What unique workforce challenges airlines face, and how next-gen org design, workforce planning, and advanced analytics solutions address them

The aviation industry stands at a critical inflection point where effective workforce management can become a strategic advantage. Airlines that successfully navigate volatile markets and evolving talent landscapes gain measurable benefits in operational efficiency, cost control, and service quality. This guide explores four key challenges airlines face today in managing their workforce:

- Organizational and regulatory complexity: Airlines operate in one of the most regulated industries, often with large-scale, complex, multilayered organizational structures. This demands accurate, real-time visibility into the workforce to ensure operational clarity and compliance.

- Demand volatility and the need for flexibility: Seasonal travel peaks, market fluctuations, and global disruptions require workforce strategies that are agile, responsive, and can scale.

- Labor shortages and skill gaps in critical roles: A shrinking pool of qualified talent, especially in specialized roles like pilots and maintenance crews, makes long-term planning for recruitment, training, and retention more urgent.

- Ongoing restructuring: Mergers, acquisitions, operational shifts, and internal realignments are frequent. They require flexible org design capabilities and clear workforce visibility to minimize disruption and maintain performance.

Effectively addressing these challenges starts with a thorough understanding of the current workforce and future needs. This is essential for ensuring compliance, maintaining organizational health in the short and medium term, and building toward long-term success.

In the following sections, we’ll break down each of these challenges and discuss how an advanced, end-to-end solution that comprises workforce planning, org design, org visualization, and advanced HR analytics can help airlines overcome them.

Challenge 1: Organizational and regulatory complexity

The airline industry operates within one of the most tightly regulated environments. Regulatory authorities such as the Federal Aviation Administration (FAA), the European Union Aviation Safety Agency (EASA), and the International Civil Aviation Organization (ICAO) impose strict standards covering everything from airworthiness and crew readiness to maintenance cycles and safety audits. These rules are non-negotiable as they directly impact passenger safety, operational continuity, and an airline's license to operate.

Compliance in aviation is dynamic, with regulations evolving frequently in response to new technologies, safety incidents, and emerging risks such as cybersecurity threats. Airlines must adapt quickly while ensuring that no critical training, certification, or staffing requirement is overlooked. This challenge becomes particularly complex when operations span multiple countries, each with their own local compliance rules layered over international standards.

A single airline may employ tens of thousands of people, both above-wing and below-wing across flight operations, maintenance, ground handling, and customer service. Each role demands different certifications, training recertification intervals, medical clearances, and safety briefings, all of which must be tracked in real time. Failure to do so risks operational delays or regulatory breaches. Airlines also face ongoing pressure to continuously reskill and upskill their workforce. With the growing use of digital tools, automation in maintenance and baggage handling, and data-driven decision-making in flight operations, the skills landscape is shifting rapidly. Pilots must train on updated cockpit technologies, while ground and maintenance crews need to master advanced diagnostics systems. Yet, the training capacity, especially for highly technical or safety-sensitive roles, is limited. Bottlenecks in pilot training programs or simulator availability can delay readiness and slow an airline's ability to react to market shifts or route changes.

Airlines also operate under highly complex organizational structures with multiple reporting lines, matrix management systems spanning different geographic regions, and specialized departments that must work in close coordination. These intricate hierarchies create significant challenges for organizational visibility and accountability. For example, a flight operations manager might report functionally to a global safety office while administratively reporting to a regional director. Managing this complexity through spreadsheets or siloed HR systems increases the risk of non-compliance, missed renewals, and operational delays.

Beyond tracking credentials, maintaining clear visibility over organizational roles and responsibilities is equally critical. Regulatory frameworks often require proof of who holds decision-making authority, who oversees key safety functions, and how responsibility flows across departments. During audits or incident reviews, this accountability chain must be clearly documented and immediately accessible. The challenge is further complicated by the difficulty in visualizing these complex hierarchies in a meaningful way. Traditional org charts struggle to represent the multidimensional nature of airline operations, where functional reporting lines may differ from administrative ones (for example in dotted line reporting), and where temporary duty assignments or special project teams create dynamic structures that change frequently (like Agile teams). Leadership teams often lack tools that can effectively display these relationships, making it difficult to identify gaps in oversight, potential compliance risks, or inefficiencies in organizational design.

All of this creates a high-stakes balancing act: meeting today's regulatory demands while preparing for tomorrow's workforce needs. Centralized, real-time visibility into skills, certification timelines, training progress, and organizational structure is now essential. Without it, airlines risk non-compliance, inefficiency, and costly delays.

Overall, this challenge can be brought down to the following points:

- Credential and compliance tracking must be centralized and available in real-time: Airlines manage thousands of certifications, medical clearances, and training renewals across jurisdictions. A single source of truth where they are clearly visible is needed.

- Organizational visibility needs to match the complexity of airline structures: Matrixed reporting lines, shifting assignments, and regional operations require dynamic org visualizations and historical records to maintain oversight and accountability, especially during audits or safety reviews.

- Operational risk must be faced before it turns into disruption: Airlines can't afford to discover expired licenses or unfilled mandatory roles after the fact. In-chart compliance indicators and proactive advanced, real-time dashboards help flag issues early, before they impact safety or schedules.

In the following section, we’ll explore how an enterprise-grade solution like Nakisa can empower airlines to navigate these regulatory and operational efficiency challenges effectively.

How Nakisa addresses regulatory and compliance challenges in the airline industry

Nakisa provides a centralized platform purpose-built for the airline industry’s organizational and regulatory complexity. By unifying workforce data and visualizing organizational structures, airlines can maintain compliance while gaining strategic insight into their workforce.

Single source of truth

Nakisa's platform integrates seamlessly with major ERP and HCM systems such as SAP HCM, SAP SFSF, Workday, Oracle Fusion, and Oracle EBS and offers platform-agnostic APIs to connect with third-party systems. This ensures real-time, synchronized compliance and workforce data across the organization, and helps airlines meet regulatory requirements while accelerating workflows and reducing operational risks.

With Nakisa, airlines can:

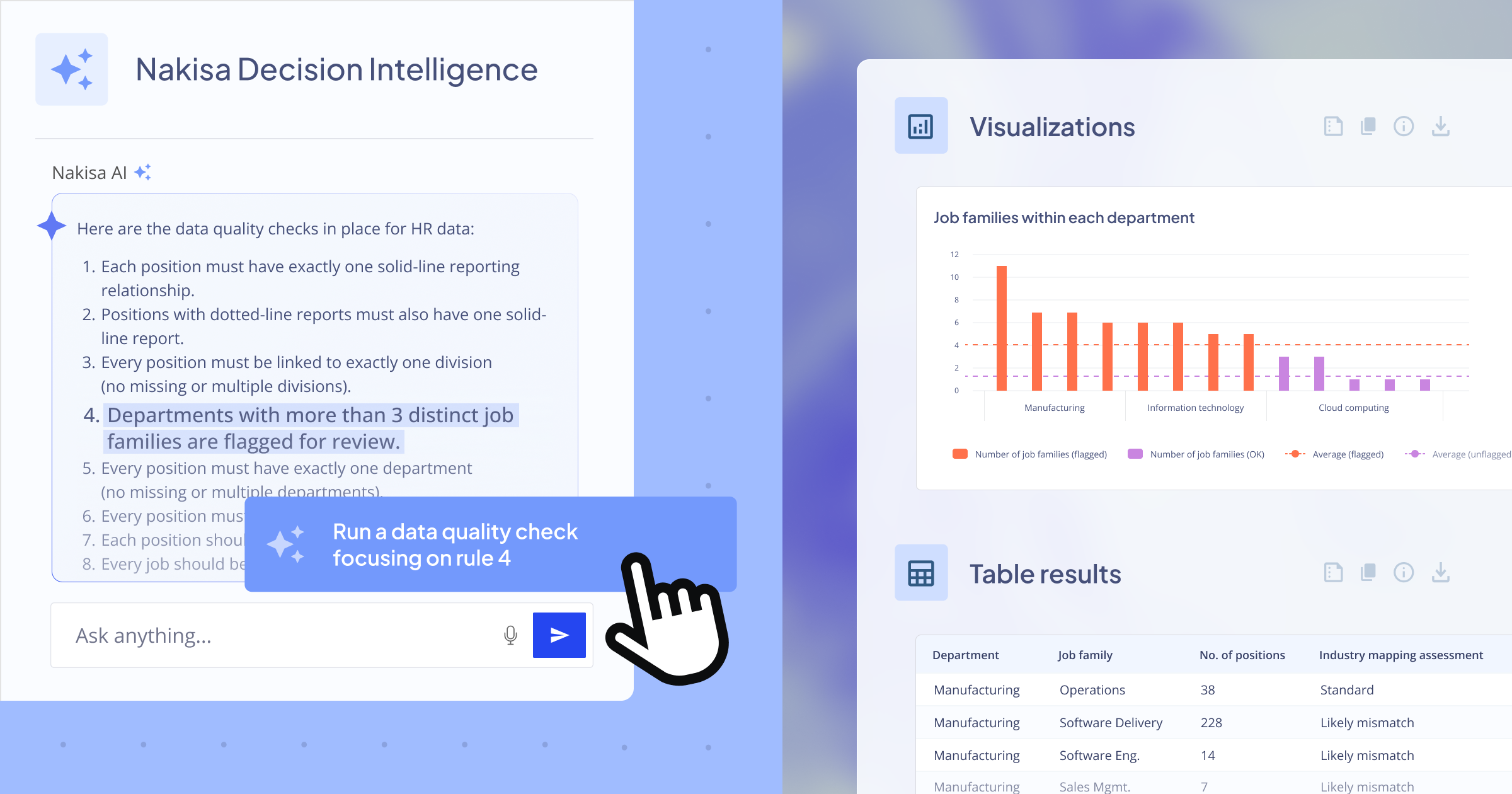

- Consolidate unlimited employee datasets into a single source of truth, including headcount, talent, skills, finance, HR, payroll, employee surveys, and more. This eliminates data cleansing and validates data quality by addressing issues like orphan records, vacancies, multiple managers, multiple incumbents, and missing or inaccurate data.

- Automate updates to reduce compliance gaps caused by manual errors.

Dynamic, interactive organizational visualization with real-time in-chart metrics

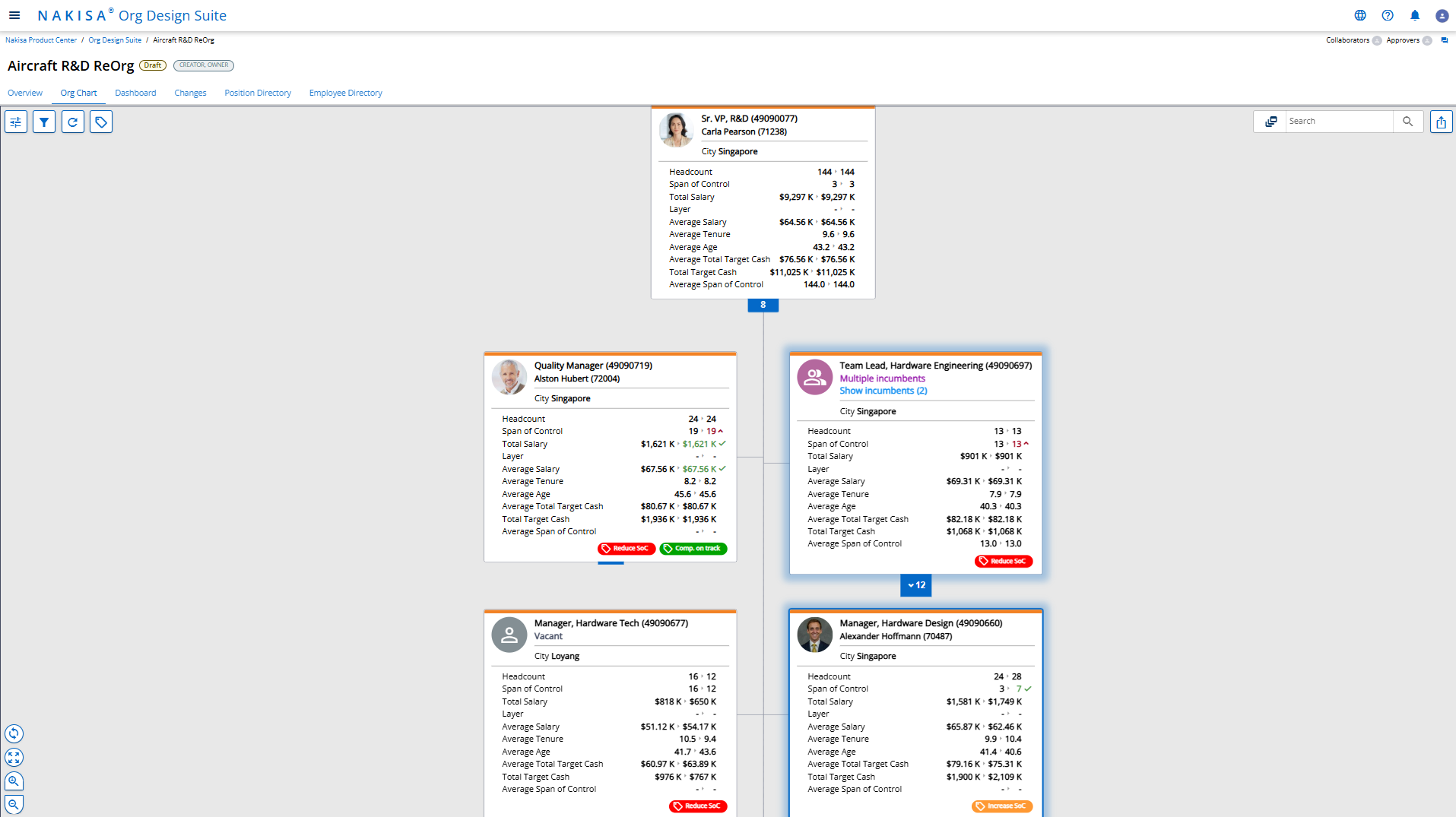

Nakisa's org chart software transforms complex airline organizational structures into intuitive, interactive visualizations that provide immediate clarity on reporting relationships, span of control, and other key metrics (layer, cost, performance, skills…). These charts update dynamically to reflect organizational changes as they happen, whether minor operational updates such as employee role changes, or major transformations including mergers, restructuring, reorganizations, or large-scale workforce shifts.

