Definition and significance of an embedded lease

An embedded lease, a term not defined in either ASC 842 or IFRS 16, refers to the components of a contract that identify assets that can be used and controlled, and how. Two key points help to explain why these components are the source of uncertainty for many organizations. First, they fall outside of the standard lease identification processes for many groups. Second, under the new leasing standards, companies face restatement and internal control risk if they fail to identify and account for contracts with embedded lease components.

Three important questions for lease determination

To determine if a contract is or contains a lease, one must identify an asset and the associated control of the said asset. To put it simply - no asset, no lease. No control, no lease. To help with your lease determination, consider the following three simple questions:

1. Is there an identified asset?

Typically, when reviewing a contract, you’ll notice that the asset involved and its intended use have been made explicitly clear. For example, a transportation contract that provides a manufacturer the right to use ten specific rail cars to ship widgets. Another example might be a concession agreement that provides a coffee company the right to use a certain space to sell lattes and pastries. These are straightforward. Sometimes, though, a contract will imply the use of a specific asset. A good example of this is a retailer that signs a deal to take a volume of a particular shirt from a garment maker, who has only one factory that produces those shirts. By implication, the plant is identified as the asset being used to perform the contract. Identifying implied assets is not always straightforward and often requires judgment. Keep in mind that even if an asset is identified, it doesn’t mean the contract is or contains a lease.

2. Is there a right to obtain substantially all of the identified asset’s economic benefits?

To control an asset, one must have the right to obtain "substantially all" of its economic benefits during the contract term. In the shirt example, if the factory has the capacity to make twice as many shirts than the retailer has agreed to buy, then the retailer has not obtained the right to substantially all of the factory’s economic benefits. If, however, the promised volume is over 90 percent of the plant’s capacity, the rules would indicate that the retailer has secured substantially all of the asset’s economic benefits. Still, keep in mind, this does not mean that the contract is or contains a lease. There is a third question to consider.

3. Who has the right to direct the use of the identified asset?

To control an asset, one must have the right to direct its use. Again, in the shirt example, if the retailer has the right to direct how and for what purpose the factory operates during the contract, without giving the factory’s owner the right to change those instructions, the leasing rules would indicate that the retailer controls the factory. If the supplier kept the right to direct the factory’s use, then it, not the retailer, would have control, and the retailer would not account for the plant as a leased asset.

When the answer to any of these three questions is no, the contract does not contain a lease. When the answer to all three questions is yes, the contract is or contains a lease. The arrangement may require further evaluation to separate the lease and non-lease components. Regardless, the customer will have to record its right to use the leased asset and book a liability for its payment obligations for that contract.

Importance of a well-defined lease identification process

These examples show the judgment required to apply the leasing principles. It’s important to have a clearly defined process that ensures contracts are flagged for review and that the same considerations are applied to each contract in the same way. Choosing a lease accounting solution with the power to address contract management is a key step in applying the new leasing standards. Industry-leading lease accounting solutions have features, like lease determination questionnaires, that not only simplify lease determination but also help to streamline the adoption and ongoing accounting and audit tasks to apply the new leasing standards.

