Product launch and rebranding

We are excited to announce that Nakisa Lease Administration has been rebranded as the Nakisa Lease Accounting Suite, a strategic evolution that reflects its enhanced functionality, expanded capabilities, and alignment with Nakisa’s vision for a unified solution portfolio.

As part of this initiative, we’ve introduced a refreshed product branding that resonates with the software’s elevated capabilities. To streamline accessibility, we’ve also added a direct link to the Nakisa Product Center in the main menu, providing users with seamless navigation across Nakisa’s integrated suite of solutions. This enhancement supports quick and efficient collaboration between products and portfolios, reinforcing our one-branch strategy.

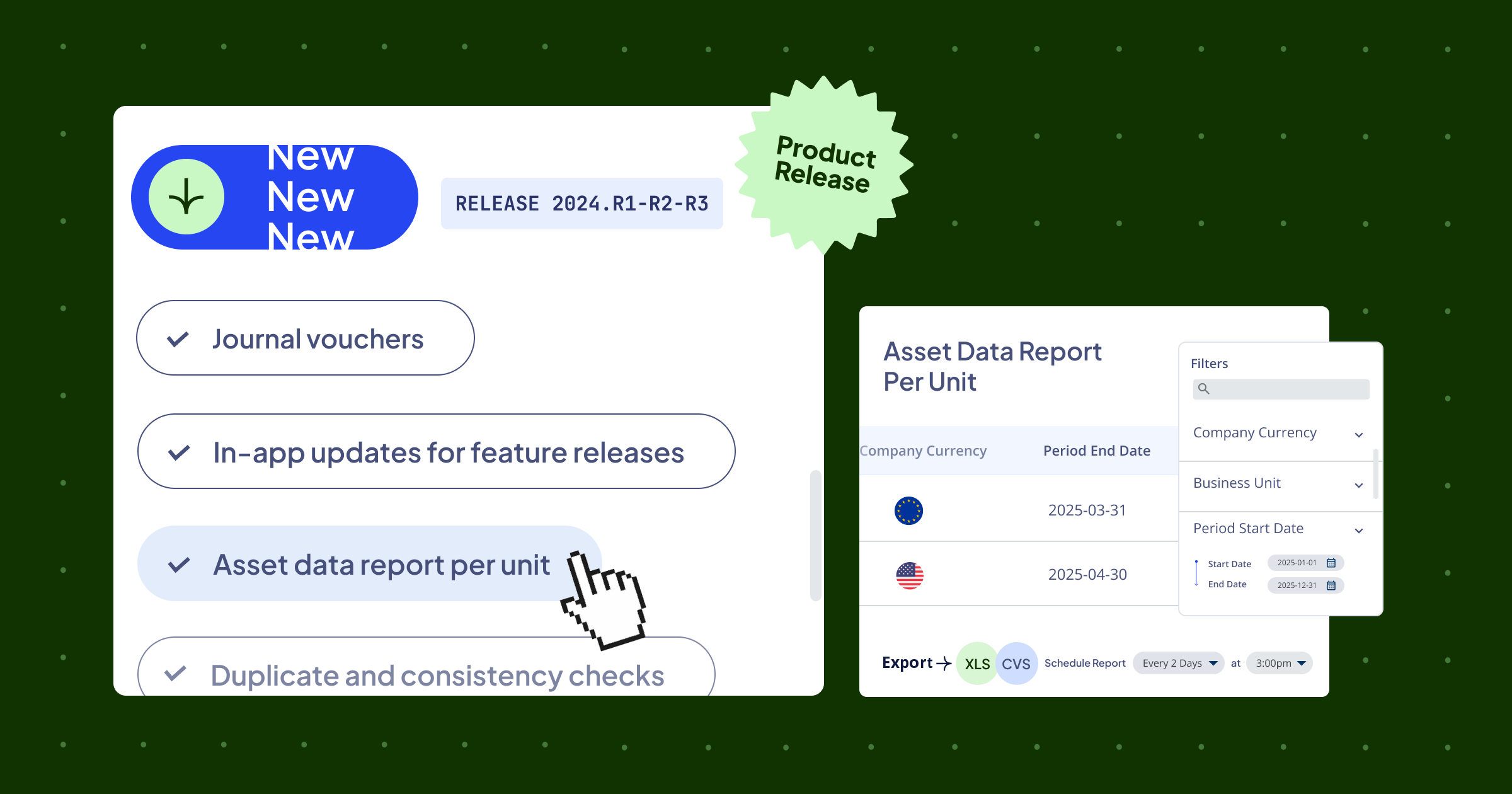

In-app updates for feature releases

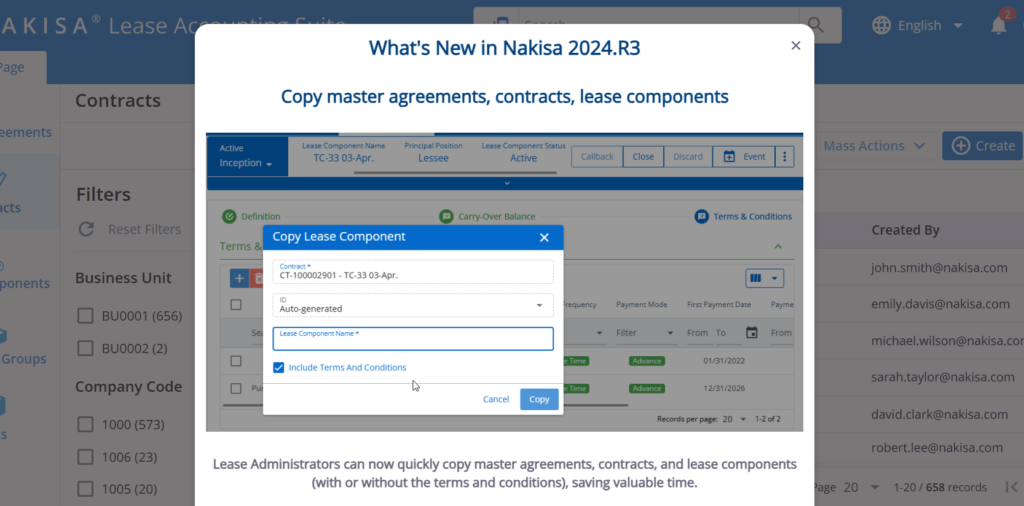

The Nakisa Lease Accounting software features a "What’s New in Nakisa" pop-up designed to keep users informed about the latest updates and enhancements introduced with each release. This dynamic feature highlights key improvements, newly added functionalities, and critical updates, ensuring users can quickly understand and leverage the software’s evolving capabilities. By offering concise, release-specific insights, this pop-up helps users stay aligned with changes that enhance their experience and optimize their workflows.

The "What's New in Nakisa" pop-up highlights the latest enhancements and features.

Lease management, financial reporting, and compliance

In the June, August, and November 2024 releases, we unveiled major enhancements to lease abstraction, lease management, and financial reporting functionalities. These updates are designed to simplify the capture and management of lease data, optimize workflows, and improve accuracy. They provide a seamless experience for contract administrators and accountants, empowering them to efficiently manage lease data and ensure compliance throughout the entire lease lifecycle.

Journal vouchers

