Operating leases can significantly influence leverage ratios and credit metrics. Yet their impact is often hard to evaluate. In this step-by-step guide, we show how treasury and real estate teams can use Nakisa Decision Intelligence to project operating lease obligations, calculate lease-adjusted debt, and assess leverage and credit impact under different scenarios.

Explore videos, use cases, guides, and best practices to unlock the full value of Nakisa Decision Intelligence (NDI)

Introducing Nakisa Decision Intelligence (NDI)

NDI is an enterprise-grade, agentic AI platform that transforms the most complex, scattered data into real-time strategic decisions that can be executed instantly, all through simple text or voice commands.

Available as a standalone solution or embedded across Nakisa products, NDI unifies, interprets, and analyzes vast internal and external datasets across any system in real time, running forecasts, simulations, and visualizations.

It goes beyond analysis by not just explaining what happened, but uncovering root causes and delivering clear, prioritized next actions. You can also execute decisions instantly using Nakisa AI agents and apply them directly across your ERP and HCM systems.

Gain clarity, confidence, and speed with Nakisa Decision Intelligence

0

%

Enhanced decision accuracy

0

%

Reduced time-to-decision

0

x

Faster Analytics

Not using Nakisa Decision Intelligence?

Get started with Nakisa Decision Intelligence

Watch the short videos below to quickly get started with Nakisa Decision Intelligence.

Introduction to Nakisa Decision Intelligence (NDI)

A high-level overview of NDI, what it is, who it’s for, and how it empowers enterprise decision-making.

Navigating the NDI Interface

A walkthrough of the user interface, menus, dashboards, and key navigation patterns.

1. How to navigate and use NDI

Get a guided introduction to NDI, learn how to navigate the interface, use predefined questions and chat instructions, ask questions, and understand how conversations, datasets, and results are organized.

2. How to analyze and visualize data in NDI

Learn how to explore data by creating and customizing charts and tables, applying filters and comparisons, and interacting with visualizations to uncover patterns and trends.

3. How to turn data into decision-ready plans in NDI

Learn how to identify gaps and risks, run scenarios, and generate defensible, data-driven recommendations using analytical, visual, and geographic insights.

1. How to navigate and use NDI

Get a guided introduction to NDI, learn how to navigate the interface, use predefined questions and chat instructions, ask questions, and understand how conversations, datasets, and results are organized.

2. How to analyze and visualize data in NDI

Learn how to explore data by creating and customizing charts and tables, applying filters and comparisons, and interacting with visualizations to uncover patterns and trends.

3. How to turn data into decision-ready plans in NDI

Learn how to identify gaps and risks, run scenarios, and generate defensible, data-driven recommendations using analytical, visual, and geographic insights.

Learn from real-world use cases

See how different teams leverage Nakisa Decision Intelligence for faster, data-driven decisions.

Capital projects, real estate, & facility

You can use NDI in multiple ways to optimize projects, portfolios, and assets for strategic alignment, operational efficiency, and peak performance, unlocking cost savings and enabling smarter investments. Some key use cases include:

