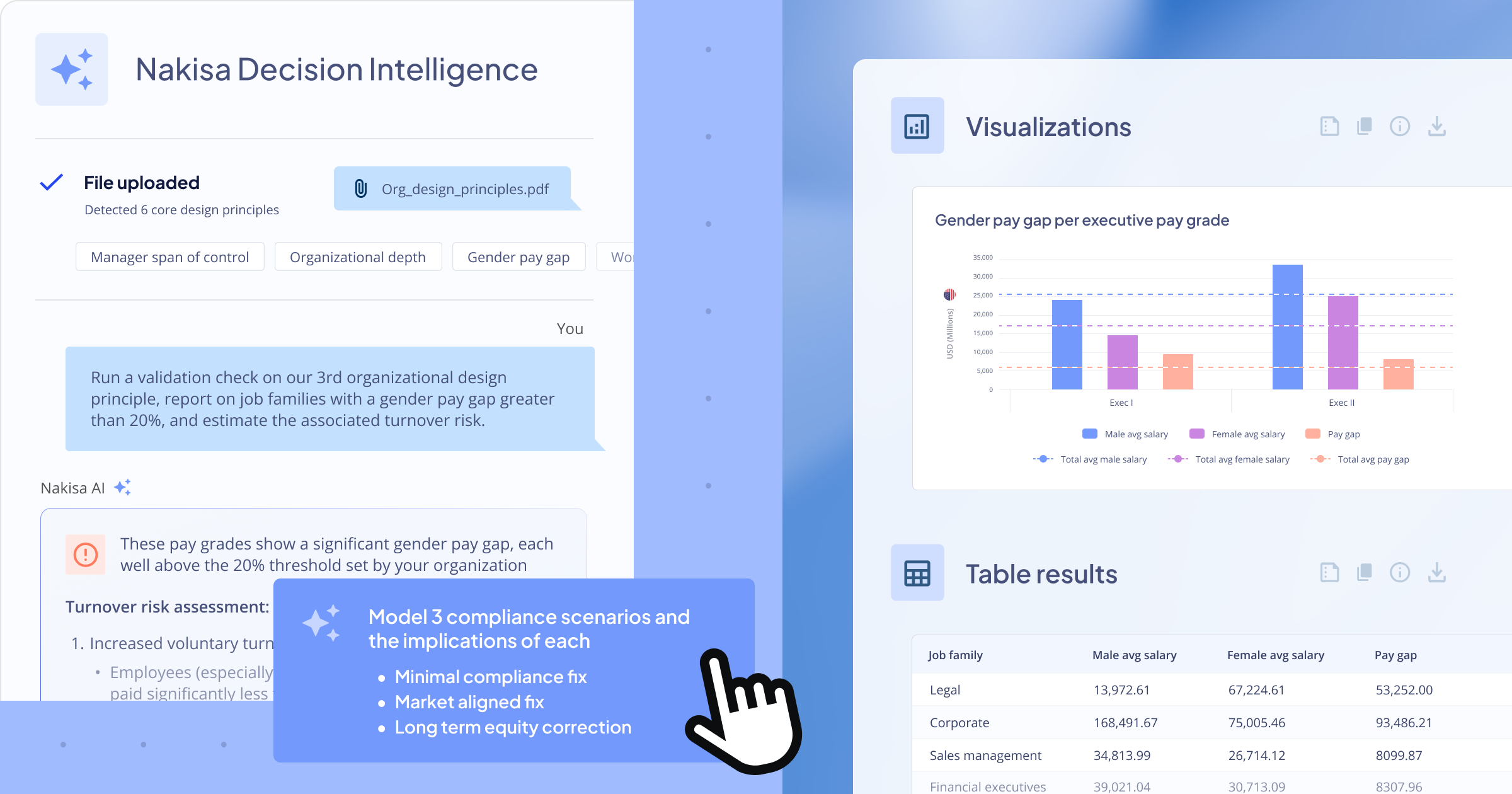

Discover how large enterprises can save on time and costs using Nakisa Decision Intelligence’s instant validations of workforce data against org design principles and guardrails.

