What are the main challenges in lease accounting and management caused by manual workflows and fragmented data?

Working closely with finance teams across industries, we’ve seen how outdated lease accounting processes weigh down daily operations. Manual data entry, fragmented spreadsheets, and constant error correction drain time and divert focus from higher-value work. Persistent data silos between finance, legal, and real estate create confusion and costly mistakes — especially during audits, when teams must scramble to compile and validate information under tight deadlines. These inefficiencies don’t just slow operations; they limit finance’s ability to act strategically. Let’s take a closer look at the core challenges in lease accounting and management.

Challenge 1: The risk and cost of manual workloads

Manual processes remain one of the most persistent and risky pain points in lease accounting. These outdated workflows not only slow down operations but also undermine the accuracy and credibility of financial reporting.

- Data entry errors: Even minor input mistakes like a single incorrect digit in a lease start or end date, can cascade into significant misstatements across amortization schedules and financial reports. Gartner reports that 59% of accountants make several errors every month, and 18% make financial errors daily.

- Missed deadlines: Without automated reminders and alerts, renewal and termination dates are easily overlooked, leading to lost negotiating opportunities or costly auto-renewals locked into unfavorable terms.

- Inefficient workflows: Many teams still rely on fragmented, spreadsheet-driven processes, manually copying and pasting across Excel tabs and hoping formulas don’t break. These inefficiencies create unnecessary friction and slow down the close process.

- Eroding confidence: In a portfolio of just 100 leases, even a 1% error rate can result in a significant issue—whether it’s missed payment, understated liability, or failed audit check. As manual errors pile up, the finance team shifts from strategic analysis to constant verification, weakening stakeholder trust.

- Increased fraud risk: Spreadsheets and manual reconciliations create environments where fraud and material misstatements become significantly more likely—up to 80–90% more common, based on industry benchmarks.

Challenge 2: Data fragmentation and organizational silos

Lease accounting is often hindered by inefficient processes, fragmented data, and compliance pressures. Finance teams must overcome several key challenges to improve accuracy and drive strategic value:

- Siloed and outdated tracking: Lease data is often managed across disconnected systems, such as spreadsheets or static documents, by accounting, real estate, and other. This results in inconsistent and outdated information, making reconciliation during close cycles slow and error prone. According to Gartner, poor data quality costs organizations an average of $12.9 million annually, largely due to disconnected systems and duplicated efforts.

- Lack of cross-functional alignment: Fragmented systems lead to misalignment across teams. Renewal dates may be missed, rent escalations misapplied, and linking contract clauses to accounting entries often becomes a manual, error-prone task. Without shared visibility, critical actions like lease modifications or impairments are delayed, reducing agility and hampering strategic planning.

- Data integrity risks: Version control issues exacerbate these challenges, leading to confusion and missed or incorrect entries for key dates, such as renewals and CPI adjustments. In a BlackLine survey of over 1,100 finance professionals, 41% cited manual data input as the main reason for mistrusting financial numbers, and only 38% had full confidence in their data. This lack of trust undermines decision-making and compliance.

- Complex and risky reporting: Disjointed data makes financial reporting and compliance more difficult. Without a clear audit trail, organizations face a higher risk of errors during audits and regulatory reviews, exposing them to compliance failure and reputational risk.

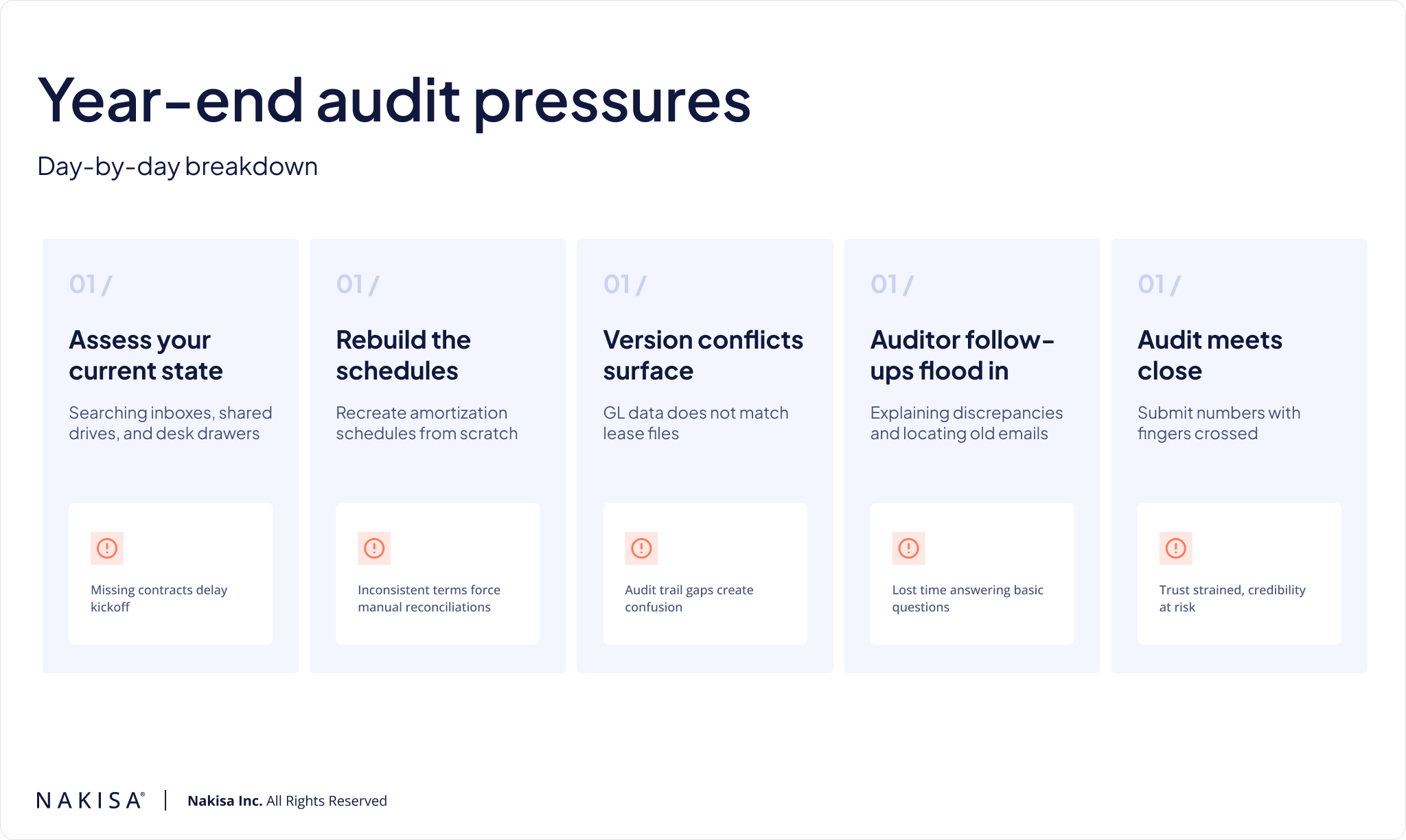

Challenge 3: High-stakes pressure of year-end audits

Year-end audits are especially challenging for organizations that still manage leases manually. Fragmented data, siloed systems, and outdated workflows turn what should be routine processes into last-minute scrambles, forcing accountants to track down contracts, rebuild amortization schedules, and reconcile mismatched data under tight deadlines. A single missing addendum or broken formula can lead to costly errors, restatements, or audit delays. Here’s a day-by-day breakdown of how a typical year-end audit unfolds when leases are managed manually:

