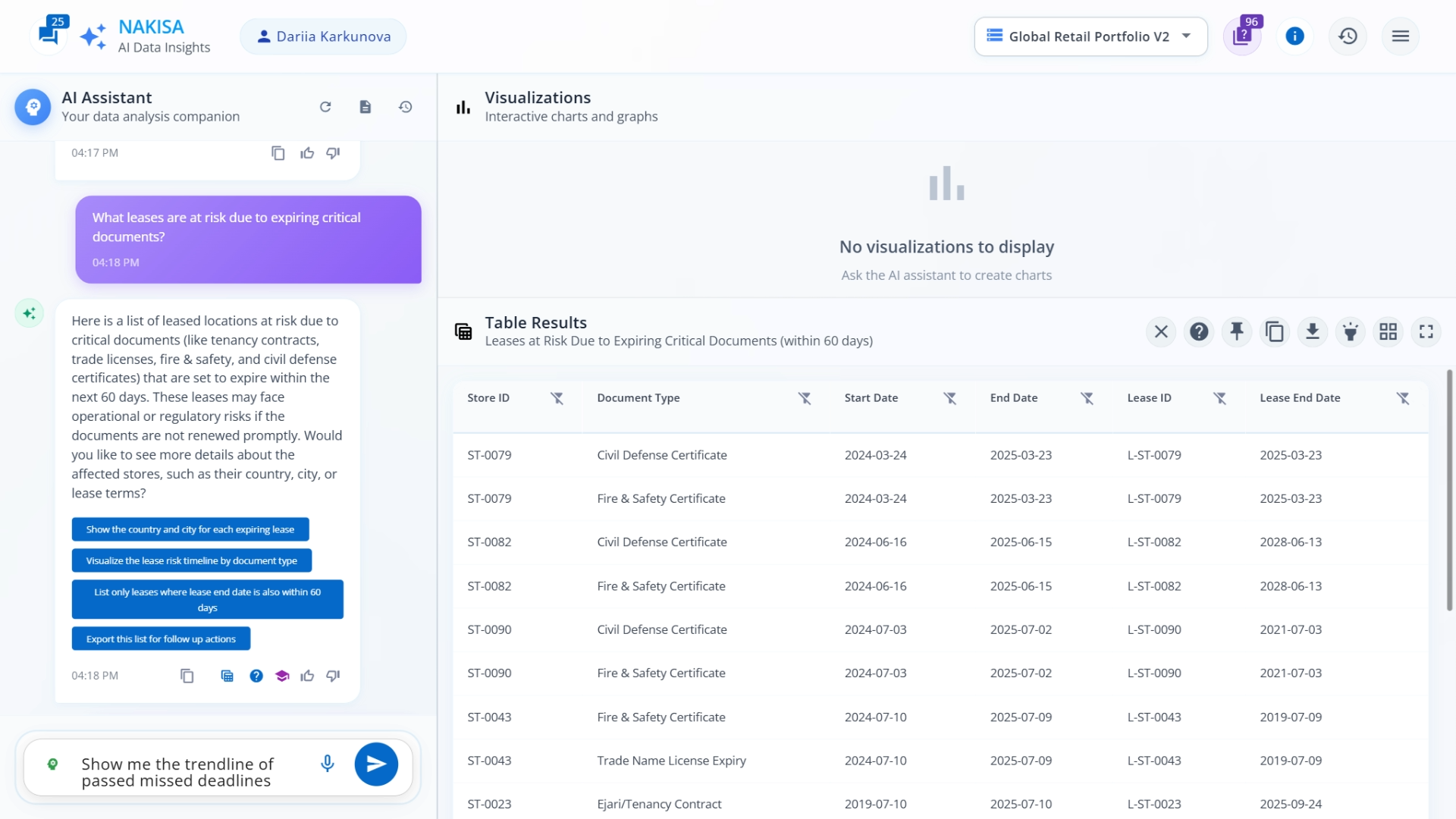

Use case 3: Identify risks and ensure compliance with contractual obligations

When managing a global real estate portfolio, monitoring lease compliance and document deadlines is crucial. Missing an expiration or renewal date can quickly lead to financial penalties or operational disruptions.