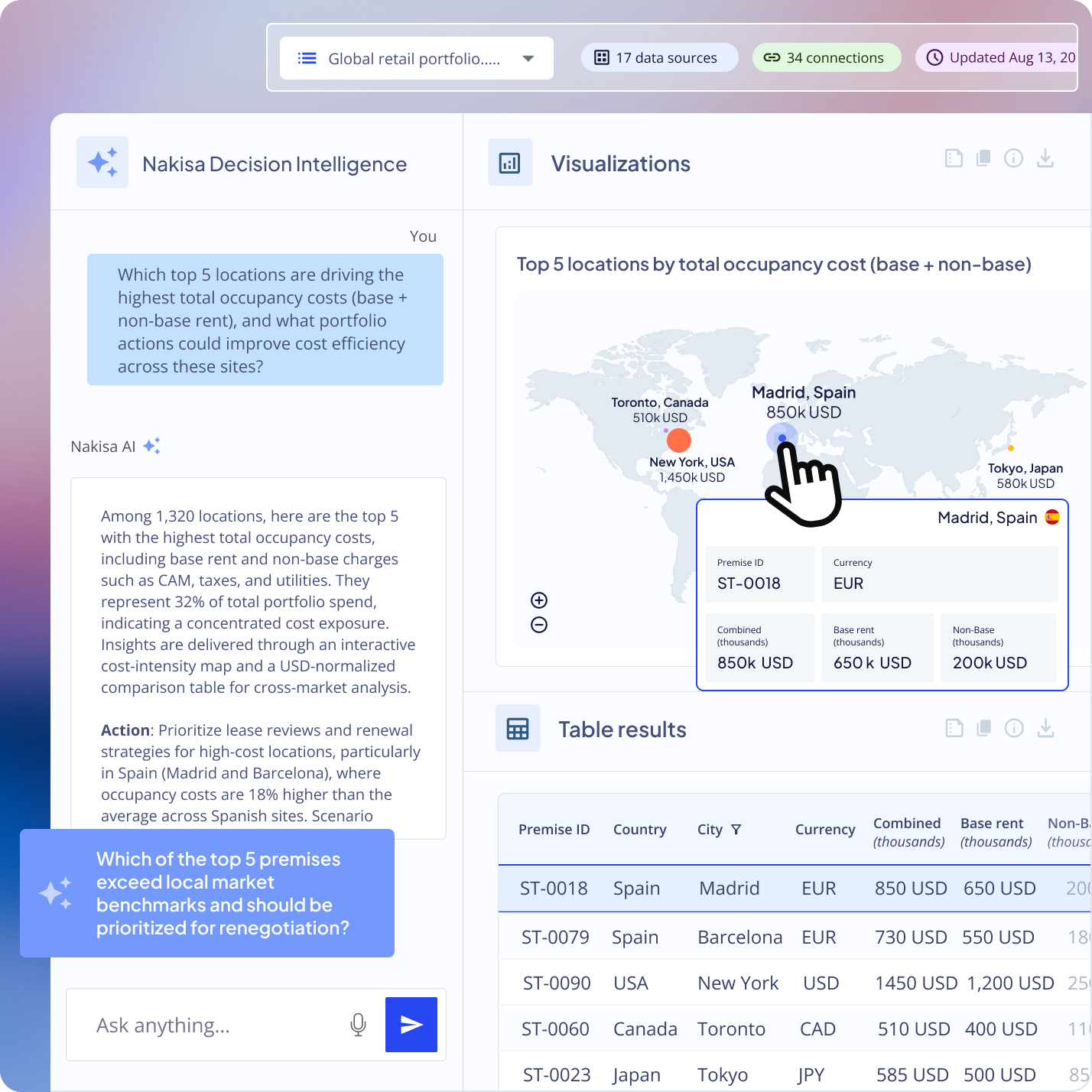

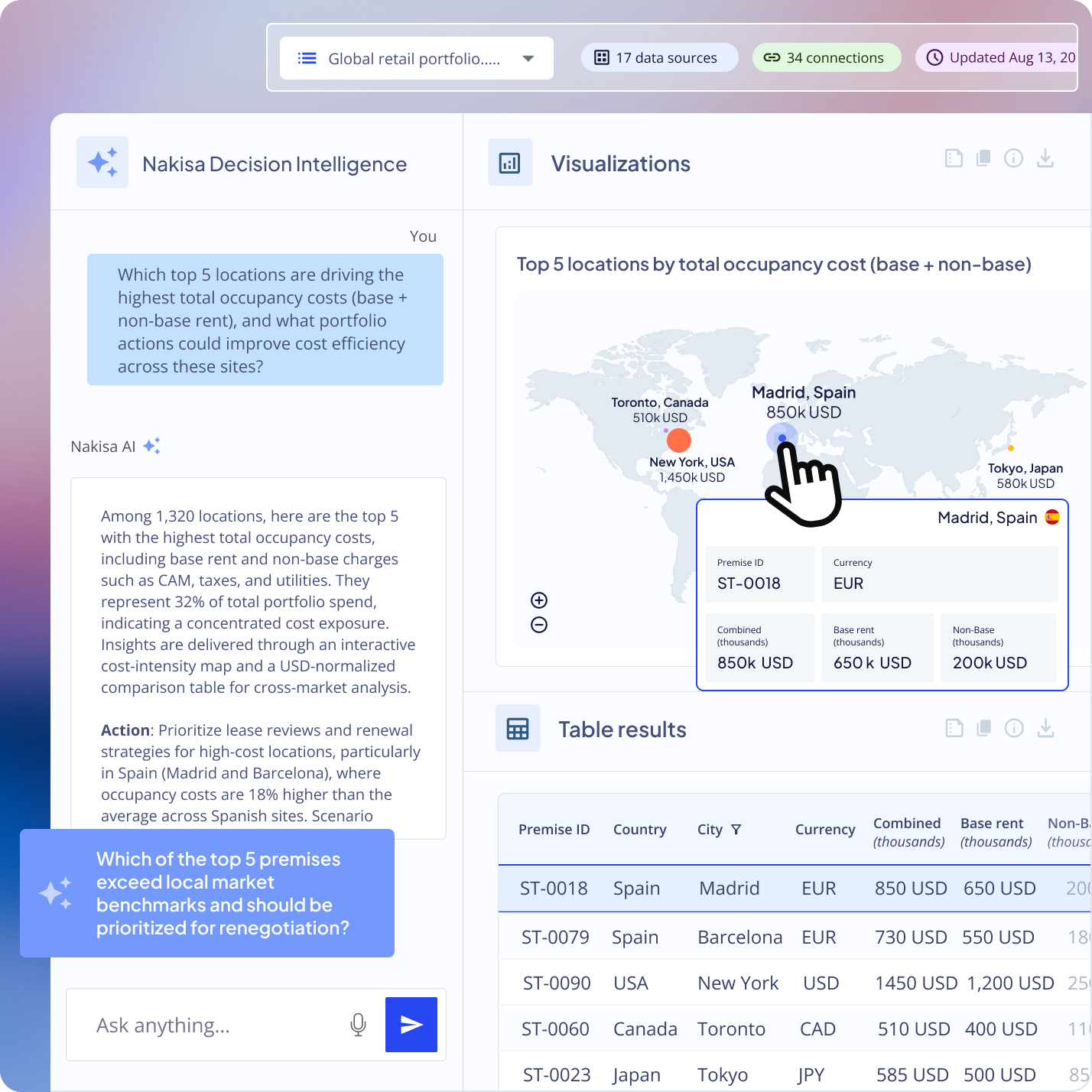

1- Location & portfolio optimization

Location and geographic insights

Analyze property locations and market trends to support portfolio decisions and site selection.

Copy prompt:

Analyze property locations alongside market, demographic, and performance data to identify geographic trends, risks, and opportunities. Recommend actions to support portfolio strategy, site selection, and investment decisions.

Analyze property locations, market, demographic, and performance data. Identify geographic trends, risks, and opportunities.

Text Copied!

Portfolio performance benchmarking

Compare properties across your portfolio to identify high- and low-performing assets.

Copy prompt:

Benchmark properties across the portfolio using financial, operational, and utilization metrics. Identify high- and low-performing assets, diagnose drivers of performance variation, and recommend prioritized actions based on internal and peer benchmarks.

Benchmark properties across the portfolio using financial, operational, and utilization metrics. Identify high- and low-performing assets.

Text Copied!

Lease compliance and optimization

Ensure lease terms are adhered to and identify opportunities to renegotiate or optimize agreements.

Copy prompt:

Evaluate lease terms, obligations, and key dates to ensure compliance with contractual and regulatory requirements. Identify compliance risks, cost leakage, and optimization opportunities such as renegotiation, consolidation, or cost recovery to improve portfolio performance. Recommend actions to improve adherence, renegotiate terms, and optimize lease outcomes.

Evaluate lease terms, obligations, and key dates to ensure contractual and regulatory compliance. Identify risks, cost leakage, and optimization opportunities.

Text Copied!

Predictive portfolio optimization

Use predictive analytics to anticipate lease rollovers, cost escalation, vacancies, demand, and maintenance issues proactively.

Copy prompt:

Analyze historical and current portfolio data to anticipate ease rollover exposure, vacancy risk, demand shifts, cost escalation, and maintenance issues over a defined planning horizon (default to 3 years if not specified). Assess financial, operational, and compliance impact, simulate proactive mitigation strategies, and recommend actions to optimize portfolio performance, flexibility, and risk exposure.

Analyze portfolio data to anticipate ease rollover exposure, vacancy risk, demand shifts, cost escalation, and maintenance issues over time.

Text Copied!

Real estate portfolio optimization

Optimize your entire property portfolio to balance performance, risk, and strategic growth.