This diagram illustrates a five-step, day-by-day breakdown of the challenges faced during an audit process. Each step highlights a common problem, ranging from assessing the current state to the final closing of the audit.

Without centralized lease management, finance teams spend valuable time fixing data instead of delivering clear, timely reports. Automating lease data and workflows transforms audits from a high-stress fire drill into a smooth, repeatable process, increasing confidence in financial data and freeing teams to focus on analysis, not paperwork.

How centralized platforms help overcome lease accounting and management challenges

True finance transformation goes beyond faster close or smoother audits. It demands a single source of truth, where lease data is consistent, accessible, and reliable across legal, real estate, and finance. This foundation reduces errors, strengthens compliance, and supports better decision-making with real-time insights.

A centralized lease management platform makes this possible by consolidating lease data and automating manual tasks. It replaces fragmented spreadsheets with automated controls and a clear audit trail, boosting confidence in financial reporting and freeing teams to focus on strategic work. A modern lease management solution supports transformation through four key pillars:

Enabling a single source of truth

Fragmented lease data across departments causes confusion, errors, and inefficiencies. A centralized platform establishes a single source of truth, aligning teams and improving accuracy across the organization, through:

- Aligned, reliable data: All lease terms, amendments, and documents are stored and maintained in one system, eliminating version conflicts.

- Real-time updates: Changes sync instantly across teams, avoiding errors and duplications.

- Audit-ready documentation: Contracts, approvals, and histories stay organized and accessible.

- Stronger accountability: Role-based access and clear ownership keep sensitive lease data secure and organized.

- Standardization: Consistent formats enhance reconciliation and reporting accuracy.

Driving operational efficiency

A centralized platform eliminates manual, repetitive tasks by streamlining processes through integrated and automated workflows, enabling teams to save time, eliminate errors, accelerate closing, and free time for more strategic work. The platform provides:

- Automated postings: Journal entries and rent schedules are generated directly from lease terms.

- Prebuilt calculations: Standard treatments like straight-line rent and CPI adjustments run automatically in the background.

- Prebuilt calculations: Standard treatments like straight-line rent and CPI adjustments run automatically in the background.

- Bulk actions: Large portfolios can be uploaded and adjusted at scale, critical for global operations.

- Integrated payments: AP systems sync automatically to eliminate duplicate entries and payment errors.

- Templates and standard setups: New leases are created quickly with validated, compliant terms.

Ensuring continuous audit preparedness

A centralized platform transforms audit preparation from a stressful year-end rush into a seamless, ongoing process, keeping your team audit-ready year-round.

- Centralized repository: All contracts and amendments are securely stored with clear version control.

- Full audit trail: Every change is tracked by user and timestamp for full transparency.

- Quick auditor access: Accurate records are retrieved quickly, no last-minute email hunts required.

- Automated disclosures: Schedules and reports are generated on demand, ready for review.