Airline HR teams can:

- Navigate complex, multi-level, matrix, and dotted-line reporting lines with clarity

- Use scoped search to generate a hierarchical list of all positions and employees

- Visualize multiple incumbents of a role directly within org charts and identify orphaned positions to help HR professionals correct data inconsistencies

- Choose the level of detail shown on employee records through detailed in-chart metrics and filters that allow to drill-down specific information (performance, span of control, cost…)

- Filter views by location, department, skills, certification status, critical roles, or other custom criteria for more targeted visualizations

- Provide interactive links to team members so they can explore charts and reports on their own, while ensuring access permissions are respected

- Export charts and reports in high-definition PDF, PowerPoint, or PNG formats for easy distribution and collaboration

Nakisa’s org chart software supports dotted-line reporting, vacant positions, and multiple incumbents per position

In-chart compliance metrics

Beyond usual KPIs, Nakisa's solution embeds critical compliance metrics directly within the org chart, enabling proactive management of regulatory requirements:

- Highlight expiring certifications with embedded visual markers

- Visualize compliance risks using color-coded alerts and real-time indicators, such as badges or custom icons

- Drill into roles to review compliance responsibilities and status, with fields like required certifications or trainings (per employee or per position)

- Display training completion rates at the team or business unit levels

- Compare required vs. actual staffing ratios for safety-critical positions

Nakisa’s org chart software provides advanced in-chart analytics along with custom badges and icons to identify and visually mark compliance risks, certifications, and more.

Historical organizational records

Nakisa’s software provides airlines with comprehensive historical charting capabilities to support audits and demonstrate past compliance, ensuring readiness for any regulatory review or investigation:

- Generate point-in-time org charts to document past compliance states, and compare past vs. present structures to identify compliance trends

- View audit trails for changes in organizational structure and certifications

- Support incident investigations with accurate historical org data

Advanced dashboard analytics

Nakisa's dashboards go beyond simple visualization, delivering strategic insights across compliance and workforce management. The platform offers out-of-the-box and highly configurable reports and dashboards tailored to different leadership roles, enabling decision-makers to focus on the metrics most relevant to their responsibilities.

With built-in analytics, airlines can forecast potential certification gaps, loss of qualified talent or future hiring needs before they impact operations, for example, through identifying high-turnover skilled teams. Out-of-the-box reports dashboards reports on people analytics, recruitment, termination, span of control, succession management, also support broader HR and DEI initiatives, providing tools to track diversity, equity, and inclusion compliance across departments and regions. Skills gap analyses further help prioritize training investments. You can easily drill down data, filter, exclude, and organize the information in easy-to-configure, schedulable reports to track targets and visualize trends on an ongoing basis.

Together, these capabilities transform workforce management from a reactive obligation into a proactive, strategic advantage. Airlines can quickly and intuitively create reports for retiring critical roles or talent with high flight risk, and proactively engage in talent retention initiatives, or succession planning.

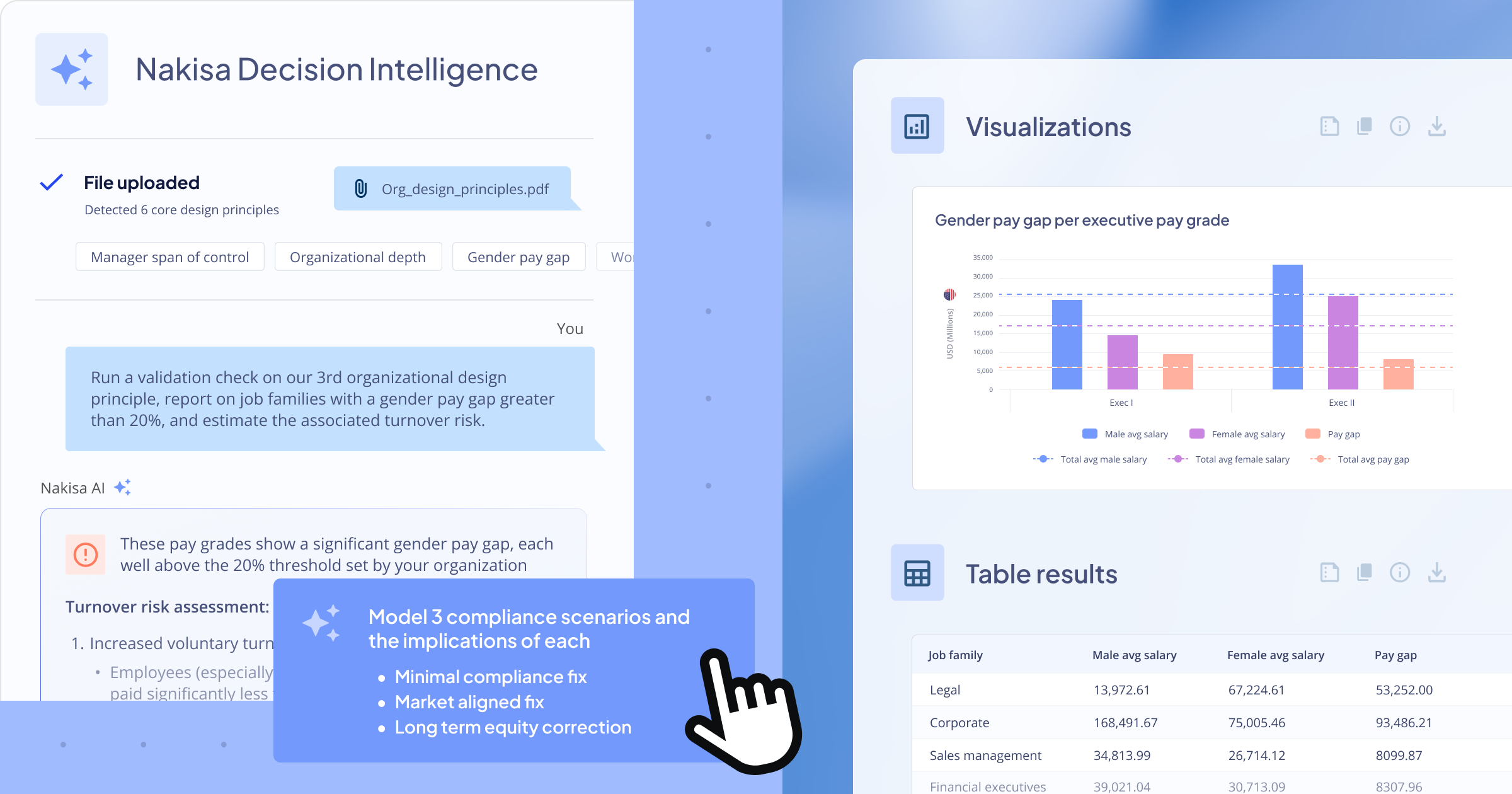

Nakisa’s AI Agent also simplifies dashboard creation and management by generating charts from simple text prompts. Any user, regardless of technical expertise, can create tailored charts instantly. Nakisa's AI assistant can also respond to conversational questions and suggest the most relevant dashboards to create based on user needs.

Michelle Seymore

Head People & Culture Transactional Solutions at Standard Bank Group

Powerful succession planning capabilities

Nakisa’s succession planning tool helps airlines meet requirements while ensuring organizational stability. The platform provides transparency and sends time-sensitive notifications to keep succession plans up to date.

Workforce planning and talent management professionals can directly assign successors from org charts or profile pages, making it easy to designate candidates for key positions. Customizable successor attributes, such as ranking and readiness, allow for more informed and strategic succession planning and talent assessment. In-chart tags and icons allow setting custom important parameters to be observable at a glance, such as retiring key positions, top performers, or potential successors. Succession pools further enhance this process by maintaining a repository of future leaders with the attributes mentioned above.

Birgin Walsh

Senior Organization Effectiveness Consultant at AIB

Nakisa’s org chart software makes it easy to build advanced reports and dashboards that provide visibility into key workforce KPIs, enabling proactive talent assessment and retention strategies.