Copy prompt:

Optimize the end-to-end real estate portfolio by balancing performance, cost, risk, and strategic growth objectives. Model optimization scenarios and recommend the most effective actions to improve long-term portfolio outcomes.

Optimize the end-to-end real estate portfolio by balancing performance, cost, risk, and growth objectives. Model optimization scenarios and recommend the best.

Text Copied!

2- Financial performance & cost management

Financial performance and forecasting

Monitor expenses, revenue, and budgets across the portfolio, with scenario modeling for CapEx, OpEx, and FP&A planning.

Copy prompt:

Analyze portfolio-level expenses, revenue, and budgets to assess current financial performance. Model CapEx, OpEx, and FP&A scenarios over a multi-year planning horizon (default to 3 years unless specified) to forecast outcomes, identify risks, and recommend actions aligned with financial objectives.

Analyze portfolio-level expenses, revenue, and budgets to assess current financial performance. Model CapEx, OpEx, and FP&A scenarios over time.

Text Copied!

Scenario modeling for capital projects

Model timelines, costs, and resource allocation to evaluate multiple project scenarios and mitigate risk.

Copy prompt:

Model capital project scenarios by evaluating timelines, costs, and resource allocation across the project lifecycle. Compare alternatives over the planning horizon (default to 3 years unless specified) to assess risk, return, and execution feasibility before committing capital.

Model capital project scenarios by evaluating timelines, costs, and resource allocation across the project lifecycle.

Text Copied!

Lease vs. buy scenario analysis

Compare leases, locations, or evaluate lease-versus-buy options to support data-driven strategic decisions.

Copy prompt:

Compare lease, buy, and location scenarios over a defined planning horizon (default to 5 years) by analyzing financial, operational, and risk trade-offs. Recommend the option that best aligns with strategic and financial goals.

Compare lease, buy, and location scenarios over time by analyzing financial, operational, and risk trade-offs.

Text Copied!

Risk-adjusted investment analysis

Evaluate financial and operational risks for property acquisitions, disposals, or renovations.

Copy prompt:

Analyze historical and current portfolio data to anticipate ease rollover exposure, vacancy risk, demand shifts, cost escalation, and maintenance issues over a defined planning horizon (default to 3 years if not specified). Assess financial, operational, and compliance impact, simulate proactive mitigation strategies, and recommend actions to optimize portfolio performance, flexibility, and risk exposure.

Analyze portfolio data to anticipate ease rollover exposure, vacancy risk, demand shifts, cost escalation, and maintenance issues over time.

Text Copied!

3- Strategic growth & portfolio planning

Expansion, consolidation, and divestment modeling

Simulate footprint changes to align real estate strategy with business objectives.

Copy prompt:

Simulate expansion, consolidation, and divestment scenarios by modeling footprint changes across locations. Evaluate financial, operational, and risk impacts over a multi-year planning horizon (default to 3 years unless specified) and recommend actions that align real estate strategy with business objectives.

Simulate expansion, consolidation, and divestment scenarios by modeling footprint changes across locations.

Text Copied!

Portfolio scenario planning

Run what-if scenarios to assess occupancy, lease expirations and renewals, demand shifts, market conditions, and cost impact.

Copy prompt:

Run what-if scenarios across occupancy, lease expirations and renewals, demand, market shifts, and cost drivers over a multi-year planning horizon (default to 3 years unless specified). Compare outcomes and recommend portfolio actions that optimize performance and resilience.

Run what-if scenarios across occupancy, lease expirations and renewals, demand, market shifts, and cost drivers over time.

Text Copied!

Market trend and competitive analysis

Assess market conditions, competitor moves, and economic indicators to guide long-term strategy.

Copy prompt:

Analyze market conditions, economic indicators, and competitor activity to identify risks and opportunities. Translate insights into strategic implications for long-term real estate and portfolio planning.

Analyze market conditions, economic indicators, and competitor activity to identify risks and opportunities.

Text Copied!

Capital project prioritization

Rank and plan projects based on strategic value, risk-adjusted ROI, and resource constraints.

Copy prompt:

Evaluate and rank capital projects based on strategic value, risk-adjusted ROI, and resource constraints. Recommend a prioritized investment roadmap that maximizes portfolio impact.

Evaluate and rank capital projects based on strategic value, risk-adjusted ROI, and resource constraints. Recommend a prioritized roadmap.

