When we last blogged about the Nakisa Real Estate (NRE) software, NRE was just getting started! We were fresh off creating the solution following our acquisition of its base technology from cloud-based real estate manager IMNAT.

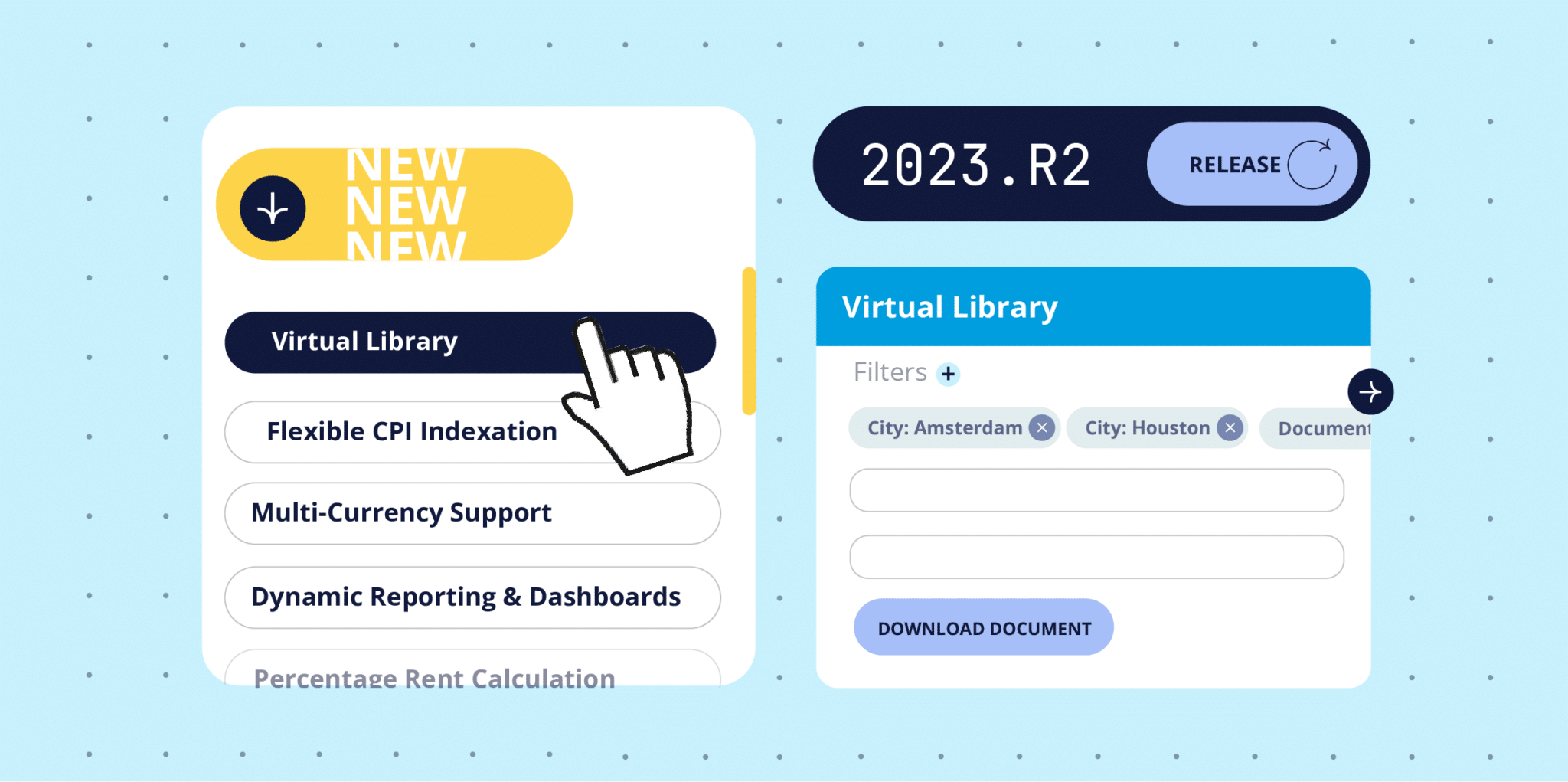

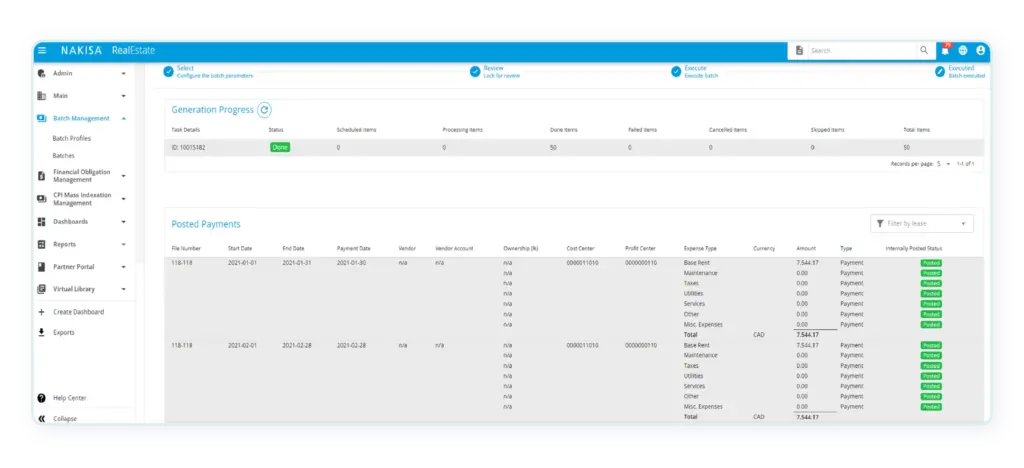

Two years later, we have quite the update. Code-named “NRE 2023.R2”, this latest release is available to help streamline commercial real estate management right now. Fully built from the ground up to cater to commercial real estate managers and lease administrators, NRE’s latest release further allows our enterprise clients to break down information silos, track critical deadlines, automate workflows and calculations, and maintain access to timely, accurate, and real-time data and analytics so that they can manage their real estate leases, costs, and other activities with ease.