Advanced analytics and reporting provide insights into organizational bench strength, with dashboards showing succession readiness across multiple dimensions such as pay grade, functional area, country, legal entity, and department. Visual data representations, such as heat maps or talent grids, enable quick gap identifications and more proactive workforce planning and risk management. Dynamic succession modeling enables proactive planning with “what-if” scenario tools. You can simulate the transfer of successors to key positions and analyze organizational impacts in real time. These scenarios integrate directly with the org chart for a holistic view of potential changes.

The platform also supports the ongoing development of potential successors. HR managers can easily drill down into data and track employees for development plans, ensuring those in succession pools continue to grow and remain prepared for future leadership roles.

Enterprise-Grade security

Given the sensitive nature of organizational and employee data, Nakisa's platform incorporates robust security features designed specifically for the aviation industry:

- Role-Based Access Control (RBAC) to ensure appropriate information access

- Granular permission settings to protect sensitive compliance data

- Geographic and jurisdictional data boundaries to ensure data storage and processing

- comply with international privacy regulations

- Comprehensive audit logging for full security compliance

- Enterprise-grade encryption and data protection standards

Nakisa empowers airlines to stay ahead of evolving regulatory demand. With a unified view of their workforce and key information like certifications, training, reporting structures, and compliance metrics, all presented in a clear and intuitive interface, leadership teams can make faster, more informed decisions. In addition to compliance, Nakisa enables airlines to continuously understand and monitor workforce composition, skills, and readiness. Whether preparing for audits, managing risk, tracking organizational health, or planning for future workforce needs, Nakisa provides the visibility, control, and agility airlines need to operate with confidence in a high-stakes, highly regulated environment.

Discover our buyer’s guide with RFP scorecard for selecting org design, workforce planning, and analytics software in the airline industry. With tailored evaluation criteria and practical insights, this guide helps you navigate the decision-making process and identify the tools best suited to your organization’s unique needs.

Challenge 2: Demand volatility and operational flexibility

The airline industry operates in a state of constant change, with passenger demand shifting due to seasons, economic conditions, competitive dynamics, and unexpected global events. This volatility creates significant planning challenges that impact every aspect of workforce management. Unlike many industries where production can be smoothed over time periods, airlines must closely match capacity to demand or risk substantial financial and operational consequences.

Airlines’ workforce needs fluctuate in three main ways:

- Predictable demand cycles such as seasonal peaks (e.g. summer holidays) and shoulder seasons that follow established patterns

- Reactive adjustments triggered by competitive shifts, new route launches, or sudden changes in market conditions

- Disruptive events including weather incidents, health crises, labor strikes, or geopolitical instability that force rapid operational realignments

Predictable seasonal changes

Seasonal fluctuations are the most predictable form of volatility in the airline industry. Many carriers experience dramatic swings between peak summer travel, holiday rushes, and shoulder seasons, where passenger volumes at some destinations may double or halve within weeks. For above-wing personnel, these fluctuations create complex crew deployment challenges. Airlines must ensure that sufficient flight crews are available at each base to operate peak schedules, while avoiding overstaffing during lower-demand periods. The specialized nature of pilot qualifications, tied to specific aircraft types, further complicates this balancing act, as pilots cannot simply be reassigned across fleets without extensive retraining.

Below-wing personnel face different but equally challenging demand patterns. Ground handling requirements fluctuate with flight frequencies, and maintenance operations must adapt to changing aircraft utilization rates. Line maintenance technicians need to be positioned at the right outstations to match flight schedules, while heavy maintenance work requires specialized teams at designated maintenance bases. Each function has its own staffing ratios and regulatory requirements that must be maintained regardless of demand fluctuations.

Reactive adjustments

Beyond seasonal patterns, airlines must respond to short-notice market opportunities and competitive threats. When new routes emerge or competitors exit markets, airlines need the flexibility to rapidly redeploy assets, including human resources, to capitalize on these developments within 12 months. This demands more than just aircraft availability; it requires properly certified flight crews, ground staff, and maintenance personnel. The lead time for training new staff or relocating existing employees becomes a critical factor in how quickly an airline can adapt to changing market conditions.

Disruptive events

Perhaps most challenging are the unforeseen disruptions that periodically impact the industry, ranging from severe weather and natural disasters to political instability, health crises, and dramatic economic shifts. During these periods, airlines must rapidly realign their networks and workforces, and in some cases, temporarily reduce operations.

The financial implications are enormous. Overstaffing during slow periods drives up costs in a margin-sensitive industry, while understaffing during peak periods risks operational failure, poor passenger experience, and regulatory non-compliance. Airlines need robust planning capabilities that support short-term resource reallocation, daily-to-monthly staffing optimization, and real-time coordination across operations, HR, planning, and finance teams to align workforce supply with fluctuating demand across regions and functions.

How Nakisa solves demand volatility and operational workforce planning challenges in the airline industry

Nakisa Operational Workforce Planning provides a centralized, intelligent platform that enables airlines to respond to workforce fluctuations with speed, precision, and compliance.

Airline workforce planners gain full visibility into staffing needs across all operational units, including pilots, cabin crew, mechanics, ground handlers, and station staff. With dynamic monthly or seasonal headcount planning, users can model and adjust staffing levels to align with route schedules, aircraft types, and maintenance cycles. The platform supports subplans by base, fleet, or function, allowing granular control over workforce distribution in compliance with regulatory requirements, crew qualifications, and labor agreements.

Seamless integration with Nakisa Org Chart allows planners to visualize organizational structures by location or role, automatically highlight vacancies, and anticipate future needs as networks expand or contract. Airline-specific constraints, such as aircraft-type pilot qualifications or maintenance certification limits, can be accounted for directly in the planning process to reduce compliance risk and operational inefficiencies.

