Whether you bear responsibility for your compliance project or are simply part of the team, your role is fundamentally about balancing time, risk, and money with the requirements prescribed in the new lease accounting standards. In less than four months, the IFRS 16 and ASC 842 accounting standards will come into effect. If you’re not using spreadsheets to manage and account for your leases, it’s a safe bet that you are using the contract modules in your core ERP systems to perform lease accounting. Either of these existing processes will require extensive system modifications to comply with the new requirements, and even then, features and functionalities may be lacking to generate the necessary accounting calculations required under the standards. The new standards provide guidance on how to measure and record ROU assets and lease liabilities at lease commencement, as well as subsequent measurements, modifications, and reassessments. Most existing legacy lease accounting software, including real-estate solutions, were not designed to handle the accounting complexities that come as a result of the new standards.

Read on to help determine if your existing technology has what it takes to support compliance.

Pillar 1: Vendor Credibility

When evaluating a lease accounting solution, there are many things to consider. It’s important to not only focus on the features and capabilities of the solution but the vendor themselves, as you will be entrusting them with your financial data. Look for a vendor whose solution is tried, tested, and trusted by hundreds of companies, across all types of industries such as aerospace, retail, manufacturing, pharmaceuticals, oil & gas, and mining. Is it able to handle all of their varying and complex lease accounting needs, and facilitate their compliance initiatives? It might be a good idea to think about the solutions that the other big players in your industry are using. In terms of accounting credibility, you should probably also consider a solution that is validated by the big four accounting firms. These are all important points that could help determine whether you have the right solution for you.

Pillar 2: Robust Lease Accounting Functionality

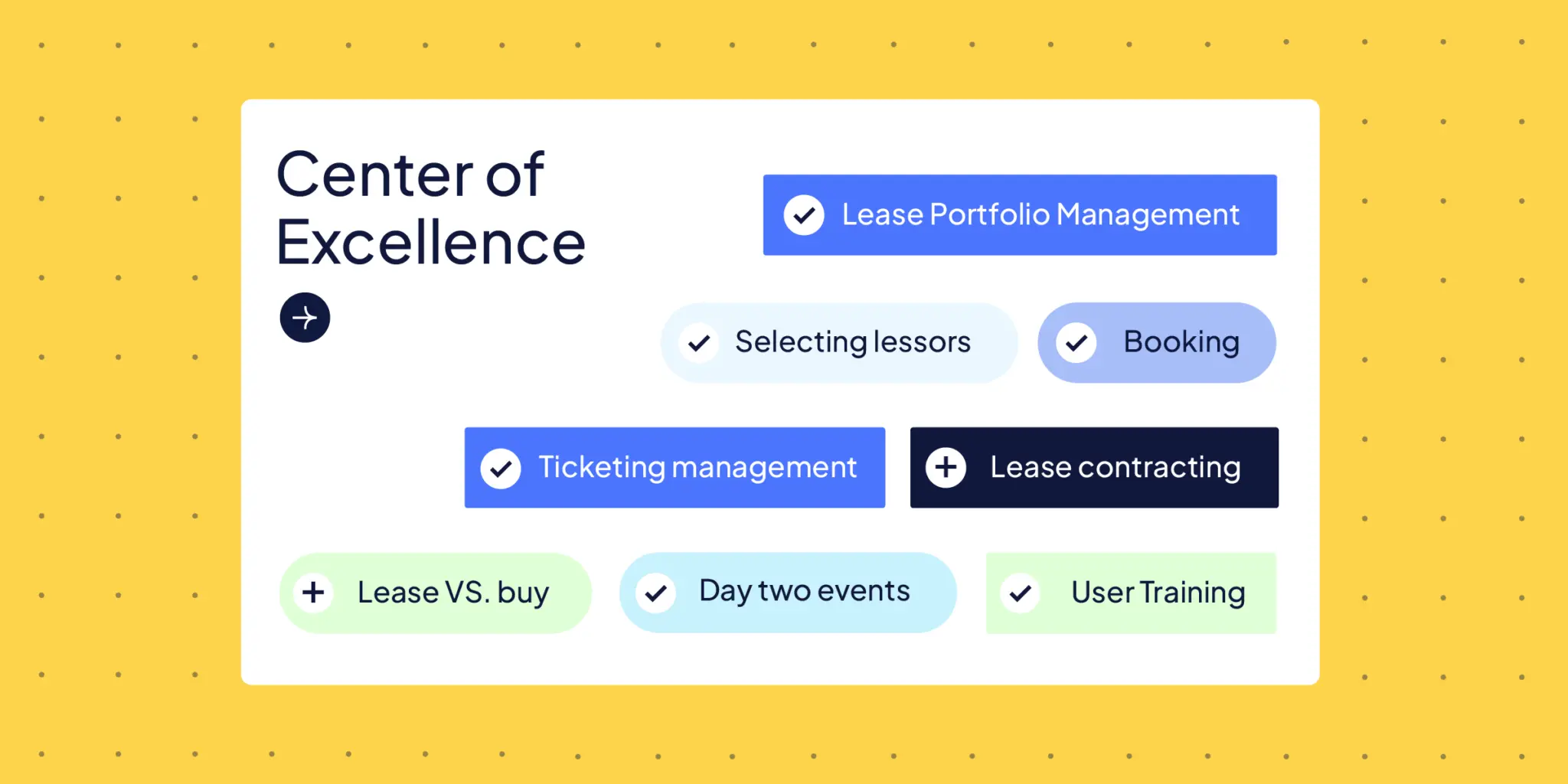

To accelerate and ensure compliance before the January 1st deadline, an end-to-end lease accounting solution that simplifies the lease accounting process, from lease determination and management to analytical and regulatory reporting, will be invaluable. What’s increasingly important is that the solution has the ability to not only handle complex leases, but also address hundreds of use cases, identify embedded leases, and facilitate event management for remeasurements, modifications, and terminations.