Prompt: Which leases are at risk due to expiring critical documents?

Result: NDI instantly generates a table listing all at-risk locations, including details such as document type and clause end date. This gives teams a clear view of upcoming expirations that could impact operations or compliance.

Monitor critical document expirations and prevent operational or compliance issues.

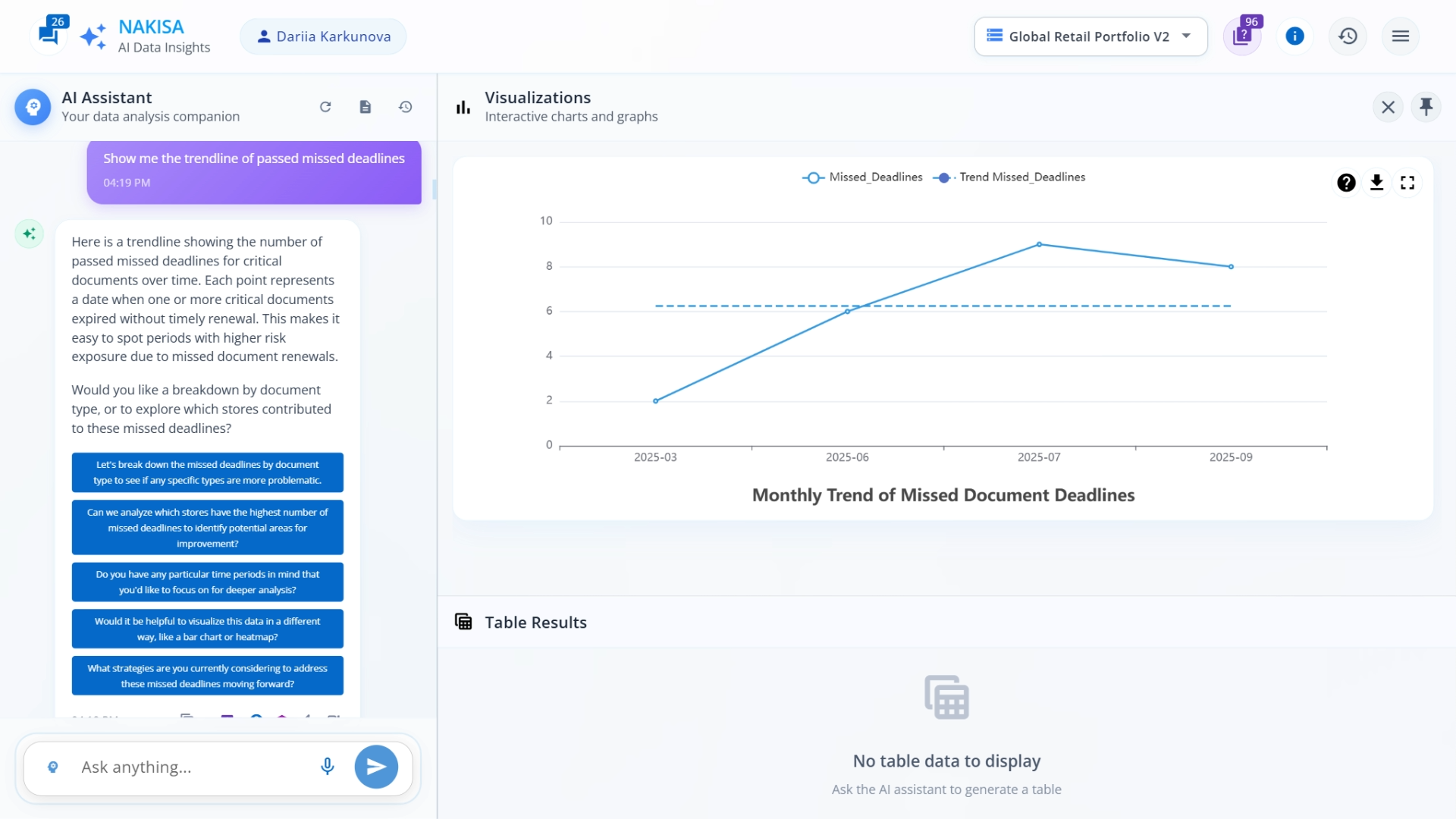

To gain deeper insights into performance, we can analyze historical trends to spot recurring patterns, seasonal fluctuations, and emerging risks, providing a richer context for proactive decision-making.

Prompt: Show the trendline of missed document deadlines.

Result: NDI produces a line graph illustrating how missed deadlines have evolved over time. In our example, missed deadlines increased steadily from March to July before slightly improving in August and September. This visibility helps identify recurring issues and plan corrective actions.

Analyze recurring issues and seasonal patterns to plan corrective actions effectively.

