Introduction – What’s inside the guide

As lease portfolios grow in scale and complexity, finance teams face pressure to go far beyond compliance. Stakeholders demand faster closes, predictive insights, and tighter alignment across finance, operations, and strategy. Yet, many organizations remain tied to spreadsheets, legacy systems, and fragmented workflows. The result? Missed deadlines, reactive audits, compliance risks, and lost opportunities to optimize portfolios.

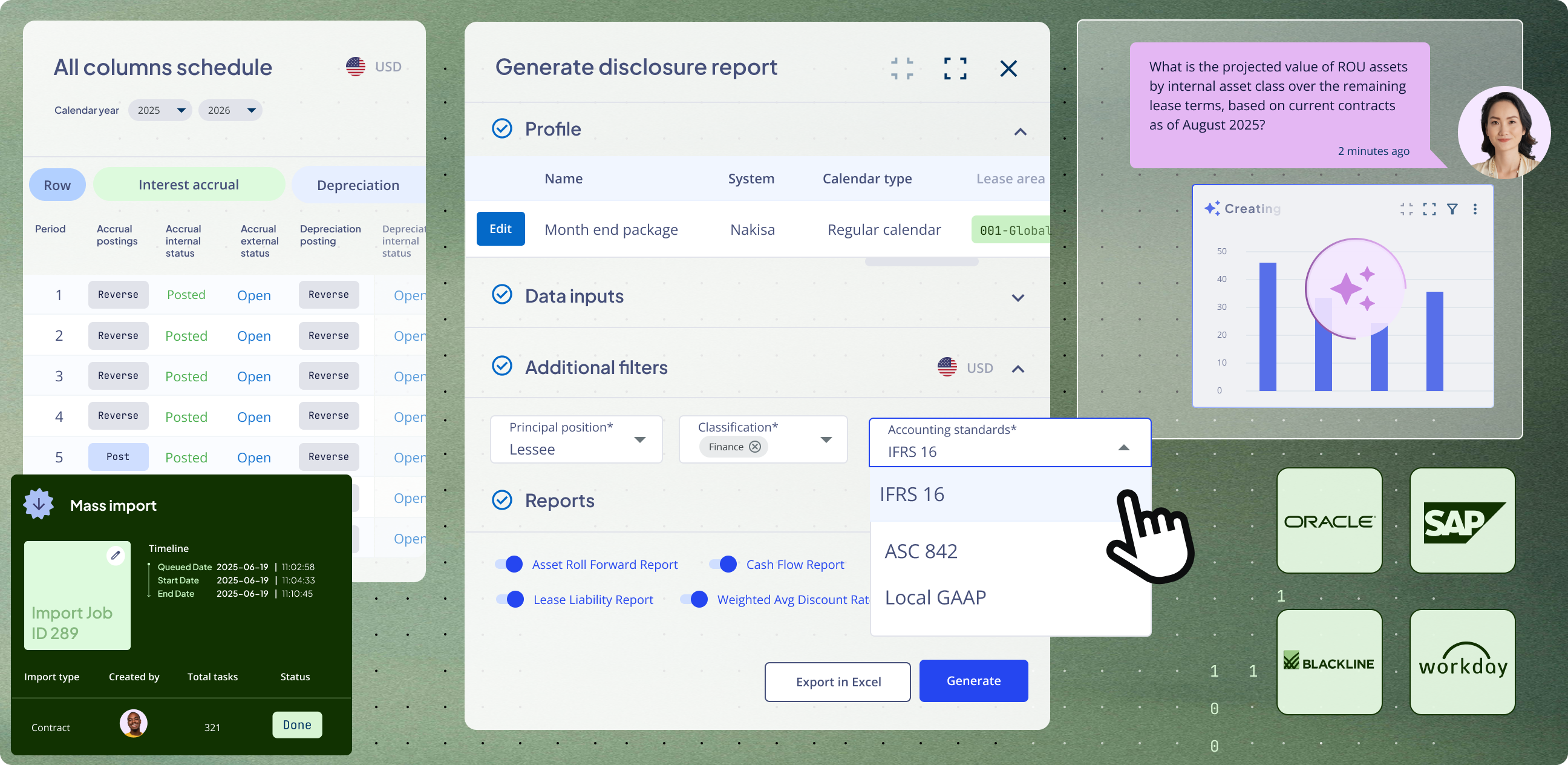

For global enterprises, the challenge multiplies. Managing multi-asset leases across geographies, currencies, business entities, and reporting standards (IFRS 16, ASC 842, and local GAAP) is nearly impossible with manual processes. At the same time, leaders must provide transparency to auditors, enable collaboration across business units, and surface actionable insights to guide smarter real estate, equipment, and fleet decisions.

