From the pandemic in 2020 to geopolitical and economic shocks in 2022, the global economy continues to shift. Economists throughout the world expect a potential recession, debating only when it will start, how long it will last, and what magnitude it will have.

Commercial real estate is not isolated from the world economy and global events. As Covid-19 showed us, even the strongest players get affected by global perturbations. In 2020, Nike’s sales fell 4% due to the pandemic, which shows us that even leaders need to take into consideration market dynamics and adjust their strategy fast.

We created this article to help you better understand the commercial real estate outlook in 2024 and the upcoming years. We invite you to think with us about trends that shape the industry, how to overcome challenges and seize new opportunities by examining vivid examples from different companies and brands. We’ve read and compared a lot of commercial real estate reports and surveys and added our in-field experience based on collaboration with the biggest retailers in the world to this post.

All commercial real estate professionals – those who work at Nakisa, who are Nakisa’s clients and who created CRE trends reports and surveys – confirm that the following trends are shaping the commercial real estate market right now.

CRE Trend #1: Changing Market Dynamics and its Challenges

In 2024, post-pandemic challenges, labor shortages, inflation, energy crisis, and disruptions in the supply chains hit the industry again. Global market instability is the primary factor that sets the context for commercial real estate in 2024.

In an unpredictable market, commercial real estate stakeholders are cautious and carefully navigate a period of price discovery. According to PwC’s interviewees, lenders have been imposing stricter borrowing requirements with increased financing costs. This creates obstacles for companies in raising capital and advancing their projects. As a result, competition for deals has decreased during price discovery, as some real estate assets come under pressure. Meanwhile, Colliers's report of 2023 states that distress will emerge in all asset classes.

Businesses are choosing different strategies for handling market uncertainty. Some of them downsize significantly their real estate footprint. For example, Meta decides to sublease their offices in Seattle and Bellevue instead of using them. Microsoft also announces that they won’t renew the lease after June 2024 for their office in Bellevue and they turn to remote work instead. Some companies even decide to leave specific markets, like Nordstrom which leaves Canada even though their Vancouver store was estimated as the best-performing store worldwide.

Other companies are seeking to seize opportunities. For example, Psycho Bunny enters the Canadian market in 2023, after amazing growth amidst the pandemic when it tripled its business and opened 20 stores across the USA. Uniqlo is set to grow with the plan to open 20-30 new stores in North America each year until 2027. The North Face also is planning to open more than 70 stores in North America and add up to 300 retail and partner locations in the next five years.

What would be the best real estate strategy for your company? Pause and wait, downsize, or expand? To answer these questions, you need to keep a close eye on market fluctuations and make business decisions based on the data from your stores and offices.

What we can say for sure is that it’s high time for transformations. Big and small businesses need to adjust their strategy to new challenges and view the real estate profile as a crucial component of the strategy. During this unstable period, companies need to search for new out-of-the-box solutions. Smart real estate management can ensure the needed resilience and cost optimization.

It’s crucial to learn from previous crises and recessions. When Covid-19 hit, companies that managed to rethink their real estate strategy and apply quickly new approaches could benefit from new opportunities and stay ahead of the curve of global transformations. Restaurants were adding cloud kitchens or ghost kitchens and food delivery services, retail was moving to online shopping and office workers switched to remote in order to face the change. Even after the pandemic, these trends continue to shape the future of the industries.

CRE Trend #2: New Customer Behavior in Retail

Retail bounces back after Covid-19, but it has greatly transformed. Now it is adapting to changing consumer buying habits and an evolving work landscape.

Here are some of the retail trends in 2024:

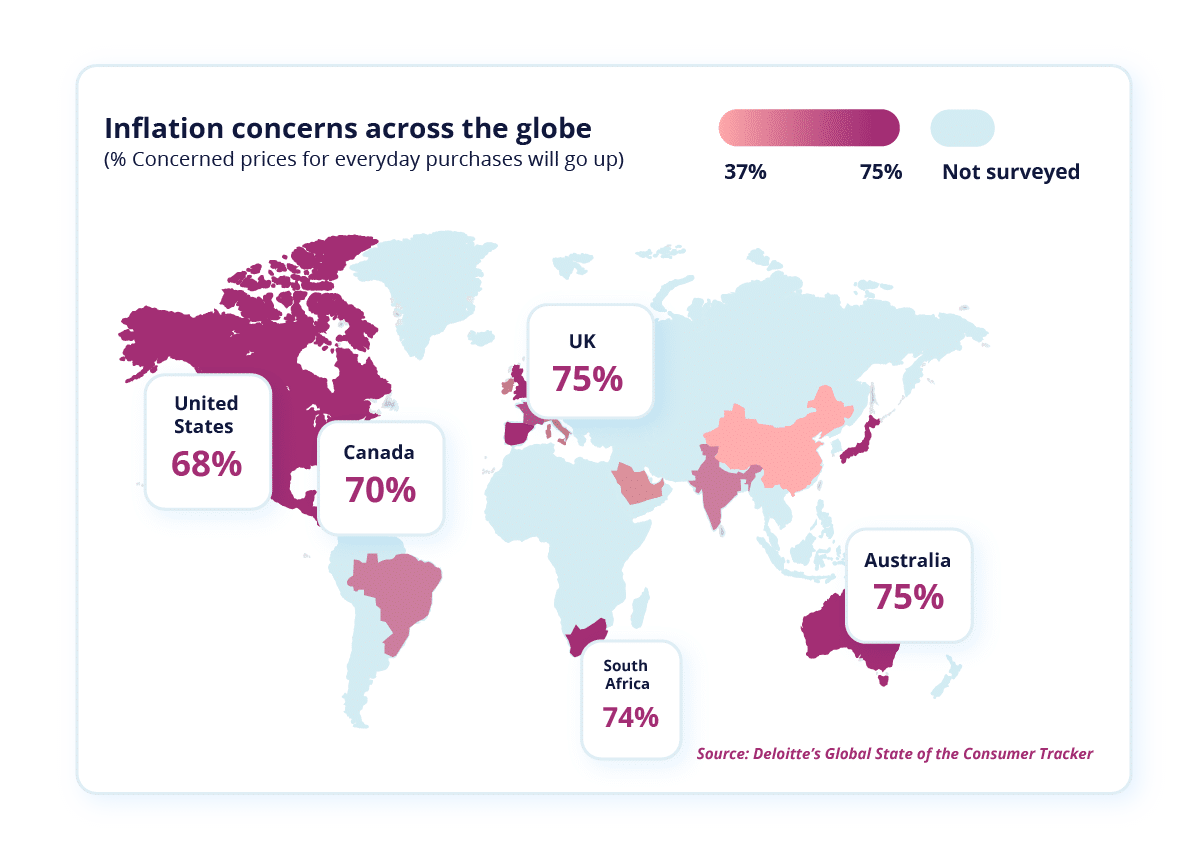

- According to Deloitte, consumers all over the world are preoccupied with inflation. Customers will be cautious while choosing where to spend money. It means that global retail sales will be unpredictable in the second half of 2024.

- The average lease size of shops is expected to decline because of rising interest rates, disrupted supply chains, and online channels of distribution. Retailers look to shrink footprints, putting emphasis on the quality of the space while ensuring their bottom line is not greatly affected. Business Insider states that more than 2,100 stores are closing across the US in 2023. Foot Locker is one of them, the company announced the closing of around 400 mall stores in North America by 2026. The company mentions that they want to change the concept of their stores and may open new-concept locations — including play-focused outlets. And this shows us another retail trend in 2024: transition from old-format to new-concept stores.

