Accounting treatment of ROU Assets under IFRS 16 and ASC 842

Under IFRS 16, ROU assets will continue to be depreciated using the straight-line method. The same applies to ASC 842 ROU for assets that are classified as finance leases. With respect to operating leases, given a lease liability is not recognized, depreciation will equal a straight-line lease expense with no subtraction of interest expense for the period.

Understanding motivations and negotiations behind fully prepaid leases

The complication arises from an operational perspective. To better understand the complexities of fully prepaid leases, one must understand why a lessee would make the business decision to pay a lease in full before the commencement of the contract. A benefit of regular leases is that it does not require the lessee to pay significant cash upfront when compared to an outright purchase. The short-term cash savings ensure the business has enough cash flow in the medium- to long-term to fund operations. Which begs the question: why would a lessee pay a lease in full?

A lessee, more likely than not, will negotiate a fully prepaid lease for a piece of land or building. The land or building will facilitate operations for the lessee for pre-determined periods. This approach would be useful in an industry like oil and gas. The lessor of gas stations in prime locations often have numerous bids. The lessees with significant cash on hand may negotiate with the lessors a lump sum payment to increase the likelihood of closing a deal.

Key considerations and addressing limitations in fully prepaid leases

Fully prepaid lease agreements often include extension options. The negotiation of an extension option is no different than that of commencement where the lessor expects additional subsequent lump sum payments. Extension options that include regular terms (i.e.: base rent paid once a month) are rare, if any exist at all. As a result, the lessee must have enough cash on hand to negotiate extension terms.

Additionally, fully prepaid leases rarely include purchase or termination options. More likely than not, the lessor has no intent to sell the asset. Moreover, the lessor is likely to negotiate to have such clauses excluded from the contract, or set with high termination fees such that the lessee is unlikely to terminate the lease early. From an operational perspective, this may be detrimental. If the lessee’s business expectations are not met, especially from a cash flow perspective, the lessee is stuck until contract expiry.

Managing non-lease components in land and building leases

Furthermore, leases for land and buildings include non-lease components such as insurance, maintenance, and taxes. These costs increase on a yearly basis but have no effect on the measurement of the ROU Asset and are expensed directly to the income statement in the period incurred (assuming no policy election for the practical expedient).

