What are evergreen leases?

Definition of evergreen leases

Evergreen leases or month-to-month leases are lease agreements that automatically renew after the initial lease term expires unless either party gives notice to terminate. Unlike traditional fixed-term leases that have a predetermined end date, evergreen leases continue indefinitely, providing flexibility for both the lessor and the lessee. This automatic renewal feature can be based on various periods, such as monthly, quarterly, or annually, depending on the terms agreed upon by the parties involved.

Characteristics of evergreen leases

To effectively manage evergreen leases, it's important to understand their key characteristics. Here are some key features to consider:

Automatic renewal: The primary characteristic of an evergreen lease is its automatic renewal without further intervention. At the end of the initial lease term, the lease renews for a specified period unless notice is given to terminate. This feature ensures continuity without the need for renegotiation or re-signing of the lease agreement.

Flexibility: Evergreen leases offer significant flexibility to both lessors and lessees. Lessees benefit from the ability to continue using the leased asset without disruption, while lessors enjoy a steady stream of rental income without the administrative burden of drafting new lease agreements.

Termination notice: Depending on the lease, either or both parties have the right to terminate the lease by providing notice within a specified period. This notice period can vary widely but typically ranges from 30 to 90 days. The flexibility of termination allows both parties to adjust to changing business needs or circumstances.

Usage-based renewals: In some cases, the renewal period may be based on the usage of the leased asset rather than a fixed time frame. For example, in equipment leases, the renewal may depend on the number of operating hours or production cycles completed.

What are the challenges of using evergreen leases?

Understanding the challenges of using evergreen leases is crucial for accurate financial reporting and effective lease management. In this section, we’ll explore what the main challenges of using evergreen leases are and how they can impact your overall lease strategy.

Identifying evergreen leases in practice

Accurately identifying evergreen leases within an organization’s portfolio can be challenging. This involves reviewing lease agreements to determine which ones have automatic renewal clauses. For instance, a retail company with numerous store locations must identify which leases have evergreen terms to avoid unintended renewals. If a retail company fails to properly identify these leases, it may face unexpected financial commitments, operational disruptions due to unplanned lease renewals, and difficulties in renegotiating more favorable lease terms, which could impact its expansion plans and profitability.

Ensuring accurate financial reporting and compliance

Effective management of evergreen lease data requires precise tracking of lease terms, renewal options, and termination notices. For example, a manufacturing company leasing factory space might face periodic rent increases or renegotiate terms, necessitating reassessment of the lease liability and right-of-use asset according to IFRS 16 and ASC 842. Failure to properly manage these aspects can lead to inaccuracies in financial reporting, poor decision-making, budget misalignments, and inefficient cost management. These issues could ultimately impact compliance, financial strategy, and overall operational efficiency, leading to potential legal liabilities and reputational damage.

Let’s delve into the evergreen lease accounting requirements under IFRS 16 and ASC 842 to see how they address the complexities and provide a framework for accurate financial reporting.

Accounting requirements for evergreen leases under IFRS 16 and ASC 842

Given the lack of explicit guidelines in IFRS 16 and ASC 842 for reporting evergreen leases, organizations must develop their own approach to reporting them. This process often involves making materiality decisions—judgments about whether the financial impact of evergreen leases is significant enough to warrant detailed reporting. For some organizations, where the rent from evergreen leases is relatively insignificant within the overall lease portfolio, a simpler approach to compliance might be appropriate.

This variation in materiality decisions has led to a wide range of interpretations in practice. To help navigate these challenges, certain publications, such as the AICPA & CIMA report by the Center for Plain English Accounting, provide practical guidance with examples of how evergreen accounting can be applied. These resources offer valuable insights but also underscore the need for organizations to tailor their approach based on their unique circumstances.

Building on these resources, subject-matter experts have developed common interpretations on handling evergreen leases under these standards. They highlight that the reporting of evergreen leases largely depends on whether the lessee, the lessor, or both have the right to terminate the lease contract, which directly affects the accounting treatment. By following these expert interpretations, organizations can ensure that their approach to evergreen leases aligns with broader industry practices, while still reflecting their own materiality decisions and specific lease portfolios.