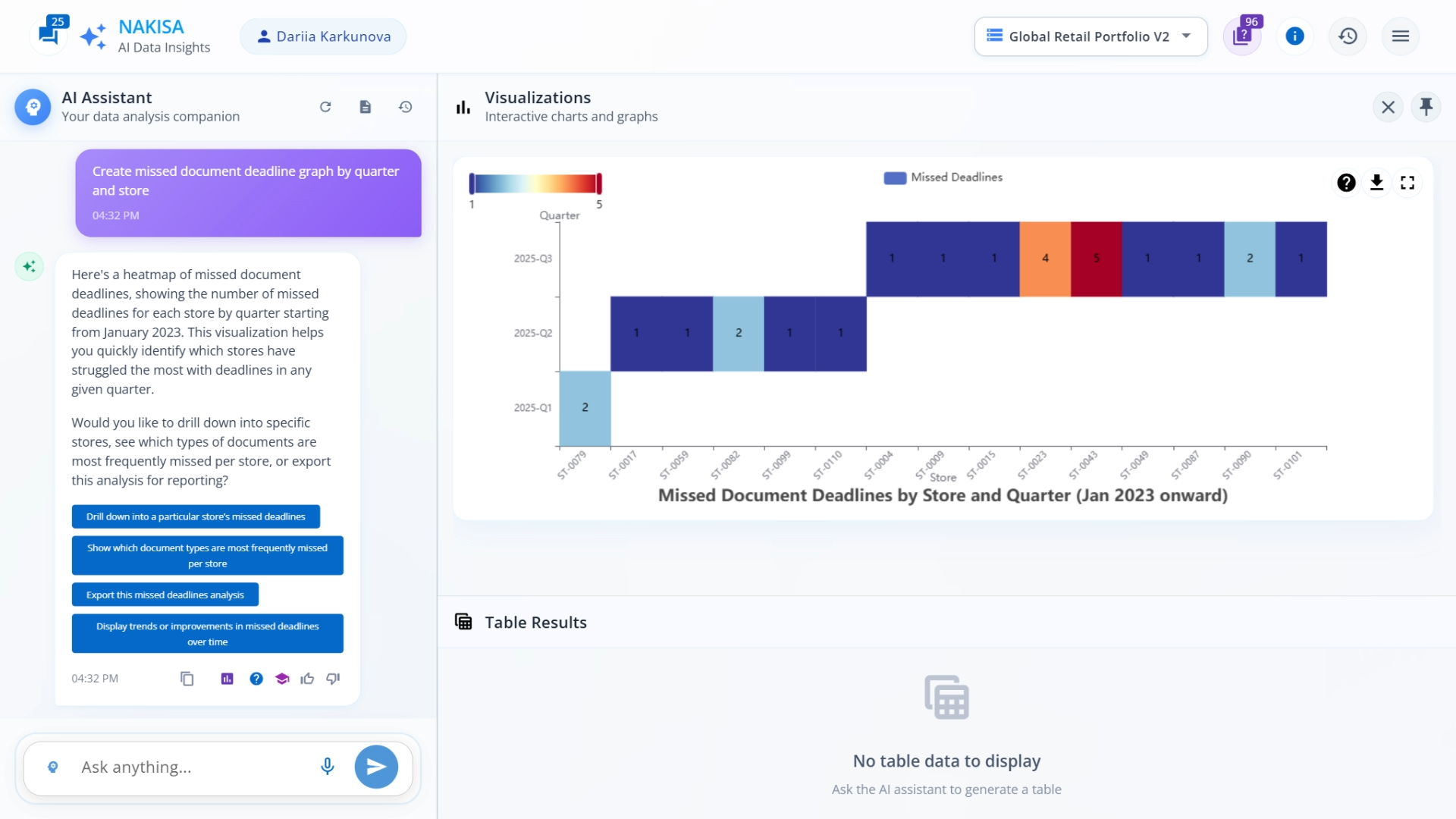

Next, we can identify specific problem areas by analyzing which locations or teams most frequently miss deadlines, giving actionable insights for targeted follow-up and process improvement.

Prompt: Display missed document deadlines by quarter and store.

Result: NDI creates a heat map highlighting exactly which stores missed deadlines and when, enabling real estate and compliance teams to spot risk clusters and regional performance patterns at a glance.

Spot risk clusters and regional performance patterns at a glance.

Use case 4: Manage future obligations by setting up email reminders

Beyond analyzing past performance, it’s critical to track future deadlines. Doing so provides foresight into upcoming obligations, allows teams to proactively plan resources, and prevents last-minute rushes that can lead to missed renewals or compliance issues.