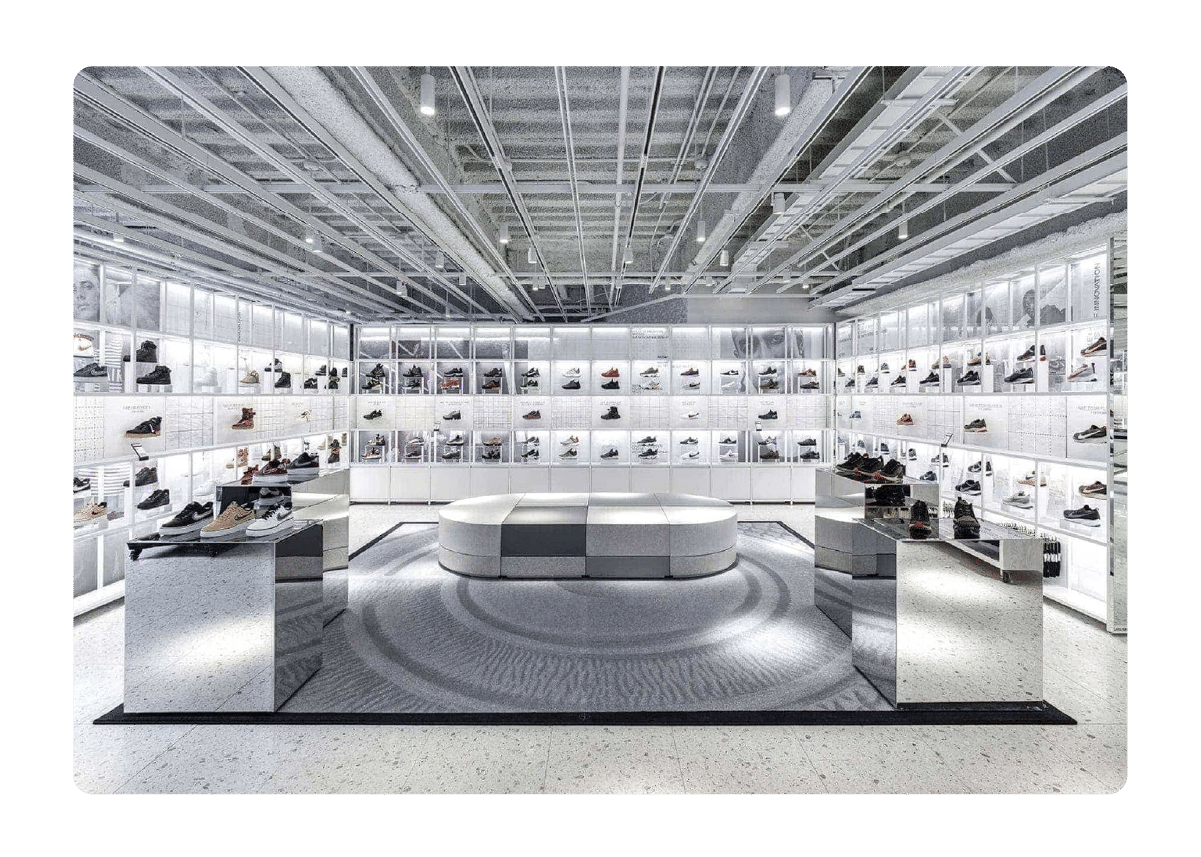

- Brick-and-mortar stores and malls redefine their format and look for new ways of attracting people. Retailers are shifting their focus from merely selling products to creating immersive and engaging experiences for consumers. This includes interactive store layouts, pop-up shops, entertainment events, photo zones, and augmented reality/virtual reality experiences that enhance customer engagement and foster brand loyalty. One of the numerous examples is the Nike House of Innovation in NYC and Paris. It's no longer just a store, it’s a Nike museum and an interactive playground where visitors can discover the history of the brand, exercise, learn more about healthy lifestyles, and create a customized pair of shoes by choosing colors and features they like.