In the following section, we will explore how the accounting treatment for evergreen leases varies depending on who holds the right to terminate the lease. We will discuss the scenarios where the lessee has the right to terminate and where either both parties or only the lessor has the right to end the lease.

Scenario 1: Lessee has the right to end

In this scenario, the lessee must initially measure the lease liability at the present value of the future minimum lease payments (PVMLP) over the estimated length that the lessee is reasonably certain to remain in the lease contract. This includes both the initial non-cancellable periods and the additional estimated periods beyond the initial non-cancellable terms. The discount rate used for this calculation is the implicit contract rate or, if not available, the discount rate at the lease commencement date. This estimation replaces the lease term defined in the contract's terms and conditions. This calculation can be complex and prone to error if done manually, as it requires precise determination of the lease term, appropriate discount rate, and accurate discounting of future payments. Even small errors in these calculations can lead to significant discrepancies in financial reporting and compliance.

Scenario 2: Lessor and lessee have the right to end or only the lessor has the right to end the lease

Lease contract with notice period

Upon the end of the non-cancellable term, the lease contract is automatically renewed with both parties (lessor and lessee) having the option to terminate by predefined notice periods. This auto-renewal continues indefinitely until either party decides to end the lease.

At the last day of the notice period:

- The lease liability is re-measured, extending the lease by the renewal term using the most current incremental borrowing rate (IBR) and offset to the right-of-use (ROU) asset.

- A renewal term is measured as the enforceable period after the end of the previous non-cancellable term. This results in a revised PVMLP at the notice period, requiring an adjustment to the carrying lease liability and ROU asset values.

- The depreciation term (the period over which the ROU asset is depreciated) is reassessed for the lesser of the revised remaining lease term or the remaining useful life of the asset.

Lease contract without notice period

Upon the end of the non-cancellable period, the lease contract is automatically renewed into a subsequent non-cancellable period. Both the lessor and lessee have the option to terminate the auto-renewal at any point in time, with the lease ending at the upcoming non-cancellable term end date. There are two ways to account for this:

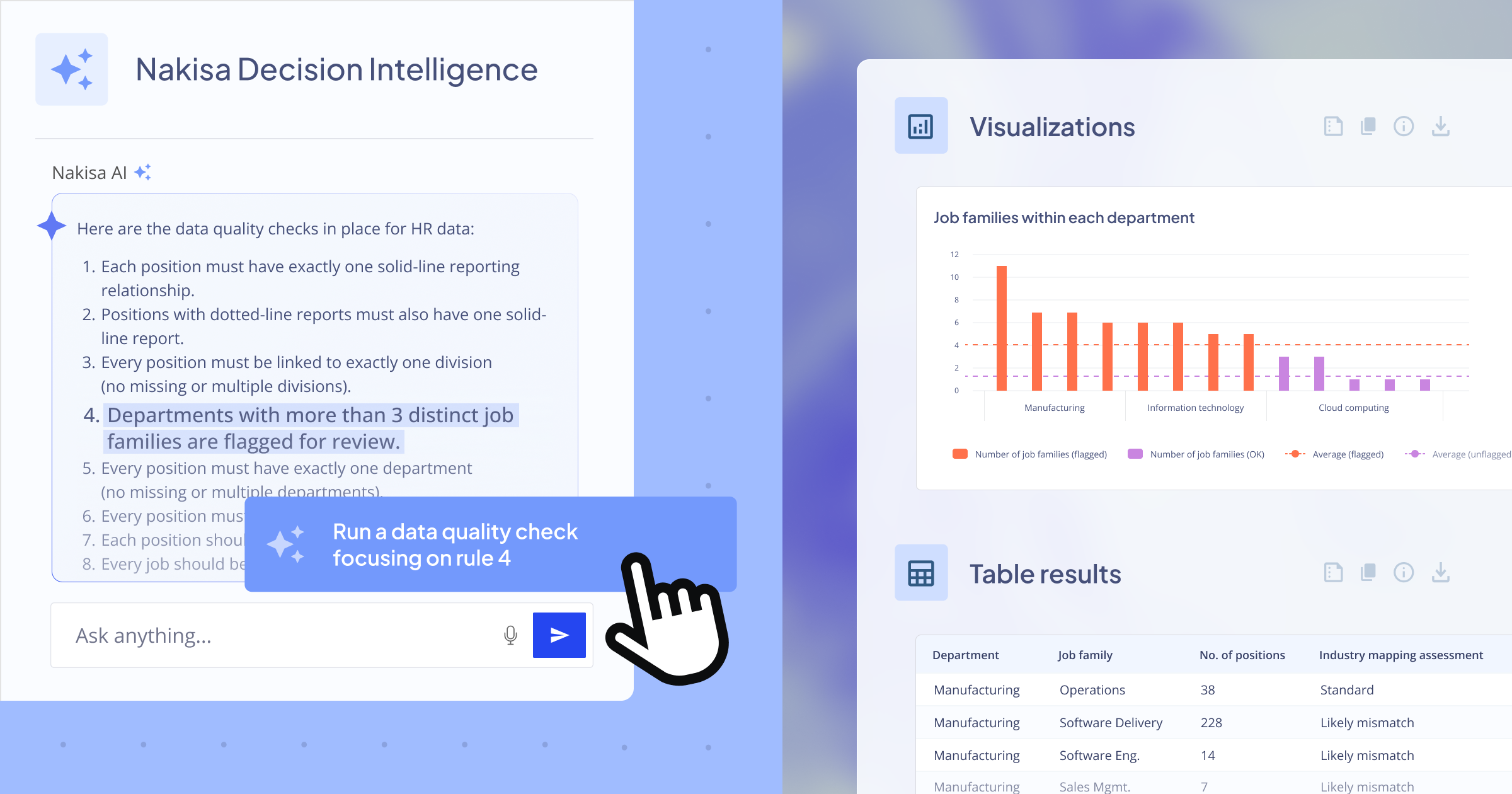

- Periodic lease remeasurement:

At each reporting period end date (e.g., calendar month-end for fiscal year reporting or period end date for non-calendar fiscal year reporting) during the active non-cancellable period, the lease liability is automatically remeasured by one payment period (e.g., one month for a lease with a monthly payment schedule, two weeks for a biweekly payment schedule).

The remeasurement process consists of:

- Lease liability remeasurement: The lease liability is remeasured, extending the lease by one payment period using the most current IBR and offset to the ROU asset.

- Extension period: The extension period consists of one period per payment schedule after the latest lease non-cancellable end date. This results in a revised PVMLP at the notice period, requiring an adjustment to the carrying lease liability and ROU asset values.

- Depreciation term reassessment: The depreciation term is reassessed for the lesser of the revised remaining lease term or the remaining useful life.

- Remeasurement at the end of the non-cancellable period:

At the end of each non-cancellable period, the lease liability is automatically remeasured for the next renewal term, which is one additional non-cancellable period. This approach is less frequent than periodic remeasurement but ensures that the financial records are updated at key intervals.

The remeasurement process consists of:

- Lease liability remeasurement: At the end of each non-cancellable period, the lease liability is remeasured to extend the lease by one renewal term using the most current IBR. This ensures that the financial records reflect the present value of future lease payments for the new non-cancellable period.

- Renewal term: The renewal term is the next non-cancellable period following the latest lease end date. This results in a revised PVMLP at the notice period, requiring an adjustment to the carrying values of the lease liability and the ROU asset.

- Depreciation term reassessment: The depreciation term for the ROU asset is reassessed to be the lesser of the revised remaining lease term or the remaining useful life of the asset. This ensures that the asset is depreciated accurately over its useful period.

Managing evergreen lease accounting requirements under IFRS 16 and ASC 842 is inherently complex. The key challenges include determining termination rights, handling notice periods, and implementing the correct remeasurement processes. However, with a clear understanding of these complexities, you can navigate the landscape of lease accounting more effectively and position your organization for success.

Conclusion

Navigating the intricate landscape of evergreen leases (month-to-month leases) under IFRS 16 and ASC 842 can be daunting. Determining termination rights, managing notice periods, and applying remeasurement processes are just a few of the complexities involved.

Thanks to established industry standards and insights from subject matter experts, we hope this blog has provided you with a clearer understanding of these challenges. By leveraging best practices and expert guidance, you can enhance your approach to lease accounting, ensuring compliance while effectively managing the nuances of evergreen leases.