The most forward-looking organizations are turning to modern lease accounting platforms powered by automation and AI. These solutions:

- support multi-entity, multi-asset, multi-currency, and multi-GAAP reporting

- centralize lease data and automate compliance workflows

- provide AI-driven insights and decision intelligence to fuel strategic decision-making

- offer predictive analytics, portfolio optimization, and intelligent scenario planning and forecasting

- accelerate month-end and year-end closes

- ensure audit readiness while unlocking strategic value

- seamlessly integrate with ERP and financial systems

- deliver robust security and access controls

- enable collaborative workflows across departments

Selecting the right platform can be daunting. Beyond compliance, it affects your operating model, integration landscape, scalability, and your role as a strategic business partner. That’s why we put together this guide to give you a clear framework for selecting the right lease accounting solution and unlocking strategic value.

Why trust this guide?

This guide draws on over 20 years of experience partnering with global finance leaders to transform their lease accounting and management. Our team has worked side by side with Fortune 1000 organizations, mapping processes and tech stacks, uncovering gaps and inefficiencies, and building a data-backed approach to accelerate value realization. Through workshops, assessments, and advisory engagements, we’ve seen firsthand how multi-asset portfolios, multi-currency operations, and evolving compliance standards stretch legacy systems beyond their limits.

This guide brings those insights together into a clear, step-by-step process. Step 1 helps you define your lease accounting needs — the objectives, scope, and priorities that form the foundation of your evaluation. Step 2 highlights the key capabilities to look for in enterprise lease accounting software, from core functionality to platform, security, and enablement features. Step 3 shows you how to use the vendor scorecard (RFP checklist and features template) to structure your evaluation, apply weighted scoring, and compare solutions objectively. Finally, Step 4 walks through the process of acquiring a lease accounting software — combining scorecard results with qualitative insights, validation, and stakeholder alignment to make a confident, well-informed decision. Let’s dive in!

Step 1: How to define your lease accounting needs

Before evaluating software vendors, organizations should first define the “why” and “what” behind their lease accounting initiative. This step isn’t about features or technical specifications — it’s about aligning stakeholders on the purpose, scope, and priorities that will shape your software evaluation. Skipping this stage often results in buying tools that solve yesterday’s problems rather than preparing for tomorrow’s challenges.

Start by clarifying your primary objectives. For some companies, compliance with ASC 842, IFRS 16, or GASB standards is the immediate driver. For others, the motivation goes beyond compliance — reducing manual work, centralizing data, gaining visibility into costs, or enabling better decision-making across the lease portfolio. Understanding which of these objectives matter most will help you distinguish between “must-have” and “nice-to-have” capabilities.

Next, establish the scope of your lease portfolio. This includes the number and types of leases you manage (real estate, equipment, fleet, land, embedded leases), the regions they span, and the level of complexity involved. Equally important is looking ahead: will the portfolio expand through acquisitions or global growth? Mapping this trajectory ensures the software you select can scale with your business.

It’s also critical to consider your organizational context. How will the solution fit into your existing technology ecosystem? Who will be the primary users across finance, accounting, legal, and operations? What level of support and change management will your teams require to adopt a new system effectively? These questions help you set realistic expectations and plan for a smooth rollout.

Finally, align on your strategic priorities. Is audit readiness the top concern? Is integration with your ERP system essential? Or is the greatest value in analytics and forecasting to support smarter business decisions? By ranking these priorities, you give structure to the evaluation process and create a framework for weighing trade-offs later.

Defining your lease accounting needs is the most important groundwork you can do before engaging with vendors. By clarifying your objectives, understanding the scope and complexity of your lease portfolio, and aligning on organizational priorities, you create a clear blueprint for evaluating solutions. This step transforms the buying process from chasing features to solving business challenges.

With your needs clearly defined, you’re ready to move into Step 2 and identify the key capabilities and platform elements to look for in an enterprise lease accounting solution — and mapping them against the priorities you’ve established.

Step 2: Key elements to look for in an enterprise lease accounting software

Choosing the right lease accounting software requires more than just checking for compliance — it’s about ensuring the platform can handle the full complexity of your portfolio while supporting future growth. In this step, we break down the key elements every enterprise should evaluate, from core accounting capabilities to platform scalability, security, and ongoing enablement. These criteria will help you separate “nice-to-have” features from business-critical functionality and guide a structured comparison of vendors.

1. Eight lease accounting core capabilities

The foundation of any lease accounting solution lies in its core capabilities. To help you assess vendors effectively, we’ll walk through eight essential areas — explaining what to evaluate in each and why it matters to your business. This framework ensures you can separate critical functionality from optional features and focus on what will truly drive compliance, efficiency, and long-term value.