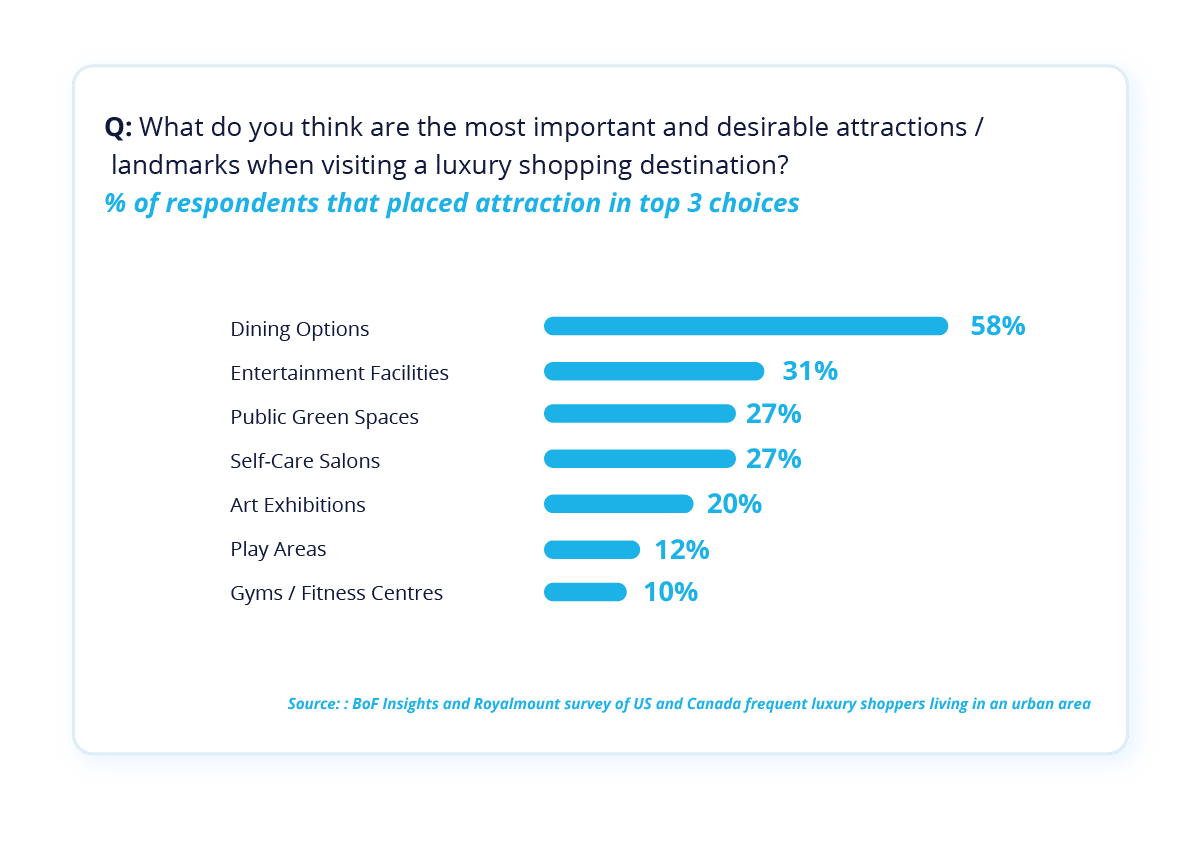

Luxury retail is pushing the boundaries of store formats with even more experimentation. The Business of Fashion (BoF) has an interesting survey on Evolving Art of Luxury Experimental Retail where they speak about adapting new activities for luxury stores to let people stay longer in their stores and deepen their connection with the brand thanks to surprising and inspiring experiences. For example, Le Bon Marché supports art exhibitions and regularly hosts concerts, readings, and other activities. The Business of Fashion also shows that adding dining options, entertainment facilities, and public green spaces are the top 3 attractions for shoppers:

- E-commerce is here to stay. Online shopping has changed customer behavior. Even with brick-and-mortar stores open, retailers need to rethink their shopping journey and harmonize their online and offline strategies. Buy Online Pick Up in Store (BOPIS) option is one of the ways to find the balance between online and offline and attract more foot traffic to brick-and-mortar stores. GAP, Nordstrom, Lululemon, The Bay, Home Depot, and so many other stores offer the BOPIS option to team up their offline and online channels. According to the Business of Fashion, luxury retailers can consider even bigger immersion to digitalization and technologies by providing AI tools to choose the right cosmetics or clothing for the client or offering new in-store tools for a unique customer experience. Another way to surprise clients with new technologies is to offer virtual try-on for clothing. Certainly, retailers need to rethink their balance of stores, warehouses, pick-up, return, or delivery centers to master omnichannel distribution. They also need real estate professionals to gather data about the various types of premises they have and find a balance to elaborate the best strategy for business growth.

- Downtown or neighborhoods dilemma. While some experts say that downtown regains its role as a life-work-play epicenter, not all retailers think this way. We do see some reopening of downtown stores such as the iconic Century 21 opening in New York downtown. However, many experts state that downtown malls lack foot traffic and need to have entertaining events or change their concept to attract more people. Many classic stores choose neighborhoods over downtown malls to be closer to people who work remotely. One of the examples of choosing the neighborhoods is Bath & Body which closes 50 mall stores in 2023 but promises to open about 90 off-mall stores in the future. Nike in Seattle also closes their downtown store, while Starbucks closes its 16 downtown stores in Los Angles, Seattle, Portland, Oregon, and Philadelphia due to security reasons. There is a snowballing effect on downtown traffic: the more stores leave downtown; the fewer reasons customers have to come there. Bloomberg states that because of remote and hybrid work, Manhattan loses more than $12 billion a year which could have been spent on meals, entertainment, and shopping near office centers.