New power features include a single repository for all documents related to each lease (the Virtual Library), lease indexation by consumer price index, and multi-currency support, among a host of other new functions and enhancements.

Here are the highlights of the NRE 2023.R2 release.

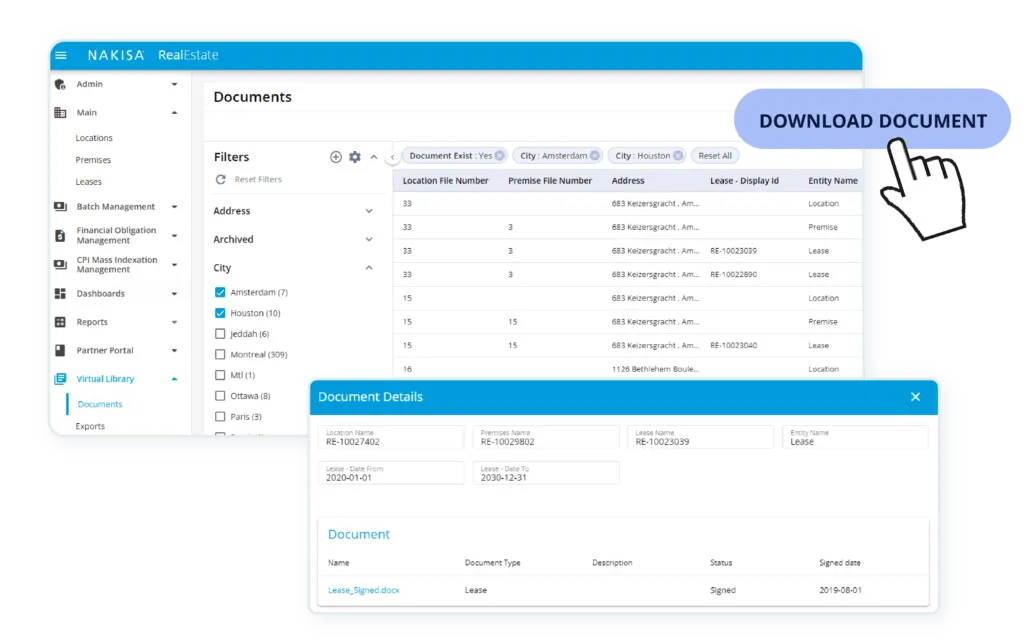

Virtual Library: Where All Your Related Files Are Stored

As you know, commercial real estate management involves a lot of paperwork. Keeping track of it all can be absurdly challenging. To make this easier, NRE provides a Virtual Library that allows users to view all the documents associated with a specific lease in one place. The Virtual Library also allows users to tag and identify missing files. Files can also be easily exported for offline use. Finally, users can link date-driven documents directly into a file so that related items can be quickly accessed, particularly for auditing purposes.

