Key business priorities for airline growth and efficiency

In a highly competitive and volatile industry, airlines are under continuous pressure to grow while maintaining lean, resilient operations. With tight profit margins, rising operating costs, and constant global disruptions, sustainable success requires aligning strategic priorities with operational agility and asset intelligence. Airlines must focus on a set of priorities that balance long-term growth with real-time performance optimization, where IWMS capabilities can play a pivotal role.

Navigating volatility and building resilience. Airlines operate in an environment shaped by frequent external shocks, from geopolitical tensions and public health crises to supply chain disruptions and fluctuating fuel prices. Events like suspended operations in conflict zones or sudden shifts in travel demand during pandemics reveal that turbulence is an inherent part of the aviation industry and highlight the need for agility and scenario-based planning. To stay resilient, airlines need more than contingency plans; they need real-time visibility and control over their asset portfolio. A unified view of fleets, facilities, maintenance hubs, and leased spaces enables airlines to assess scenarios, reallocate resources quickly, and ensure operational continuity. By centralizing data and automating insights, airline teams can respond to disruptions with agility and make informed, cost-efficient decisions.

Managing profitability under pressure. Even in strong years, airlines operate with razor-thin profit margins, typically under 5%. Intense competition, complex regulations, and high fixed costs (including fuel, labor, aircraft leases) make profitability a constant challenge. To stay financially viable, airlines must focus on improving yield, increasing load factors, and optimizing cost per available seat kilometer (CASK). Strategic revenue management alongside targeted ancillary services empowers airlines to maximize returns on every flight and strengthen financial resilience.

Intense competition. Competition in the airline industry is relentless, with carriers constantly adjusting fares, routes, and capacity to protect market share. Low-cost operators continue to challenge traditional models, while global alliances and partnerships redefine route economics. In this environment, strategic differentiation depends on operational intelligence. From optimizing gate utilization and maintenance turnaround to reallocating leased spaces and support facilities, integrated workspace management systems help airlines stay agile and competitive in real time.

Driving operational efficiency through digital transformation. Managing complex, capital-intensive assets is critical to controlling costs and ensuring service reliability. Capital-intensive assets such as aircraft, maintenance infrastructure, and leased facilities demand coordinated lifecycle planning. Airlines need to track leases, maintenance schedules, space usage, and compliance deadlines, minimizing downtime and preventing costly disruptions. Airlines are increasingly adopting intelligent systems that unify data across departments into a single source of truth. Those leveraging automation for maintenance, lease abstraction, and asset forecasting are better positioned to control costs, optimize resources, and improve service reliability. Predictive maintenance, AI-powered crew scheduling, automated passenger handling, and integrated lease and facility management platforms all contribute to faster, better-informed decisions—ultimately improving asset utilization, reducing downtime, and enhancing the overall passenger experience.

Prioritizing fleet modernization and cost control. Modern aircraft offer better fuel efficiency, lower emissions, and reduced maintenance costs, making fleet renewal a proven strategy for improving performance and sustainability. However, optimizing the broader asset portfolio is equally critical. Airlines must evaluate total cost of ownership, manage contract terms, and make data-driven decisions about leasing versus owning infrastructure—ensuring that every capital investment aligns with long-term operational and financial goals.

Enabling network agility and demand-based planning. With fluctuating demand and frequent route changes, agility in space and asset deployment is essential. Airlines are moving away from rigid schedules and instead use real-time data and AI to dynamically scale support facilities (e.g., ground operations, maintenance hangars, or crew housing), repurpose spaces, and consolidate assets based on shifting demand patterns. This approach reduces overhead while enabling faster, more effective responses to external events.

Enhancing customer experience and loyalty retention. As passenger expectations rise, airlines must deliver seamless, personalized experiences across every touchpoint. Satisfaction increasingly hinges on the quality of physical environments, from lounges and gates to boarding processes. Optimizing passenger-facing spaces by tracking usage, maintenance needs, and service delivery across airport properties ensures that investments in customer experience are both effective and efficient. Meanwhile, enhanced loyalty programs, flexible booking policies, and premium service tiers strengthen trust while unlocking new revenue opportunities.

Integrating sustainability and compliance as long-term strategies. As industry embraces sustainability, airlines are accelerating their investments in sustainable aviation fuel (SAF) and eco-efficient aircraft. They must also monitor energy usage across facilities, track sustainability KPIs, and support carbon reporting. Built-in compliance tracking ensures alignment with ESG commitments and helps airlines stay ahead of evolving environmental regulations. Meeting these standards isn’t just about compliance; it strengthens long-term brand reputation and builds investor confidence.

Strengthening safety and security across operations. Safety remains the cornerstone of aviation, and in an era of heightened cyber threats, geopolitical tensions, and complex global operations, it extends far beyond physical maintenance. Airlines must ensure not only the safety of passengers and crews but also the integrity of digital systems, facilities, and assets. Modern IWMS platforms can support this by improving visibility into safety-critical infrastructure, ensuring timely maintenance compliance, and centralizing incident tracking and reporting. Combined with integrated data and automated alerts, these capabilities help reduce risks, enforce regulatory adherence, and enhance both physical and cyber resilience across the airline’s network.

In an industry defined by high risk and tight margins, sustainable growth for airlines hinges on making smarter, faster decisions. Effective asset management, backed by accurate data, real-time visibility, and proactive planning, is key to controlling costs and maintaining operational agility. As airlines accelerate their digital transformation, integrating systems and automating key processes across the asset lifecycle enables real-time operational agility, data-driven decision-making, and enhanced visibility across their global portfolio. The airlines that prioritize adaptability, innovation, and data-driven strategy will be best equipped to navigate uncertainty and capture long-term value.

Asset types in the airline industry

Following the deregulation of the airline industry in 1980s in the United States, airlines began to shift away from owning assets and started relying more heavily on leased portfolios. This trend later expanded across the globe, driven by the need for fleet flexibility, lower upfront costs, and more agile responses to market demand. Today, both in the U.S. and around the world, airlines operate with a diverse mix of assets: from aircraft and terminal gates to catering equipment and ground vehicles, all sourced through a combination of ownership and leasing arrangements.

Managing this complex asset landscape requires robust processes that account for varying asset classes, contractual terms, and operational interdependencies.

Let’s take a closer look at the main asset types in the airline industry.

Real estate assets

Real estate assets in the airline industry can be classified into on-terminal and off-terminal spaces. Below are examples of each:

On-terminal spaces:

- Airport terminals. The core infrastructure of any airport. Airlines typically lease space within terminals for check-in desks, boarding gates, passenger lounges, security and baggage handling areas, and operational offices.

- Airport parking lots. Airlines may lease parking areas as part of passenger service offerings or employee convenience.

Off-terminal spaces:

- Cargo facilities. Warehousing and logistics hubs that are used for freight operations and are typically located near the airport but outside the terminal. Airlines may lease or own large spaces for loading, unloading, and storing cargo.

- Maintenance hangars. Critical for aircraft MRO (maintenance, repair, and overhaul), these hangars are located off-terminal but often on airport-owned land. They are essential for keeping aircraft in good condition and ensuring safety standards.

- Office buildings. Airlines may own or lease administrative buildings for departments like HR, IT, finance, and marketing, often close to the airport but not in terminal areas.

- Airport support and maintenance buildings. Infrastructure for maintaining runways, lighting systems, and terminal equipment, often owned by the airport and leased to airlines and service providers.

Fleet assets

Fleet assets are the most capital-intensive and strategically significant resources in the airline industry. They directly impact operational capacity, route flexibility, and long-term profitability. Fleet assets encompass aircraft, engines, onboard systems, and specialized components, acquired through a mix of ownership and leasing.

Leasing plays a central role in airline fleet strategy. As of 2024, the majority of global aircraft are leased. Leasing offers flexibility to scale operations and optimize fleets without heavy upfront investment. This is especially valuable in an industry where demand is cyclical and affected by factors like fuel prices, seasonality, and global events.

Airlines primarily use two leasing models:

- Dry leases. Aircraft that is leased without crew, maintenance, or insurance. Commonly used by full-service and budget carriers, these long-term arrangements (2 to 12 years) can be structured as:

- Finance leases, where the ownership transfers at the end

- Operating leases, where the lessor retains ownership.

- Wet leases. Aircraft, crew, maintenance, and insurance (ACMI) are included. Wet leases are typically short-term (1 to 24 months), used quickly to meet demand surges or cover operational shortfalls.

While leasing offers agility, many airlines still own part of their fleets, especially aircraft deployed on high-yield, long-haul routes. Ownership provides more control over customization, asset lifecycle management, and long-term value retention, especially when financed under favorable terms.

In addition to aircraft, fleet assets include:

- Engines. Spare engines are leased to reduce downtime and maintain continuity.

- Specialized components. Auxiliary power units (APUs), avionics, and other subsystems are often leased separately to lower upfront costs or support specific aircraft models.

- Other parts and systems. Landing gear, interior fittings, and communication systems are often leased as standalone items or bundled within maintenance agreements.

Equipment assets

Operational equipment ensures smooth day-to-day flight and airport operations. These include:

- Ground support equipment (GSE). Items like baggage handling systems, pushback tractors, and belt loaders. Leasing helps reduce capital expenditure while maintaining flexibility.

- Maintenance tools. Specialized systems for aircraft inspections and repairs, often leased to align costs with usage.

- Catering equipment. Trolleys, ovens, and storage units used for in-flight services, often leased to meet varying passenger needs and support seasonal demand.

Understanding the nature, lifecycle, and contractual terms of both leased and owned equipment is vital for not only for ensuring efficiency, regulatory compliance, and cost control, but also for supporting long-term growth and sustainability. A purpose-built IWMS solution enhances capital allocation, planning, and execution for upcoming projects, centralizes asset tracking, automates lease and depreciation management, and streamlines equipment transfers, all while ensuring regulatory compliance with standards such as IFRS 16 and ASC 842.

Discover our buyer’s guide with RFP scorecard to select the right commercial real estate management software for airlines. With tailored evaluation criteria and practical insights, this guide helps you navigate the decision-making process and identify the tools best suited to your organization’s unique needs.

How does IWMS software solve unique challenges for the airline industry in each step of asset lifecycle management?

The airline industry, with its complex infrastructure and heavily regulated environment, faces significant challenges throughout the asset lifecycle management. From strategic planning and capital project execution to lease negotiation, daily operations, and eventual renewal or termination, each stage requires careful coordination and data-driven decision-making.

An Integrated Workplace Management System (IWMS) equips airlines with essential tools to manage every stage of the asset lifecycle. By centralizing data and automating key processes, IWMS solutions help carriers streamline operations, enhance visibility, and maximize asset value. Research shows that adopting an IWMS solution like Nakisa can reduce capital project costs by up to 45%, improve facility utilization by 40%, lower asset lifecycle costs by 35%, and enhance workspace management by 47%.

In this section, we’ll examine the core phases of the asset lifecycle in the airline industry, the common challenges that arise, and how exactly a solution like Nakisa IWMS can help overcome them.

Planning and finding

Capital projects are essential to the airline industry’s ability to operate efficiently, stay compliant, and grow sustainably. These projects include fleet acquisition and modernization, maintenance facility construction or upgrades, airport infrastructure improvements, digital transformation initiatives, and sustainability investments. Each of these large-scale initiatives involves significant investment and long-term planning.

Given their impact on capacity, safety, and profitability, airlines must align their capital plans with broader business strategies, ensuring funding is secured, timelines are realistic, and plans are flexible enough to adapt to evolving market conditions.

Let’s examine the key challenges airlines face when planning and overseeing capital projects and how Nakisa IWMS can help.

Challenge 1: Managing financial forecasting, budget allocations, and cost control for capital projects

Capital projects in the airline industry demand precise financial planning to align with operational priorities and long-term strategic goals. Airlines must accurately forecast costs and outcomes, allocate budgets, and control spending, all while navigating through volatile fuel prices, shifting regulations, and resource constraints. The complexity increases for airlines operating across multiple regions, where infrastructure readiness, demand, and cost structures vary widely.

Improving accuracy in financial forecasting and budget allocation

A common pitfall in capital project planning is misalignment among stakeholders and a lack of clear, data-driven financial analysis. Without reliable forecasting, investments in new aircraft, hangar builds, MRO facilities, or digital system upgrades can lead to budget overruns and reduced ROI.

Before committing to any large-scale project, airlines must:

- Align stakeholders around shared objectives

- Estimate total lifecycle costs, including acquisition, leasing, operations, maintenance, and compliance

- Consider external risk factors such as fuel price volatility, supply chain delays, emissions regulations, infrastructure readiness, labor costs, and shifting market demand

- Model financial scenarios to assess risks and opportunities of each project

Given the long lead times and interdependencies of capital projects, avoiding budget overruns and missed opportunities requires agile scenario modeling that account for a wide range of market and operational variables and supports robust contingency planning.

With accurate forecasting, airlines gain greater control over leasing and capital expenditures, across projects and geographies, empowering strategic investments in fleet expansion, modernization, and infrastructure, all while maintaining operational resilience.

How Nakisa IWMS enhances financial forecasting and budget allocations for airlines

Nakisa IWMS, specifically its Capital Projects Suite, gives airline finance and project teams the tools to analyze financial scenarios, allocate realistic budgets, and maintain rigorous budgetary control across fleet investments and infrastructure initiatives. By integrating data from the current real estate and asset portfolio, upcoming capital projects, external market insights, and evolving industry trends, the suite provides an advanced level of data visibility, empowering airline to make informed decisions and allocate budgets based on real-time, dynamic conditions rather than static, historical assumptions.