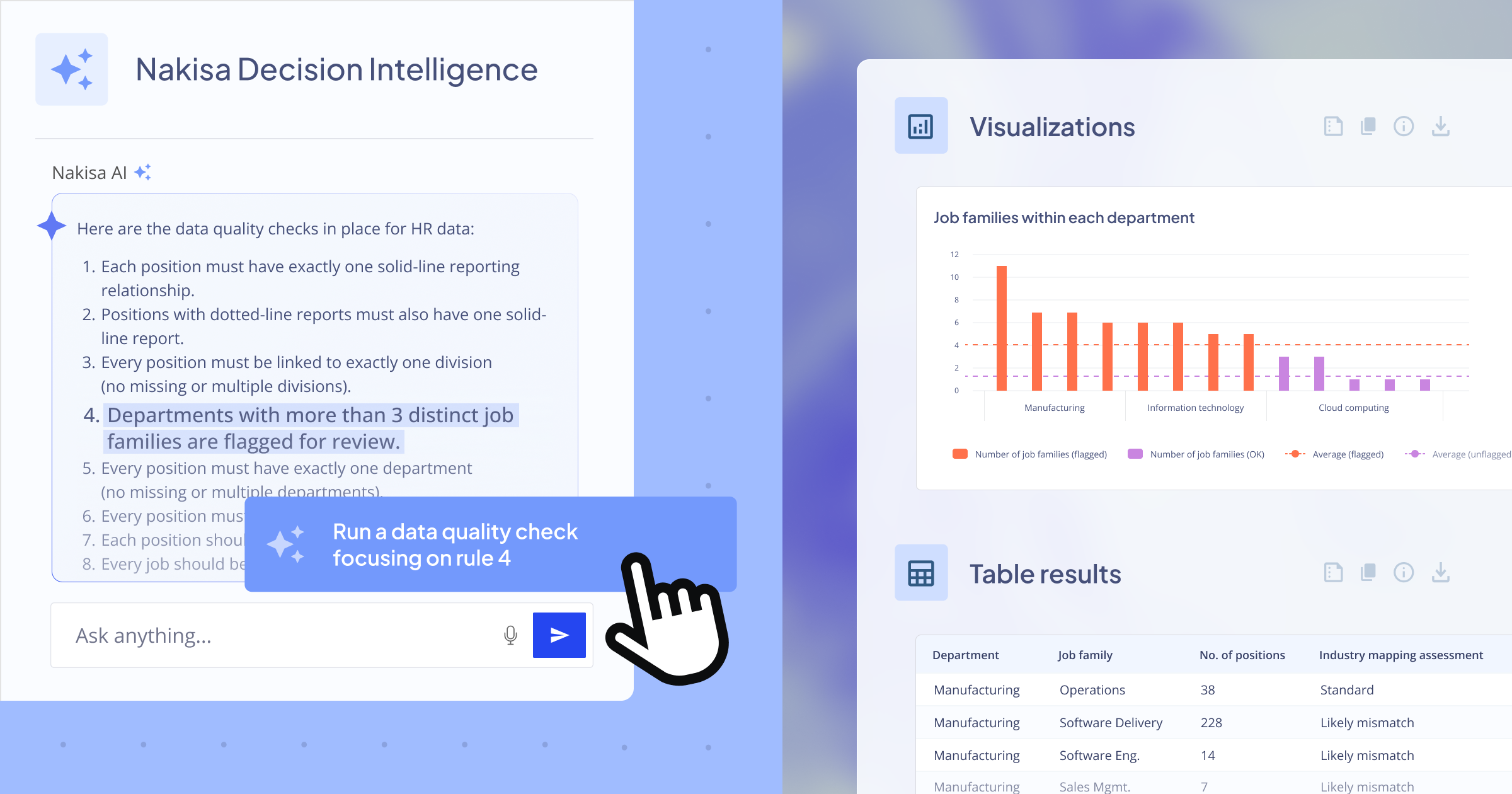

Beyond compliance requirements, lease administrators, especially in an industry such as oil and gas, require a central repository that ties both lease and non-lease components. With rising miscellaneous costs and prepayments, it is essential to integrate a financial planning and analysis module into a lease accounting solution to empower key decision-makers with the tools to build relevant reports in real time.

Accounting for today is easy. The challenge is to prepare for tomorrow.

Prepare for a seamless year-end audit with Nakisa! Read our guide where industry experts share their knowledge and best practices from Fortune 1000 companies.