Text Copied!

Strategic impact forecasting

Evaluate how decisions on locations, leases, and capital projects affect revenue, costs, and operational capacity.

Copy prompt:

Forecast the strategic impact of decisions related to locations, leases, and capital projects over a multi-year planning horizon (default to 3 years unless specified). Quantify effects on revenue, costs, and operational capacity to support informed decision-making.

Forecast the strategic impact of decisions related to locations, leases, and capital projects over time. Quantify effects to support informed decisions.

Text Copied!

Contingency and resilience planning

Stress-test the portfolio against disruptions such as market shifts, natural disasters, supply chain issues, and tenant changes.

Copy prompt:

Stress-test the real estate portfolio against disruption scenarios such as market shifts, natural disasters, supply chain issues, or tenant changes. Assess exposure and recommend mitigation actions to strengthen portfolio resilience.

Stress-test real estate portfolio against disruption scenarios: market shifts, natural disasters, supply chain issues, tenant changes, regulatory or economic shocks.

Text Copied!

4- Operational, financial, & compliance risk management

Contractual and lease compliance risk

Identify missed, current, and upcoming obligations, and surface expired or missing lease documentation.

Copy prompt:

Identify past missed contractual obligations (payments, renewals, critical dates), detect current compliance gaps, and flag upcoming obligations at risk. Assess lease and property documentation to surface expired, missing, or incomplete records (e.g., insurance certificates, permits, inspections), and recommend corrective and preventive actions to restore and maintain compliance.

Identify past missed contractual obligations (payments, renewals, critical dates), detect current compliance gaps, and flag upcoming obligations at risk.

Text Copied!

Financial risk and cost exposure

Detect financial exposure from rent escalations, variable rent volatility, or inaccurate lease data, and cost overruns.

Copy prompt:

Detect financial risk driven by rent escalations, variable rent volatility, inaccurate lease data, and capital cost overruns. Quantify potential financial impact and recommend mitigation actions to reduce uncertainty and exposure.

Detect financial risk driven by rent escalations, variable rent volatility, inaccurate lease data, and capital cost overruns.

Text Copied!

Facilities, safety, and operational risk

Flag delayed work orders, unresolved maintenance issues, safety compliance gaps, facility outages, vendor disruptions, and operational risks.

Copy prompt:

Identify delayed work orders, unresolved maintenance issues, safety compliance gaps, facility outages, vendor dependencies, and environmental exposure. Assess operational and safety impact and recommend prioritized remediation and continuity actions.

Identify delayed work orders, unresolved maintenance issues, safety compliance gaps, facility outages, vendor dependencies, and environmental risks.

Text Copied!

Capital project risk monitoring and mitigation

Identify capital projects trending toward delays, cost overruns, or resource bottlenecks.

Copy prompt:

Monitor capital projects for early warning signs of schedule delays, cost overruns, or resource bottlenecks. Assess execution risk and recommend corrective actions to keep projects on track.

Monitor capital projects for early warning signs of schedule delays, cost overruns, or resource bottlenecks.

Text Copied!

Regulatory and environmental risk

Ensure properties, facilities, and capital projects meet local regulatory and environmental requirements.

Copy prompt:

Evaluate properties, facilities, and capital projects against applicable local and industry regulations. Identify non-compliance risks and recommend actions to maintain ongoing regulatory adherence.

Evaluate properties, facilities, and capital projects against applicable local and industry regulations.

Text Copied!

5- Operational efficiency & space management

Workplace space optimization

Optimize layouts, utilization, and occupancy to improve efficiency and employee experience.

Copy prompt:

Given occupancy patterns, team adjacencies, hybrid work policies, and space constraints—combined with operational and vendor signals such as work orders, service coverage, performance, and store-level productivity—what space optimization scenarios maximize utilization, employee experience, and cost efficiency? Identify underutilized or operationally inefficient locations and simulate trade-offs across layout changes, space consolidation, service models, and future growth. Recommend the optimal configuration with a clear execution plan.

Identify underutilized or inefficient locations. What space optimization scenarios maximize utilization, employee experience, and cost efficiency?

Text Copied!

Work order and vendor management

Track work orders, service requests, and day-to-day vendor performance to streamline operations.