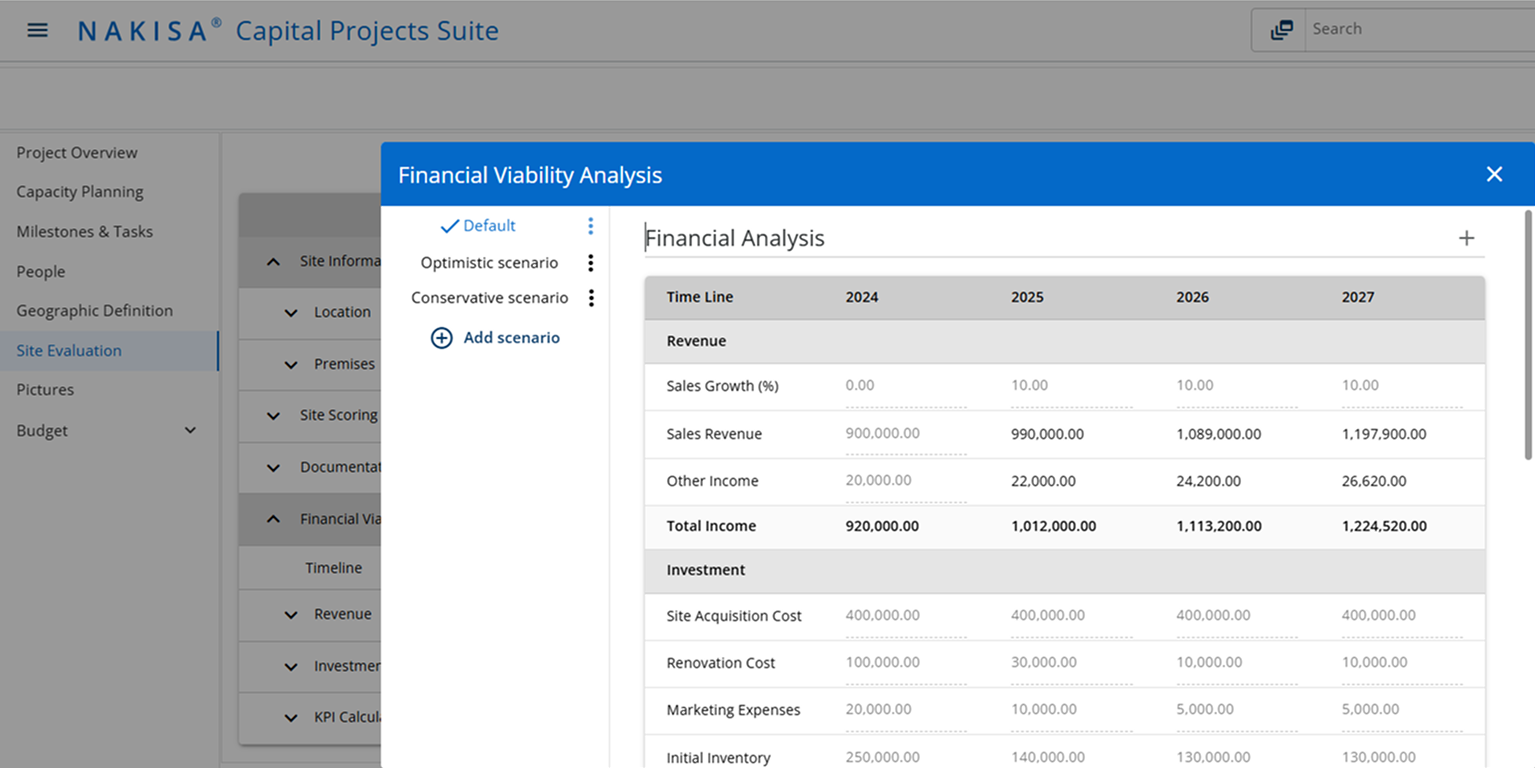

The platform leverages AI-driven analytics and automation to streamline financial viability assessments. It automatically calculates key metrics such as Net Present Value (NPV), Discounted Cash Flow (DCF), Return on Investment (ROI), and Break-Even Points. These calculations help airlines comprehensively evaluate the potential returns and risks of capital expenditures, from fleet expansion to facility upgrades and technology transformations.

Nakisa IWMS supports detailed scenario modeling, allowing airlines to develop and compare multiple budget scenarios, from best-case to worst-case. Teams can easily adjust key variables, such as aircraft acquisition costs, fuel price fluctuations, compliance-related expenses, and projected passenger demand, to assess the financial impact of each scenario. The system also accommodates contract-specific modeling, including lease escalation clauses, route seasonality, and conditional savings or penalties.

Creating multiple financial scenarios in Nakisa Capital Projects

AI-powered automation enables capital project managers to rapidly generate detailed project expenditure and assess how different assumptions affect project outcomes. This level of control and visibility allows airlines to allocate budgets more effectively, avoid cost overruns, and maintain alignment with long-term strategic goals.

Seamless approval workflows are built in, promoting transparent collaboration between finance, project leaders, and executive stakeholders. Budget allocation requests, scenario reviews, and strategic signoffs are streamlined within the platform, reducing bottlenecks and enhancing governance.

By utilizing unified data, intelligent automation, advanced analytics, and built-in approval workflows, Nakisa IWMS equips airlines to improve budget accuracy, adapt rapidly to market changes, and maintain strong financial oversight across all capital initiatives.

Optimizing budget tracking and cost control

Once a budget is approved and allocated, rigorous cost tracking becomes critical. Poor visibility into actual spending and outdated forecasts can lead to misaligned budgets, project delays, and reduced return on investment. To avoid these risks, airlines need to adopt robust analytics tools that track expenditures, support accurate forecasting, and flag issues early. Real-time monitoring, combined with automated alerts and spending controls, reinforces financial discipline and allows project teams to make timely, informed adjustments aligned with business goals.

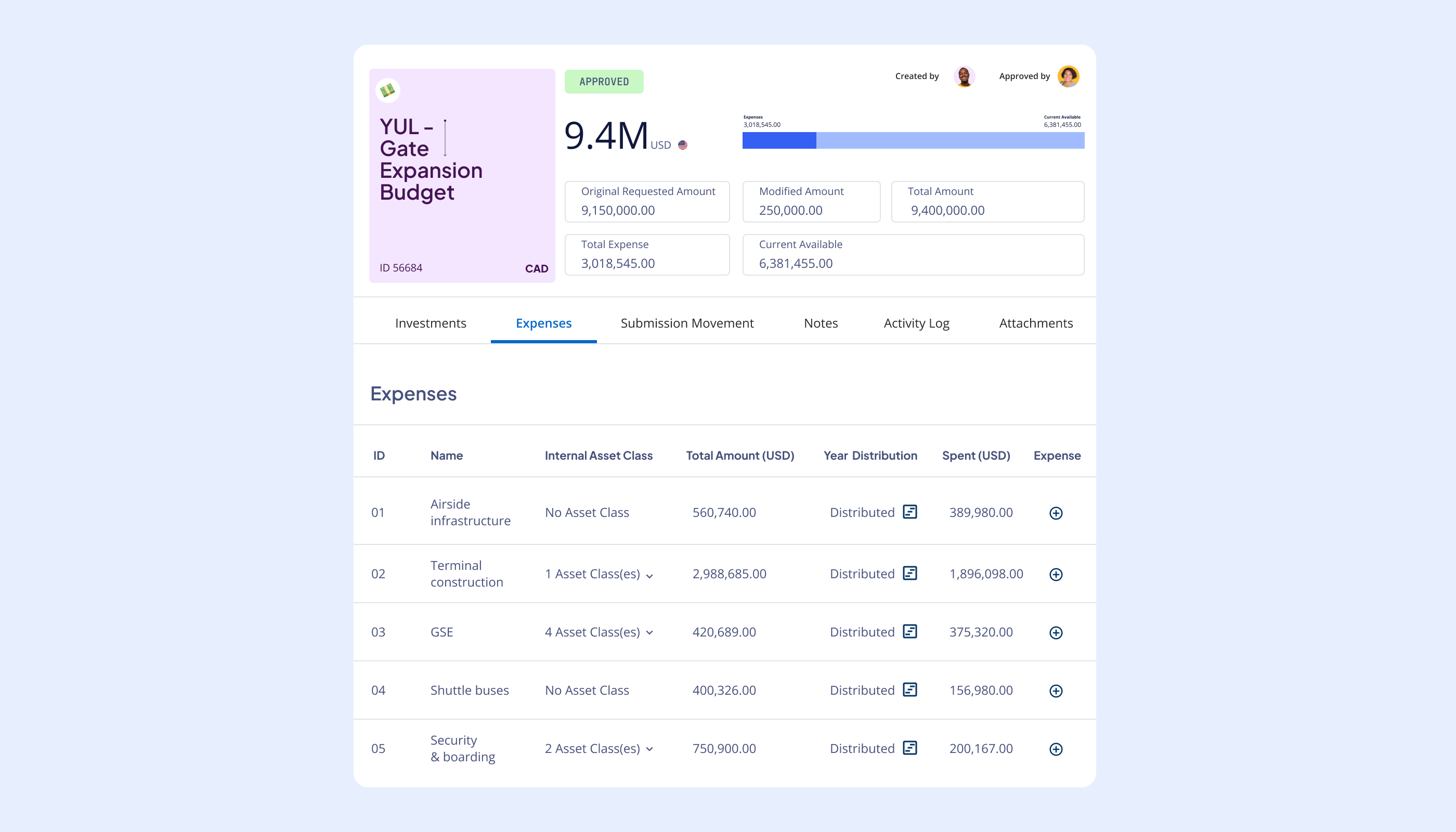

How Nakisa IWMS optimizes budget management and cost control

Nakisa IWMS streamlines budget management with highly configurable, role-based workflows and a multi-level approval system that seamlessly aligns finance, operations, and senior leadership. Once budgets are approved, they can be allocated across capital projects, such as aircraft acquisition, MRO facility upgrades, and digital transformation initiatives, with support for multiple budget lines, allowing for flexible planning and precise tracking.

Nakisa enables accurate cost management with real-time monitoring of budgeted versus actual expenditures, available in multiple currencies. Capital project managers can instantly review budget statuses, detect overruns, and ensure spending remains within approved limits. Built-in hard stops and automated alerts promptly notify the appropriate stakeholders when thresholds are exceeded, enabling quick intervention and better financial governance. With these tools, airlines can stay on top of their capital spending and make informed decisions that keep projects aligned with strategic and financial objectives.

Easily manage capital project budgets and track the associated expenses in Nakisa Capital Projects (part of Nakisa IWMS)

