The reach of the IFRS 16 and ASC 842 lease accounting standards spreads into nearly every major industry.

From construction to transportation—even mining— organizations with business in almost every industrial sector need to understand the guidelines and how best to comply.

One sector where the lease accounting guidelines have a particularly large effect is the chemicals industry.

“The financial reporting effects are just the most obvious of the impacts the new standard will have on companies in the chemicals sector,” according to a PwC guide to the new standards. “Companies will need to analyze how the new model will affect contract negotiations as well as the impact on key metrics, whether systems are equipped to generate the data requirements of the new reporting and disclosure model, and the impact on business processes and controls around operating leases that will now be subject to recognition on the balance sheet.”

Here are just a few questions organizations in the chemicals industry will need to ask themselves about their lease accounting strategies under the new standards:

1. How do we identify and account for fixed assets under the new standards?

A large proportion of fixed assets in the chemicals industry are leased and have been classified as operating leases.

Moving forward under the new standards, the lease agreements will not only have an impact on the balance sheet but also on the operating costs. Many chemicals companies enter into lease contracts to gain access to storage tanks, pipelines, transport hubs, manufacturing molds, or other assets. IFRS 16 and ASC 842 bring most of these leases onto balance sheets, exposing billions in lease liability across the industry.

One of the biggest impacts on the industry is going to be a compliance exercise. Companies with fixed assets in the chemicals industry will need to identify everything that meets the definition of a lease, determine if any contracts meet any of the exemptions, such as low value or short-term leases, and perform necessary disclosures. Once this process is complete, it becomes a complex operations exercise to manage the lease lifecycle.

2. What are the contractual and financial implications of bringing assets on-balance sheet?

The chemical industry is capital-intensive in nature and traditionally uses off-balance sheet operating leases for assets. This means that there will be challenges specific to this sector, like customer supply contracts and tolling agreements as with storage tanks, pipelines, transport hubs, and others.

The capitalization of lease obligations will contribute to the increase of median debt to 13 percent and median EBITDA to 6 percent, according to a recent PwC Global Lease Capitalization study. Organizations in the chemicals industry will need to carefully consider the contracts where an asset may not be obvious to determine the party with economic benefit. Common arrangement examples where lessees must establish a process of evaluation for their lease include pipelines in a supply arrangement; the storage of hazardous chemicals; or the use of precious metals.