A journal voucher is a document used to record financial transactions that do not involve cash or bank activities, such as adjustments, transfers, and corrections within general ledger accounts. Typically associated at the account level without impacting individual contracts or activation groups, journal vouchers are essential for various purposes, including recording account adjustments at the end of an accounting period, correcting errors in previously recorded transactions, transferring balances between accounts within the same chart of accounts and company code, and reclassifying transactions without affecting cash. In Nakisa Lease Accounting, the process begins with an accountant accessing the Nakisa General Ledger to create a Journal Voucher, providing all required inputs before submitting it for approval. The contract manager then reviews the submission, either approving or rejecting it. If approved, the Journal Voucher is entered into the Nakisa General Ledger and posted externally during the next applicable SAP Posting Job.

Partner modification

This new feature enables modifying Lessor partners during a Contract Event when the Generate Vendor Invoice option is active. Payment terms are adjusted, allowing allocations to different vendor GL accounts in varying proportions over the lease term. In Nakisa Lease Accounting, contract administrators initiate a Contract Event to add or replace a partner, adjust lease component payment terms, and create new payment terms as needed, while accountants reverse impacted postings, execute an AG Event, and apply changes to ensure updated payment allocations. This feature reflects real-world changes in asset ownership, particularly for real estate leases, ensuring accurate financial postings in Nakisa General Ledger and the external ERP.

Optional asset class selection (lessee accounting)

Previously, asset class selection was mandatory for all lease components, regardless of lease type. This requirement created inefficiencies, especially for lease types that do not require right-of-use (ROU) asset capitalization, such as low-value, short-term, and non-lease service contracts. Users had to select an asset class even when it was irrelevant, leading to unnecessary data entry and a higher likelihood potential for errors.