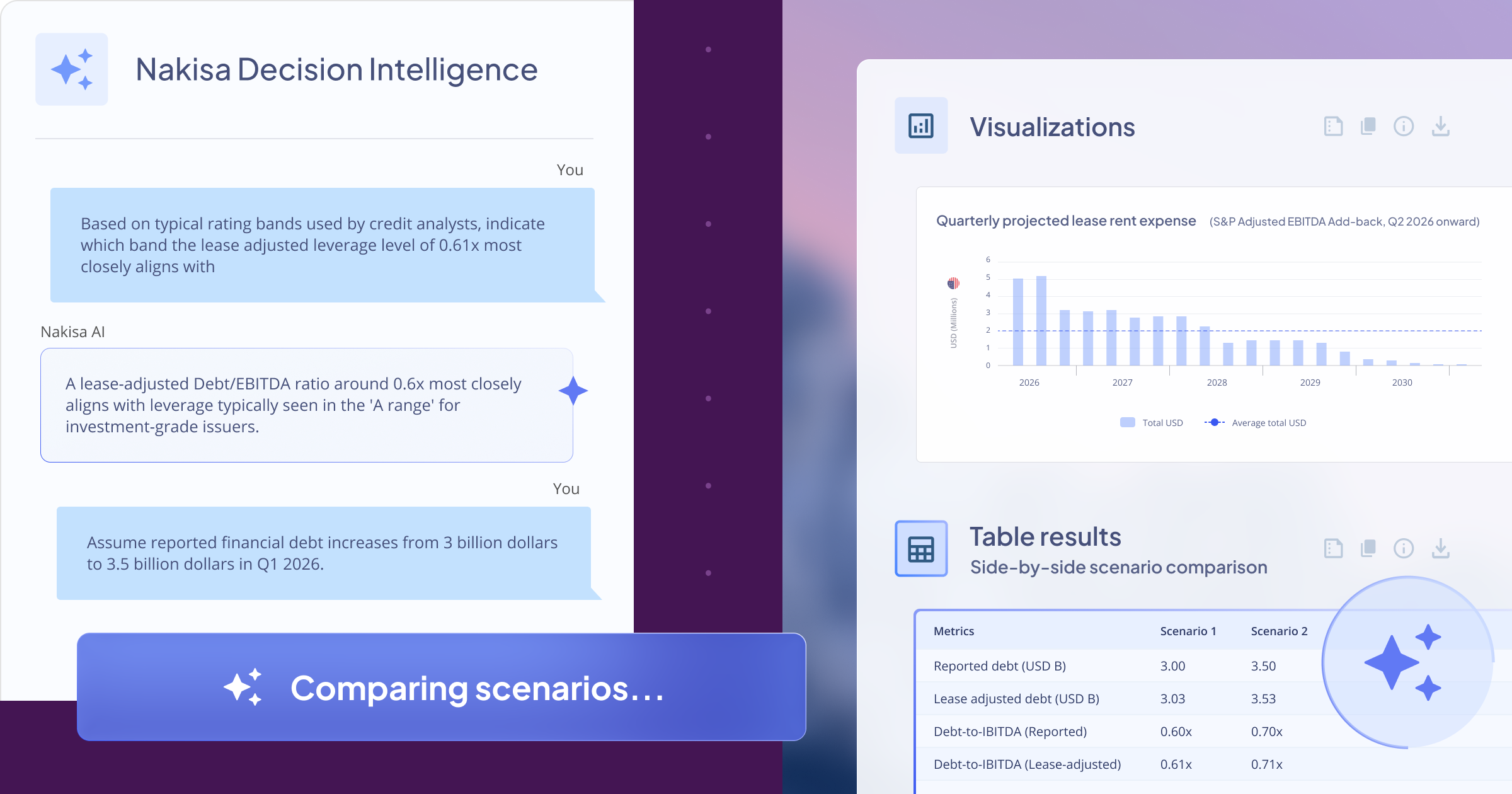

Nakisa’s built-in analytics track staffing trends by region and function, measure actuals against plan, and support data-driven decision-making. The conversational AI assistant simplifies planning by analyzing HR data, suggesting adjustments, tracking stakeholder feedback, and enabling headcount plan creation, all from a single, well-worded prompt. This feature enhances decision-making efficiency while reducing complexity.

The platform promotes collaborative planning across crew scheduling, operations, HR, and finance. Role-based access and configurable workflows ensure adherence to union agreements, bid lines, and other contractual constraints, while maintaining the flexibility to adapt to demand shifts. Automated alerts and status tracking further improve coordination and reduce approval delays.

Bidirectional integration with core HRIS and ERP systems (e.g., SAP HCM, SAP SFSF, Workday, Oracle, PeopleSoft) consolidates workforce data into a real-time, synchronized planning environment. This ensures alignment between operational needs and actual crew availability, qualifications, and budgets.

By adopting Nakisa’s operational workforce planning software, airlines can ensure they have the right crew, in the right place, at the right time, without overspending or compromising safety and service. The solution supports agility in a volatile environment and helps build operational resilience and short-term workforce sustainability.

Challenge 3: Labor shortages and skills gaps in critical roles

The airline industry faces an unprecedented workforce challenge that threatens to constrain growth and compromise operational integrity. Unlike temporary staffing fluctuations, these structural labor shortages in highly specialized roles represent a fundamental threat to long-term sustainability. The issue is particularly severe because training pathways for many critical aviation roles span over years, making rapid workforce expansion virtually impossible.

Key drivers shaping this labor shortage crisis include:

- Pilot production bottlenecks due to retirements and lengthy training timelines

- Maintenance technician shortfalls amid an aging workforce and complex new aircraft systems

- Attrition in ground and service roles caused by working conditions, compensation, and high turnover

- Niche operational expertise that takes years to build and is now at risk of disappearing through retirements, like route-specific knowledge, training on legacy aircraft systems still flying regionally, etc.

- Poor defined skill taxonomy that limits workforce planning and training investment effectiveness

Before we explore how a dedicated solution takes this context into account, let’s take a closer look at these drivers:

For above-wing roles, pilot shortages have reached crisis levels in many regions. A variety of factors have contributed to this situation: a wave of mandatory retirements at age 65, reduced military pilot output that historically fed commercial aviation, and stricter qualification requirements that have lengthened training extending the training timeline and increasing costs. Meanwhile, global carrier expansion, particularly in high-growth markets, has intensified competition for experienced pilots, particularly those rated on high-demand aircraft like the Boeing 737 and Airbus A320.

While flight attendants face shorter training periods, they confront their own recruiting and retention challenges. The demanding nature of the role, with irregular schedules, extended time away from home, and high-stress passenger interactions, has led to higher-than-historical attrition rates. Cultural and language requirements for international operations further narrow the talent pool for certain routes and markets.

Below-wing personnel shortages, though less visible to the public, pose equally critical risks. The global supply of certified aircraft maintenance technicians is dwindling just as aircraft complexity is rising. New generation models like the Boeing 787 and Airbus A350 require specialized training and certification that few technical education pipelines currently provide. Aging workers and lack of incoming talent are creating serious succession gaps.

Ground operations roles present different but equally challenging workforce issues. Baggage handling, aircraft servicing, and passenger services positions often experience high turnover due to physical demands, outdoor working conditions, and compensation limitations. At many airports, particularly in high-cost metropolitan areas, airlines compete with other industries offering more regular schedules and comparable compensation for entry-level positions. This creates persistent staffing challenges at key operational hubs.

Meanwhile, specialized operational roles, such as flight dispatchers, load planners, safety inspectors, and quality assurance specialists, face their own talent pipeline constraints. These positions require deep industry knowledge, often gained through years of experience in other aviation roles. As experienced personnel retire, there is limited bench strength ready to replace them.

One persistent obstacle in effectively addressing labor shortages is the lack of a well-defined skill taxonomy. As aviation roles evolve with technology and regulations, and as many experienced workers near retirement, without a structured skill taxonomy, airlines struggle to accurately assess skill gaps across their workforce, forecast future needs, and build strategic training pipelines. This lack of clarity hinders workforce forecasting, succession planning, and internal mobility, just when agility is most needed.

The financial implications of these shortages and lack of taxonomy are severe. Labor costs represent a substantial portion of an airline's operating expenses, and shortages escalate compensation as carriers compete for limited talent. Training costs increase as airlines are forced to develop more of their own talent rather than hiring experienced personnel. Most concerning from a strategic perspective is the potential constraint on growth and network development. Airlines may find themselves unable to deploy aircraft or launch routes not because of insufficient demand or capital, but simply because they cannot staff the operation.

How Nakisa addresses strategic workforce planning challenges in the airline industry

As seen above, facing these mid- to long-term structural challenges, global airlines need a solution that can:

- Conduct a detailed current state assessment using the 5C framework, particularly for critical operational and long-training roles like pilots and specialized maintenance technicians

- Define and incorporate key future state drivers (supply, market, demand) across multiple timelines to anticipate labor shortages, training needs, and market fluctuations

- Do a gap analysis of current vs. future state to pinpoint critical talent shortages and identify where internal development is needed

- Create, compare and select scenarios based on various talent acquisition strategies, that balance workforce capacity across bases, fleets, and routes to prevent bottlenecks and align workforce planning with strategic business initiatives like fleet modernization and network expansion

- Create, compare and select scenarios based on various talent acquisition strategies, that balance workforce capacity across bases, fleets, and routes to prevent bottlenecks and align workforce planning with strategic business initiatives like fleet modernization and network expansion

These are the very challenges Nakisa’s strategic workforce planning software is built to solve. Rather than relying on reactive measures, airlines can take a data-driven, forward-looking approach to workforce planning. Nakisa equips teams to understand their current workforce in context, model future needs across time horizons, and build sustainable strategies to close gaps while maintaining safety, compliance, and passenger service levels.