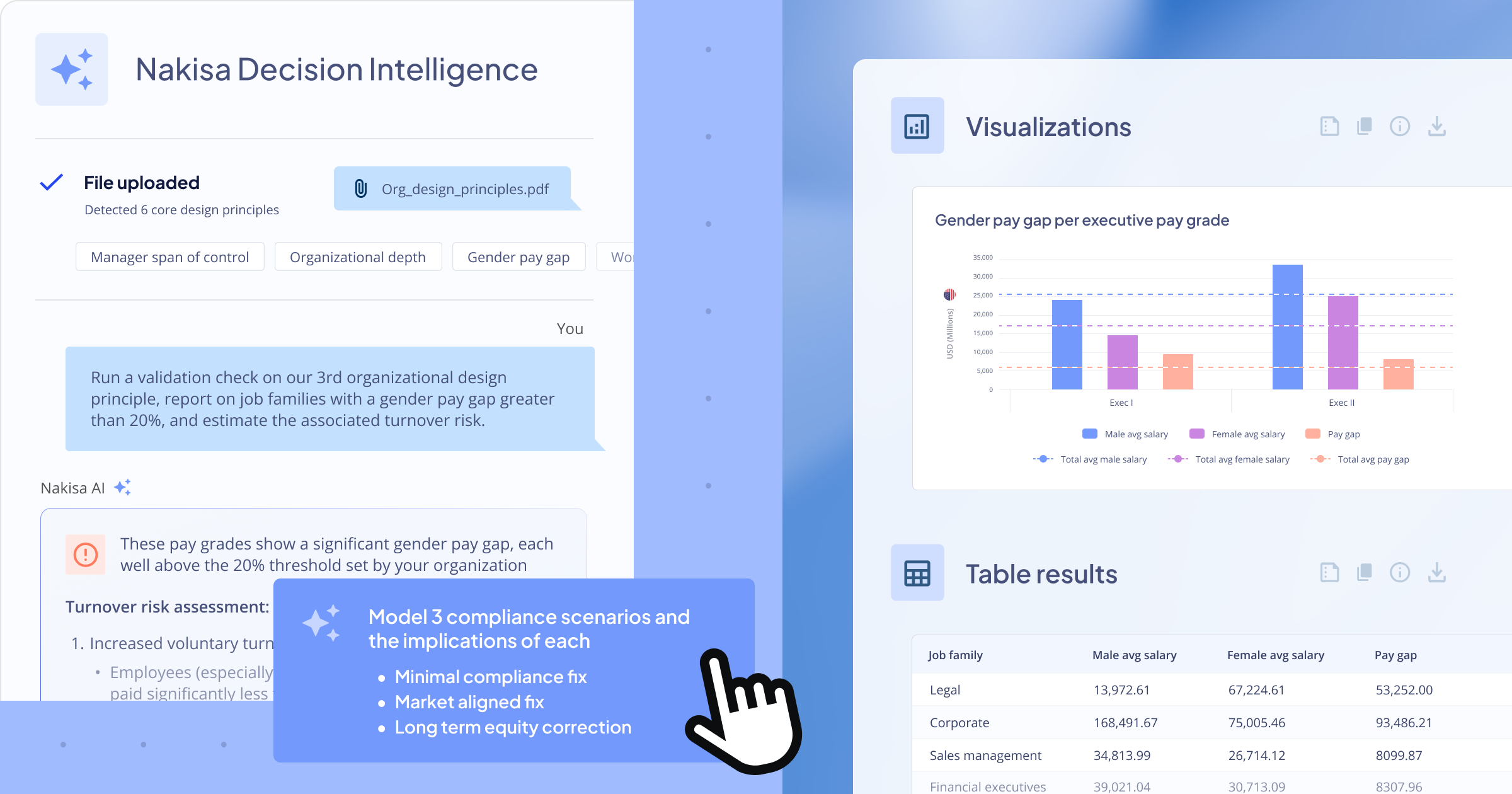

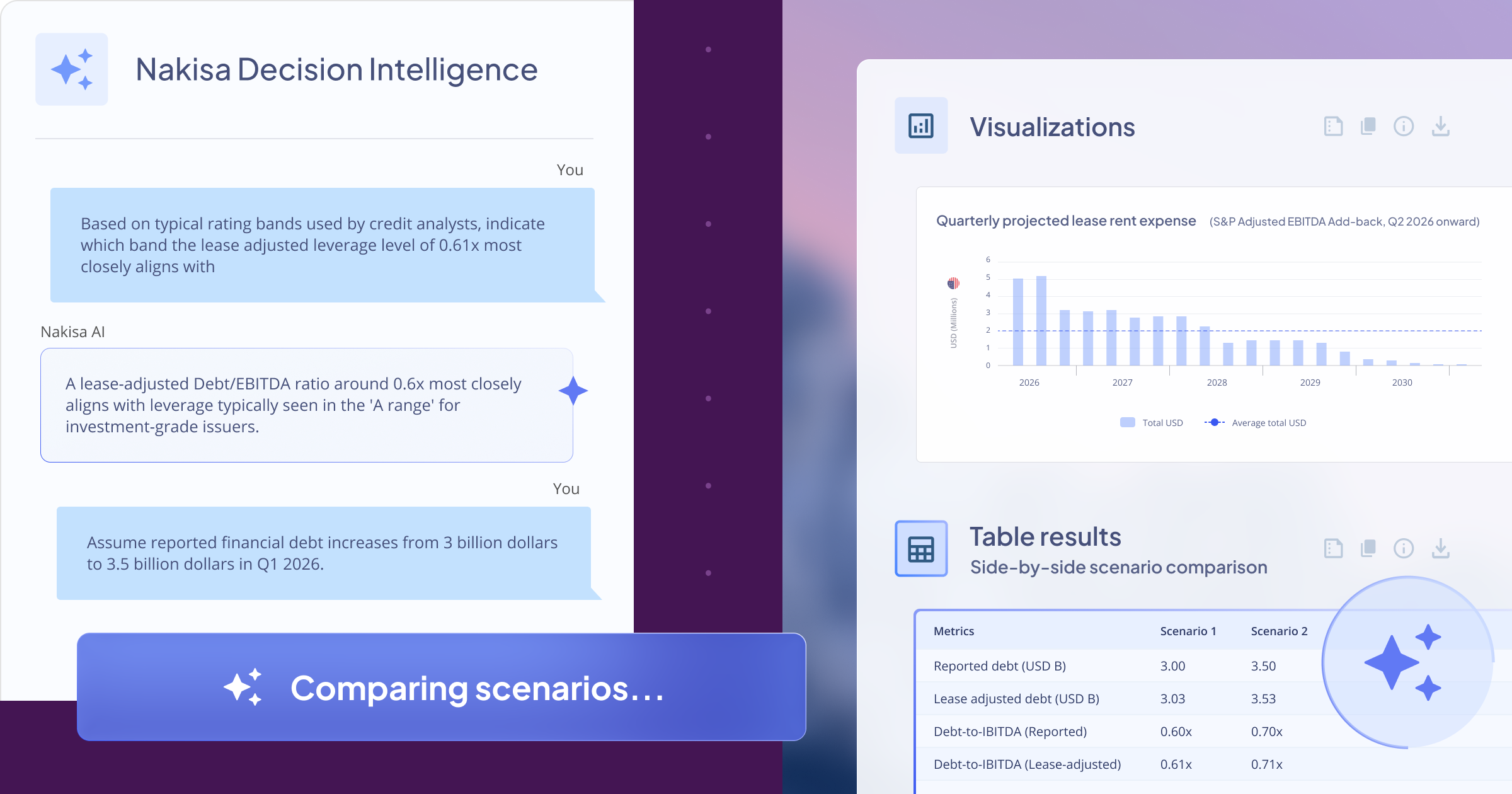

The role of lease accounting software in managing fully prepaid leases

Lease accounting software, such as Nakisa, plays a crucial role in managing the complexities of fully prepaid leases. These platforms provide comprehensive solutions for lease administration, accounting, and compliance, offering functionalities tailored to address the nuances of fully prepaid lease agreements. With Nakisa, organizations can streamline lease data management, automate lease calculations, and generate accurate financial reports, ensuring compliance with accounting standards such as IFRS 16 and ASC 842. By centralizing lease information and facilitating seamless communication between lessors and lessees, Nakisa enables efficient negotiation of extension options and lease amendments, enhancing operational transparency and risk management. Additionally, Nakisa's advanced analytics and reporting capabilities empower organizations to optimize lease portfolios, mitigate risks, and make informed strategic decisions in lease administration. Contact us if you're interested to see a demo of Nakisa lease accounting software, trusted by Fortune 1000.