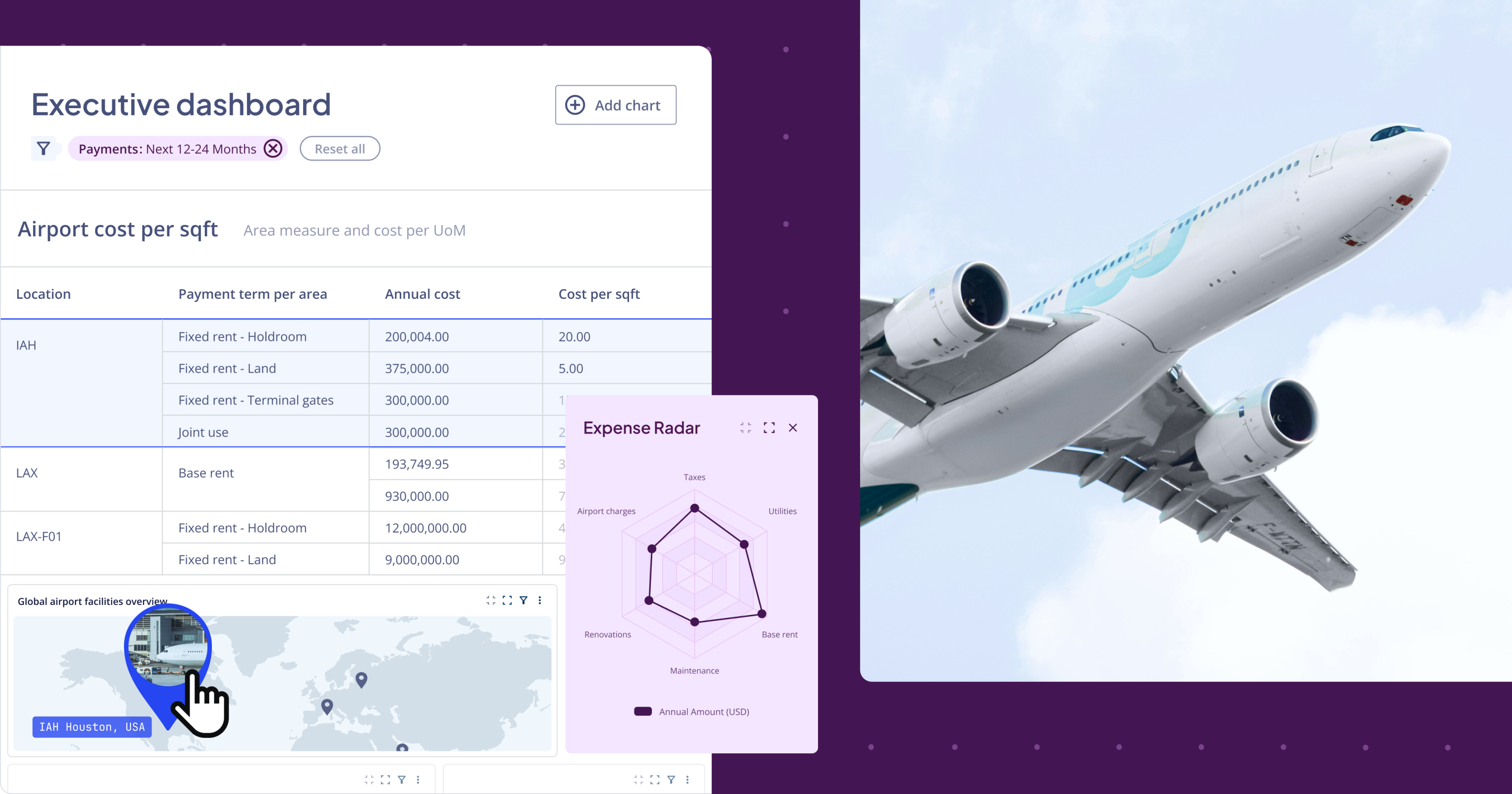

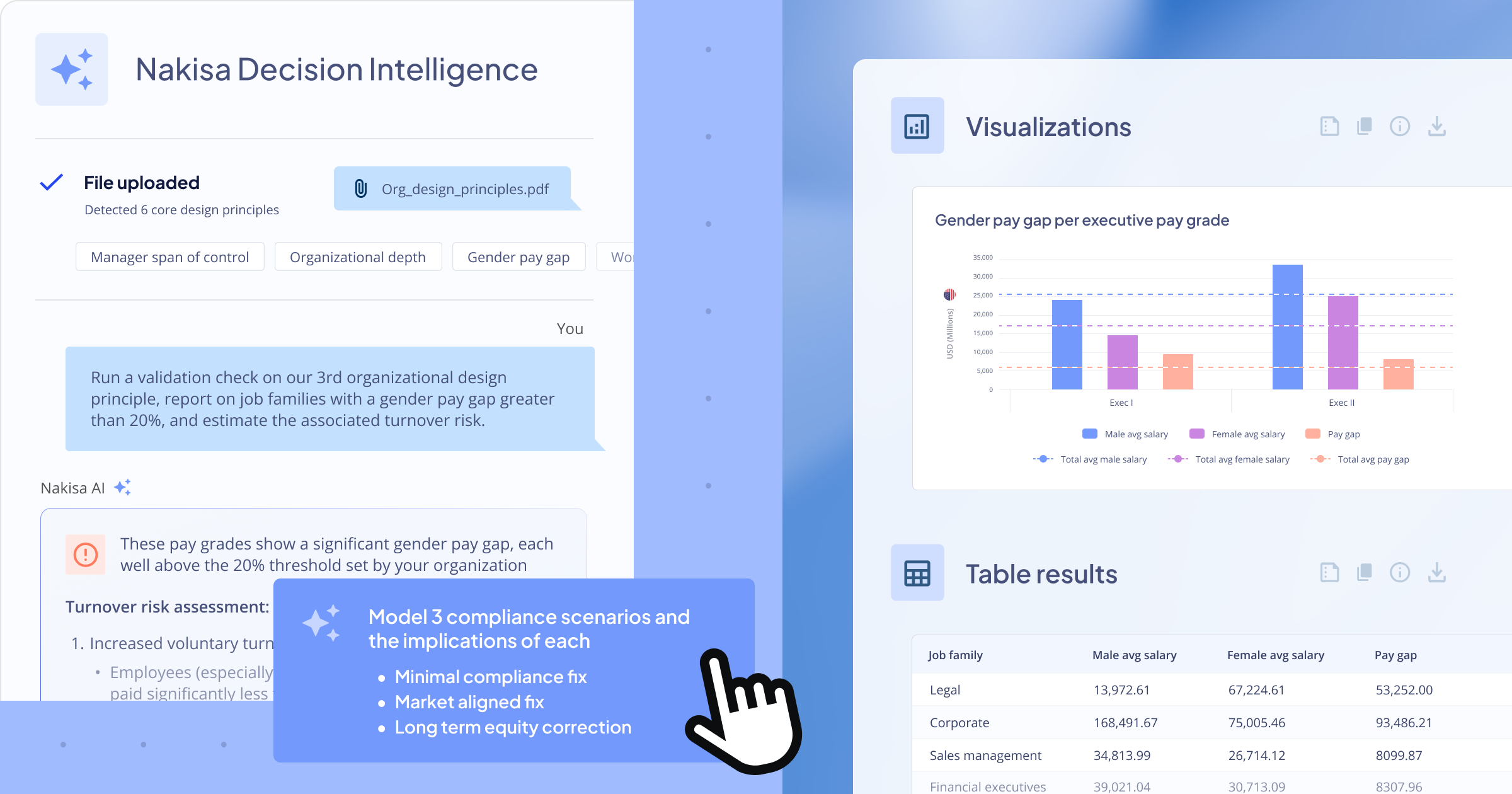

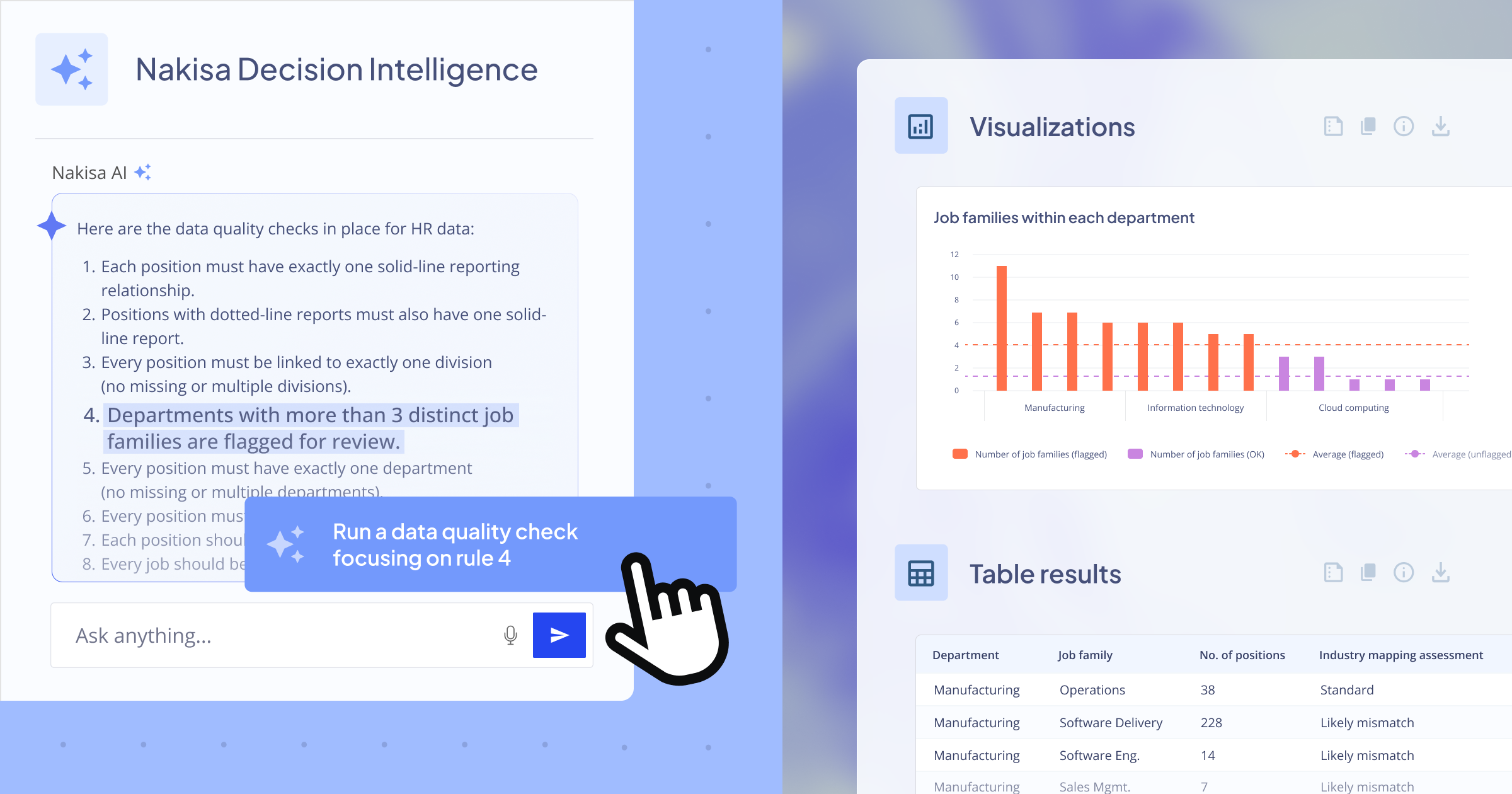

Through real-time expense tracking and intuitive dashboards, capital project managers gain clear, actionable insights into financial performance across all projects. This is powered by Nakisa Decision Intelligence (NDI) — an AI-first decision platform that unifies, interprets, and analyzes vast internal and external data in real time. NDI enables managers to run forecasts and simulations, receive tailored expert guidance, and prompt the system in natural language to instantly generate dynamic financial reports and dashboards. They can also benchmark estimated budget allocations and rates against market standards, ensuring more informed and strategic decisions. By identifying potential risks and providing greater visibility across global capital project activities, NDI empowers organizations to optimize performance and ensure stronger financial control.

Nakisa IWMS goes further by streamlining vendor and invoice management. External vendors and service providers can directly upload invoices to the platform, providing a centralized view that links budgeted amounts, contractual commitments, and actual invoiced costs. This unified approach enhances both financial accuracy and transparency.

Nakisa supports comprehensive budget and cost management across both capital projects and operational areas such as leasing and facilities. The platform monitors a wide range of expenditures, from construction and capital investments to lease-related payments (such as rent, taxes, insurance, and utilities) and facility maintenance activities (such as repairs and scheduled work orders), all intuitively organized by team and user role, ensuring stakeholders access the right information quickly and efficiently.

Challenge 2: Prioritizing the best-fit capital projects

For airlines, identifying and prioritizing the best capital projects, along with finding their optimal locations, is essential to maximizing operational efficiency and long-term growth. A core challenge in airline capital projects is determining which locations to prioritize based on expected return, operational impact, and strategic alignment.

However, capital projects are rarely straightforward. Airlines must navigate competing objectives such as fleet modernization, terminal upgrades, maintenance facility expansion, and sustainability initiatives, all while addressing rising passenger expectations and stricter environmental regulations. Location decisions, whether for terminals, hangars, or MRO facilities, carry high stakes. Poor site selection can lead to costly delays, compliance issues, and long-term operational inefficiencies. For instance, selecting an airport with difficult or expensive permitting processes can add years to project timelines, severely impacting profitability.

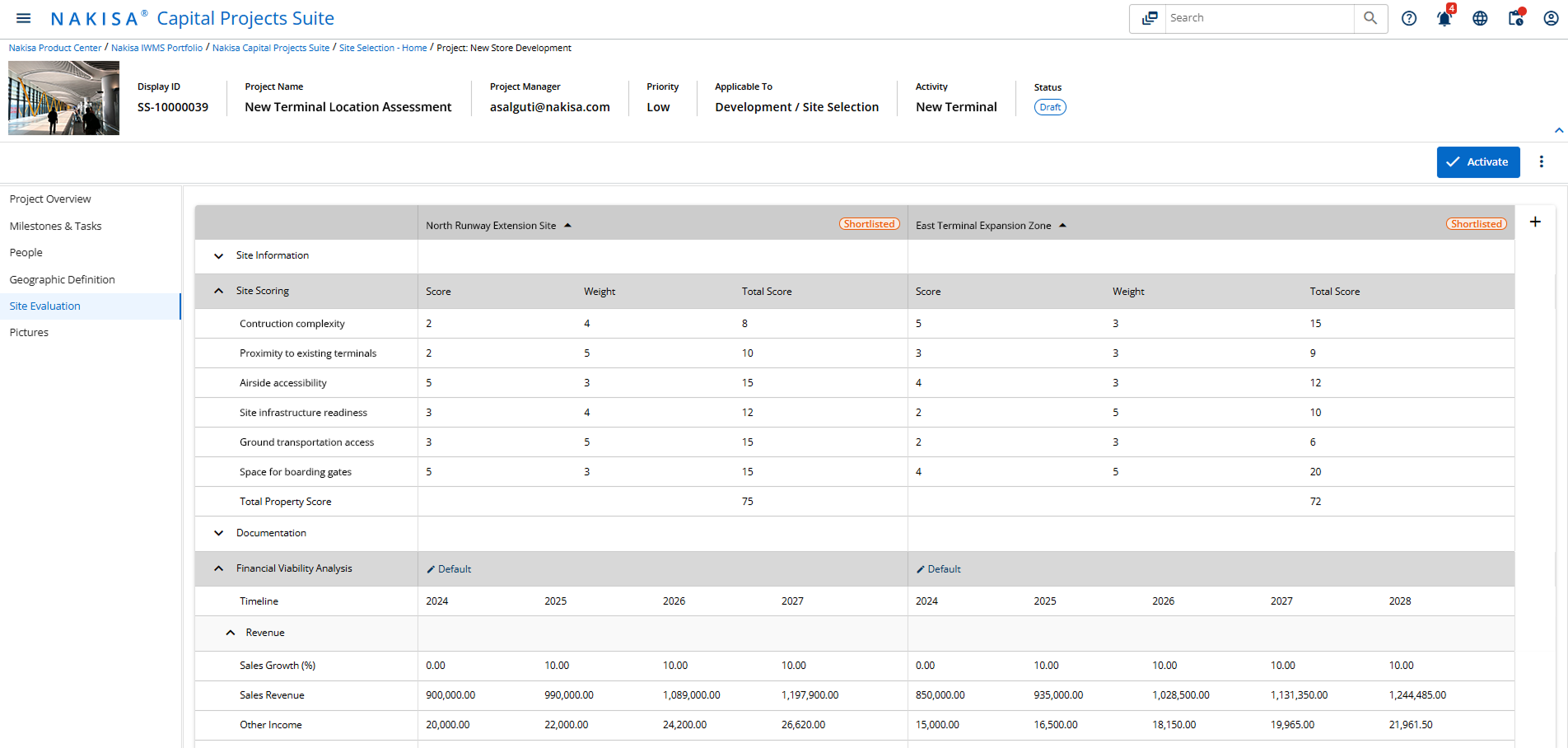

Effective prioritization requires evaluating both projects and locations across multiple dimensions, including airport accessibility, market demand, infrastructure readiness, labor availability, regulatory environment, government incentives, and competitive landscape. Logistic factors such as route connectivity and expansion potential must also be considered, along with the expected impact on network capacity. This often involves modeling multiple scenarios, comparing different types of projects or the same project across various locations, and weighing trade-offs between short-term gains and long-term value.

Unfortunately, the process is often hindered by fragmented data and siloed decision-making. Many airlines still rely on disconnected tools or outdated information, making it difficult to gain a holistic, real-time view of airport infrastructure, market trends, competitor movements, or local regulations, increasing the risk of investing in projects that underperform or overlooking higher-value opportunities elsewhere. Without integrated systems and real-time visibility, it becomes challenging to accurately evaluate project potential or adjust priorities as conditions change.

How Nakisa IWMS supports capital project prioritization and site selection

Nakisa empowers airlines to systematically identify and prioritize capital projects and locations that best align with strategic business objectives. Key features include:

- Centralized project and location repository: Nakisa consolidates all current and potential capital projects, featuring detailed site information, supporting documentation, configurable scorecards, and financial forecasts, all within a single platform. Project managers can visualize locations using Geographic Information Systems (GIS) integration and analyze surrounding infrastructure, connectivity, and demand factors. Flexible filters and dynamic dashboards streamline the exploration and direct comparison of multiple investment options.

- Decision intelligence platform that goes beyond traditional analytics and reporting: Nakisa Decision Intelligence integrates and interprets multiple external and internal data sources, providing airlines with timely market intelligence and comparing their portfolio performance with market benchmarks. With natural language prompts, NDI runs multiple scenarios and forecasts to help airlines find the optimal-fit fleet and location options, giving tailored expert assistance in the matter of seconds.

- Strategic alignment and scoring: Capital project managers can create customizable scorecards tailored to their airline’s unique goals, using KPIs such as airport capacity utilization, connectivity index, cost efficiency, and regulatory compliance. Projects and locations are evaluated side by side for a comprehensive metric breakdown, helping teams easily shortlist and prioritize the most promising initiatives. The solution also offers financial viability analysis with metrics like Discounted Cash Flow (DCF), Net Present Value (NPV), Return on Investment (ROI), and Break-Even Point to evaluate the expected value of each project-location combination.