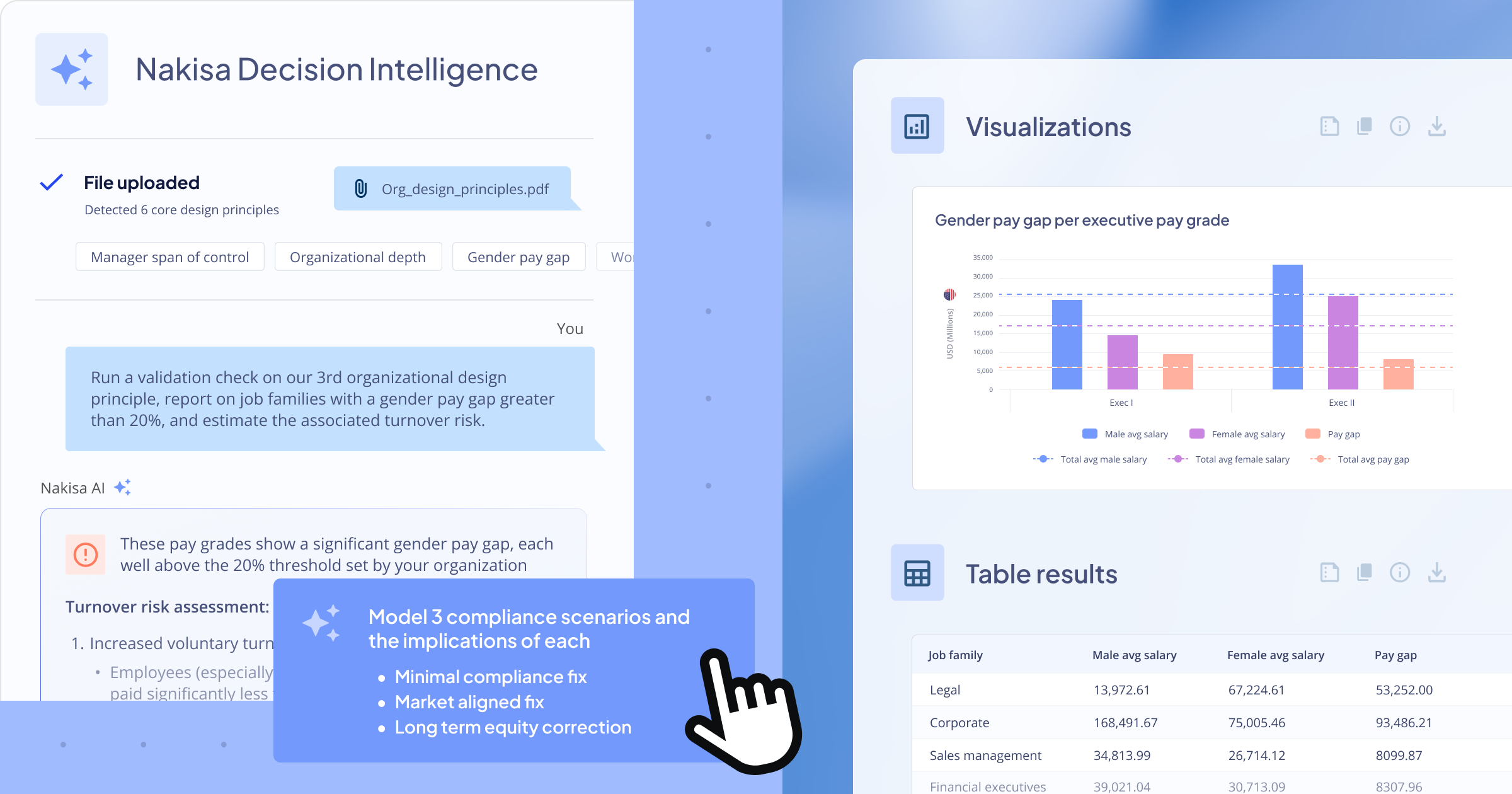

Unlocking actionable lease intelligence

A centralized platform delivers real-time lease intelligence for portfolio-wide visibility, enabling teams to shift from transactional tasks to strategic, data-driven management. That said, the value lies in platforms that translate data into truly actionable insights, providing:

- Portfolio clarity: Total costs, renewals, and obligations can be viewed in one single dashboard.

- Risk insights: Underused assets, risky clauses, or cost-saving opportunities are identified early.

- Dashboards and trends: Anomalies and patterns are visualized clearly to guide action.

- Scenario planning: The impact of term changes, CPI adjustments, or asset disposals can be modeled effectively.

How Nakisa overcomes lease accounting and management challenges with advanced technology, data integration, and cross-functional collaboration

Nakisa Lease Accounting, part of Nakisa IWMS, overcomes lease accounting and management challenges by integrating lease accounting with real estate and facility management on its cloud-native Nakisa Cloud Platform (NCP). With real-time, bidirectional integration with major ERPs like SAP and Oracle—and flexible APIs for tools like BlackLine—Nakisa eliminates manual data transfers, reduces errors, and keeps financials accurate and up to date. Its global network of secure data centers, ISO 27001, ISO 27017, SOC 1 & 2 Type II certifications, and robust encryption ensure data security and compliance. The Nakisa Lease Accounting Suite integrates seamlessly with Nakisa Portfolio Management, Capital Projects, and Facility Management suites, enabling cross-functional teams to collaborate seamlessly with unified data sharing, real-time updates on key lease events, and comprehensive reporting for better visibility, decision-making, and strategic planning.

Lyn Kok

Project and Change Management Lead at NTUC FairPrice

How AI, intelligent automation, and advanced analytics transform lease accounting and management

Centralized platforms have set the groundwork for modern lease accounting by unifying data, streamlining audits, and minimizing manual work. AI, automation, and advanced analytics are pushing transformation even further. Gartner predicts that by 2026, 90% of finance teams will use AI-driven tools to automate routine processes and enhance decision-making. These technologies help process large volumes of data faster, flag risks earlier, and drive more accurate forecasts — supporting a more agile, proactive, ang insight-driven approach to lease accounting. Here’s how leading solutions are putting these technologies to work today.