To address this, we made asset class selection optional for specific lease types, including low-value, short-term, and non-lease service contracts. Administrators and accountants can now save or submit a lease component without selecting an asset class for leases in these categories. This enhancement simplifies the lease component creation process by eliminating unnecessary steps where asset class selection is nonessential, ultimately improving workflow efficiency and reducing the risk of errors.

Editable base and reference indexation rates

This update introduces editable base and reference indexation rates, delivering key advantages for both contract administrators and accountants.

For contract administrators, it ensures greater precision by allowing adjustments to indexation rates for each payment term. This capability supports financial continuity and consistency in schedules post-migration. The addition of an option for US GAAP treatment further enhances flexibility in managing financial reporting from the lease inception.

Accountants benefit from the ability to correct base and reference rates to ensure accurate indexation amounts in financial reports and align migrated leases with legacy systems for data reliability. This flexibility enhances compliance with accounting standards while preserving financial reporting integrity.

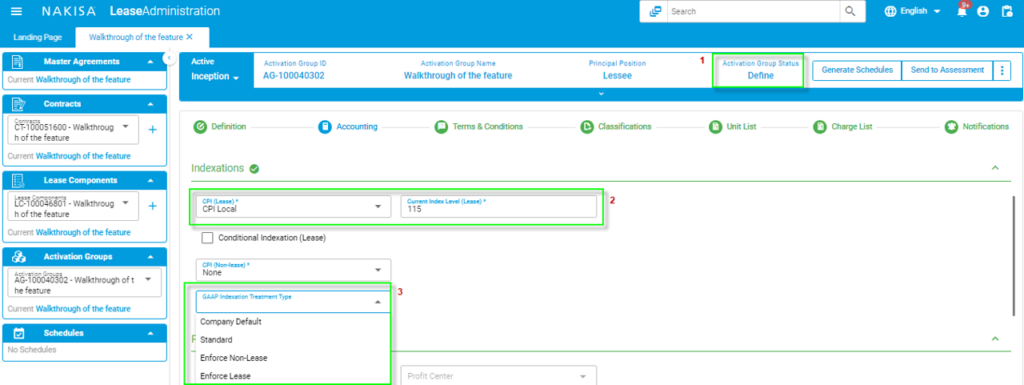

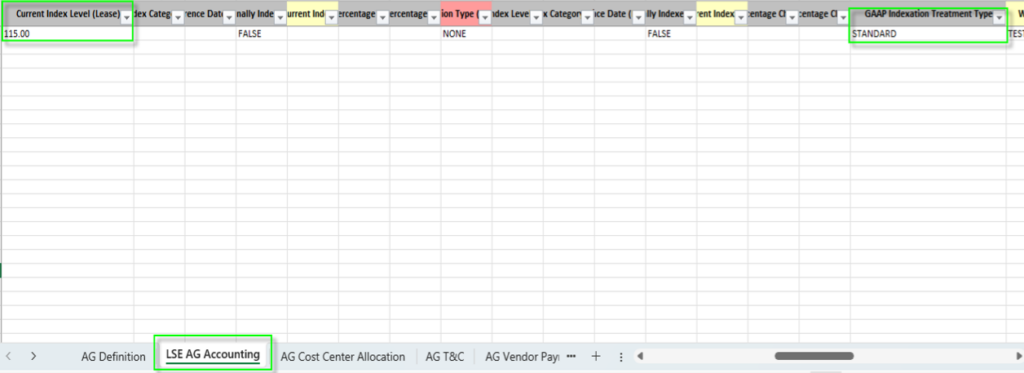

When activating the lease component, users are automatically placed in the Activation Group (AG). In the Accounting tab, users can define the CPI type by selecting either “local” or “global”. Finally, users must specify the GAAP Indexation Treatment Type by selecting the appropriate option from the drop-down menu.