- Seamless integration and operational efficiency: Once the optimal site is selected and the rent is signed, the asset can be automatically added to Nakisa IWMS, immediately connecting it to lease administration and facility management workflows. This unified process enhances long-term asset tracking, streamlines project execution, and supports ongoing success in managing airline real estate assets and capital investments.

Compare up to 10 options side-by-side, evaluating their scores and financial analysis

Challenge 3: Capital project management for airlines

Capital project management is essential for airlines undertaking planning, financing, and executing large-scale initiatives such as fleet expansion, hangar construction, terminal upgrades, or digital infrastructure improvements. Earlier, we discussed the challenges related to financial forecasting, cost tracking, and selecting the right project and location, all critical components of capital planning. This section focuses specifically on the execution phase: managing timelines, teams, priorities, and deliverables.

Managing project priorities, timelines, and milestones

Once priorities are established, executing projects adds another level of complexity. Airlines often manage multiple initiatives in parallel, each with distinct phases, interdependencies, and approval workflows. Projects such as airport lounge renovations, MRO facility upgrades, or digital system rollouts must follow strict schedules, often tied to regulatory deadlines, seasonal traffic peaks, or aircraft delivery windows. Coordinating across internal teams, contractors, and third-party vendors, often across multiple regions, further increases the challenge.

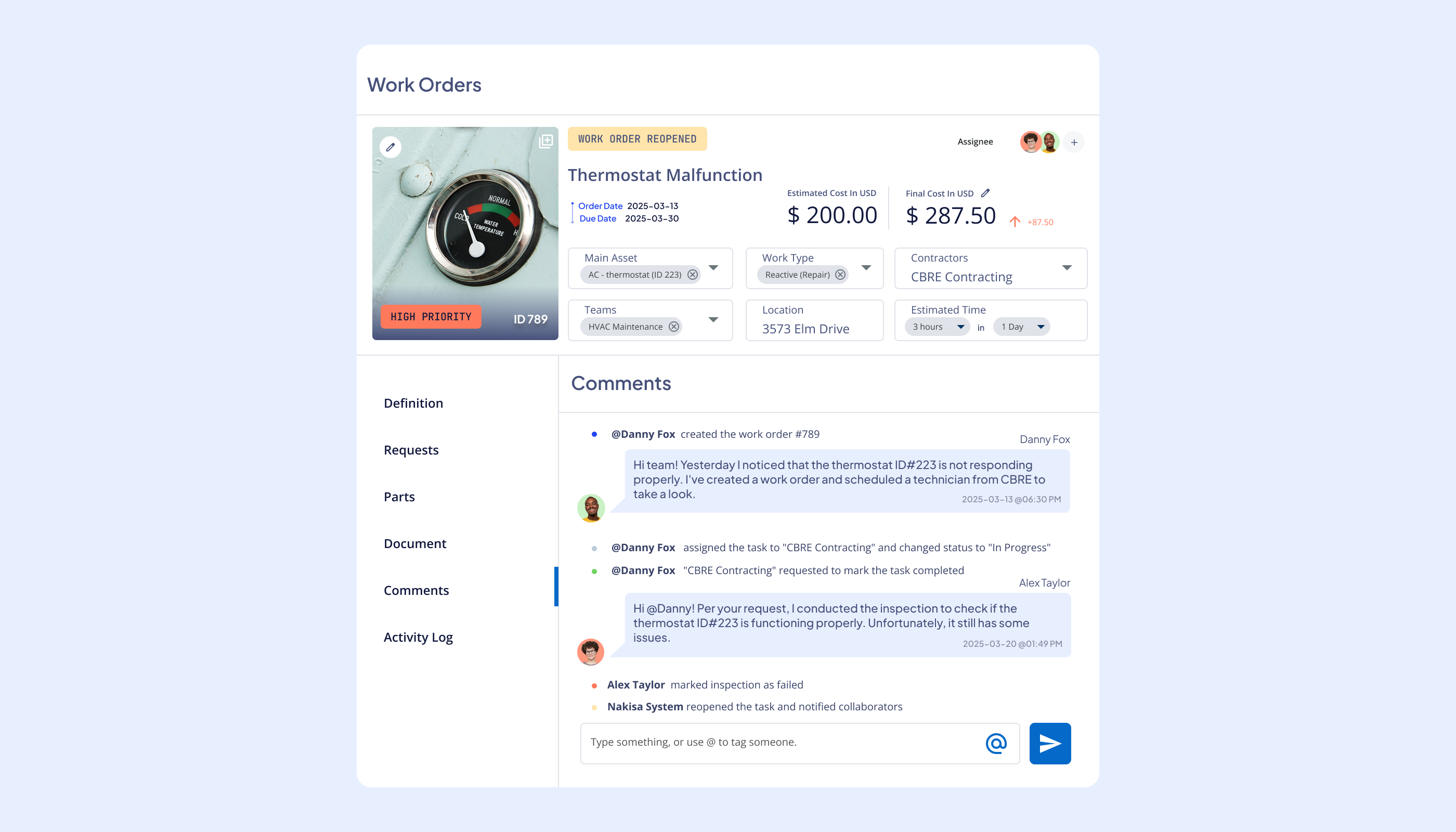

Delays frequently stem from manual task tracking, communication breakdowns, missed handoffs, or underperforming vendors. Without centralized oversight and real-time updates, project managers can easily lose visibility into progress, leading to missed milestones and budget overruns. Keeping everything on track requires structured workflows, proactive risk management, and streamlined coordination.

To deliver projects on time and within scope, airlines need tools that allow them to monitor progress in real time, coordinate tasks across teams, and keep stakeholders aligned throughout every phase.

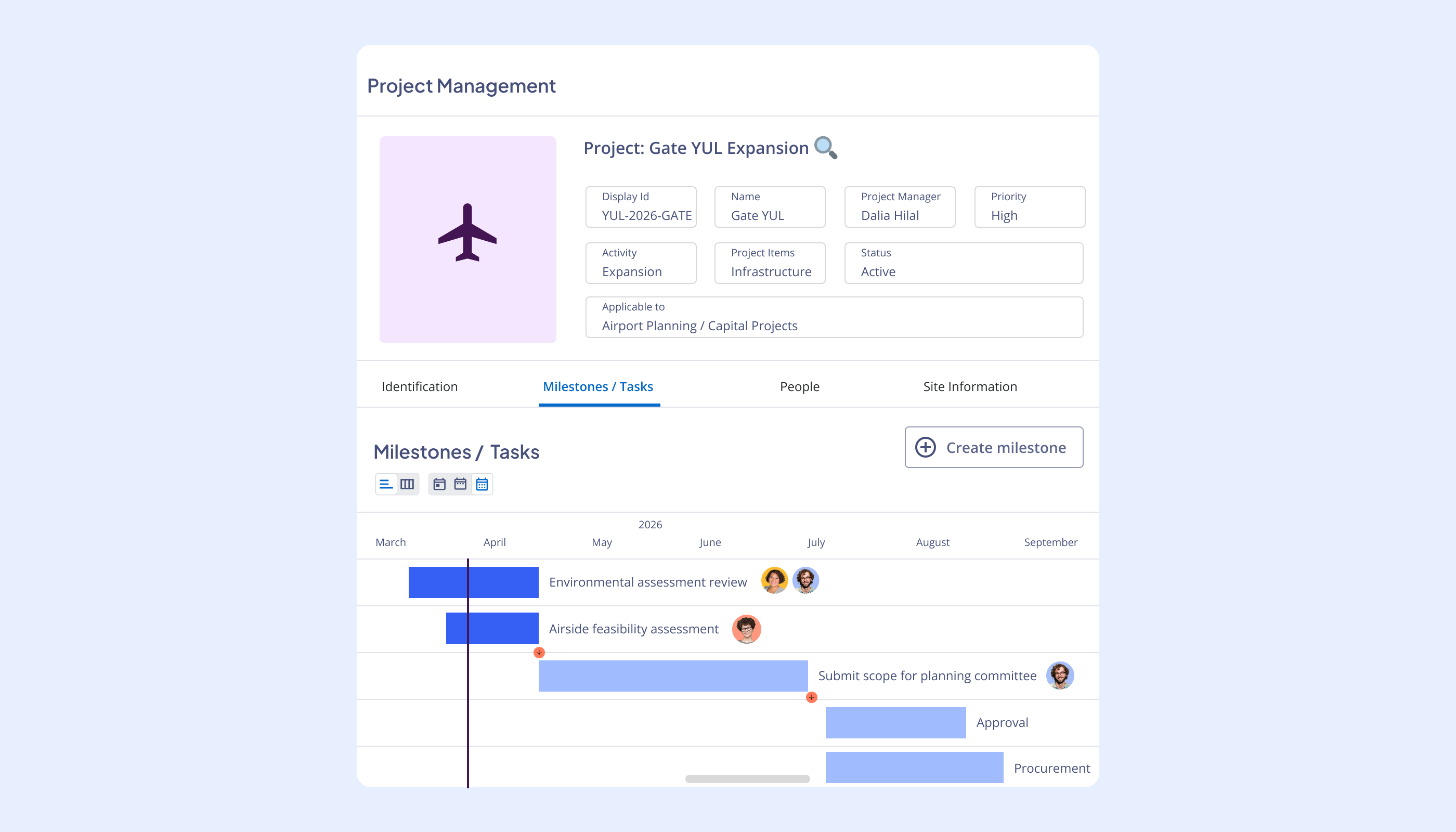

How Nakisa IWMS streamlines priority, timeline, and milestone management

Nakisa IWMS offers purpose-built tools for capital project planning and execution tailored to the unique operational needs of airlines. Project managers can define the purpose of each initiative, whether it's renovating secure airport zones under strict regulatory oversight, upgrading terminal fit-outs, or enhancing lounges. The platform allows assignment of priority levels, clear definition of project scope (ranging from full facility overhauls to equipment-specific changes), and configurable visibility settings for sensitive initiatives.

Built-in functionality supports comprehensive milestone, approval, and deliverable tracking. Project managers can create projects with task lists, assign owners, set deadlines, and monitor progress using dynamic dashboards and Gantt charts. Automated notifications help keep key milestones on track, while role-based access facilitates smooth collaboration between internal teams and external vendors.

To increase efficiency and standardization, Nakisa IWMS provides reusable project templates designed for different types of capital initiatives, such as hangar construction, terminal renovations, or aircraft refits. These templates are easily adaptable by region or business unit, minimizing manual effort and reducing the risk of overlooked tasks. This organized approach to task management and progress monitoring allows airlines to deliver capital projects on time and budget.

Create and prioritize tasks, assign people, and stay on top of the deadlines with Nakisa.

Enhancing internal collaboration

Capital projects in the airline industry require close coordination across internal teams, such as design, construction, legal, and finance throughout complex, interdependent timelines that span planning, procurement, execution, and closeout phases.

Without a unified system with built-in collaboration and approval workflows, project managers may struggle to keep teams aligned as deadlines shift and requirements evolve. This misalignment can lead to delayed tasks, missed milestones, and disruptions that affect operations, customer experience, and financial outcomes.

As projects expand across regions, added complexity arises from time zone differences, language barriers, and varying regulatory standards. To stay on track, all internal stakeholders must have real-time access to updates, approvals, and financial data.

How Nakisa optimizes cross-team coordination and streamlines project execution

Nakisa Capital Projects Suite fosters seamless collaboration by enabling team members to assign, track, and update tasks in real time. Responsibilities are clearly allocated to relevant teams or individuals, with deadlines and task dependencies explicitly defined. Automated notifications and alerts keep everyone informed about upcoming deadlines or schedule changes, ensuring critical steps are not missed. For example, if construction delays arise due to unforeseen circumstances, the system promptly alerts procurement and legal teams to adjust timelines or reallocate resources accordingly.

To maintain momentum across all project phases, the platform offers integrated Gantt charts and timeline views that allow project managers to track progress from initial planning to project closeout. Project milestones and key performance indicators (KPIs) are clearly outlined, enabling quick identification of delays and potential bottlenecks. This level of visibility is especially crucial for high-stakes projects like airport terminal expansions, where on-time delivery is key to uninterrupted operations. When critical milestones are at risk, Nakisa flags these issues for immediate attention, enabling proactive problem-solving.

Whether managing the complexities of a new runway development or coordinating a major fleet overhaul, Nakisa ensures that no detail is left behind. With tools tailored to airline capital projects, it empowers airline teams with the confidence, clarity, and control they need to execute successfully.

Enhancing external collaboration: contractors, advisors, landlords, suppliers, and more

Managing a diverse set of vendors, contractors, advisors, landlords, and service providers across multiple capital projects is another challenge. Airlines often work with a wide range of external partners, each with different contractual terms, service-levels expectations, and compliance requirements. Without a centralized vendor database, automated tracking system, and built-in collaboration and approval tools, maintaining visibility into performance metrics, safety compliance, insurance documentation, and contractual obligations can become cumbersome.

These gaps can lead to missed deadlines, compliance violations, and strained vendor relationships, ultimately affecting project timelines, cost control, and quality. Effective external collaboration requires clear accountability, centralized information, and real-time coordination across all project stakeholders.

How Nakisa facilitates external collaboration with third parties

Nakisa centralizes vendor management by consolidating all vendor-related data—including agreements, performance metrics, compliance documents, service history, and certifications—into a single, unified platform. This centralized database reduces the risk of lost documentation or overlooked contractual obligations, while also improving transparency and collaboration across teams.

Vendor assignments can be precisely scoped to specific premises, giving real estate professionals an efficient way to track service providers by location and ensure the right vendors support the right sites.

What’s more, Nakisa enables vendors and external contractors to directly upload invoices and credit notes through the vendor portal. This centralized approach gives airline real estate teams full visibility into service quality and financials, enabling them to easily compare estimated vs. actual costs, track vendors' performance, and confidently approve or reject invoices.

This functionality automates financial calculations, streamlines reconciliation, and simplifies auditing processes, reducing manual effort and risk of error. By allowing vendors to communicate and transact through the same platform, Nakisa fosters smoother collaboration and minimizes the need for back-and-forth emails or phone calls—saving time and improving overall accountability and efficiency.