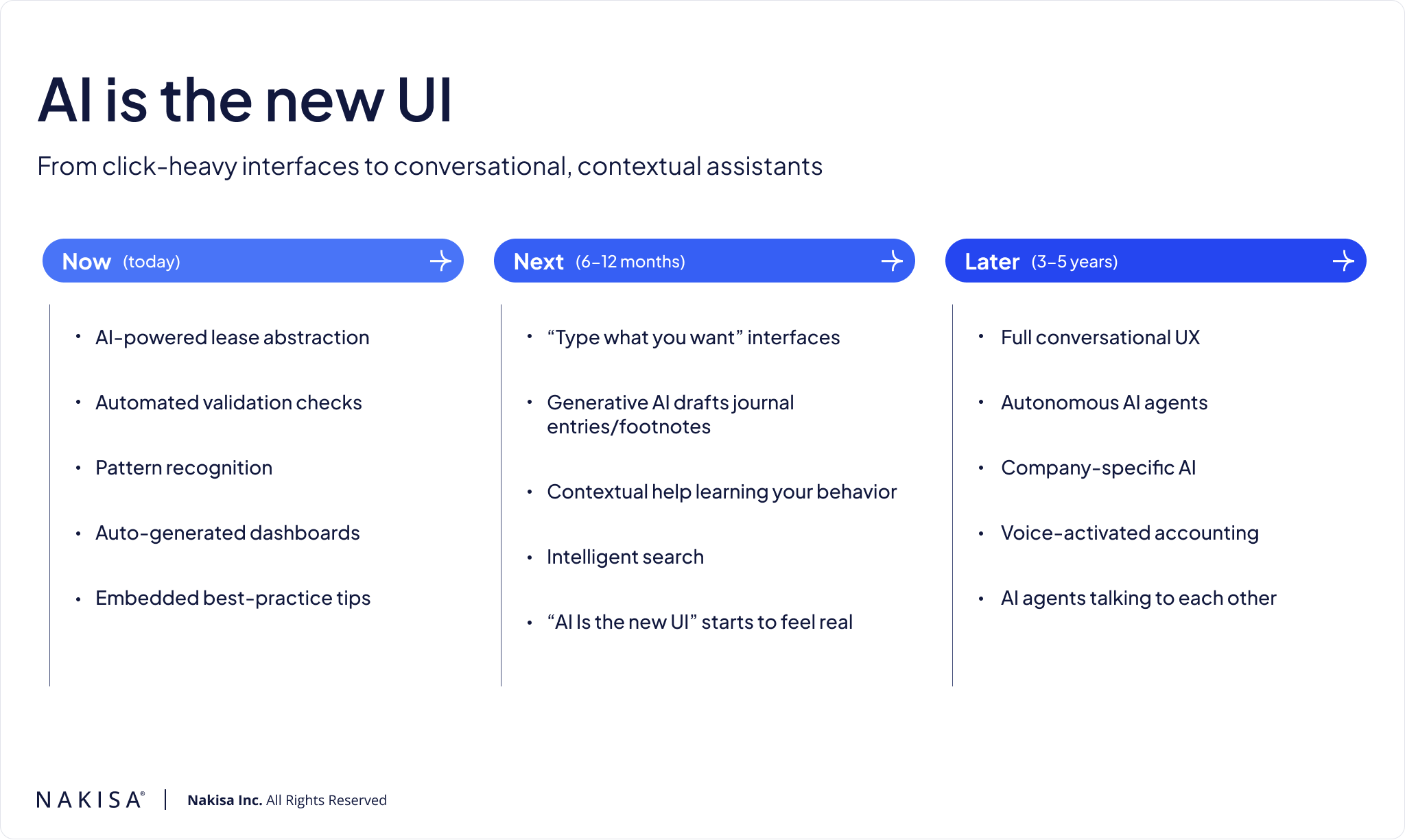

Automation and AI capabilities

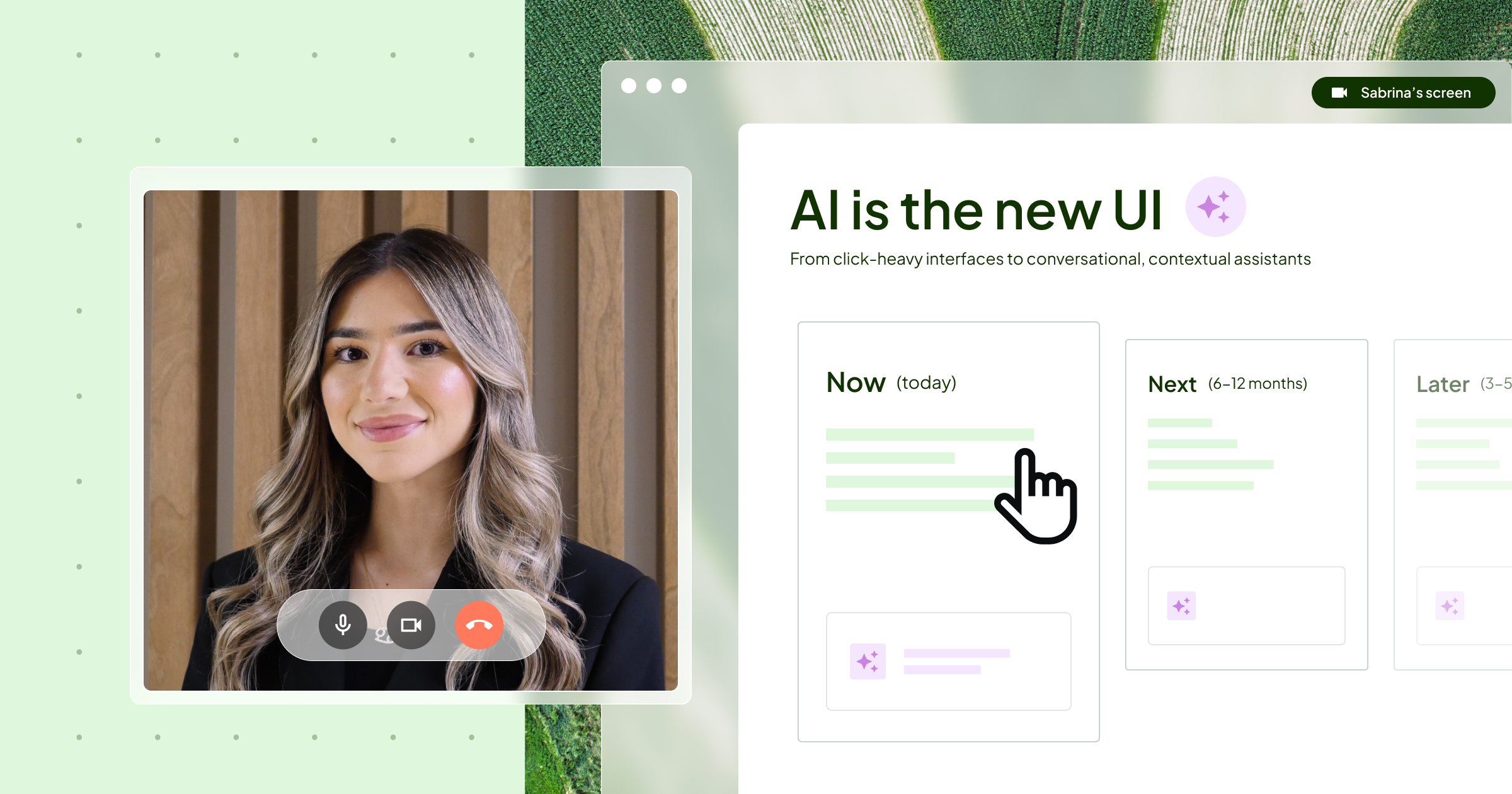

The evolution of AI in lease accounting and management is unfolding in clear stages, redefining how finance teams interact with systems. As AI progresses from reactive support to autonomous execution, it transforms user experience from interface-heavy workflows to intelligent, conversational engagement, streamlining tasks, anticipating needs, and autonomously executing actions. Here’s what that journey looks like:

The diagram presents a roadmap for how AI will transform user interfaces, moving beyond today's manual interactions.

Today: AI supports manual workflows

- Extracts lease terms automatically, reducing data-entry errors and improving accuracy.

- Validates lease clauses against accounting standards like ASC 842 and IFRS 16 to ensure compliance.

- Automates complex calculations such as CPI escalations and straight-line rent adjustments, accelerating routine tasks.

- Still requires users to manually navigate interfaces to generate reports and trigger workflows—AI acts as a reactive assistant.

In 6 to 12 months: AI becomes a proactive assistant

- Enables natural language queries to request information or actions, eliminating the need to navigate menus or dashboards.

- Instantly generates disclosures, drafts journal entries, and runs compliance checks using historical data.

- Shifts the finance team focus from manual data entry to review, insights, oversights.

In 3 to 5 years: Autonomous AI agents become strategic partners

- Understand internal policies, audit trails, and workflows to autonomously carry out complex tasks.

- Manage lease negotiations, forecast updates, and system interactions across ERPs and vendors.

- Empowers finance teams to focus on high-value strategic activities, transforming them from operators to trusted advisors and decision-makers.