1.1 Lease data management and abstraction

What to evaluate: The solution should centralize all lease data across asset types (real estate, equipment, fleet, land) in one repository with robust search, version control, and audit trails. Look for mass data upload and validation tools, flexible categorization, multi-format document management, and AI-powered abstraction to extract key terms and clauses.

Why It matters: Without a single source of truth, lease accounting quickly becomes error-prone and fragmented. Centralization and automation reduce manual effort, enforce data quality, and ensure audit-ready records at scale.

1.2 System configuration

What to evaluate: The platform should support configurable fields, workflows, templates, and user interfaces to reflect your business structure. Key features include multi-currency, multi-unit, multi-language, and parallel compliance support, along with an AI assistant to guide users through setup and ongoing tasks.

Why it matters: Lease portfolios are highly diverse. Flexible configuration ensures the system adapts to your processes, geographies, and standards — not the other way around — enabling global adoption without costly workarounds.

1.3 Lease inception: types, classification, terms, and conditions

What to evaluate: Look for support of all lease types (property, equipment, fleet, land, payable, receivable, subleases, intercompany), hierarchical contract structures, complex ownership models, and robust classification logic. The ability to capture critical terms, conditions, and dates — with alerts and automated charge management — is essential.

Why it matters: Misclassification or incomplete capture of terms can lead to financial misstatements and compliance failures. Comprehensive inception functionality ensures accuracy from day one and streamlines ongoing administration.

1.4 Lease lifecycle and event management

What to evaluate: The system should handle renewals, modifications, impairments, remeasurements, intercompany transfers, and backdated events, all with version control and approval workflows. Scenario analysis tools for “what-if” modeling of lease decisions (e.g., extend vs. replace) are also critical.

Why it matters: Leases are dynamic, not static. A solution that can manage complex events without breaking compliance gives finance teams confidence that disclosures remain accurate as business circumstances evolve.

1.5 Accounting and compliance

What to evaluate: Ensure full compliance with IFRS 16 and ASC 842, plus parallel support for local GAAP. Key features include CPI adjustments, IBR/discount rate management, automated journal entries, impairment accounting, remeasurements, and embedded accounting policies. Look for drill-down audit capabilities, residual value handling, and ARO support.

Why it matters: Lease accounting is a disclosure-driven function under intense auditor scrutiny. Robust compliance functionality minimizes manual intervention, strengthens controls, and ensures reporting accuracy across multiple standards.

1.6 Transaction posting, journal entries, and payment management

What to evaluate: The platform should automate journal entries across currencies and calendars, generate payment schedules, manage CAM and operating expenses, and reconcile actual vs. scheduled rent. Look for multi-vendor management, pervasive rent tables, and support for abatements, step-ups, and variable rent.

Why it matters: Payments and postings are where accounting meets cash. Automation here prevents costly errors, strengthens ERP alignment, and provides visibility into actual costs vs. obligations.