“Downtown is a mixed bag. There’s some recovery going on — and there’s some folding up and going away going on as well.” - says Jeffrey Rosen, a commercial real estate broker at Seattle Pacific Realty specializing in retail.

While brands are leaving downtown, the interest in neighborhood shopping centers is constantly growing. Neighborhood and community shopping centers are ranked as respondents’ top investment recommendation among commercial and multifamily subsectors for 2024.

These trends reflect the evolving consumer preferences and the industry's response to meet their demands for convenience, personalization, sustainability, and immersive experiences. Retailers that successfully embrace these trends are likely to thrive and remain competitive in the dynamic retail landscape of 2024.

CRE Trend #3: Smaller but Better Offices in Corporate Real Estate

The return to the office brings new considerations for businesses. While some companies may opt for remote work arrangements, others recognize the value of physical office spaces for collaboration and fostering company culture. This has led companies to lean toward smaller but premium office spaces (Grade A or A+) designed to attract and retain top talent, providing an enhanced employee experience and promoting productivity.

Let’s explore more trends for the corporate real estate market in 2024:

- Smaller offices. According to the Collier report, the typical reduction of office footprint for large occupiers will be 20% to 30% is typical, while some companies can cut 50% or more. Google announced that it plans to sublease more than 1.4 million square feet of its Silicon Valley office. Kickstarter puts their headquarters office for sale and the list is going on. Uber, EA, Intel, GitLab, Salesforce, Meta and other tens of companies cut their office footprint.

- Search for quality: premium offices are not only about work. To attract and retain top talent, companies are focusing on creating flexible and amenity-rich workplaces. This includes incorporating versatile workspaces, such as hot desking and shared co-working spaces, as well as offering amenities like fitness centers, on-site dining options, and wellness facilities. Corporate real estate teams are looking for ways to make their offices eco-friendlier by choosing carbon-neutral materials and setting green spaces for workers. The aim is to provide a comfortable and engaging environment that enhances productivity and employee satisfaction. Amazon Canada, for example, presented their new office tower in Vancouver that has a community garden, dog parks, and an outdoor basketball court. Senior manager of communications with Amazon Canada Kristin Gable stated that it won’t be just an Amazon office but a community space.

- Repurposing of office spaces: As remote work becomes more prevalent; some office spaces are being repurposed for alternative uses. This includes transforming office buildings into mixed-use developments, such as combining office spaces with residential, retail, or leisure facilities. Repurposing allows for maximizing the utilization of office real estate and catering to evolving community needs. The USA and Canada actively discuss converting office space to residential property to kill two birds – empty offices and lack of housing. Some big projects have already been launched in New York, Atlanta, Chicago, Philadelphia, Calgary, Toronto, and other US and Canadian cities. Still, it’s important to understand that only a small percentage of the offices can be converted into residential spaces due to electrical and plumbing needs, the size and number of windows, and other factors. Some experts state that converting office buildings with a low score in “conversion calculator” can be even more expensive than constructing ones from scratch. The debate on the future of empty offices is on and the world awaits creative solutions from real estate professionals and business leaders.

- Sustainable and green offices. Environmental sustainability is a growing focus in office real estate as it helps attract environmentally conscious tenants and employees. Companies are prioritizing eco-friendly practices and seeking green-certified buildings that reduce energy consumption, promote recycling, and incorporate sustainable materials. Companies also understand that there will be soon new environmental regulations and standards which will affect their real estate reporting and strategy, so they try to prepare for these regulations beforehand and strive to generate zero-carbon emissions. Market leaders like Microsoft go even beyond carbon-zero and set goals to become “carbon-negative”, “water-positive” and “zero waste”. Their new office in Israel is one of the most sustainable in the country. It has air filtration and water irrigation systems to make the office look like an oasis and save more than 3 million liters of water each year. The office also ensures energy conservation and generation with photovoltaic cell power dining facilities and exterior lighting.

These trends reflect the evolving nature of work and the changing expectations of employees.

CRE Trend #4: Environmental, Social, and Governance (ESG) Considerations and Challenges

With growing awareness of sustainability and social responsibility, stakeholders in the industry are increasingly recognizing the need to incorporate ESG principles into their operations. From reducing carbon footprints and energy consumption to promoting community engagement and ethical practices, ESG initiatives are driving positive change in commercial real estate.