Copy prompt:

Based on work order volumes, response times, service quality, and vendor SLAs, which operational and vendor performance issues are driving delays or cost overruns? Simulate alternative vendor allocations, prioritization rules, and service models, and recommend actions to improve service levels while controlling costs.

Which operational and vendor performance issues are driving delays or cost overruns? Recommend improvement actions.

Text Copied!

Predictive maintenance analytics

Forecast maintenance needs to reduce downtime, extend asset life, and lower costs.

Copy prompt:

Using asset condition data, usage patterns, maintenance history, and failure risk, which assets are most likely to fail in the next planning horizon? Model preventive maintenance scenarios and investment trade-offs to minimize downtime, extend asset life, and reduce total maintenance cost.

Using asset condition data, usage patterns, maintenance history, and failure risk, which assets are most likely to fail in the next planning horizon?

Text Copied!

Space and resource utilization analytics

Measure how spaces and resources are used and identify inefficiencies and consolidation opportunities.

Copy prompt:

How are spaces and shared resources actually being used versus planned capacity across locations and time periods? Simulate consolidation, repurposing, or reallocation scenarios to improve utilization, reduce underused space, and support evolving workforce needs without impacting productivity.

How are spaces and shared resources used compared to planned capacity across locations and time periods? Simulate optimization scenarios.

Text Copied!

Vendor and contract analytics

Analyze vendor contracts, costs, and performance to optimize procurement and strategic decisions.

Copy prompt:

Across all vendor contracts, spend, performance metrics, and renewal timelines, where are cost leakage, risk exposure, or underperformance occurring? Model renegotiation, consolidation, and replacement scenarios to optimize cost, service quality, and long-term vendor strategy.

Across vendor contracts, spend, performance, and renewal timelines, where are cost leakage, risk exposure, or underperformance?

Text Copied!

6- Sustainability & ESG

Sustainability and emissions management

Monitor energy use, emissions, and environmental impact to meet sustainability targets.

Copy prompt:

Evaluate sustainability performance across the real estate portfolio by analyzing store-level energy consumption, costs, and emissions. Identify high–energy-intensity locations using annual consumption (kWh), energy use intensity (EUI) per square foot, and emissions benchmarks. Model decarbonization scenarios across targeted interventions, energy sourcing, and operational changes, and compare cost, emissions reduction, and risk trade-offs to recommend the optimal portfolio-wide sustainability pathway.

Evaluate sustainability performance across the real estate portfolio by analyzing store-level energy consumption, costs, and emissions.

Text Copied!

Energy efficiency and conservation planning

Identify high-energy areas and implement strategies to reduce consumption and costs.

Copy prompt:

Identify high-energy-intensity locations by analyzing annual energy consumption (kWh), energy use intensity (EUI), and operating costs per square foot. Model targeted energy-efficiency interventions and estimate indicative cost and consumption savings. Compare scenarios across retrofit options, operational changes, and implementation timing to prioritize conservation initiatives with the highest ROI and fastest time to impact.

Identify high-energy-intensity locations. Compare scenarios and prioritize conservation initiatives with the highest ROI and fastest time to impact.

Text Copied!

Green building and certification tracking

Track certifications and compliance for different sustainability programs.

Copy prompt:

Benchmark facilities using energy consumption, EUI, and operational performance metrics to assess readiness for green building certifications. Identify efficiency gaps and required interventions, estimate investment and savings implications, and compare certification pathways to prioritize buildings that deliver the greatest sustainability impact, compliance confidence, and portfolio value.

Benchmark facilities using energy consumption, EUI, and operational performance metrics to assess readiness for green building certifications.

Text Copied!

See Nakisa Decision Intelligence at work. Watch these videos for real examples.

How to assess global portfolio, financial impact, and risk

Gain full visibility into your global real estate portfolio, assess financial impact, and identify lease risks and critical dates by location.

How to get a full overview of your real estate portfolio

Analyze global lease and owned assets, capital projects, and spend distribution and drill-down by region, lease type, and asset category.

How to analyze and manage critical dates proactively

Identify compliance risks from missed or upcoming critical deadlines, analyze trends over time, and trigger automated alerts to reduce exposure.

How to evaluate operating leases for debt, leverage, and credit impact

Forecast operating lease obligations, calculate lease-adjusted debt, and evaluate leverage and credit impact across different scenarios.