Most major ERP vendors, such as Oracle, do have lease administration tools - but in terms of functionality, are all lacking the breadth and depth required for compliance with IFRS 16/ASC 842. For example, the ability to handle multiple currencies, both real estate and equipment leases, as well as multiple accounting standards.

Pillar 3: Ability to Meet Your Deadlines

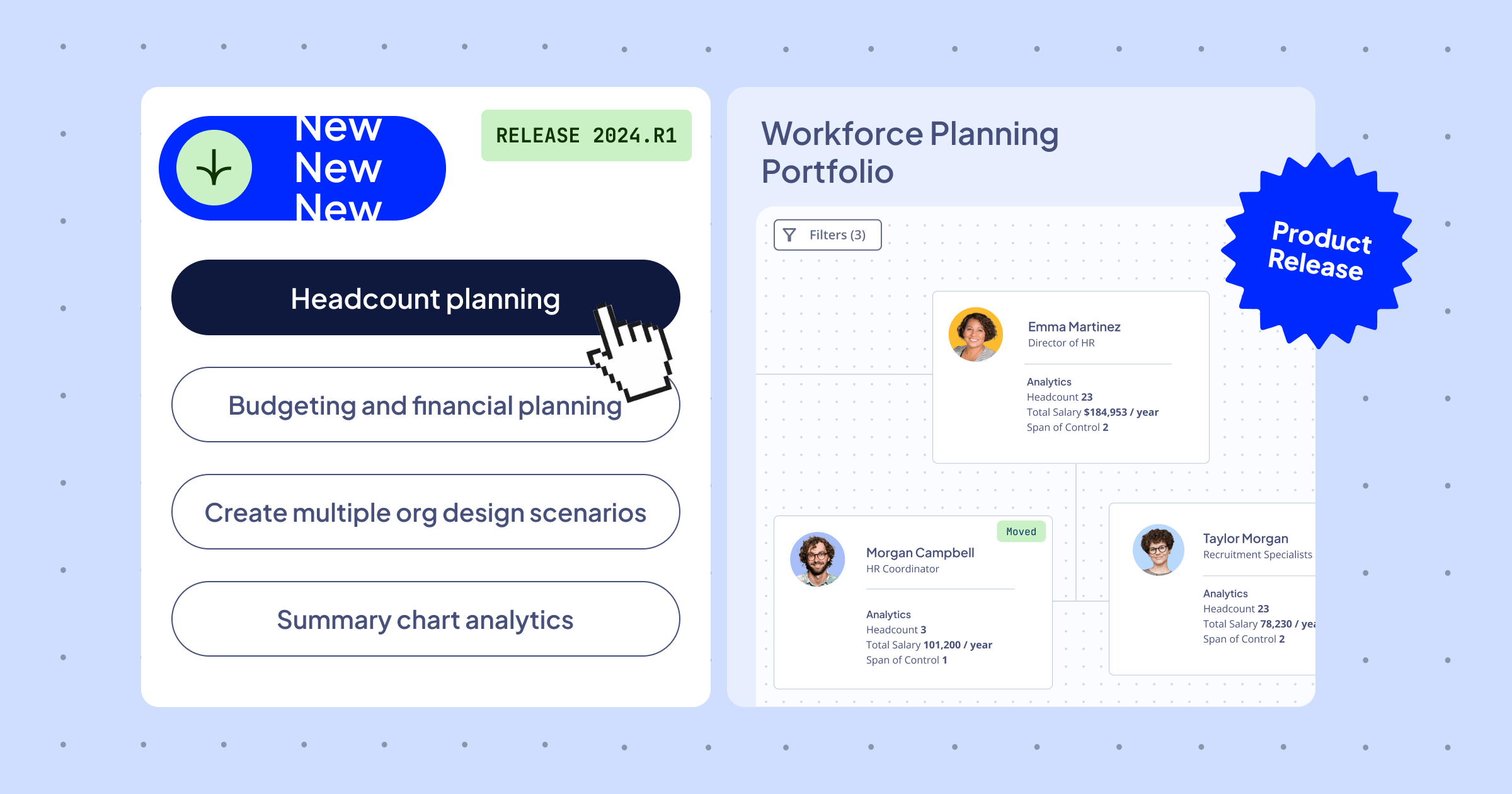

With three months to go, there is still time to get a solution up and running by the deadline – but time is of the essence. Solution implementation is often a long and time-consuming process. For companies taking steps to make significant changes to their lease accounting systems, lengthy discussions over hardware requirements and software compatibility will often be involved. With the deadline around the corner, it’s important to get these discussions out of the way. Cloud solutions are one way to get around this. Cloud-based solutions reduce implementation headaches and eliminate complex set-up, server maintenance, and security concerns. With the cloud, many organizations are also opting for a phased deployment in order for more time and effort to be dedicated to compliance initiatives. This means that they can deploy a solution today, manage their entire lease portfolio and the lease lifecycle from inception to termination, prepare the necessary disclosure reports for the compliance deadline, and once compliant, integrate with their ERP. You can read more about the phased deployment in our blog post - How to Start Lease Accounting Sooner.

We Can Take Care of Your Leases

Nakisa Lease Administration is a standalone cloud solution designed to help companies get compliant and quickly. By leveraging a cloud-based solution, disconnected from your ERP, the focus can be first and foremost on compliance. Once compliance has been achieved, configuration to your ERP system can be done at a later date, ensuring that, as lease terms and conditions change over time, the information is reflected in your ERP.