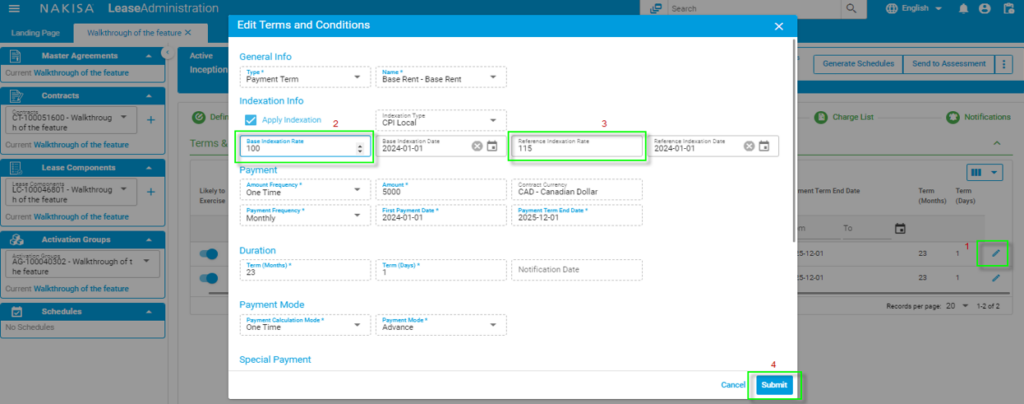

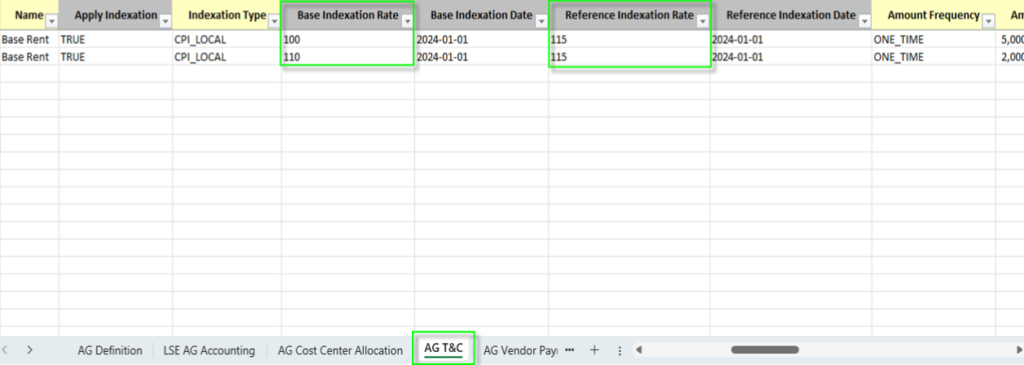

Within the Terms and Conditions tab, users can update payment terms by exercising and indexing them. To modify the base or reference indexation rate, users simply click the Edit icon and adjust the indexation base and reference rates along with their dates, and finally submit the updated term using the dialogue box.

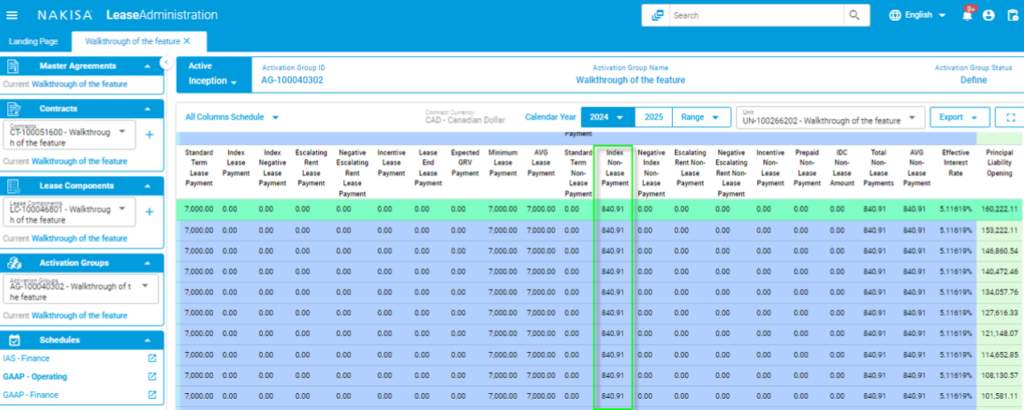

The selected GAAP Indexation Treatment Type, set as Standard, highlights the impact of indexation amounts at inception, visible under the Index Non-Lease Payment field.

When changes are in bulk, users can leverage the mass import job to update multiple field values across various lease contracts (MLA, Contract, LCs, etc.). Using the Excel template within the Activation Group (AG), users the user can modify the current index level and GAAP indexation treatment type via the mass import feature.