Challenge 4: Navigating regulatory compliance and risk management across jurisdictions

Meeting environmental and regulatory requirements across multiple jurisdictions is a complex task for airlines. Projects must often comply with international and regional standards such as ISO 14001 for environmental management, ISO 14064 for greenhouse gas reporting, and green building standards like LEED or BREEAM when developing terminals, hangars, or support facilities. Failure to comply can lead to costly fines, construction delays, or denied approvals. Airlines must also adhere to aviation-specific regulations related to passenger safety, accessibility, airport security, and environmental impact. These requirements vary widely across countries and airports, making compliance both time-sensitive and resource-intensive.

Adding to this complexity, airlines must plan for unforeseen risks, such as geopolitical shifts, supply chain disruptions, or extreme weather events. Without effective risk management and contingency planning, capital projects become vulnerable to delays, cost overruns, and compliance failures.

How Nakisa ensures compliance with global regulations

Nakisa IWMS provides the tools airlines need to stay compliant, mitigate risks, and maintain project momentum, no matter the location or scale of the initiative.

Centralized regulatory tracking. Nakisa IWMS centralizes all project-related data, providing capital project managers with a comprehensive overview of compliance requirements, project statuses, and regulatory milestones. The platform offers real-time visibility, so teams can act proactively on compliance risks before they escalate. Managers can assess risk levels and evaluate the potential operational, safety, and environmental implications of each project to ensure alignment with corporate and regulatory standards. This approach supports informed decision-making and better preparation for approval processes or audits.

Streamlined compliance communication. The proposal comments feature enhances documentation and accountability by capturing compliance-related discussions, approvals, and regulatory concerns in a centralized, structured format. This minimizes miscommunication, creates a clear audit trail, and simplifies demonstration of compliance during inspections or formal audits.

Custom compliance metrics and scorecards. Airlines can define custom compliance metrics for individual airport locations or facilities using configurable scorecards. These metrics ensure that every project is evaluated against all relevant aviation and construction standards, including safety, environmental, and operational guidelines.

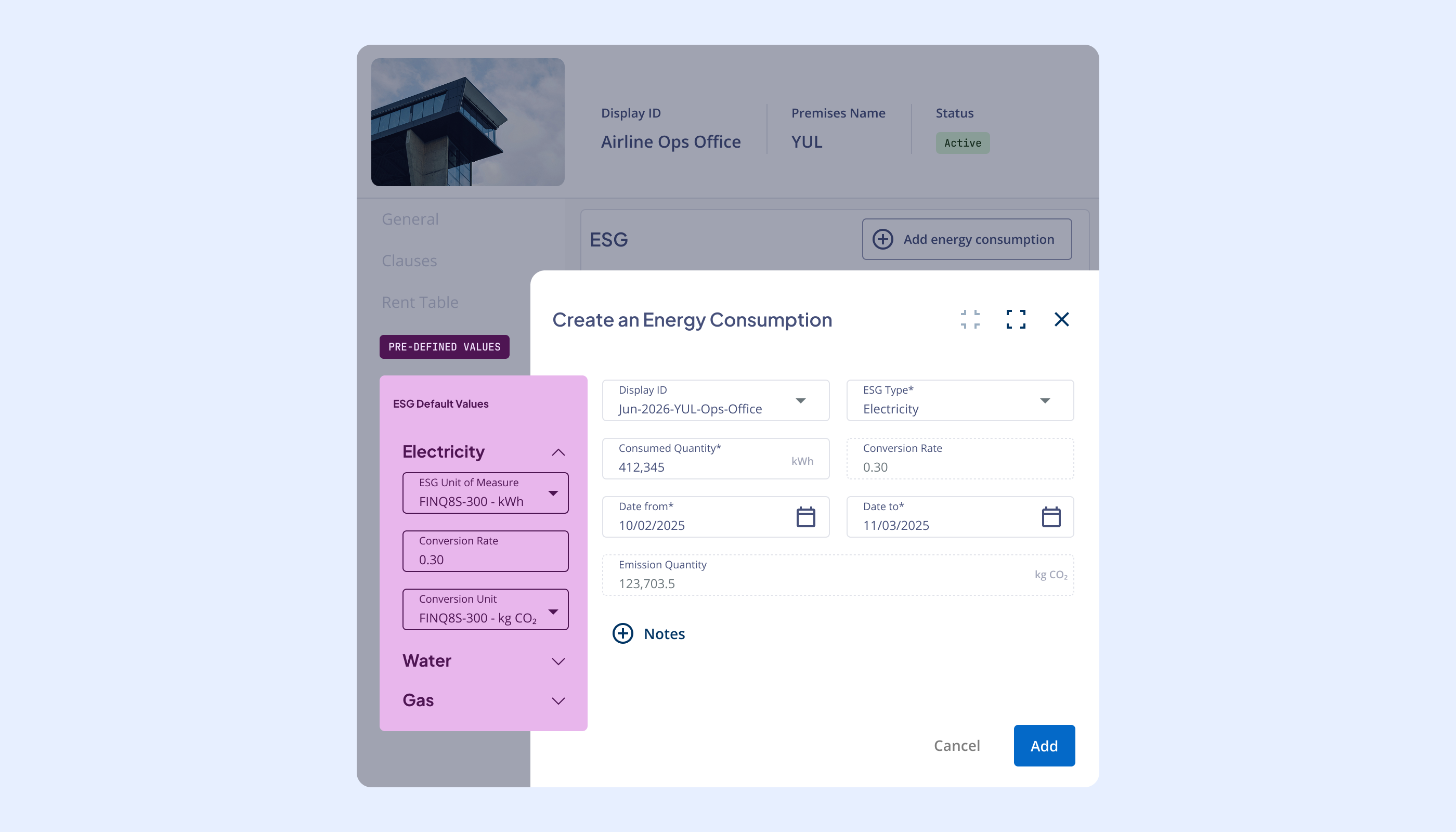

Sustainability and ESG tracking. Nakisa also enables airlines to track energy usage and sustainability initiatives. This functionality supports alignment with ESG targets, carbon emissions reduction, which adherence to environmental standards such as LEED certification, ISO 14001, or Airport Carbon Accreditation (ACA) programs.

Risk management and scenario planning. Built-in tracking and forecasting tools allow capital project teams to identify risks early and adapt project plans proactively. Scenario modeling simulates potential disruptions and evaluates impacts of different risk factors, enabling teams to minimize vulnerabilities and plan for contingencies.

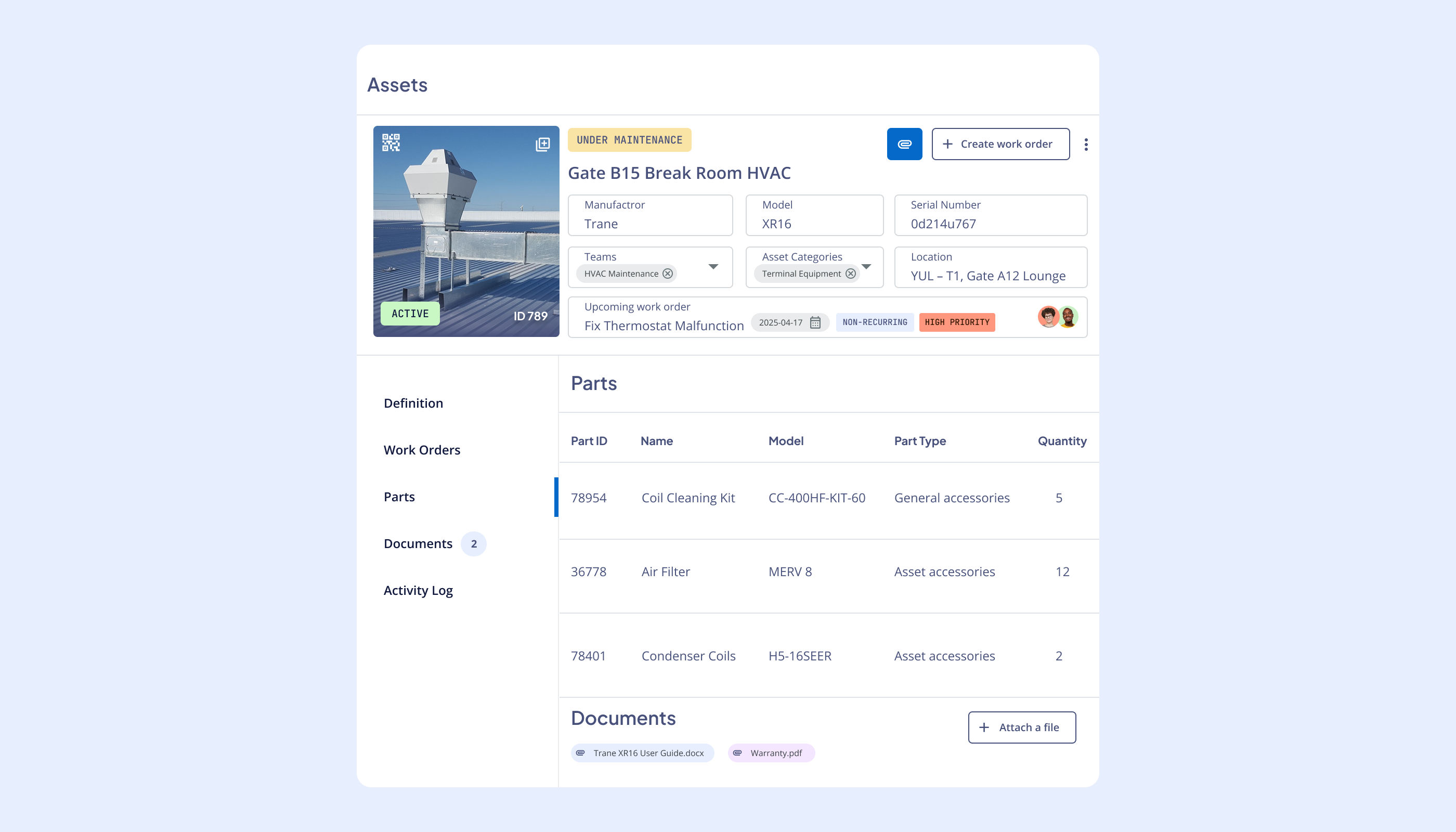

Facility compliance and maintenance oversight. Nakisa’s facility management capabilities include asset monitoring to ensure continuous compliance with safety codes and maintenance schedules for airport properties, hangars, and operational sites. This prevents unplanned downtimes and supports the long-term integrity of critical assets.

Zoning and local construction requirements. Some projects, such as terminal fit-outs or hangar expansions, must meet local zoning regulations and airport-specific development standards. Nakisa ensures that all documentation is centralized and accessible, making it easier to manage zoning approvals, track permit timelines, and comply with local construction requirements.

By consolidating all compliance, risk, and environmental data in one accessible platform, Nakisa provides airlines with the structure and visibility needed to stay audit-ready, reduce regulatory risk, and seamlessly manage project continuity across global jurisdictions.

Challenge 5: Overcoming fragmented systems in capital planning and project execution

As airlines face increasing pressure to modernize operations and maximize capital investment returns, effective capital planning and project execution depend on seamless technology integration. Yet many airlines still rely on manual data aggregation or siloed systems spread across real estate, finance, engineering, and operations. This fragmentation hinders enterprise-wide visibility into operations, locations, and projects, slows timely decision-making, and increases the risk of costly errors, budget overruns, and missed opportunities.

Airline capital projects span a wide array of assets and activities, from new terminals and maintenance hangars to route-specific infrastructure and back-office technology. When stakeholders plan initiatives without unified data, they risk overlooking critical asset performance metrics, ignoring lease obligations or utilization rates, or duplicating efforts across locations. Disconnected systems make it nearly impossible to assess the true impact of potential investments or accurately identify underperforming, redundant, or non-compliant sites.

Airlines must integrate both internal (operational, financial, and asset) and external (local regulatory, market demand, competitive, and environmental) data to inform capital project management:

- Internal integration ensures all project costs, from initial design and construction to ongoing maintenance and lease obligations, flow directly into finance, ERP, and maintenance management platforms. This enables real-time budget oversight, dynamic scenario modeling, and rapid response to events such as regulatory changes, route expansions, or volatility in passenger demand.

- External integration connects enterprise systems to aviation-specific tools, such as flight operations platforms, route planning tools, airport authority databases, and environmental monitoring services. These external feeds provide vital context for capital investment decisions, helping airlines anticipate shifts in market demand, comply with evolving safety and environmental regulations, and benchmark against industry standards.

Traditional planning approaches, reliant on isolated spreadsheets and manual data transfers, cannot keep pace with the complexity of today’s aviation landscape. Inaccurate forecasting, delayed approvals, duplicated projects are common consequences, translating to wasted capital and missed growth opportunities.

To overcome these challenges, airlines need a unified technology platform that connects their people, systems, and data, providing a single source of truth for enterprise-wide capital project management.

What integrations Nakisa IWMS offers and their benefits

Nakisa is designed for secure, seamless integration between internal and external systems, eliminating data silos that often slow down planning, increase error risk, and hinder informed decision-making. Here’s how Nakisa IWMS supports system integration to streamline airline capital planning and execution:

Cross-product integration within Nakisa IWMS. Nakisa IWMS connects capital projects, real estate, and facility teams through a shared, real-time data environment. While each team accesses tailored user interfaces, all teams rely on consistent, centralized information. For example, capital project managers can evaluate existing airport assets and lease terms before initiating a new development, ensuring the project is well-aligned with current operations. Once a capital project is complete, the new site is added directly to the real estate portfolio, where lease terms, compliance needs, and maintenance tasks can be managed. Data for vendors, contractors, and airport authorities is also consolidated across modules, supporting smarter sourcing decisions and strategic long-term planning.

Native finance systems and ERP integration. Nakisa offers native bidirectional ERP integration to SAP ECC, SAP S/4HANA, Oracle, Workday, as well as API integration to platforms like BlackLine. This ensures smooth data flow between project and finance teams, automates bulk financial postings and reconciliation, and gives accounting teams instant access to relevant project and capital expenditures, including lease and construction costs. The results are streamlined reporting, improved data accuracy, and enhanced compliance tracking.

API connectivity to external tools. Robust REST APIs allow airlines to connect Nakisa IWMS platform to external systems such as market research databases, environmental compliance tools, and aviation-specific analytics platforms. These integrations help project teams evaluate site potential, assess real-time market and regulatory changes, and anticipate operational needs with greater precision.

Advanced analytics and AI-driven intelligence. Nakisa transforms static reports into dynamic, shareable dashboards powered by advanced analytics and AI. Project managers can track project health, compare budgeted versus actual costs, and model future scenarios with configurable visualizations. With Nakisa AI, including its Analytic Agent and AI Assistant users can generate dashboards or filtered reports on demand using natural language prompt (e.g., by budget range, region, or project phase) This speeds up access to relevant data and supports confident, timely decisions, without requiring technical expertise.