At core of this strategic approach is Nakisa’s support for structured skill taxonomies. By establishing a clear, standardized framework of skills across all roles, both above-wing and below-wing, airlines can identify critical gaps more precisely and align workforce planning with actual operational needs. The taxonomy enables granular workforce segmentation, supports role-based forecasting, and facilitates the creation of targeted training and upskilling paths. It also enhances internal mobility by making skill equivalencies visible across functions and bases, allowing airlines to redeploy talent more intelligently.

Nakisa Strategic Workforce Planning provides a powerful, flexible tool to address a variety of workforce planning needs across multiple timeframes and organizational requirements. Whether building workforce strategies by legal entity, business unit, job family, or region, the platform provides AI-powered, data-driven tools to align talent supply with operational needs.

Nakisa provides a comprehensive assessment of the current state using the 5C framework, Capacity, Cost, Capabilities, Composition, and Configuration. By consolidating workforce data from ERPs, HRISs, and other systems, the platform enables organizations to analyze their workforce across these five key dimensions:

These are the very challenges Nakisa’s strategic workforce planning software is built to solve. Rather than relying on reactive measures, airlines can take a data-driven, forward-looking approach to workforce planning. Nakisa equips teams to understand their current workforce in context, model future needs across time horizons, and build sustainable strategies to close gaps while maintaining safety, compliance, and passenger service levels.

At core of this strategic approach is Nakisa’s support for structured skill taxonomies. By establishing a clear, standardized framework of skills across all roles, both above-wing and below-wing, airlines can identify critical gaps more precisely and align workforce planning with actual operational needs. The taxonomy enables granular workforce segmentation, supports role-based forecasting, and facilitates the creation of targeted training and upskilling paths. It also enhances internal mobility by making skill equivalencies visible across functions and bases, allowing airlines to redeploy talent more intelligently.

Nakisa Strategic Workforce Planning provides a powerful, flexible tool to address a variety of workforce planning needs across multiple timeframes and organizational requirements. Whether building workforce strategies by legal entity, business unit, job family, or region, the platform provides AI-powered, data-driven tools to align talent supply with operational needs.

Nakisa provides a comprehensive assessment of the current state using the 5C framework, Capacity, Cost, Capabilities, Composition, and Configuration. By consolidating workforce data from ERPs, HRISs, and other systems, the platform enables organizations to analyze their workforce across these five key dimensions:

- Capacity analysis allows airlines to see whether they have enough personnel in the right roles, locations, and training stages to meet current and near-future operational demands. For example, planners can assess upcoming pilot retirements against simulator capacity to identify potential training bottlenecks that could delay readiness for seasonal demand spikes or new route launches.

- Cost visibility enables finance and HR teams to gain a clear and accurate overview of the airline’s current workforce-related expenses, including salaries, benefits, training, and other compensation costs. By understanding these current and contractually committed expenditures, airlines can ensure effective budget management and maintain alignment with union agreements or ongoing restructuring initiatives.

- Capabilities assessment links job roles to a standardized skill taxonomy, enabling planners to identify critical technical or regulatory qualifications currently present or missing within the workforce. For example, as new aircraft types enter the fleet, this assessment can reveal gaps in maintenance technician certifications, helping understand immediate upskilling needs and compliance risks.

- Composition analysis provides insight into the current makeup of the workforce, including tenure distribution, diversity indicators, role mix, and internal mobility trends. By examining these factors, Airlines can identify areas with potential succession risks, such as bases that rely too heavily on nearing-retirement pilots or departments with limited opportunities for internal promotion.

- Configuration refers to the current organizational structure, including legal entities, operating units, job families, and geographic deployment. By analyzing workforce distribution across hubs, aircraft bases, and maintenance facilities, airlines can identify inefficiencies or imbalances. For instance, leadership can observe that a high attrition region lacks sufficient junior pilot inflow, promoting consideration of adjustments in recruitment, base assignments, or incentives.

Nakisa’s strategic workforce planning software enables efficient assessment of your organization’s current resource state.

Nakisa supports future state workforce analysis by leveraging AI-driven modeling and predictive analytics to forecast supply, market, and demand drivers. The platform consolidates data from multiple sources and enables planners to incorporate both automated insights and manual inputs for a comprehensive outlook. Common drivers include:

Supply drivers

- Pilot retirement rates and age distribution

- Technician attrition and internal mobility

- Internal training pipeline throughput and delays

Market drivers

- Labor availability in expansion region

- Competitor hiring activity and wage inflation

- Regulatory changes affecting licensing or certification needs

Demand drivers

- Planned fleet growth and aircraft type changes, such as shifts between wide-body and narrow-body aircraft, which require different pilot certifications and crew ratios

- New base openings or international route launches

- Long-term operational shifts, like insourcing vs. outsourcing

Nakisa’s dynamic gap analysis compares 5C workforce metrics with future workforce targets, enabling airlines to pinpoint misalignments that could impact operations or growth. For example, the system can identify projected shortages in type-rated pilots for specific aircraft families, upcoming gaps in certified aircraft maintenance engineers, or staffing discrepancies at high-growth bases. It also highlights areas such as underrepresentation of multilingual cabin crew on international routes, succession planning gaps for operational leadership roles, and missing technical competencies in emerging fields such as digital flight operations, predictive maintenance, or fuel efficiency optimization. These insights are presented in intuitive dashboards, both tabular and graphical, allowing for clear, side-by-side year-over-year comparisons within the selected time horizon. With this clarity, airlines can act early to secure talent pipelines, proactively address talent gaps, and support uninterrupted execution of strategic initiatives.

Nakisa supports scenario planning to close the supply/demand gap through the 6B Strategy framework, Buy, Build, Bot, Borrow, Bind, and Bounce, enabling airlines to evaluate and compare a range of talent strategies and their associated trade-offs. The scenarios include:

- Buy talent by recruiting professionals (e.g., hire experienced captains in a competitive market)

- Build internal capabilities through targeted training and development programs (e.g., train next-gen maintenance technicians)

- Bot certain repetitive planning tasks using automation

- Borrow talent via partnerships, contractors, or outsourcing

- Bind critical staff with retention incentives and engagement initiatives

- Bounce underperforming or redundant roles to optimize workforce effectiveness

By modeling and comparing the impact of these scenarios, the platform helps airlines select the best possible scenario to balance cost, capacity, and capabilities while staying aligned with operational goals, regulatory constraints, and long-term workforce sustainability.

Nakisa’s strategic workforce planning software enables easy scenario creation to explore and apply the right 6B strategies for closing workforce gaps.

Ultimately, with Nakisa, airlines gain a structured, practical approach to long-term workforce planning. The platform continuously monitors workforce supply and demand helping organizations detect gaps early, before they impact operations, and align staffing strategies with evolving business and regulatory needs. It brings consistency and transparency to workforce decisions, making planning more efficient and responsive to change.