In the same Excel template, users can navigate to the AG T&C tab to input or update base and reference rates for multiple activation groups simultaneously, streamlining bulk adjustments effectively.

Introduction or override Carry-Over Balances (COB) through mass imports

The introduction of Carry-Over Balances (COB) fields in the mass import Excel template addresses a significant challenge for accountants, particularly when managing split activation groups with differing COBs across lease components. Prior to this, accountants had to manually update COBs for each lease contract, a process that was both time-consuming and error-prone, especially when dealing with large portfolios. With this new solution, COB fields are available in the Excel template for mass imports, enabling accountants to update or override COBs for multiple leases simultaneously. This significantly streamlines the process, reducing the effort required and allowing accountants to focus on more tasks. By consolidating updates, accountants can work more efficiently, maintain better control over financial data, and ensure a smoother review process, all of which contribute to more accurate and consistent financial management.

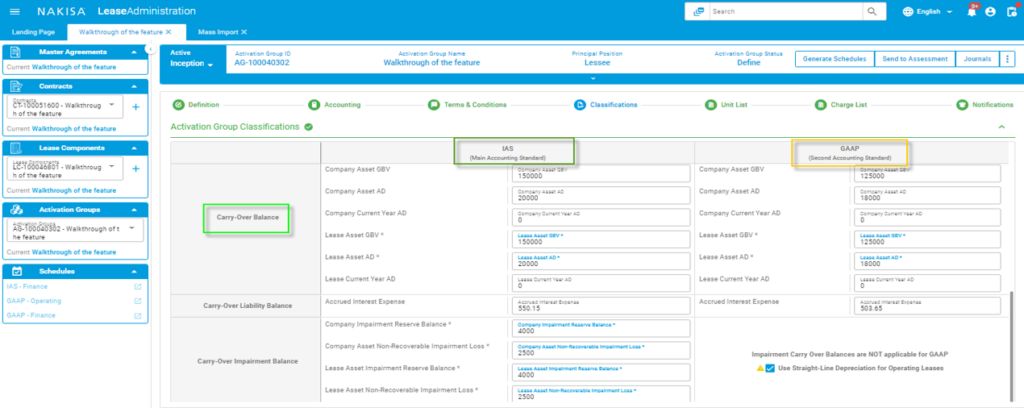

Users can enter the Carry-Over Balances (COB) at the Activation Group level for individual lease contracts, enabling efficient and accurate management of financial data across multiple leases.

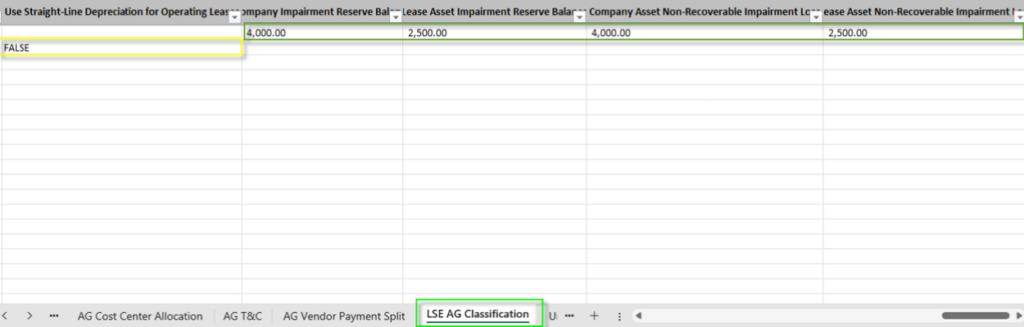

In the Classification tab of this Excel template, two rows are provided for each activation group to accommodate both IFRS 16 and US GAAP balances. The first row allows users to input or override the Carry-Over Balances (COB) for IFRS 16, while the second row is designated for the US GAAP balances, ensuring proper alignment with accounting standards for both frameworks in parallel.

In the same Excel tab, users can input the Impairment Reserve Balances for IFRS 16. For US GAAP, users can select either TRUE or FALSE for straight-line depreciation (highlighted in yellow).