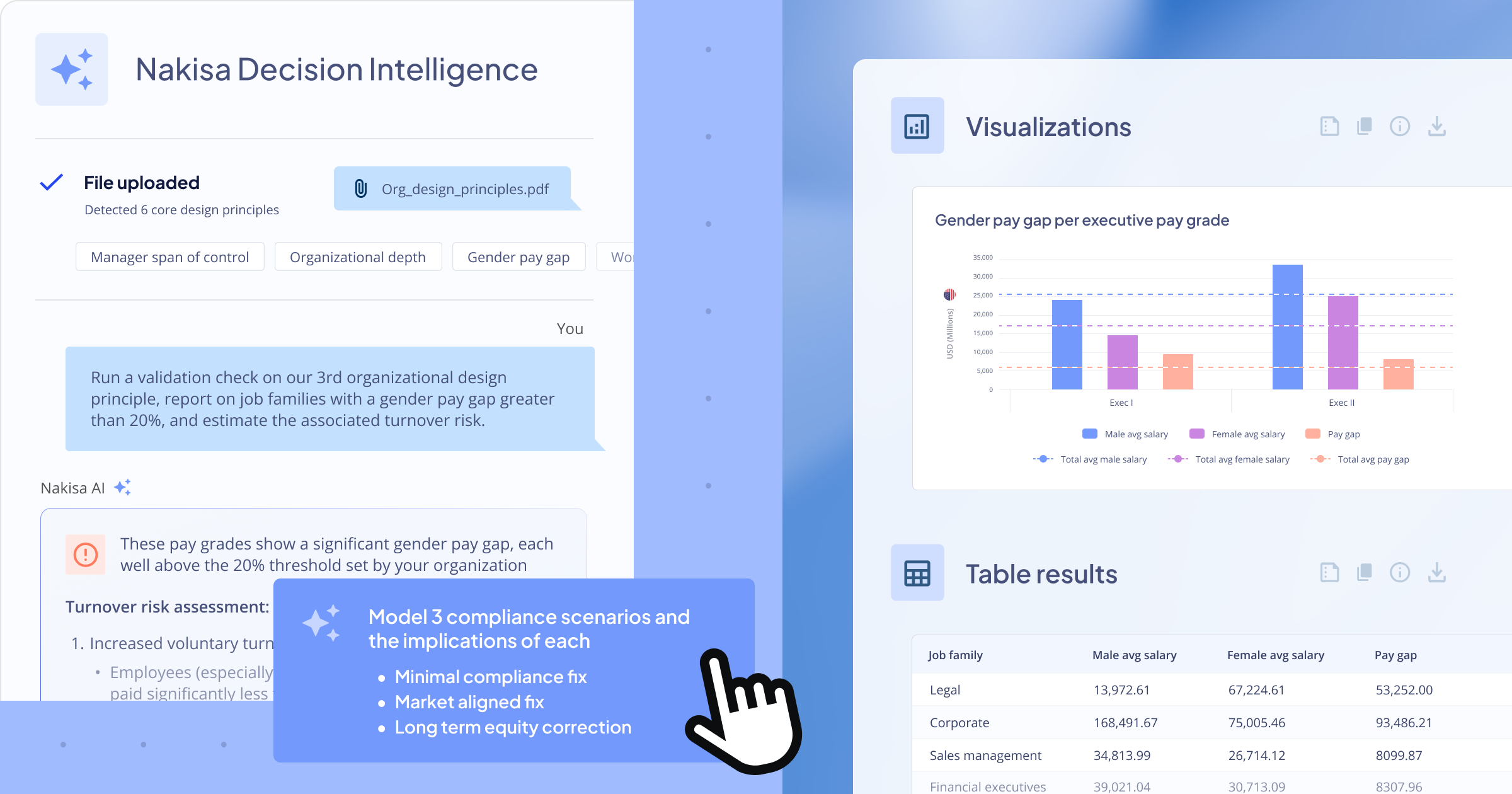

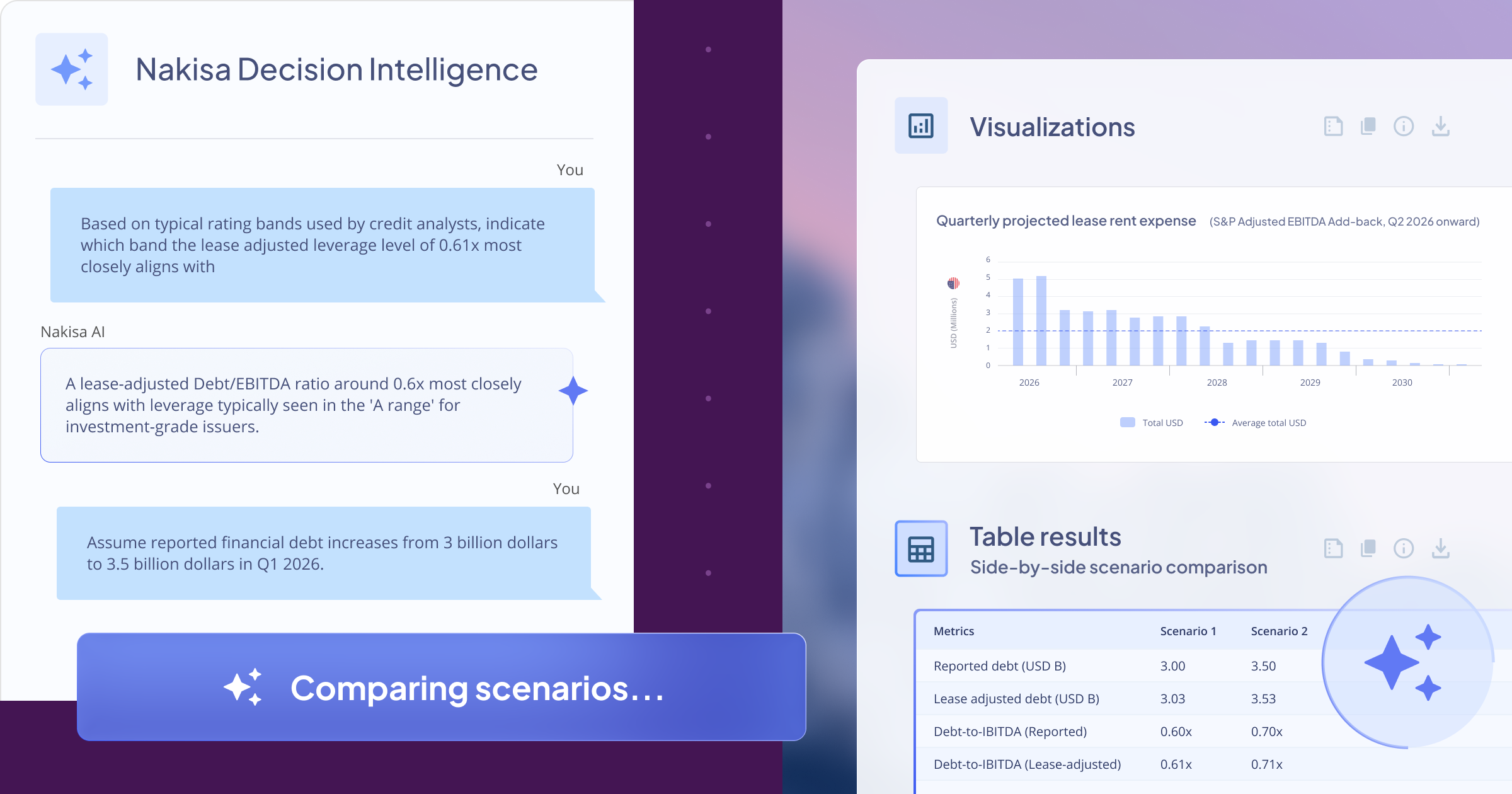

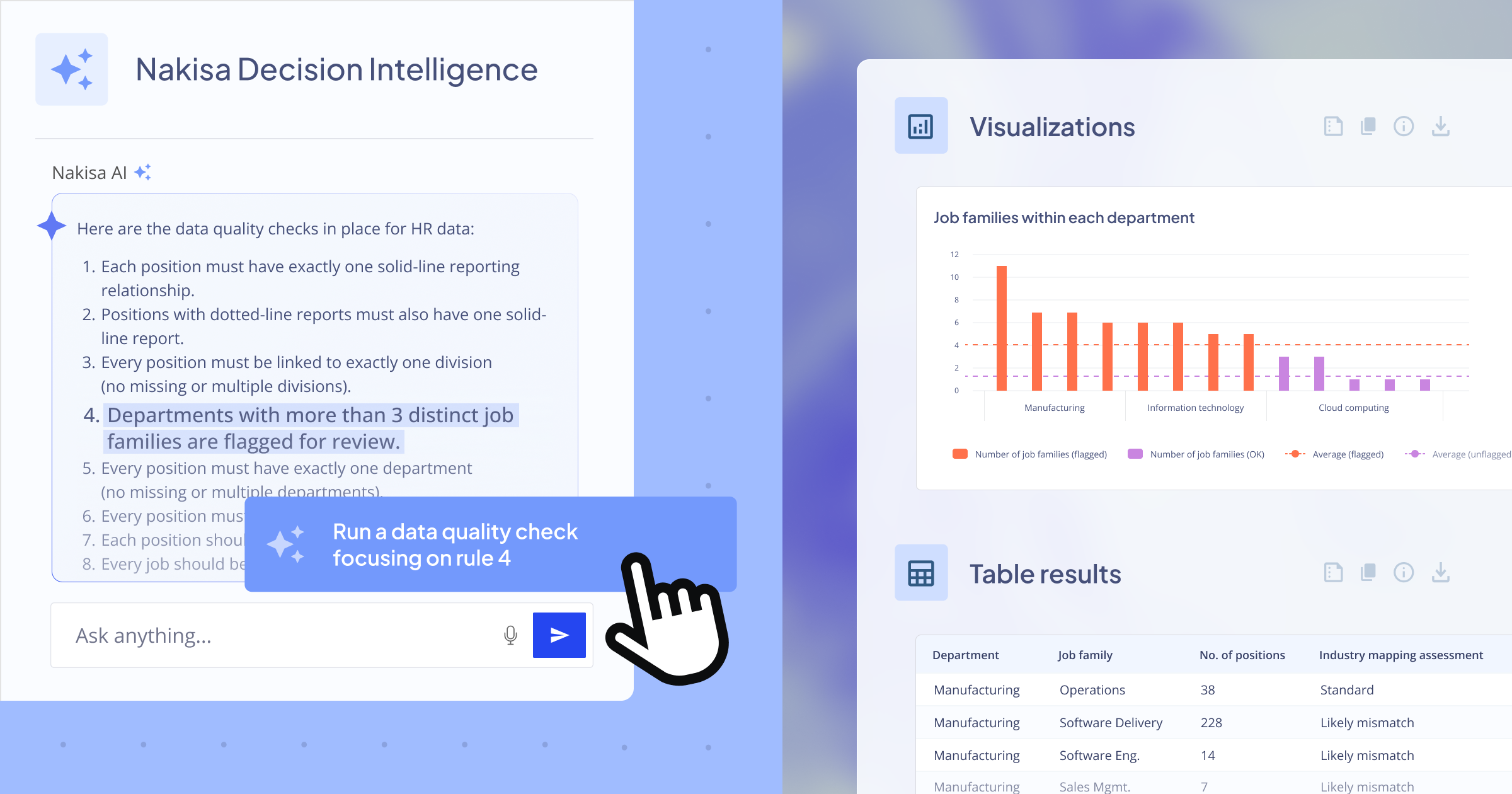

1.7 Analytics: filters, reports, and dashboards

What to evaluate: Look for a mix of out-of-the-box financial/disclosure reports, ad-hoc configurability, scheduled reports, historical comparisons, and dynamic dashboards. The strongest solutions include AI-driven conversational analytics and the ability to generate visuals and KPIs on demand.

Why it matters: Reporting is where lease data turns into insight. Advanced analytics help finance leaders move beyond compliance to strategic decision-making — forecasting expenses, identifying savings, and improving portfolio performance.

1.8 AI capabilities

What to evaluate: Assess whether AI is embedded across document abstraction, analytics, FP&A automation, and user assistance. Look for decision intelligence tools that can unify and interpret vast amounts of internal and external data to answer complex enterprise questions, run what-if simulations and forecasts, produce actionable plans, and execute them through AI agents. Ideally, these tools should allow natural language prompts to democratize intelligence across the organization with no technical skills required.

Why it matters: AI accelerates insights, reduces manual effort, and enables scalable compliance and analysis. It turns large, complex datasets into actionable guidance, simulates scenarios, forecasts outcomes, and supports strategic decision-making, transforming lease accounting from a compliance task into a driver of business value.

2. Five platform capabilities

While core lease accounting capabilities ensure compliance and accuracy, the broader value of a solution depends on the strength of its platform, security, and enablement capabilities. These factors determine whether the software can integrate seamlessly into your ecosystem, protect sensitive data, scale with your portfolio, and support your teams through change and growth.