Various companies are already committed to ecological and social matters and promote them as their mission and values. Brands have various initiatives supporting zero-waste and raising awareness of environmental problems. One of the examples is a new Uniqlo store in Maebashi, Japan. It is built from recycled materials and equipped with solar panels to achieve zero-carbon emissions. Also, it has a repair and customization service RE.UNIQLO STUDIO that helps clients repair, reuse and remake their favorite clothes.

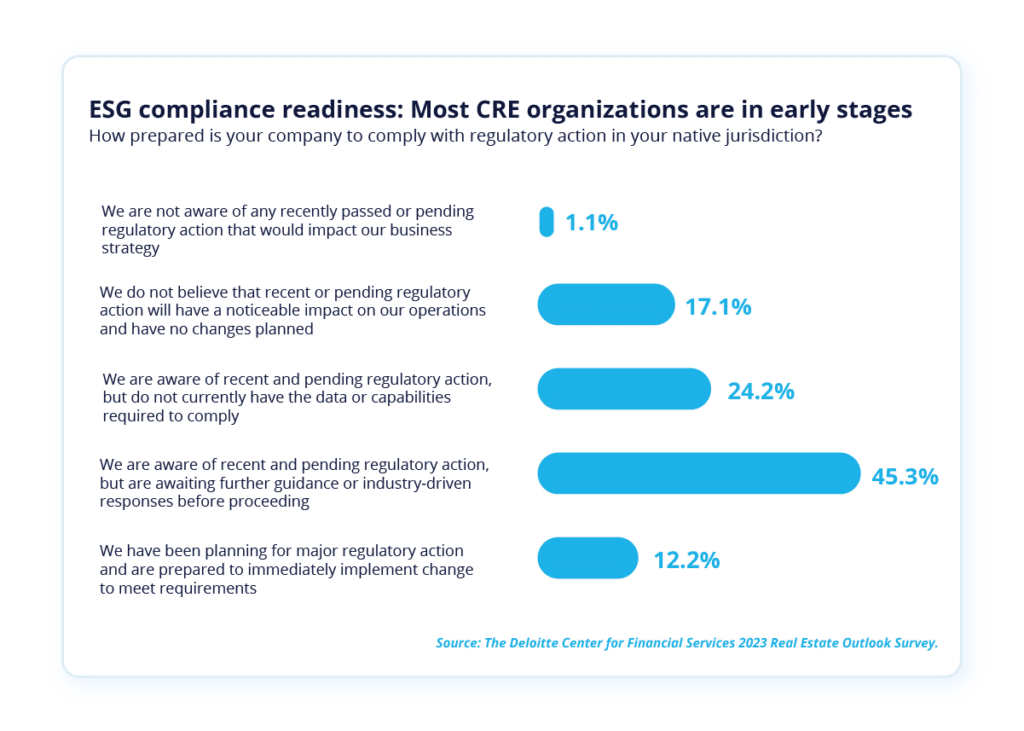

However, not many companies are ready for the upcoming ESG real estate regulations. According to Deloitte, only 12,2% of companies are prepared to meet future requirements immediately.

In terms of environmental factors, commercial real estate stakeholders need to work to reduce their environmental impact. This includes implementing energy-efficient technologies, such as smart building systems and renewable energy solutions, to minimize energy consumption and carbon emissions.

Deloitte and PwC reports insist that the transparency of ESG metrics is required and state that soon we will see new ESG disclosure rules and regulations. For instance, in the United States, the Securities and Exchange Commission (SEC) has proposed a new rule that would require issuers to share information about climate-related factors. This includes vital details like greenhouse gas emissions and climate risks. Real estate tenants, investors, or lenders associated with SEC issuers, might have to provide this information. It is all part of an effort to promote transparency and ensure that everyone is aware of the environmental impact of their assets.

The International Sustainability Standards Board (ISSB) is also finalizing requirements for climate-related disclosures and expects to issue an IFRS Sustainability Disclosure Standard around the end of Q2 2023.

Commercial real estate professionals need to keep in mind upcoming regulations and be ready for them. By integrating ESG principles into their strategies, commercial real estate stakeholders can align their operations with global sustainability goals, enhance their competitive edge, and contribute to a more sustainable and socially responsible future.