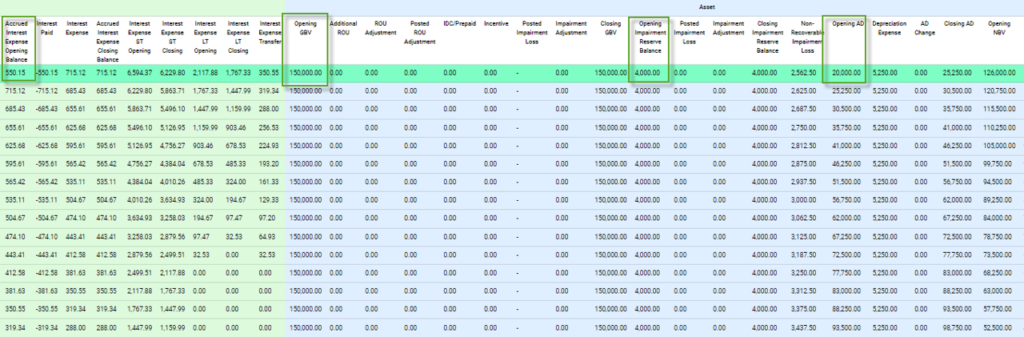

Once the import job is completed, users can view the impact of Carry-Over Balances in All Column Schedules.

Cutover date implementation (lessee accounting)

In Nakisa Lease Accounting (NLA), all postings, such as journals, accruals, and depreciation, are only posted to SAP or externally if the posting date is beyond the cutover date. Currently, cutover dates are configurable only at the ERP level, which limits the ability to manage posting restrictions across different companies and classifications. The proposed enhancement will extend the cutover date functionality in NLA to include configurations at both the company and classification levels, offering more flexibility in managing postings.

Data quality and integration

The June, August, and November 2024 releases introduce key enhancements in data quality and integration, offering tools that enhance data accuracy and ensure seamless connectivity across systems. With these updates, users can now better manage and synchronize data, resulting in improved consistency and reliability across all reporting and operational processes.

Asset data report per unit

To support a smooth transition to Nakisa Lease Accounting with FI-GL integration, the Asset Data Report per Unit offers a valuable solution for accountants and contract administrators. This report provides detailed unit-level asset data, ensuring a smooth transition while supporting effective lease contract management and accurate financial reporting. By accessing this granular unit-level information, users can make informed decisions, enhancing operational efficiency and ensuring consistent asset data.

File storage

During migration to Nakisa Lease Accounting, historical schedules are not migrated, which can make generating reports for periods before the cutover date challenging. To address this, users can generate disclosure reports for the current and previous fiscal years, upload them to Nakisa's File Storage, and access these reports easily. Each file is stored with timestamps and user details, ensuring convenient and secure future reference.

Lease migration and document management

Migration flag filtering: The migration flag streamlines the identification and management of migrated leases, enabling batch operations, import/export, and reporting. This feature enhances productivity by quickly filtering migrated leases, ensuring accurate data handling and reducing errors in lease management and reporting processes.

Flexible file upload: Contract administrators can now upload documents in various formats (e.g., PDFs, Word, Excel) without the need for file conversion or compression. This feature displays metadata such as uploader details and timestamps across entities, enhancing document tracking and accountability. Additionally, API tools support bulk uploads of files of any size, allowing seamless document management by accepting original file formats and providing essential metadata for efficient data management.

Resolution of external posting failures

We resolved issues with failed postings in SAP caused by discrepancies in closing dates and incorrect reversal reasons. For example, closing an activation group in January 2024 instead of December 2023 could generate termination journal entries dated 2023, which SAP has already closed, resulting in external posting failures. Using SAP’s document reversal feature, accountants can now fix failed transactions in the ledger report by correcting reversal reasons and adjusting termination entry dates. This ensures accurate, compliant postings while enabling third parties or auditors to track changes easily, improving transparency and compliance.

Duplicate and consistency checks in SAP Posting Bot

The Duplicate and Consistency Check Reports in SAP Posting Bot addresses duplicate transactions that can cause financial discrepancies and audit challenges. Admin users and system administrators can utilize the Duplicate and Consistency Check Report, which scans for duplicates every 24 hours based on criteria like posting period, transaction code, and Nakisa internal document number. This proactive approach helps identify and resolve duplicates efficiently, ensuring system integrity and financial data accuracy. It also supports contract administrators, accountants, and the finance team in maintaining compliance and prevents costly duplicate payments or receipts, saving time and resources.

System configuration and analytics

The June, August, and November 2024 releases bring key improvements to system configuration, providing system administrators with greater flexibility and control over setup and management. These enhancements streamline processes, making it easier to adjust configurations and optimize system performance and meet evolving business needs.