By providing real-time data access and eliminating system disconnects, Nakisa IWMS helps airlines streamline team collaboration and reporting, improve capital allocation and financial accuracy, boost compliance and audit readiness, and respond quickly to changing market and operational conditions. These integrations form the technological backbone of scalable, efficient capital project management across global airline operations.

Leasing, financing, or building

Once capital projects are prioritized and scoped, airlines must navigate the intricate processes of leasing, financing, or constructing airport-related facilities. Leasing negotiations demand sophisticated risk assessment and regulatory compliance, as strong passenger demand meets limited infrastructure availability and rising costs. After securing a lease or purchase agreement, the focus shifts to financing and construction, which require close coordination to stay on budget and schedule, every misstep poses risks of operational disruption and margin erosion.

Challenge 6: Managing complex lease negotiations for global airline infrastructure

Securing competitive lease terms is more challenging than ever for global airlines. Airports and government stakeholders offer a limited supply of desirable locations, such as high-traffic terminals or strategically placed hangars. Intense competition pushes leasing rates higher. Compounding this, regulatory complexities, local variations in lease formats, tax regimes, and legal structures heighten the negotiation burden and extend approval cycles. These hurdles mean missed strategic opportunities or being locked into suboptimal contracts, ultimately constraining efficiency and future growth.

When evaluating whether to lease, invest in facility fit outs, or co-develop infrastructure, airlines must weigh factors including forecasted passenger traffic, route strategy alignment, available airport capacity, and the long-term financial implicit of each deal. Key financial terms, such as lease duration, escalation clauses, service fees, insurance, maintenance responsibilities, and utility costs can significantly impact the profitability and flexibility of operating in a given airport. Failing to rigorously analyze these conditions during negotiations can lead to agreements that burden the airline with high costs and inflexible obligations over time.

The challenge escalates for airlines with a global portfolio, as they must navigate widely varying legal, regulatory, and operational frameworks across regions. Differences in language, currency, tax policy, and lease execution formats multiply the difficulty of negotiations and ongoing contract management. Without a centralized platform for tracking and managing leases, airlines often rely on disconnected spreadsheets or local tools, increasing the risk of overlooking critical terms, misinterpreting obligations, or unintentionally falling out of compliance. These gaps can lead to costly financial decisions, operational disruptions, non-compliance, or unfavorable contract terms that hinder long-term performance.

How Nakisa IWMS simplifies lease negotiations and financial oversight

Managing complex lease negotiations in the aviation industry requires agility, transparency, and strong financial insight. Nakisa IWMS addresses these challenges with a suite of centralized tools designed to streamline decision-making and reduce risk exposure for airline teams.

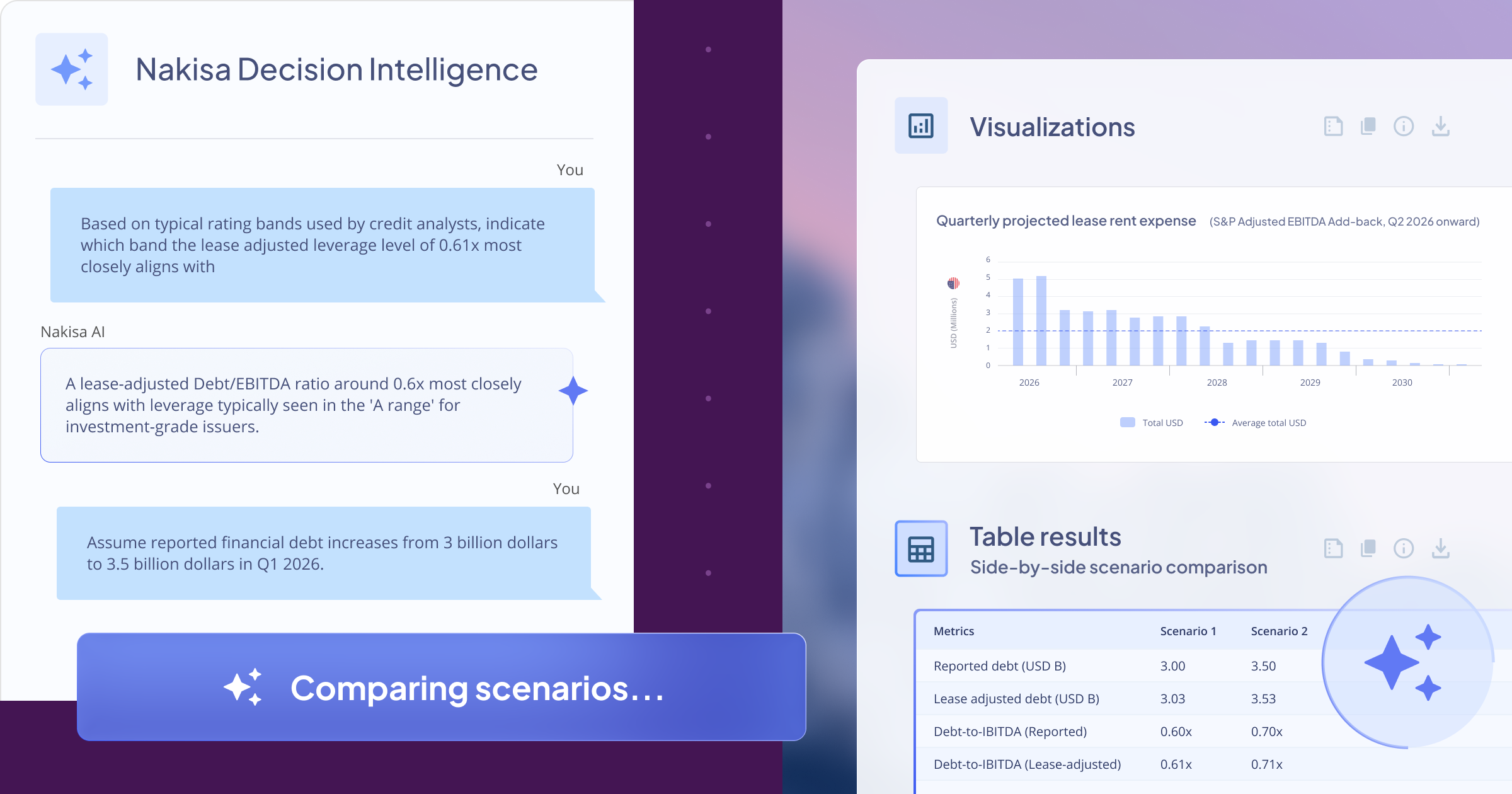

Nakisa Decision Intelligence (NDI). Nakisa’s enterprise-grade decision intelligence solution empowers leaders to approach lease negotiations with confidence. NDI unifies and analyzes vast internal and external data in real time, providing forecasts, simulations, and actionable guidance. By leveraging market insights from multiple sources, NDI helps teams identify new opportunities, assess risks, and flag out the underperforming assets. With natural language queries via text or voice, leaders can receive tailored recommendations instantly and act on them through leveraging multiple Nakisa AI Agents.

Side-by-side site and lease comparison. Nakisa allows airlines to evaluate multiple leasing and owning scenarios simultaneously. Each option can be assessed based on projected revenues, investment costs, and automatically calculated financial KPIs such as net present value, internal rate of return, break-even point. Airlines can create multiple scenarios for each option, ranging from optimistic to conservative, ensuring selection of the most strategic and cost-effective solution.

Financial scenario modeling and forecasting. Airlines can analyze the mid- and long-term financial impact of lease terms, including rent escalations, airport service charges, insurance, and maintenance obligations. With built-in forecasting, they can simulate market scenarios to strengthen negotiations and support resilient, profitable decisions. Once teams are agreed, contract managers can draft agreements, apply proposed conditions, and automatically generate future payment schedules.

Integration with market and portfolio data. Nakisa can integrate multiple external data sources, such as airport market data, to allow contract managers to benchmark lease terms against current agreements and local trends. This alignment with market conditions and the airline’s broader network strategy ensures that new deals are competitive and support long-term business objectives.

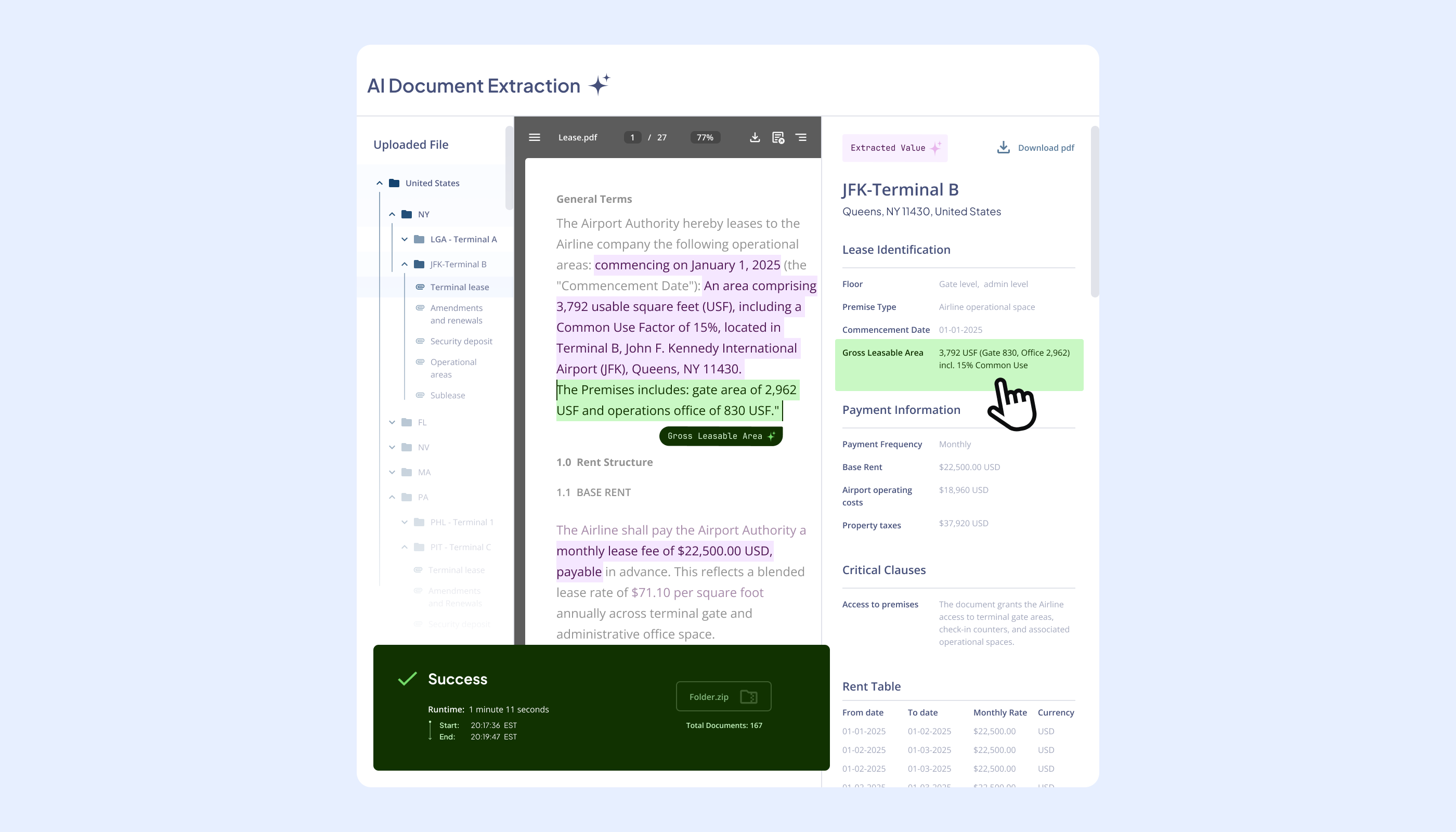

AI Document Abstraction. Nakisa AI Document Abstraction rapidly identifies and extracts key fields from lease and concession agreements, across jurisdictions and languages. Users can query Nakisa AI-driven chatbot to instantly summarize contracts or surface specific critical details. This automation minimizes manual work, speeds up review cycles, and improves accuracy throughout contract evaluation.

Upload multiple documents and let Nakisa AI abstract them. You’ll see the extracted key data alongside the original document for quick validation

Centralized data management. Nakisa’s virtual library brings together all lease-related information on a single, unified platform, ensuring that no critical detail—such as escalation terms, renewal provisions, or financial commitments—is overlooked. Contract managers can quickly categorize, search, and view all documents linked to specific leases. This centralized approach reduces manual tracking risks and provides stakeholders across the organization with easy access to essential information.

Internal alignment across departments. Lease negotiations in the airline industry often involve multiple regions and functions. Nakisa facilitates alignment with automated workflows, role-based permission, and real-time collaboration tools. All related documents are securely stored in a structured, centralized repository, available to authorized stakeholders. This simplifies document management, provides transparency and control, and ensures a reliable audit trail for compliance and review purposes.