In this section, we’ll outline what to evaluate and why it matters across areas such as integrations, scalability, security, change management, and vendor support. Considering these elements alongside the core lease accounting capabilities is essential — without them, even the most feature-rich system may struggle to deliver sustainable success.

2.1 Platform: integrations, scalability, configurability, and innovation

What to evaluate: Look for a platform that integrates seamlessly with ERP, AP, and other enterprise systems through bidirectional connectors, APIs, and webhooks. Ensure it supports data quality checks, real-time synchronization, mass operations, and unlimited scaling without performance degradation. Configurable fields, workflows, dashboards, and a history of continuous product releases are signs of a future-proof platform.

Why it matters: Lease accounting doesn’t operate in isolation. A solution that scales with your portfolio, plugs into your digital ecosystem, and adapts to evolving business needs will save millions in avoided customizations and future migrations.

2.2 Security and segregation of duties

What to evaluate: Enterprise-grade security includes single sign-on (SSO), role-based access control, configurable permissions, audit logs, and support for regulatory standards (SOC, ISO, GDPR). Ensure the system offers encryption, intrusion detection, backup and recovery, disaster recovery SLAs, and customizable data sovereignty options.

Why it matters: Lease data often spans multiple entities, geographies, and sensitive financial disclosures. Robust security safeguards against compliance breaches, operational risk, and reputational damage — while also giving auditors confidence in your controls.