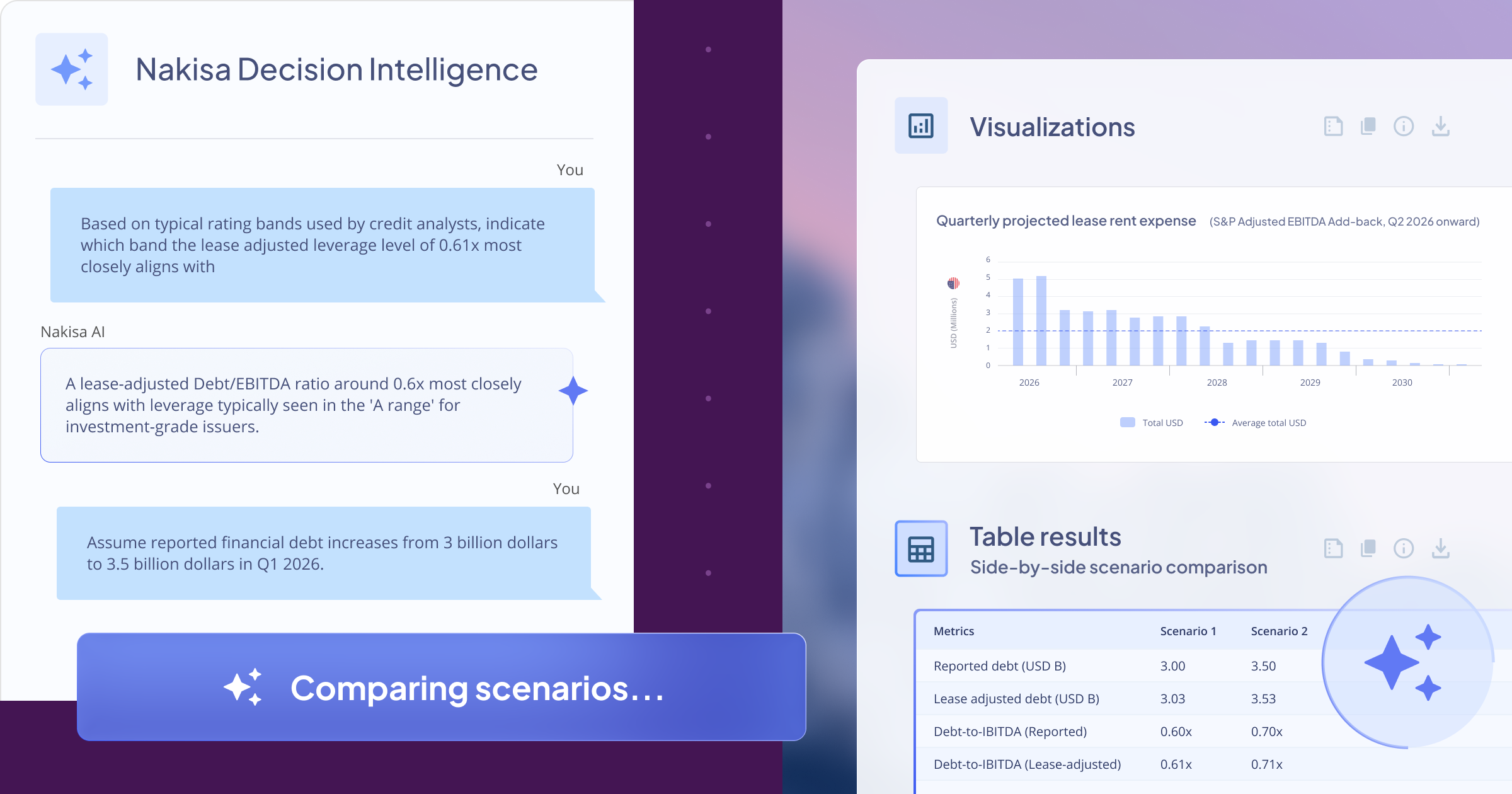

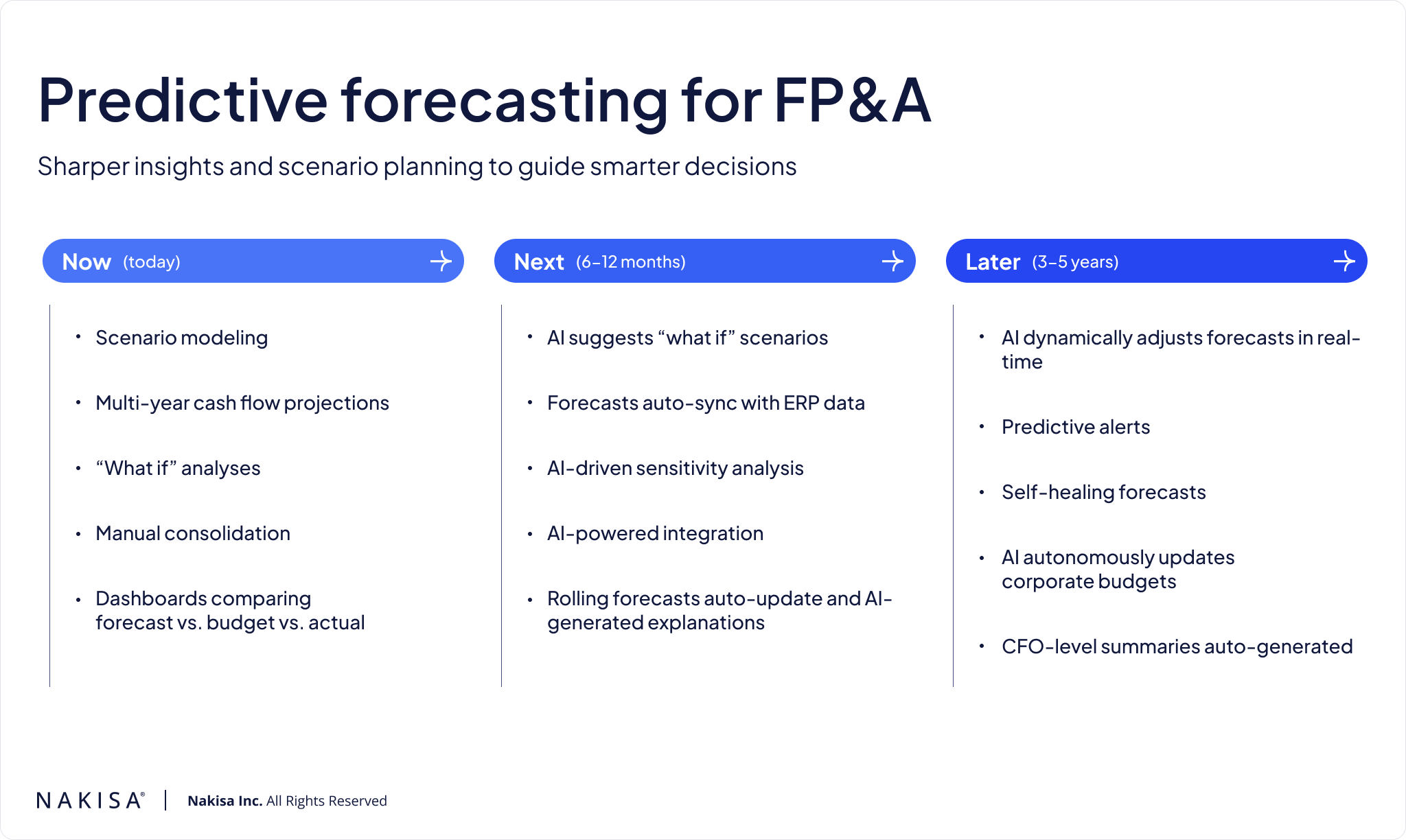

Predictive forecasting for FP&A teams

Lease forecasting has traditionally been a manual, time-intensive process. FP&A teams often export data, build models in spreadsheets, and validate figures across disconnected systems. However, AI and automation are rapidly transforming this workflow. Below is an overview of how forecasting is evolving—from today’s static models to real-time, AI-powered planning:

The diagram illustrates the shift from manual financial planning to AI-powered insights and automated forecasting across three stages: present, near-term, and future.