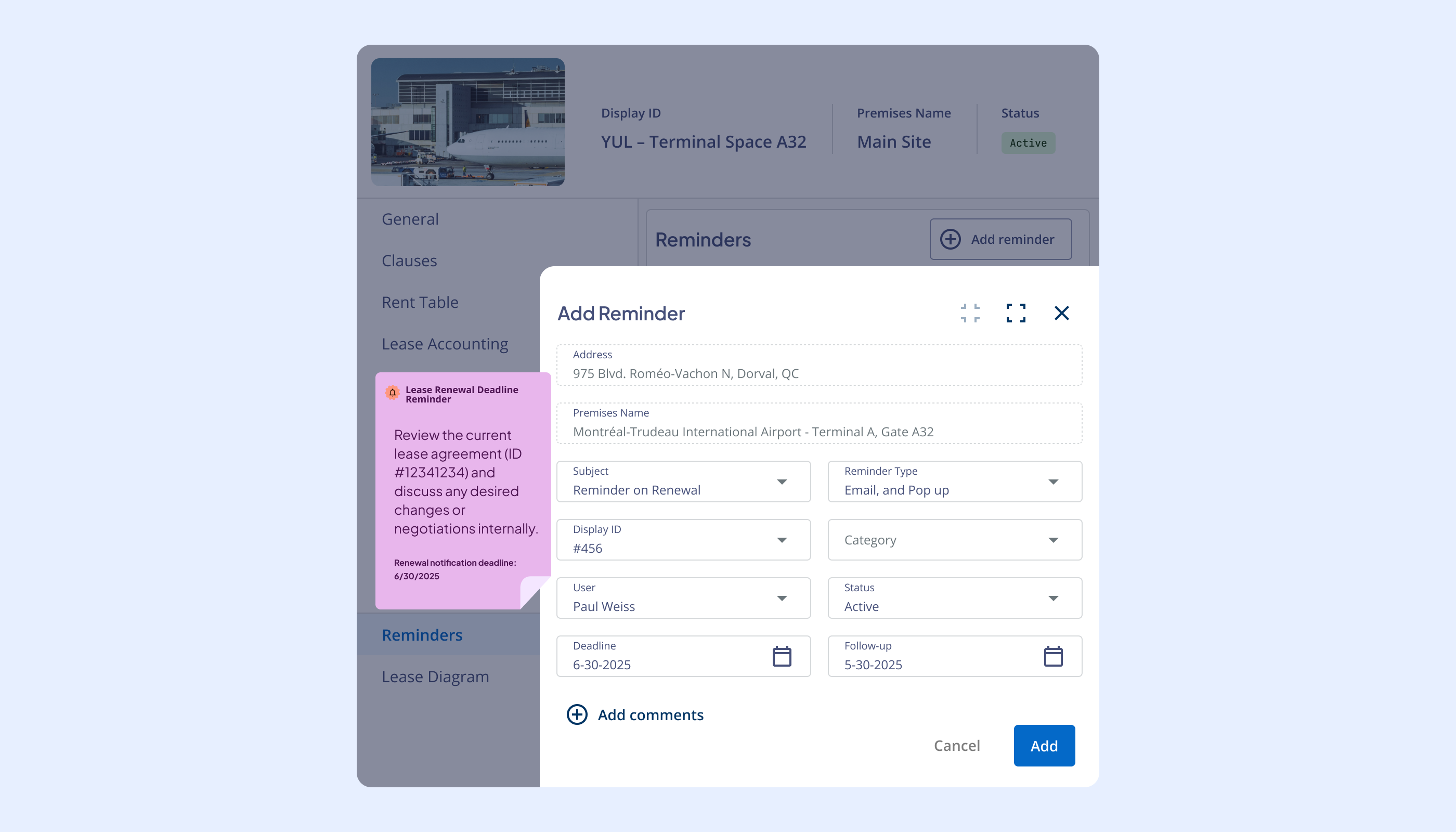

Critical dates monitoring. Nakisa IWMS tracks key milestones, including negotiation deadlines, renewal periods, and payment due dates. Assigned team members receive timely in-app alerts and email notifications to help them stay on schedule and never miss key deadlines.

Altogether, Nakisa IWMS gives airlines the visibility and control needed to manage lease negotiations strategically and oversee financial commitments with confidence. By centralizing lease information and automating workflows, teams are well-positioned to transition smoothly into the next stage: lease operations and monitoring. In the next section, we will explore this stage while examining common challenges airlines face when leasing, financing, or constructing new assets.

Richard van der Laan

Director of Accounting and Reporting at Air France - KLM

Operating and monitoring leases and facilities

Once leases are activated, the focus shifts from contract execution to the complex day-to-day management of ongoing lease operations. This phase demands diligent oversight of lease payments, tracking contractual dates, and strict adherence to financial reporting standards such as IFRS 16, ASC 842, and applicable local GAAP regulations. For airlines operating large, geographically dispersed portfolios with varied lease types and terms, maintaining real-time visibility and control over all lease obligations is a considerable challenge.

Effective lease management is now essential, not only to control costs and minimize financial risk, but also to sustain operational efficiency and keep pace with regulatory demands. This becomes particularly important when handling complex lease arrangements, multiple payment structures, and rigorous compliance obligations.

We will now examine these challenges in more depth and explore how IWMS solutions like Nakisa can help address them effectively.

Challenge 7: Managing large, global, multi-asset airline infrastructure portfolios

Global airlines manage an extensive range of geographically dispersed assets, from passenger terminals and hangars to ticket counters, maintenance facilities, and corporate offices. Each lease agreement operates under unique terms, regulatory requirements, and operational constraints that can vary widely between countries, regions, and airport authorities. Coordinating all this across multiple time zones, currencies, and jurisdictions demands strong centralized oversight and complete data visibility.

As portfolios expand, the need for consistent processes, accurate real-time information, and strategic alignment becomes even more critical. Without robust, integrated systems, airlines face fragmented information, process inefficiencies, missed opportunities to optimize their space and asset usage, and heightened risk of non-compliance.

Handling high volumes of contracts and complex lease data

For global airlines, managing infrastructure means staying on top of hundreds, sometimes thousands, of lease agreements and service contracts worldwide. Each lease can contain different payment structures, cost-sharing terms, escalation clauses, maintenance obligations, renewal rules, and compliance obligations. Tracking these manually through spreadsheets or legacy systems increases the risk of human error, missed renewals, contractual breaches, potential non-compliance, and unnecessary financial losses.

These inefficiencies can disrupt operations, weaken negotiating leverage, and expose airlines to reputational and regulatory risks. To operate efficiently, airlines require a centralized, enterprise-grade system that can track, manage, and report on large portfolios of infrastructure contracts in real time.

How Nakisa IWMS automates large-scale contract management for airlines

The Nakisa Portfolio Management Suite, a core component of Nakisa IWMS, is built to handle the complexity of global airline infrastructure. From hangar and terminal lease agreements to maintenance and service contracts, Nakisa helps airlines manage over 100,000 contracts from initiation through termination.

Centralized contract management. Nakisa consolidates all contract information into a single, unified system structured across three levels: location, premise, and individual contract. Multiple contracts for one location, such as facility leases, ground handling services, or catering agreements, are all tracked under a master agreement, giving teams a complete view of all obligations and associated payments for clear oversight at each facility.

Users can also upload contract documents in various formats, enhancing accessibility and visibility, particularly valuable for compliance audits or renewal evaluations. Built-in alerts and email notifications keep stakeholders informed about upcoming milestones, like payment schedules, activation deadlines, or lease expirations. This allows airlines to mitigate oversight risk and maintain full compliance across diverse operational hubs.

Custom attributes and operational hierarchies. Nakisa IWMS lets airlines configure aviation-specific custom attributes and hierarchies to categorize and track all assets and operational areas. Examples include zones (international arrivals, domestic departures), terminals, lounges (business, airline specific), counters (check-in, ticketing), and gates. Attributes can be organized by airport, facility type, or function, creating a highly structured portfolio view. This granular organization improves visibility into asset usage, maintenance needs, and operational performance, enabling smarter resource planning and streamlined coordination across diverse airport facilities.

Nakisa AI Document Abstraction. This tool automatically extracts and validates key terms from lease and service agreements with high precision. Bulk abstraction and validation accelerate onboarding of new contracts, dramatically reducing manual workload and error rates.

Automated mass operations and batch processing. Nakisa IWMS offers a powerful mass data import feature that streamlines data entry for extensive lease and infrastructure portfolios. With built-in format validation and error detection, imports are fast and accurate. The mass event management feature allows bulk updates to lease components, such as modifying ROU asset values or rent terms. By simply filtering relevant contracts, users can schedule mass modification jobs, reduce repetitive manual input, and minimize data inconsistencies.

The bulk integration. This functionality automates frequent tasks, such as transaction postings, workflow updates, and asset remeasurements, saving time for teams managing hundreds or even thousands of lease and service agreements.

The mass reversals and period adjustments feature facilitates historical data corrections, ensuring clean and auditable financial records. Additionally, the job posting scheduling automates key month-end activities, providing detailed logs for real-time tracking and full transparency.

Together, these capabilities enable airline teams to efficiently manage large volumes of contracts across multiple airport locations and jurisdictions.

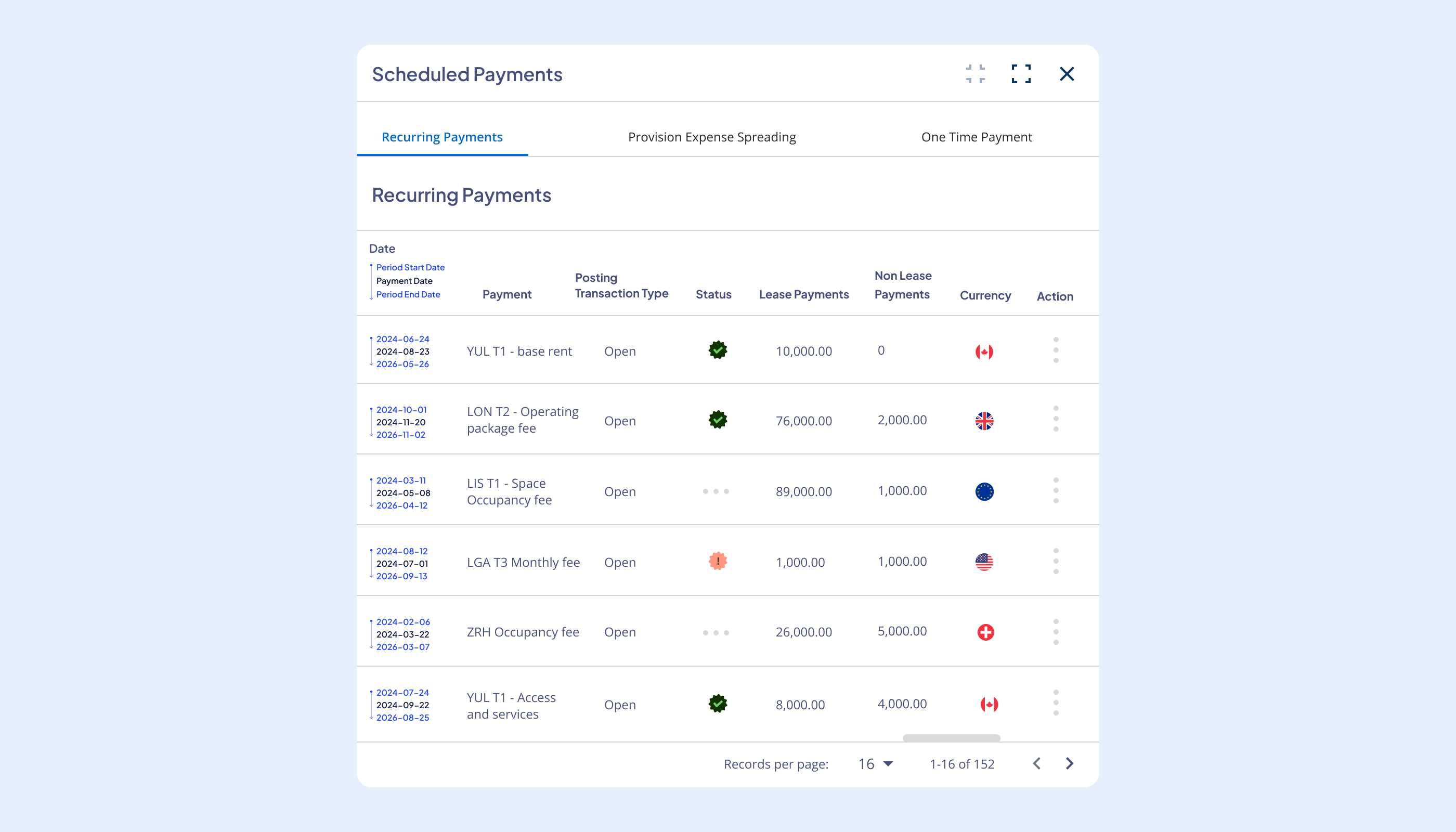

Automated calculations for lease and non-lease costs. Nakisa automatically generates rent tables, calculates cost allocations, and creates journal entries based on contract terms. This includes both fixed lease costs and variable components. Nakisa’s flexible calculation engine allows for complex formulas tailored to airline-specific lease conditions, such as rent based on passenger volume, landing or take-off frequency, gate usage, tiered service fees for ground handling, seasonable rate adjustments during peak travel periods, and fuel throughput fees tied to volume consumed. Airlines can also manage hangar leases, cargo facility charges, slot usage fees, and airport improvement levies in the same system.

Based on contractual agreements, Nakisa Portfolio Management software schedules recurring and one-time payments for lease and non-lease expenses.

Leveraging advanced agentic AI, Nakisa streamlines payment calculations even further. The AI Agent for complex rent calculation generates custom rent formulas automatically, handling multi-factor agreements and complex escalation rules.

These capabilities ensure precise expense recognition, support budgeting and forecasting, and reduce manual errors. By automating these financial processes, Nakisa helps airlines maintain compliance with accounting standards while gaining real-time visibility into cost drivers and operational expenditures.

Managing multi-asset airline portfolios

Global airlines oversee a highly diverse mix of assets, including airport facilities, leased fleet, ground service equipment, hangars, and administrative properties, each with its own regulatory, operational, and financial requirements. Managing this complexity demands precise oversight for compliance, lifecycle tracking, and cost control. For example, aircraft leases require vigilant monitoring of variable rent clauses, maintenance events, and usage thresholds, while ground equipment like baggage tugs and catering trucks must be scheduled for preventive maintenance and tracked within inventory systems. Hangars and terminal spaces involve contract administration, utilities management, and adherence to airport-specific zoning and development guidelines.

Most airlines manage both leased and owned assets spread across numerous airport locations. Balancing lease obligations with the operational oversight of owned infrastructure is challenging, especially when asset data is siloed across departments and geographies. Without a centralized platform, it becomes difficult to achieve a unified view of asset performance, total ownership and leasing costs, or financial impact.

Cost allocation further complicates management. Tracking maintenance, fuel, usage fees, and facility-related expenses across multiple sites is resource-intensive and prone to errors when handled manually. As airlines expand, the scalability of asset management becomes critical, requiring alignment between financial precision, operational reliability, and strategic objectives.

An integrated system consolidates property, fleet, equipment, and facility data into a single source of truth. This enables real-time visibility, automated lifecycle tracking, centralized cost allocation, and compliance oversight, reducing inefficiencies, improving decision-making, and ensuring strategic alignment across the entire multi-asset portfolio.

How Nakisa IWMS centralizes multi-asset portfolio management for airlines

Nakisa IWMS empowers airlines to manage their entire asset ecosystem in a single, centralized platform, covering everything from real estate and land holdings to fleet and equipment. This unified solution provides contract managers, finance teams, and operations with a single source of truth across all asset types and ownership structures.