2.3 Business value acceleration and digital transformation

What to evaluate: Beyond compliance, assess whether the vendor offers more than advisory support during implementation — look for a comprehensive, lifetime partnership that continues to deliver value long after go-live. The best providers take clients through a structured value acceleration journey, designed to align current vs. future workflows, evaluate technology stack efficiency, model ROI and total cost of ownership, build executive business cases, validate fit through demos or pilots, and track value realization post-deployment through regular health checks.

Why it matters: Lease accounting software is not just a one-time compliance project — it’s a long-term transformation tool. A vendor that provides structured, ongoing support ensures the solution adapts as your business evolves and continues to deliver measurable outcomes over time.

2.4 Change management and deployment

What to evaluate: Look for structured migration planning, ETL support, workflow validation, training programs, and a dedicated implementation team. Evaluate the presence of a client success manager and subject-matter experts for ongoing adoption and optimization.

Why it matters: Even the best software fails without adoption. Strong change management ensures a smooth transition, minimal business disruption, and faster return on investment.

2.5 Client support

What to evaluate: Evaluate support SLAs, 24/7 availability, access to a client portal, and whether the vendor offers dedicated client success managers. Look for a test environment, robust documentation, AI-enabled support, and evidence of client satisfaction.

Why it matters: Lease accounting needs do not stop after go-live. Ongoing expert support is critical for resolving issues quickly, enabling new users, and ensuring your solution evolves with changing standards and business models.