Challenge 4: Ongoing organizational changes

The airline industry evolves regularly, and organizational structures rarely stay the same. Airlines must adapt rapidly to stay competitive, respond to market shifts, comply with regulatory changes, and capitalize on growth opportunities. From new fleet introductions to network expansions, no part of an airline’s organization remains static for long. But while change is constant, managing it is challenging, not only because of resource allocation, but also because simulating different scenarios, analyzing their impact, selecting the best scenario, and reflecting these changes on the org chart, is a complex process.

Airline organizational design is shaped by two distinct categories of drivers:

Strategic organizational design drivers (large-scale transformations):

- Fleet transitions (e.g., introducing new aircraft families, phasing out older models): Few transformations disrupt airline org structures more than fleet changes. By 2027, 58% of the global fleet will consist of newer aircraft. Above-wing, new aircraft families come with new type ratings, training pipelines, check airmen hierarchies, and crew pairing complexities. Below-wing, maintenance teams must shift from supporting legacy airframes to managing new materials, systems, and technical workflows, often requiring re-certification and team restructuring. HR leaders must re-architect entire job families, adjust labor models, and plan for overlapping competencies during the transition phase, where old and new fleets coexist. Coordinating these transitions while maintaining operational continuity is a core org design challenge.

- Mergers and acquisitions: When airlines merge, the entire operating model changes. Above-wing functions like flight operations and in-flight services often have deeply entrenched SOPs, reporting structures, and cultures. Below-wing, MRO departments may follow entirely different inspection regimes or tooling systems. Org design becomes the mechanism for unifying these disparate structures, balancing legacy practices with the future-state vision. Harmonizing job roles, spans of control, and performance standards while integrating leadership layers across regions is complex work that spans HR, safety, and operations.

- Shifts in business model (e.g., from full-service to low-cost or hybrid): Moving from a full-service model to low-cost, or hybrid operations affects organizational design from the ground up. Above-wing, this might mean reducing or altering service roles, changing cabin crew staffing ratios, or centralizing scheduling. Below-wing, a leaner operational model could require new vendor relationships or more outsourced maintenance. This shift pushes HR and operational leaders to evaluate which functions stay in-house, which can be outsourced or consolidated, and how to align cost structures with new value propositions, all without compromising safety or service reliability.

- Geographic expansion into new markets: Whether entering new countries or opening additional hubs, geographic expansion introduces new regulatory requirements, labor considerations, and local leadership needs (for example, certain countries require a percentage of leadership or management to be local). Above-wing, international crew operations require more complex rostering and qualifications tracking. Below-wing, ground handling and line maintenance functions may need to be built from scratch or integrated with third-party providers. Org design must account for decentralized operations, multilingual and multicultural management structures, and variable workforce availability, all while replicating brand standards and operational consistency.

- Major route network restructurings (e.g., hub changes or international growth): Strategic changes to the route network ripple through the org chart. Above-wing, adjustments in frequencies and fleet allocations lead to shifts in base staffing, supervisory roles, and training volumes. Below-wing, ramp operations, baggage handling, and overnight maintenance routines may require resizing or complete reorganization. Network realignments often expose mismatches between workforce structure and demand, which makes organizational design essential for rebalancing oversight, improving cost-efficiency, and sustaining performance across new patterns of operation.

Operational organizational design drivers (manager-driven smaller-scale changes):

- Adjusting team structures to match workload fluctuations: Above-wing, daily changes in flight volumes or irregular operations can quickly lead to cabin crew shortages or overstaffing. Below-wing, ramp and maintenance teams face similar fluctuations depending on schedule changes, weather disruptions, or unplanned maintenance events. Managers on the ground are best positioned to spot these shifts and reorganize teams in real time. But without intuitive tools, they often rely on HR or manual workarounds. Giving them the ability to make structural adjustments, like redistributing team members or reshaping shift coverage, helps ensure the operation stays nimble and cost-effective.

- Opening or resizing crew or maintenance bases: Base adjustments are often driven by seasonal schedules, network changes, or temporary fleet shifts. Above-wing, this may involve moving cabin crew or pilots between locations based on route frequency. Below-wing, a new line maintenance site may need to be stood up with a lean team, only to scale down after a few months. Managers need to be able to design base structures on the fly, test staffing models, and update supervisory coverage without escalating every change to corporate HR. When base management is locally driven, it allows for faster ramp-up and better resource alignment.

- Reallocating spans of control to improve oversight and efficiency: Supervisory effectiveness is directly tied to how teams are structured. Too few direct reports wastes leadership capacity; too many, and oversight suffers. Above-wing, inflight and training supervisors need balanced teams to ensure coaching and safety compliance. Below-wing, maintenance leads must be able to review work, sign off on tasks, and escalate issues efficiently. Line managers are often the first to recognize when spans of control are off-balance but lack the autonomy to fix them. Giving them the ability to suggest changes or adjustments to the reporting structures within their area of responsibility leads to faster improvements in accountability, oversight, and performance.

- Addressing compliance risks or performance gaps flagged by audits or KPIs: When audits flag recurring issues, like training delays, safety incidents, or missed signoffs, the answer often lies in the org structure. Maybe QA oversight is too thin, or roles are unclear. Line managers are closest to the root cause, whether it’s in the cockpit, cabin, or hangar. By giving them the power to make targeted structural fixes, adding a dedicated QA role, reshaping reporting lines, or clarifying responsibilities, airlines can respond to risks much faster, without routing everything through HR.

Taken together, both strategic and operational organizational design changes are essential to keeping airlines agile and competitive. Strategic transformations like fleet transitions or business model shifts reshape the entire structure of an airline and require deep, coordinated planning across departments. At the same time, operational adjustments led by frontline managers allow for day-to-day responsiveness, keeping teams aligned with shifting workloads, compliance requirements, and service expectations.

The challenge for HR and operational leaders lies in managing both ends of this spectrum. Traditional tools and processes are often too rigid or siloed to support this dual need. Strategic changes demand advanced modeling and scenario testing, while operational updates require fast, localized action without excessive administrative overhead. In a highly regulated, safety-critical industry like airlines, even small misalignments in structure can lead to compliance risks, inefficiencies, or service disruptions. In the next section, we’ll explore how an enterprise-grade org design solution like Nakisa can address both strategic and operational challenges simultaneously.

How Nakisa addresses operational and strategic org design challenges in the airline industry

Nakisa supports both strategic org design (for large-scale projects, led by OD teams) and operational org design (for smaller readjustments and day-to-day staffing optimizations, led by line managers and HRBPs).

Strategic org design

Nakisa Strategic Org Design empowers airline leaders and org design professionals with top-down organizational planning tools, enabling data-driven decisions during complex structural changes. Whether it’s reorganizing the entire organization, restructuring specific departments, managing M&A activities, handling divestitures, or launching new divisions, Nakisa provides the purpose-built capabilities to model, analyze, and implement changes with ease and confidence. Its intuitive UI ensures easy and fast adoption by in-house OD teams.

The platform’s advanced scenario modeling enables unlimited what-if scenario iterations. Users can set headcount and structure targets upfront and track alignment with organizational goals. This includes quantitative targets, such as reducing headcount by a certain percentage or adjusting span of control, or qualitative objectives, like enhancing DEI, complying with local regulations, or streamlining workforce structures. For example, during a fleet transition, an airline might reduce headcount in one unit while increasing crew leadership roles in newly opened bases. Real-time analytics show how each scenario impacts those goals, enabling precise decision-making.

You can safely and quickly create what-if scenarios in a sandbox environment to model changes in your organization’s structure and workforce without affecting the current arrangement.