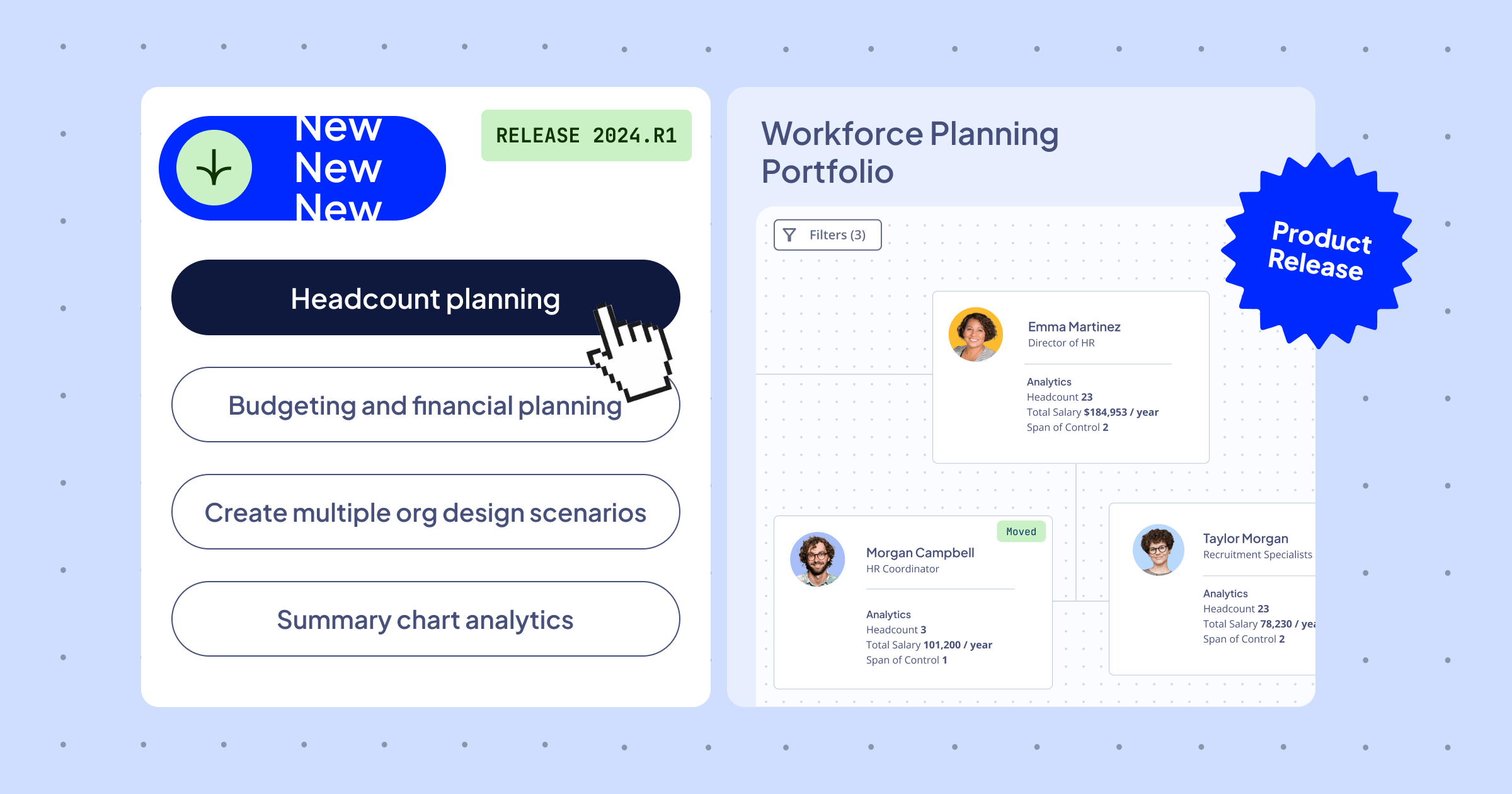

3. How can technology help streamline your lease accounting strategies?

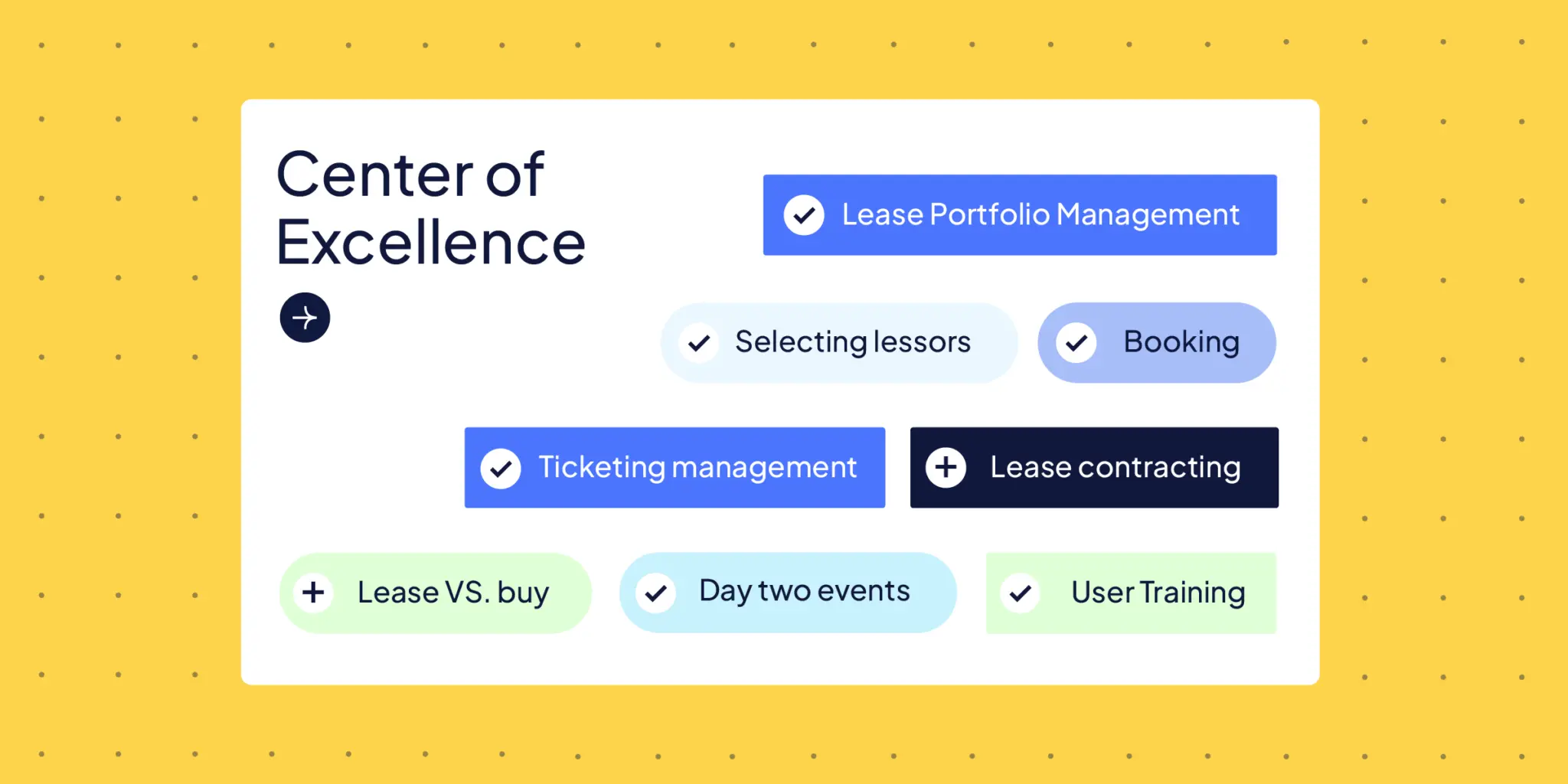

For organizations in the chemicals industry, the reality is complying and adapting to the new lease accounting standards is no easy task. Accessing accurate, real-time leasing data, identifying leases, including value, payments, and depreciation, and producing required disclosure reports requires a strategic, centralized, and streamlined approach.

The most efficient way for accounting and finance departments to manage accounting challenges and achieve compliance is to leverage accounting technologies that centralize lease data and automate lease accounting. Instead of sifting through spreadsheets with duplicate or missing information, a single system for lease management helps to streamline and simplify accruals, payments, reconciliation, and financial reporting on leases.

Here are a few ways lease accounting software, such as Nakisa Lease Administration, can help:

- Insights: Gain insight into contractual data to identify lease exposure and analyze the impact on financial statements. Understand financial implications and make informed decisions.

- Visibility: Centralize contract data in a single repository to provide a global view of lease contracts. Gain clear visibility into leasing data including liabilities and commitments.

- Compliance: Handle comprehensive lease accounting requirements and support compliance. Software allows organizations to transition to the new standards, process required accounting lookback, and fulfill reporting requirements.

- Efficiency: Reduce costs by making lease data accessible and actionable for stakeholders. Automate finance and accounting through push and pull ERP integration. As organizations in the chemicals industry continue to transition into the new lease accounting standards, they face many unique industry challenges. Centralizing and streamlining data through the use of lease accounting technology is one of the most important ways to reduce the time and effort required to comply.