With these considerations in mind, the next step is moving from theory to practice. That’s where the vendor scorecard comes in. By structuring your evaluation across functional, platform, and enablement criteria, the scorecard helps you translate priorities into measurable comparisons—so you can cut through vendor claims and make a decision grounded in facts, not guesswork.

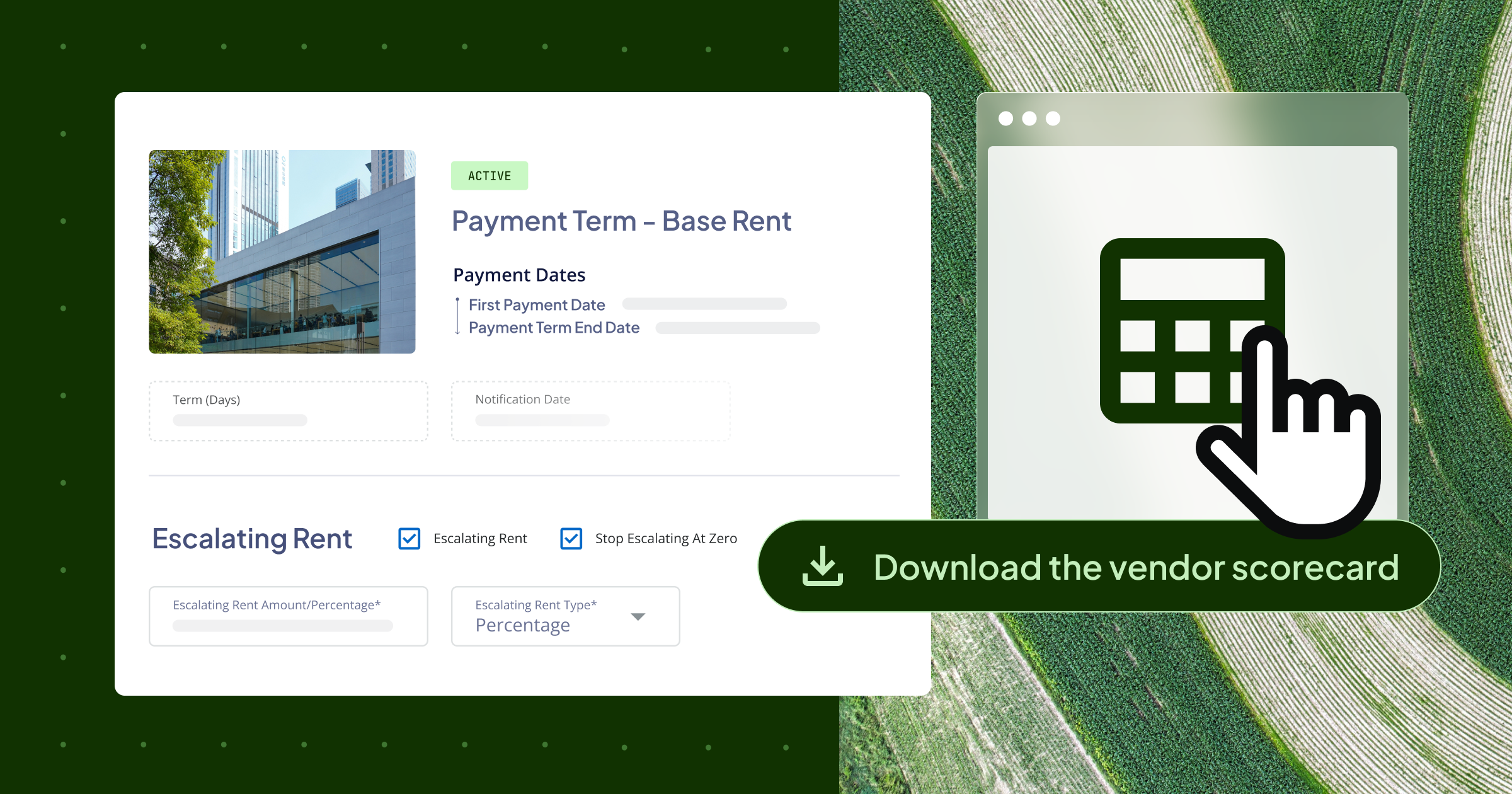

Have you been exploring different enterprise lease accounting solution providers? Use Nakisa’s vendor scorecard to evaluate vendors and share a comprehensive scoring with your peers.

Step 3: How to use the vendor scorecard

The vendor scorecard is a structured tool to objectively evaluate and compare lease accounting solutions across nearly 150 critical criteria discussed above. It provides a clear view of each vendor’s capabilities, highlighting strengths and gaps in areas such as lease data management, accounting compliance, analytics, AI, integrations, and platform scalability.