Today: Manual forecasting with static models

- FP&A teams spend hours building lease scenario models in spreadsheets.

- CPI assumptions and lease schedules are manually entered and exported to integrate into cash flow models.

- “What-if” analysis is complex and error-prone, slowing agility.

- Data mapping and validation across systems delay decision-making.

6 to 12 months: AI-supported scenario planning

- AI assistants suggest and run forecast scenarios on demand via simple, natural language requests.

- Seamless data flows between lease systems, ERPs, and FP&A tools automate sensitivity analyses.

- Rolling forecasts auto-update with each journal entry posting.

- AI explains variances in real-time, enhancing insight and confidence.

3 to 5 years: Dynamic, self-updating forecasts

- Forecasting becomes a continuous, intelligent process that reacts instantly to changes in interest rates, occupancy, and more.

- AI predicts cash flow risks months ahead, improving accuracy with each cycle.

- Budgets, board reports, and rolling forecasts update automatically, delivering concise CFO-ready summaries and actionable recommendations.

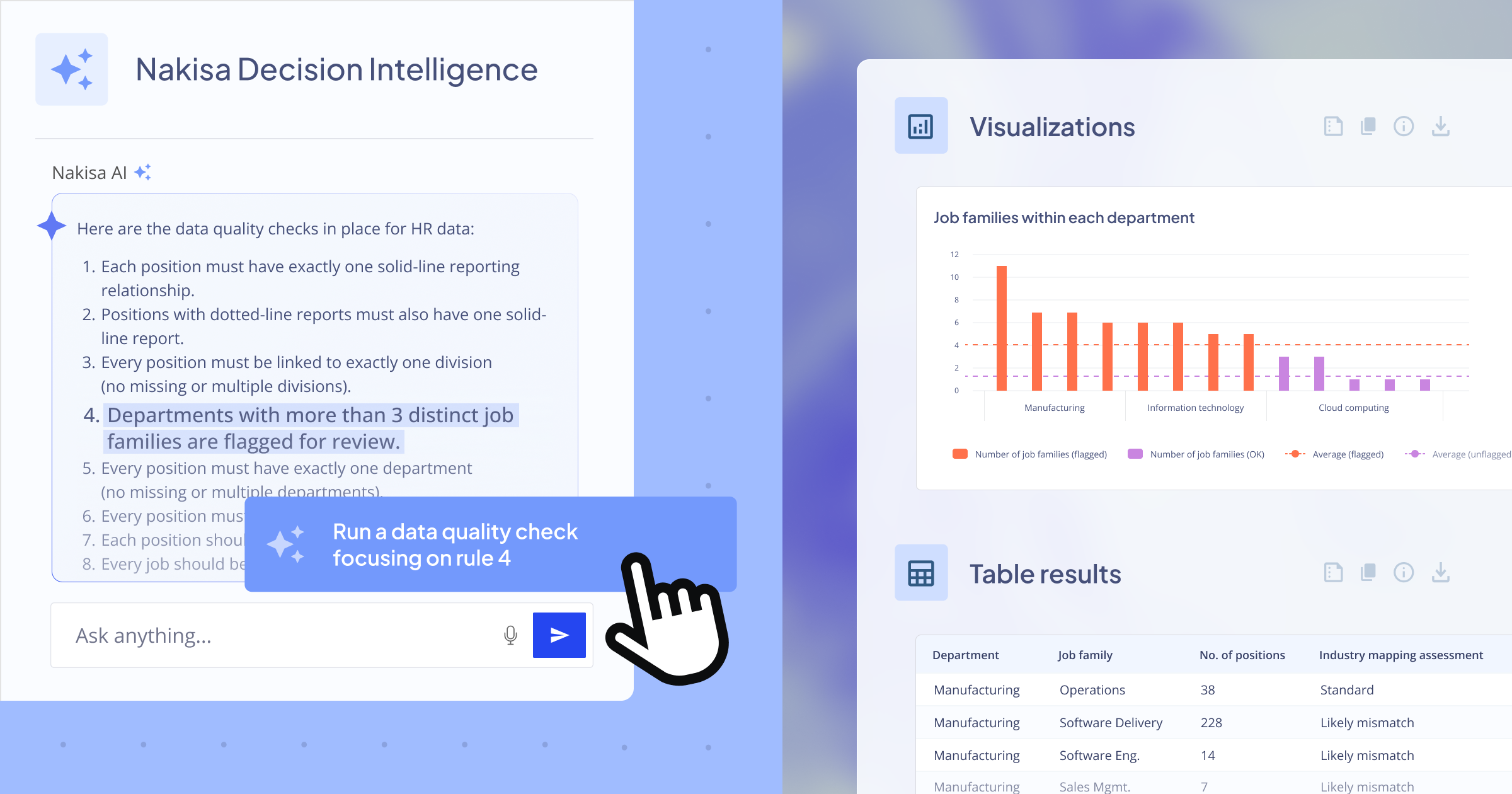

How Nakisa leverages AI, automation, and advanced analytics in each step of the lease lifecycle

The Nakisa AI Platform leverages advanced AI to automate complex or routine tasks, optimize operations, and provide real-time, data-driven insights, empowering you to make smarter decisions and drive business success. Nakisa’s AI capabilities combine the conversational AI Assistant for instant, plain-language guidance with specialized AI Agents that automate tasks like document abstraction, analytics, and complex calculations to cut manual work and improve accuracy. The AI-first Nakisa Extension Platform empowers developers to build and customize workflows quickly using secure APIs, low-code tools, and real-time dashboards, all within a unified, secure framework powered by in-house models, Retrieval-Augmented Generation (RAG), and strict data privacy that ensures client data is never used to train third-party models.