Nakisa’s strategic org design software allows for custom tagging, target setting, and KPI before and after comparisons when modeling sandbox scenarios.

Unlike other vendors, Nakisa imposes no limits on the number of employee records used in org design activities. Users can upload all data at once for a comprehensive view, and scenario comparisons, eliminating inefficiencies caused by smaller batch uploads.

The platform makes it simple to create, edit, move, delimit, or delete positions and employees, including reporting lines (double-dotted or dotted lines). Bulk actions and automation save time and streamline processes by allowing users to edit, move, normalize, and compare records in bulk. This is extremely useful for applying bulk updates to crew bases, MRO units, or airports during large transitions. These changes are automatically logged, with change reports summarizing all updates within each scenario.

In Nakisa’s org design software, all changes are logged in comprehensive change reports, can be tracked and undone before being sent out for approval.

Nakisa’s side-by-side comparison feature is especially valued by airline clients. It helps visualize differences between scenarios and their potential impact. Airlines frequently use this to compare current org charts against future-state models when evaluating the organizational impact of route network changes, or to contrast central vs. regionalized station management structures. Users can compare KPIs across scenarios and use drag-and-drop functionality to reconfigure departments and divisions, making modeling more intuitive and efficient across global operations.

In Nakisa’s org design software, all changes are logged in comprehensive change reports, can be tracked and undone before being sent out for approval.

For large-scale transformation initiatives, Nakisa enables work to be broken down into smaller work areas and designated owners. For instance, during a merger or alliance restructuring, this allows responsibilities to be assigned by region or function (e.g., flight operations, engineering, in-flight services), improving project management. Built-in collaboration tools like chat and approval workflows ensure all stakeholders are aligned. The proposed org charts can also be exported as an editable PowerPoint for offline collaboration with stakeholders.

With native bidirectional integration to leading systems like SAP HCM, SAP SFSF, Workday, Oracle Fusion, Oracle EBS, and PeopleSoft, along with a robust API framework, Nakisa ensures access to real-time, up-to-date data for organizational modeling. This is particularly critical for airlines, where frequent changes like crew movements, base openings, or seasonal restructurings require real-time accuracy. Effectively, this enables users to focus on designing, validating, and approving new org plans while Nakisa handles the data updates across their systems.

Critical functions such as data synchronization, error detection, reporting, and writebacks are all supported and accelerated through automation. The sync process check detects any changes or conflicts between the scenario and source data, a critical step in ensuring that organizations have the right information underpinning their designs. Additionally, a powerful scenario validation feature allows users to apply predefined validation rules to ensure the scenario aligns with the business logic of the source data, flagging violations like missing parent nodes for review. This eliminates the risk of human error and streamlines implementation, ensuring new structures are accurately executed.

Finally, Nakisa’s comprehensive user control and role-based access ensure that users can access only the data they need based on their roles and permissions. Whether you’re a manager, administrator, or collaborator, the software allows for granular control over who can view, edit, or share specific objects within the org chart. This is essential in airline org design projects where sensitive information like RIF plans, new base launches, or leadership reshuffles must be carefully managed and shared only with relevant stakeholders. This helps streamline collaboration while ensuring that sensitive or restricted information is safeguarded and accessible only to authorized individuals.

Operational org design

Nakisa Operational Org Design provides a market-first framework that enables airlines to swiftly adjust team structures, redistribute workloads, and redefine spans of control to align with business goals. HRBPs and line managers can leverage what-if scenario modeling to simulate and visualize potential changes, assessing their impact on spans of control, labor costs, DEI, and other key workforce metrics. For example, when a new international route is launched, line managers can model team adjustments in flight operations or crew planning without waiting for centralized HR intervention.

Once the desired changes are identified, the solution’s collaborative proposal management allows line managers and HRBPs to create staffing proposals and share them with collaborators and approvers (such as leadership, compliance officers, risk managers, and other key stakeholders) for real-time feedback. This means a base manager opening a new outstation in a remote city can propose a custom org setup with appropriate coverage and reporting chains and get leadership input instantly.

Nakisa’s org design software enables collaboration with multiple stakeholders in real time.

Structured approval workflows ensure alignment with airline strategy, budget constraints, and regulatory requirements, while built-in audit trails provide transparency for regulatory reporting. Nakisa enhances decision-making with AI-powered insights, summarizing discussions, tracking proposed changes, and suggesting responses to streamline collaboration. Seamless bidirectional ERP and HCM integration (SAP HCM, SAP SFSF, Workday, Oracle, PeopleSoft) ensures that approved changes are automatically synchronized across systems, eliminating manual errors and accelerating execution. This becomes especially valuable when managing frequent readjustments and changes across unionized, safety-critical departments where delays or inconsistencies can lead to operational or compliance risks.

For above-wing functions, short- and mid-term workforce planning often requires adapting the organizational structure of flight operations to handle upcoming shifts, whether that’s opening new crew bases, transitioning to different aircraft types, or scaling pilot training programs. Nakisa enables flight ops planners to test and refine organizational models before rollout. They can simulate different leadership structures, evaluate span of control across training and supervisory roles, and understand how changes will affect check airman availability, onboarding timelines, or reporting chains. This allows small but impactful adjustments, like creating regional lead roles or redistributing administrative tasks, to be implemented in a way that supports growth without overwhelming HR.

For below-wing operations, the focus is often on realigning maintenance, ground handling, and airport operations teams to meet projected demand or integrate new capabilities. Nakisa helps planners design team structures that reflect both regulatory requirements and operational realities like rebalancing shift supervisors across high-volume stations. It supports decisions like adding intermediate leads at busy outstations, adjusting technician-to-lead ratios, or modifying reporting flows for better issue escalation. These org design moves may seem tactical, but they reduce friction, improve accountability, and help operations scale without requiring constant hands-on support from corporate HR.

With Nakisa Operational Org Design, airlines gain the agility to make informed, structural adjustments right where they’re needed, on the ground and in the air. By empowering local teams with intuitive tools and governance, the solution helps ensure organizational changes are timely, compliant, and aligned with both operational realities and strategic goals.

Conclusion: empowering airlines with AI-driven org design, workforce planning, and analytics software

As this guide has illustrated, airlines operate in one of the most complex and ever-changing environments. To remain competitive, they must be agile and forward-thinking, managing large, distributed teams while maintaining operational efficiency, controlling costs, , and ensuring compliance with stringent regulatory standards. Balancing these demands with broader strategic objectives is a challenge even for the most experienced teams.

This is where Nakisa Workforce Planning Portfolio delivers transformative value It provides an end-to-end, enterprise-grade solution that unifies org chart visualization and analytics, strategic and operational org design, and strategic and operational workforce planning. The platform empowers HRBPs, org design professionals, executives, and managers to collaborate seamlessly and address today and tomorrow’s workforce challenges, driving meaningful organizational transformation and ensuring to have the right people, at the right time, at the right place.

With Nakisa’s cloud-native, AI-powered solutions, airlines can centralize and streamline critical functions, from real-time visualization and analysis of complex organizational structures to forecasting future talent needs and building agile org models. The platform delivers real-time, actionable insights into org structure, labor costs, and talent trends and needs, while automated workflows and enhanced collaboration tools enable proactive planning for growth and swift adaptation to changing market conditions. The result is enhanced agility, optimized costs, and a sustainable competitive edge across global operations.

Discover how Nakisa, backed by decades of experience with Fortune 1000 companies, can benefit your organization. We invite you to experience a personalized demo of our software and see why leading airlines rely on Nakisa to navigate the challenges and opportunities of modern aviation.