Our recommended weights reflect how often these requirements are prioritized by Fortune 1000 clients in the specific context of lease accounting solutions — not their enterprise-wide importance. Some items may be critical to your business overall but are often handled in other systems. In those cases, a lower weighting simply means the requirement is less frequently decisive in software selection. Adjust the weights to match your own priorities, compliance obligations, and system landscape.

By customizing the weighting model, you ensure the scorecard reflects the realities of your business rather than a generic checklist. The result is a structured, repeatable way to rank vendors and bring clarity to an otherwise complex evaluation process.

Step 4: How to select the right lease accounting software

Once you’ve completed the scorecard and have clear results, the next step is turning those structured scores into a confident selection. The scorecard provides visibility into each vendor’s strengths and weaknesses, but the final decision also depends on qualitative insights and real-world validation. It is best used as a complement to your broader due diligence and RFP/RFI process — acting as a blueprint to structure requirements, compare responses, and highlight the features that matter most to your organization. To get the most value from it:

- Validate claims through hands-on experience. Conduct vendor demos, proofs-of-concept (PoCs), or sandbox testing with your own lease data to confirm real-world performance.

- Leverage client references and real-world performance. Explore case studies, industry guides, and client references to understand practical implementation outcomes and customer satisfaction.

- Go beyond the rankings. Consider qualitative factors like industry reputation, solution roadmap, training resources, and support availability. Reviewing customer portal, release notes, and publicly available training materials reveals the vendor’s ongoing commitment to improvement.

- Use multiple evaluation methods. While the scorecard can guide your RFP comparisons, combine it with demos, PoCs, reference checks, and hybrid assessments to gain a holistic view of fit, usability, and scalability.

- Make an informed decision. Integrate insights from the scorecard, hands-on validation, and qualitative research to select the vendor that best aligns with your unique requirements. While the highest-scoring vendor is a strong contender, this comprehensive approach ensures long-term success.

The vendor scorecard is more than a comparison tool—it’s a strategic guide that organizes your evaluation, aligns stakeholders, and ensures nothing critical is overlooked. When combined with hands-on validation, reference checks, and qualitative insights, it empowers you to make a well-informed, confident decision, selecting the solution that best supports your lease accounting, compliance, and operational goals.

Dana Jircikova

Head of Capital and Financial Investments Reporting at Nestlé

Discover the Nakisa Accounting Portfolio

Built for global enterprises with complex needs, the Nakisa Accounting Portfolio enables finance teams to automate lease accounting for portfolios of 100,000+ contracts—including leased, sub-leased, and owned assets (equipment, fleet, real estate, land, and more). It handles everything from lease abstraction to administration, accounting, compliance, auditing, reporting, forecasting, and budgeting.

Nakisa Lease Accounting

Nakisa Lease Accounting offers a powerful, intuitive solution to centralize and automate the full lifecycle of lease accounting—from abstraction to reassessment, renewal, and termination—while ensuring parallel compliance with IFRS 16, ASC 842, local GAAP, and government standards. The suite features advanced automation for event management and batch operations, plus AI-powered capabilities such as an AI Assistant for complex task navigation and AI Agents for document abstraction, analytics, charge management, and more, and handles consolidations, intercompany transactions, and FX adjustments.

It delivers a wide range of out-of-the-box financial and disclosure reports, including Income Statement, Balance Sheet, Cash Flow, Asset Roll Forward, Lease Liability, and Maturity Analysis, supporting regulatory filings like 10-K and 10-Q. Built with a configurable multi-level approval system and collaborative workflows and integrated with leading ERP/AP systems and Nakisa IWMS, it unites financial and operational data to improve collaboration and alignment across finance, real estate, and other cross-functional teams.

What sets Nakisa apart is a relentless focus on:

- Innovation: cloud-native architecture, continuous AI-powered innovation, centralized data hub, and dev extensions.

- Integration: cross-product analytics, native bidirectional ERP integrations (SAP, Oracle, & Workday), and robust APIs.

- Security: GDPR, SOC 1 Type II, SOC 2 Type II, ISO compliant, with full ITGC control, RBAC, and multi-level approvals.

- Client trust: our value advisory team helps understand the current state, recommends best practices, supports expert implementation and change management, and ensures client success.

Italo Ferrufino Magaña

IFRS Corporate Analyst at Unicomer Group

Discover Nakisa Lease Accounting in action

We invite you to schedule a personalized demo to see how AI-driven automation, advanced analytics, and centralized workflows can simplify lease accounting, ensure multi-standard compliance, and deliver actionable insights for smarter, faster decision-making across your organization.

Barbara Book

Senior Teamhead of Consolidation and Group Reporting at PUMA