How to evaluate operating leases for debt, leverage, and credit impact

Forecast operating lease obligations, calculate lease-adjusted debt, and evaluate leverage and credit impact across different scenarios.

Nakisa’s decision intelligence solution is the most advanced I have seen so far, most competitors only talk about AI without being able to show anything.

— Managing Director and RE Tech Leader, Global Services Company with 400K employees

Blogs

Access educational content designed to help you unlock the full power of Nakisa Decision Intelligence.

In this post from our new series, our CTO, Faraz, explains how Nakisa Decision Intelligence (NDI) turns instructions into intelligent decisions using our guiding principles, called chat instructions, making the difference between a useful answer and a transformative one.

In this post from our new series, our CTO, Faraz, explains how Nakisa Decision Intelligence (NDI) interprets intent and adapts to user behavior by balancing analytical precision with creative flexibility through Context Memory and Instruction Strictness.

In this post of our new series, our CTO, Faraz, explores how generative AI powers dynamic UI generation. Learn how adaptive interfaces evolve using an AI-friendly schema and how Nakisa Decision Intelligence (NDI) applies this approach.

With AI-first analyses, prompt-based forecasts, simulations, and real-time visualizations, NDI delivers tailored, expert recommendations and unlocks new levels of strategic value across large enterprise real estate portfolios.

Operating leases can significantly influence leverage ratios and credit metrics. Yet their impact is often hard to evaluate. In this step-by-step guide,…

In this post from our new series, our CTO, Faraz, explains how Nakisa Decision Intelligence (NDI) turns instructions into intelligent decisions using…

In this post from our new series, our CTO, Faraz, explains how Nakisa Decision Intelligence (NDI) interprets intent and adapts to user…

In this post of our new series, our CTO, Faraz, explores how generative AI powers dynamic UI generation. Learn how adaptive interfaces…

With AI-first analyses, prompt-based forecasts, simulations, and real-time visualizations, NDI delivers tailored, expert recommendations and unlocks new levels of strategic value across…

See why market leaders trust NDI

This is not a wrapper; we have tried many AI systems, and no one is close to Nakisa. The major benefit, is that NDI has and knows our data. Other AI systems won’t have that access. NDI doesn’t hallucinate and is made for our use case. This has our data and is enterprise-grade.

VP, Systems and Policies,

Manufacturing Leader with 50K employees

Nakisa’s decision intelligence solution is the most advanced I have seen so far, most competitors only talk about AI without being able to show anything.

Managing Director and RE Tech Leader,

Global Services Company with 400K employees

We have our own AI, but it is nowhere close to Nakisa, because it has and knows our HR-specific data. This is much more reliable compared to even our own AI system that we are developing. Other players in the market don’t have anything like this!

Director, ERP Solutions,

Global Health and Science Company with 95K employees

FAQs

What is the Nakisa Decision Intelligence (NDI) Platform?

NDI is an agentic, enterprise-grade decision intelligence platform that combines AI reasoning with deterministic analytics to deliver real-time, explainable insights. It unifies and interprets vast internal and external datasets across any system in real time. NDI goes beyond analysis by running forecasts, simulations, and visualizations, while providing expert, context-aware guidance every step of the way. Ask complex business questions in natural language (text or voice) and receive tailored recommendations. And it doesn’t stop there: execute decisions instantly through Nakisa AI agents and apply them directly to your ERP and HCM systems.

How is NDI different from traditional BI tools?

Traditional BI answers what happened; NDI explains why it happened and what to do next.

It interprets context, runs forecasts and simulations, provides expert, context-aware guidance and recommendations, and turns insights into actions instantly.

What does agentic architecture mean?

NDI is powered by multiple specialized AI agents—retrieval, predictive, visualization, and orchestration—that work together under a central controller to generate fast, accurate, and contextual results. Learn more about the powerful AI agents behind NDI’s capabilities here.

How does NDI minimize the risk of hallucinations in AI?

It uses a hybrid reasoning model: large-language-model intuition for understanding context, and deterministic computation for mathematical precision and traceability.

Can users trace how NDI arrived at a result?

Yes. Every NDI output includes an explainable reasoning path showing the data, calculations, and agents used, ensuring auditability and compliance.

What types of data can NDI analyze?

NDI is data agnostic; it handles both structured (e.g., financials, HR records, lease data) and unstructured information (documents, reports, text). It understands hierarchies, relationships, and multi-dimensional datasets.