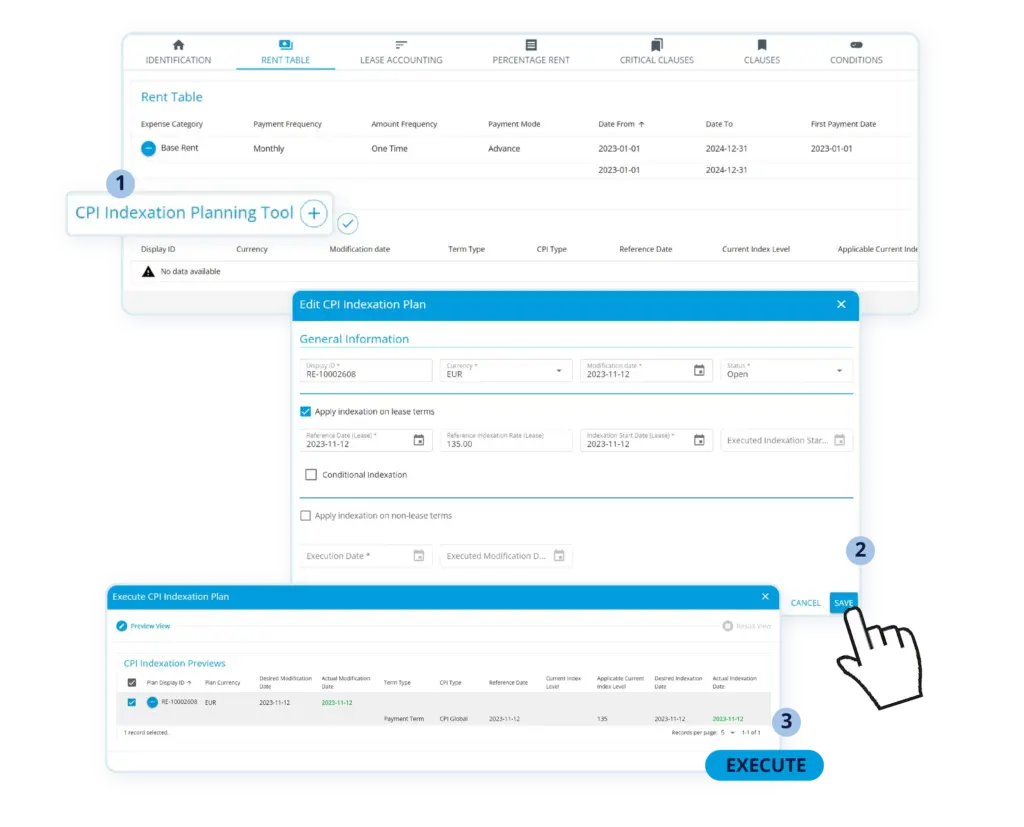

Flexible CPI Indexation: Keeping Up with Inflation

It’s critical to be able to index leases to price inflators such as the Consumer Price Index (CPI) or Libor. Now, Nakisa's commercial real estate management software offers several useful options to meet this need. Contracts can be indexed individually, and it’s also possible to index individualized expense categories within the same lease contract.

Beyond that, multiple lease contracts can be indexed in bulk. When using NRE’s new Mass Indexation module, users can index and sync contracts with base rents and other expenses with multiple indexations in the same lease contract for convenience and heightened accuracy.

There’s even more flexibility and granularity to be had: If base rent and common area maintenance (CAM) have different indexation levels and/or base years, these indexations can be applied. Nakisa's real estate lease management software now allows users to link and assign individual indexations per payment type as part of a rent table. Furthermore, these indexed amounts compliantly transition to IFRS 16 and ASC 842 compliance.