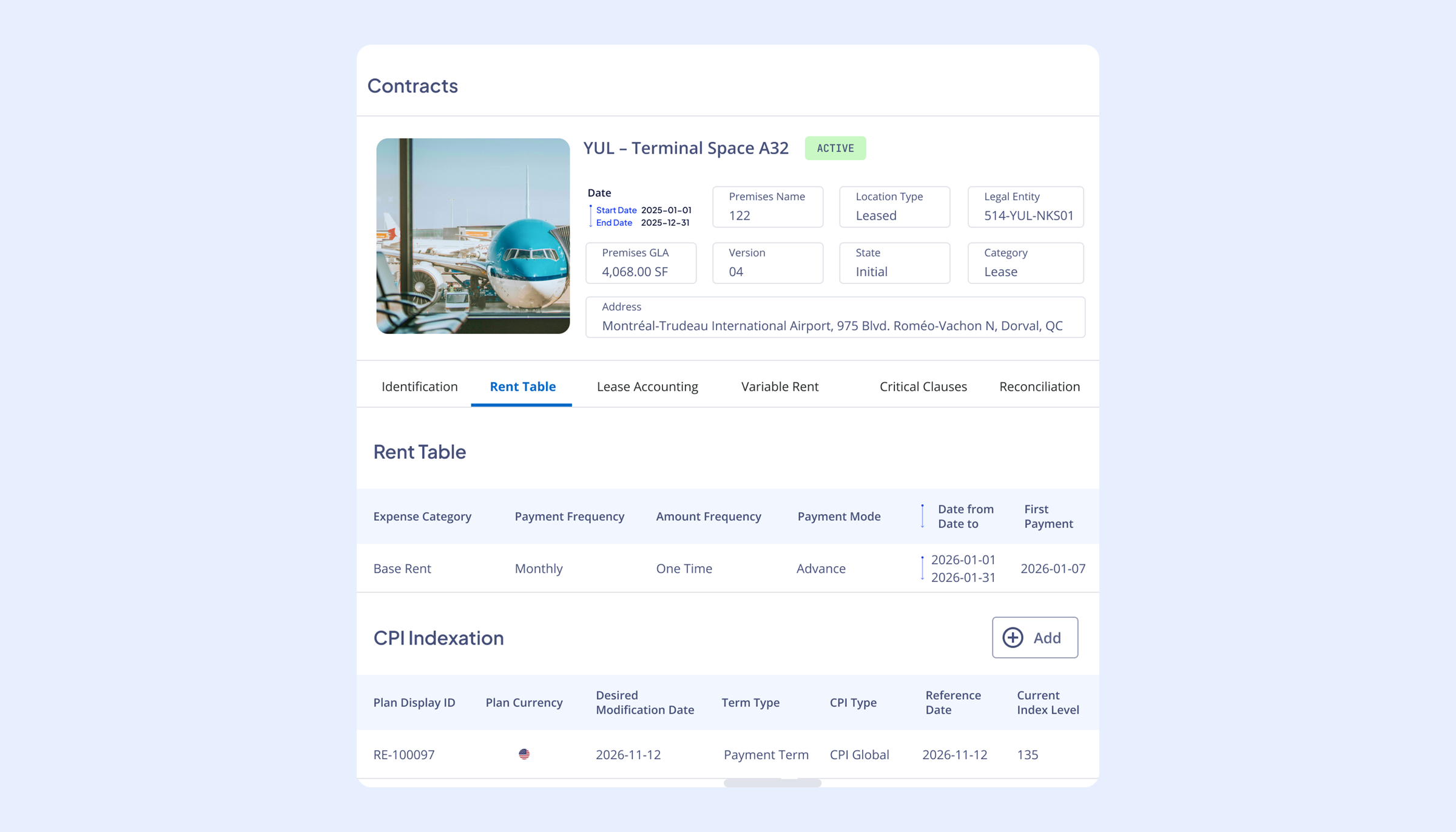

For real estate assets, Nakisa automates rent table creation and supports both fixed and variable rent calculations. It also streamlines management of non-lease clauses, including maintenance chargebacks and airport service fee reconciliations. Lease hierarchies are structured from location to premise to contract, giving teams a clear view of obligations and payments across all facilities. For equipment and aircraft fleets, the platform supports complete lease lifecycle management, from initiation and activation to modifications and termination. Asset hierarchies can be defined with high granularity, from master lease agreements to activation groups and individual aircraft tail numbers or equipment units, ensuring precise oversight at every level. Beyond accounting, Nakisa also streamlines asset lifecycle oversight, including inventory tracking, maintenance and repair history, and part management, giving airlines complete visibility and control over their fleets.

The system accommodates multiple ownership models, enabling teams to manage leased, owned, and subleased assets in a single system. All contracts, amendments, financial terms, and supporting documents are securely stored in a centralized repository for full traceability. For owned facilities such as airport terminals, hangars, lounges, and other operational buildings, the platform tracks asset usage, associated expenses, and critical documentation, supporting better performance monitoring and preventive maintenance planning.

The system is fully compliant with IFRS 16, ASC 842, and local GAAP standards. Its true asset-level accounting allows airlines to accurately calculate depreciation, generate journal entries, and process remeasurements across diverse asset classes. This thorough approach ensures audit readiness, minimizes financial discrepancies, and supports rigorous regulatory compliance, an essential advantage in the highly scrutinized and competitive aviation sector.

Optimizing global portfolio management: parallel accounting, multi-currency, multi-calendar, and multi-language support

Managing leases in a global airline operation is inherently complex, requiring an operational and financial balancing act, as each jurisdiction can have its own regulatory framework, tax obligations, financial reporting requirements, and operational practices. Cross-border considerations, such as varying banking infrastructure, contract enforcement standards, and fluctuating exchange rates can further complicate contract management, payment processing, and portfolio oversight.

Navigating global compliance and accounting standards. Airlines often lease and operate a wide array of assets, such as aircraft, engines, terminal space, hangars, ground equipment, airport counters, across many countries. Each location may require compliance with different financial regulations and lease accounting standards such as IFRS 16, ASC 842, or local GAAP, alongside regional tax laws and specific contract obligations. As portfolios grow, ensuring accuracy and alignment across all jurisdictions becomes increasingly difficult, and without consistent processes the risk of inconsistencies, audit findings, and missed reporting deadlines increases significantly.

Handling multi-currency lease agreements. Lease payments are often negotiated in local currencies, while airlines must report in their corporate currency. This creates complexities in tracking rent, calculating asset value, reconciling payments, or forecasting future costs, especially when exchange rates fluctuate. Without systems and processes that capture accurate real-time currency conversions and consolidate reports in both local and reporting currencies, financial transparency and performance forecasting can be compromised.

Managing diverse fiscal calendars. Global airlines operate across regions where fiscal year differ from the corporate calendar, whether aligning with the calendar year (January to December), a peak travel season, or regulatory reporting cycle (such as April to March or July to June). Coordinating payment schedules, renewals, and reporting in a way that satisfies both local and corporate timelines requires meticulous planning and consistent oversight.

Supporting multi-language lease operations. Lease contracts, operational documents, and correspondence are often written in local languages. Without multi-language support, contract interpretation becomes risky and error prone. Legal, financial, and operational terms can be misinterpreted, leading to costly mistakes or compliance issues. A global airline requires a system that supports multiple languages across the interface and documents, allowing teams in different regions to work effectively while ensuring data consistency and regulatory alignment.

How Nakisa IWMS helps airlines manage global lease complexity

Compliance across multiple jurisdictions. Nakisa IWMS allows airlines to manage leases in accordance with IFRS 16, ASC 842, and local accounting standards. All lease data, whether for aircraft, equipment, and airport facilities, is centralized, with built-in compliance checks ensuring entries are accurate and audit-ready. Seamless, bidirectional ERP integration ensures that accounting records reflect both local regulations and enterprise-wide policies. This unified approach enhances financial visibility and significantly reduces audit risk across an airline’s global footprint.

Multi-currency lease support. Nakisa supports leases and payments in any currency. The system automatically calculates amounts in both local and corporate currencies, manages exchange rate updates, and ensures transparent tracking of gains or losses due to currency fluctuations. This is critical for managing international aircraft leases, engine swaps, or equipment rentals across regions with volatile currencies.

Alanna Bilben

Business Transformation IT RTR Lead at 3M

Multi-calendar functionality for regional alignment. The platform’s robust multi-calendar management lets airlines configure fiscal calendars by legal entity, country, or lease type. Whether operating on a standard annual calendar or adapting to region-specific year ends, Nakisa ensures lease lifecycles, rent schedules, escalations, and reporting align precisely with regional fiscal realities. Teams can account for contract anniversary dates, local holidays, and schedule remeasurements or renewals with accuracy.

This flexibility is essential for airlines operating across jurisdictions with diverse regulatory and fiscal requirements. While non-standard calendars like 4-4-5 are less common in aviation, Nakisa’s support for custom fiscal configurations ensures consistent data, regulatory compliance, and timely financial processes across global lease and asset portfolios.

Multi-language lease management. Nakisa provides comprehensive language support, including English, French, Spanish, and more, allowing global airline teams to operate in their preferred language. This minimizes the risk of misinterpretation, improves contract accuracy, and enhances collaboration among legal, finance, and operations teams across borders.

With a centralized, intelligent, and global-ready lease management solution, Nakisa IWMS equips airlines to confidently manage large volumes of diverse contracts. From aircraft and auxiliary equipment to terminals and ticket counters, Nakisa helps streamline operations, ensure compliance, and support faster, data-driven decisions worldwide.

Challenge 8: Managing complex lease structures in airline operations

Airlines operate within increasingly complex leasing environments involving diverse asset types and varied lease structures. These arrangements can include subleases of critical assets such as aircraft or engines, shared-use or licensed arrangements for airport infrastructure, embedded leases within maintenance or service contracts, and evergreen agreements with auto-renewal provisions. Effectively managing these complex lease structures is critical to ensuring regulatory compliance, financial accuracy, and operational continuity across global airline portfolios.

Managing multiple area types under the same location and contract

Airlines often lease diverse spaces within the same location, including baggage zones, lounges, check-in counters, hangars, and retail kiosks. Each area may have unique rent structures, variable fees, vendor agreements, and contractual clauses, making cost control and compliance particularly complex. For global carriers, reconciling charges and handling fee adjustment notices (FANs) across such a broad portfolio adds another layer of operational and financial challenge. Ensuring accurate billing, tracking, and compliance across multiple area types demands robust processes and centralized oversight.

How Nakisa assist with flexible multi-area management

Nakisa IWMS allows airlines to manage multiple area types within the same premises and contract seamlessly. Each area can be configured with distinct rates, vendors, clauses, and charge structures, providing full visibility into costs and obligations. The platform centralizes tracking of all financial and operational data, automates reconciliations, and ensures that fee adjustment notices are accurately processed. With dashboards and configurable reports, airlines gain real-time insights into area utilization, expenses, and lease compliance, reducing administrative burden and enabling informed decision-making.

Managing subleases and dual-role lease structures

A common industry scenario involves airlines acting simultaneously as lessees and lessors, particularly with assets such as aircraft, engines, and airport facilities. For example, an airline may lease an aircraft from a lessor and then sublease it to a partner carrier under a dry lease agreement or share gate space leased from an airport with a codeshare partner. In these dual-role lease structures, the airline manages inbound lease obligations (acting as a lessee) while also generating income from subleases (acting as a lessor).

This dual function adds layers of operational, legal, and financial complexity. As a lessee, the airline must comply fully with lease terms including timely rent and fee payments, maintenance obligations, insurance coverage, and adherence to service-level agreements. Simultaneously, as lessors, the airline must ensure accurate invoicing, enforce lease escalations, and hold subtenants accountable for contractual and operational commitments. Coordinating these responsibilities require seamless integration of legal, operational, and finance teams to avoid gaps that could expose the airline to regulatory breaches or financial losses.

Central to managing these multi-layered leases is the careful tracking of lease liabilities for inbound contracts and lease income from subleases. Airlines must also reconcile payment and renewal schedules across layers of leases and align these with diverse regulatory frameworks that differ by jurisdiction. Importantly, accounting for the right-of-use (ROU) assets and lease liabilities becomes more complex, especially if original lease terms are modified due to sublease arrangements.

Without centralized, robust lease management systems capable of handling these intricate and multi-layered arrangements, airlines risk financial discrepancies, regulatory non-compliance, and operational inefficiencies. Strong lease governance and integrated contract oversight are critical to mitigate these risks in today’s dynamic, global airline leasing landscape.

How Nakisa IWMS streamlines subleasing for airlines

Nakisa Portfolio Management, a key suite of Nakisa IWMS, is purpose-built to handle the complexities of dual-role lease structures common in the airline industry. For airlines acting as both lessee and lessor, Nakisa automates the distinct lease accounting treatments required, recognizing lease liabilities for head leases while generating income for subleases. The lessor accounting module supports operating leases, allowing airlines to manage leased-out assets like aircraft, lounges, or equipment with precision. The platform allows multiple contracts to be linked to the same asset, for example managing a head lease of an aircraft alongside a sublease to a partner airline. Automated reassessment of ROU assets and lease liabilities is handled when subleasing events occur, ensuring accurate financial reporting and compliance.

All sublease terms, payment obligations, and renewal conditions are centrally stored and tracked, with the same system issuing separate invoices for head lease payments and sublease income. This streamlines financial processes and reduces administrative complexity. Automatic notifications keep stakeholders up to date on important contract events, such as terminations, escalations, or renewals.

With out-of-the-box dashboards and configurable reports, Nakisa provides finance and operation teams with full transparency into both leased and subleased assets. Key metrics such as lease income, asset utilization, contract modifications, and financial impacts can be analyzed in real time, helping airline teams make informed decisions and stay compliant with audit requirements. With Nakisa AI Agent for analytics, it’s even easier to create tailored reporting dashboards focused on critical operational and financial metrics specifically for subleases. Nakisa Decision Intelligence optimizes sublease management even further with tailored expert assistance built on internal and external data sources.

Managing sale and leaseback (SLB) arrangements

Sale and leaseback (SLB) transactions remain a common and strategic financing strategy in the airline industry, enabling companies to free up capital tied up in high-value assets, such as aircraft, engines, or airport facilities, while retaining operational control. By selling an owned asset to a lessor and leasing it back, airlines free up immediate liquidity to fund growth, repay debt, or strengthen their balance sheet.

While financially attractive, SLBs introduce complex accounting, tax, and operational considerations, especially under IFRS 16 and ASC 842. Airlines must determine whether the transaction qualifies as a genuine sale, accurately measure any retained right-of-use (ROU) asset, and properly recognize gains or losses. Misclassification can result in misstated financial results, compliance risks, and increased audit scrutiny for airlines managing complex, global fleets.