How a lease accounting solution can help

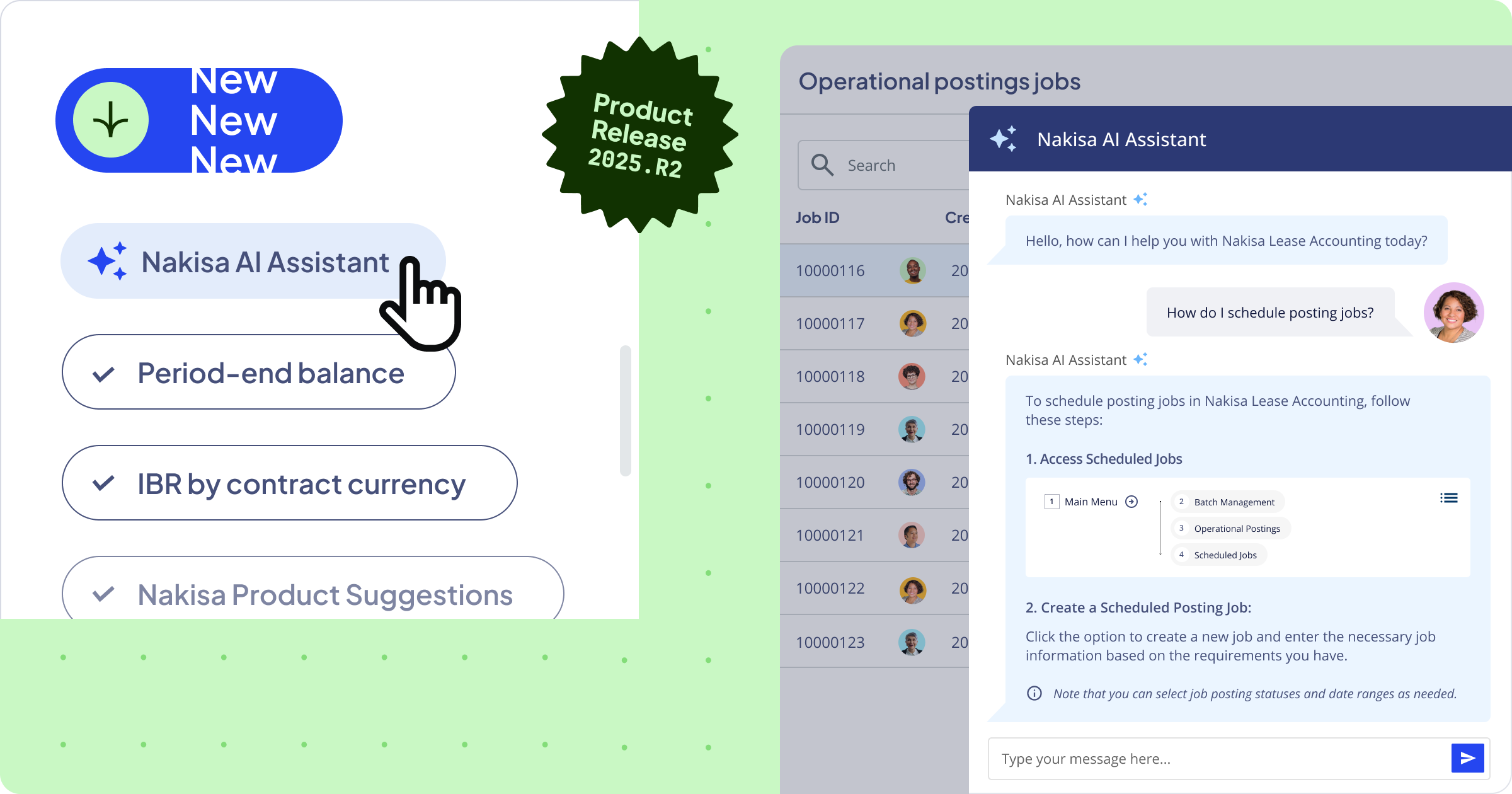

A robust lease accounting solution, like Nakisa Lease Administration software, can greatly assist in navigating the complexities of IFRS 16 and ASC 842 lease accounting standards. These solutions can automate the identification and management of embedded leases, ensuring that all contracts are thoroughly reviewed and accurately accounted for. Key benefits of using a lease accounting solution include:

- Automated lease identification: The solution can automatically scan contracts to identify potential embedded leases, reducing the manual effort and risk of missing critical components.

- Comprehensive reporting: Generate detailed reports that provide insights into lease liabilities, right-of-use assets, and other critical metrics, ensuring compliance with IFRS 16 and ASC 842.

- Streamlined processes: Simplify the process of lease modifications and remeasurements, allowing for timely updates and accurate financial reporting.

- Enhanced control and compliance: Maintain a clear audit trail and ensure all lease-related activities are documented and compliant with the latest standards.

By leveraging a lease accounting solution, companies can reduce the risk of errors, ensure compliance, and focus more on strategic financial planning rather than manual lease management tasks. Interested in learning more about Nakisa Lease Administration software? Visit our product page or request a personalized demo to see firsthand why Fortune 1000 companies trust us with their lease accounting.