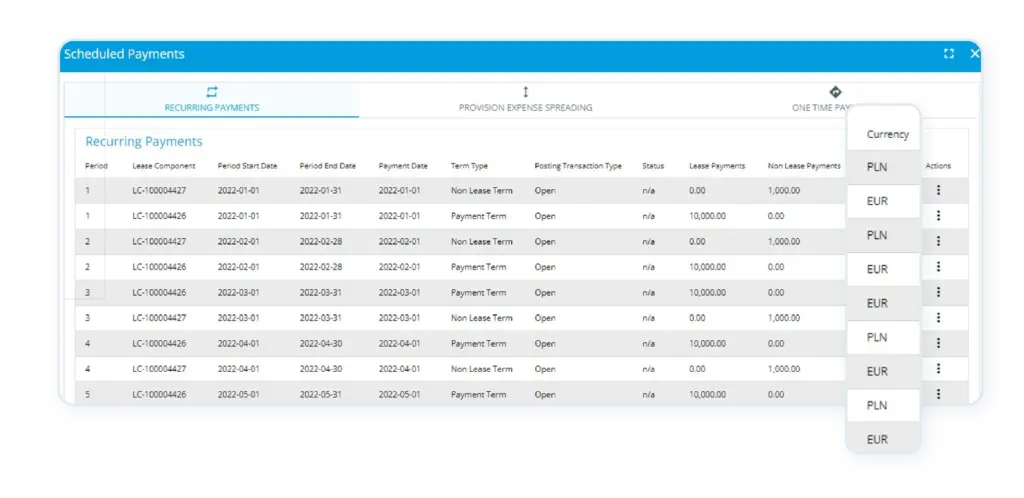

Multi-Currency Support: Working in a Global Village

Enterprises will have real estate holdings and leases worldwide. This often results in having to work with multiple currencies within the same lease. NRE streamlines this process by allowing users to simply specify the currency in which each contract associated with one lease should be paid. For example, NRE supports real estate lease management scenarios in which base rent is paid in one currency and CAM (or any other expense) is paid in another. For added convenience, NRE can roll up each currency’s conversion for proper reporting to comply with IFRS 16 and ASC 842. This feature makes lease accounting more accurate and provides clients with greater financial control.

Ad-Hoc Dynamic Reporting and Dashboards: For Management and Analysis

NRE’s reports and dashboards are powerful tools to create and accommodate ad-hoc requirements. Each report comes with dynamic filtering to enable users to download and view reports with user-specific filters. The dynamic dashboard tool provides real estate managers with up-to-date analytics and ensures a concise visualization of entire portfolios. The dashboard also permits easy drill-downs into critical information. Users can also take advantage of asset-level (local) and portfolio-level (global) reporting – a feature that’s of paramount importance to real estate departments. Finally, NRE allows embedding no-code scripts to incorporate ad-hoc calculations for all custom requirements in its advanced reporting features.

Financial Obligations Reporting: Understanding Financial Impacts

The new Financial Obligation Report allows users to understand the financial impact of selected expenses on one or more leases in any period. The feature generates an easy-to-understand report that breaks down the details of the expenses for transparency and granularity; it makes analyses critical to real estate lease management much clearer. It also lets the user isolate obligations per expense, vendor, and period. This grants much greater visibility for analyses, budgeting, and expense planning.

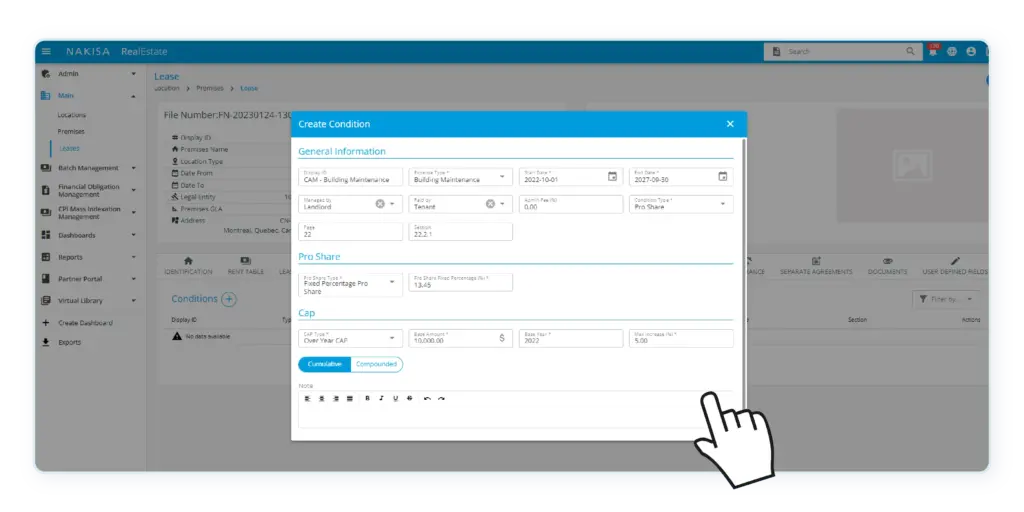

Operating Expense Provisions and Reconciliation: Demystifying Complexity

Users can define operating expenses such as CAM and provision periodic expenses throughout the lease, based on contract lease conditions. These provisional amounts can then be reconciled with the actual operating costs. How? By reconciling a vendor invoice detailing the tenant’s share of operating costs for the location.