Alanna Bilben

Business Transformation IT RTR Lead at 3M

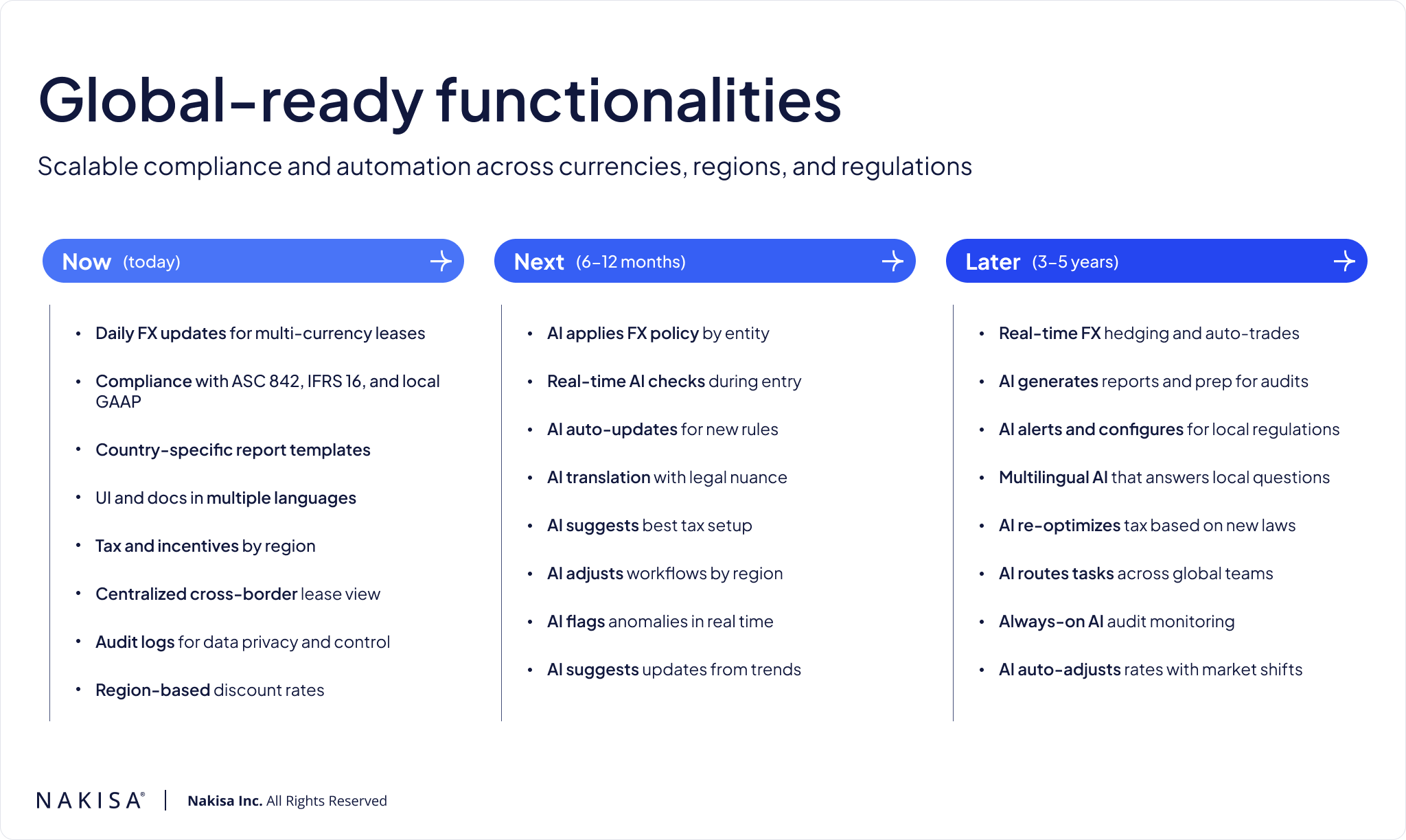

How global-ready lease accounting capabilities are shaping the future of lease accounting

Managing leases across multiple countries adds significant complexity to accounting and compliance. AI is transforming global lease accounting, evolving from today’s manual-intensive processes to intelligent, autonomous systems that reshape how multinational organizations operate. The following illustrates this transformation:

This diagram maps the evolution of global compliance and automation, showcasing the transition from current methods to advanced AI-driven solutions across three timeframes.

Today: Foundational capabilities and key challenges

- Compliance with multiple accounting standards (ASC 842, IFRS 16).

- Daily FX rate updates and localized disclosures.

- Centralized tracking of cross-border leases.

- Region-specific discount rates and comprehensive audit trails.

- Heavy reliance on manual review and intervention for accuracy and compliance.

6 to 12 months: AI-powered automation

- Automated application of FX and accounting policies.

- AI recommendations for tax treatments by jurisdiction.

- Real-time compliance risk alerts.

- Auto-updated reports in response to regulatory changes.

- AI understanding of local legal terminology, reducing translation errors.

- Proactive AI guidance based on user roles and local regulations.

3 to 5 years: Fully autonomous AI ecosystems

- End-to-end global lease lifecycle management with minimal human intervention.

- AI bots that trigger hedging strategies based on market conditions.

- Adaptive, jurisdiction-specific tax strategies.

- Fully localized, audit-ready reports generated automatically.

- Real-time collaboration across legal, tax, and finance teams.

- Finance teams shift focus from data management and compliance to policy, strategy, and value creation.

How Nakisa delivers end-to-end lease accounting to ensure global compliance

Nakisa Lease Accounting, as part of Nakisa IWMS, offers a comprehensive suite of features designed to support the scale, complexity, and regulatory demands of global enterprises. These capabilities are built to address the operational and financial challenges organizations face when managing diverse lease portfolios—across regions, currencies, asset types, and business units. It handles multi-currency payments with automated revaluations, supports mass operations through bulk uploads and ERP integration, and tracks layered contracts in a single structure. With support for multiple fiscal calendars (e.g., 4-4-5, 360-day, standard) and languages, organizations can meet local reporting needs while ensuring global consistency. Nakisa also ensures parallel compliance with ASC 842, IFRS 16, and local GAAP, delivers precise asset-level accounting, and provides detailed, audit-ready reports and forecasts. Automated event management keeps lease data accurate with real-time updates for modifications, renewals, and terminations, supported by full audit trails to maintain transparency and compliance at every stage.