CRE Trend #5: Digitalization and the Rise of PropTech

For a long time, the real estate industry was slow at digitalization. Historically, the industry heavily relied on traditional methods such as physical property listings, face-to-face interactions, and manual paperwork.

Recently, property technology, or PropTech, has emerged. PropTech includes digital solutions that help real estate professionals build, manage, maintain, buy, sell, and lend property. Covid-19 and economic shocks gave another boost to PropTech and helped fasten the digitalization of the industry. Digitalization is driven by thousands of entrepreneurs and start-ups. According to Forbes, the Proptech market is currently valued at $18.2 billion and is forecasted to reach $86.5 billion by 2032.

One of the most interesting trends in digitalization is the Internet of Things (IoT). It is an interconnected network of physical objects that are equipped with sensors, software, and technologies that collect and share data with little to no human involvement. According to BuildingEngines report, the property team’s interest to invest in smart buildings and IoT increased by 53% since the previous year.

Here are four amazing examples of how IoT helps commercial real estate professionals and businesses achieve their goals:

- Ensuring the right temperature, lighting and quality of the air in a real estate asset – store or office. Smart building management includes having specific sensors that can adjust temperature and lighting in different areas of the building according to occupancy. Heating, ventilation, and air-conditioning (HVAC), as well as lighting, can now be optimized, based on the data from sensors and greatly reduce costs and energy consumption.

- Discovering occupancy and vacancy rate to realign business strategy. Having all the data from occupancy sensors, commercial real estate professionals can rethink their building plans and come up with new ideas on how each area can be changed. Both for retail and corporate real estate, it’s important to understand how people interact with their real estate assets. For example, retailers need to monitor the foot traffic in their location, the mall, and their store. They can also create heat maps to understand what area of their store attracts clients the most. Various software providers offer in-store customer analytics and help retailers better understand who their clients are (age and demographics), when their clients come to the store (business days or weekends, afternoons or evenings, rainy or sunny days), and what store area attracts clients the most. All this data is crucial for business strategy: add another shift of workers for the busy time, change the working hours of the store, or analyze if a sale really helped attract more people to the store. All this has a direct impact on sales.

- Better maintaining and preventing issues for main areas, elevators, and automated doors. For example, Kone offers 24/7 connected services to prevent elevators, escalators, and automated building doors from breaking. Kone tracks the performance and notifies about the issue before the equipment gets broken, which reduces expenses and prolongs the equipment’s lifetime.

- Guaranteeing the security of real estate assets. Humidity sensors and fire or smoke detectors prevent damage to real estate assets by notifying people about abnormalities in the fastest way. Besides that, common practices are adding video cameras to stores or office buildings, as well as Radio Frequency Identification (RFID) badges or smart locks with key code entry for store employees.

Besides the Internet of Things, PropTech empowers commercial real estate professionals with digital documentation and transactions, online platforms to discover new commercial real estate assets and opportunities, visual tours of the premises, as well as highly analytical tools for a better understanding of operational efficiency, lease management, and maintenance needs.

The 2022 report by JLL highlights that real estate needs are becoming more complex than ever before. Enterprises need to gather more data to create complex reports and ensure transparency and compliance with accounting standards across the globe. JLL and Deloitte mention the growing importance of having a trusted partner or software to manage commercial real estate challenges. According to JLL, 43% of companies expect they will need more support for CRE technology solutions over the next three years.

“Corporates will need to revisit their CRE strategies and invest in solutions that enable continuous adaptation to rapidly changing market dynamics”, says JLL.

Wonder how software can help enterprises realign their business strategy? Read our blog on CRE software to enjoy the benefits of digitalization to the fullest!

Conclusion

In the commercial real estate market in 2024, factors like unstable market dynamics, retail and office transformations, ESG considerations, and the rise of prop-tech are shaping the landscape. Understanding these trends enables businesses to make informed decisions, optimize their costs and seize growth opportunities.

We can say for sure that 2024 is not easy year for the global economy and commercial real estate industry. However, we see that the commercial real estate market is transforming and that experimenting and offering new solutions to real estate challenges can help companies get ahead of the curve of this transformation.

If you want to get more updates or discuss commercial real estate topics, follow Nakisa LinkedIn page!

Luxury retail is pushing the boundaries of store formats with even more experimentation. The Business of Fashion (BoF) has an interesting survey on

Luxury retail is pushing the boundaries of store formats with even more experimentation. The Business of Fashion (BoF) has an interesting survey on