Resources

Blogs

Cloud Solutions for Lease Management, Commercial Real Estate, and Organizational Design

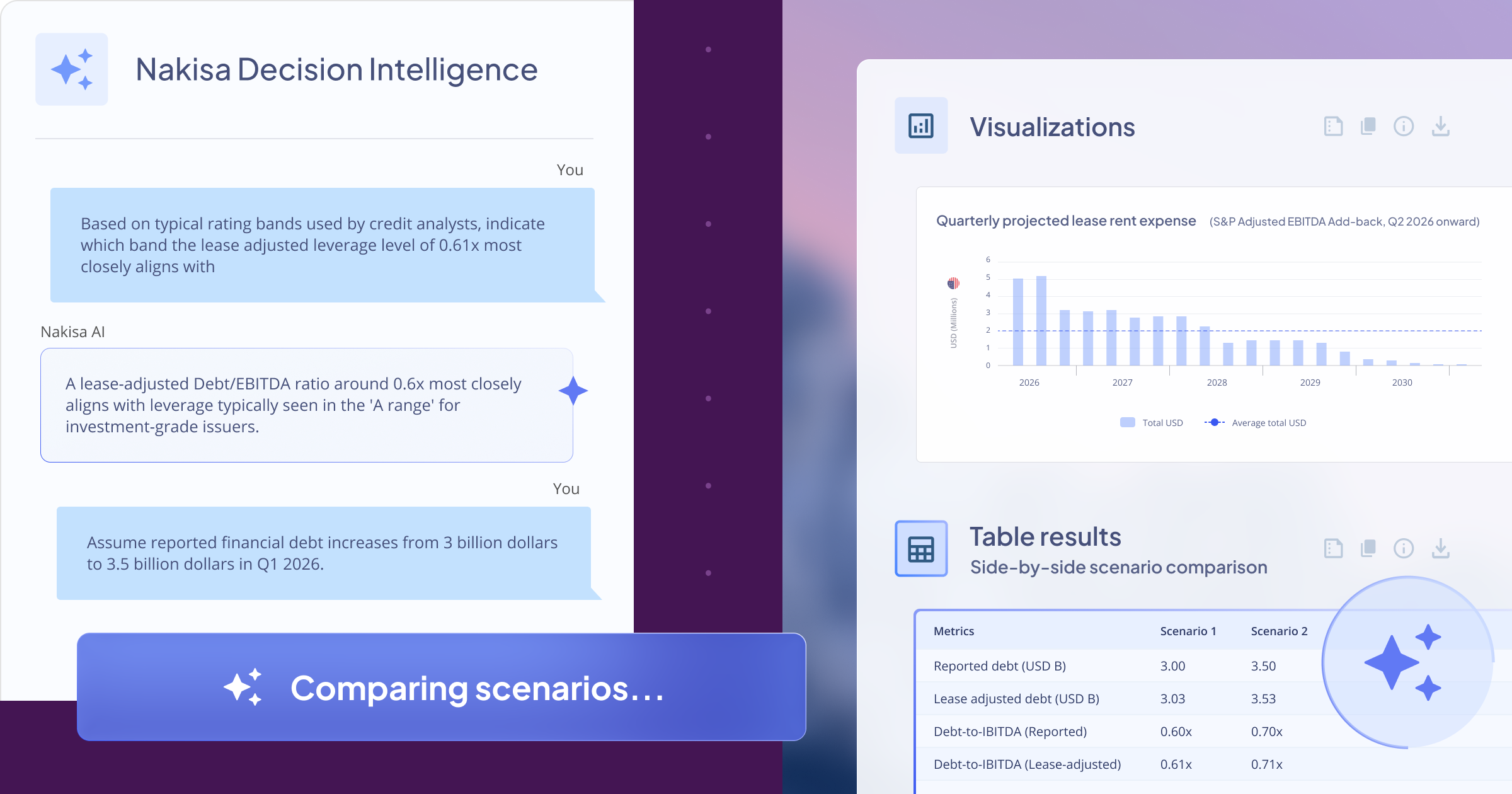

Operating leases can significantly influence leverage ratios and credit metrics. Yet their impact is often hard to evaluate. In this step-by-step guide, we show how treasury and real estate teams can use Nakisa Decision Intelligence to project operating lease obligations, calculate lease-adjusted debt, and assess leverage and credit impact under different scenarios.