What types of visualizations does NDI produce?

NDI automatically selects the most appropriate visualization—pie, treemap, bubble, chord, 3D scatter, boxplot, diagram, and more—helping users instantly grasp patterns and dependencies. Users can also customize chart types, axes, components, and colors directly through their prompts. Learn more here.

How does NDI perform on large datasets?

Its distributed, agent-based architecture executes queries in parallel, processing millions of records in seconds while maintaining accuracy and data integrity. We currently have tables with over a million records in sample datasets.

How does NDI support scenario and predictive analysis?

NDI’s predictive agents run real-time what-if simulations and forecasts, letting users test assumptions and see potential business outcomes instantly. When certain data isn’t available in your datasets—such as departmental targets, company growth targets, region-specific costs, market rates—NDI prompts users to enter these values, so scenarios can reflect the full picture and generate accurate results. Learn more about NDI’s advanced forecasting and simulation capabilities here.

What makes NDI trustworthy for enterprise decisions?

NDI is governed, explainable, and secure. Every result is reproducible, traceable, and based on governed data, enabling reliable, defensible decision-making.

How does NDI ensure data security and governance?

NDI runs on Nakisa’s secure, enterprise-grade SaaS infrastructure, featuring role-based access control (RBAC), encryption at rest and in transit, single sign-on (SSO), multi-level approvals, and comprehensive audit trails. The platform is compliant with SOC 1 & 2 Type II, FIPS 140-2, ISO 27001 and ISO 27017, is GDPR ready, and meets ITGC standards. Importantly, client data is never used to train or fine-tune third-party AI models.

Does NDI replace existing analytics tools?

No. NDI complements them. It acts as a decision layer above existing BI and ERP systems, unifying data and accelerating cross-functional decision cycles.

How quickly can NDI be deployed?

For existing Nakisa clients, activation can take days; for new environments, governed connectors enable deployment within weeks depending on data readiness.

What level of technical expertise do users need?

No technical expertise is required. Users simply type or speak their questions in natural language. NDI interprets intent, performs analysis, runs forecasts and simulations, and automatically delivers results, tailored recommendations, and intuitive visualizations.

How does NDI maintain consistency across departments?

By applying shared business logic and governed data models, NDI ensures all teams, such as Finance, HR, and Operations, work from one consistent source of truth.

Can NDI connect to non-Nakisa systems?

Yes. While natively integrated with Nakisa Lease Accounting, IWMS, and Workforce Planning portfolios, NDI can also connect to ERP and HCM systems such as SAP, Oracle, Workday, and PeopleSoft, as well as CRM and data platforms like Salesforce and Snowflake.

How does NDI integrate results into daily workflows?

Users can export insights, generate reports, or trigger workflow actions directly within NDI, turning analytics and recommendations into operational actions without switching platforms.

How does NDI facilitate collaboration between teams?

NDI's conversational interface and shared decision history enable organization-wide teams, such as Finance, HR, and Operations, to explore the same scenarios, align assumptions, and act in alignment.

What value or ROI can organizations gain from using NDI

Organizations using Nakisa Decision Intelligence (NDI) can expect measurable value and ROI across multiple dimensions:

- Faster, smarter decisions: By turning complex, siloed data into real-time, actionable insights, NDI accelerates decision-making and reduces reliance on manual analysis.

- Improved accuracy and confidence: Hybrid AI architecture ensures decisions are both creative and precise, minimizing errors and risks associated with data misinterpretation.

- Operational efficiency: Automated workflows and AI-driven actions reduce manual work, freeing teams to focus on high-value, strategic initiatives.

- Cross-functional alignment: Shared decision history and a conversational interface enable organization-wide teams to align assumptions and act cohesively.

- Cost savings and risk mitigation: NDI identifies opportunities and risks early, optimizes resources, and improves compliance, reducing financial exposure.

- Scalable insights: Supports enterprise-wide adoption, allowing organizations to analyze multiple business domains (HR, real estate, finance) in one unified platform.

In short, NDI transforms data into confident, coordinated action, enabling organizations to maximize strategic impact while lowering costs and operational risk.

Need assistance or want to share feedback?

If you didn’t find what you’re looking for, need assistance, or have feedback or questions, fill out this form. We’re here to help.