Users can parse out complicated calculations at the outset, and then reconcile lease conditions by pegging provisioned (and budgeted) expenses against vendor invoices - all in an automated fashion. This module helps flag discrepancies and optimize year-end processes with landlords by generating calculation reports comparing operating expenses that were provisioned, invoiced, and adjusted.

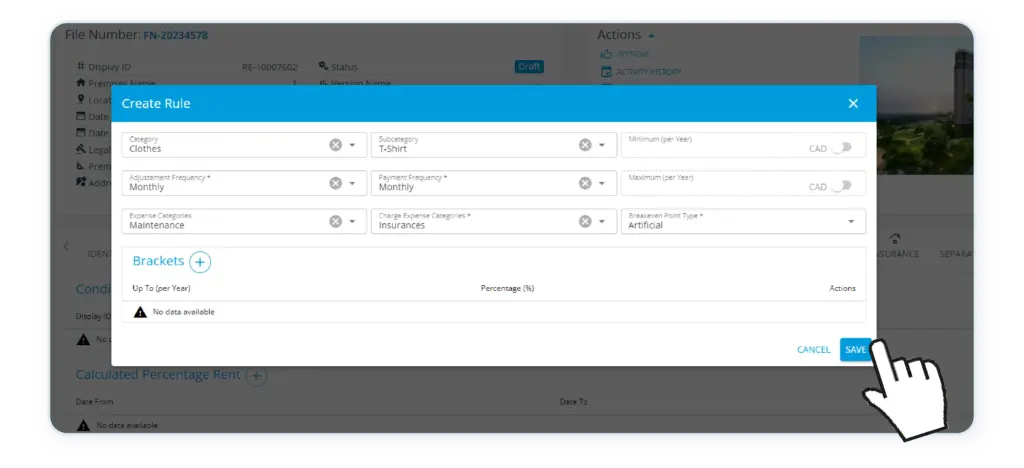

Percentage Rent Calculation: Complex Scenarios

Percentage rent is the ultimate incentive for lessors and lessees to establish equitable agreements and payment structures. NRE makes it easier than ever to create rules that determine which and what sales data to consider in calculating percentage rent, and then just do it automatically. In addition to being able to incorporate sales data in NRE, users can associate business rules with percentages to be allocated in the variable expense linked to percentage-based rent. Sales categories, along with both natural and artificial break-even points can be attributed to the allocation of percentage bracket calculations. NRE is also powerful enough for the user to embed and incorporate any percentage rent rules including If, Average and SumProduct scenarios.

Sub-leasing Support: Tracking Parts of a Whole

NRE now makes it possible to effectively manage sub-leases. It’s a common occurrence in real estate lease management, particularly in the post-COVID era. Users can generate lessor operating leases so that they can easily track and administer sub-leased assets. As such, should there be any section or sub-division of a premises that is sub-leased, NRE will support managing the area (Square Meter/Square Footage). It’s an additional layer of granularity that saves time and increases accuracy.

A Final Word for Now

Those are all the new features that are available now if you deploy NRE for your commercial real estate management needs, and that’s on top of a much larger, fully complete, and easy-to-use set of tools that make real estate management simple.

Ready to transform your real estate management? Get Nakisa Real Estate software today to make your tasks more efficient and enhance your business. Learn more about Nakisa Real Estate software’s full set of features. Interested to see NRE in action and explore how it can help your organization streamline real estate portfolio operations and administration? Talk to our solution experts.

Are you a current client? Please visit the Nakisa Customer portal to access the release notes for this version. Reach out to your dedicated Nakisa Account Manager if you would like to discover the features of the latest NRE version and how it can help your organization specifically or to request tailor-made training for your organization. Keep an eye on Nakisa's YouTube page for more training videos to streamline your real estate portfolio management.