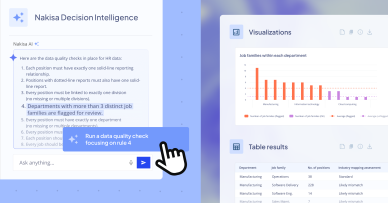

Discover how large enterprises can save on time and costs using Nakisa Decision Intelligence’s instant, prompt-based workforce data quality checks and rule-based validations to ensure organizational health.

In this post from our new series, our CTO, Faraz, explores how the Nakisa Decision Intelligence platform can audit, validate, and visualize AI generated rules instantly through natural-language questions, charts, tables, and automated insights.

In this post from our new series, our CTO, Faraz, explores how AI is transforming data quality management. By prompting decision intelligence platforms with precise instructions, leaders, analysts, and HRBPs can instantly generate comprehensive, reusable data quality rules, covering integrity, validity, and completeness, and adapt them across HR, Finance, Real Estate, and beyond.

In this new post of our series, our CTO, Faraz, explores how org charts are evolving. Once static and quickly outdated, they’re now brought to life by decision intelligence platforms. By converting natural language questions into intelligent visualizations, leaders, analysts, and HRBPs can unlock real-time organizational insights, gaining clarity and agility that simply didn’t exist before.

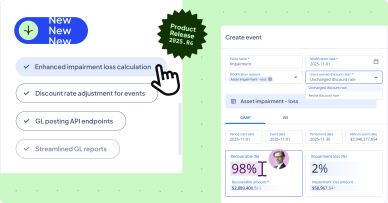

The Nakisa Lease Accounting 2025.R4 release introduces targeted enhancements to streamline workflows, improve GL reporting, and provide flexible control over posting processes. These updates empower finance teams with greater accuracy, traceability, and efficiency across lease management and financial operations.

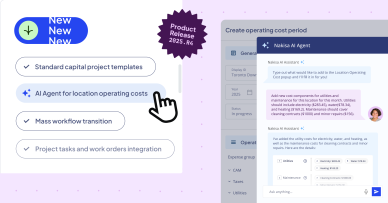

The 2025.R4 release brings new levels of intelligence and efficiency to Nakisa IWMS. From AI-driven location operating cost analysis to enhanced mass workflows and streamlined product integrations, this release empowers real estate and operations teams to work smarter, faster, and more collaboratively.

In this post from our new series, our CTO, Faraz, explains how Nakisa Decision Intelligence (NDI) turns instructions into intelligent decisions using our guiding principles, called chat instructions, making the difference between a useful answer and a transformative one.

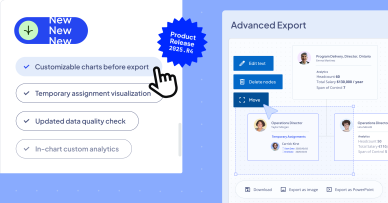

The 2025.R4 release brings several purpose-built updates to the Nakisa Workforce Planning Portfolio, including customizable exports, clearer visualizations for temporary assignments, and enhancements to collaboration tools in Nakisa Org Design. See the full list below.

In this post from our new series, our CTO, Faraz, explains how Nakisa Decision Intelligence (NDI) interprets intent and adapts to user behavior by balancing analytical precision with creative flexibility through Context Memory and Instruction Strictness.

Be the first to know

Subscribe to the Nakisa monthly newsletter.