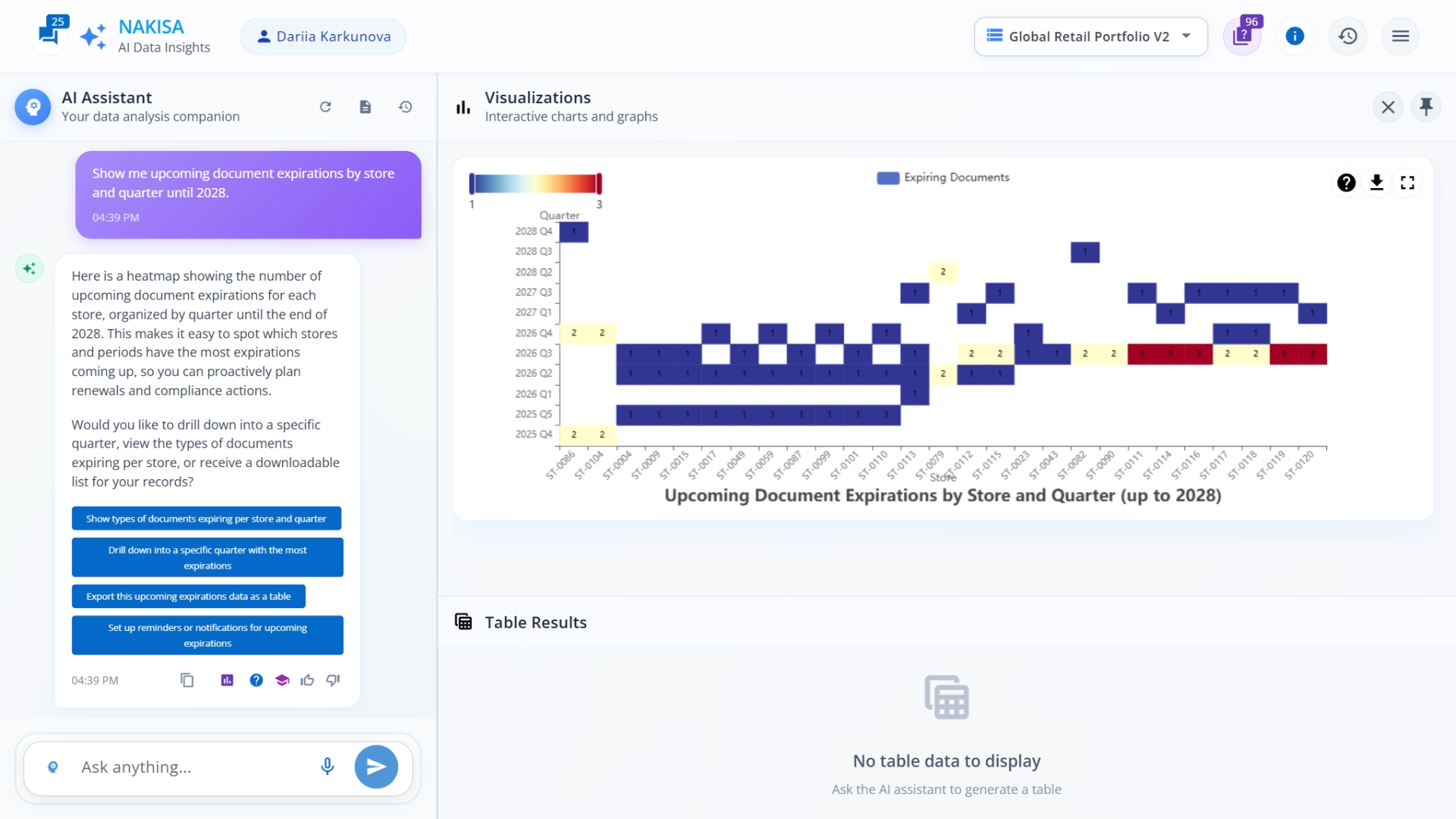

Prompt: Show upcoming documents expirations by store and quarter until 2028.

Result: NDI generates another heat map showing all future document expirations per location and quarter. This gives real estate teams visibility into when and where they should prepare ahead, avoiding last-minute renewals or contract lapses.

Plan ahead to avoid last-minute renewals or compliance issues with real-time portfolio visibility.