Shawn Husband

Senior Director, Lease Center of Expertise at Walmart

How Nakisa supports enterprise-grade digital transformation

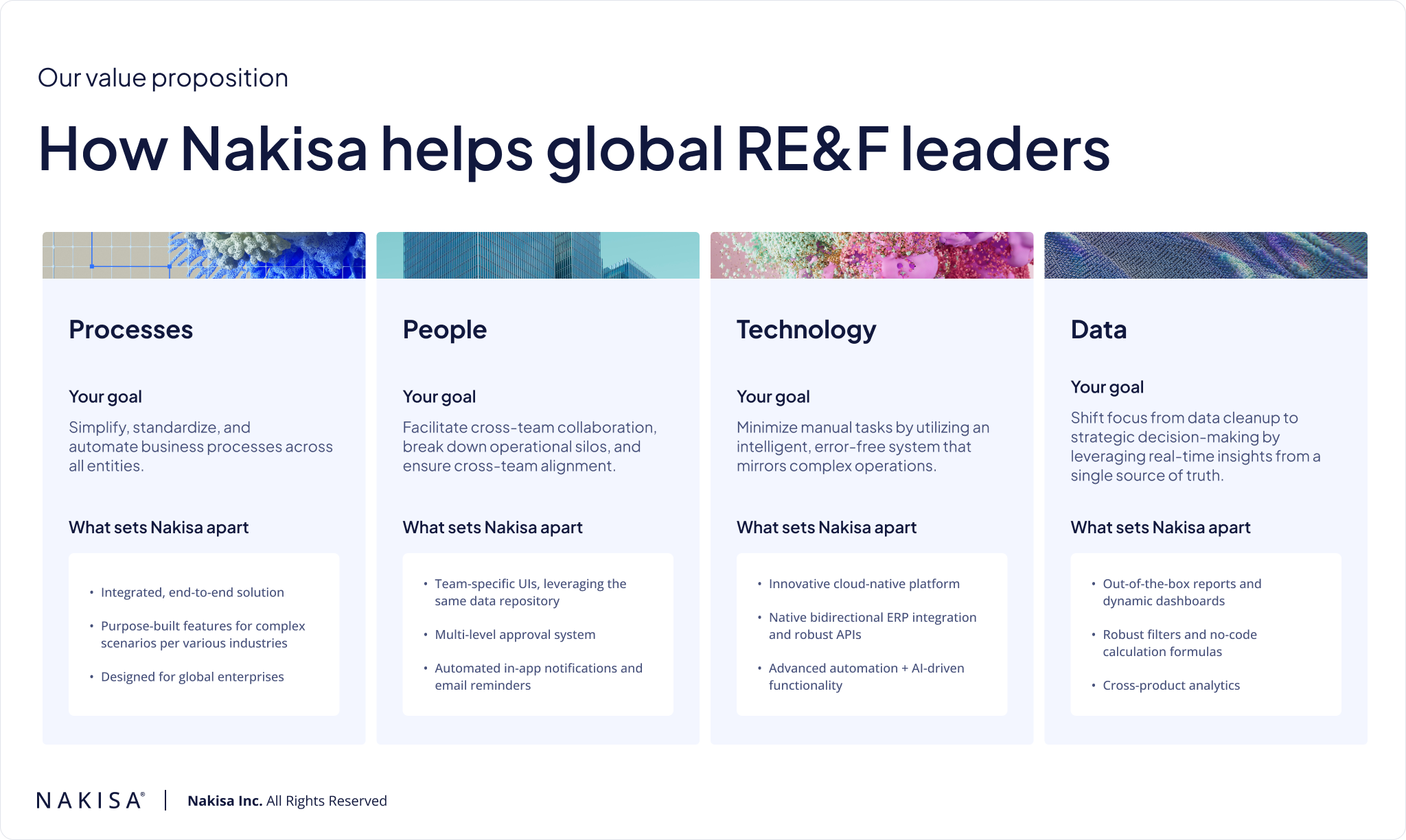

Nakisa's AI-powered, enterprise-grade platform provides large, global organizations with the tools they need to embrace digital transformation. To address these challenges systematically, Nakisa begins every engagement with a structured approach to transformation planning and continues to support organizations throughout implementation and ongoing usage to ensure sustained impact. Let’s explore how Nakisa helps global real estate and finance leaders across processes, people, technology, and data.

This diagram highlights Nakisa's value proposition for real estate and finance leaders across four core areas: Processes, People, Technology, and Data, aiming to simplify operations and enhance strategic decision-making.

Nakisa Value Acceleration Workshop

For over 20 years, we’ve partnered with the world’s largest organizations to solve complex challenges. Backed by our deep domain expertise, consultative mindset, and enterprise-grade technology, Nakisa is a trusted ally for organizations navigating transformation.

The Nakisa Value Acceleration Workshop is a fast, collaborative, and outcome-focused engagement designed to give your team the clarity and confidence to move forward. It includes six interconnected steps that guide you from solution assessment to execution, with Nakisa experts supporting, advising, and co-creating at every stage to ensure measurable success.

The six steps include:

- Current state vs. future state mapping: Co-create optimized workflows by capturing your current reality and designing improvements aligned with your strategic goals.

- Technology stack evaluation: Identify overlaps, inefficiencies, and modernization opportunities by working closely with our IT experts.

- ROI and TCO modeling: Quantify the financial value Nakisa can deliver through detailed return on investment (ROI) and total cost of ownership (TCO) analysis.

- Executive business case development: Build a compelling, executive-ready case with ROI, risk reduction, and transformation alignment to gain stakeholder buy-in.

- Demos, pilots, and PoCs: Validate solutions fit through real-world scenarios and, if desired, hear directly from current Nakisa clients.

- Post-deployment value realization tracking: Track value outcomes against your KPIs to ensure that expected benefits are delivered and sustained over time.

Whether you’re an existing Nakisa client, currently evaluating solutions, or in the early stages of transformation planning, our Value Advisory Team would be happy to help assess your systems, processes, and strategic goals, ensuring you have the right tools and foundation for long-term success.

Dana Jircikova

Head of Capital and Financial Investments Reporting at Nestlé

Conclusion

Managing complex lease portfolios across global markets presents significant challenges from handling diverse regulatory requirements and fluctuating currencies to coordinating financial, operational, and compliance data. Organizations must navigate increasing volumes of lease data while maintaining accuracy, efficiency, and audit readiness.

Centralized, AI-powered automation offers a powerful solution by streamlining data extraction, validation, forecasting, and compliance monitoring. These technologies reduce manual effort, enhance data accuracy, and provide actionable insights that enable proactive decision-making across lease accounting and financial operations.

Nakisa’s AI-powered lease accounting software addresses these challenges head-on, delivering real-time integration, intelligent automation, and advanced analytics within a unified system. Trusted by global enterprises such as Nestlé, 3M, Volvo, Walmart, PUMA, and Unicomer Group, Nakisa continuously evolves its AI capabilities offering enhanced automation, predictive insights, and collaborative tools that drive operational excellence.

Explore these innovations in greater detail through the Nakisa Resource Center or our Nakisa YouTube channel featuring in-depth training videos. For personalized assistance, book a demo with one of our experts today.

Stay connected and informed by subscribing to our monthly newsletter, delivering the latest webinars, product updates, expert insights, and best practices directly to your inbox.