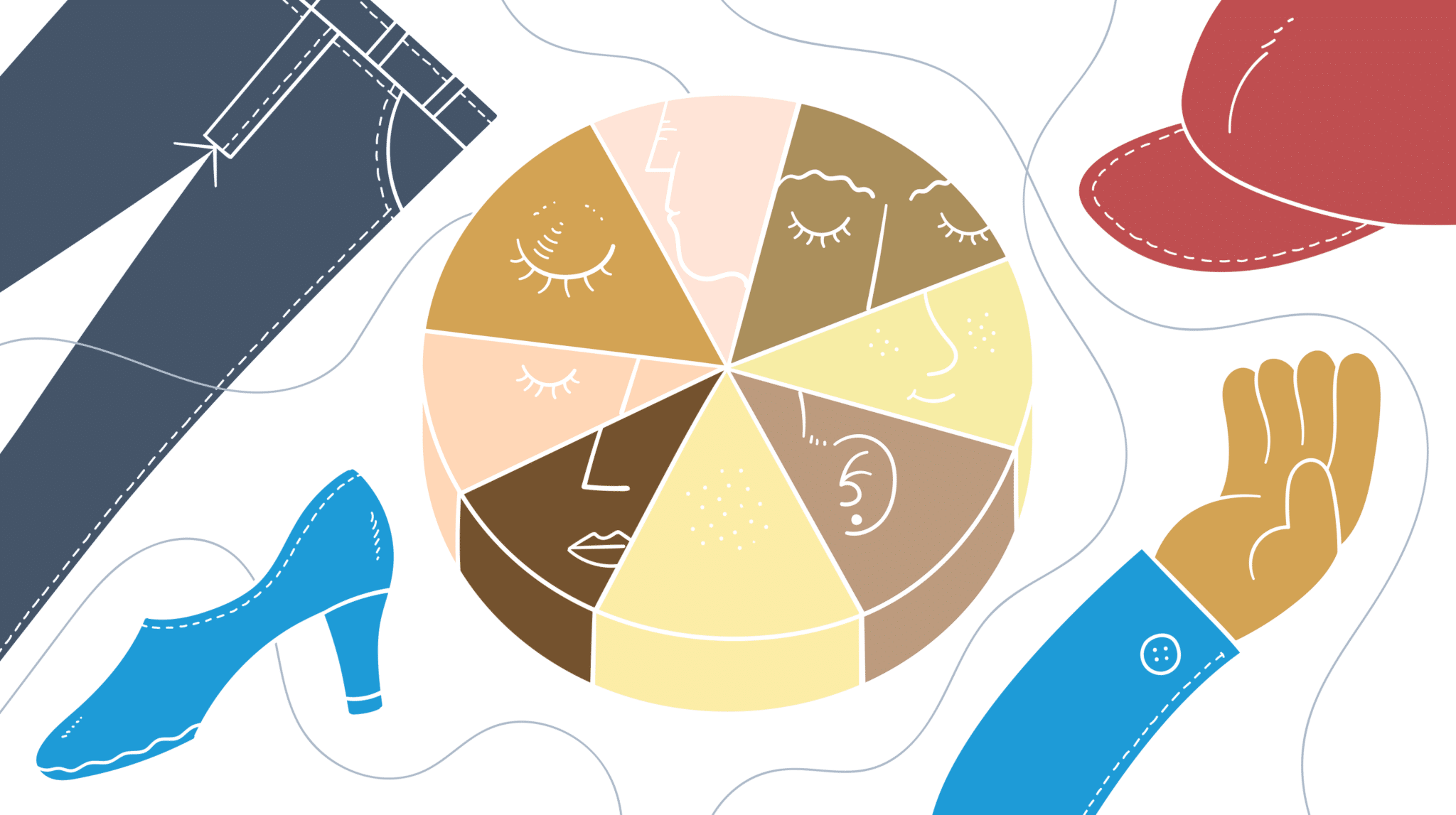

What public companies need to know about the SEC’s new human capital disclosure requirement

We’ll discuss the new U.S. Securities and Exchange Commission (SEC) rules requiring public companies to disclose details about their human capital management practices, metrics, and workforce contributions to long-term value creation.