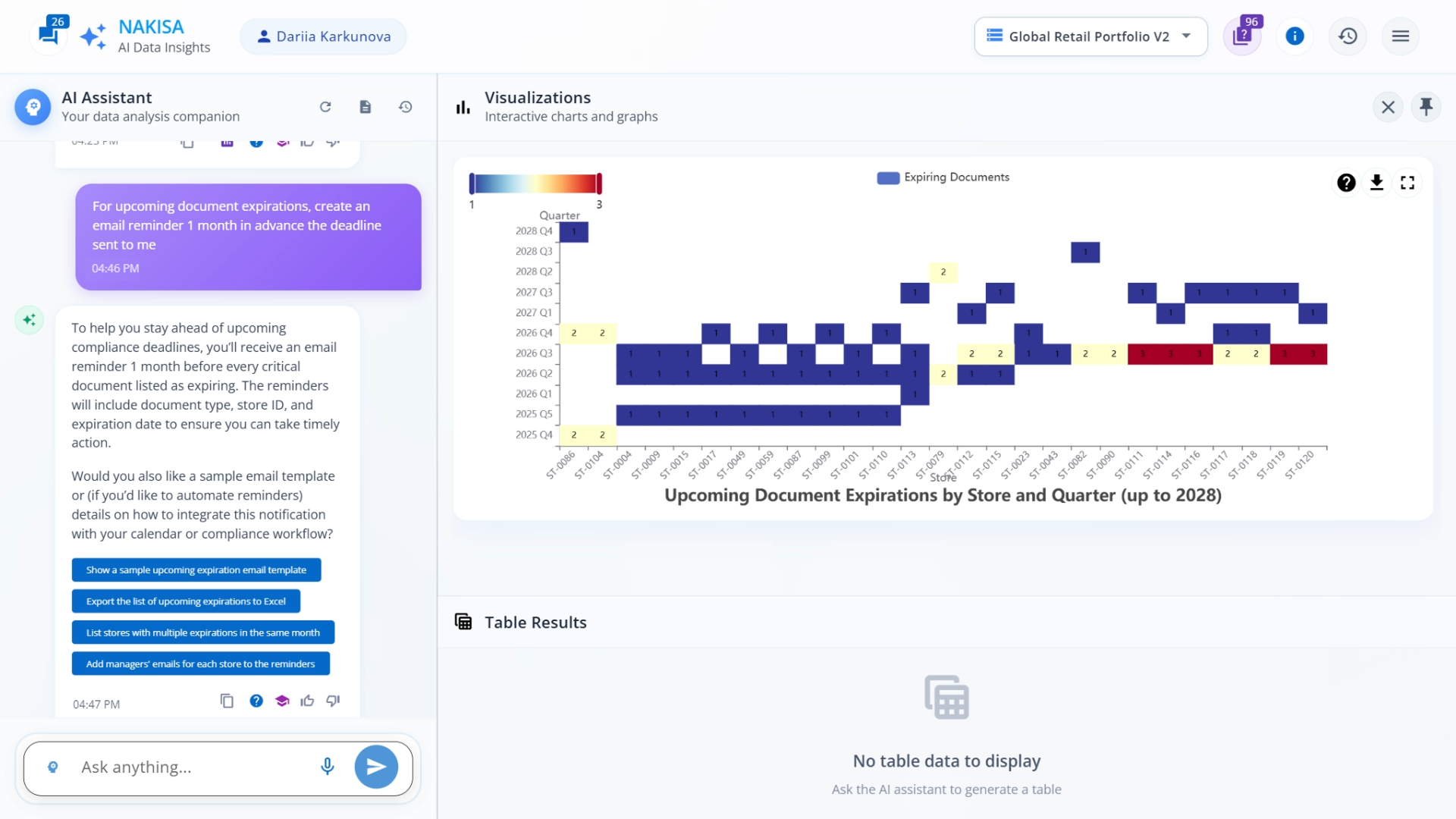

To take proactive monitoring a step further and ensure no deadlines are missed, we can set up automated alerts right through NDI, bridging analytics and execution under the same interface. This feature not only reduces manual effort but also provides real-time oversight, empowering teams to act immediately on critical upcoming events.

Prompt: For upcoming document expirations, create an email reminder one month in advance.

Result: NDI schedules automated notifications for upcoming deadlines and can send reminders to specific store managers based on store ID. This automation eliminates manual tracking and ensures no critical date is overlooked.

Prompt NDI to use AI Agents and set automated alerts to ensure no critical date is missed

Conclusion

Traditional real estate decision-making often relies on manual research, static reports, and fragmented data, making it slow, error-prone, and reactive. In contrast, Nakisa Decision Intelligence (NDI) transforms complex, siloed real estate data into actionable insights and confident actions in real time, within a single AI-first platform. Using natural language prompts (text or voice), NDI analyzes, forecasts, simulates, and creates intuitive visualizations, while providing expert, context-aware guidance every step of the way. It doesn’t stop there; you can execute decisions instantly via Nakisa AI agents and apply them directly to your ERP systems.

With just a few natural language prompts, we were just able to:

- Visualize the entire global portfolio

- Analyze capital spend and lease structures

- Identify risks and trends across locations

- Set automated reminders for critical dates

All of this is achieved without manual work or complex queries. NDI empowers real estate professionals to make faster, smarter, and more confident strategic decisions, driving greater business impact and freeing teams to focus on high-value tasks.

The real estate industry is undergoing a transformation, with AI redefining how decisions are made, improving speed, accuracy, and strategic impact. Nakisa Decision Intelligence continues to expand its capabilities daily, helping teams adapt to this new way of working.

Join us in revolutionizing real estate portfolio management! Learn more about Nakisa Decision Intelligence (NDI) and the IWMS solution to see how AI can deliver tangible value across your operations. Request a demo of Nakisa Decision Intelligence here, or reach out to your dedicated Client Success Manager to access the preview environment.

Subscribe to our YouTube channel for the latest insights and innovation updates.