Batch role segmentation

The batch management capabilities introduce five new roles: Mass Workflow (nla_btchwflw), Mass Indexation (nla_btchindx), Mass Modification (nla_batchmod), Mass Postings (Internal) (nla_btchipos), and Mass Postings (External) (nla_btchxpox). These roles are designed to enforce stricter control procedures by limiting the scope of mass activities available to individual users. For example, while an accountant may execute mass modification and indexation jobs, they should not have the ability to run a mass workflow transition job. In Nakisa Lease Accounting, the process of role assignment via single sign-on (SSO) remains unchanged, but system administrators can leverage these new granular roles to meet specific requirements. The existing nla_batch role remains available for use, offering flexibility with two approaches: a controlled approach using combinations of the five new roles or a fluid approach utilizing the nla_batch role.

Dashboards

Nakisa Lease Accounting provides robust dashboard functionality to efficiently manage leasing data through a combination of out-of-the-box and custom dashboards. Pre-built dashboards offer insights into critical areas like Master Agreements, Contracts, Lease Components, Activation Groups, and Units. For more tailored needs, users can create custom dashboards with options for visual dashboards featuring charts and graphs, pivot table dashboards for grouped data analysis, and list dashboards for tabular representations. Dashboards are easily accessible via the main menu, and users can save default and custom filters as profiles for quick access. Collaboration is streamlined through sharing options with access controls (read/edit), and data can be exported in Excel or CSV formats, including scheduled exports. Available datasets include the GL Transactions Dataset and the Amortization Dataset, covering All Columns Schedules and Asset Transition Schedules.

Sales taxes

In Nakisa Lease Accounting, the system administrator configures the tax setting to “True”, providing a No Tax Jurisdiction input for each country and linking each company code to its respective country. They also set up the Tax Code Determination for each company code and specified vendor. Contract administrators then enter the terms and conditions, including the required tax inputs, while accountants post financial transactions that incorporate the tax amounts to Nakisa General Ledger and SAP.

User-defined fields

User Defined Fields (UDFs) are configurable fields that allow users to add specific types of information within system objects such as Master Agreements and Contracts. They give users the ability to create customized fields tailored to capture and store pertinent data in the database. In Nakisa’s lease accounting software, the system administrator accesses the admin section from the main menu to create a UDF, configuring the field type and status according to requirements. Once set up, the UDF becomes available in subsequent objects, enabling contract administrators and accountants to seamlessly complete the necessary information.

Other key enhancements

In addition to the major updates covered, the January 2024 release introduced several valuable features designed to enhance functionality, streamline operations, and improve user experience across various processes. Here's a closer look at these exciting additions:

- Non-lease indexation in disclosure reports: New Variable Non-Lease columns in IFRS 16 Expense and Cashflow reports provide visibility into non-lease indexation impacts, ensuring consistency across IFRS 16 and ASC 842 reports.

- Multi-currency support for non-lease expenses: Users can now add multi-currency non-lease expenses within a single lease contract, facilitating accurate financial tracking and vendor management across regions.

- Conditional indexation with Max and Min CPI: Lessees can set CPI limits within lease agreements, allowing for smoother CPI adjustments that protect both landlords and tenants.

- Mid-month indexation: Indexation calculations now start on a specific day of the month, ensuring accuracy for arrears scenarios and aligning with payment frequencies.

- Salvage value: Adds a salvage value field for assets with ownership transfer options, excluding salvage from depreciation calculations and supporting lease terms adjustments.

- Default field values: Reduces errors in creating deals by enforcing specific default options, improving accuracy in data entry for lease admins and accountants.

- Disable unit workflow: Introduces an option to skip the reception date step in the unit workflow, streamlining the activation process.

Conclusion

This 2024.R1-R2-R3 product release brings a series of powerful enhancements to Nakisa Lease Accounting for contract administrators, accountants, and contract managers. From streamlining data management with improved mass import functionalities to offering better financial oversight with enhanced reporting and posting capabilities, these updates are designed to increase efficiency, accuracy, and compliance across lease management processes. With smarter workflows, more flexible configurations, and robust tools for maintaining data integrity, this release empowers teams to manage leases and financial data seamlessly while reducing manual effort and potential errors. We are excited to see how these improvements will contribute to more efficient operations and a smoother user experience.

To gain a deeper understanding of these features, explore our NLA demo catalog for a comprehensive overview. For a tailored experience, book a personalized demo with one of our experts today.

To access the latest release notes, please visit the Nakisa Customer Portal or the Nakisa Resource Center.