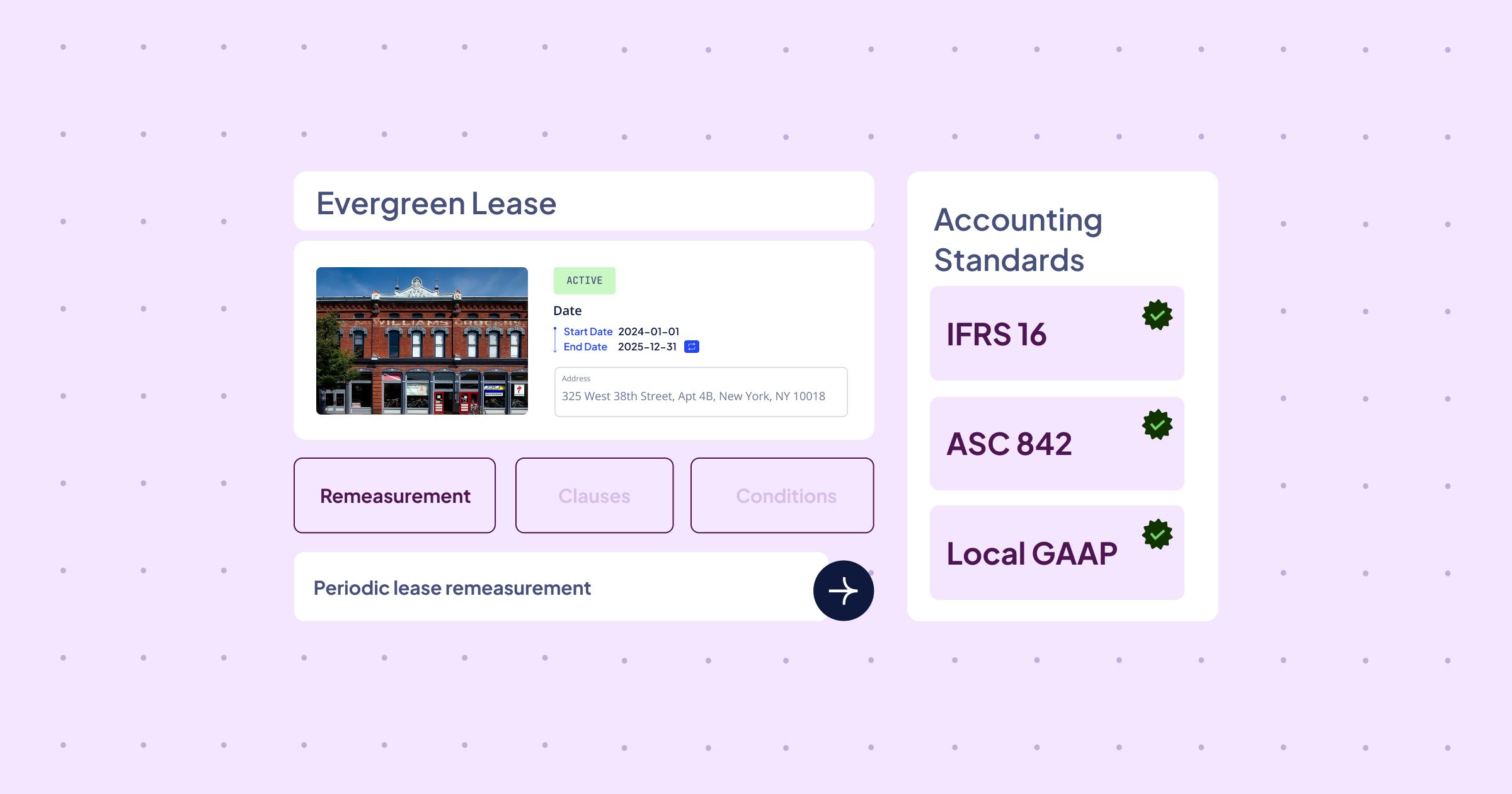

At Nakisa, thanks to many years of experience with Fortune 1000 clients, we provide comprehensive solutions tailored to the evolving needs of enterprise-grade lease accounting. Our Nakisa's lease accounting software enables global organizations to efficiently manage their large and complex lease portfolios while ensuring compliance with IFRS 16, ASC 842, and local GAAP. Explore our product and schedule a personalized demo today to see how we can help you streamline your lease accounting processes!